Description

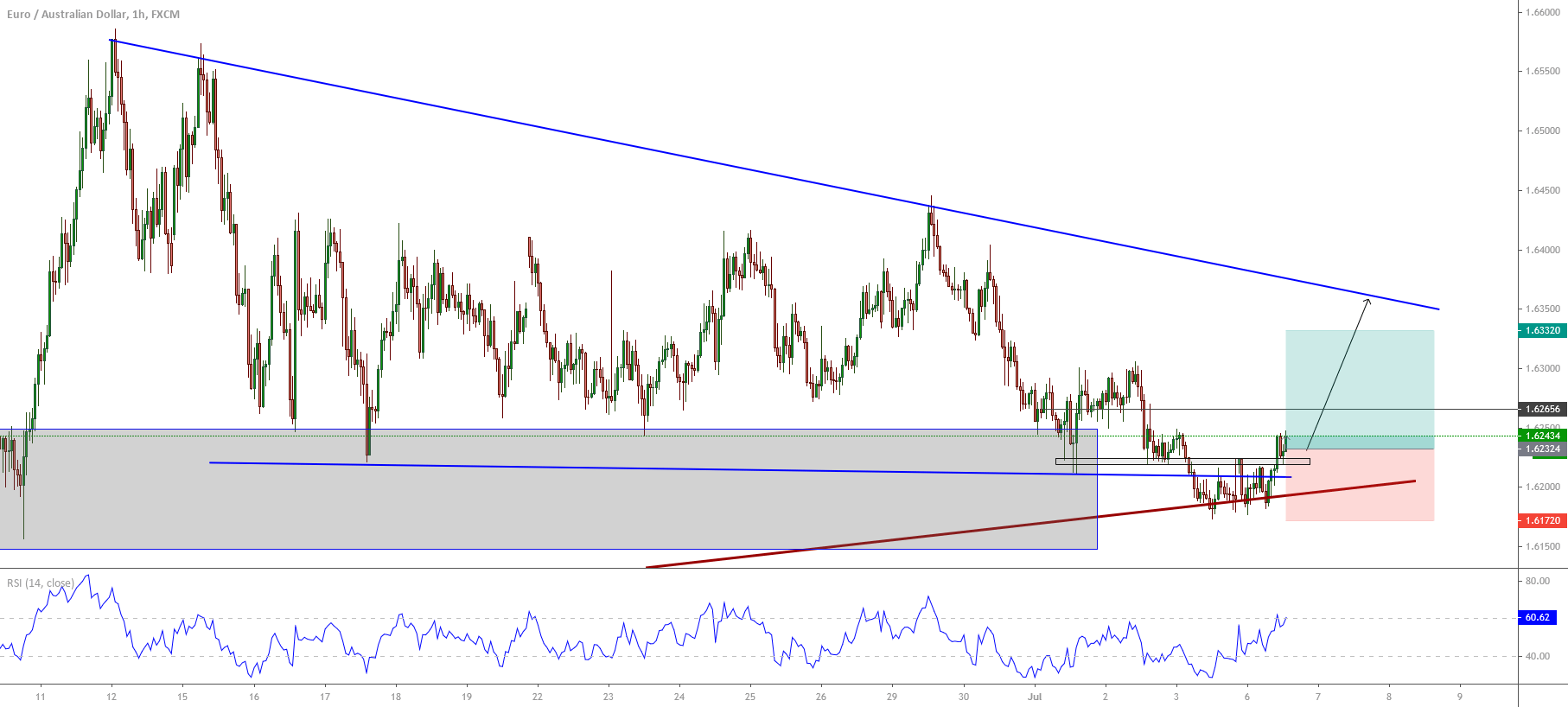

The EURAUD cross in its hourly chart illustrates the bounce developed by the price after the breakout of the previous intraday resistance at 1.6223. This upward movement makes us expect more raises in the following trading sessions.

The short-term picture exposes the price action developed by the cross, which reacted mostly bullish from the ascending mid-term trendline surpassing the high of the July 05th session at 1.6223. This bullish movement leads us to observe strength signals which could support the price until the upper line of the mid-term descending trendline.

The reflecting candle left by the EURAUD cross over the pivot level at 1.6223 confirms the possibility of upsides on the current trading session. In this context, a potential rally could drive the price action until the 1.6332 level, which coincides with the June 30th intraday support.

The invalidation level of our bullish outlook locates at 1.6172, which corresponds to the lowest level of the trading session.

Chart

Trading Plan Summary

- Entry Level: 1.6231

- Protective Stop: 1.6171

- Profit Target: 1.6331

- Risk/Reward Ratio: 1.67

- Position Size: 0.01 lot per $1,000 in trading account.