On Wednesday, the gold prices trade sideways after trading mostly on the higher side on Tuesday. The bullish trend was seen on expectations of interest rate reductions by central banks as influencing policymakers from the Group of Seven (G7) countries gathered to address how to embrace the economic shock from the global coronavirus break.

The Fed made an emergency interest-rate cut, the first one since the global financial crisis of 2008. The cut was of half a percentage point (to a range of 1.00%-1.25%) in response to mounting anxieties about the economic influence of the coronavirus. Fed Chair Jerome Powell pointed out: “The virus and the measures that are being taken to contain it will inevitably weigh on economic activity for some time, both here and abroad, however, we do consider that our work will contribute a meaningful addition to the economy.

Besides, the Reserve Bank of Australia lowered its benchmark interest rate by 25 basis points to a record low of 0.50%, saying that it is prepared to ease monetary policy further to support the economy amid the impact of the coronavirus.

The gold will probably trade higher further as traders seek to park their funds into safe-haven assets such as gold. It is mostly due to concerns over the global economic slowdown.

The coronavirus is presently expanding faster outside China, and the US Fed’s emergency rate reduction disturbed financial markets; thus, the demand for safe assets like gold will grow.

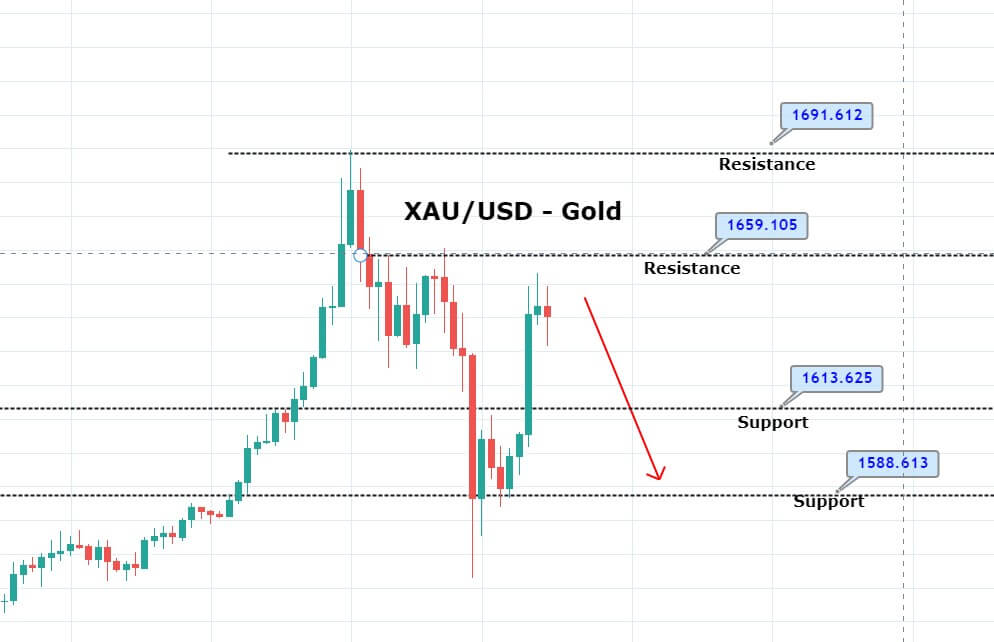

Daily Support and Resistance

Support Resistance

1,606.47 1,662.39

1,572.03 1,683.87

1,516.11 1,739.79

Pivot Point 1,627.95

At the moment, gold is expected to gain a critical resistance near 1,651 level, and breach of this can stretch the bullish trend till 1,662. As we can see on the 4-hour chart above, the gold has formed a Doji candle followed by a strong bullish candle, which is suggesting that there are chances of a bearish retracement below 1,652 level. On the lower side, the immediate support stays around 1,632 and 1,613. Let’s consider staying bullish above 1627.95 and bearish below 1,652 today. Good luck!