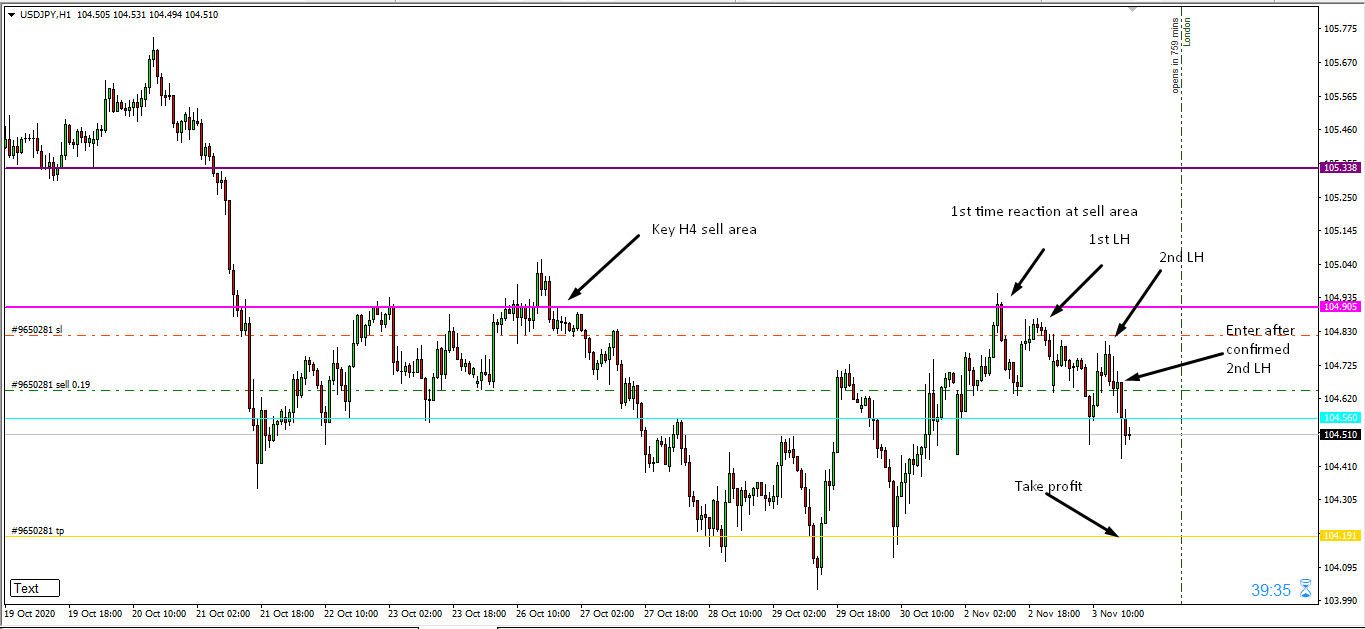

The USD/JPY pair was closed at 103.364 after placing a high of 103.758 and a low of 103.174. The USD/JPY pair was dropped to its lowest since 8th March. The U.S. dollar against the Japanese Yen on Friday dragged the pair to a fresh 8-months lowest level as the chances for Joe Biden to win the U.S. election increases. The USD/JPY pair followed the USD weakness throughout the week and reached the 103 level.

The investors have welcomed a Democrat government’s prospects with a split congress where Republicans can block initiatives to raise taxes or introduce tighter regulations with a risk rally that sent the safe-haven U.S. dollar to multi-month lows against its main rivals.

On the data front, at 04:30 GMT, the Average Cash Earning for the year came in as -0.9% against the forecasted -1.1% and supported the Japanese Yen and added further losses in the USD/JPY pair. The Household Spending for the year came in as -10.2% against the expected -10.5% and supported the Japanese Yen that added further weakness in the currency pair USD/JPY.

From the U.S. side, at 18:30 GMT, Average Hourly Earnings from the U.S. for October weakened to 0.1% from the anticipated 0.2% and weighed on the U.S. dollar added further losses in the USD/JPY pair. The Non-Farm Employment Change for October surged to 638K against the anticipated 595K and supported the U.S. dollar, and capped further losses in the USD/JPY pair. In October, the Unemployment Rate from the U.S. weakened to 6.9%from the anticipated 7.7% and supported the U.S. dollar. At 20:00 GMT, the Final Wholesale Inventories for September came in as 0.4% against the anticipated -0.1% and weighed on the U.S. dollar and dragged the pair USD?JPY to the multi-month lowest level.

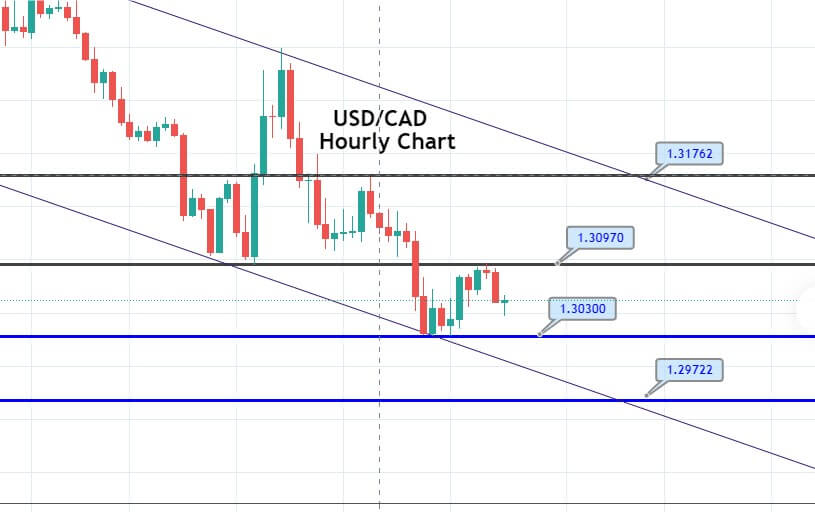

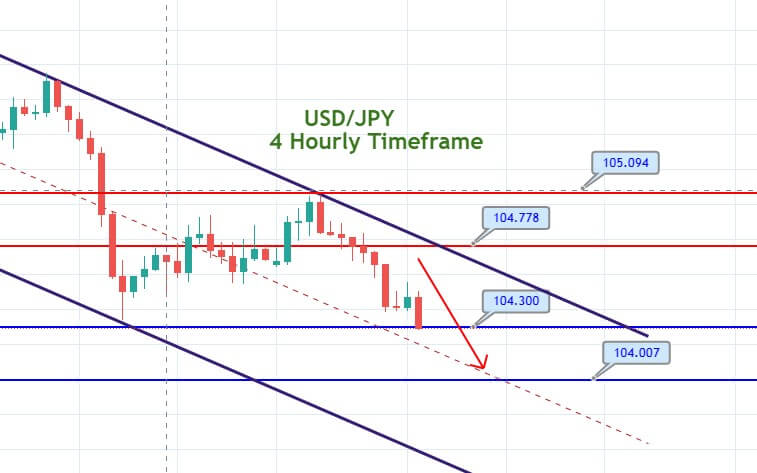

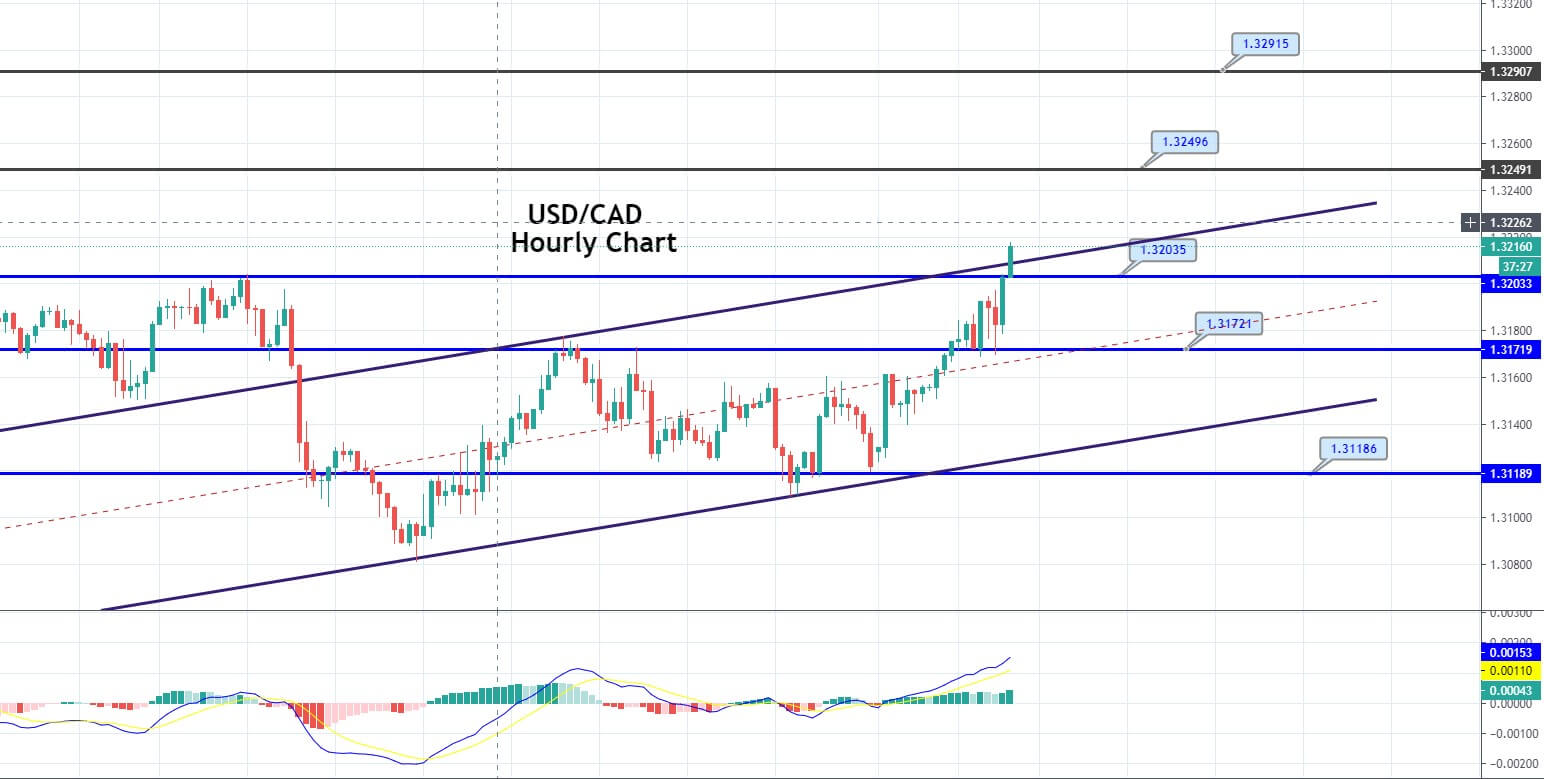

The USD/JPY has violated the descending triangle pattern at 104.149 area, and on the lower side, it’s testing the support area of 103.270 level. Recently the closing of bullish engulfing patterns may drive an upward movement in the market. On the higher side, the USD/JPY can go after the next 103.850 mark. On the flip side, violation of the 103.215 level can extend selling until the 102.750 mark. The MACD is also showing oversold sentiment among investors; therefore, we should look for a bullish trade over 103.270 and selling below the 103.830 level today.

Entry Price – Buy 1912.42

Stop Loss – 1906.42

Take Profit – 1919.92

Risk to Reward – 1:1.25

Profit & Loss Per Standard Lot = -$600/ +$750

Profit & Loss Per Micro Lot = -$60/ +$75

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US