Introduction

In our previous articles, we presented the introductory concepts to design, create, test, optimize, and evaluate a trading system. In this section, we will be using a practical example of the development process of a trading system.

Starting to Build the Trading System

In his work, Robert Pardo exposes a seven-step methodology that must be followed to develop a trading system. These steps are as follows:

- Formulate the trading strategy.

- Write the rules in a precise form.

- Test the trading strategy.

- Optimize the trading strategy.

- Trade the strategy.

- Monitor the trading performance and compare it to test performance.

- Improve and refine the trading strategy.

Picking a Trading Strategy

A trading system starts with an investment idea that could arise from a publication in a specialized trading site or another related source. In our case under study, we are going to develop a trading strategy based on the Turtle Traders.

Our reader must consider that the process applies to any other strategy.

The Turtle Trading System Rules

The Turtle System uses the following set of rules:

- Timeframe: Daily range.

- Entry:

- Richard Dennis defined two systems; the first one corresponds to a short-term strategy considering the 20-day breakout. In parallel, He added a long-term system using the 55-day breakout. In our system, we will be conservative and use the long-term strategy based on the 55-day breakout.

- Stop Loss: The stop loss should be placed a the distance corresponding to one time the Average True Range (ATR) of the 20 days.

- Exit: The system developed by Richard Dennis doesn’t consider a specific take-profit level as it happens with some chartist patterns. Instead, Dennis defines the exit criterion after the price moves against the position for a 10-day and a 20-day breakout. For long positions, the exit will be a 20-day low, and for short positions will correspond to 20-day high. However, to simplify our system, we will consider a profit target level at one 20-day Average True Range distance (1 20-ATR).

- Position Size: The size will correspond to 1% of the capital available in the trading account.

- Adding Positions: For educational purposes, we will not consider increasing the positioning criterion.

Charting the Turtle Trading System

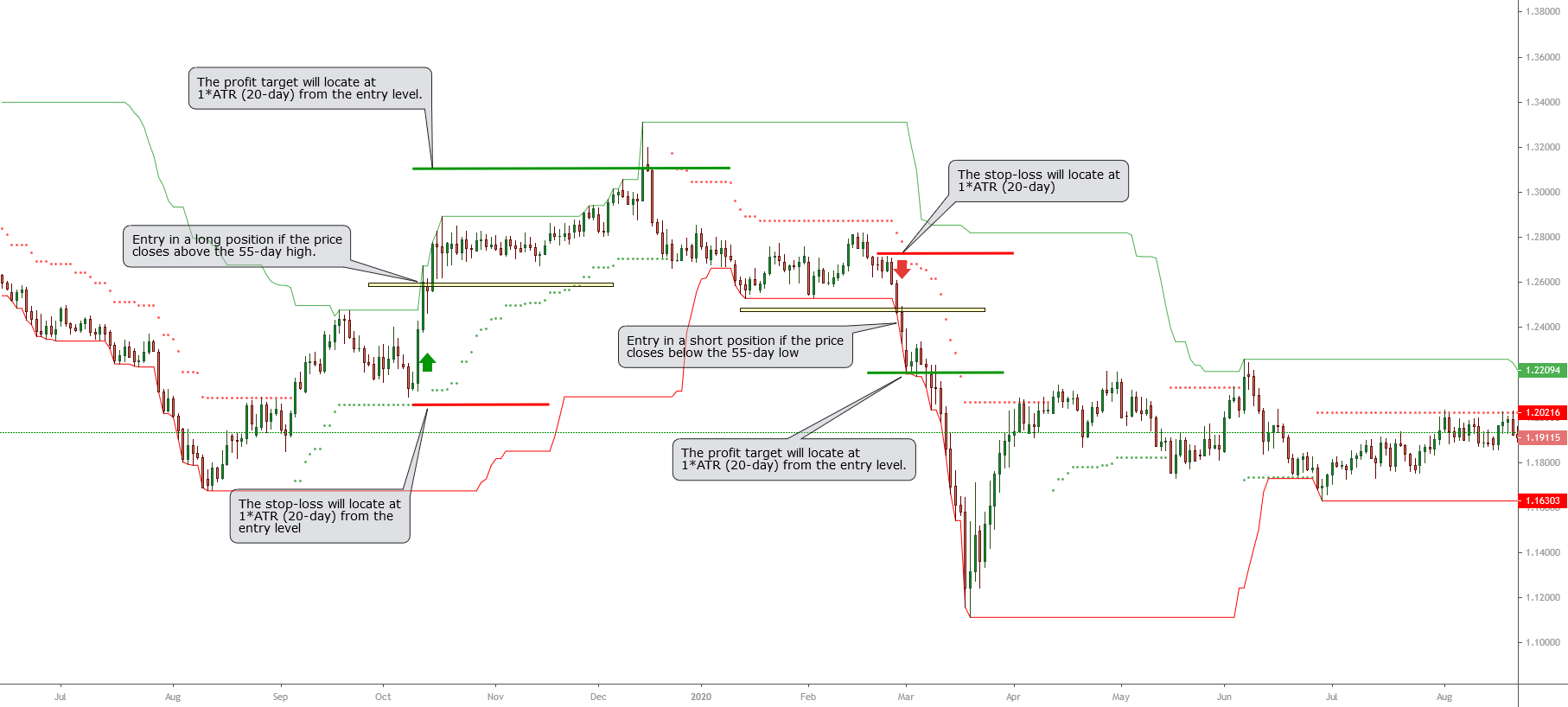

As a way to visualize what our first version of the trading system should do, we will illustrate the strategy on a chart for both long and short positions.

In the previous figure, we can observe the set of rules for the entry, stop-loss, and profit-target. The rule of position sizing will correspond to 1% of capital in the trading account.

Conclusions

In this first part, we identified a trading strategy and specified a set of rules corresponding to what the system should do. In the next educational article, we will start to transform the ideas into a set of instructions.

Suggested Readings

- Jaekle, U., Tomasini, E.; Trading Systems: A New Approach to System Development and Portfolio Optimisation; Harriman House Ltd.; 1st Edition (2009).

- Pardo, R.; Design, Testing, and Optimization of Trading Systems; John Wiley & Sons; 1st Edition (1992).

- Faith, C. M.; Way of the Turtle. New York: McGraw-Hill; 1st Edition (2007).

Conclusions

Suggested Readings

- Jaekle, U., Tomasini, E.; Trading Systems: A New Approach to System Development and Portfolio Optimisation; Harriman House Ltd.; 1st Edition (2009).