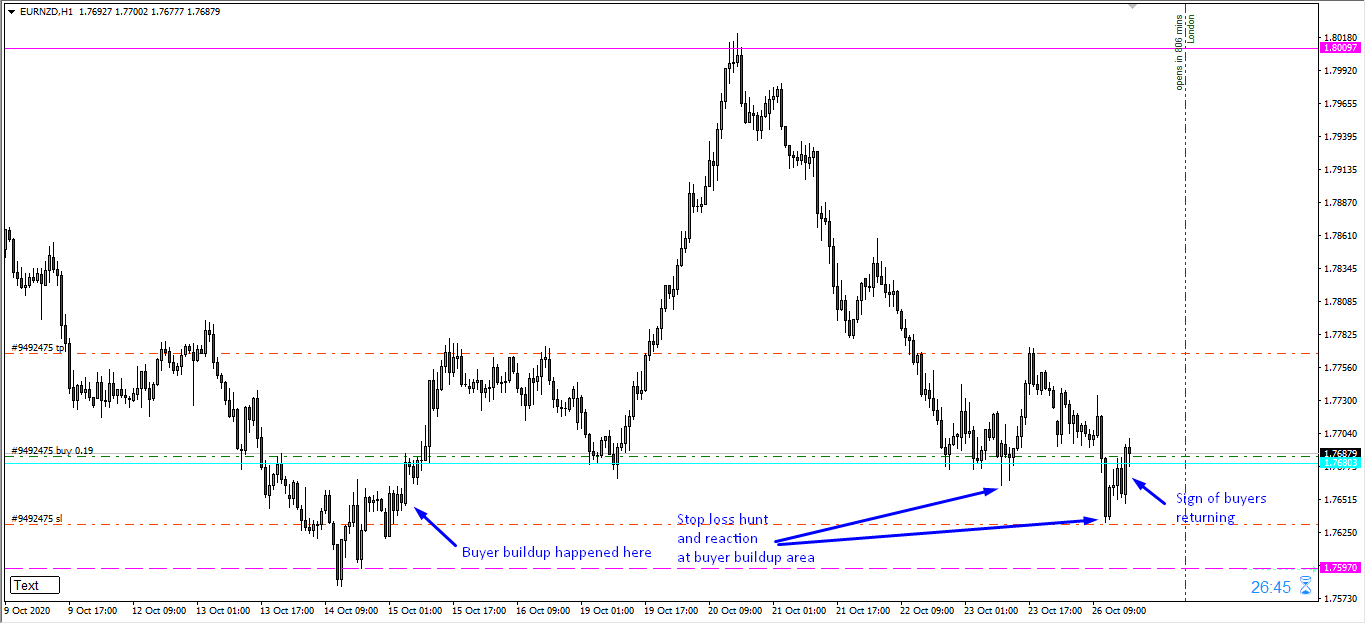

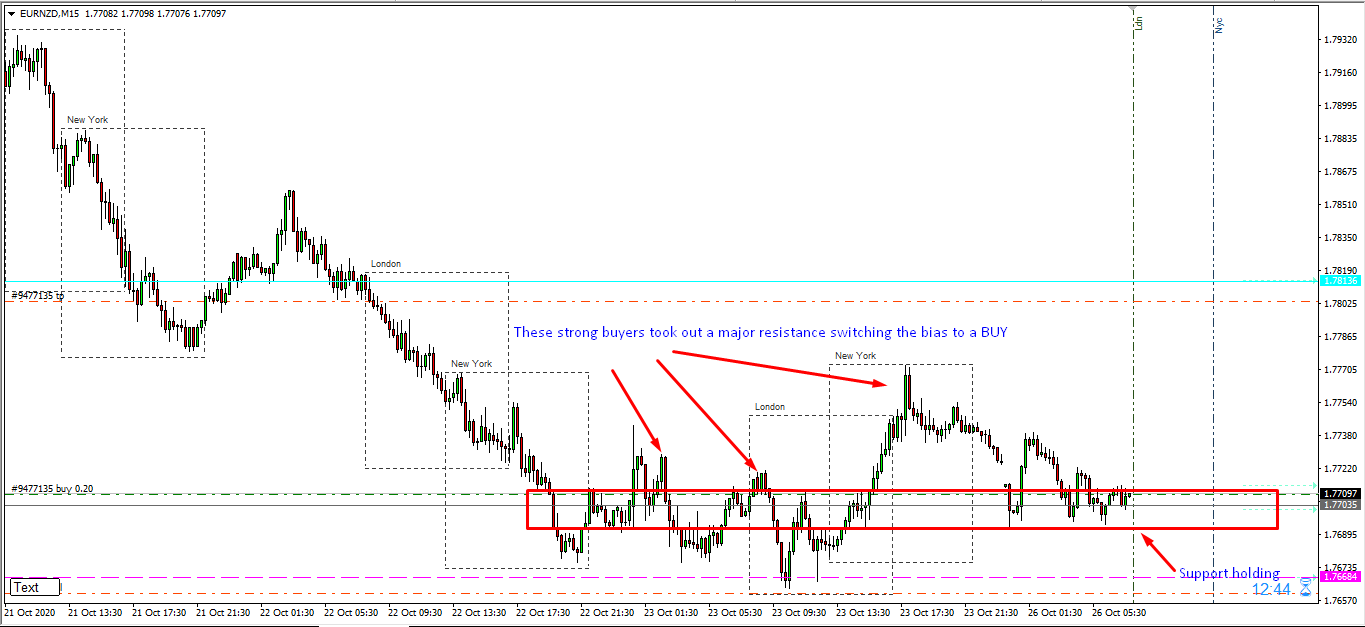

EURNZD Swing Failure BUY

Signals will list Live Trading Signals with Entry, Stop-loss, and Profit Targets (Future addition)

During Friday’s European trading hours, the USD/JPY currency pair failed to stop its previous session bearish moves and took further offers below mid- the 0.9000 level. However, the reason for the bearish tone around the currency pair could be associated with the broad-based U.S. dollar weakness, triggered by the risk-on market mood, which tends to undermine the safe-haven U.S. dollar. Hence, the upbeat market sentiment, supported by optimism over a potential vaccine/treatment for the highly infectious coronavirus.

During Friday’s European trading hours, the USD/JPY currency pair failed to stop its previous session bearish moves and took further offers below mid- the 0.9000 level. However, the reason for the bearish tone around the currency pair could be associated with the broad-based U.S. dollar weakness, triggered by the risk-on market mood, which tends to undermine the safe-haven U.S. dollar. Hence, the upbeat market sentiment, supported by optimism over a potential vaccine/treatment for the highly infectious coronavirus.

During Friday’s European trading hours, the USD/JPY currency pair failed to stop its previous session bearish moves and took further offers below mid- the 0.9000 level. However, the reason for the bearish tone around the currency pair could be associated with the broad-based U.S. dollar weakness, triggered by the risk-on market mood, which tends to undermine the safe-haven U.S. dollar. Hence, the upbeat market sentiment, supported by optimism over a potential vaccine/treatment for the highly infectious coronavirus.

On the contrary, the positive tone around the equity market also weakened the safe-haven Swiss franc and became the factor that cap further downside momentum for the USD/CHF currency pair. Currently, the USD/CHF currency pair is currently trading at 0.90430.9043 and consolidating in the range between 0.9040 – 0.9095.

While discussing the positive side of the story, the renewed optimism over a possible vaccine for the highly infectious coronavirus disease boosted the market risk tone. However, the hopes of the vaccine were boosted after Gilead Sciences received US FDA approval for its antiviral therapy to treat the highly contagious coronavirus disease. Elsewhere, the reasons for the risk-on market trading sentiment could also be attributed to rising expectations of further U.S. stimulus package. These hopes were fueled after the positive remarks of President Donald Trump and House of Representatives Speaker Nancy Pelosi, which eventually raised hopes for the measures to be passed before the election. Thus, the risk-on market mood tends to undermine the safe-haven Swiss franc, which becomes the key factor that lends some support to the currency pair to ease the intraday bearish pressure surrounding the USD/CHF pair.

As a result of the upbeat market sentiment, the broad-based U.S. dollar failed to gain any positive traction on the day. Apart from this, the U.S. dollar losses could also be associated with the increasing expectations of a strong Democratic victory in the U.S. elections, which tend to undermine the greenback. However, the U.S. dollar losses became the key factor that kept the currency pair under pressure. Simultaneously, the U.S. Dollar Index that tracks the greenback against a basket of other currencies dropped to 92.757.

Across the ocean, the equity market’s optimism was rather unaffected by the intensified US-China tussle and Brexit concerns. At the US-China front, the U.S. Secretary of State Michael Pompeo designated 6-more Chinese publications as “foreign missions”, or media outlets controlled by Beijing, at a Wednesday briefing. These headlines have little to no impact on the CHF markets.

Looking forward, the market traders will keep their eyes on the USD moves amid the lack of major data/events on the day. However, the final presidential debate between President Donald Trump and his Democratic rival Joe Biden. will be key to watch. Furthermore, the risk catalyst like geopolitics and the virus woes, not to forget the Brexit, could not lose their importance.

Daily Support and Resistance

S1 0.9016

S2 0.9042

S3 0.9058

Pivot Point 0.9069

R1 0.9085

R2 0.9096

R3 0.9123

Entry Price – Sell 0.90606

Stop Loss – 0.91006

Take Profit – 0.90206

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The yellow metal gold soared 1% to its highest in a week as traders confidence that a U.S. coronavirus aid package will be announced before the Nov. 3 presidential elections urged the dollar and supported bullion’s appeal as an inflation hedge.

The yellow metal gold soared 1% to its highest in a week as traders confidence that a U.S. coronavirus aid package will be announced before the Nov. 3 presidential elections urged the dollar and supported bullion’s appeal as an inflation hedge.

The yellow metal gold soared 1% to its highest in a week as traders confidence that a U.S. coronavirus aid package will be announced before the Nov. 3 presidential elections urged the dollar and supported bullion’s appeal as an inflation hedge.

On the contrary, the broad-based U.S. dollar strength has become the factor that helps the currency pair limit its deeper losses. Moreover, the bullish tone around the U.S. dollar was sponsored by Thursday’s released upbeat U.S. jobless data, which showed a larger than expected drop in the initial jobless claims.

Daily Technical Levels

Support Resistance

1902.14 1923.14

1888.87 1930.87

1881.14 1944.14

Pivot point: 1909.87

Gold is fell dramatically on the bearish side, dropping from the 1,930 mark to the 1,912 level. It’s a support mark that’s prolonged by a previously disrupted symmetric triangle pattern. On the lower side, the 1,912 support level violation may trigger more selling until the 1,897 level today.

Entry Price – Buy 1909.86

Stop Loss – 1903.86

Take Profit – 1915.86

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$600/ +$600

Profit & Loss Per Micro Lot = -$60/ +$60

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

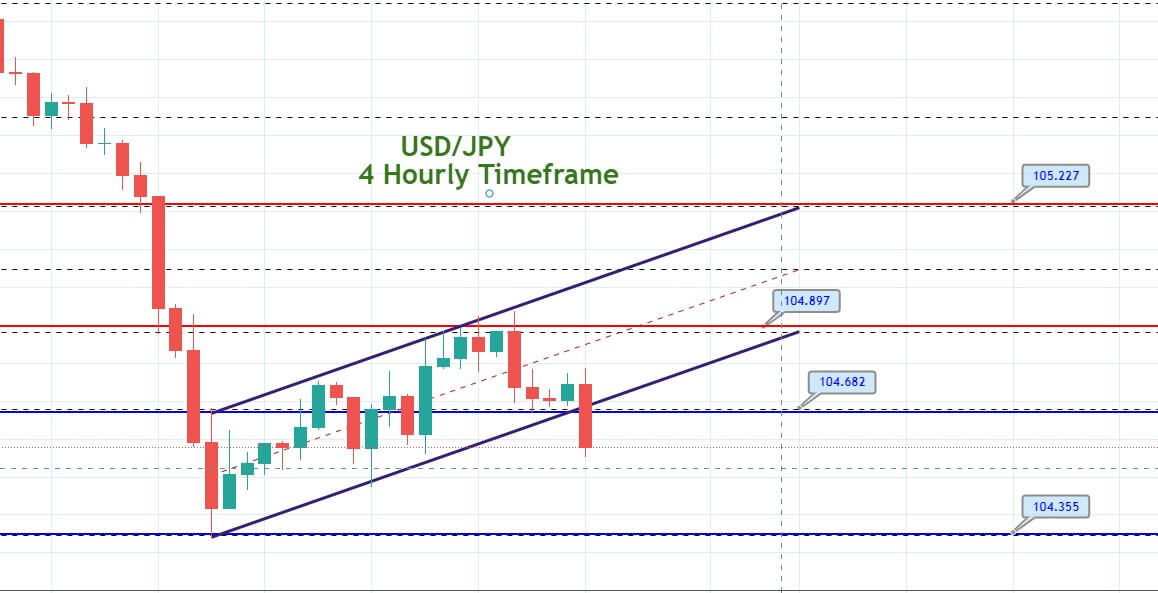

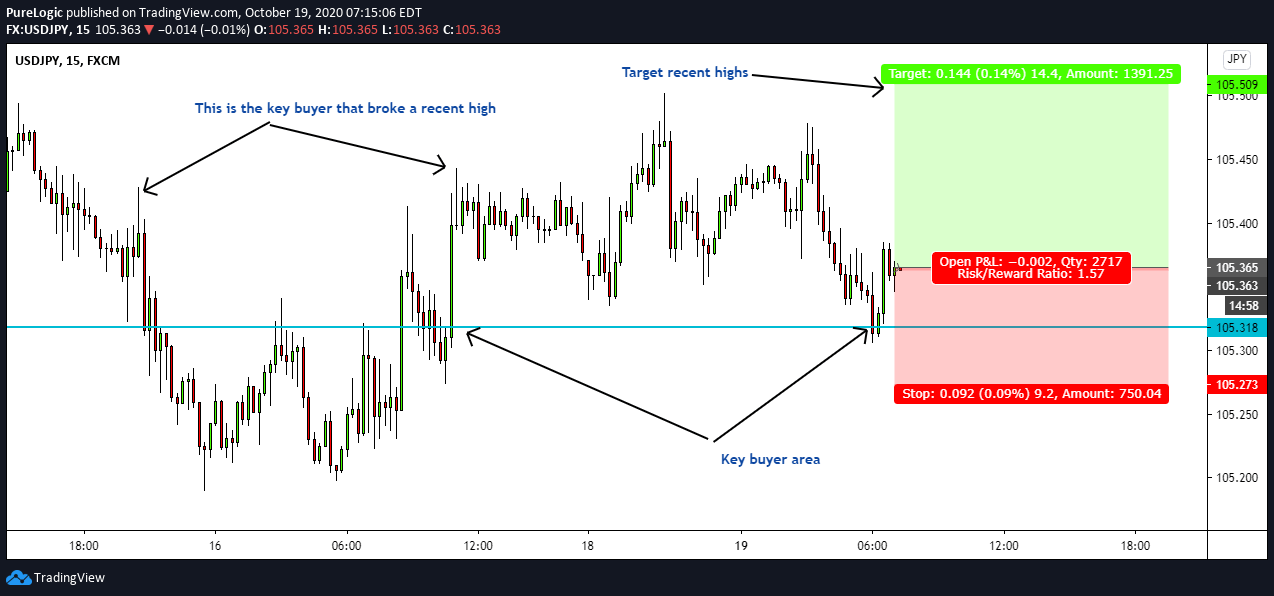

The USD/JPY pair is trading sharply bearish after violating the bearish flag at the 104.680 level. Below this level, we may have more selling trade opportunities. The USD/JPY pair traded with a positive note during the whole Thursday session after a goodish pickup in the U.S. dollar demand. The rebounded U.S. dollar helped currency pair USD/JPY to gain positive traction and move away from the six-week lowest level it touched on Wednesday.

The USD/JPY pair is trading sharply bearish after violating the bearish flag at the 104.680 level. Below this level, we may have more selling trade opportunities. The USD/JPY pair traded with a positive note during the whole Thursday session after a goodish pickup in the U.S. dollar demand. The rebounded U.S. dollar helped currency pair USD/JPY to gain positive traction and move away from the six-week lowest level it touched on Wednesday.

The USD/JPY pair is trading sharply bearish after violating the bearish flag at the 104.680 level. Below this level, we may have more selling trade opportunities. The USD/JPY pair traded with a positive note during the whole Thursday session after a goodish pickup in the U.S. dollar demand. The rebounded U.S. dollar helped currency pair USD/JPY to gain positive traction and move away from the six-week lowest level it touched on Wednesday.

The slow progress in the U.S. stimulus measure package attracted some buying in the greenback that dampened the hopes that financial aid will be delivered before elections. The statement by House of Representatives Speaker Nancy Pelosi that soon there will be pen to paper on the stimulus bill failed to impress investors, and the USD/JPY pair continued moving in the upward direction.

Pelosi even said that the stimulus package could be passed in the House before election day, but investors were somewhat unconvinced that the bill could pass through the Senate due to the strong opposition from Republicans over a bigger stimulus deal. This, in turn, weighed on risk sentiment and supported the Japanese Yen that ultimately capped further upside in the USD/JPY pair prices.

Apart from developments surrounding the U.S. fiscal stimulus, the USD bulls further took clues from the better than expected release of the U.S. initial jobless claims. The number of Americans filed for unemployment benefits declined to 787K during the previous week for the first time against the projected 860K and supported the U.S. dollar. The decline in unemployment claims means less need for a U.S. stimulus package and more strength for the U.S. dollar and USD/JPY pair.

On the data front, the C.B. Leading Index from the U.S. dropped to 0.7% against the expected 0.8% and weighed on the U.S. dollar. The Existing Home Sales advanced to 6.54M in comparison to projected 6.20M and supported the U.S. dollar. Another favorable economic data release gave strength to the U.S. dollar that pushed the USD/JPY pair even higher on grounds. Meanwhile, the rising number of coronavirus cases across the globe and fears for economic recovery due to lockdowns imposed to curb the spread of the virus raised the safe-haven appeal, supported the Japanese Yen, and weighed on the USD/JPY pair to limit its bullish move on Thursday.

The USD/JPY traded dramatically bearish to drop from 105.460 level to 104.349 level. Like other pairs, the USD/JPY has also entered the oversold zone, and now sellers seem to be exhausted. On the higher side, the USD/JPY pair has reversed some of the losses to trade at the 104.700 level. On the higher side, the pair may go after the 38.2% Fibonacci retracement level of 104.900 and 50% Fibo level of 105. Let’s consider taking a buying trade over 104.350 area today.

Entry Price – Buy 104.593

Stop Loss – 104.993

Take Profit – 104.093

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

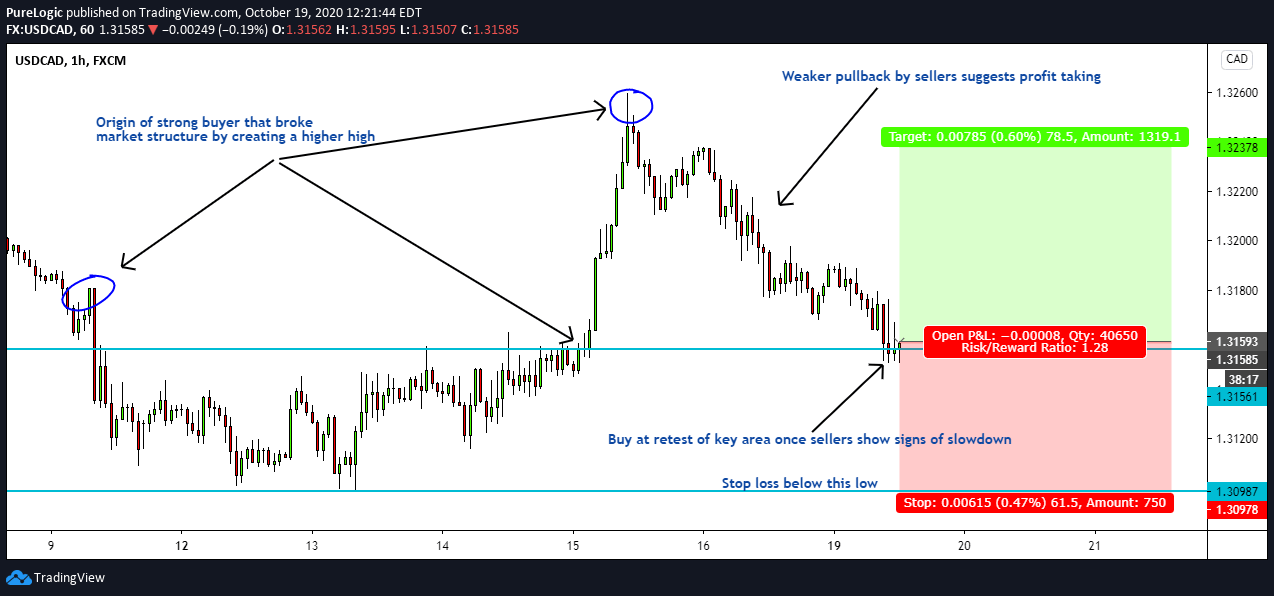

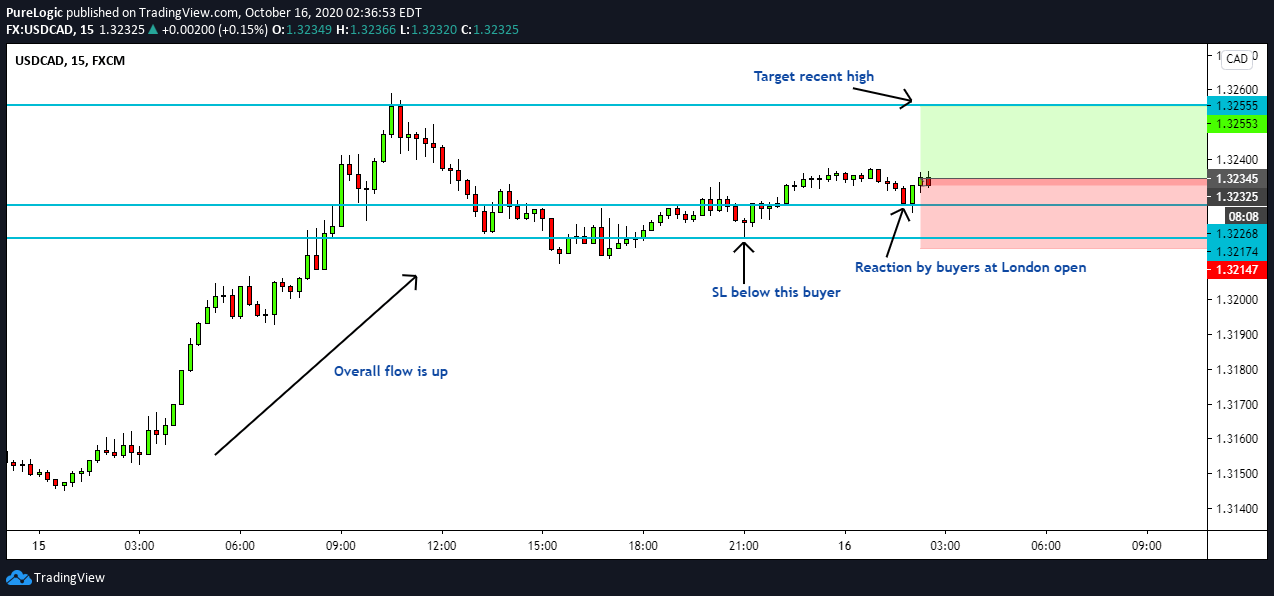

The USD/CAD pair was closed at 1.31447 after placing a high of 1.31519 and a low of 1.30808. Overall the movement of the USD/CAD pair remained bullish throughout the day. In the early trading session on Wednesday, the USD/CAD pair followed its Tuesday’s move and dropped to its lowest since 7th September over the US dollar’s weakness. The decline in crude oil prices also played a role in raising the USD/CAD pair on board. The negative macroeconomic data from Canada also added strength to the USD/CAD pair gains on Wednesday.

The USD/CAD pair was closed at 1.31447 after placing a high of 1.31519 and a low of 1.30808. Overall the movement of the USD/CAD pair remained bullish throughout the day. In the early trading session on Wednesday, the USD/CAD pair followed its Tuesday’s move and dropped to its lowest since 7th September over the US dollar’s weakness. The decline in crude oil prices also played a role in raising the USD/CAD pair on board. The negative macroeconomic data from Canada also added strength to the USD/CAD pair gains on Wednesday.

The USD/CAD pair was closed at 1.31447 after placing a high of 1.31519 and a low of 1.30808. Overall the movement of the USD/CAD pair remained bullish throughout the day. In the early trading session on Wednesday, the USD/CAD pair followed its Tuesday’s move and dropped to its lowest since 7th September over the US dollar’s weakness. The decline in crude oil prices also played a role in raising the USD/CAD pair on board. The negative macroeconomic data from Canada also added strength to the USD/CAD pair gains on Wednesday.

On the data front, the Consumer Price Index from Canada was released at 17:30 GMT for September, which came in line with -0.1%. The Core Retail Sales from Canada for September declined to 0.5% from the projected 0.9%. For September, the Retail Sales dropped to 0.4% against the expected 1.0% and weighed on the Canadian dollar. Dollarmmon and Median CPI from Canada came in line with the expectations of 1.5% and 1.9%, respectively.

Whereas the NHPI for September raised to 1.9% from the forecasted 1.2%. The Core CPI for September also remained the same as the year at 0.1%. However, the Trimmed CPI for the year raised to 1.8% against the forecasted 1.7%. The highlighted CPI, Retail Sales, and Core Retails Sales data came in negative or as expected and weighed on the Canadian Dollar tDollartimately pushed higher the USD/CAD prices on Wednesday.

Meanwhile, the Crude Oil Inventories from the previous week dropped to -1.0M against the forecasted 0.5M and raised the demand for crude oil that ultimately supported the declining WTI crude oil prices on Wednesday.

Crude oil prices suffered on Wednesday though most of its losses recovered still, it closed its day weak, which made its commodity-linked currencies Loonie weaker and supported the rising USD/CAD pair.

Daily technical Levels

Support Resistance

1.3103 1.3184

1.3051 1.3213

1.3023 1.3265

Pivot point: 1.3132

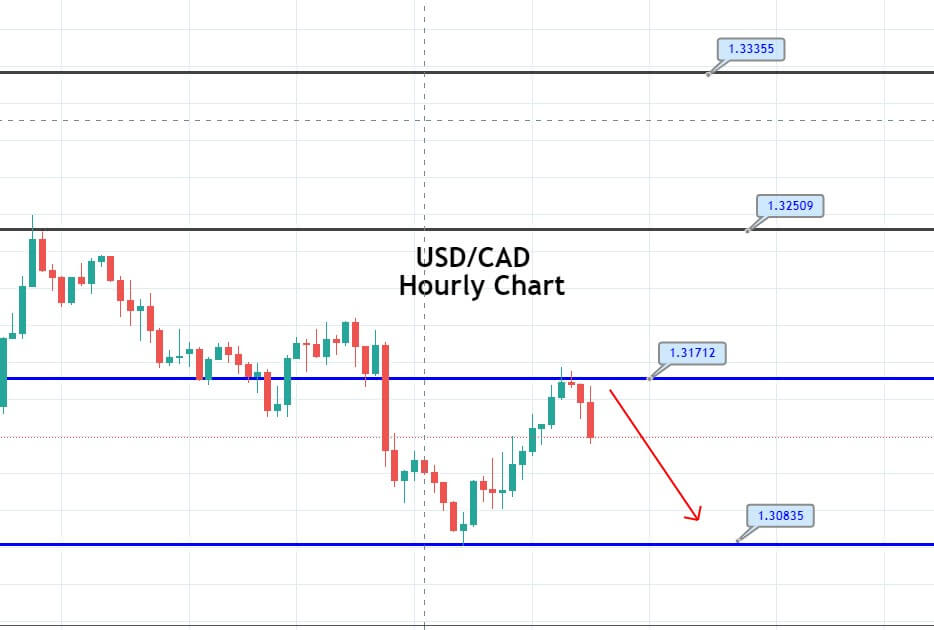

The USD/CAD is facing immediate resistance at the 1.3171 level, and closing of candles below this level is likely to drive selling bias in the market. The USD/CAD has recently closed a Doji candle below 1.3172, which is suggesting that the bullish bias seems to be over, and sellers may enter the market soon. As we can see on the chart, the USD/CAD’s very next candle is bearish engulfing, followed by a doji candle, support strong selling bias for the pair. Therefore, we have opened a sell signal, and we aim for quick 40 pips. Check out a trading plan below.

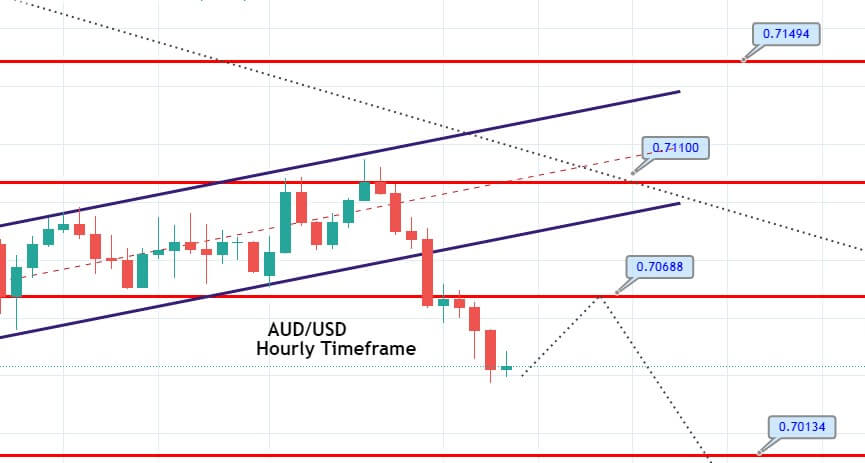

Entry Price – Buy 0.71124

Stop Loss – 0.70724

Take Profit – 0.71524

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The AUD/USD pair was closed at 0.71174 after placing a high of 0.71365 and a low of 0.70445. Overall the movement of the AUD/USD pair remained bullish throughout the day. On Wednesday, the AUD/USD pair posted the biggest gain since October 09 amid the broad-based US dollar weakness and the improved risk sentiment due to US stimulus package talks’ developments.

The AUD/USD pair was closed at 0.71174 after placing a high of 0.71365 and a low of 0.70445. Overall the movement of the AUD/USD pair remained bullish throughout the day. On Wednesday, the AUD/USD pair posted the biggest gain since October 09 amid the broad-based US dollar weakness and the improved risk sentiment due to US stimulus package talks’ developments.

The AUD/USD pair was closed at 0.71174 after placing a high of 0.71365 and a low of 0.70445. Overall the movement of the AUD/USD pair remained bullish throughout the day. On Wednesday, the AUD/USD pair posted the biggest gain since October 09 amid the broad-based US dollar weakness and the improved risk sentiment due to US stimulus package talks’ developments.

Investors were confident about the chances of a coronavirus stimulus agreement in the US that raised the market’s risk appetite and supported Aussie’s risk. The US President Trump said that he was willing to accept a larger relief bill despite Senate Republicans’ opposition and boosted optimism in the market. Like the Australian dollar, the riskier currencies gained from it and supported the AUD/USD pair’s upward movement on Wednesday.

On the data front, at 04:30 GMT, the MI Leading Index for September came in as 0.2% compared to August’s 0.5%. At 05:30 GMT, the Retail Sales from Australia came in as -1.5%. The investors mostly ignored Australia’s data as the focus was shifted towards the US stimulus package deal.

The latest minutes released by the Reserve Bank of Australia showed that the further rate cut has been on the table. This weighed on market sentiment as well as increase the bearish pressure on the Australian dollar. The Aussie dropped in previous days because of increased negative pressure generated by the rising chances of further monetary easing. However, on Wednesday, the AUD/USD pair recovered most of its previous day’s losses and rose about 1% on a day.

The risk sentiment was also supported by the hopes that the results from phase-3 trials of vaccines will be delivered in the coming months that will approve one-or-two vaccine by the end of the year. These hopes favored the Australian dollar further and pushed AUD/USD pair even higher.

Daily Technical Levels

Support Resistance

0.7057 0.7144

0.7010 0.7184

0.6970 0.7230

Pivot point: 0.7097

The AUD/USD is trading with a bullish bias at 0.7110, heading towards the next resistance level of 0.7136 level. On the lower side, the AUD/USD may find support at 0.7087, and closing of candles above this level may drive the pair further higher. The MACD is suggesting a buying trends; therefore, we have opened a buying trade over 0.7110. Checkout a trade signal…

Entry Price – Buy 0.71124

Stop Loss – 0.70724

Take Profit – 0.71524

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The yellow metal gold has traded sharply bearish, dropping from the 1,930 mark to the 1,912 level. Gold gained support at 1,912, the same level that extended support previously after a violation of a symmetric triangle pattern. Gold fell despite a dip in the U.S. stocks as they posted modest losses after a choppy session. The Dow Jones Industrial Average fell 98 points (-0.35%) to 28210, the S&P 500 dropped 7 points (-0.22%) to 3435, and the Nasdaq 100 eased 12 points (-0.11%) to 11,665.

The yellow metal gold has traded sharply bearish, dropping from the 1,930 mark to the 1,912 level. Gold gained support at 1,912, the same level that extended support previously after a violation of a symmetric triangle pattern. Gold fell despite a dip in the U.S. stocks as they posted modest losses after a choppy session. The Dow Jones Industrial Average fell 98 points (-0.35%) to 28210, the S&P 500 dropped 7 points (-0.22%) to 3435, and the Nasdaq 100 eased 12 points (-0.11%) to 11,665.

The yellow metal gold has traded sharply bearish, dropping from the 1,930 mark to the 1,912 level. Gold gained support at 1,912, the same level that extended support previously after a violation of a symmetric triangle pattern. Gold fell despite a dip in the U.S. stocks as they posted modest losses after a choppy session. The Dow Jones Industrial Average fell 98 points (-0.35%) to 28210, the S&P 500 dropped 7 points (-0.22%) to 3435, and the Nasdaq 100 eased 12 points (-0.11%) to 11,665.

On the forex front, the U.S. dollar widened its weakness against other major currencies amid a looming fiscal stimulus deal. The ICE Dollar Index dropped 0.48% to a 7-week low of 92.61, posting a four-session losing streak.

The U.S. Federal Reserve said in its Beige Book economic report that all districts have seen continued growth at a moderate pace since the downturn. The central bank added that employment increased across all districts, and prices rose modestly.

Daily Technical Levels

Support Resistance

1902.14 1923.14

1888.87 1930.87

1881.14 1944.14

Pivot point: 1909.87

On the downside, the 1,912 support level’s breakout may trigger further selling unto the 1,897 mark today. Conversely, gold has solid probabilities of jumping off above the 1,912 level to trade bullish unto the 1,930 level. Let’s look for bullish trades over the 1,909 level today.

Entry Price – Sell 1920.15

Stop Loss – 1914.15

Take Profit – 1926.15

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$600/ +$600

Profit & Loss Per Micro Lot = -$60/ +$60

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The USD/CAD pair was closed at 1.31273 after placing a high of 1.32036and a low of 1.31042. Overall the movement of the USD/CAD pair remained bearish throughout the day. The USD/CAD pair fell to its fifth day lowest level on Tuesday amid the broad-based US dollar weakness and the strong rebound in crude oil prices.

The USD/CAD pair was closed at 1.31273 after placing a high of 1.32036and a low of 1.31042. Overall the movement of the USD/CAD pair remained bearish throughout the day. The USD/CAD pair fell to its fifth day lowest level on Tuesday amid the broad-based US dollar weakness and the strong rebound in crude oil prices.

The USD/CAD pair was closed at 1.31273 after placing a high of 1.32036and a low of 1.31042. The USD/CAD fell to its fifth day lowest level on Tuesday amid the broad-based US dollar weakness and the strong rebound in crude oil prices.

The greenback was weak across the board due to the pertaining uncertainty over the US stimulus package’s development. The US Dollar Index dropped to 93.02 level, its lowest since October 9 on Tuesday amid the US equity market’s strength. The improved risk sentiment supported the US equity market and weighed on the US dollar that ultimately dragged the USD/Cad pair’s prices on Tuesday.

The focus of traders has been shifted to the US negotiations for a new round of US stimulus package for the coronavirus crisis. The US Speaker of the House, Nancy Pelosi, has set a deadline for reaching an agreement before the November 3 election.

Though US President Donald Trump has shown his support for the wide range of stimulus measures, still Nancy Pelosi has failed to break the impasse, and these developments have faded away from the hopes that US stimulus will be delivered before elections. These uncertainties kept the market sentiment under pressure, and the USD/CAD pair suffered because of it.

There was no macroeconomic fundamentals to be released from Canada on the data front, and from the US, the Building Permits were released for September that raised to 1.55M from the expected 1.52M and supported the US dollar. While the Housing Starts were declined to 1.42M from the expected 1.45M and weighed on the US dollar that ultimately dragged the USD.CAD pair’s prices.

On the crude oil side, the WTI prices soared on Tuesday after falling for three consecutive days and reached near the $42 level amid the broad-based US dollar weakness. The rising crude oil prices gave strength to commodity-linked Loonie that ultimately added weight on the already declining USD/CAD pair. The Canadian dollar’s strength driven by raised risk sentiment and crude oil prices dragged the USD/CAD pair’s prices towards its five days lowest level on Tuesday.

Daily Technical Levels

Support Resistance

1.3083 1.3186

1.3041 1.3247

1.2980 1.3289

Pivot point 1.3144

The USD/CAD traded sharply bearish at the 1.3103 level, having violated the double bottom support area of the 1.3103 level on the 4-hour timeframe. Below this level, we may see further selling until the 1.3055 mark; however, the MACD and RSI are in an extremely oversold zone, and we may see a slight bullish recovery before entering into an additional selling zone. The idea is to wait for a bullish correction until the 1.3140 level that marks the 38.2% Fibonacci retracement level before taking another selling trade. Good luck!

Description

Description

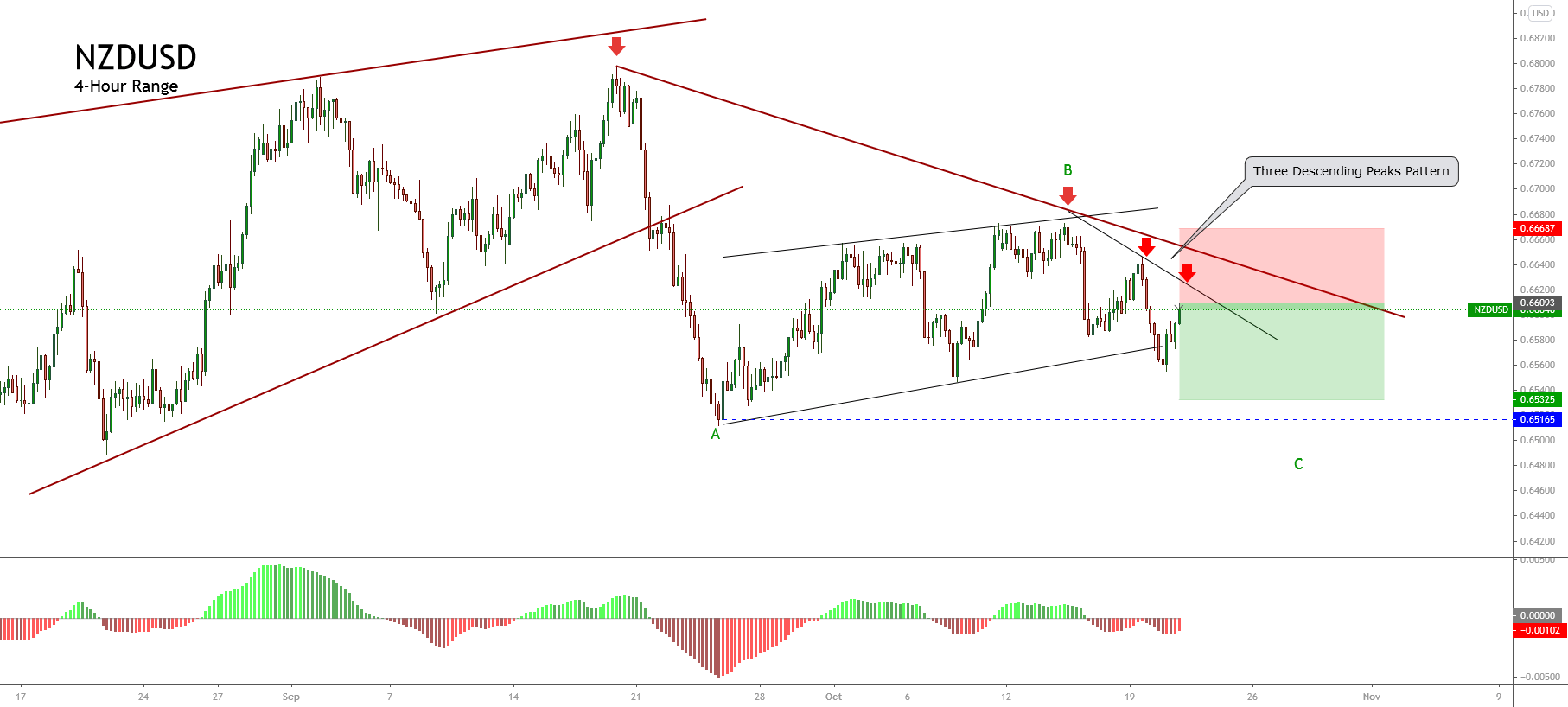

The NZDUSD prices develop an incomplete corrective formation that suggests a new decline, which could complete a three-wave movement in the following trading sessions.

In its 4-hour chart, the kiwi illustrates a bearish move that the price started when topped at 0.67978, starting a corrective structure that remains in progress. The figure highlights the completion of waves A and B labeled in green. According to the Elliott wave theory, the NZDUSD pair should start to develop a downward wave C subdivided into five waves from its corrective sequence. In this context, the price could drop at least at 0.65165, which corresponds to the September 24th low.

On the other hand, from the chartist perspective, the last decline looks like a three descending peaks pattern, which suggests the continuation of the primary bearish move supporting the scenario of further falls.

The bearish scenario’s invalidation level locates above 0.6670, which coincides with the surpassing of the short-term bearish trendline identified in brown.

Check out the latest trading signals on the Forex Academy App for your mobile phone from the Android and iOS App Store.

During Tuesday’s early Asian trading session, the USD/CAD currency pair managed to extend its previous session modest gains and remain well bid around closer to 1.3200 level due to the declines in the crude oil prices, which tend to undermine the commodity-linked currency the Loonie and helps the currency pair to put the fresh bids during the early Asian session.

During Tuesday’s early Asian trading session, the USD/CAD currency pair managed to extend its previous session modest gains and remain well bid around closer to 1.3200 level due to the declines in the crude oil prices, which tend to undermine the commodity-linked currency the Loonie and helps the currency pair to put the fresh bids during the early Asian session.

During Tuesday’s early Asian trading session, the USD/CAD currency pair managed to extend its previous session modest gains and remain well bid around closer to 1.3200 level due to the declines in the crude oil prices, which tend to undermine the commodity-linked currency the Loonie and helps the currency pair to put the fresh bids during the early Asian session.

On the contrary, the broad-based U.S. dollar weakness, triggered by the combination of factors, could be considered one of the key factors that kept the lid on any additional gains in the currency pair. As of writing, the USD/CAD currency pair is currently trading at 1.3190 and consolidating in the range between 1.3148 – 1.3195.

The optimism over the coronavirus (COVID-19) vaccine/treatment was recently overshadowed by the concerns about the second wave of coronavirus infections, which keep fueling the doubts over the global economic recovery. Besides this, the renewed conflict between the U.S. and China also weighed on the market trading sentiment. It is worth mentioning that Mike Pompeo has stated that ‘We are sanctioning mainland-China and Hong Kong entities and individuals for conduct related to the sanctioned proliferator the Islamic Republic of Iran Shipping Lines. He further added that our warning is clear: If you do business with IRISL or its subsidiaries, you will face U.S. sanctions.” This recently exerted downside pressure on the trading sentiment and contributed to the currency pair losses.

Despite this, the broad-based U.S. dollar remained depressed as the investors continue to sell U.S. dollars in the wake of the renewed hopes of additional U.S. fiscal stimulus measures and hopes of a coronavirus vaccine at the end of this year, which tends to undermine the safe-haven U.S. dollar. Elsewhere, the U.S. dollar losses were further bolstered by the doubts over the U.S. economic recovery amid rising coronavirus cases. Thus, the U.S. dollar losses become the key factor that cap further gains in the currency pair. Simultaneously, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped by 0.04% to 93.672.

On the bullish side, the WTI’s weakness restricts the USD/CAD bearish moves as oil is the biggest export-item for Canada. However, the WTI crude oil prices failed to extend its previous day gaining streak and remain depressed on the day mainly due to China’s GDP grew less than expected in the third quarter (Q3), which fueling concerns over the demand for crude oil from the world’s second-largest oil consumer. This, in turn, undermined the sentiment around the crude oil prices. The concerns over the sharp rise in new coronavirus cases, which could trigger renewed lockdown restrictions and damage the global economy’s ongoing recovery, continued challenging the crude oil bulls. Thus, the crude oil prices’ losses undermined the commodity-linked currency the Loonie and contributed to the currency pair gains.

Looking forward, the market traders keeping their eyes on the Housing Starts and Building Permits data. In the meantime, the updates surrounding the fresh Sino-US tussle, as well as the coronavirus (COVID-19), could not lose their importance.

Daily Support and Resistance

S1 1.308

S2 1.3141

S3 1.3166

Pivot Point 1.3202

R1 1.3226

R2 1.3263

R3 1.3323

The USD/CAD is trading mostly sideways over the 1.3170 level, and recently, it’s trying to a bullish engulfing pattern that may drive upward movement in the market until the 1.3250 level. Conversely, the bearish breakout of 1.3175 level can drive selling bias until 1.3095. Overall, the RSI and MACD are in support of selling bias until the 1.3095 level. Let’s consider taking a buy trade over 1.3170 and selling below the same level today. Good luck!

The AUD/USD pair was closed at 0.70685 after placing a high of 0.71144 and a low of 0.70685. Overall the movement of the AUD/USD pair remained bearish throughout the day. The AUD/USD pair extended its previous day’s losses and dropped for the third consecutive day on Monday as the market sentiment soared after the reports from the US dampening hopes of a US COVID-19 stimulus deal.

The AUD/USD pair was closed at 0.70685 after placing a high of 0.71144 and a low of 0.70685. Overall the movement of the AUD/USD pair remained bearish throughout the day. The AUD/USD pair extended its previous day’s losses and dropped for the third consecutive day on Monday as the market sentiment soared after the reports from the US dampening hopes of a US COVID-19 stimulus deal.

The AUD/USD pair was closed at 0.70685 after placing a high of 0.71144 and a low of 0.70685. Overall the movement of the AUD/USD pair remained bearish throughout the day. The AUD/USD pair extended its previous day’s losses and dropped for the third consecutive day on Monday as the market sentiment soared after the reports from the US dampening hopes of a US COVID-19 stimulus deal.

The upbeat Chinese GDP data for the third quarter gave strength to the Australian dollar and helped AUD/USD pair to open its week on a strong note. The Asian giant’s economy and the largest trading partner of Australia expanded by 4.9% in Q3 and showed strong industrial output and consumption figures that pointed out a strong recovery from the pandemic that hit Q2 hardest.

The China-proxy Aussie gained traction after the upbeat data from China, and the US dollar became weak, ultimately pushing the AUD/USD pair on the higher side in the early trading session on Monday. However, the gains were short-lived, and the AUD/USD pair’s movement reversed as the hopes for a US stimulus package faded away.

During the Weekend, the statement from Nancy Pelosi that a deal might be reached before elections over the US stimulus package gave strength to the risk sentiment. The improved risk sentiment pushed AUD/USD pair to open on a strong note, but the upward momentum was broken after hopes deteriorated on Monday.

The Republicans added another 0.1 trillion dollars to the previous $1.8 trillion stimulus package that failed to get approval. The US President showed his willingness to approve more stimulus before elections; however, he needed to deal with Republicans first. The US House Speaker Nancy Pelosi provided a 48-hours deadline to Republicans to reach a deal to pass the coronavirus stimulus package before elections.

The mixed situation has weighed on the risk sentiment as the stimulus hopes are fading with the passage of time and the risk perceived Aussie suffered that reversed the direction of AUD/USD pair on Monday.

The pair AD/USD started moving in the downward trend because of the rate differentials between 10-year government bond yields of Australia and the US. The US 10-year Treasury yields were around 0.77%, and the Australian counterpart was at 0.750%.

The market participants will be looking forward to the release of monetary policy meeting minutes from the Reserve Bank of Australia on Tuesday and will keep following the bearish bias until finding some fresh clues for future trading.

Daily Technical Levels

Support Resistance

0.7078 0.7101

0.7064 0.7110

0.7056 0.7124

Pivot point: 0.7087

The AUD/USD is trading at the 0.7043 level, having violated the bullish flag pattern on the 2-hour timeframe. On the lower side, bearish trend continuation can lead the AUD/USD pair towards the support area of 0.7014 level. At the same time, the support continues to stay at the 0.7068 level. The bearish bias remains dominant today; therefore, we should look for selling trades below the 0.7067 level today. Good luck!

Description

Description

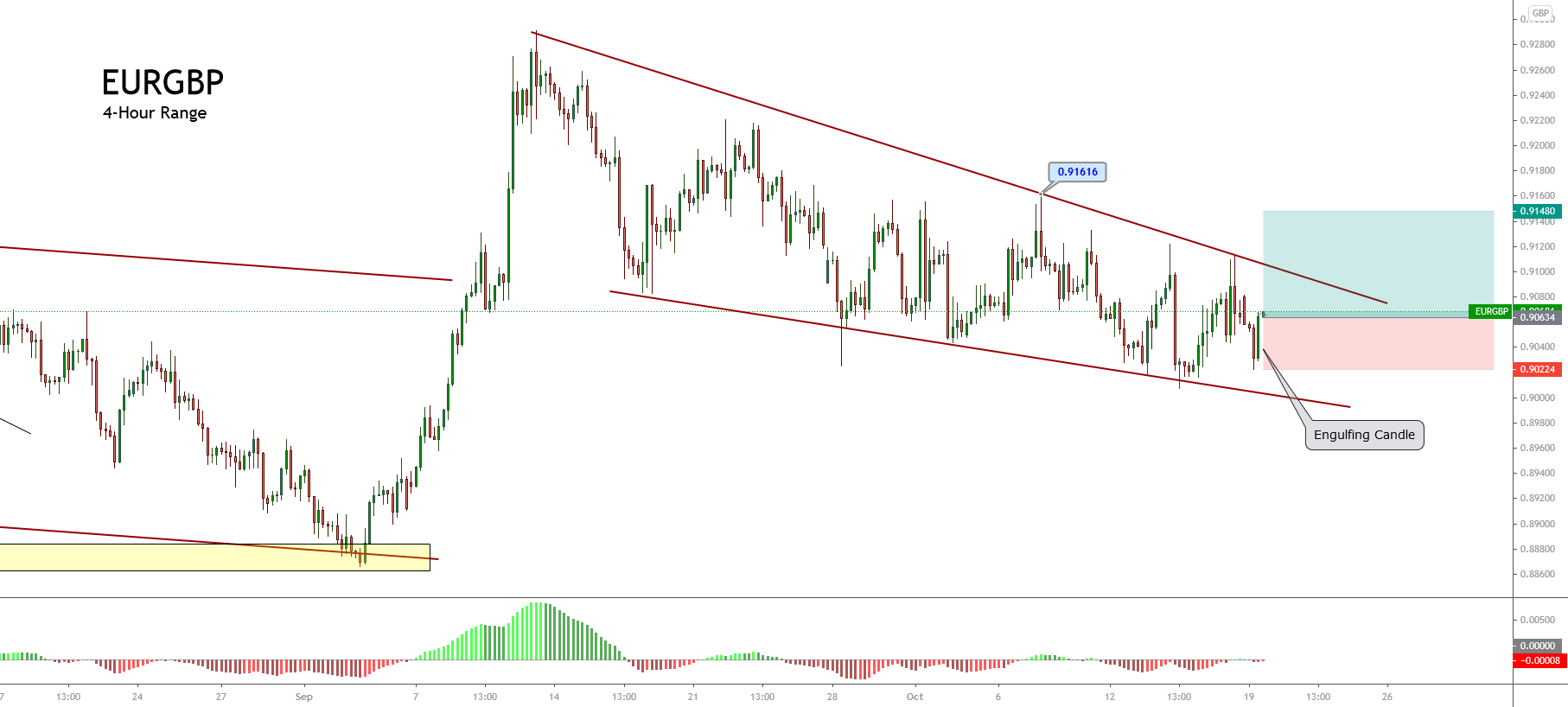

The EURGBP cross, in its 4-hour chart, illustrates a downward corrective sequence that seems to be ending. The engulfing candle pattern in the first trading session of the week unveils the possibility of a new rally.

The big picture reveals an impulsive movement developed since early September at 0.88685; this move ended on September 11th, when the price topped at 0.92212. Once the price found resistance, the cross started to develop a retrace as a descending wedge pattern. This chartist formation calls for the continuation of the previous upward impulsive move.

The engulfing candle formation suggests the possibility of a bullish side positioning at 0.90634 (or better) with a potential profit target at 0.9148, which corresponds to the nearest resistance zone from where the price could start to consolidate.

A second option is to maintain the trade looking for the AB=CD pattern completion, with a potential profit target located at 0.94329.

The invalidation level locates below the intraday low at 0.90224.

Check out the latest trading signals on the Forex Academy App for your mobile phone from the Android and iOS App Store.

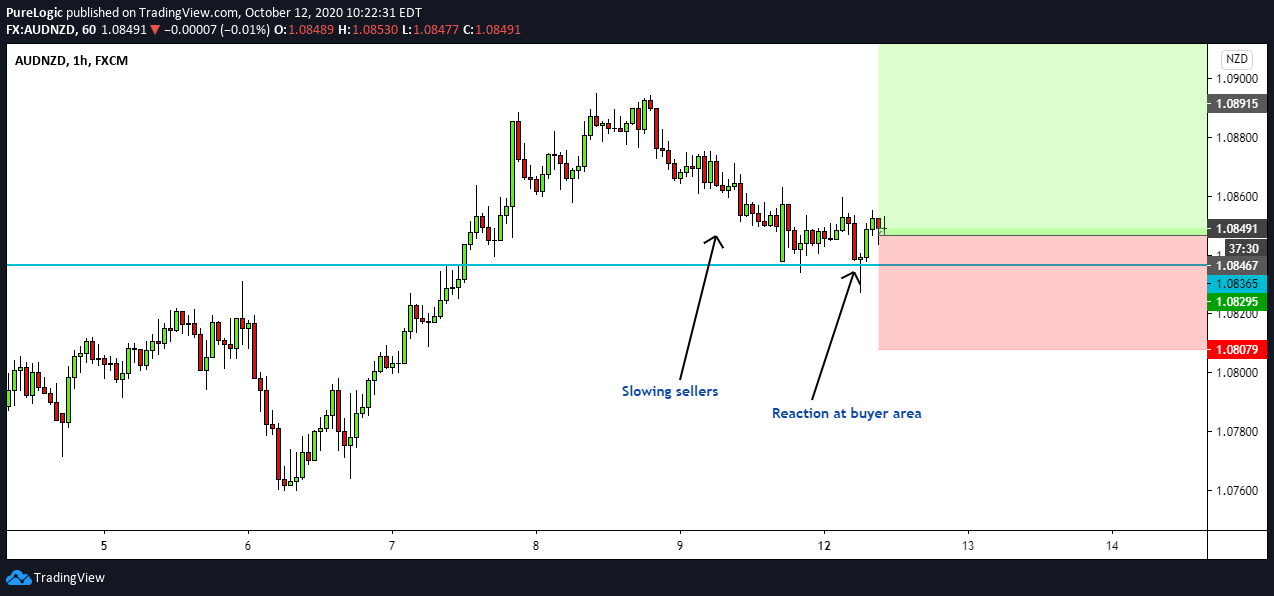

During Monday’s early Asian trading session, the AUD/USD currency pair failed to stop its Friday’s losing streak and witnessed some fresh selling on the first trading day of the week while dropped to the near three-week lows below the 0.7100 level. However, the prevalent bearish sentiment around the currency pair could be associated with the on-going expectations of further policy easing by the RBA, which tends to undermine the Australian dollar and contribute to the currency pair losses.

During Monday’s early Asian trading session, the AUD/USD currency pair failed to stop its Friday’s losing streak and witnessed some fresh selling on the first trading day of the week while dropped to the near three-week lows below the 0.7100 level. However, the prevalent bearish sentiment around the currency pair could be associated with the on-going expectations of further policy easing by the RBA, which tends to undermine the Australian dollar and contribute to the currency pair losses.

During Monday’s early Asian trading session, the AUD/USD currency pair failed to stop its Friday’s losing streak and witnessed some fresh selling on the first trading day of the week while dropped to the near three-week lows below the 0.7100 level. However, the prevalent bearish sentiment around the currency pair could be associated with the on-going expectations of further policy easing by the RBA, which tends to undermine the Australian dollar and contribute to the currency pair losses.

Apart from this, the currency pair’s declines were further bolstered by the long-lasting tussle between the US-China and stimulus deadlock in the U.S., which leads to the decline in U.S. stock’s future. This, in turn, undermined the perceived risk currency Australian dollar and contributed to the currency pair losses. The acceleration in the coronavirus (COVID-19) wave 2.0 also played its major role in undermining the market trading sentiment, which adds further burden around the perceived risk currency Australian dollar and dragged the currency pair low. On the contrary, the declines in the broad-based U.S. dollar, triggered by the combination of factors, becomes the factor that helps the currency pair to limit its deeper losses. At this time, the AUD/USD is currently trading at 0.7085 and consolidating in the range between 0.7073 – 0.7086.

As we already mentioned that the AUD/USD currency pair took a hit from Reserve Bank of Australia’s Governor Philip Lowe, who had provided a strong hint on Thursday that the central bank will likely cut interest rates, or announce further stimulus measures at its next meeting in early-November in order to support jobs growth and alleviate currency pressures within the current pandemic situations. This, in turn, undermined the Australian dollar.

The global market trading sentiment failed to stop its Friday negative performance and remains pessimistic on the day amid the intensifying market worries over the rapid rise in new coronavirus cases, which leads to the new lockdown restrictions and hinder the global economic recovery, undermining the perceived riskier Australian dollar. Elsewhere, the intensifying tensions between the U.S. and China added additional burdens around the global trading market. The tension between the world’s two largest economies fueled further after China aggressively warns the U.S. to step back from Taiwan Strait. However, these lingering Sino-US tensions keep challenging the risk market sentiment and contributed to the currency pair losses.

Apart from this, the U.S. policymakers’ inability to offer the much-awaited COVID-19 stimulus also played its major role in weakening the market trading sentiment, which in turn, exerted some additional pressure on the perceived riskier Australian dollar and contributed to the currency pair losses.

Across the pond, the reason for the downbeat market trading sentiment could also be associated with the China-Australia tussle. Having initially halted Aussie coal and cotton, the Dragon Nation recently passed a law to limit exports of its controlled items. This shows China’s willingness to combat global criticism to dump the markets with exports and heavy risks.

Despite the U.S. upbeat data, the broad-based U.S. dollar failed to stop its bearish bias and remained under pressure on the day. Moreover, the U.S. dollar losses could also be associated with political uncertainty in the U.S. ahead of U.S. elections. Thus, the weaker U.S. dollar is seen as the major factor that kept the currency pair higher. Simultaneously, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped to 93.705.

Looking forward, the traders will keep their eyes on China’s 3td-quarter (Q3) GDP, which is expected 5.2% YoY against 3.2% prior. In the meantime, the Fed Chair Powell Speaks will closely be followed. At the same time, the NAHB Housing Market Index data will also be key to watch. Apart from this, the continuous drama surrounding the US-China relations and updates about the U.S. stimulus package will not lose their importance.

Daily Support and Resistance

S1 0.6931

S2 0.7014

S3 0.7054

Pivot Point 0.7096

R1 0.7137

R2 0.7179

R3 0.7261

The AUD/USD is trading with a bearish bias at the 0.7092 level, forming a bearish flag pattern on the four hourly timeframes. A bearish breakout of 0.7068 level supports the pair; however, this support violation can trigger selling until 0.7014 level. On the flip side, a bullish crossover of 0.7107 can lead the AUD/USD price towards the next target level of 0.7165. Good luck!

Good luck!

Entry Price – Buy 1904.88

Stop Loss – 1898.88

Take Profit – 1910.88

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The USD/CAD was closed at 1.31927 after placing a high of 1.32374 and a low of 1.31770. Overall the movement of the USD/CAD pair remained bearish during the Aisan session today. Most of the selling is seen following the gains in USD/CAD for three consecutive days. The USD/CAD pair posted losses on Friday amid the mixed sentiment around the US stimulus package and Canada’s strong data. On late Thursday, President Trump said that he was raising the size of a fiscal stimulus package to win the support of Democrats to deliver the package to struggling Americans. The republicans were not in favor of big stimulus, and it raised concerns that the stimulus package will not be delivered before elections.

The USD/CAD was closed at 1.31927 after placing a high of 1.32374 and a low of 1.31770. Overall the movement of the USD/CAD pair remained bearish during the Aisan session today. Most of the selling is seen following the gains in USD/CAD for three consecutive days. The USD/CAD pair posted losses on Friday amid the mixed sentiment around the US stimulus package and Canada’s strong data. On late Thursday, President Trump said that he was raising the size of a fiscal stimulus package to win the support of Democrats to deliver the package to struggling Americans. The republicans were not in favor of big stimulus, and it raised concerns that the stimulus package will not be delivered before elections.

The USD/CAD was closed at 1.31927 after placing a high of 1.32374 and a low of 1.31770. Overall the movement of the USD/CAD pair remained bearish during the Aisan session today. Most of the selling is seen following the gains in USD/CAD for three consecutive days. The USD/CAD pair posted losses on Friday amid the mixed sentiment around the US stimulus package and Canada’s strong data. On late Thursday, President Trump said that he was raising the size of a fiscal stimulus package to win the support of Democrats to deliver the package to struggling Americans. The republicans were not in favor of big stimulus, and it raised concerns that the stimulus package will not be delivered before elections.

This raised the risk sentiment and pulled back the demand for the safe-haven greenback, and made the USD/CAD pair to post losses on the day. However, the investors remained doubtful about the concerns related to a steep rise in new coronavirus cases in Europe, and this continued to lend some support to the US dollar due to its safe-haven status. The improved US dollar helped cap further losses in the USD/CAD pair.

On the data front, at 17:30 GMT, from the Canada side, the Foreign Securities Purchases for August increased to 15.51B from the expected -3.01B and supported the Canadian Dollar that added pressure on the downward momentum of the currency pair USD/CAD. The Manufacturing Sales data from Canada dropped to -2.0% from the expected -1.4% and weighed on the Canadian Dollar.

The Capacity Utilization Rate was dropped to 71.5% against the anticipated 72.1% and weighed on the US dollar from the US side. The Industrial Production in August also dropped to -0.6% from the forecasted 0.6% and weighed heavily on the US dollar. The US side’s negative economic data added further pressure on the declining USD/CAD pair’s prices.

Meanwhile, the rising fears that another round of lockdowns worldwide to control coronavirus spread could weaken the global energy demand affected crude oil prices. The WTI crude oil dropped on Friday and weighed on commodity-linked Loonie that helped the USD/CAD pair to limit its losses on Friday.

The risk sentiment in the market also kept the USD/CAD pair’s losses limited on Friday after the US pharmaceutical giant Pfizer said that it is expected to file for emergency use authorization for its COVID-19 vaccine in late November. The company said it would move with the vaccine after its safety data are available in late November. The news’s risk sentiment was boosted and kept the USD/CAD pair’s losses under control.

Daily Technical Levels

Support Resistance

1.3175 1.3191

1.3169 1.3201

1.3159 1.3207

Pivot point: 1.3185

The USD/CAD is trading mostly sideways over the 1.3170 level, and recently, it’s trying to a bullish engulfing pattern that may drive upward movement in the market until the 1.3250 level. Conversely, the bearish breakout of 1.3175 level can drive selling bias until 1.3095. Overall, the RSI and MACD are in support of selling bias until the 1.3095 level. Let’s consider taking a buy trade over 1.3170 and selling below the same level today. Good luck!

The USD/CHF extended its previous session losing streak and hit the intra-day low around the 0.9130 regions in the last hours. However, the reason for the currency pair prevalent bearish bias could be attributed to the risk-off market sentiment, which underpins the safe-haven Swiss Franc and contributes drive selling in the pair. Hence, the market trading bias was being pressured by the fears of the steep rise in new coronavirus infections in Europe and the U.S.

The USD/CHF extended its previous session losing streak and hit the intra-day low around the 0.9130 regions in the last hours. However, the reason for the currency pair prevalent bearish bias could be attributed to the risk-off market sentiment, which underpins the safe-haven Swiss Franc and contributes drive selling in the pair. Hence, the market trading bias was being pressured by the fears of the steep rise in new coronavirus infections in Europe and the U.S.

The USD/CHF extended its previous session losing streak and hit the intra-day low around the 0.9130 regions in the last hours. However, the reason for the currency pair prevalent bearish bias could be attributed to the risk-off market sentiment, which underpins the safe-haven Swiss Franc and contributes drive selling in the pair. Hence, the market trading bias was being pressured by the fears of the steep rise in new coronavirus infections in Europe and the U.S.

Moreover, the risk-off market sentiment was further bolstered by the prevalent impasse over the next round of the U.S. fiscal stimulus measures, which further pessimism around the currency pair. On the flip side, the broad-based U.S. dollar weakness, triggered by doubts over the U.S. economic recovery, also played its major role in undermining the currency pair. At this particular time, the USD/CHF currency pair is currently trading at 0.9134 and consolidating in the range between 0.9130 – 0.9164.

The market risk tone has been shaky since the day started, possibly due to the worsening coronavirus (COVID-19) conditions in the U.K., Europe, and the U.S., which keeps fueling the worries over the global economic recovery. Meanwhile, the renewed conflict between the U.S. and China and the China-Australia tussle also exerted downside pressure on the market risk-tone and underpinned the safe-haven Swiss franc. As per the latest report, the daily new cases increased past Thursday’s record level of 6,638, with 7,334 new infections leading to 348,557 total numbers. The death toll seems to ease from the previous day’s 33 to 24 while marking a total of 9,734 deaths. As in result, the investors remained cautious that the rise in new coronavirus cases could lead to renewed lockdown measures.

Apart from this, the U.S. policymakers’ inability to offer the much-awaited COVID-19 stimulus also played its major role in weakening the market trading sentiment, which exerted some additional pressure on the market trading sentiment. At the US-China front, the renewed concerns over worsening diplomatic tensions between the world’s two largest economies also exerted downside pressure on the market trading sn time, which keeps the USD/CHF currency pair under pressure. Check out the trading plan below…

Daily Support and Resistance

S1 0.9083

S2 0.9113

S3 0.9128

Pivot Point 0.9142

R1 0.9158

R2 0.9172

R3 0.9201

Entry Price – Sell 0.91405

Stop Loss – 0.91805

Take Profit – 0.91005

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

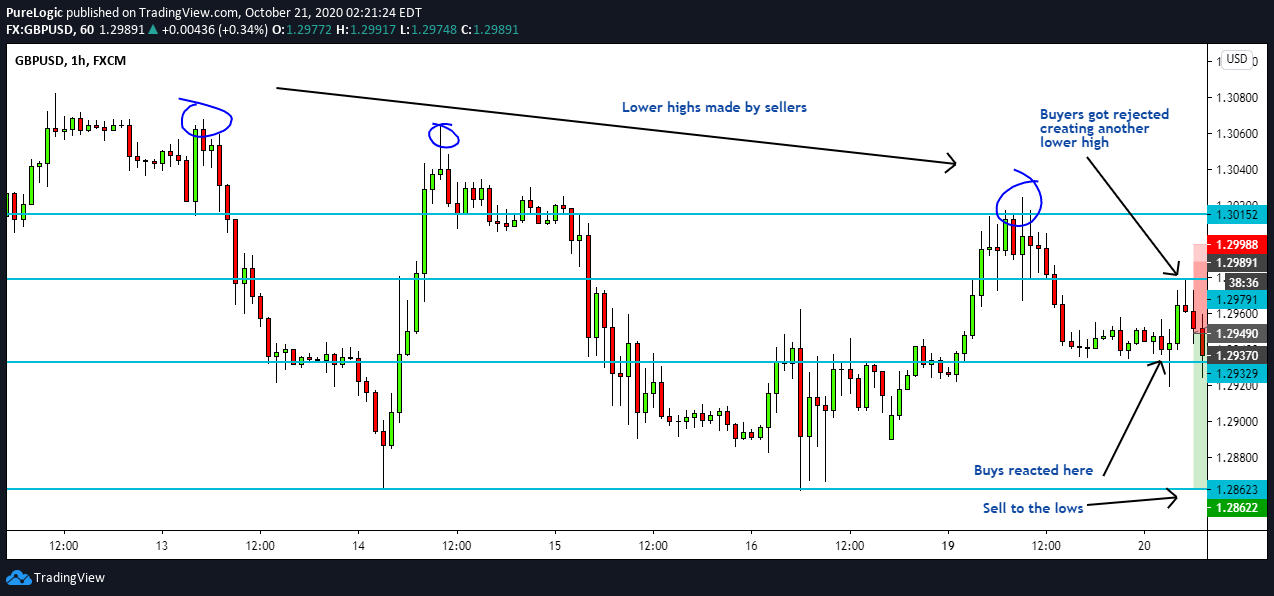

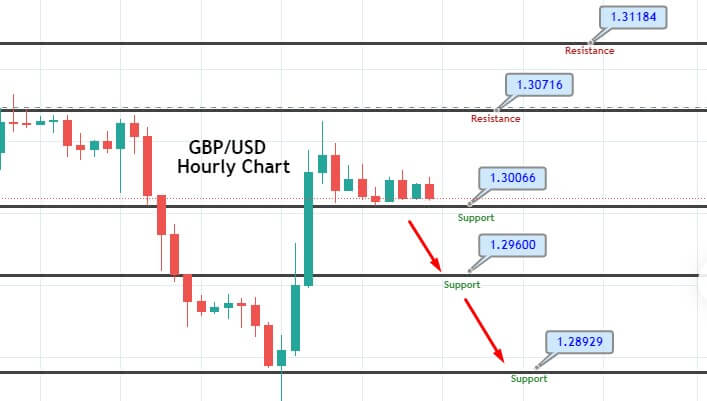

During the Friday’s early European trading session, the GBP/USD currency pair managed to stop its early-day declining streak and recovered from the daily lows of 1.2883 to the 1.2925 level mainly due to the fresh optimism about the Brexit deal, triggered by the report suggesting that the European Union (E.U.) and the U.K. policymakers are ready to extend talks, which eventually helped the currency pair to limit its deeper losses.

During the Friday’s early European trading session, the GBP/USD currency pair managed to stop its early-day declining streak and recovered from the daily lows of 1.2883 to the 1.2925 level mainly due to the fresh optimism about the Brexit deal, triggered by the report suggesting that the European Union (E.U.) and the U.K. policymakers are ready to extend talks, which eventually helped the currency pair to limit its deeper losses.

During the Friday’s early European trading session, the GBP/USD currency pair managed to stop its early-day declining streak and recovered from the daily lows of 1.2883 to the 1.2925 level mainly due to the fresh optimism about the Brexit deal, triggered by the report suggesting that the European Union (E.U.) and the U.K. policymakers are ready to extend talks, which eventually helped the currency pair to limit its deeper losses.

Besides, the Brexit hopes were further fueled after the U.K. Foreign Secretary Dominic Raab said, “We are close to a deal.” On the flip side, the broad-based U.S. dollar fresh weakness, backed by the worries over the U.S. economic recovery, also played its major role in supporting the currency pair. On the contrary, the worsening COVID-19 conditions in the U.K. and the renewed fears of tough lockdown measures become the key factor that kept the lid on any further gains in the currency pair.

As we already mentioned, the GBP/USD currency pair witnessed some instant progress over the last hours after the European Union (E.U.) and the U.K. policymakers showed a willingness to extend Brexit talks. As per the latest report, the E.U.’s chief negotiator Michael Barnier said he is ready for Brexit talks “until last possible day” while his British counterpart blamed the regional leaders for the prevailing impasse the Brexit deal. These positive headlines instantly underpinned the British Pound and pushed the currency pair higher.

In the meantime, the U.K. Foreign Secretary Dominic Raab said in response to the E.U.’s ultimatum of deciding on the Brexit fate that the “We are disappointed and surprised by the European Union (E.U.) position on Brexit,” He further added that “We are close to a deal.” Hence the Raab’s latest optimism about the Brexit deal helped the currency pair to stay bid.

Despite the rising number of COVID-19 cases and the U.S. Congress’ lack of progress towards passing the latest stimulus measures ahead of the November 3 presidential election, the broad-based U.S. dollar failed to put any heaven bids and remain depressed on the day, possibly due to the doubts over the U.S. economic recovery, which tend to undermine the greenback. The losses in the U.S. dollar becomes the key factor that helps the currency pair.

On the contrary, the COVID-19 cases in the U.K. and Europe getting worse day by day as the daily counts reached closer to the 20,000 threshold, 18,980 new cases, 138 deaths marked in the latest report. Considering the virus’s current condition spreading, the opposition Labour Party ordered the national lockdown for at least two weeks. Apart from the USK, the U.S. cases of the novel coronavirus crossed 8 million so far, rising by 1 million in less than a month, as another wave in cases hits the nation at the onset of cooler weather.

The traders will keep their eyes on September month’s Retail Sales and Michigan Consumer Confidence for October. Meanwhile, the USD moves and coronavirus headlines will also closely followed as they could play a key role in the crude oil.

Daily Support and Resistance

S1 1.2671

S2 1.2806

S3 1.2856

Pivot Point 1.2941

R1 1.2991

R2 1.3075

R3 1.321

The GBP/USD is trading at 1.2890 level, having supported over 1.2890 level. Above this, the next target is likely to be found around 1.2957 and 1.3020 level. Simultaneously, a bearish breakout of the 1.2890 support level can extend selling bias until 1.2840. The bearish bias remains solid below the 1.2890 mark.

Entry Price – Sell 1.2917

Stop Loss – 1.2877

Take Profit – 1.2957

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

The AUD/CAD failed to extend its early-day modest gains and edged lower around the 0.9362 level. However, the bearish sentiment around the currency pair could be associated with the on-going tussle between the US-China and stimulus deadlock in the U.S., which leads to the decline in U.S. stock’s future. This, in turn, undermined the perceived risk currency Australian dollar and contributed to the currency pair losses. The acceleration in the coronavirus (COVID-19) wave 2.0 also played a major role in undermining the market trading sentiment, which added further burden around the Australian dollar’s perceived risk currency and dragged the currency pair low.

The AUD/CAD failed to extend its early-day modest gains and edged lower around the 0.9362 level. However, the bearish sentiment around the currency pair could be associated with the on-going tussle between the US-China and stimulus deadlock in the U.S., which leads to the decline in U.S. stock’s future. This, in turn, undermined the perceived risk currency Australian dollar and contributed to the currency pair losses. The acceleration in the coronavirus (COVID-19) wave 2.0 also played a major role in undermining the market trading sentiment, which added further burden around the Australian dollar’s perceived risk currency and dragged the currency pair low.

The AUD/CAD failed to extend its early-day modest gains and edged lower around the 0.9362 level. However, the bearish sentiment around the currency pair could be associated with the on-going tussle between the US-China and stimulus deadlock in the U.S., which leads to the decline in U.S. stock’s future. This, in turn, undermined the perceived risk currency Australian dollar and contributed to the currency pair losses. The acceleration in the coronavirus (COVID-19) wave 2.0 also played a major role in undermining the market trading sentiment, which added further burden around the Australian dollar’s perceived risk currency and dragged the currency pair low.

On the contrary, the weaker crude oil prices, triggered by the combination of factors, tend to weaken the demand for the commodity-linked currency the loonie, which becomes the factor that helps the currency pair to limit its deeper losses. The AUD/CAD currency pair is currently trading at 0.9362 and consolidating in the range between 0.9357 – 0.9386.

Intensifying restrictive measures such as lockdowns and curfews in Europe and the U.K. to control the 2nd-wave of coronavirus outbreak pushed global equity markets down. As per the latest report, the daily new cases increased past Thursday’s record level of 6,638, with 7,334 new infections leading to 348,557 total counts. The death toll seems to ease from the previous day’s 33 to 24 while marking a total of 9,734 fatalities. Apart from this, the U.S. policymakers’ inability to offer the much-awaited COVID-19 stimulus also played its major role in weakening the market trading sentiment, which in turn exerted some additional pressure on the perceived riskier Australian dollar and contributed to the currency pair losses.

Elsewhere, the intensifying tensions between the U.S. and China added additional burdens around the global trading market. The tension between the world’s two largest economies fueled further after China aggressively warns the U.S. to step back from Taiwan Strait. However, these lingering Sino-US tensions kept challenging the risk-on market sentiment and contributed to the currency pair losses.

Access the pond, the reason for the downbeat market trading sentiment could also be associated with the latest report suggesting that the World Health Organization (WHO) said that the previously cheered corona-vaccine from Gilead Sciences Inc., Remdesivir, did not affect COVID-19 patients’ length of hospital stay or chances of survival. These negative headlines exerted some additional pressure on the market sentiment. The S&P 500 Futures dropped as it currently marks 0.15% intraday losses to 3,472.

The reason for the crude oil losses could also be associated with the latest reports suggesting that the Organization of the Petroleum Exporting Countries (OPEC) decided to ease supply cuts despite rapidly falling fuel demand in Europe and the U.S. amid rising numbers of COVID-19 cases in both regions. Thus, the decline in oil prices undermined the demand for the commodity-linked currency the loonie and became the key factor that helps the currency pair limit its deeper losses.

In the absence of the major data/events on the day, the market traders will keep their eyes on September month’s Retail Sales and Michigan Consumer Confidence for October. Meanwhile, the USD moves and coronavirus headlines will also closely followed as they could play a key role in the crude oil.

Daily Support and Resistance

S1 0.9242

S2 0.9303

S3 0.9341

Pivot Point 0.9364

R1 0.9402

R2 0.9426

R3 0.9487

Entry Price – Sell 0.93594

Stop Loss – 0.93994

Take Profit – 0.93194

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

During Thursday’s early European trading hours, the AUD/USD currency pair failed to stop its previous session bearish moves and took further offers near well below 0.7100 level, mainly due to the disappointing release of employment details, which showed that Australia’s economy lost 29.5K jobs in September. This, in turn, undermined the Asutliann dollar and contributed to the currency pair declines. Apart from this, the increasing probabilities of an interest rate cut by the Reserve Bank of Australia in November also played its major role in undermining the Australian dollar. Across the pond, the prevalent risk-off market sentiment, triggered by the worsening coronavirus (COVID-19) conditions in Europe and the U.K., exerted some additional pressure on the perceived riskier Aussie and dragged the currency pair below 0.7100 mars.

During Thursday’s early European trading hours, the AUD/USD currency pair failed to stop its previous session bearish moves and took further offers near well below 0.7100 level, mainly due to the disappointing release of employment details, which showed that Australia’s economy lost 29.5K jobs in September. This, in turn, undermined the Asutliann dollar and contributed to the currency pair declines. Apart from this, the increasing probabilities of an interest rate cut by the Reserve Bank of Australia in November also played its major role in undermining the Australian dollar. Across the pond, the prevalent risk-off market sentiment, triggered by the worsening coronavirus (COVID-19) conditions in Europe and the U.K., exerted some additional pressure on the perceived riskier Aussie and dragged the currency pair below 0.7100 mars.

During Thursday’s early European trading hours, the AUD/USD currency pair failed to stop its previous session bearish moves and took further offers near well below 0.7100 level, mainly due to the disappointing release of employment details, which showed that Australia’s economy lost 29.5K jobs in September. This, in turn, undermined the Asutliann dollar and contributed to the currency pair declines. Apart from this, the increasing probabilities of an interest rate cut by the Reserve Bank of Australia in November also played its major role in undermining the Australian dollar. Across the pond, the prevalent risk-off market sentiment, triggered by the worsening coronavirus (COVID-19) conditions in Europe and the U.K., exerted some additional pressure on the perceived riskier Aussie and dragged the currency pair below 0.7100 mars.

However, the global risk sentiment was further pressured by the fading hopes of additional U.S. fiscal stimulus. On the data front, the economy has lost 29.5K jobs in September against expectations for 35K losses and down from August’s 111K additions. The seasonally adjusted Unemployment Rate surged to 6.9% against expectations for a rise to 7.1% from 6.8%. In the meantime, the part-time jobs dropped by 9.4K in September against 74.8K additions in August. At the same time, the full-time employment sank by 20.1K against 36.2K additions in August.

Considering the recent condition of the economy, the RBA’s Governor Lowe said that the benchmark interest rate could be cut down to 0.10% from the current record low of 0.25%, which undermined the Australian dollar exerted some additional pressure on the currency pair. The market trading sentiment remains depressed during the early European session as the condition of the second wave of coronavirus infections in Europe and the U.K. getting worse time by time, which suggests that the local lockdowns cannot tame the pandemic, which in turn suggests fresh national activity restrictions.

In the meantime, the fears of a no-deal Brexit and the dovish tone of major central bankers pushing for further fiscal help also exert downside pressure on the market trading sentiment, which in turn undermined perceived riskier Aussie and dragged the currency pair below 0.7100 marks.

Additionally, the long-lasting inability to pass the U.S. fiscal package also weighed on the risk sentiment, which eventually undermined the perceived riskier Australian dollar and contributed to the currency pair gains. Despite U.S. President Donald Trump’s recent push to break the coronavirus stimulus deadlock, the opposition Democratic Party remains up in its demands. As per the latest report, the U.S. Treasury Secretary Mnuchin recently blamed the opposition to put obstacles for the much-awaited aid package before the presidential election to keep President Donald Trump lagging the election polls.

At the US-China front, the renewed concerns over worsening diplomatic tensions between the world’s two largest economies also exerted downside pressure on the market trading, which keeps the AUD/USD currency pair under pressure. Other than the US-China tussle, Australia and China are also loggerheads with each other.

As a result, the broad-based U.S. dollar succeeded in extending its Asian session loss gains es and took some further bid during the early European session as investors still prefer the safe-haven assets in the wake of the risk-off market sentiment. However, the U.S. dollar gains seem rather unaffected by the intensifying political uncertainty ahead of the upcoming U.S. presidential election on November 3. However, the incoming polls tend to recommend a clear-cut presidential success for the Democrat nominee Joe Biden, which might cap additional upside momentum for the U.S. dollar. However, the U.S. dollar gains become the key factor that kept the currency pair under pressure. At the same time, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies inched up 0.02% to 93.398 by 9:58 PM ET (1:58 AM GMT).

Looking forward, the traders will keep their eyes on the weekly U.S. Initial Jobless Claims, which is expected 825K versus 840K prior. Apart from this, the continuous drama surrounding the US-China relations and updates about the U.S. stimulus package will not lose their importance.

Daily Support and Resistance

S1 0.7095

S2 0.7133

S3 0.715

Pivot Point 0.717

R1 0.7187

R2 0.7208

R3 0.7245

The AUD/USD pair has violated the double bottom support level of 0.7150 level, and below this, the pair may drop further until the next support area of 0.7098 level. On the higher side, the pair may find resistance at 0.7150 and 0.7190 level. The bearish bias remains solid today, especially below 0.7150.

Entry Price – Buy 105.245

Stop Loss – 105.645

Take Profit – 104.845

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

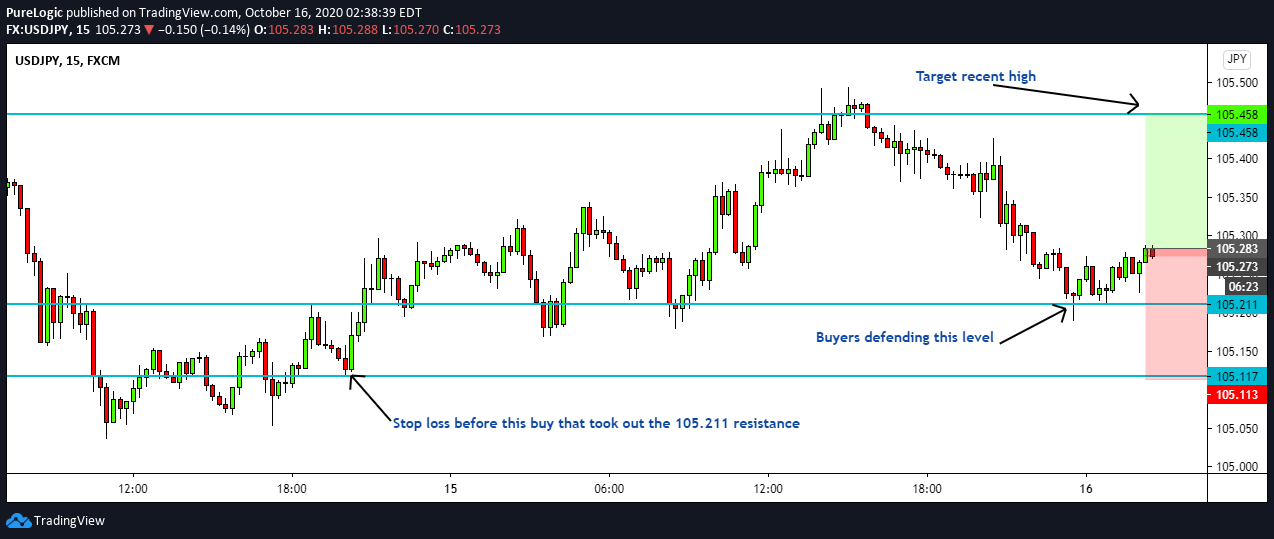

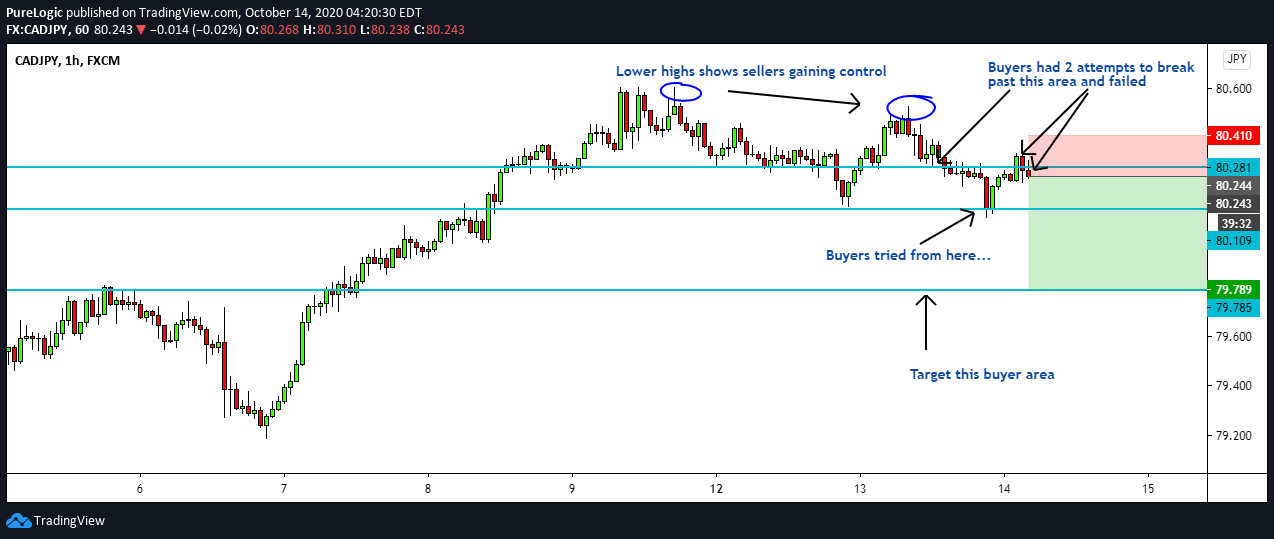

The USD/JPY pair was closed at 105.161 after placing a high of 105.514 and a low of 105.034. Overall the movement of the USD/JPY pair remained bearish throughout the day. The rising uncertainties in the market related to US stimulus, vaccine development, global economic recovery, and the US November presidential elections gave a push to safe-haven appeal that supported safe-haven Japanese Yen and weighed on USD/JPY pair.

The USD/JPY pair was closed at 105.161 after placing a high of 105.514 and a low of 105.034. Overall the movement of the USD/JPY pair remained bearish throughout the day. The rising uncertainties in the market related to US stimulus, vaccine development, global economic recovery, and the US November presidential elections gave a push to safe-haven appeal that supported safe-haven Japanese Yen and weighed on USD/JPY pair.

The USD/JPY pair was closed at 105.161 after placing a high of 105.514 and a low of 105.034. Overall the movement of the USD/JPY pair remained bearish throughout the day. The rising uncertainties in the market related to US stimulus, vaccine development, global economic recovery, and the US November presidential elections gave a push to safe-haven appeal that supported safe-haven Japanese Yen and weighed on USD/JPY pair.

The currency pair dropped on Wednesday to one week’s lowest level as the hopes for the next round of US stimulus package before elections fell after Nancy Pelosi said that the newly proposed package of $1.8 trillion by President Trump would be not sufficient to provide support to economic recovery from the pandemic and deep recession.

Another reason behind the faded risk sentiment was the latest news about the vaccine trials from different candidates. Earlier this week, Johnson & Johnson halted their coronavirus vaccine’s clinical trials due to an unexpected illness in one of the participants. And on Wednesday, the Eli Lilly and Co. also stopped its vaccine’s trials for coronavirus, and this raised concerns that without a vaccine, the economic recovery will be slow. These concerns added in demand for safe-haven and raised the Japanese Yen that ultimately weighed on the USD/JPY pair.

On the data front, the Revised Industrial Production from Japan for August dropped to 1.0% from the forecasted 1.7% and weighed on the Japanese Yen. The PPI and the Core PPI data from the United States for September raised to 0.4% from 0.2% of forecasts and supported the US dollar. Macroeconomic data from both sides supported the USD/JPY pair but failed to reverse the direction as the investors were focusing on the rising number of uncertainties in the market.

Meanwhile, the 2020 World Bank Group-IMF Annual Meetings started on October 12th to 18th, in which global finance leaders warned that the fragile recovery would be crushed by the failure to stop the spread of coronavirus, maintain stimulus, and rising debts in developing nations.

Global poverty has been raised to the highest levels for the first time in 2 decades due to the coronavirus crisis. Developing nations had been hit hard by the pandemic as the debts for recovering through the crisis rose in developing nations to alarming levels. The annual meetings’ agenda was to take necessary actions to build a strong foundation for a strong recovery that would help all countries.

The US Treasury Secretary Steven Mnuchin urged both global institutions IMF and World Bank on Wednesday to work thoughtfully within their existing resources to battle the coronavirus pandemic. Mnuchin also urged G20 nations to approve a proposed debt restructuring framework.

The rising hopes that developing nations will be getting help to recover from the pandemic also raised the market’s risk sentiment that limited additional losses in USD/JPY prices on Wednesday.

Furthermore, on Wednesday, the Federal Reserve Vice Chair Richard Clarida said that the US economic data has been shockingly strong since May, but the output will still take another year to climb back to its pre-pandemic level. Clarida’s comments raised uncertainty over recovery and supported the Japanese Yen that weighed on the USD/JPY pair.

Daily Support and Resistance

S1 104.26

S2 104.74

S3 104.93

Pivot Point 105.22

R1 105.41

R2 105.7

R3 106.18

The USDJPY pair is trading with a selling bias below an immediate resistance level of 105.349 level. On the 4 hour timeframe, the USD/JPY has formed a downward channel that’s extending resistance at 105.349. Closing of candles beneath this level is likely to keep the USD/JPY pair in a selling mode until the 105.050 mark, conversely, the bullish breakout of the 105.349 level may lead the pair further higher towards the 105.580 level.

Entry Price – Buy 105.245

Stop Loss – 105.645

Take Profit – 104.845

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

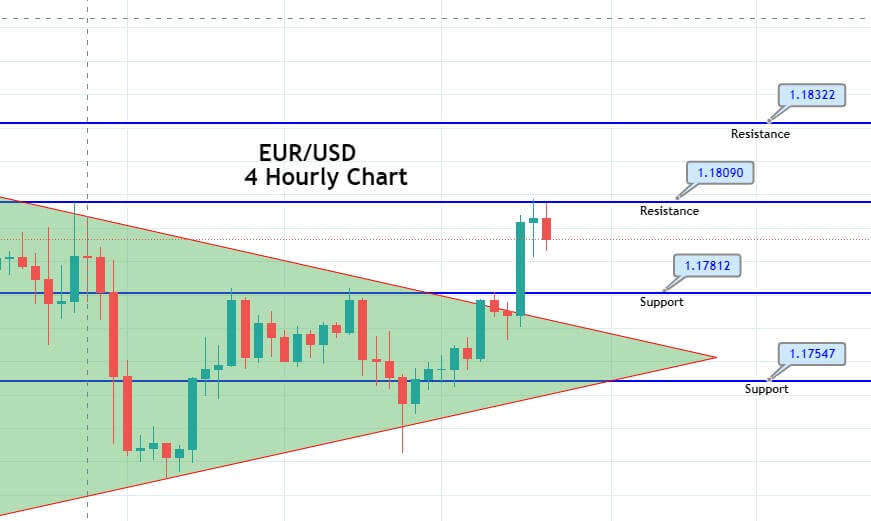

In the European trading session, the GBP/USD currency pair managed to stoop its previous session declining streak and refresh the intra-day high around mid-1.2900 level mainly due to easing fears of a no-deal Brexit, which initially underpinned the Pound and contributed to the currency pair gains. This was witnessed after the latest reports suggesting that the European Union leaders will be meeting in Brussels on Thursday and Friday to discuss Brexit and label progress in talks with the U.K.

In the European trading session, the GBP/USD currency pair managed to stoop its previous session declining streak and refresh the intra-day high around mid-1.2900 level mainly due to easing fears of a no-deal Brexit, which initially underpinned the Pound and contributed to the currency pair gains. This was witnessed after the latest reports suggesting that the European Union leaders will be meeting in Brussels on Thursday and Friday to discuss Brexit and label progress in talks with the U.K.

In the European trading session, the GBP/USD currency pair managed to stoop its previous session declining streak and refresh the intra-day high around mid-1.2900 level mainly due to easing fears of a no-deal Brexit, which initially underpinned the Pound and contributed to the currency pair gains. This was witnessed after the latest reports suggesting that the European Union leaders will be meeting in Brussels on Thursday and Friday to discuss Brexit and label progress in talks with the U.K.

On the other hand, the broad-based U.S. dollar fresh weakness, backed by the U.S. economic recovery worries, also played a major role in supporting the currency pair. Moreover, the U.S. dollar losses were further bolstered after the Bank of America Corp (N: BAC) reported a 15.8% drop in quarterly profit, which instantly raised extra doubts about the U.S. economic recovery pushed the U.S. dollar down. At a particular time, the GBP/USD currency pair is currently trading at 1.2978 and consolidating in the range between 1.2864 – 1.2980.

As we already mentioned, the GBP/USD currency pair witnessed strong progress over the last hours, in the wake of the latest Brexit headlines ahead of the critical meeting between the UK PM Boris Johnson and the E.U. Commission President Ursula von der Leyen later on Wednesday. As per the latest report, the 27 national leaders will tell their negotiators to extend conversations with the U.K. to reach an agreement from January 1, 2021. They will also decide to step up contingency preparations for an abrupt economic split without a deal to avoid tariffs or quotas. These positive headlines instantly underpinned the British Pound and pushed the currency pair higher.

Across the pond, the Bank of U.S. reported a 15.8% drop in quarterly profit on the day, hit by higher provisions for credit losses due to the COVID-19 pandemic, which in turn, adds burden around the broad-based U.S. dollar. Detail suggested, “Net income applicable to common shareholders dropped to $4.44 billion, or 51 cents per share, in the 3rd-quarter ended September 30, from $5.27 billion, or 56 cents per share, a year earlier.

Despite the risk-off market sentiment, the broad-based U.S. dollar failed to extend its long-day bullish rally and edged lower during the European session amid Bank of America profit falls on pandemic woes. On the other hand, the concerns about the ever-increasing number of coronavirus cases and weakness in the U.S. Consumer Price Index (CPI) also weighed on the broad-based U.S. dollar. However, the losses in the U.S. dollar kept the currency pair higher. Whereas the U.S. Dollar Index that tracks the greenback against a basket of other currencies down to 93.493.

On the contrary, the COVID-19 cases in the U.K. continue to pick up the pace as the U.K. reported the highest new cases since June on the previous day, with 143 deaths and 17,234 new confirmed cases. As in result, the opposition Labour Party ordered the national lockdown for at least two weeks. While considering the previous day’s downbeat employment data, the ruling Conservatives imposed local lockdowns. Hence, the renewed coronavirus worries became the key factor that kept the lid on any additional currency pair gains.

Daily Support and Resistance

S1 1.2683

S2 1.2829

S3 1.2883

Pivot Point 1.2976

R1 1.3029

R2 1.3122

R3 1.3268

Entry Price – Buy 1.29966

Stop Loss – 1.30366

Take Profit – 1.29566

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US

Today in the European trading session, the USD/CHF currency pair stopped its previous session bullish momentum. They edged lower below the 0.9150 level, mainly due to the risk-off market sentiment, triggered by lack of additional U.S. fiscal stimulus and the US-China tussle, which eventually underpinned the safe-haven Swiss franc and kept the currency pair under pressure. Moreover, the market trading sentiment was further pressured by the downbeat reports that Johnson & Johnson paused the coronavirus vaccine trails, which also burdened the currency pair.

Today in the European trading session, the USD/CHF currency pair stopped its previous session bullish momentum. They edged lower below the 0.9150 level, mainly due to the risk-off market sentiment, triggered by lack of additional U.S. fiscal stimulus and the US-China tussle, which eventually underpinned the safe-haven Swiss franc and kept the currency pair under pressure. Moreover, the market trading sentiment was further pressured by the downbeat reports that Johnson & Johnson paused the coronavirus vaccine trails, which also burdened the currency pair.