Hello and Welcome to this latest installment of on-demand courses by Forex.Academy. In this particular course, we’ll be unveiling the mysteries behind Candlestick Formations, outlining how they can be used to supplement the training decisions of technical traders. Just before we begin, please do take a quick moment to read through the disclaimer and note the financial risks which are involved in trading the financial markets. Please do feel free to pause this recording so that you are familiar with our disclaimer, and we shall proceed to go through exactly what is involved in this particular course. Hopefully, you’ve had an opportunity to go through this.

Right, let’s look now at the course outline. What we do is we pride ourselves on blending theory with practice. What we look at is the display of price information in itself. We’ll introduce you to what’s called Japanese candlesticks. We’ll look at the history of those candlesticks and the origins. We don’t need to break down into quite considerable detail in terms of the anatomy of a Japanese candlestick, we’ll look at how different time frames can impact the information that we as traders use. We’ll look at the different types of Candlestick Formations. And there are many, many different types. They vary from bullish candlesticks to bearish and also neutral candlestick formations as well. Then we’ll look at the link to charting patterns. Obviously, technical trading is identifying patterns of price movement and the purpose of this particular course is to identify the use of Japanese candlesticks within their overall charting picture. It’s important we do link the two. Then we’ll look at some tools that can be used to assist with decision making on a MetaTrader 4 platform. And we’ll finish the theoretical side of this course by looking at the impact that an understanding of Japanese candlesticks can have on your ability to manage risk and therefore protect your capital. We’ll finish as we always do with a session on the practical application of candlestick formations. We do hope you will enjoy that at the end of this course.

Okay. Let’s begin with the display of price information. Price can be displayed in a variety of different ways. Now, some of those ways include originally more of a ticker-tape type of display of price information. For example, there we’ve got the gold. This happens to be the price information of the gold market, and you can see the price is quoted there on the left-hand side, $1333.72, in this case, because it’s backed by the US dollar. And what we can see for the duration of this is that we’re currently on a daily basis, we’re seeing an increase in the price of $15.32. This is an increase of 1.16% in this particular market. That’s just useful information that we, as traders, can look at that information and we can identify right well currently prices moving to the upside, and we can therefore potentially be able to make decisions off the back of that information. Now in addition to the ticker tape, there’s also things like bar charts which gives you very, very simplistic information. Just an example currently up on the screen now, which will, broadly speaking, give you a very basic understanding of entry prices, exit prices, highs, and lows, or should I say open and closed prices along with high and low prices, as well. It’s just a basic form of what we’ll go on to look at in more detail very shortly, which is candlestick formations. In addition to bar charts, we’ve also got line charts. A lot of these different displays of price action can actually effectively give you similar information. But it’s displayed in very, very different ways. And of course, Renko charts as well. There’s pros and cons associated with each of these forms of price information.

I guess the question you need to ask yourself it is which should you choose? In reality, it doesn’t really matter. It is often a personal decision in terms of how you like the information presented to yourself. Now, they all do have pluses and negatives. I won’t necessarily go into the positives and negatives of each particular type. But what is of vital importance is that you can clearly identify the price movements of a chart in line with your own trading strategy. That’s really the important part to take away from this. However, by far, the most commonly used display of price used by traders globally is, without doubt, the Japanese candlestick price chart. That’s the essence of this particular course.

To give you an introduction to Japanese candlestick formations, I’d like to draw your attention to this chart which we’re just going to put up on the screen. Within the nature of this chart, and I just want to just draw your attention to the fact that this is a dollar related daily timeframe as you can see up the top left-hand corner there, and along the x-axis you will find the relevant date associated with the price information currently up on the screen. And, along the y-axis you will find the price movement. What we’re looking at is the price movement over a particular period of time. Now that gives us some fantastic opportunities for technical traders. We can see that the price is, at this particular time frame, is effectively towards the top left of this particular chart. And, we can see what the price is currently at this particular time frame and we can see therefore what is happening to price between those two timeframes. And that this is why technical charting is really useful. Because we can use a number of techniques necessary to get a feeling and understanding for what’s happening to this market.

To just give you a very quick overview, what is clear to see is this market is moving to the downside. We’re in what’s called a bear market. However, this is where our understanding of Japanese candlestick formations can come into its own. Because at every stage within this particular price movement to the downside, the information that’s displayed through price, and as a result, Japanese candlestick formations, can give traders real significant edge in terms of making their trading ideas and executing their trading plan. And that’s really some of the profound benefits that an understanding of Japanese candlestick formations can have. I just want to draw your attention to a specific part of this particular chart. I’ll just bring that up on the screen. Just looking at this particular price action we can see what price action has occurred prior to this point. It’s just largely, I hope you would agree, it’s definitely on the bearish side. Meaning prices are moving to the downside. That’s effectively what we’re seeing. Now, even within this small sample of this price action, we can make certain assessments of what’s going on with this price. We clearly see that as the market moves lower, it then moves into a period of sideways moving consolidation. And we can actually physically see that play out because of our understanding of Japanese candlesticks, where this market really struggles to break above or to break below these levels. And that’s because we’ve got a comprehensive understanding of Japanese candlesticks. But then something really important and significant occurs. I just want to draw your attention to this particular candlestick here where we get a continuation to the downside. And we can see that with volume and momentum pushing prices lower. And it’s price action like that that can give us as traders a real advantage and a real edge in understanding firstly a broader understanding of price movements on a technical price chart. But it’s the use of Japanese candlestick formations that can really give you a significant edge in terms of making decisions when you’re trading these markets. So that’s just a very brief introduction to Japanese candlestick formations, just the basic principle about how they exist within technical charting.

Let’s now just take a couple of steps back and we’ll have a look at the history of Japanese candlesticks. Let’s start at the very beginning. In the early 15th century, the last feudal Japanese military government, which were referred to as the Shogun Tokugawa, unified Japan by pacifying and peacifiying the 60 different ruling Daimyo Feudal Lords. Now, this uniform unification was quite important. What it did was enabled more freedom to be able to trade between the provinces of Japan. To just sort of give you a bit of an image, you know, these this would be a typical image of a Shogun now. That led to some significant developments. What we then saw in the early 16th century was records actually showed that charts were used for the very first time in Japan. And the use of those charts was to record the price movements of the Japanese rice exchanges. Rice was not only the primary dietary staple of the Japanese people, but it was also essential to the Japanese economy because it was used as a unit of exchange also.

It all effectively started with rice. At that particular time, there was as many as 1,300 rice traders working in the Dojima Rice Exchange in Osaka, Japan. And as trade started to develop and volume started to increase, receipts from rice warehouses were accepted as a form of payment, at which particular point the first futures contracts were effectively traded. And that’s quite significant because from this particular era came a very brilliant rice merchant and his name was called Sokyu Honma, or Munehisa Homma for many in India in the West. Munehisa Homma was widely acknowledged as being, and is broadly known as being, the godfather of candlestick charting. Homma himself became such a successful trader that he developed a series of rules which were called the Sakata Constitution.

Now to just touch upon that. When trading the Sakata Constitution, which many, many traders followed, and its Five Methods, traders could now analyse price movements and be able to identify patterns which exist in the financial markets, or in the market of the rice exchange. This would then help them to identify very, very simple trends in the market and therefore increase the chances for increased profits. This is the beauty about technical charting and our understanding of Japanese candlesticks. That is effectively what it allows us to do. Just to conclude this particular session action, you know, the birth of Japanese candlesticks effectively gave traders the ability to extract some very, very useful information which they could then use to make more informed decisions when trading. And it all started with the beautiful rice, as you can see up on screen. That’s just hopefully giving you a comprehensive understanding of the origins of Japanese candlesticks.

Taking that on just a step, I think it’s useful that we do cover the anatomy of a Japanese candlestick. What I’m going to do is just start with what’s called bullish Japanese candlestick. And this simply means that when we see this on a price chart it means that what we’re experiencing is price moving higher, or, price moving to the upside. To isolate one of these Japanese candlesticks, just to show you what it looks like, it would look something similar to what you’re seeing up on-screen on the left-hand side. Now, it has some very, very important characteristics which I do want to elaborate on. The first one, if we just refer to this particular price point down here, and we’re just talking about the bottom edge of this quite large rectangle, the price that’s quoted when we look at Japanese candlesticks, if it’s green in color is actually the open price. And that is really, really significant. All of these candlesticks open and closes at various different times depending on the timeframe that you’re looking at. It’s important to note that each and every candlestick that’s green in color means that prices are moving higher. And it will effectively mean that the open price is at the bottom edge of the rectangle. Let’s just say for argument’s sake, the price at this level is $185. Now let’s also look at another very, very important part of the anatomy of a Japanese candlestick, and this is referred to as the closed price. What we’re talking about is the top edge of a particular Japanese candlestick, and the fact that it’s green in color means it’s bullish. And it’s very important to note that each and every candlestick has what’s called an open price, but also closing price. Whatever time frame you’re looking at, whatever time that particular market closes, it’ll print a particular price. That closing price is quite significant. Let’s just say for argument’s sake we’ve had an increase in price over the course of the day from $185 to $195. We’ve seen a nice explosive move to the upside.

1540

However, there’s two more aspects to a Japanese candlestick, each and every candlestick, that you need to be aware of. And that simply means the first one is that each candlestick will have a high price. Let’s say for example, over the course of this candlestick the price peaked at $200 before pulling back a little bit and then closing at the $195 level. So, it records the high price. And then the final piece of this jigsaw is that each and every candlestick, especially a bullish Japanese candlestick, will have a low price. This is the lowest price that this market will have achieved over the course of this time period. Let’s say the market opened at $185. We had a bit of a pullback initially where prices pulled back to $180 before a nice explosive move to the upside, making a high, and then pulling back to close. That’s effectively, the information that this can give traders is quite profound. It’s very, very useful if we see a candlestick that looks something similar to this, then we would expect a continuation to the upside. That’s the information that it can give us. And the size of this green body is quite significant, and it will determine how much momentum exists in a market at any particular time period, and point in time. So, the size of this does have an important role to play. Now, this is a bullish Japanese candlestick. In addition, we also have bearish Japanese candlesticks. And this effectively means that prices are moving lower. What we will see now very shortly is the same for price points, however in reverse. We’re going to start as we always do with an open price. This particular market, having broken to the upside, and closing at $195, now looks like it’s beginning to reverse. Because the open price is, once you get a close price on one particular candle, the next candlestick will open with that same price. However, what we’re seeing with this next candlestick is actually the opposite. We’re seeing the prices close much, much lower to the downside. In this case, we’re actually getting a complete reversal of price action. Where prices are opening at 195 and over the course of this candlestick it actually closes much, much lower at a $185. Now in the meantime, it does also print a high price in this market. Let’s say that’s the $200 level once more, before making a nice extended move lower, creating a low price in this market, $180, before we get that same pullback before this market actually closes. What we can clearly see with this price action is we’re seeing a really nice explosive move to the upside in a bullish candlestick pattern and a really nice explosive move to the downside on a bearish candlestick. These are the important things to note and just identify as well. On a bullish Japanese candlestick, you’ll see the open prices at the bottom edge. Whereas on a bearish candlestick you will see the open prices at the top edge of the rectangle. It’s just the opposite applies. And the same for the closing prices. The closing prices can be located on a bullish candlestick at the top edge. And the closing prices can be identified at the bottom edge of the rectangle if this is a bearish Japanese candlestick. Hopefully, that makes sense.

1950

What we will do now is we’ll have a look at the importance of the real body. As we’ve alluded to, the difference between the open price and the closing price of the corresponding markets, you know, is represented as the real body of any particular Japanese candlestick. Whether it’s a bullish candlestick where the open is at the bottom and the close is at the top, the difference between the open and the close and this bullish candlestick, is the real body. And the same for a price action to the downside. The open price is much higher, the lower price is lower, and the difference between those two is the real body in this situation. Okay, moving on then. The closing is often the most important piece of information. The close of a particular candlestick is very, very important for us. It concludes the trading session. Whatever that time period happens to be – whether the timeframe of the candlestick is an hour, whether it’s a 4-hour, whether it’s a daily, weekly, or monthly timeframe – the close gives traders some very, very useful information as it gives an insight into market sentiment.

It’s also worth noting that most technical indicators use the closing prices as the basis for their calculations. That’s very, very important to bear in mind as well, and you’ll see that when it comes to using technical indicators. They’re often based on the closing price. It is of significant importance not just to technical traders who read charts, but also to technical indicators as well. Now the size and the color of the real body can provide useful clues regarding potential price moves. If we’re seeing a series of green candlesticks it means we can expect continuation to the upside. If we get a green candlestick followed by a red candlestick it can mean that potentially we might experience a correction in this market. Or, perhaps even, a reversal depending on the information that we get. That is just touching upon the real body of a particular Japanese candlestick, or, in Japanese is referred to as Jittai. That is effectively the real body of any given candlestick.

In addition to the real body we also, as you can see, we can have a shadow. The reason why they’re called Japanese candlesticks is they can often look like candlesticks. However, we often can get a wick to the upside or to the downside, or, as it’s referred to, as an upper shadow. Which is, in Japanese, is Uwakage. And to the downside we would be looking for the lower shadow or wick, and excuse me if my pronunciation is a little bit off, but, Shitakage. It’s a word that I’ve always struggled with. However, there’s no need for you to actually know that at all. It’s just we emphasize the origins of these candlesticks which is Japanese in nature. What we need to do and identify as traders is, the information that we can glean from upper and lower shadows could be quite significant. They are important. The upper shadow represents the area above the real body, and the lower shadow represents the area below the real body. That’s really what you need to take away. It’s the length of the upper and/or the lower shadow which can give traders valuable information regarding potential price moves. For example, we can certainly see a small wick like this on a lovely green candlestick would signify continuation to the upside. Whereas if this closed, so we open at this price here, if the market pulled right back and we saw a close at this market, more around this level down here just for example. If this market closed at that level down there, then the wick would actually be excessive and that could potentially mean that what we’re likely to get next is a bit of a reversal in this market to the downside.

The information that can be gleaned from our knowledge and understanding of Japanese candlesticks can be really, really important. It can give you as a trader some real significant edge trading these markets. So that’s just a bit of an overview in terms of the anatomy of a Japanese candlestick. In terms of the four price points – the highs, the lows, the open, and the close prices. And also, the real body, and of course the shadow to the upside and the shadow to the downside as well.

Bearing that information in mind, we shall now look at some of the different types of candlestick formations. It’s important to note that Japanese candlestick formations come in all shapes and sizes, however each and every one of them can give a trader valuable information with regards to future price moves. There are three categories of candlestick formations for you to embrace.

The first one is Bullish Candlestick Formation. These can be broken down into three different categories we could have Single Bullish Candlestick Formations. We can also have Two Candle Bullish Candlestick Formations. And of course, Three Plus Candlestick Formations. And that just refers to the number of candlesticks that are involved in that piece of analysis. Without confusing you too much, we also have the same when it comes to Bearish Candlestick Formations. We’ve got Single, Two Candle, and Three Plus Candlestick Formations to consider if we’re looking for what would be regarded by traders, as being those that are proficient in technical analysis and understanding price charts, as being Bearish Candlestick Formations. In addition to price action moving to the upside and price action potentially moving to the downside, we also have neutral candlestick formations. Now these can be interpreted as giving neutral price information. But they can gain also significance when these form part of other candlestick formations. In their own right, they can remain somewhat neutral. However, when we start seeing that the price action, which has come before it, and after that particular neutral candlestick formation, then it can then give us some very, very useful information. Often when we see these, we as traders, we look to pause and to just consider what might occur next and allow the market to determine that decision-making process. All we need to do as traders is be prepared for all eventual outcomes and we can do that in a very consistent way.

We have bullish candlesticks, bearish, and neutral candlestick formations to consider. We’re actually going to go through each form one at a time. I thought that, we thought it’d be quite useful for you to see the variations of Single Candlestick Formations. And all of these have implications for bullish price action. Meaning, when we see these sorts of setups, we can look to stack the odds in our favor in terms of having an understanding, in terms of what might happen next, which is all what’s very, very important for us as traders.

We’ll start with the Hammer on the left-hand side and we’ll work across the screen. The candle that is of real interest to us, and don’t forget these are Single Candlestick Formations. Meaning we’re getting price action clearly moving to the downside one period at a time. And then lo and behold the candle gives us, it prints this particular candlestick. It means we see the low price. We can see the high price in this market. It just so happens to be the open as well. And we can see the close of this market. There’s quite an extended gap between the low and the close, and that gives us some real valuable information as a trader. When we see price action like this, traders consider this fairly bullish in a downtrend. Meaning, we’re very likely to get a little bit of price action as a result back to the upside in a market like this. That’s what we can expect from a hammer. You know, it is important to know the names of these different candlesticks. But there’s so many of them, and all we’re discussing in the next few slides is the major candlesticks. There’s many, many more, however. Probably there’s too many variations. Some, you know, a lot, of these major candlesticks can have real profound impacts on the markets. And there’s others which would just probably confuse traders to some degree as well. We’ve just highlighted some of them, the most commonly used candlestick formations, and we’ll explain the anatomy of the actual Single Candlestick Formation itself and what traders can glean from that information.

When we see a Hammer and it also there’s it’s commonly known that you know this sort of single candlestick formation can hammer out a bottom of a market. So, you’re getting that quite explosive move lower. The market puts in this candlestick and this gives fantastic opportunities for traders to start pushing this price higher. Therein lies the potential for us as traders to see this kind of price action and then act accordingly. If you decided to buy above the high of this, it has the potential to give you a significant risk reward potential to the upside if you see this kind of price action.

Moving along then to an Inverted Hammer. This time, as you can see, we’re going to focus very very carefully on the anatomy of this particular candlestick just in here. It’s just middle one that we’re really focusing on. What we’re seeing is that again that price move consistently, make new lows. We can clearly see that price action is moving lower and what we see then is an Inverted Hammer. It’s the same as the Hammer, it’s just the actual hammer end is at the bottom of the shadow rather than at the top. But for all intents and purposes when we see this price action it’s referred to as an Inverted Hammer. And what the signal that that sends to traders when they trade is that is potentially considered bullish in a particular downtrend. Again, we are prone to this kind of price action and there’s no guarantees that this market will behave like that. But you are stacking the odds in your favour if you can identify this price action and perhaps you… we’re going to look at the approach to risk management very shortly. But what you’ll often see is a reversal in prior action. And it’s not guaranteed every single time. It’s just you’re probably stacking the odds in your favor more by utilizing your understanding in this way.

Moving on to a Dragonfly Doji now, so what we’re seeing in this market again is this market continued to move to the downside and on this occasion, we make a low in this market. But as you can see, we get a bit of a reversal on price action and what this is telling us is the open and the close of this market is exactly the same however, and the high should I say. There’s a lot going on here with this candlestick. The market opens, it moves to the downside. There’s a complete reversal, and a rejection of these lows, and we get buying pressure coming into this market to such an extent that the open, the close, and the high of the market is exactly the same price, or very, very close to being the same price. Again, what you’re likely to experience is that the longer the lower shadow signals are, the more potential for upside movement. When this appears at the bottom it is considered to be a fairly strong reversal signal. Looking for Dragonfly Dojis can give traders a real advantage and as a trader you can make that decision to look to drive that price back to the upside. So that’s Dragonfly Doji Single count Candlestick Formations.

We’ll just finish the fourth one, which is bullish spinning top. This one I want to draw your attention to this middle candlestick just in there, and we’re getting some bullish price action now on this particular situation and we get to see a brand new high in this market. However, the market at some point sort of reverses to make a considerable low and it struggles to get back up to those previous highs. That effectively, is referred to as a Spinning Top and it’s a Bullish Spinning Top just because it’s got a significant bullish, it’s green in color, so it has a bullish connotation to when we see this on a price chart. So, the size of the shadows can vary and are probably less important unless they’re quite extreme. And if we see this kind of price action, and certainly if we get a break above the high price, then we’re very likely to see continuation and is viewed by traders as being quite bullish in an uptrend. It’s important that we do see the bullish price action prior to this candlestick and if we get a break above the high, we’re very likely to see a continuation to the upside. And this is how traders utilize these formations to understand exactly what’s going on with price, and what is the likeliest next in these markets. That’s just an overview of four of the main Single Candlestick Formations.

3550

What we also have is Two Candlestick Formations, as well. Again, we shall go through these one at a time. We’ll start on the left-hand side and we’ll look for Bullish Kicker Candlestick formations. Now we’re effectively looking for two candlesticks. It’s not a single candlestick that can give us the information, it’s actually what’s going on in the relationship between two different candlesticks. What we mean by that is we’re seeing in this example we’re seeing price move lower and then we see this candlestick printed. This is candlestick 1 for us, and we’re also looking at this one just above. And what information does this kind of price action give us? What I’ll do is I’ll just place this 2 just above this particular candlestick just so that you are comfortable in terms of which two candlesticks we’re referring to. We can see on this fourth bearish candlestick that price is closed lower it’s very, very bearish in this particular market. But on the very next period or the next day, if this is a daily timeframe, what we can see with the next candlestick is that we close down here, however we open significantly higher. In fact, we open above the previous candlestick. If this is the open of the previous day, we can see the open is just above it, however the closed price is quite significantly lower than that particular level. We see the close of this candlestick, we see the open. But we also, most importantly, see the open of the new candlestick. And in a situation like this it’s regarded as being very, very bullish indeed. It’s considered bullish when the next green candlestick gaps to the upside. So, there’s a gap in there and it just means that a lot of the sellers have been blown out of the water. Those that look to buy markets like this will look to aggressively push higher. Again, not every single case. But certainly, the odds would be stacked in your favour if that is the case more often than not.

Moving on then to a personal favourite of mine which would be Bullish Engulfing. Here what we can see is again we can see quite consistently a series of markets. These don’t necessarily have to move in a linear fashion, these could be a little bit erratic. But what’s important to take away of this is the previous candlestick. I’m looking at Candlestick 1, and also the very next Candlestick 2. And it’s these two candlesticks which interest us. What we can see is this market open lower and we can see that the close of this price is significantly higher. And what it does is it completely engulfs all of these candlesticks. They’re completely engulfed by one day of price action, if this happens to be daily timeframes. Whatever this period is, it doesn’t necessarily matter. When you see a print of a candlestick like this, it effectively blows all these candlesticks out of the water and we get to see some real dominance in this market. What this means is quite bullish if we see a bullish engulfing two candlestick formation which exists. We need to engulf the previous candlestick and if that occurs to multiple candlesticks, that’s even better, and it adds more credibility to the trader and certainly more confidence in that market. It’s considered a major bullish signal in a downtrend if this market is moving lower, we get a Bullish Engulfing, and we can often see some really nice explosive price action to the upside. And I’ll show you some practical examples of this very shortly.

Moving on then to Bullish Harami. In this situation we’re getting some quite considerable selling pressure. You can see its kind of an inverted Bullish Engulfing. But we’re seeing a complete dominance to the downside until we get this. Again, in this situation we’re looking at Candlestick 1 and we’re looking at the very next, Candlestick 2, and we can see that that price opens, closes, high and low is all contained within the price action of the previous candlestick. What this does, as far as sellers is concerned, is put a question mark in their mind. Would they expect to see further continuation to the downside once we get a bit of a Bullish Harami in this situation where we’re actually getting a close much lower and we’re getting the open much higher within that candlestick? That creates a bit of doubt in the minds of sellers. And it gives bullies a fantastic opportunity to look to capitalise on this price action, look to get into this market, and look to drive this price higher. This is stacking the odds in your favour again to the upside if you identify a Bullish Harami in this way. It’s considered a bullish signal in a downtrend.

That’s the Bullish Harami and we’ll just finish the Two Candlestick Formations by just reviewing what’s called a Piercing Line. What we’re seeing in this particular candlestick, and again, I would like to I would like you to draw your attention to these two candlesticks in here, one bearish, one bullish. I just put those numbers just above these candlesticks, and what we’re seeing is price action move consistently lower. And the fourth candlestick here is what is of interest to us. We’re actually seeing the next candlestick open much lower, and the price action actually pushes lower. We’re clearly operating in a price action that would be conducive to sellers until price starts to reverse, and we start getting this little bit of buying pressure coming in. And what’s often identified is 50% of the previous candlestick is really what’s quite important. What we’re seeing is we’re actually getting a close of this market above. We’re seeing before our very eyes a bit of a rejection of the previous price action having made new lows. A lot of this starts to stack up in the minds of a trader, certainly those that are looking to buy this market and they’re seeing the rejection to the downside. They’re seeing the market open lower, which is quite bearish, and we’re seeing a reversal of that bearish price action. And we’re actually seeing the market close above 50% of the previous candlestick.

44

With all this in mind, and what this has great potential for, is some nice explosive price action to the upside, and start printing new highs from these levels. So, it’s considered a bullish reversal signal when it opens lower but closes back above halfway of the preceding candlestick. These are just metrics, it’s roughly 50%, but you know you don’t have to be too precise with that. But you just got to be open to the fact that it’s a clearly defined reversal signal and we’re very likely to get some bullish price action off the back of a piercing line. Those really are your two candlestick formations to the upside where you’re likely to get some bullish price action off the back of them.

Let’s finish the Bullish Candlestick Formations and we’ll look at Three Plus Candlestick Formations. Now, you know we’ve identified four main Three Plus Candlestick Formations. there are more out there. But these will certainly give you a very comprehensive understanding in terms of what is going on in these markets if you’re able to identify these candlestick formations. We’ll start again on the left-hand side by looking at the Morning Star. What we’re seeing in this kind of price action is price consistently moving lower. The reason why we’re looking at a Three Plus is that it can contain three or more candlesticks, effectively. Now, we’re looking at this first candlestick, this second one just in here, and we’re also now looking at the third candlestick for us to get the information that we need to really act and to utilize this information. What we’re seeing is three days of bearish price action, if this was a daily timeframe. And the fourth candlestick actually gaps down lower. But it doesn’t continue lower. As you can see, we have a green body which is actually bullish in nature. What we’re seeing is effectively a reversal signal even though this market is gapped lower. We’re clearly seeing the close of this market and the open considerably lower. This is effectively the gap in this market. that is not to be ignored.

When we see these gaps, you know, what price action do we see next? And we see the fact that, in fact the open of this market is even lower than that. This is the gap which is quite considerable and what we see price action do next is make a new low, and then all of a sudden, it actually becomes quite bullish where we actually close higher. And then that extended that is extended in the third candlestick and then you’re very likely to see that for subsequent candlesticks. It’s just being a little bit patient, you’re seeing this price action. It might be more prudent for you to get into a Morning Star after the third candlestick which is actually closed. And that can give you the very important information to be able take this market higher. Now there’s all sorts of variations with this third candlestick. It can close much, much lower and that might mitigate the potential for such a strong reversal signal. So, we need to see some bullish price action off the back of the gap, lower. This price action is considered a major reversal signal in a downtrend. The market has to be moving to the downside and if we see this price action with two and three, we’re very likely to see continuation to the upside, in this example.

47

Moving on to Bullish Abandoned Baby. Again, just to identify that this market is moving lower and the three mark, the three candlesticks, we’re really interested in are these three, as you can see. When we go to the first candlestick we can see, we see a normal sort of consistent move lower. We are in a downtrend and what we see is an Abandoned Baby. All of these names are weird and wonderful. You know you don’t necessarily need to memorize all of these different types of candlestick formations. But what you do need to understand and comprehend is that you know when you see price action like this it can look and it can become very, very bullish. What we’re seeing is a considerable gap lower where this market again gaps down quite considerably. We’re seeing a really significant gap in this particular example; however, it doesn’t continue lower. We get a little bit of a reversal pushing to the upside and then the very next day, if this is a daily timeframe, the market actually gaps again to the upside. Without confusing you too much, we get two gaps in this market and this is very, very bullish indeed if we get this kind of price action. We’re getting two gaps in this market and then we need to literally wait and see what happens to the third candlestick. And if the conditions are right, then you’re very likely to experience a considerable reversal in this market. It’s considered a major bullish signal in a downtrend. That is a Bullish Abandoned Baby.

Moving on then to Three Soldiers. What we’re seeing now in this particular situation is continuation to the downside, as you can see. And the three candlesticks we’re looking at in particular would be… this market continued to move lower, and it’s these three candlesticks that get to offset a lot of the bearish price action in the action in the candlesticks which came before it. What we’re looking for here is three long green candle sticks with consecutively higher closes in a downtrend. And this is considered a very, very, not a significant, reversal signal in this market. We’re getting really quite significant price moves to the downside. But then this particular market fails to make a new low and we actually start printing three consecutively higher you know long green candlesticks. In this situation it’s the size of the candlestick which is quite important and as you can see these are three significant bullish candlesticks which means that if we can mitigate most of the previous price action then it’s looking considerably, significantly, bullish to the upside in this situation. So that’s Three Soldiers in a downtrend.

The the final Three Plus Candlestick Formation is Three Line Strike. This is, as you can see, sort of fairly similar to a Bullish Engulfing if you see this in a downtrend. What we’re needing to see is we’re kind of looking at, and this is why it’s Three Plus, we’re kind of looking at these three bearish candlesticks and then we’re seeing the fourth candlestick which completely blows these three previous candlesticks out of the water. It’s considered a major bullish reversal signal when in a downtrend. You can clearly see that opportunities to buy perhaps above the high would constitute continuation to the upside in price action like this.

Okay, so that concludes an overview of the different types of Bullish Candlestick Formations. I’ll take off those scribbles and we’ll move on with the presentation. We’ll look into this time Bearish Candlestick Formations. Again, as you can see, a lot of these names are very different, there’s aspects which are similar. A lot of these are very similar to the Bullish Candlestick Formations, just they’re actually more bearish than bullish. When you identify opportunities like this in the market, you should be looking for opportunities for these markets to be moving lower, in this case. And we’ll start again with the Hanging Man, and again this is a Single Candlestick Formation. Again, what we can see is a little bit of a reversal in this situation. It’s kind of the opposite of a Hammer. What we’re seeing now is price action squeeze higher and we’re seeing this one candlestick, just in here, which opens above and then starts to push much, much lower, create a low in this market, pullback, and is still looking a little bit on the bearish side. And if we get continuation the following day then what we’re likely to see is a nice a nice move lower. The lower shadow should be at least twice as big as the body. And that’s an important aspect of this market. If we’re saying the body of a Hanging Man, it would need to be at least one third of the overall range of this market. Meaning you want to see a long lower shadow, at least twice as long as the body, otherwise it means something slightly different.

It’s whether a market conforms to this type of price action which will determine what your steps are, what potential trade ideas you could look to execute. As you can see we’re getting a little bit of a reversal price action off the back of a Hanging Man. It’s just called a Hanging Man just because it gives the appearance on a chart, you know if this is a man’s head, then he it gives the appearance that it looks like he’s hanging there. Okay so it’s a bit morbid, but it is referred to as a Hanging Man.

So, in addition, moving on to a Shooting Star. We’re seeing quite bullish price action as you can see. We make a brand-new high which is obviously great at the time, however we start to reverse this price action and actually we open at this level and we close much lower. That is significantly bearish and what it means is, this is now a Shooting Star and it’s considered a significant bearish bit of price action in an uptrend. What we’re needing to see this time is market looking like it’s just about to roll and it could give you fantastic opportunities to take this market lower if you see price action like that.

55

Moving on then to Gravestone Doji. We’re seeing this market push higher on this occasion. And on this occasion, we’re looking at this candlestick in here. Again, this middle one just in there. That’s what we would be looking at. And again, the Gravestone Doji candlestick means that this market pushes higher. But as you can see it rejects the high, starts pushing to the downside, and this time it’s a very similar bit of price action to the Dragonfly Doji which is quite bullish. Now, the Gravestone Doji is actually quite bearish. I’m going to just remove this here, hide, so it doesn’t confuse you. We’re actually now seeing the low-priced the open and the close all at the same level and this is very, very bearish and can give traders fantastic opportunities to actually look to take this trade actually to the downside. When this bit of price action appears at market tops it is considered to be a reversal signal and quite a significant one at that.

So, moving on then to Bearish Spinning Top. We’re seeing this market continue. It’s the opposite of a Bullish Spinning Top where we get a bit of indecision in this market you know; this is the candlestick we’re looking at. We get a bit of indecision in this market; it has the potential to reverse. A break above these highs could potentially mean that we could be reversing to the upside. However, what we actually see is the market continued pushing lower. That is actually quite important where we can see continued sort of bearish price action. What should be taken note of is the previous price action which has been quite bearish, and also the size of the shadow itself to the upside or the downside can vary somewhat. And you’re really needing to see the continuation of prices pushing lower. And under the circumstances like this, this is quite a Bearish Spinning Top. You’re likely to see prices move to the downside.

Okay, those are the Bearish Single Candlestick Formations. Moving on then to the Two Candlestick Formations and we’ll start with the Bearish Kicker. Which is the opposite of a Bullish Kicker. We’ll start with this one first. We’re getting we’re seeing consistent price action to the upside. The candlestick we are looking at is this candlestick in here, and also this second candlestick here. And what we’re actually seeing is the market close so much higher, and it actually gaps lower. We actually open considerably lower than the close of the previous candle and it actually gaps lower. It actually opens beneath the open of the previous candlestick. That is quite significant and quite bearish in its own right. And off the back of that you’re very likely to see continuation of prices pushing lower. it’s considered bearish when the next red candlestick gaps to the downside. It’s the fact that we’re experiencing a gap and the nature of this second candlestick is red in color and quite bearish. Meaning we’re very likely to see price action squeezing lower.

Okay, moving on now to a Bearish Engulfing. This is considered a major bearish signal in an uptrend. Again, you know these are personal favorites. I do like to see price action squeeze higher. So, this is Candlestick 1, and this is Candlestick 2 that we are interested in. And actually, this engulfs this bearish candlestick. It engulfs the previous price action of all three candlesticks. But the previous one is a starting point, and if it engulfs more candlesticks than that, then it can just add more conviction to the trades that you’re looking to take. And as you can see, the open and the close blow these bullish candle sticks out of the water. And we’re going to we’re very likely to see continuation of prices moving to the downside. When you see a Bullish or a Bearish Engulfing Candlestick you should sit up and take note of that price action because you’re very likely to see some significant opportunities off the back of it. It is considered a major bear signal in an uptrend. You’re getting prices moving higher, you’re getting reversal signal, and you’re very likely to see prices push lower.

Okay, moving on to Bearish Harami now. These candlesticks, like we saw in the Bullish Harami, in this occasion is pushing higher and we see price action contained within the previous candlestick. This is kind of stick one that we’re looking at this is candlestick – we can see that the price action is contained comfortably within the range of the previous number one candlestick which is quite bullish, and the nature of the Harami is bearishness in this situation. And what you’re likely to see in a situation like that is continuation of price action actually to the downside. It’s considered a bearish signal in an uptrend. That’s something for you to consider. A Bearish Harami.

We’ll just finish the Two Candlestick Formations by looking at a Dark Cloud Cover. This is an interesting bit a bit of price action. What we’re seeing in a situation like this is that this is very much considered a bearish reversal signal when it opens higher but closes back below halfway of the preceding candlestick. That is significantly important. What we’re seeing is price action look quite bullish where we’re getting this this little move to the upside. It’s quite similar to the Piercing Line. But what we see is prices open higher, which is bullish at that particular point. And what we are looking at is Candlestick 1, and also Candlestick 2. What we need to see is prices push higher and then a bit of a reversal of that particular price action. However, it’s important that approximately the market reverses quite considerably so that we break below the roughly the 50% level on Candlestick 1. And that’s really structurally quite important because what you’re likely to see when you see setups like this is a continuation to the downside. It is considered a very bearish reversal signal when it opens higher but closes back below halfway of the preceding candlestick. And you’re very likely to be able to capitalize on a bit of a price move to the downside in this market if you’re trading a Dark Cloud Cover. Okay, so that covers some of the major Two Candlestick Formations.

We will finish the Bearish Candlestick Formation action with looking at Three Plus Candlestick formations. We’ll start as we always do on the left-hand side looking at an Evening Star Formation. What we’re looking at here is some bullish price action or what we should be looking for is some bullish price action. The three candlesticks we’re very interested in is one, this little candlestick up here, and then the third one in play there. And potentially subsequent candlesticks as well. But we work with these three for the time being where we get a close of the candlestick number one. We get a considerable gap higher in this market and that’s quite important because that’s referred to as an Evening Star. And what we’re seeing is in fact I’ve kind of done it again. But what we’ll do is we’ll work with the level at which this market opens, which is that high of the rectangle on a bearish candlestick. We’re getting a considerable gap in in this market. It’s important to consider that prices have gapped to the upside. But we’re getting a bit of a reversal price action. We’re looking like we’re going to close this particular gap. And potentially, if it breaks lower then we’re likely to get continuation to the downside. When we see an Evening Star it’s considered a major reversal signal in an uptrend. We’re very likely to see that bit of price action look to squeeze lower in a market like this.

Moving on this time to a Bearish Abandoned Baby rather than a Bullish Abandoned Baby. We’re seeing the market look quite bullish which is making new highs, the market gaps up. The gap is quite interesting. I’ll put G for gap. But the market fails to make considerable highs and actually starts to reverse. The close of Candlestick 2. I’ll put 2 in here, and then number 3 down at the bottom. The close of Candlestick 2 is quite significant because if we get a smaller gap it doesn’t matter the size of the gap necessarily. But in this example, we’re getting a smaller gap. But we’re getting continuation with Candlestick 3. And that’s the important part of a Bearish Abandoned Baby is that you’re seeing this abandoned baby here at the top. But now you’re getting some quite, these are quite good, bearish signals for us as traders to try and take advantage of. And it’s considered a major bearish signal in an uptrend. Okay, that’s the Bearish Abandoned Baby.

Moving along, let’s have a look at the Three Black Crows. This is similar to the Three Soldiers in a Bullish Candlestick Formation. What we’re getting this time is some initial bullish price action. What’s interesting for us to look at in this situation like this, is a bit of an unraveling of those of previous bullish price action with three very, very bearish candlesticks. What we’re looking for here is three long red candle sticks with consecutively lower closes in a downtrend. This is considered a significant reversal signal when you see price action like this. You’re very likely to see continuation to the downside if you see Three Black Crows. They mitigate against a lot of the work by the bulls in this market, where price action is pushing higher. Now, these three back-to-back Black Crows are very likely to give extended opportunities to the downside and become quite bearish.

And just the last one, an Evening Doji star. This is what we’re currently seeing up on screen now. Again, the three candlesticks that we’re looking at is Candlestick 1, Candlestick 2, and also Candlestick 3. And what we’re seeing is some bullish price action pushing prices higher. We can see that the close of candlestick number one is quite significant and certainly pushing higher and the open absolutely gaps to the upside on Candlestick 2. There is a bit of a gap to the upside, which you may think looks quite bullish, but what we see is we get actually a bit of indecision in this market. We can’t push higher; we can’t push lower. The open and the close price of Candlestick 2 is actually the same. What it, it puts it some indecision in the minds of those buyers because now they’re there, they’re looking at this price action, and they’re actually anticipating opportunities for sellers to enter this market and to drive prices lower. At which case, if we see Candlestick 3 start to move to the downside, then that, for all intents and purposes, signifies a significant reversal signal in what was an uptrend. It is considered a very very major bearish reversal signal. When we identify it in an uptrend prices have to be moving to the upside, we need to see the Evening Doji Star and then we need to see price action look to reverse. Then that can give us some fantastic opportunities to the downside. Okay, so that’s an overview of Bearish Candlestick Formations.

There’s one set of candlestick formations that we need to look at, and that is those candlestick formations which are Neutral in nature. These candlesticks are very much neutral by nature but can gain significance when they form part of other candlestick formations. It’s actually what often precedes it and then comes after these candlesticks is what can give us some very very useful information. We’ll start by a very popular candlestick which is called a Doji Candlestick. Now, for all intents and purposes, when we see these candlesticks on a price chart it creates some indecision. Meaning it’s largely neutral. We don’t know whether buyers or sellers are in control of this particular market. It’s very, very neutral in nature. But what we’re seeing technically is the market open. It doesn’t matter whether it’s moved higher or move lower. Let’s say for example it’s moved higher. We’ve made a new high in this market. We’ve also pushed lower and made a new low and price comes back to close at the same level as the open. This is the anatomy of a Doji Candlestick in this situation. These largely Neutral Candlesticks have long shadows but very smaller or non-existent bodies. The size of the shadow can vary greatly. We can have normal Dojis and we can have a long-legged Doji Candlesticks as well and that just sort of tends to give the impression of some considerable extended indecision in markets, depending on the size or the difference between the highs and the lows in markets like these. The size of the shadows can vary and can vary quite dramatically. But they really do gain importance when they form part of other formations. And what we mean by that is if the next candlestick starts to push to the upside, then that lends itself to some continuation in prices looking to push higher. The same to the downside if we start breaking the daily lows, then you’re very likely to see a price action move lower. That’s effectively what can happen with these price moves, you can have prices moving higher or you can also have potentially prices moving lower off the back of what is a Doji Candlestick. So that hopefully gives you a bit of an idea. But you know traders do understand these candlesticks as more like indecision candlesticks rather than neutral. I do bear that in mind as well.

Moving on then to Spinning Top Candlesticks. These are quite similar to Doji Candlesticks however the main difference is the real body, which you can see from a bullish perspective and also from a bearish specific perspective. These largely Neutral Candlesticks have long shadows. But very, very small bodies, as you can see. Now the size of the shadow can vary again quite considerably. These can be quite extended, or they can be quite short, and they gain as well importance as a part of other formations. The same thing applies. If we get price action breaking above the high, we’re likely to see continuation to the upside and a break beneath the low we’re likely to see price action move lower. And the same for a Spinning Top which has a bearish viewpoint to it we’re likely to see prices squeezed lower and we are also potentially likely to see prices move higher. It actually depends on what comes next. And we also want to take note of what comes before it you know if we’re seeing some bullish price action, we might get continuation, or we might get reversal. It’s really identifying what comes before and then making decisions in terms of what we’re likely to see next. Those are Spinning Top Candlesticks.

Moving on then to Marubozu Candlestick Formations. As you can see, as opposed to a Doji Candlestick, where the high and the low, and the open and the close, should I say are exactly the same, the opposite of that would be a Marubozu Candlestick. Where the open and the low price, the open and low, and the close and the high. That’s what we’re seeing in a bullish Marubozu and it’s the opposite way around. Now we’re seeing the open plus the high price and the close plus the low. That’s what we’d want to bear in mind when we’re talking about Marubozu close is that we’re getting the highs in the close and the opens and the lows which is virtually the same price. A normal or long candlestick with no shadow meaning the high price and the low price represent the opening and closing prices of the respective Japanese candlesticks. That’s just an explanation of what we’re seeing. We’re just seeing an accumulation of prices stacking up. And these are always quite interesting because again we’d be interested to see whether from the close whether this market starts to move lower or whether we start getting extension pushing higher. We can actually it can actually work both ways off a candlestick like this either to the upside we’re likely to see prices push higher off that level or also potentially push lower. That’s the situation regarding Marubozu Candlestick Formations. And again, in their nature, all of these three are relatively neutral or create indecision let’s say for technical traders. But it all can contribute to a coherent approach to trading these markets.

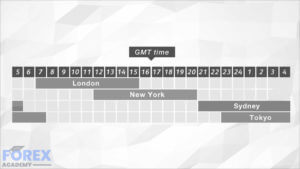

Let’s move on then and we’ll look at you know different time frames and the different information that can be gleaned from looking at different time frames. Now, it is very important to note that you can view candlestick formations in different time frames. The larger the time frame normally, the more important the signal can become. And to show you this I’d like to bring up a price chart. Let’s review a live chart to explain this in more detail, excuse me, let me take that back and let me get up the price chart here for you. What we’re currently seeing on chart right now and if we do our technical analysis, we can see there’s effectively a double bottom here. There’s potentially a little bit of the potential for this market to eventually maybe squeeze higher. We’d be looking at these levels in here to see if we get a bit of a push higher. Now we’ve just had a pullback off these levels. That’s quite interesting, so you know this market could very easily you know look to squeeze higher or could look to squeeze further lower as well. We want to bear that in mind. We can quite clearly see over the course of this time frame, and a this is an hourly candlestick, each one of these candlesticks that you’re currently seeing up on screen represents various different information on an hourly basis. We can see our Doji candlesticks and we can see the price action of this hour. We can see nice big extended continuation candlesticks. We can also see you know Bearish Engulfing and there’s a whole myriad of different types of candlestick formations that we can use.

Now to just sort of highlight and show you, and this is a live chart currently, we can do our analysis on this time frame. I want to go through the time frames and look at higher time frames and see how the picture starts to change. You can see that we’re kind of getting a bottoming out of this market. We’ve kind of created a double low on an hourly timeframe. Let’s look at it on a on a four-hourly chart. You can see this this convergence down here at the bottom of this price. We’re struggling to break beneath this level here above the 131 level. And this is the EURJPY. Now, each of these candlesticks represent four hours of price action. You can get your Marubozu Candlestick on a 4-hour chart which is the open and the high is exactly the same as the close and the low, which you would expect continuation, which we see we get a little bit of a pullback and then we get continuation to the downside. And you get your Bearish Engulfing in there as well and you get this sort of grinding price action, you know squeezing prices lower. We’re currently struggling to break beneath the 131 roughly down at this bottom right hand corner. We might see some continuation pushing higher. But generally, prices moving from top left to bottom right.

The timeframe that you look at is of significant importance to us as traders because our impression can change slightly depending on the timeframe that we look at. We take this information on to a daily timeframe and now we can actually see, we can conduct a little bit of technical analysis. We can see that this level is quite important. We can see our Bearish Spinning Top Candlestick and we can also see our Hanging Man which is not quite made the low. But you can see this Hanging Man which is actually today’s candlestick. Let’s see what happens what we’re seeing is a bit of bearish price action which precedes it. Really, we would be looking to see, what happens next would give us some really interesting information. We can give that some very, very interesting very easy and straightforward candlestick fashion candlestick analysis and technical analysis to this chart, to give us a little bit more information. But you can see we’re on the back end of a quite considerable move lower and we’re getting a bit of a rejection of prices moving lower in this situation. You can therefore make decisions based on different time frames. Based upon the different opportunities that may exist. You might find some buying opportunities on an hourly chart, whereas if you can move up the time frames, you can see sort of a little bit more clearly.

You can see that we’re actually now looking at a weekly time frame. We’re in a significant bull run basically since 2016. Prices are moving higher over this particular time frame and we’re seeing a bit of consolidation around these levels which just coincides with our very briefly drawn level of support around the 130-147 level and we’re getting just prices just gathering around this level. When you go through the different time frames, you can then see again we’ve got a Bearish Spinning Top, and it all depends on what happens next. And if what happens next puts a bit of indecision in a trader’s mind, then it can give opportunities for traders to actually look to take this price even higher. It can very much, when you go through the time frames and you look at Japanese candlesticks, it can very much give you a different impression in terms of the information that you need. Now again, you go even higher than that. And without the need to confuse you to any great extent, you can see that we’ve got a Bearish Engulfing. On a monthly timeframe if you if you happen to be trading really, really long timeframes, you would expect continuation to the downside. We’ve got highs, we’ve got lows, we’ve got swing highs again. This could be a high of this market on the top left-hand corner. We have a lower high, and now we have another lower high once more. And when you mix that with your understanding of Japanese candlesticks and perhaps Bearish Engulfing, and we’re seeing the same again, we’re just likely to get some continuation in this market pushing prices lower. That’s how you can use different timeframes and your understanding of Japanese candlesticks and if we get a break beneath the monthly low, then we would expect and anticipate, on a monthly timeframe, for this market to move lower.

Of course, your approach to risk may deviate somewhat and I shall explain that very, very shortly. But that’s hopefully just explained to you that how different timeframes can impact the decisions that we take as traders.

Okay, and just to link and I’ve kind of just alluded to it, but it’s also important to note that candlestick formations do not necessarily need to stand alone when it comes to decision making as a trader. They can form part of a much, much bigger picture. For example, you can often, you can often see a situation on a price chart where you identify a candlestick formation. But it forms part of a bigger charting pattern. As a result, the idea is for you to use the information a price chart can give you to formulate trade ideas. It’s effectively looking to put all these things together. I just want to share this chart with you, it’s a static chart. We’re getting some price action pushing higher, we can see that we get a bit of a pullback in this market, and then we push considerably higher withso.me considerable momentum. When we look at a price chart like this, we can see that we’ve had some rejections here to the upside and it’s a very, very poorly constructed Bearish Spinning Top which has the potential to see these prices move lower. However, it would certainly look to create a bit of indecision. We’re not necessarily suggesting that you need to trade all of these decisions or you can even make money on all of them you may do for a particular period of time.

But you need to take into account you know a lot more information perhaps previous price action and seeing how things develop and unfold. But you’re getting quite a number of very sort of bearish price action in markets like this. You’re getting a triple top which is important, and another sort of charting pattern that we can see would be a kind of a Head & Shoulders. You can see the symmetry moving across this price action. If I just draw sort of fairly simple lines you can see that we have our shoulders here and you could see that this could formulate a fairly easy to identify head, followed by another shoulder. And it’s the symmetry of price action like that which can give us really, really useful information. If we’re coming to the price action like this where we’re getting a bit of a Spinning Top, and a bit of price action which is looking kind of like a Shooting Star, slightly bigger Shooting Star, then you know all of these price actions don’t necessarily need to conform to any great extent. They need to be variations of candlestick formations that you identify followed by a Bearish Spinning Top. And then, that’s just very likely to see continuation of prices moving lower before you get your major Bearish Engulfing Candlestick which is quite bearish looking to take this market lower.

But from a from a technical perspective we can look to put information together in a very coherent manner to decide what we should do with these markets. We can have charting patterns, we can have our Head & Shoulders price action, and if we blend that nicely with our understanding of these candlesticks, we can look for really, really prime opportunities to get into this market with the view to look to sell it and look to capitalize. And then when other charting patterns start to materialize, you can formulate an extended trade plan on that basis. That’s just hopefully linking our understanding of Japanese candlesticks which can be standalone decisions that traders can make. And if you can blend them in with charting patterns, because the you know Head & Shoulders, in this example, is quite bearish in its own right. You can put your understanding of Japanese candlesticks, and your understanding of charting patterns as well, you can put those together and formulate a really useful approach to trading.

Let’s have a look at some technical tools now that can be used to assist with decision making. Let’s take a look at some of the technical tools that you can use on a live price chart. I’ll bring up our live price chart again and we will move this along a chart. We can see this price chart up on screen, and some of the tools that we can use, we can certainly label certain bits of price action in here. What I’m going to do first is just identify this price action on this chart. And I’m going to identify, or isolate should I say, these three bits of price action. When we identify, and what we’re looking for, is almost big-picture moves. We’re looking to see you know what occurs in these levels. Is there anything that I can identify from this that can give me useful information? The answer to that question is sometimes it might do, sometimes it might not, you know. This is where skill and experience starts to come in. We’re looking for these major highs and major lows, and identify, can any decisions be made off the back of this can we see rejection on numerous candlesticks and can we see potentially some bullish price action entering this market.

I’m going to look at these three in turn and then as this market sort of clearly breaks to the downside, can we see anything that we that we can suggest that might be significant to us when we trade. This is the principle and the approach that traders are going to take with regards to formulating trade ideas. And this is where our understanding of Japanese candlesticks can come in quite nicely. Just to identify, we’ll have Candlestick 1, Candlestick 2, and we should also look at Candlestick 3. What you can do when you identify these interesting situations on a chart, we can sort of utilize some of these tools up here. You can put a little text box in here and Candlestick 1 for us and would be a Shooting Star. Put that in there. What I’ll do as well, I’ll just change the format. You can change the color, you know, it’s a Shooting Star, it’s bearish in nature. And maybe just reduce the size down a little bit. We could put that in here. You can identify that particular chart, we’ll have a look at chart number two. We put another label onto that. This is a Bearish Spinning Top, if you can see that chart in there now. What we can do is we can slide this, sorry, I just move the chart ever so slightly. So there we go. So that can be charting pattern number two, and we can look at Candlestick 3 there and we can place that in there. And we can look and assess the characteristics of that particular candlestick, and it’s actually, what we see, there’s a couple of sort of bearish candlesticks in there. You have a Bearish Engulfing and also a Gravestone. All of these are as you can see, let me just move this across. Just these two candlesticks in here, Bearish Engulfing, I’ll just bring it down the bottom there you can see it. Candlestick 1 for us or Candlestick 3 is the Bearish Engulfing followed by the Gravestone Doji candlestick or it’s very, very close to it.

All of these three different candlestick formations intimate price movement to the downside. Now as you can see, we do get smaller moves before we get the actual bigger move in this market lower. You get your again, another Bearish Engulfing, and you’re just likely to get prices moving to the downside. Now we’ll discuss rich risk management very, very shortly.

But that’s just their an overview of different tools that can be used to just assist you with in this process what we can also use are what called genuine levels of support resistance. We can identify the highs, we can see the triple top, we can also now identify these lows and see the rejections here. Now we can begin to formulate a bit of a trade plan and identify that this is actually a Head & Shoulders, a bit of price action with some significant bearish candlestick formations. And what it just extends is to the potential trade idea for this market to move lower. Knowing what direction the market moves in is very important for technical traders and that’s some of these technical tools that can be used. There’s still there’s also arrows to the upside or arrows to the downside. You can post those accordingly if you’re identifying you know a nice confirmed break to the upside, you can place arrows into your charts. And this is obviously all on a MetaTrader 4 platform. You can you can identify little breakouts to the upside, you can place arrows. And do use these when you are starting out to just give you some you know awareness and understanding, and certainly you can retain some of these features as well so when you log back into your trading platform you can access all of that information accordingly.

Okay, so continuing with the presentation then, that will lead us nicely into our understanding or impact on risk management. A comprehensive understanding of Candlestick Formations can really assist with your approach to risk. It can help you to clearly identify a price point in the market where you will not want to commit any more capital if price moves against you. That should be just a general basic overview in terms of a trader’s approach. You know, we’re advocates of trading with stop losses and being aware of the risks involved in trade and financial markets at all times.

So again, let’s take a look at an example on a live trading platform. I’ll bring this back upstairs and back up on screen. I just want to draw your attention to this Bearish Spinning Top up here. What I’ll do is I’ll zoom in a little bit more for you. We’re just going to look at this particular, I’m going to just delete this one, until, and I shall also delete this one here. I just want you to draw your attention to this candlestick in here. What we’re actually seeing is in fact, this is actually a Shooting Star, this was your Bearish Spinning Top. I’ll just edit that briefly. This is our Shooting Star just in here. This is the candlestick that we’re interested in. When we trade these financial markets what you want to do is obviously be able to assess your approach to risk. What we could very, very easily do is identify the highs and the lows of this particular market, and identify the high of the 1.2092, and I’m just looking at the data window in the bottom left hand corner and looking at the high price of this market. If you know that this if we’re in an uptrend and we’re identifying a shooting star which is effectively what we’ve what we’ve identified, you need to see the uptrend, and we can see it consistently. We’re absolutely fine with the fact that this market is moving to the upside. This can become a significantly bearish bit of price action when we see a Shooting Star in an uptrend. For us as traders, if we’re trading this independently and we can certainly identify the lower of this market followed by the high, it would be a bit of a straight forward situation for you as a trader to basically place your stop-loss above the high of this market, with the expectation being a Shooting Star which has a bearish connotation to look to send this market lower to the downside. And as you can see, markets don’t move in a linear fashion so you get the inevitable pullback.

A trade like this which is quite simple to see and to identify can become very, very bearish very quickly. Therein lies your potential to see significant risk reward, positive risk rewards, on a trade like this. You could be looking at four or five to one on a positive risk reward nature to the downside. This is how sort of our understanding of Japanese candlesticks can actually assist you with regards to being precise and accurate, with regards to your risk management, and calculate that risk accordingly in line with your Japanese candlesticks, and look to mitigate risk as quickly as possible. To just come back to this, if we get a bit of a reversal and we get prices moving higher, then this is not a market that you would look to be selling. You can you continue you can make sure you draw a line in the sand, work with the highs or just above the highs, and if you get a reversal then this is a market that you no longer want to be selling. However, if you stack the odds in your favour and you can conduct some fairly basic support resistance and some other technical analysis to this market, you could identify a fantastic opportunity to take this market to the downside. Okay, so that’s just the impact that Japanese candlesticks can have on risk and our ability to protect our own capital at all times.

Okay so now we are just moving on to the Practical Application, and we have been looking at practical live charts on over an extended period. Let’s now put you to the test as a trader. Shortly I shall reveal a live price chart and will then give you approximately 60 seconds to see if you can identify as many major candlestick formations as possible within that 60 seconds. It is not necessarily necessary for you to know the name of the candlestick formations. But we would be interested to see if you can, it’s a useful skill for you to develop to be able to identify its locations and the potential price moves thereafter. We will put you to the test and afterwards we will review the main candlestick formations and we will see how many you get right. We wish you the best of luck. To just give you a tip, what we’ve done is, what you can look at when I show you this chart, you could look for swing highs and swing lows which are significant areas for us as technical traders to look at and to be able to identify and see what’s going on. Just so that you know, we’ve identified four major bullish and four major bearish candlestick patterns in this chart. What I’d like to do is to put this chart up on screen and just give you 60 seconds to see if you can identify as many as you possibly can. There’s eight in total. There is many more on this chart, but and we’re looking for the more significant or the more major candlestick formations on this chart.