Thank you for visiting the Forex.Academy FX Options Expiries Section. Each day, where available, we will bring you notable maturities in FX Options of amounts of $100 million-plus, and where these large commutative maturities at specified currency exchange rates often have a magnetic effect on price action, especially in the hours leading to their maturities, which happens daily at 10.00 AM Eastern time. Each option expiry should be considered ‘in-play’ if labelled as Hot, Warm, or ‘out of play’ if labelled Cold with regard to the likelihood of price action meeting the strike price at maturity.

……………………………………………………………………………………………………………………..

FX option expiries for May 7 NY cut

FX option expiries for May 7 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

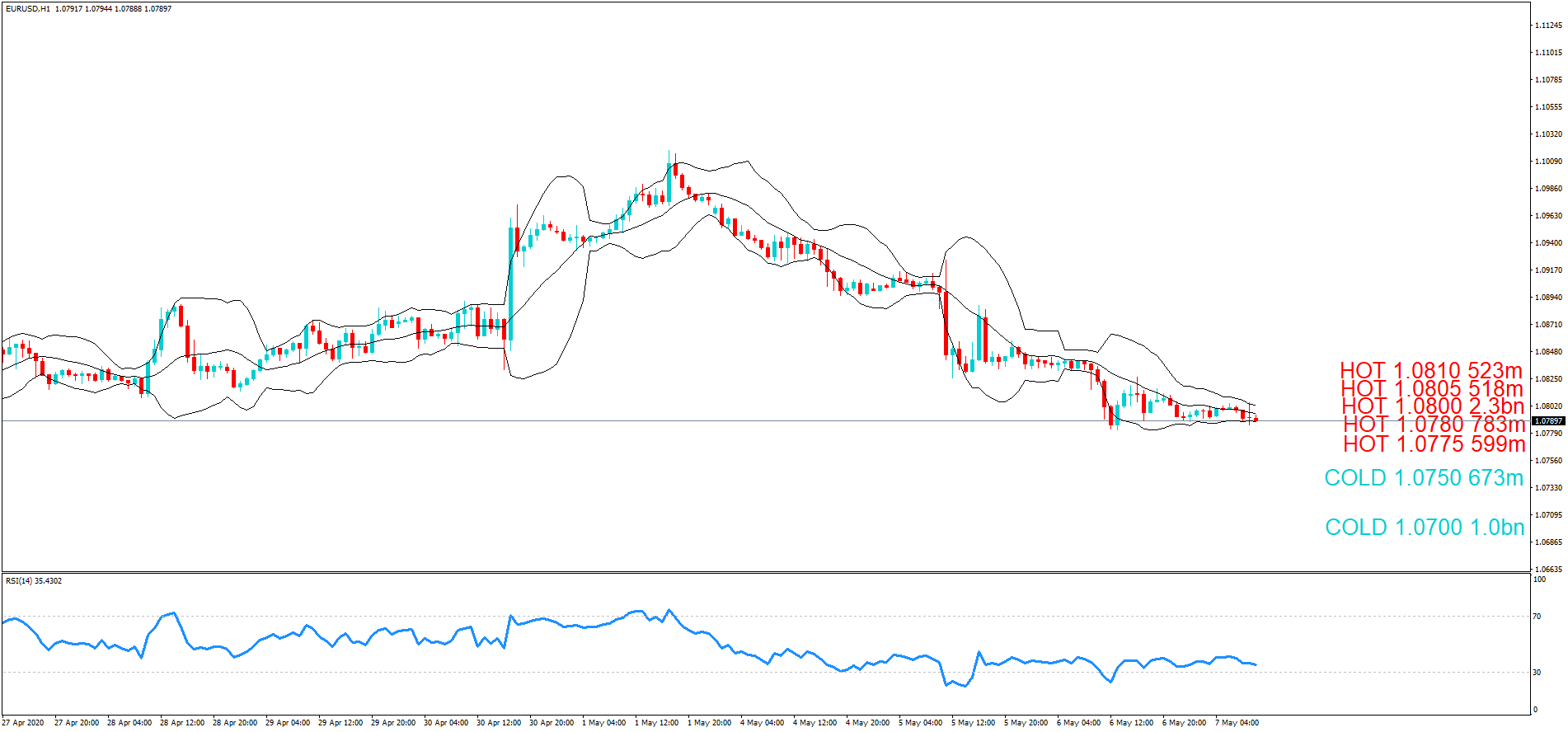

– EUR/USD: EUR amounts

- 1.0700 1.0bn

- 1.0750 673m

- 1.0775 599m

- 1.0780 783m

- 1.0800 2.3bn

- 1.0805 518m

- 1.0810 523m

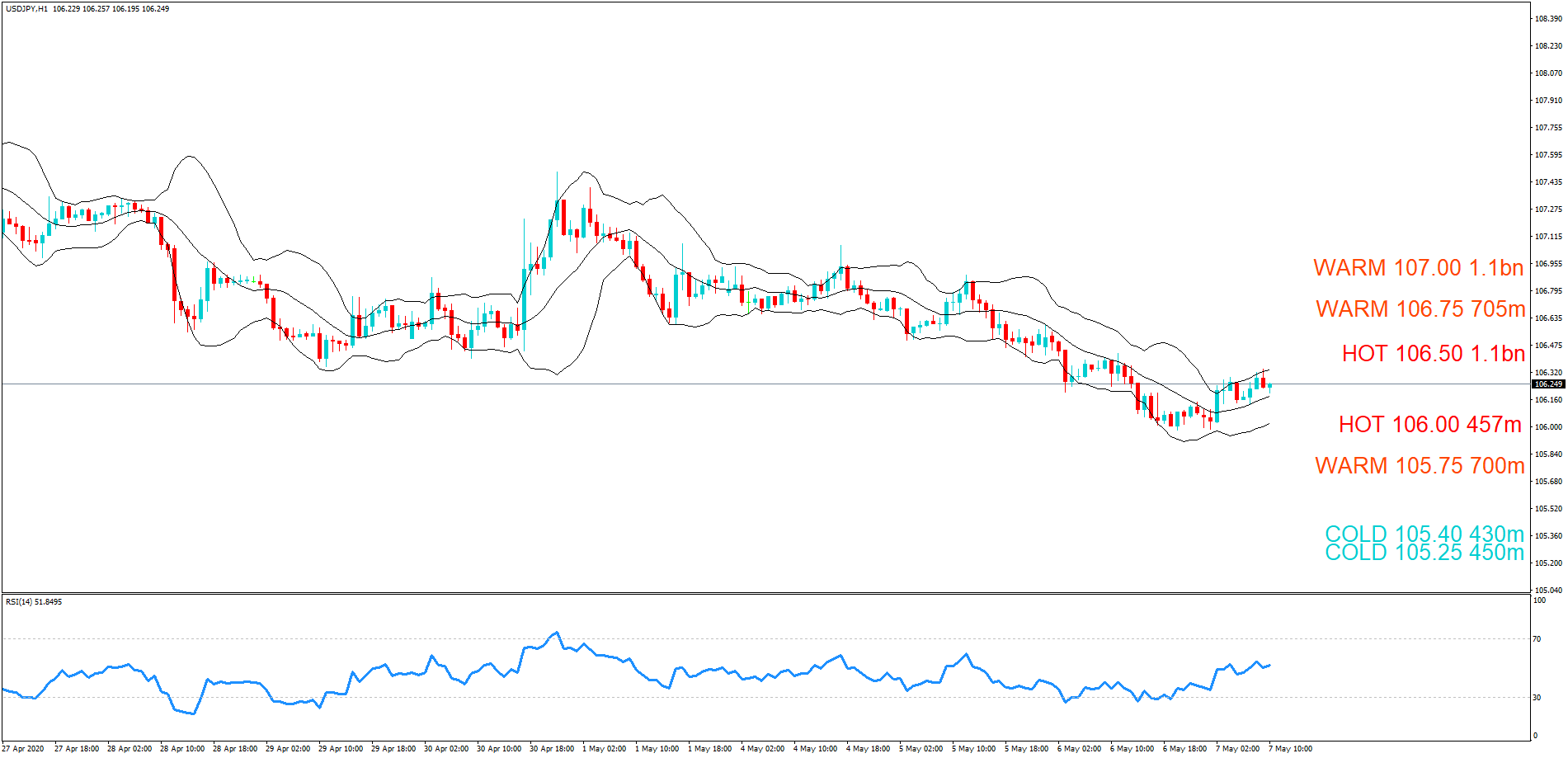

– USD/JPY: USD amounts

- 105.25 450m

- 105.40 430m

- 105.75 700m

- 106.00 457m

- 106.50 1.1bn

- 106.75 705m

- 107.00 1.1bn

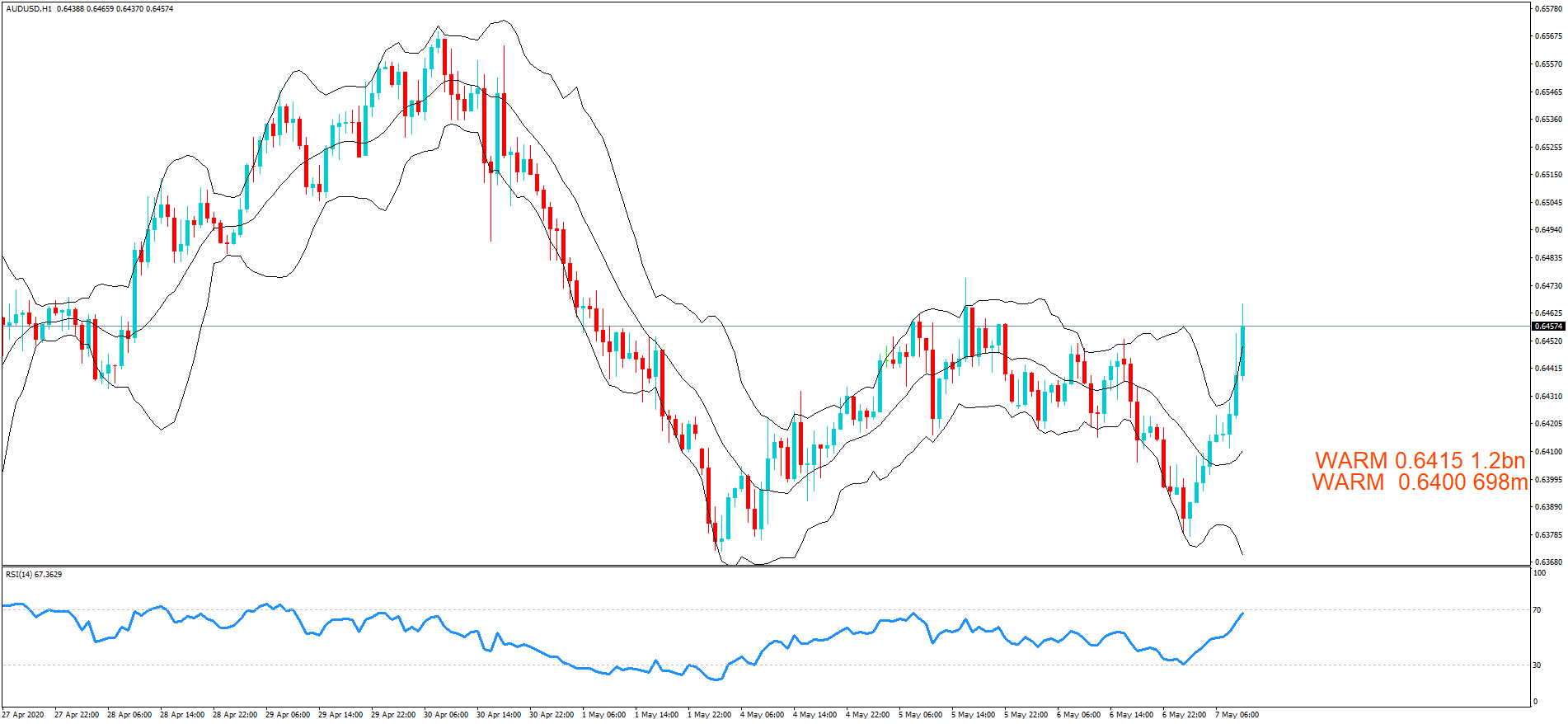

– AUD/USD: AUD amounts

- 0.6400 698m

- 0.6415 1.2bn

………………………………………………………………………………………………………………

If you want to learn how forex option expiries affect price action in the spot FX market see our educational article by clicking here: https://bit.ly/2VR2Nji

DISCLAIMER: Please note that this information is for educational purposes. Also, heat levels may change throughout the day in line with the exchange rate fluctuations due to technical analysis trading and upcoming economic data releases of the associated pairs.