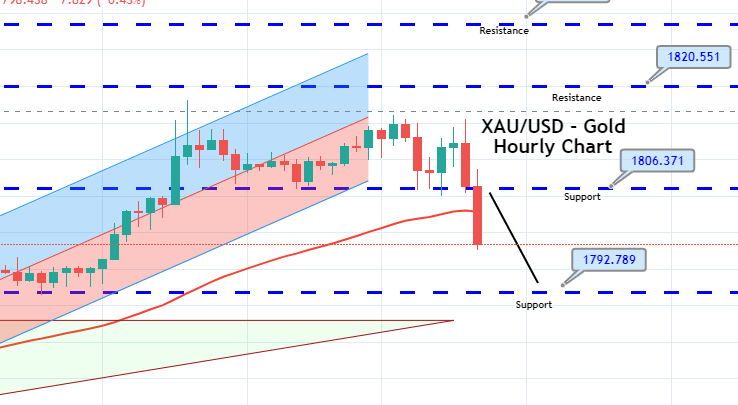

On the news front, the primary focus will stay on the ADP non-farm payroll figures, which are expected to be positive. If the actual data also comes out positive, we are going to see sharp selling in gold. Conversely, the negative data can drive selling the dollar and buying in gold.

Economic Events to Watch Today

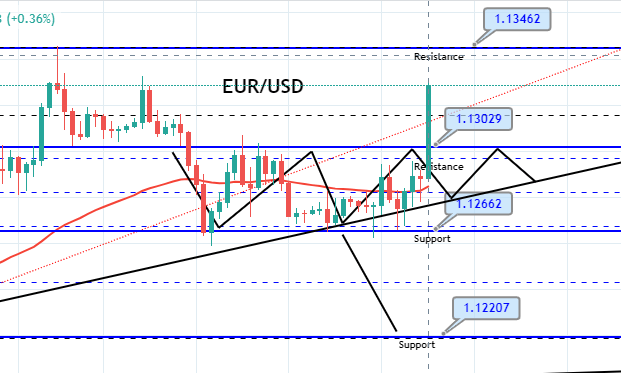

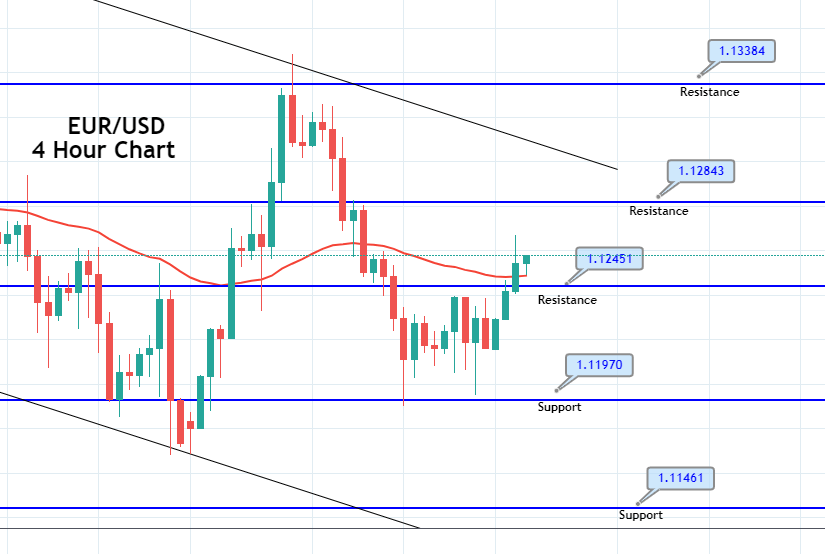

EUR/USD – Daily Analysis

The EUR/USD closed at 1.12333 after placing a high of 1.12616 and a low of 1.11908. Overall the movement of the EUR/USD pair remained flat but slightly bearish throughout the day. The pair EUR/USD moved in sideways during Tuesday’s trading session and ended the day with some losses. The greenback was strong throughout the day ahead of Fed chair Jerome Powell’s speech and weighed on EUR/USD pair. However, after the speech, the U.S. dollar became weak, and the EUR/USD pair recovered some of its daily losses.

On the data front, at 11:45 GMT, the French Consumer Spending for the month of May increased to 36.6% from the expected 30.0% and supported Euro. The French Prelim CPI for the month of June dropped negative to -0.1% from the forecasted 0.4% and weighed on Euro, which ultimately dragged the EUR/USD pair with itself.

At 14:00 GMT, the CPI Flash Estimate for the year increased to 0.3% from the expected -0.1% and supported Euro. The Core CPI Flash Estimate for the year remained flat with the projected 0.8%. The Italian Prelim CPI also remained flat with the expectations of 0.1% in June.

On the other hand, from the United States, the S&P/CS Composite-20 HPI increased to 4.0% from the expected 3.8% and supported the U.S. dollar for the year. At 18:45 GMT, the Chicago PMI dropped to 36.6 from the anticipated 45.0 and weighed on the U.S. dollar. At 19:00 GMT, the C.B. Consumer Confidence rose to 98.1 from the expected 91.6 and supported the U.S. dollar added in the downfall of EUR/USD pair on Tuesday.

The U.S. Fed chairman, Jerome Powell, provided a gloomy and unexpectedly uncertain outlook for the biggest economy of the world, which weighed on the U.S. dollar and supported the EUR/USD currency pair.

The increased number of infected cases from many states of the U.S. raised alarming bells, and some states again started to shut down economic activity. The second outbreak forced people to stay in their homes once again and keep them away from the labor market after hurting their confidence level. According to Powell, full consumer confidence was vital to full economic recovery. Euro investors will be looking forward to the release of Germany’s Unemployment Rate figures for June on Wednesday for fresh impetus.

Daily Support and Resistance

- R3 1.1241

- R2 1.1235

- R1 1.1229

Pivot Point 1.1223

- S1 1.1217

- S2 1.1211

- S3 1.1205

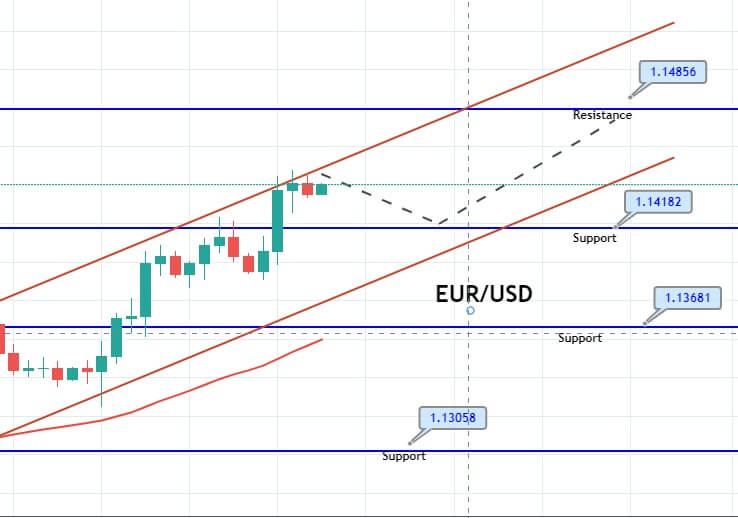

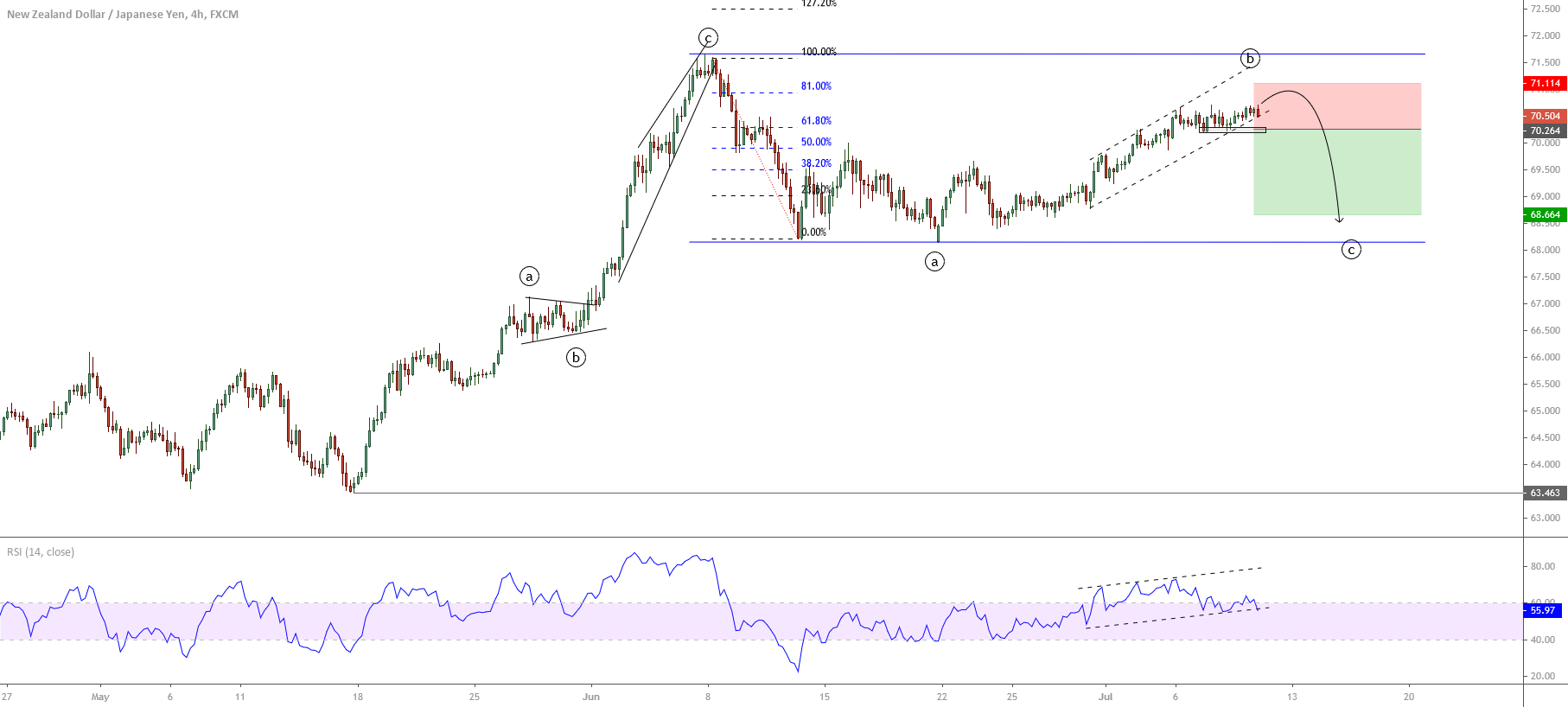

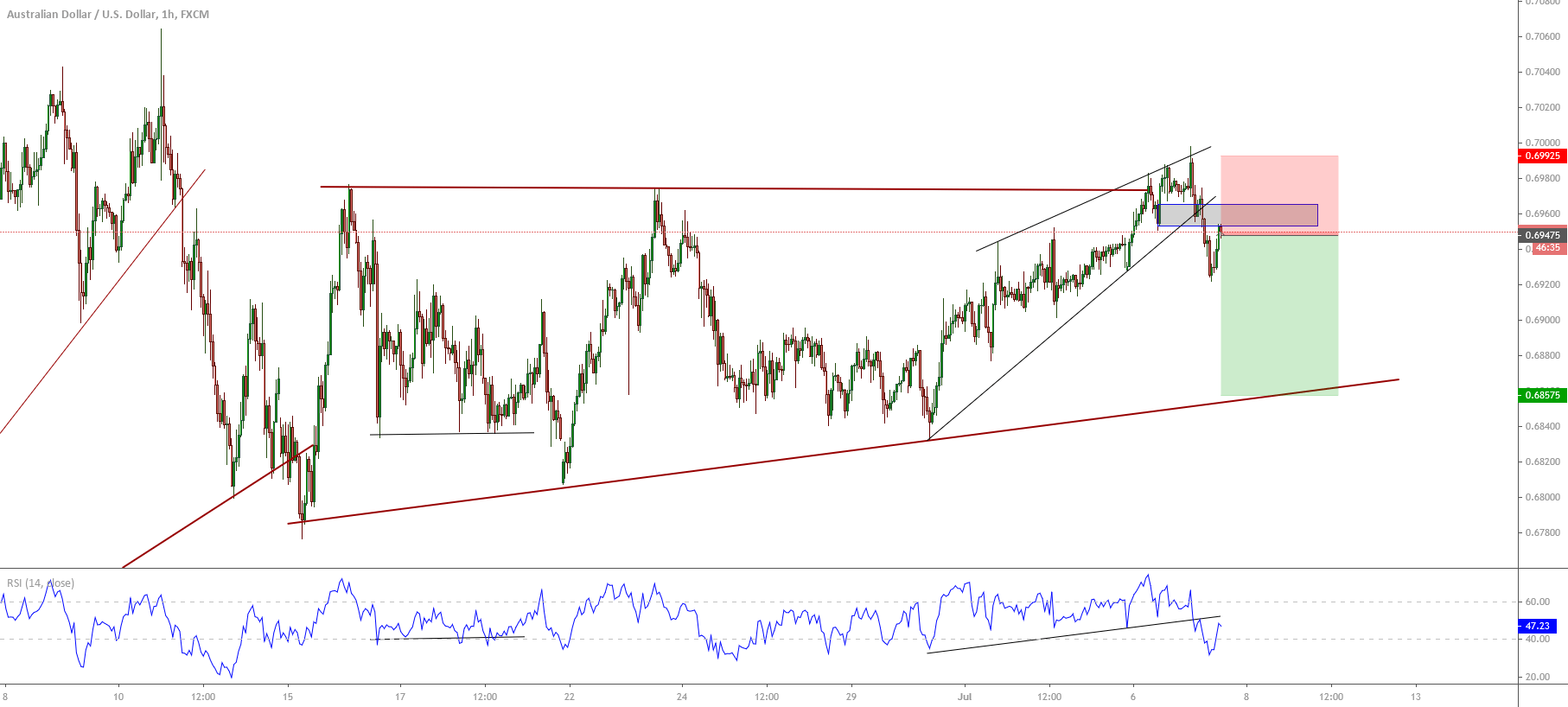

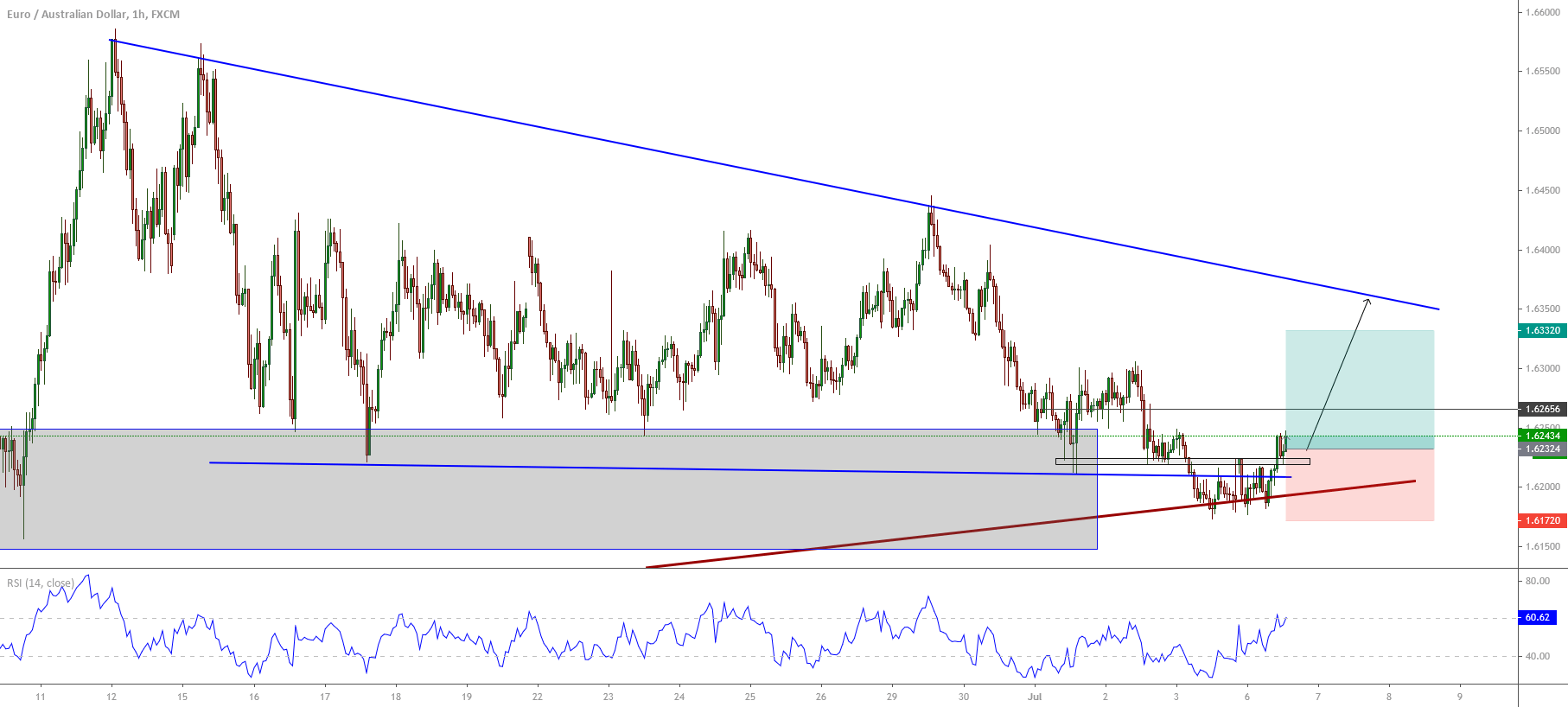

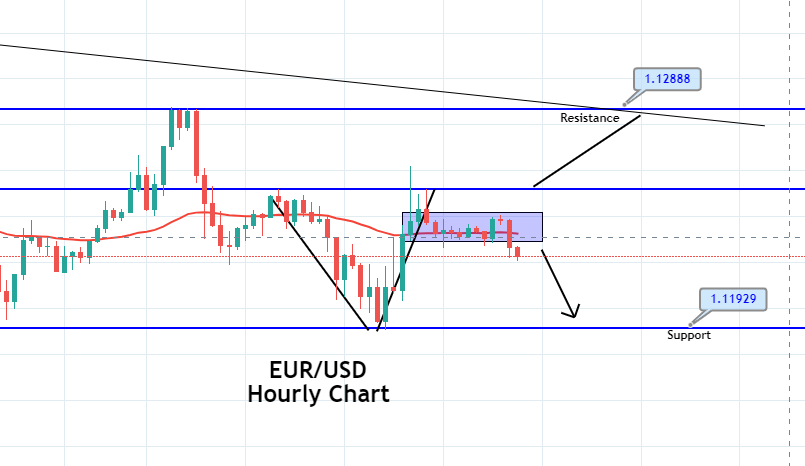

EUR/USD– Trading Tip

The EUR/USD is trading below a strong resistance level of 1.1245 level, closing candles below this level, and suggesting chances of selling bias until the 1.1218 level. Continuation of selling trend under 1.1218 level can extend selling unto 1.1195 level today. Alternatively, a bullish breakout of the 1.1245 level can continue buying until 1.1289. Mixed sentiments play as investors are waiting for the U.S. ADP figures, which are due later today.

GBP/USD – Daily Analysis

The GBP/USD pair was closed at 1.24002 after placing a high of 1.24016 and a low of 1.22574. Overall the movement of GBP/USD pair remained bullish throughout the day. The Pound raised against the dollar after clawing back early day losses on Tuesday amid the suggestion by Bank of England that the U.K. was on track for a stronger than expected rebound after the worst slump in more than 40 years in the first quarter of 2020.

At 11:00 GMT, the Current Account Balance from the United Kingdom showed a deficit of 21.1B against the expected deficit by 15.2B and weighed on British Pound. The Final GDP for the first quarter dropped to -2.2% against the forecasted -2.0% and weighed on British Pound. The Revised Business Investment for the quarter also came in as -0.3% from the 0.1% and weighed on British Pound.

In an earlier trading session on Tuesday, GBP/USD remained under pressure due to poor than expected data from Britain’s side. However, after the positive comments from the chief economist from the Bank of England, the pair GBP/USD gained traction.

On Tuesday, Andy Haldane said that recent signs suggested that Britain was on course for V-shaped economic recovery from the coronavirus-induced lockdowns, but there was still a risk of high & persistent unemployment.

According to Haldane, the risks of the economic outlook were considerable and two-sided. He added that the risks were more evenly balanced in June than in May and remained skewed.

The views that the U.K. economy was on track for V-shaped recovery gave strength to the British Pound on Tuesday and pushed the GBP/USD pair on the upward track.

The strong rebound in the Pound could also be attributed to the little signs of progress on the latest post-Brexit talks. E.U. Negotiator Michel Barnier criticized Britain for choosing not to extend the deadline for the transition period that will end on Dec.31. He also said that Britain was trying to secure as many single markets as possible while showing little compromises on key sticking points, including the level playing field, security, and fisheries.

On the U.S. front, the dollar was weak across the board after the speech of Federal Reserve Chairman Jerome Powell, who provided an uncertain and gloomy outlook for the U.S. economy due to an increased number of infected cases in the U.S. that had forced the renewed lockdown measures in some states. The weak U.S. Dollar added in the gains of the GBP/USD currency pair on Tuesday.

Daily Support and Resistance

- R3 1.2381

- R2 1.2367

- R1 1.2354

Pivot Point 1.234

- S1 1.2327

- S2 1.2313

- S3 1.23

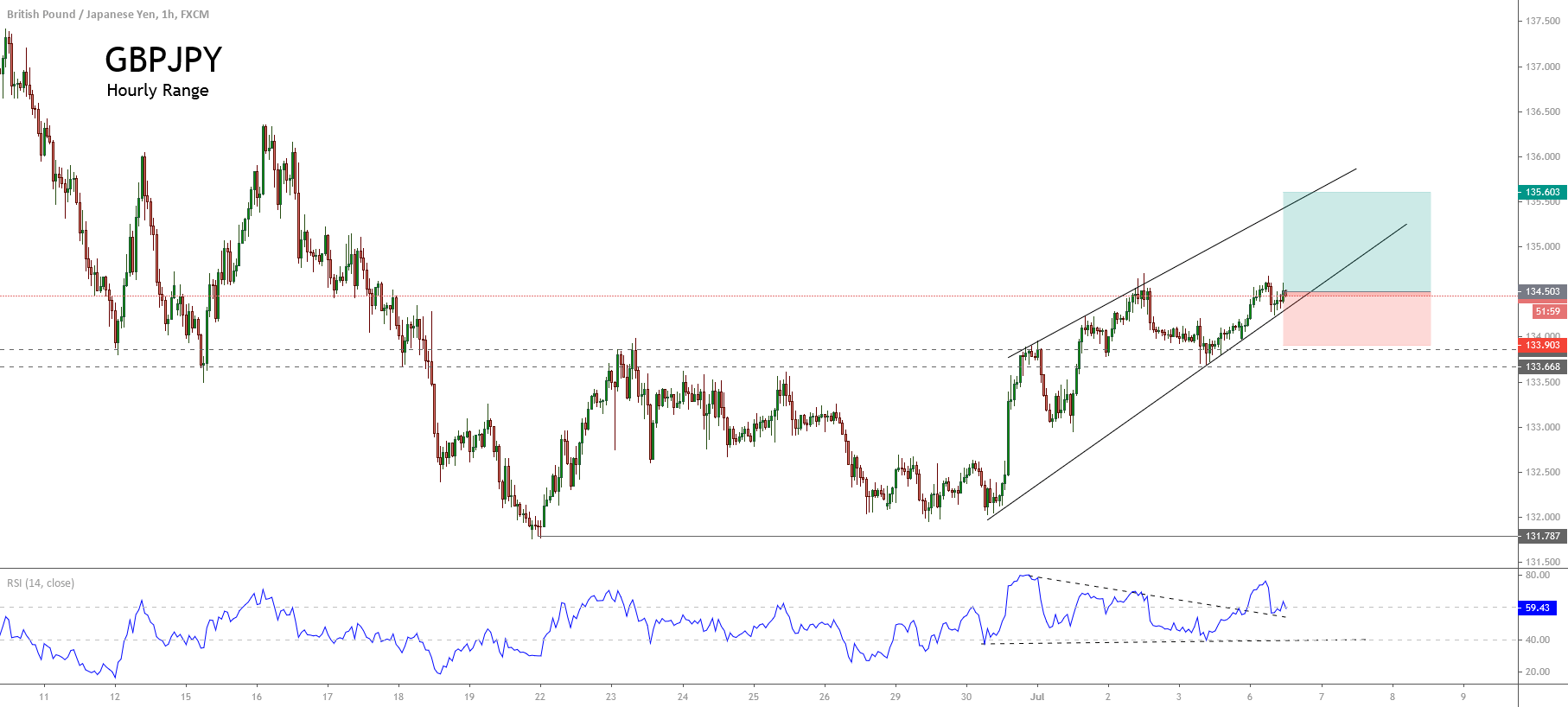

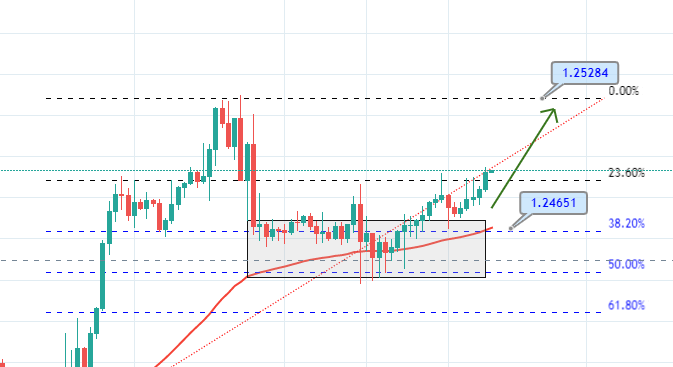

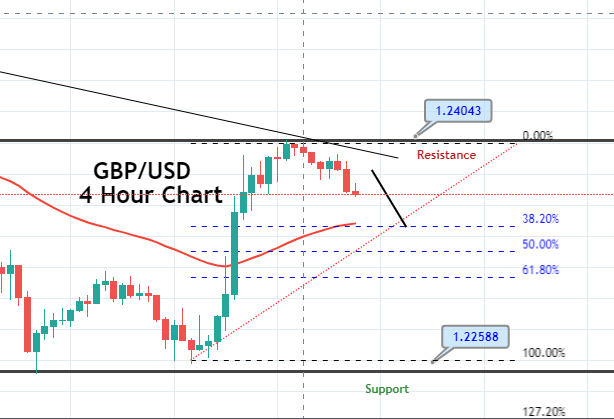

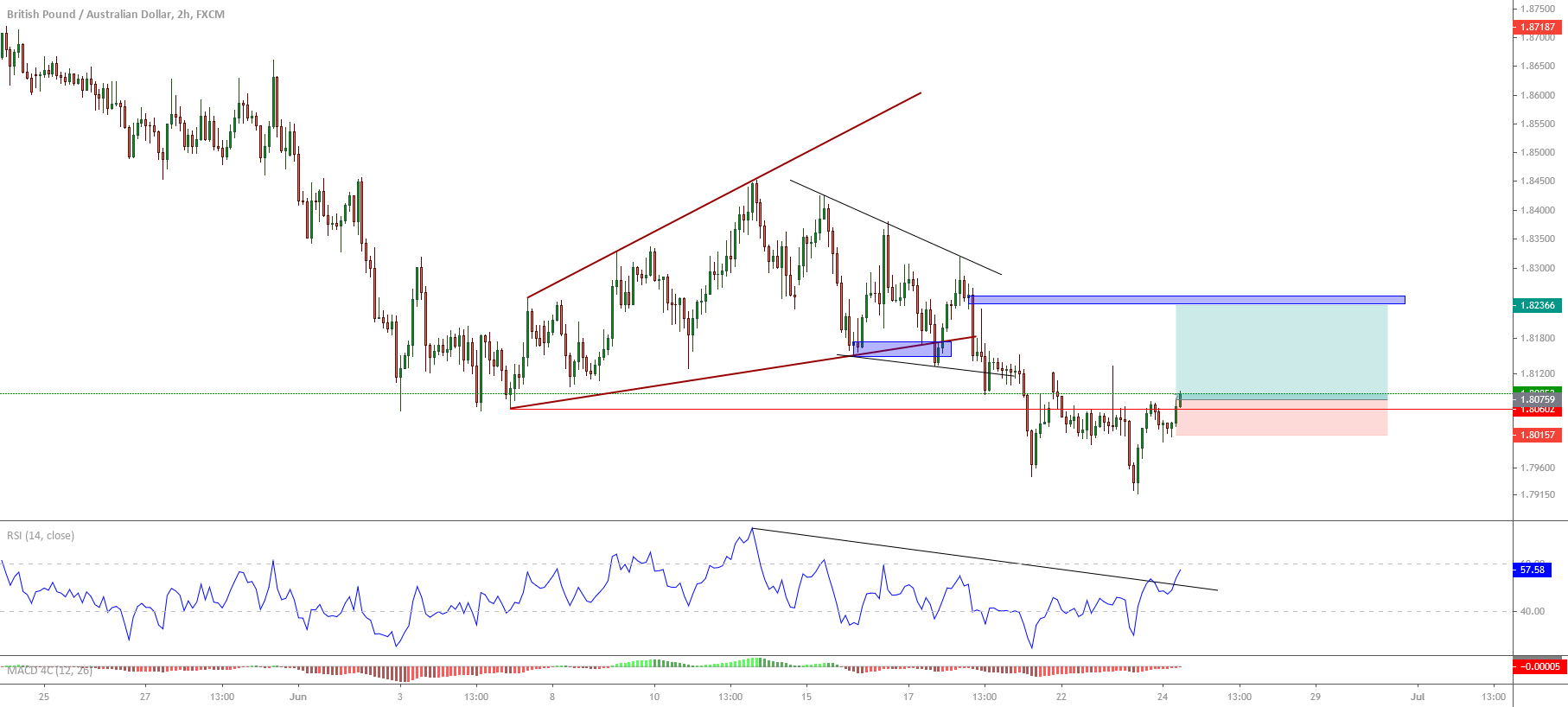

GBP/USD– Trading Tip

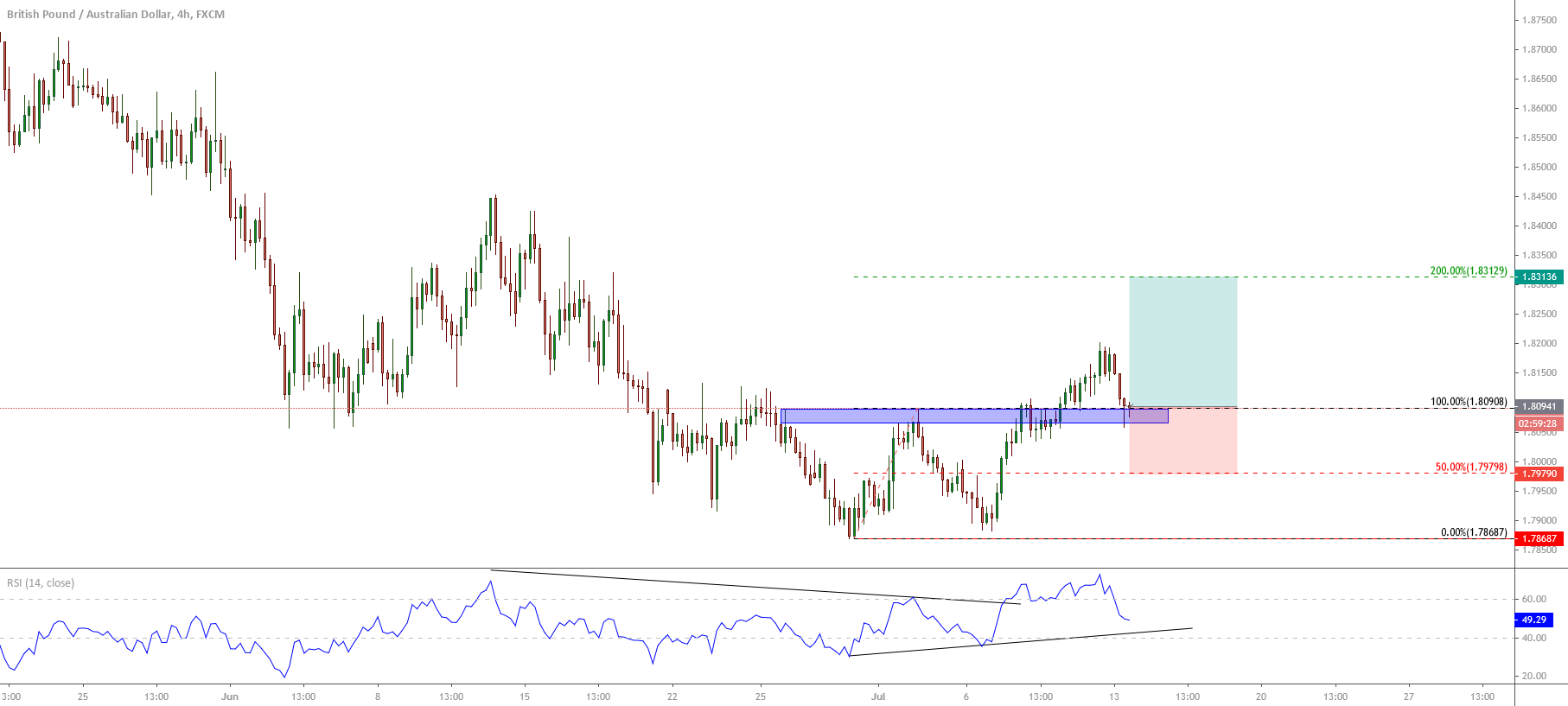

On Wednesday, the GBP/USD is trading with a bearish bias as the dollar is getting strong, perhaps due to the positive forecast of ADP figures. The GBP/USD is trading at 1.2375 level, and it’s finding immediate support at 1.2358 level. Closing of candles below 1.2404 level can open further room for selling until 38.2% Fibo level of 1.2340 level. But the bullish breakout of 1.2400 level can drive buying in Cable and can lead its prices towards the next target level of 1.2504 level. The RSI and MACD show diverse opinions as the MACD is in a selling zone, while the RSI is in a buying zone. Let’s consider taking a selling trades below 1.2400 level and buying above the same.

USD/JPY – Daily Analysis

The USD/JPY was closed at 107.925 after placing a high of107.982 and a low of 107.519. At 4:30 GMT, the Unemployment Rate from Japan increased to 2.9% against the forecasted 2.8% in May and weighed on Japanese Yen that pushed USD/JPY pair higher. At 4:50 GMT, the Prelim Industrial Production was dropped by 8.4% in May against the expected drop of 5.6%, it weighed on Yen and supported USD/JPY pair.

The Japanese yen saw significant outflows into overseas investments towards the end of the month but could all come back on the risks of a second wave impact on U.S. stocks. Some states in the U.S. have reversed the reopening of economies and closed their businesses in the fears of the second wave of coronavirus. The U.S. Federal Reserve Chairman Jerome Powell warned on Tuesday that the second wave of coronavirus outbreak would damage consumer confidence and weaken the economy.

He was cautious that during the second outbreak, the government and people could withdraw again from the economic activity. He added that the worst part of the second wave would be the downward impact on public confidence, which could play a crucial role in getting back to economic activity.

In Republican Arizona, gyms bars, movies, and theaters and water parks were shut down for at least 30 days. These institutions were reopened in middle May, but after the rise in the infected cases across the country, the government announced to shut them down.

The health care professionals in Houston have urged residents to remain at home, wear masks, and cancel gatherings in the wake of intensified virus cases. The residents of Houston also received an emergency alert on their phones to stay home as virus infections have spiked in the town.

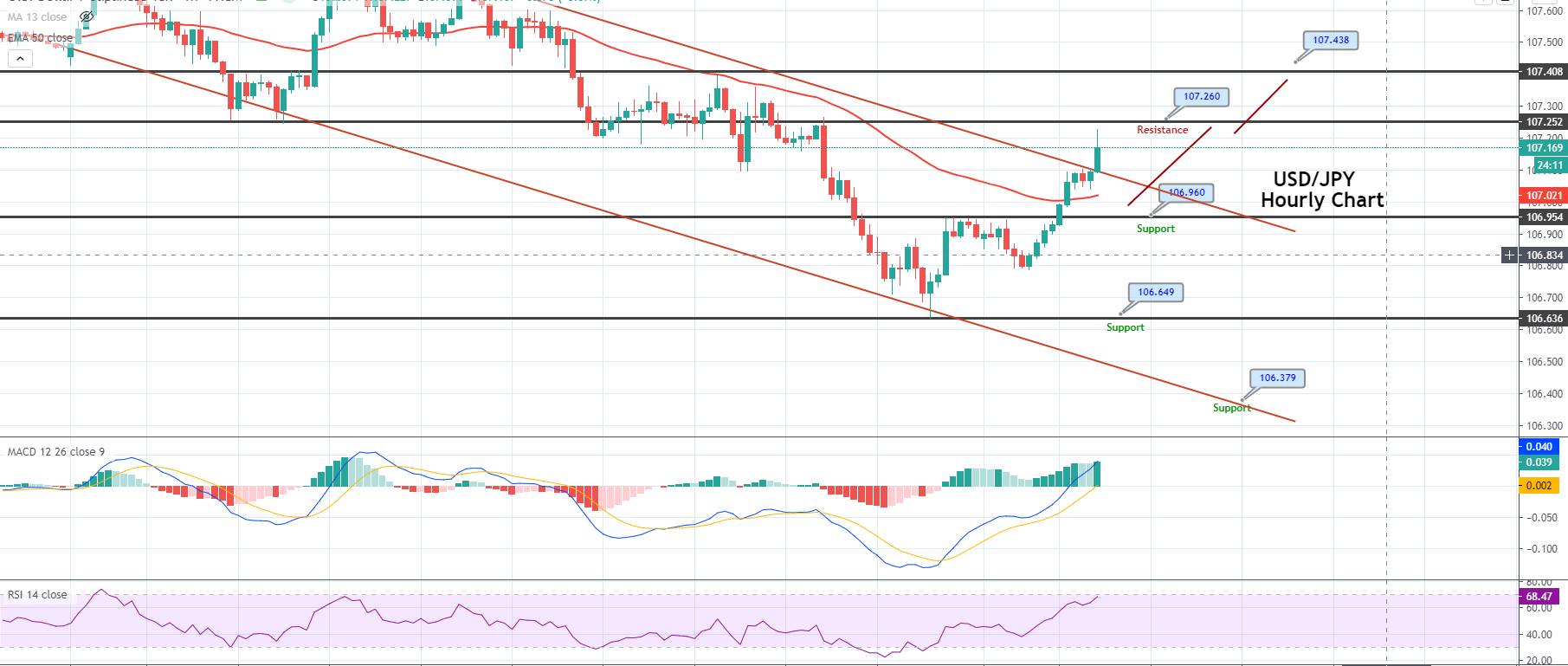

Daily Support and Resistance

- R3 107.39

- R2 107.31

- R1 107.27

Pivot Point 107.19

- S1 107.14

- S2 107.07

- S3 107.02

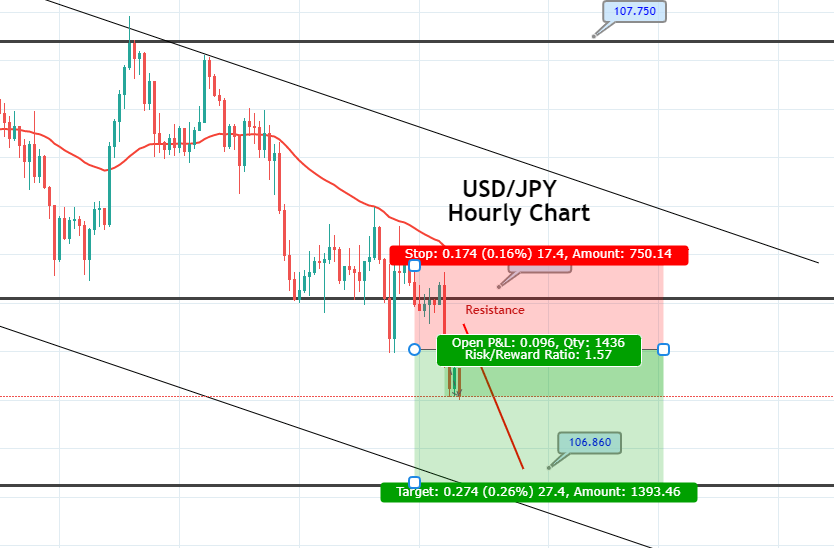

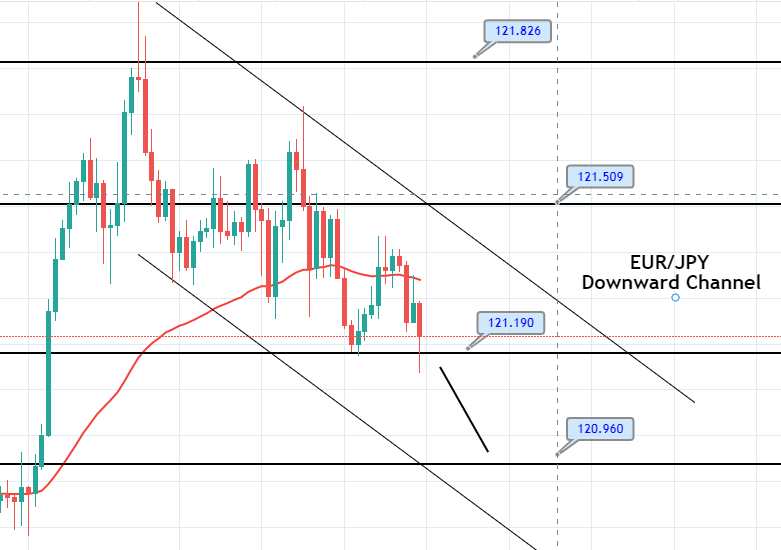

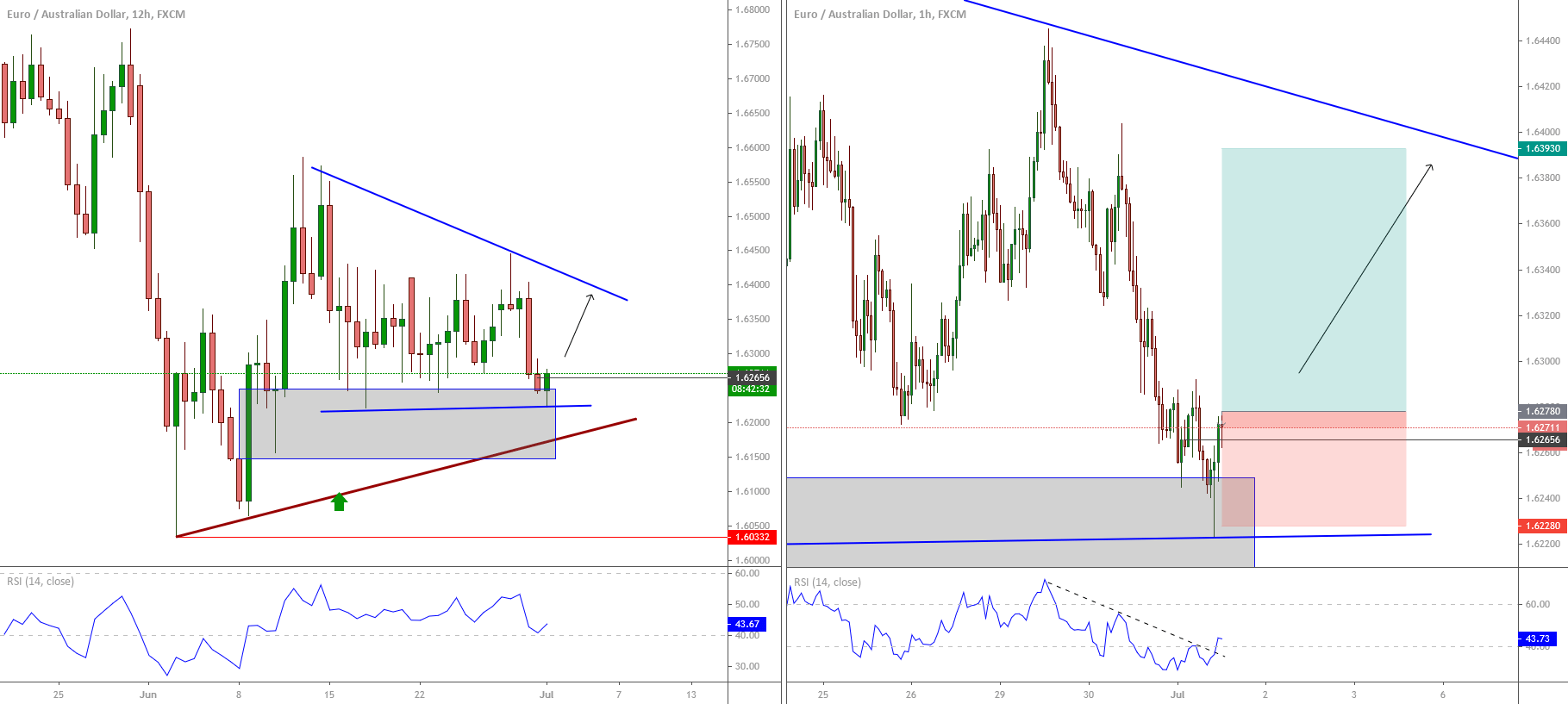

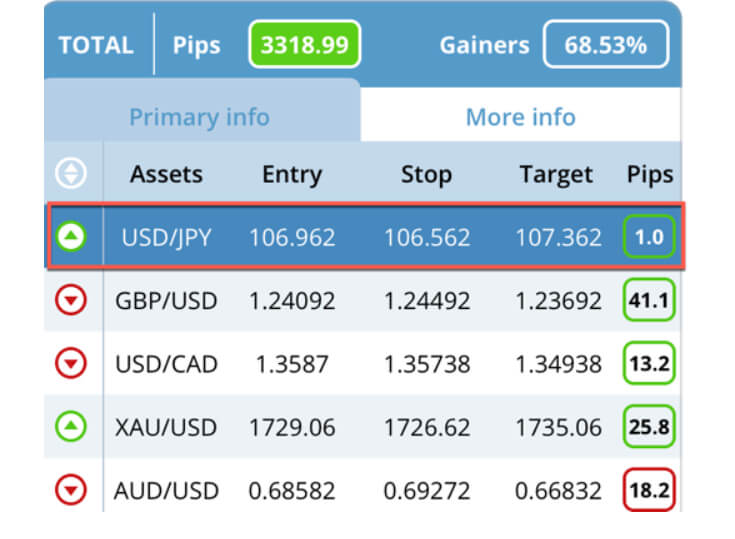

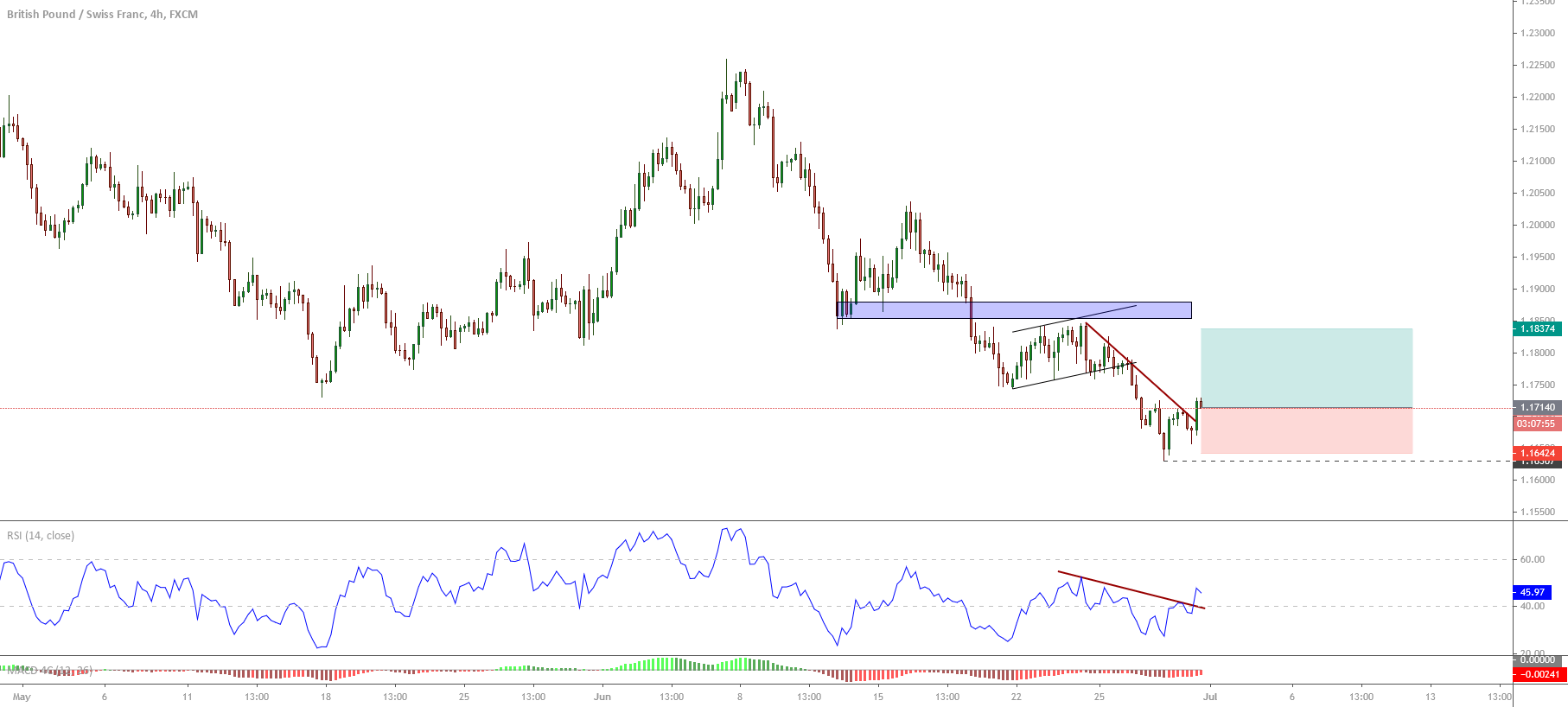

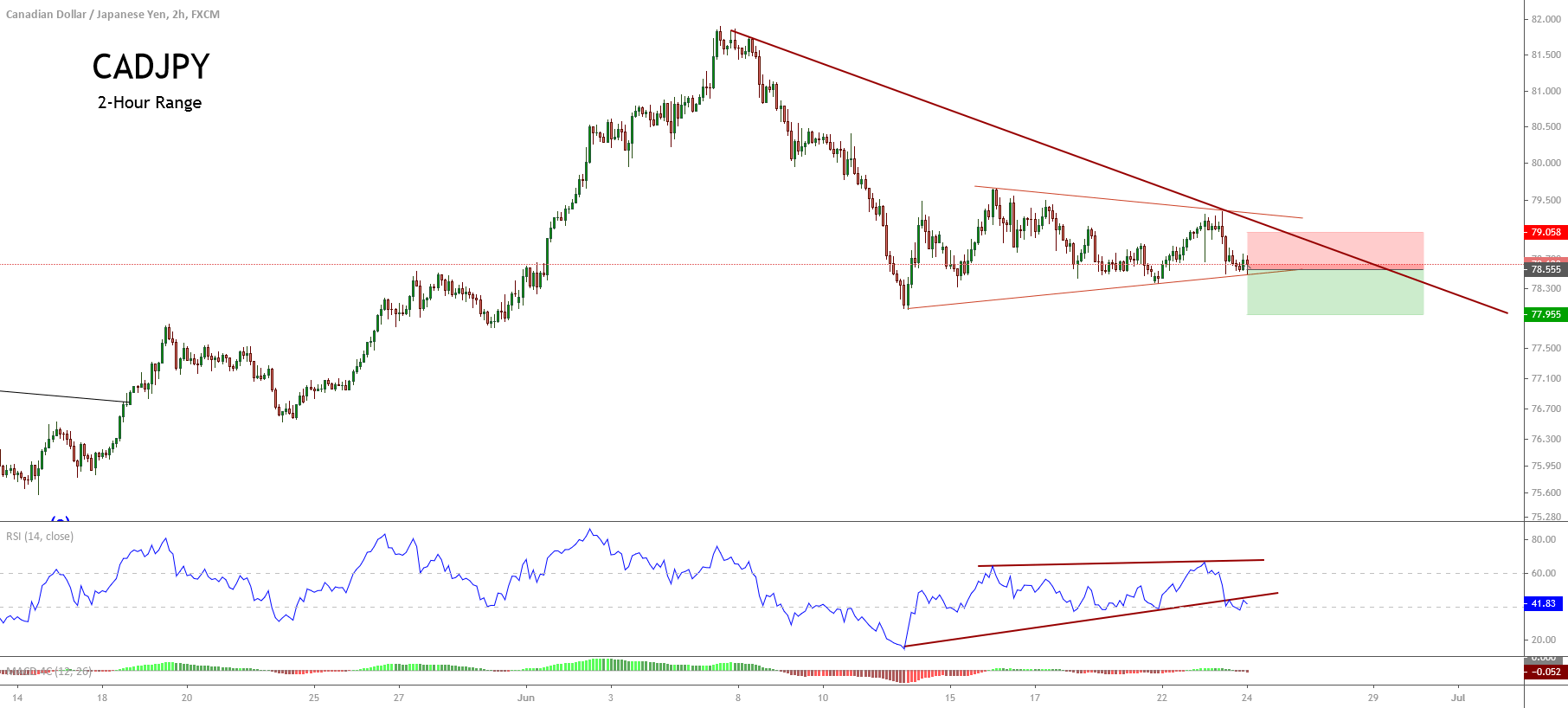

USD/JPY – Trading Tips

On Wednesday, the USD/JPY is trading with a bearish bias of around 107.560. On the two-hourly charts, the USD/JPY is gaining bullish support from the regression channel. Channel is expected to support the USD/JPY pair around 107.420 while crossing below this level can open up further room for selling until 107 and 106.850 level. The 50 EMA will also be supporting the Japanese pair at 107.300 level. However, the MACD and RSI are suggesting selling bias. Let’s keep an eye on 107.400 level to buy above and sell below this level. Good luck!