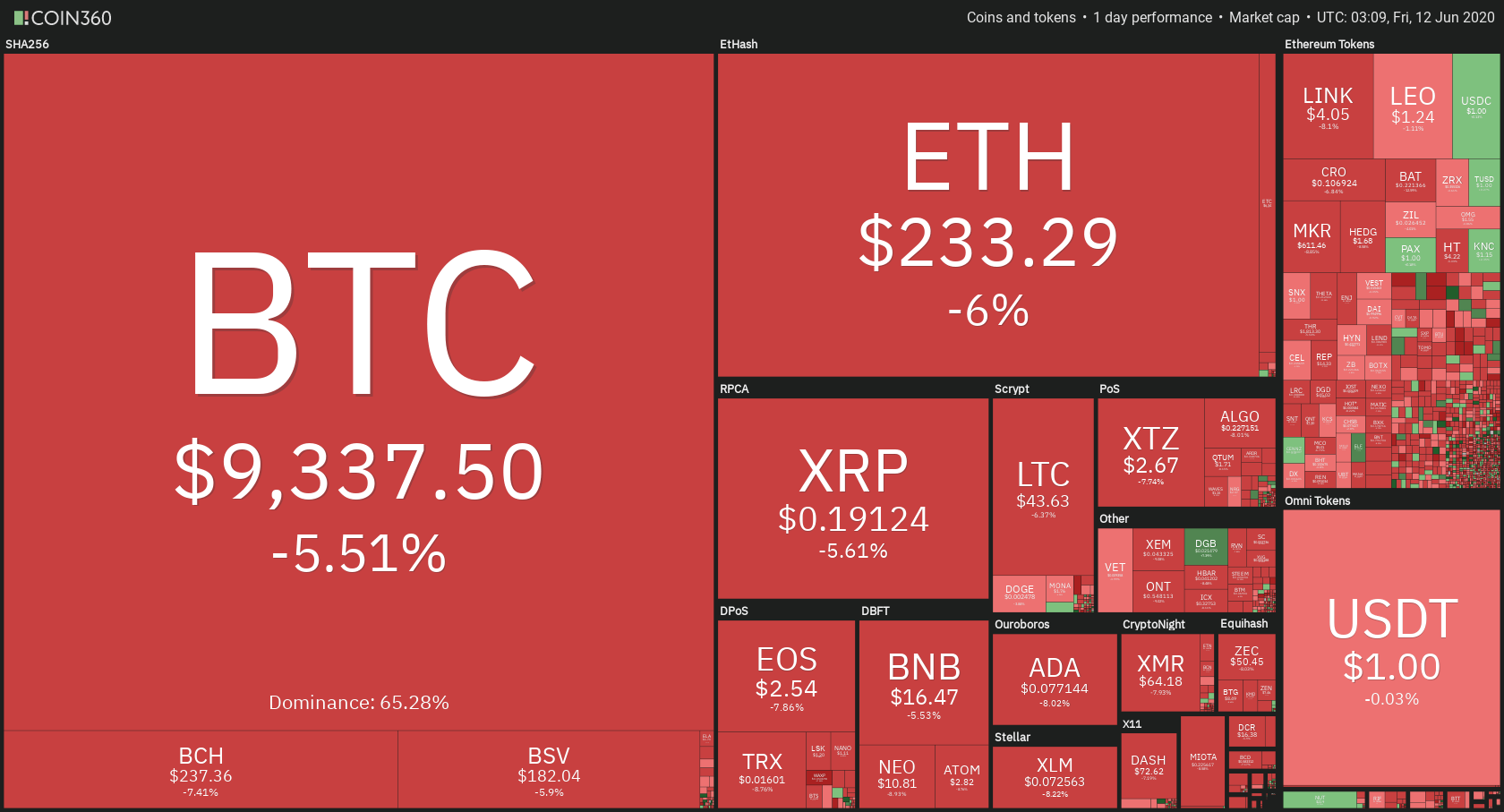

The crypto market has plunged over the course of the day, bringing the overall crypto market to a two-week low point. Bitcoin is currently trading for $9,337, which represents a decrease of 5.51% on the day. Meanwhile, Ethereum lost 6% on the day, while XRP lost 5.61%.

DigiByte took the position of today’s biggest daily gainer, with gains of 5.14%. Loopring lost 20.86% of its daily value, making it the most prominent daily loser.

Bitcoin’s dominance stayed at the same place since we last reported, with its value currently at 65.28%. This value represents a 0.6% difference to the downside when compared to yesterday’s value.

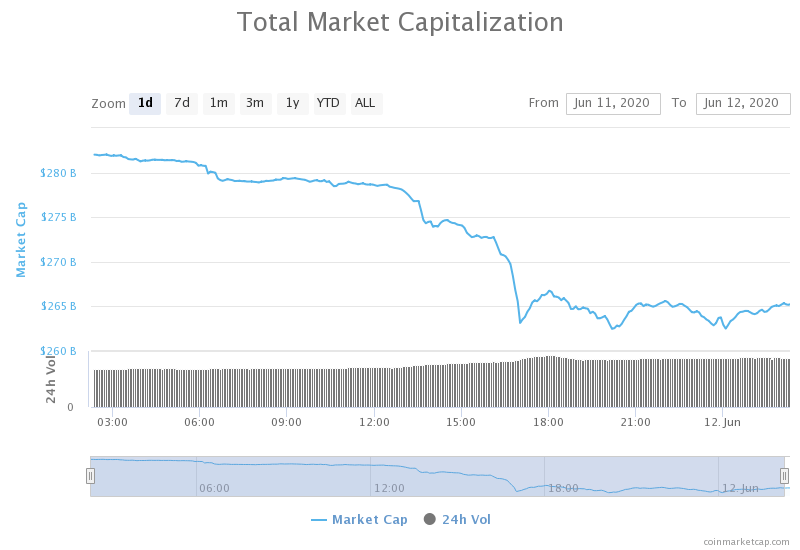

The cryptocurrency market capitalization decreased greatly over the course of the day, with the market’s current value being $264.51 billion. This value represents a decrease of $16.72 billion when compared to the value it had yesterday.

What happened in the past 24 hours

500 Crypto Companies in Estonia losing their permits

Estonia is one of the European Union’s most crypto-friendly countries when it comes to regulation. However, due to the $220 billion scandal regarding money laundering through crypto, Estonia started cracking down on many licensed cryptocurrency companies. So far, over 500 companies have lost their permits.

Honorable Mention

Cryptocurrency exchange powerhouse Binance has just launched a new Bitcoin futures product. The launch came through despite institutional investors visibly showing uncertainty about the future of cryptocurrencies.

In a blog post that came directly from Binance on June 11, the company revealed its quarterly futures contracts product is going live. The first contracts will have a settlement due in September.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

The largest cryptocurrency by market capitalization has spent the day plunging to its two-week lows, falling as low as $9,070. The $9,251 line has, however, held up, and BTC is now consolidating above it. The downward-facing move should be over for now as RSI stepped into oversold while the volume faded.

Bitcoin’s volume increased multiple-fold over the course of the price dump but has since returned to its average levels.

Key levels to the upside Key levels to the downside

1: $9,580 1: $9,251

2: $9,735 2: $9,120

3: $9,870 3: $8,980

Ethereum

Ethereum followed Bitcoin’s initiative to move towards the downside and fell as low as $225. However, the $225.4 support line held up and stopped the move from going any further. Ethereum has recovered slightly and is now trading at a $233 level.

Ethereum’s volume increased drastically during the peak of the move but has since returned to normal. Its RSI level has entered the oversold territory but has (again) returned above it once the pressure faded.

Key levels to the upside Key levels to the downside

1: $240 1: $225.4

2: $251.4 2: $217.6

3: $260 3: $198

Ripple

XRP did not stray away from other cryptocurrencies in terms of market direction. The third-largest cryptocurrency by market cap has broken the range it was trading in for a long time as it fell below the $0.2 support level. The downward-facing move reached $0.184 before going up. XRP is still trying to find equilibrium and a place to consolidate at, and it is still uncertain whether that will be above or below the $0.19 level.

Key levels to the upside Key levels to the downside

1: $0.2 1: $0.19

2: $0.205 2: $0.178

3: $0.214