FX option expiries for Apr 29, NY cut at 10:00 Eastern Time, via DTCC, can be found below.

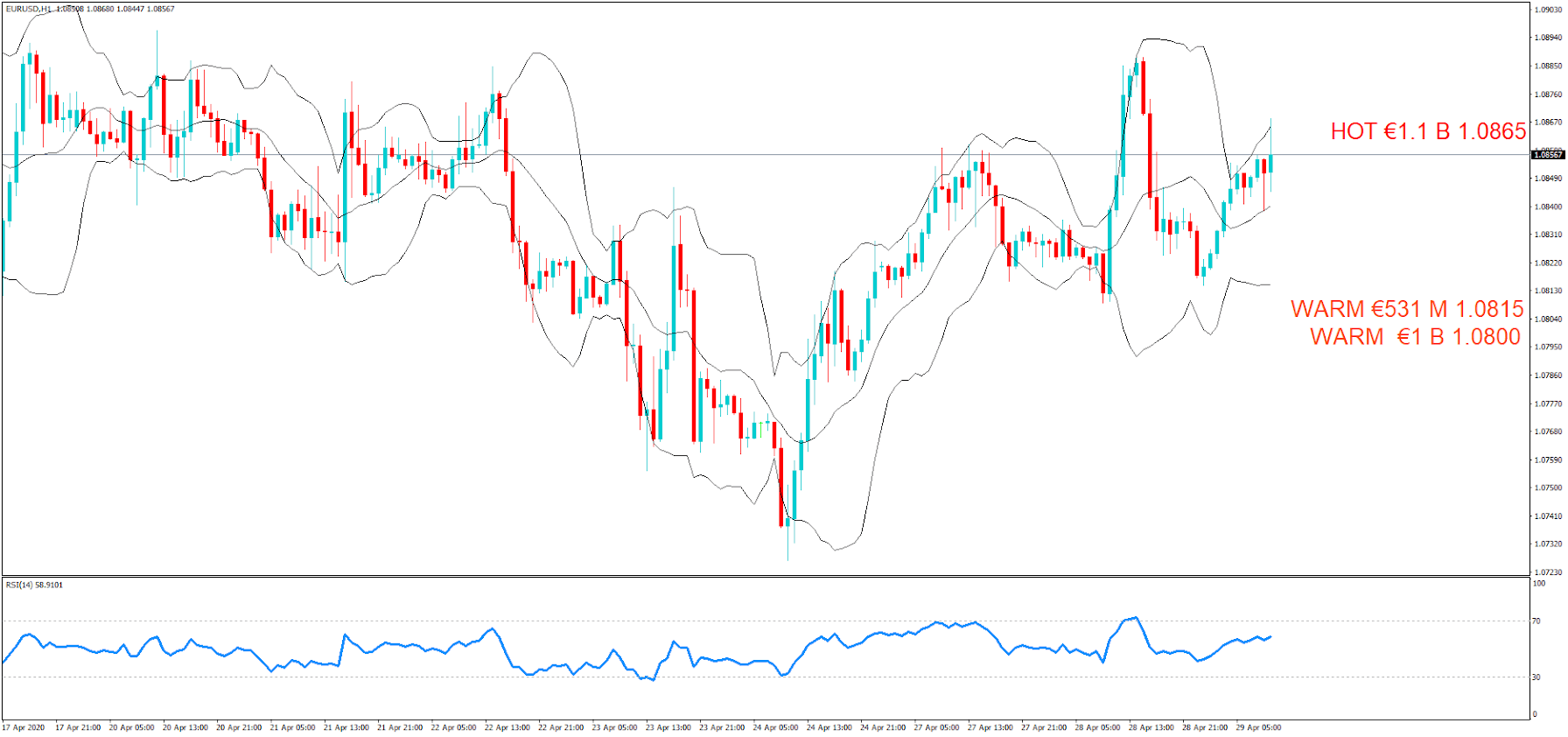

– EUR/USD: EUR amounts

• 1.0800 1.0bn

• 1.0815 531m

• 1.0865 1.1bn

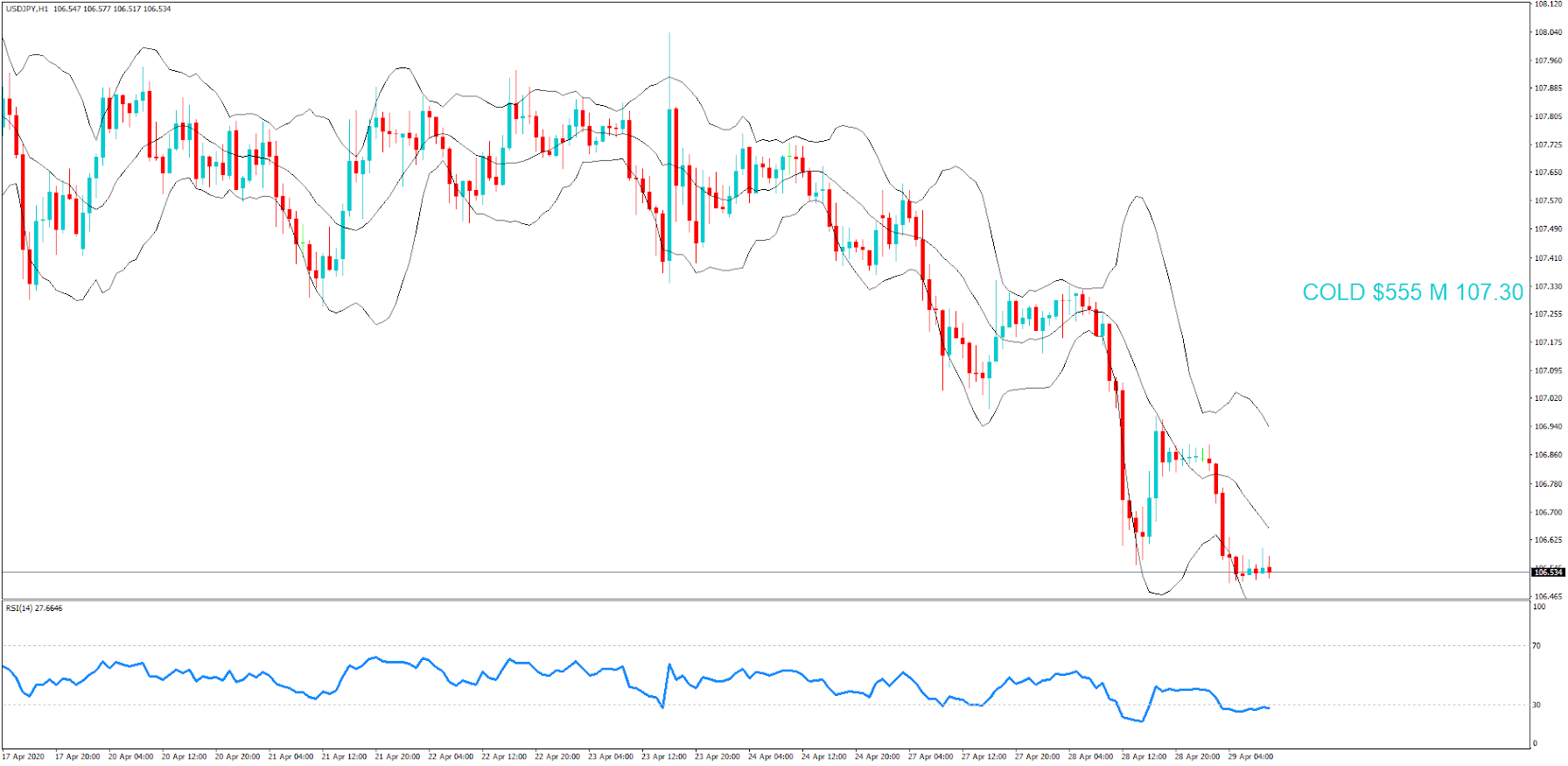

– USD/JPY: USD amounts

• 107.30 555m

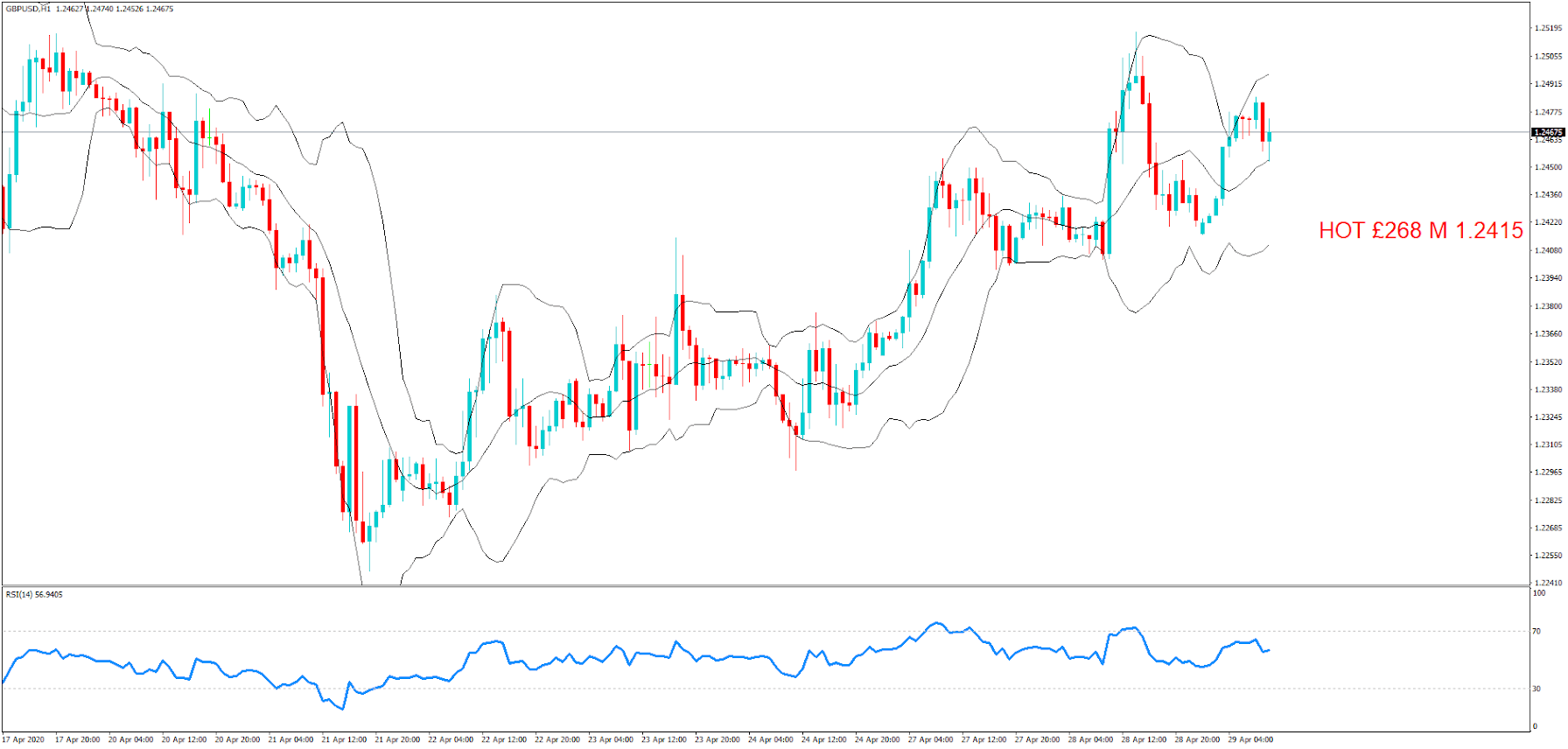

– GBP/USD: GBP amounts • 1.2415 268m

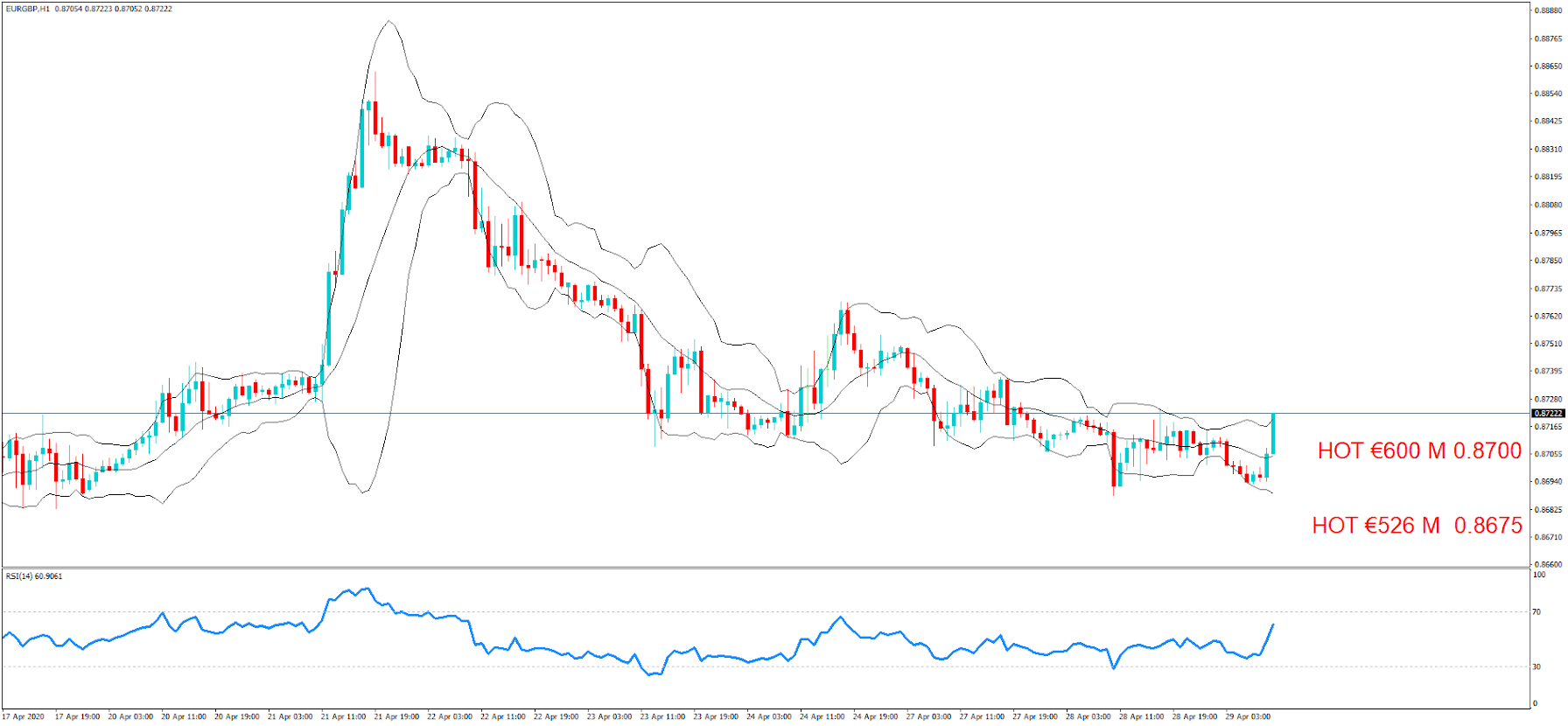

– EUR/GBP: EUR amounts

• 0.8675 526m

• 0.8700 600m

Hello everybody and thank you for joining us for the daily FX expiries briefing video for the 10 am New York cut today. If it is your first time with us, the FX currency options market runs in tandem with the spot FX market, but where traders typically place Call and Put trades on the future value of a currency exchange rate and these futures contracts typically run from 1 day to weeks, or months.

Each day we bring you details of the notable FX option expiries where they have an accumulative value of a minimum of $100M + and where quite often these institutional size expiries can act as a magnet for price action in the Spot FX arena leading up to the 10 a.m. cut.

We will also plot the levels on to the relevant charts at the various exchange rates where there are due to expire, and also identify the levels which are in play, and where we believe there is a greater chance of the expiry maturing based on technical analysis at the time of writing, we will label them as hot, warm or cold.

So today, we have Option Expires for the EURUSD, one of which is considered Hot at 1.0865 in the amount of €1.1bn. This is very much in the money with price action currently very close to the strike rate.

We also have Warm strikes at 1.0815 for €531m and 1.0865 for €1.1bn

Also, there is also an Option expiring for the USDJPY pair at 107.30 for $555M, however, although this is currently cold, as price action on our one hour chart is gravitating to the downside currently.

Moving on to the GBPUSD, we have one notable strike, which is in the money and labeled Hot on our 1-hour chart at 1.2415 for £268M. Price has been very volatile for the pair but looks to be running out of steam to the upside at the time of writing.

Finally, we have two hot ones for you in EURGBP at 0.8675 for €526 M and 0.8700 in €600M. Price action is in a downward channel on our one hour chart.

We suggest you take the levels and plot them onto your own trading charts and incorporate the information into your own trading methodology in order to use the information to your advantage.

Remember, the higher the amount, the larger the gravitational pull towards the exchange rate maturity at 10:00 AM Eastern time.

For a detailed explanation of FX options and how they affect price action in the spot forex market, please follow the link to our educational video.