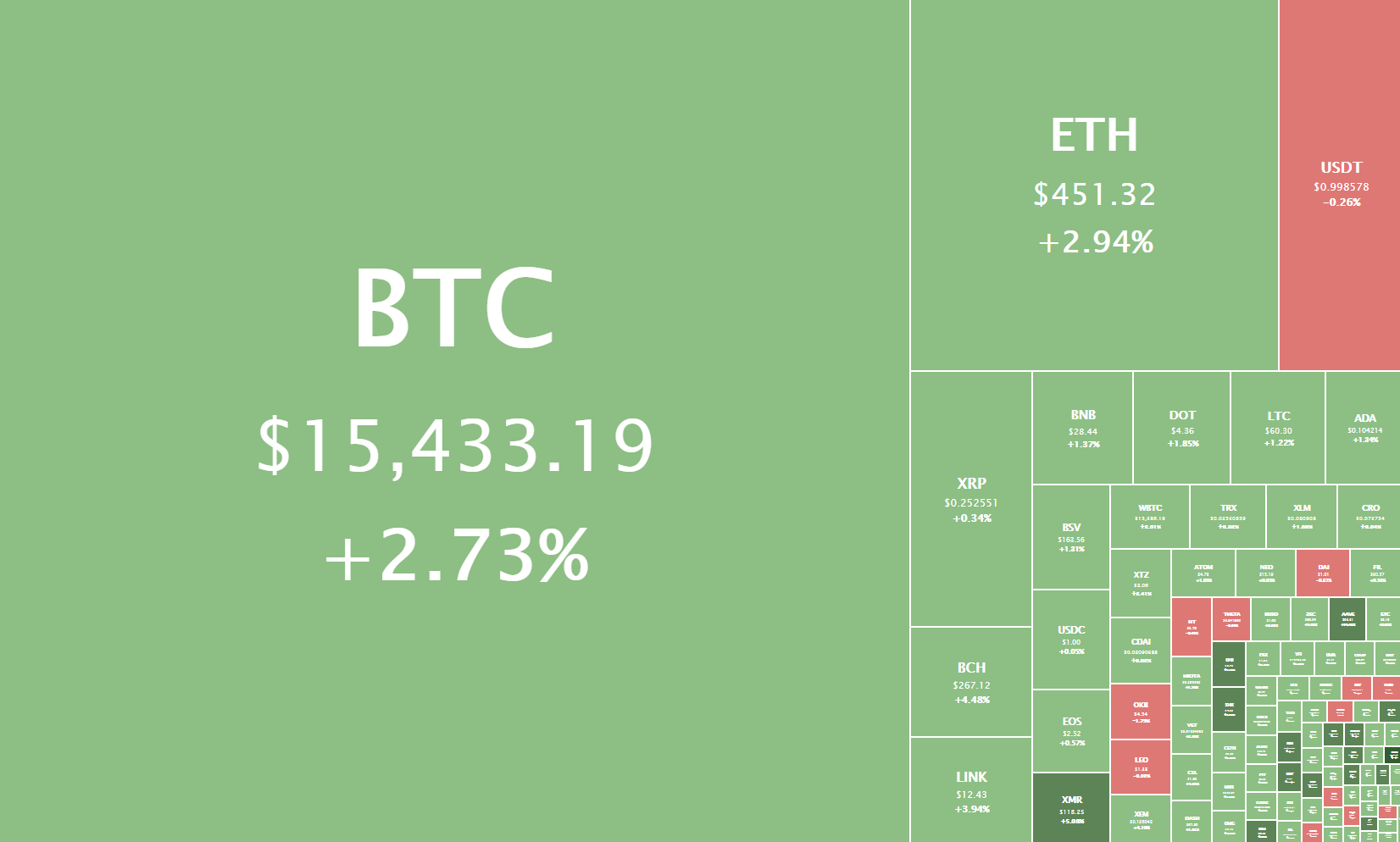

The cryptocurrency sector has spent the weekend trying to recover and regain previous highs after most cryptocurrencies briefly dropped in price due to the election uncertainty. The most recent spike was triggered by the end of the US presidential elections, which caused mass uncertainty in the markets, as well as by now-President Biden hiring pro-crypto Gary Gensler as a member of his team. The largest cryptocurrency by market cap is currently trading for $15,433, representing an increase of 2.73% on the day. Meanwhile, Ethereum gained 2.94% on the day, while XRP gained 0.34%.

Daily Crypto Sector Heat Map

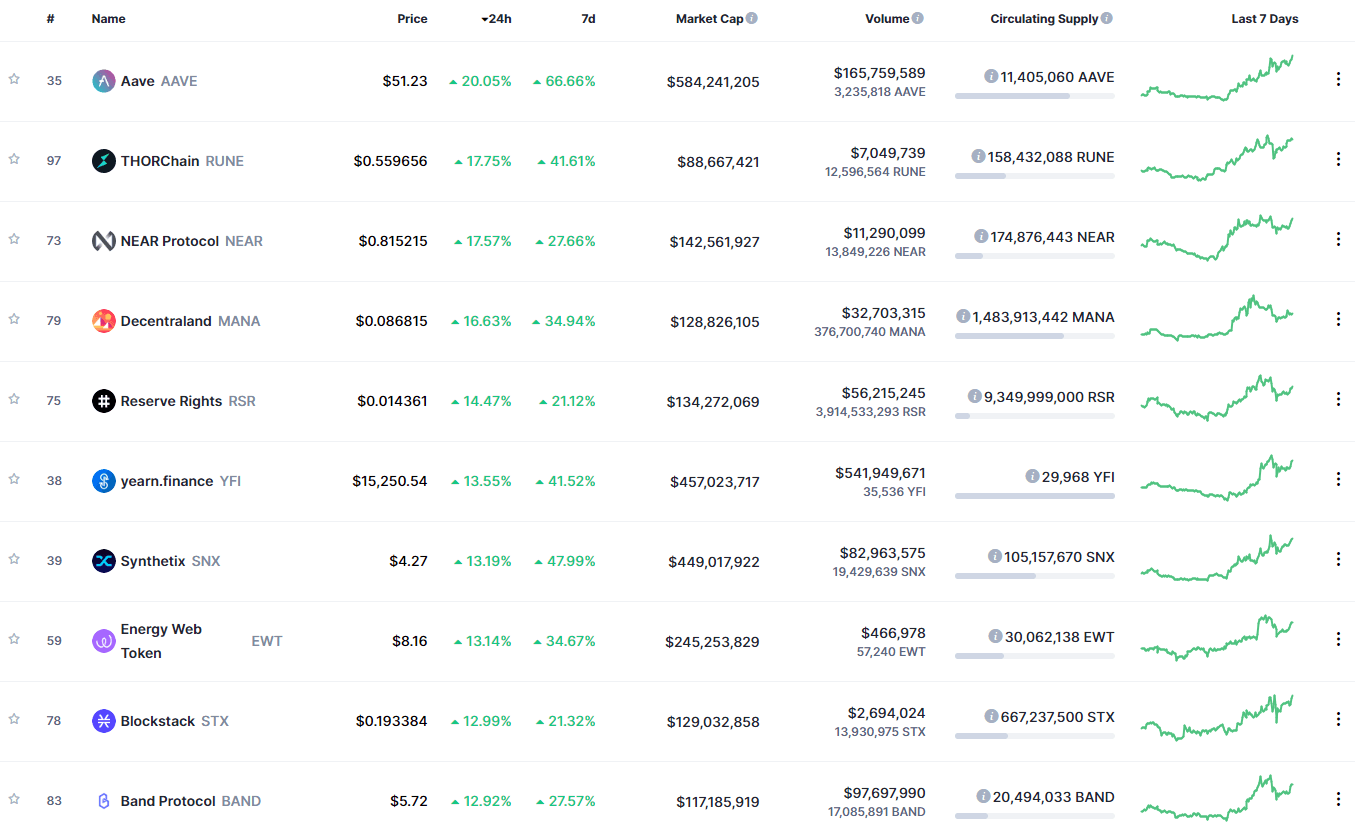

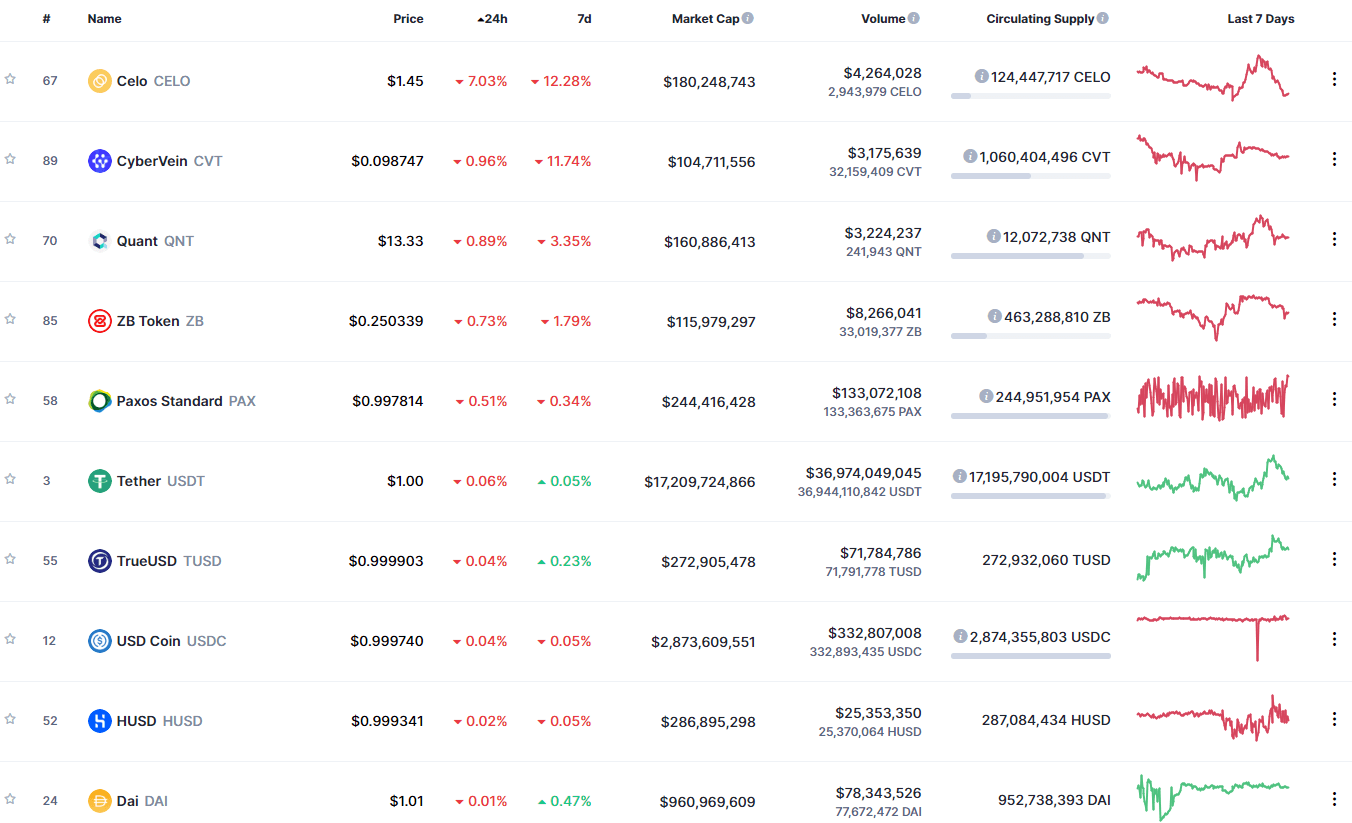

Aave gained 20.05% in the past 24 hours, making it the most prominent daily gainer out of the top100 cryptos ranked by market capitalization. It is closely followed by THORChain’s gain of 17.75% and NEAR Protocol’s 17.57% gain. On the other hand, Celo lost 7.03%, making it the most prominent daily loser. The rest of the cryptocurrencies barely suffered any losses in the past 24 hours.

Top 10 24-hour Performers (Click to enlarge)

Bottom 10 24-hour Performers (Click to enlarge)

Bitcoin’s market dominance has decreased slightly since we last reported, with its value is currently staying at 64.3%. This value represents a 1% difference to the downside compared to the value it had on Friday.

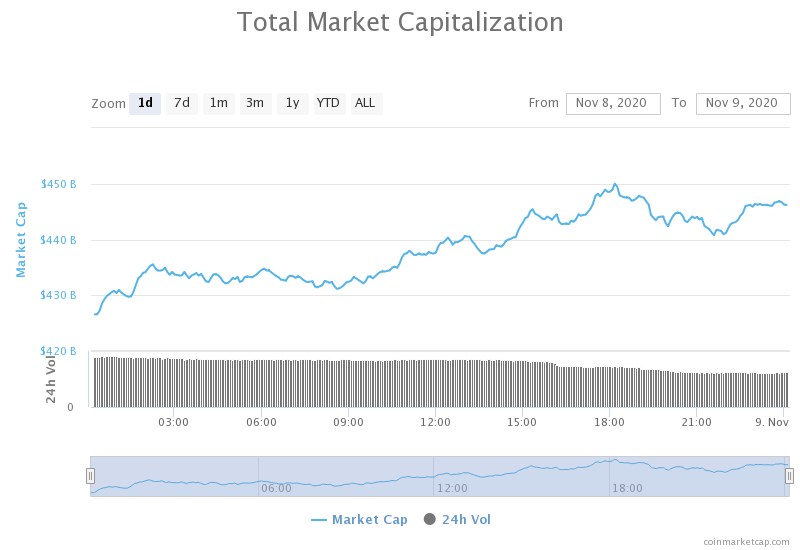

Daily Crypto Market Cap Chart

The crypto sector capitalization has gone up slightly over the weekend. Its current value is $446.21 billion, representing a $4.85 billion increase compared to our previous report.

_______________________________________________________________________

What happened in the past 24 hours?

_______________________________________________________________________

- Crypto Impact Unclear After Joe Biden Unseats Donald Trump as Next US President (Coindesk)

- Crypto Long & Short: Bitcoin Gets Ready for a New Type of Hedge (Coindesk)

- Legitimate volume on spot crypto exchanges fell to $125.8 billion in October (The Block)

- The U.S. government owns $1b in Bitcoin—and some don’t think they should sell it (Cryptoslate)

- ySqueeze: the effort that helped to drive Yearn.finance (YFI) 140% higher in 36 hours (Cryptoslate)

- Nouriel “Dr. Doom” Roubini admits Bitcoin is a “partial” store of value (Cryptoslate)

- Once $80-million privacy crypto Grin comes under 51% attack (Cryptoslate)

- New Addresses Joining Cardano Jumps 202%, ADA Takes Aim at Yearly Highs (Cryptobriefing)

- Cred Files for Bankruptcy Following Fraud Incident (Cryptobriefing)

- Crypto ATMs continue to boom globally in 2020 (Cointelegraph)

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

The largest cryptocurrency by market capitalization has entered a state of uncertainty due to how close the US presidential election process was, and even had a brief drop due to less crypto-friendly Joe Biden winning. However, a new announcement regarding Biden hiring crypto-friendly advisors, as well as general stabilization of the political sphere, has triggered a spike in both stocks and Bitcoin.

Bitcoin has, after a brief drop below the yellow ascending line, come back above it, but only slightly as the move to the upside was stopped by the $15,420-$15,480 level.

Traders should wait for Bitcoin to “decide” whether it will go above $15,480 or below $15,420 and trade off of that.

BTC/USD 4-hour Chart

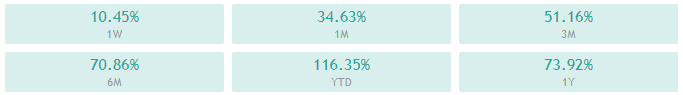

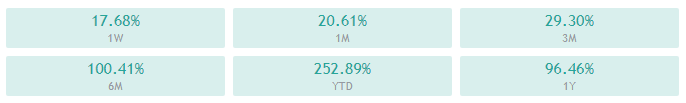

Bitcoin’s technicals are bullish on all time-frames, with smaller time-frames showing a bit of neutrality and longer time-frames being completely bullish.

BTC/USD 1-day Technicals

Technical factors (4-hour Chart):

- Price is above both its 50-period EMA and its 21-period EMA

- Price is at its middle Bollinger band

- RSI is neutral (60.66)

- Volume is slightly elevated

Key levels to the upside Key levels to the downside

1: $15,480 1: $14,640

2: $16,665 2: $14,100

3: $17,260 3: $13,900

Ethereum

Ethereum has had an amazing weekend, with its price skyrocketing past the top line of the ascending channel. While most analysts thought that the second-largest cryptocurrency by market cap couldn’t get back above this line after the Nov 7 drop, Ethereum has proven them wrong and went above $450.

However, the immediate area above $450 is a zone of strong resistance, and Ethereum traders have to watch out how they enter trades here. The safest pick when it comes to trading Ethereum right now would be “riding the wave” towards the upside when ETH decides to spike.

ETH/USD 4-hour Chart

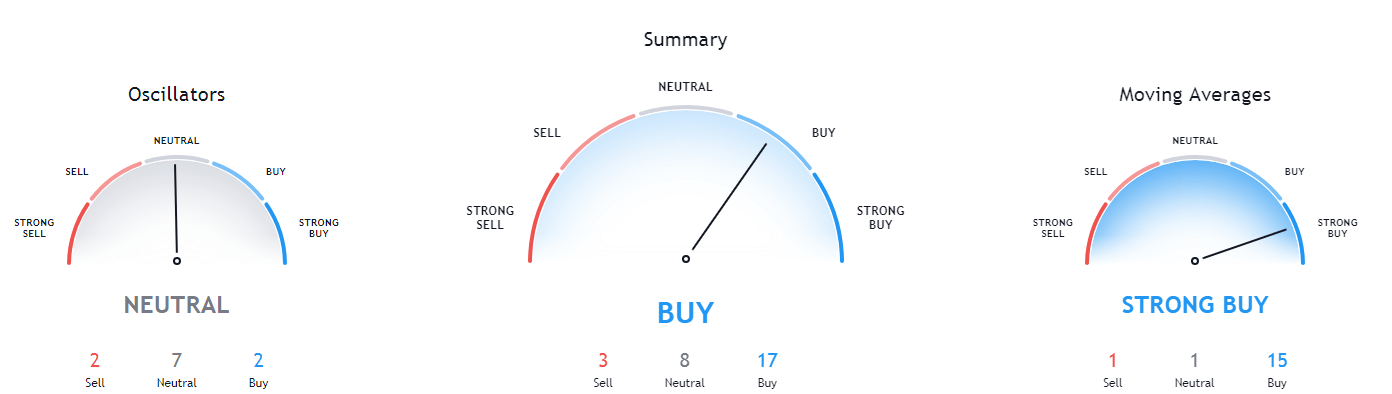

Ethereum’s technicals are almost completely neutral on the 4-hour and daily time-frames, while its longer time-frames are heavily tilted towards the buy-side.

ETH/USD 1-day Technicals

Technical Factors (4-hour Chart):

- The price is above both its 50-period and its 21-period EMA

- Price slightly above its middle Bollinger band

- RSI is neutral (62.07)

- Volume is elevated

Key levels to the upside Key levels to the downside

1: $451 1: $445

2: $470 2: $420

3: $490 3: $415

Ripple

The fourth-largest cryptocurrency by market cap had ended its ascension on Nov 7, when most cryptocurrencies dropped heavily in price. However, while most cryptos managed to get back near its previous highs, XRP failed to do so. It is currently trading in a wide range between $0.2454 and $0.26, after stopping its upward move at the ~$0.256 level.

Traders can consider trading XRP’s sideways movement as the volume is now reduced, and the possibility of a strong move is low. However, if such a move does happen, it could be easily predicted due to XRP’s current position.

XRP/USD 4-hour Chart

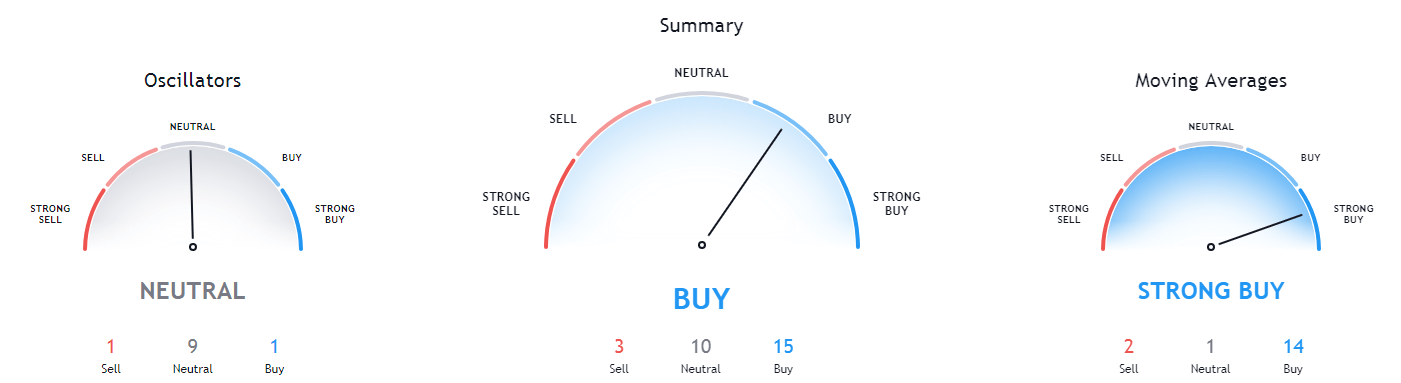

XRP’s technicals on the 4-hour, daily, and weekly slightly bullish, with some hints of neutrality. Its monthly overview, however, is still tilted towards the sell-side.

XRP/USD 1-day Technicals

Technical factors (4-hour Chart):

- The price slightly above its 50-period EMA and at its 21-period EMA

- Price is slightly below its middle Bollinger band

- RSI is neutral (53.59)

- Volume is average

Key levels to the upside Key levels to the downside

1: $0.26 1: $0.2454

2: $0.266 2: $0.235

3: $0.27 3: $0.227