The safe-haven-metal succeeded in maintaining and extend its gains and traded near the highest level since September 2011 at $1,845. The bullion gains could be attributed to the noise surrounding the record surge in the U.S. coronavirus (COVID-19) cases as fear of virus dampened prospects for a swift economic recovery and continued increasing demand for the safe-haven yellow metal. The broad-based U.S. dollar weakness triggered by the upbeat market mood also impressed gold bulls and kept the gold prices higher.

At the moment, the yellow metal prices are currently trading at 1,840 and consolidating in the range between 1,845.93 and 1,820.24. Elsewhere, the gains in the S&P 500 Futures backed by the hopes of the potential virus vaccine kept a lid on any additional gold prices.

However, the reason behind the upbeat market sentiment could be associated with the hopes for a fiscal rescue package in Europe and the U.S. and progress toward a coronavirus vaccine. Moreover, the risk-on market sentiment was further bolstered by the positive reports about the receding pandemic numbers from the U.S.

The European Union (E.U.) leaders agreed on late Monday for a possible €1.8 trillion ($2.06 trillion) coronavirus spending package but with some changes in the proposal that was meant to reverse the coronavirus-induced slump in the European economies. This news boosted the risk-on market sentiment and strengthened the bid tone around riskier assets. An additional boost on the risk sentiment was derived from negotiations for a second stimulus package in the U.S., which also exerted pressure on the safe-haven U.S. dollar.

Apart from this, the encouraging data from Oxford University’s coronavirus vaccine and CanSino Biologics’ drug developed in coordination with China’s military research unit also favored the risk-on market sentiment. The intraday positive progress in gold seemed rather unaffected by a modest rebound in the global equity markets.

The latest coronavirus (COVID-19) numbers from Texas and L.A. County showed mild reduction in the pandemic figures compared to the recent high statistics. While both added a total of 10,564 new cases on Monday, Texas remained the worst affected state with 7,404 addition taking the state-wise total to 332,434. On the flip side, there are 159,045 total cases in L.A. County with the latest extra numbers of 3,160.

Apart from the virus woes, the on-going war between the world’s top two economies remained under fire as the U.S. policymakers were set to levy heavy sanctions on China’s ruling party members. This action could push the dragon nation towards rouge retaliation and the fears of which kept a lid on any further optimism in the risk sentiment.

As in result, the broad-based U.S. dollar failed to gain any positive traction and edged lower on the day. However, the losses in the U.S. dollar could be attributed to the uptick in the U.S. stock futures. The losses in the U.S. kept the gold prices higher as the price of gold is inversely related to the price of the U.S. dollar.

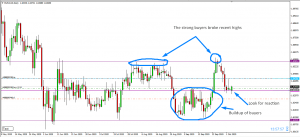

Besides the market’s fundamental side, the technical side is now suggesting strong odds of selling bias in gold. Gold prices can take a dip below 1,840 level to complete 38.2% Fibonacci retracement until 1,831 level. Bearish crossover of this level can extend further selling until 1826.78, which marks 61.8% Fibo level today. Check out the trade plan below…

Entry Price – Sell 1836.78

Stop Loss – 1841.78

Take Profit – 1826.78

Profit & Loss Per Standard Lot = -$500/ +$1000

Profit & Loss Per Micro Lot = -$50/ +$100

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

2 replies on “Gold Enters Overbought Zone – Let’s Capture Quick Retracement!”

SL HIT?

manual close. But it seems there was an error in the process.