The cryptocurrency market took a small price blow in the past 24 hours. Most cryptocurrencies ended up being in the red due to no significant buying volume coming into the markets. If we take a look at the past 24 hours, Bitcoin went down 2.96%, and it is now trading at $8,187. Ethereum gained 2.68%, while XRP went down 2.55%.

Of the top100 cryptocurrencies by market cap, the biggest gainer is MMO coin, with 1,083.20% daily gain. The biggest loser of the day was ZB, which lost 13.72% of its value.

Bitcoin’s dominance remained at the same place from the last time we checked the markets. Its dominance now sits at 65.75%.

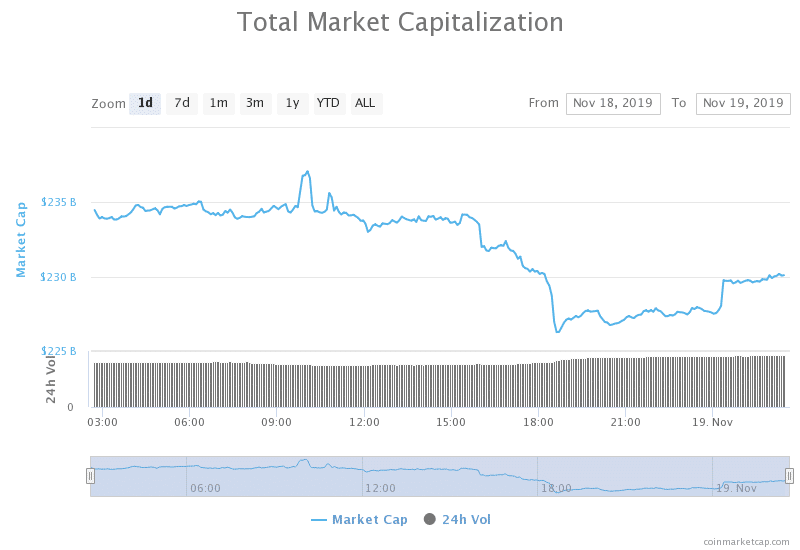

The cryptocurrency market as a whole now has a market capitalization of $229.89 billion, which represents a slight decrease when compared to the value it had yesterday.

What happened in the past 24 hours

A senior agency official announced that criminal investigators at the IRS were focused on implementing taxation on users of cryptocurrency kiosks and ATMs.

“If you can walk in, put cash in and get Bitcoin out, obviously we’re interested potentially in the person using the kiosk and what the source of the funds is, but also in the operators of the kiosks.” – said the IRS criminal investigation chief John Fort.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

Bitcoin had yet another failed attempt at going past the $8,640 resistance. At one point, the volume increased and everything pointed to Bitcoin crossing the resistance. However, that did not happen and Bitcoin’s price started to fall down as the bears kicked in. Its price went all the way down to $8,000 but quickly rose up to $8,150, which is the price Bitcoin is currently at.

Bitcoin’s volume has been gradually increasing during the day as the attempt to pass the resistance started to happen. However, the most significant volume increase was the candle where Bitcoin fell from $8,430 to $8,005.

The critical level of $8,000 has been added as the price respected this support line.

Key levels to the upside Key levels to the downside

1: $8,640 1: $8,425

2: $8,820 2: $8,000

3: $9,120

Ethereum

Ethereum broke another support key level. The price anchored to the $178.6 key support level and seemed to have stabilized there. However, today’s bear presence brought its price down just below $178.6. Ethereum is still struggling to decide whether the price will remain above this line or end up below it.

The key level of $178.6 moved to the upside as the price went below it.

Key levels to the upside Key levels to the downside

1: 178.6 1: $167.8

2: $185

3: $193.5

XRP

XRP is currently stuck in a price limbo. As it fell below its major support of $0.266, it had no clear support lines to anchor to for a couple of days now. With the first major key support level being $0.245, XRP is now roaming freely between this level and the $0.266 level, which now became resistance. XRP had quite of a red day in the past 24 hours, falling all the way down to $0.242 but quickly returning to its range and now trading at $0.252.

The key levels remain the same as they were before the weekend as XRP didn’t pass any key levels up or down.

Key levels to the upside Key levels to the downside

1: $0.266 1: $0.245

2: $0.285

3: $0.31