Ichimoku is a popular indicator made by Japanese experts decades ago, yet, as with other products made in Japan, it is still usable today. It is a composite indicator with several elements that are made to ensure high probability signals. However, some prop traders analyzed each element separately to determine if their roles are performing well. This article will explain the elements, describe the default way of using it, and present two beginner-friendly strategies useable right away. Ichimoku can be used in many different ways, it is far more complex than Moving Averages opening the doors for many interpretations and strategies.

Indicator Theories

There are many theories about the indicator, going very deep in its meaning even creating exclusive fan trader groups. To beginners, this might be overwhelming and unnecessary to know. The opinions presented here about the indicator and its elements are just for reference, your trading and decisions should be your own. A lot of research was done by traders about Ichimoku summarized in this article, giving you a good starting point in understanding the trend following strategies.

If you are a beginner, then definitely you do not need to concern yourself with the mathematical background of each element, what they account in measurements, history, MA names translations, and so on. Practical application is what matters in the end, your end balance, and other, theoretical information is not going to add value at this point. Therefore, we will focus on what you do to use Ichimoku effectively in two ways.

Indicator Elements

This indicator has five different parts. They can be grouped by their action. Moving Average crossovers is the dominant category. Two Moving Averages, Tenkan-San and Kijun-Sen are fast and slow MAs that generate the main trend confirmation signal. These do not move smoothly as classic MAs, they have their calculations causing this, but this is not a con. A second category also has two elements that make the Ichimoku Cloud – Senkou Span A and B. The cloud is a filter. It represents an area of lower quality signals generated by the fast and slow MA crossovers, therefore you should not trade.

If the price is above or below the cloud, you are safe to take the MA crossover signals. Some traders complicate the role of could elements, paying attention to the width, slope, and so on, but this is unnecessary. The last piece is the Chikou Span. This element does not have an obvious, clear role. Some traders use it while others just do not see where it fits. When you test an indicator or experiment, you try to give some meaning to it in conjunction with the price action, taking various patterns as a signal in some way. Imagination can take you to see a pattern but testing will prove if that idea is consistent and worthy. However, the factor Chinkou Span represents can be worthy or not to you.

Kumo Cloud

Let’s start with the Kumo Cloud part. Ichimoku is already integrated into the MT4/5 platform by default, no need to install it from other sources. The image below is showing only the Ichimoku cloud without the other elements on the tradingview.com platform. Note that the USD (USD index) is inside the cloud after a rally in a long downtrend, each candle is one day. This moment is not good for trading the USD in any currency pair since the price is in the cloud. So Ichimoku has a filter, a rare element in an indicator. For beginner traders, this is very important. When we first start trading forex, we take all the signals we can from an indicator, even though we know not all are going to be good. We also do not know which one is fake and we do not have any money management plan. Ichimoku is showing you how to discipline yourself and wait for high probability trades, a very important lesson when creating your first system and a trading plan.

There are other ways to use the cloud but for now, we will stick with its filtering role. The cloud color change and switches are some other signals that are also going to be analyzed in another article about this indicator. Now, the Kumo Cloud has another function, not only does it tell you to stop trading that pair or asset, but it also tells you to trade only in one direction if the price is not inside it. Therefore, you enter only short trade signals if the price is below the cloud and only long if above. Now, because of these rules, a lot of your trades are not going to be eligible. Suddenly, trading you used to know as fun is becoming boring. It is now a waiting game. If you are a trader looking for fun, excitement, forex will not give you that for free. If making money is exciting to you, this waiting game for high probability trades sounds great, but do not get emotional when losing streaks come. When you get a bit more experienced, you can try to trade signals inside the cloud at half the risk you normally would. The trading system can get more advanced as you build it to the point even these trade entries end up good enough.

Trade Entries

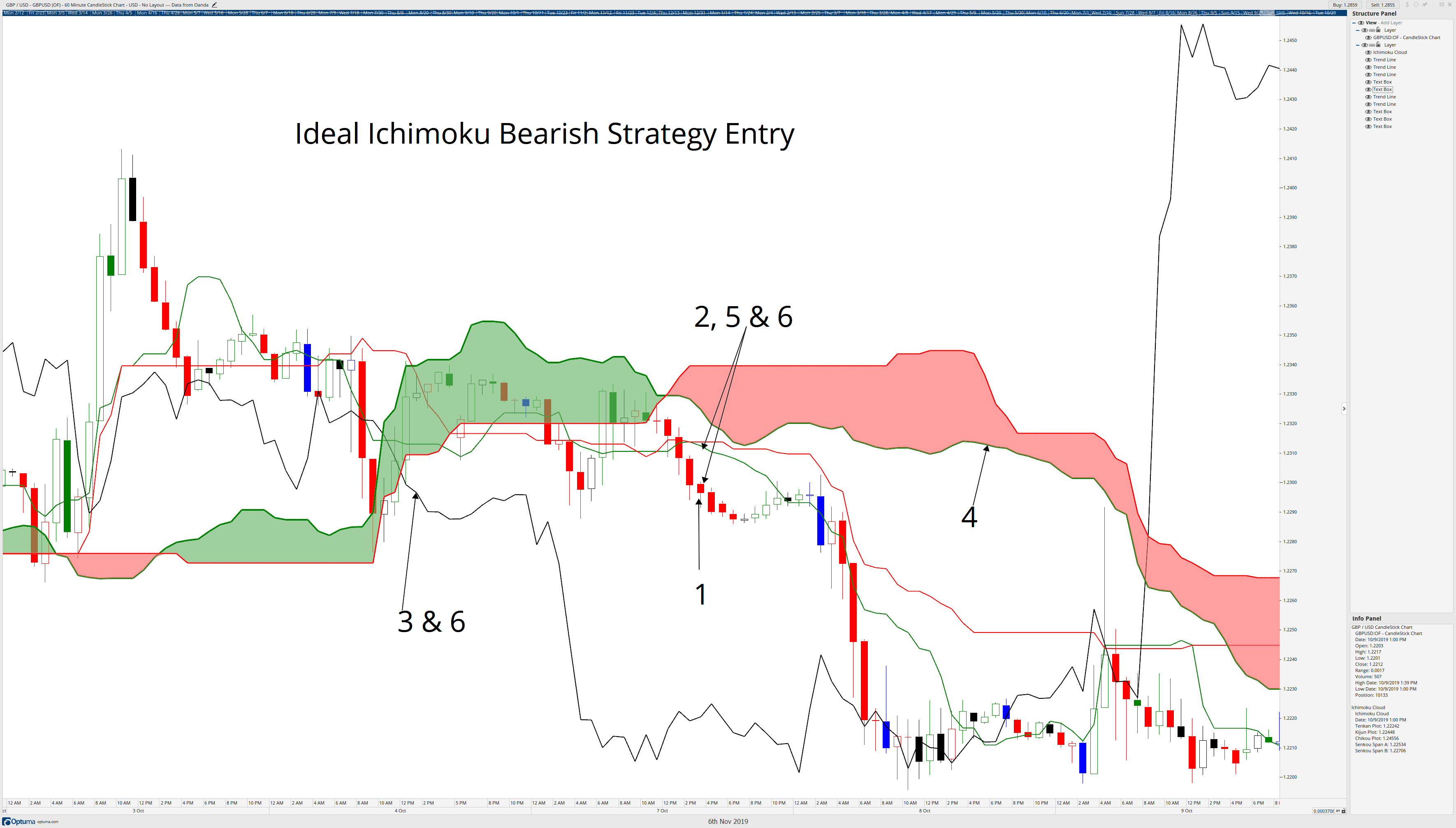

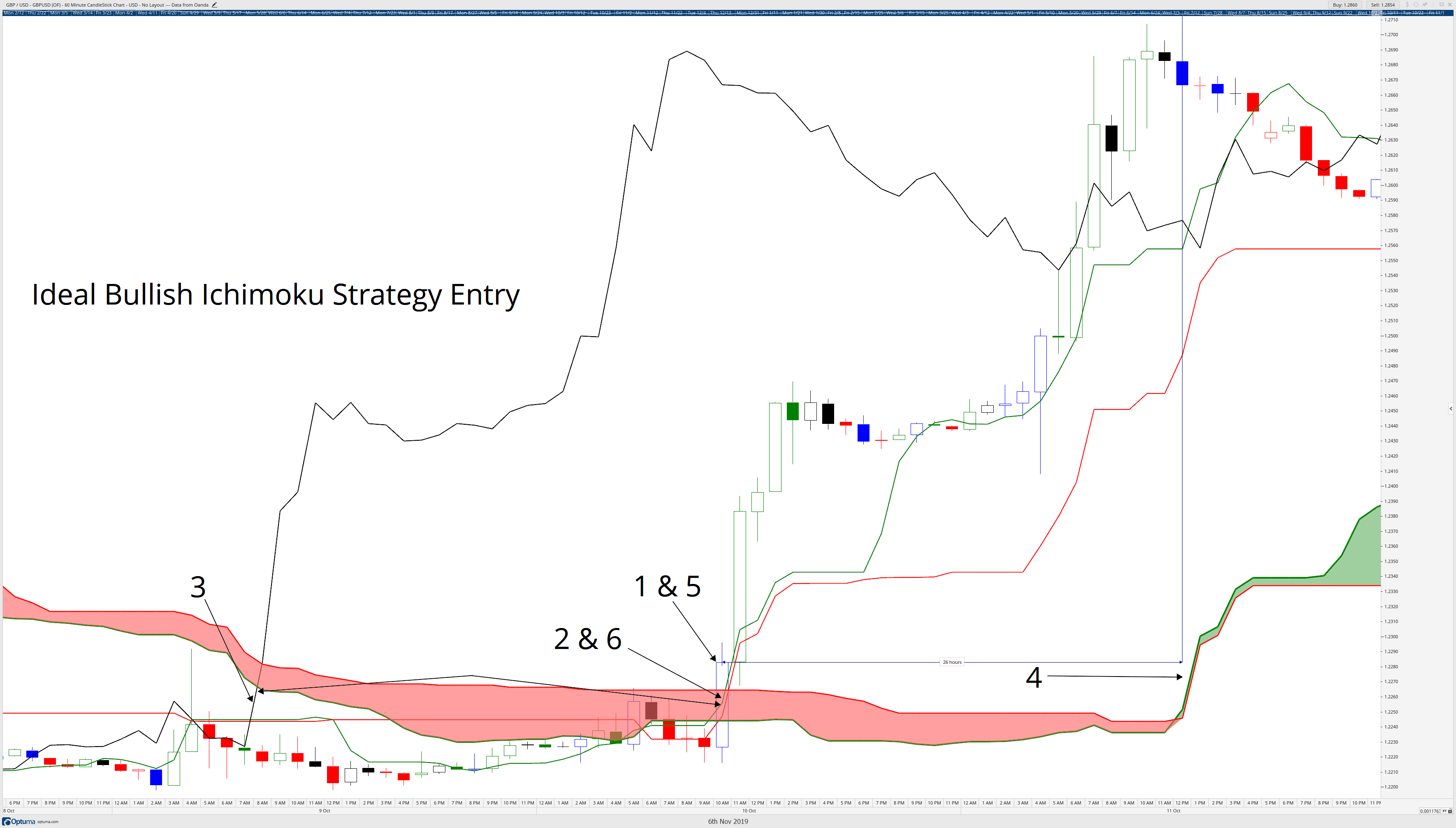

Talking about the trade entries, Ichimoku has an interesting MAs crossover solution but also price combo signals. In the picture below we have the same chart but with the Tenkan-San and Kijun-Sen present. We have added arrows for entry signals and exit markers when the MAs crossed back again. As you can see, we have only traded short trades once the price broke out the Kumo Cloud down, ignoring all long signals – when the faster blue MA crossed the slower orange MA up. All signals gave us successful trades if we are to short the USD with the best-performing currencies in this period.

Even though we are using the USD Index, you can apply any asset here. Ichimoku settings are by default. Train your discipline by following the signals to the letter including the rules of the cloud. Add on money management, where you put your Stop Loss and Take Profit, and how big are your positions. After this practice, your understanding of trends and trading will sip into your mindset. Now, every system you come up with will have these values in the core, your ascension to a professional level is now not in question.

Put this Ichimoku trading strategy to all 28 currency pairs having the major 8, test all signals on a demo account, see if it works. If you keep it on a daily timeframe, the signals will be more consistent but you will have to trade for a longer time.

Money Management

Money management is one of the top priorities in trading, above technical systems like Ichimoku. If you are struggling to create one, this indicator can also help you with that. For simplicity’s sake, you can always set your risk per trade to 1% of the account balance. Stop Loss placement can be put on the slower Ichimoku MA at the moment of the trade entry. When you are winning, if you wait for the faster MA to cross the other the exit might not be optimal. A better position can be when the price crosses the faster MA. This can also be your Take Profit in a form of a trailing stop. In the picture below we see Ichimoku in action on a daily EUR/USD chart.

Added arrows mark the moment when the price broke out of the cloud and when the MAs had a long signal. This trend lasted for about 10 days until the price closed below the fast blue Ichimoku MA. We have marked this moment with a cross, here you exit a position. If you were to exit when the MAs cross again you would take considerable drawdown risk, even though the position would have been a bit better on both long trades. The second long trade is a continuation. MAs crossed again and we have a green light to enter. This trend was even better. Ichimoku is not only an effective tool but also a great teacher of trading. As a bonus, it spurs ideas on how you interpret patterns into signals. You are probably thinking about using the slower MA as the exit moment instead of the faster, or look for a signal when the MAs broke out of the cloud. All of these are legitimate options. At the end of the day, you need to test them all. Still, have in mind improving technical analysis is not your priority, money management rules and psychology is.

Chikou Span

The final element of the Ichimoku and the most mysterious is the Chikou Span. The line lags 26 periods, it is not drawn at the current period, it is shifted. It represents the exact price action except it is shifted back 26 periods, it is not a Moving Average. Chikou Span’s classic use is as a filter. When the line is in the cloud, 26 periods before, you do not enter a trade if there is a signal currently.

In the picture below we have Gold on a daily with a complete Ichimoku indicator on default settings. The usual MA cross gives us a signal to short the Gold, the price went out of the cloud and the Chikou Span line colored black is also out of the cloud. We have everything set up to short here, the entry moment is marked with an arrow, and the Chikou Span is checked.

Chikou Span can also sometimes be above the cloud when you have a short signal. This is also a case when signals are filtered. Sometimes this filter can cause you to miss good trends and sometimes it keeps you out of fake signals. Some traders do not see it as an effective tool while others rely on it every time. Again, what every trader needs to do is test it out. Not only every trader is different and has different systems, but also they trade different assets, some of which Chikou Span is a very useful filter. This element can be interpreted in your own way, you do not have to blindly follow classic views.

A Final Word

Ichimoku is fantastic for beginners. It has money management levels, filters, effective confirmation elements, and trains discipline. Furthermore, the ideas that it can spur create motivation to dive deep into forex trading. Just take caution not to get overexcited, when you meet a losing streak your morale can take a hit to avert you from trading completely. Since Ichimoku is already integrated into the MT4, there is no effort barrier to start trading the right way.

Do not think if you trade Ichimoku only will get you to the professional level. You will have results, but beginners need to understand that having a break-even result at the end of the year is a success. Most traders are bust because of bad money management (if any) and no discipline, while Ichimoku traders have learned how to stay above. The rules you set before testing are permanent. Think about how do you want to use the elements of this indicator, if the Chikou Span is good enough, where are your Take Profit and Stop Loss levels, how much to risk, how will you measure volume or volatility since Ichimoku does not cover this category, and so on.

Set everything up and then start executing without deviations. After testing is done, analyze your trades, try to cut the losers first with some measure or a tool, and then try to catch more winners with other methods. This indicator has so many traders and there are so many methods to use it. Some professional traders just use one or two elements and add other tools that improve on it, creating a unique system. The second Ichimoku article will present other aspects of this indicator you can also take and apply to your trading right away.