The safe-haven currency, the United States dollar, known under the ISO symbol of USD or nicknames such as dollar and greenback, has enjoyed a prestigious position as the leading global currency for many years now. Although now the most traded currency worldwide, the USD only took over the throne from the GBP in the late 1800s, that is the early 1900s, which compared with the country’s inception on July 4, 1776, is in fact a rather short period. The USD has experienced times of crisis in the past, and especially now, amid the COVID-19 pandemic, the questions regarding the currency’s strength arise. Surrounded by a plethora of news, which keeps coming out daily, and the US institutions issuing statements in lieu of the current state of affairs, the USD once again defends its long-held unique status among the world currencies.

History of USD

Before the late 1800s, the British conquest of half of the world helped establish their dominance, rendering the GBP the strongest currency for a period spanning a couple of hundred years. The recognition of the new standard, that is the view of the USD as the new currency of value, resulted primarily from the country’s strong economy and functioning government. Consequently, this new market became also the biggest market in the world with the USD growing to be the most desired currency worldwide.

Now bearing the title of the world’s reserve currency, the USD is the currency of choice whenever foreign governments desire to hold onto their money. As they prefer not to keep these funds in their own currencies, they rely on such diversification mostly due to the need to increase the level of safety. The need for such an approach is most prominent in a small country with an unstable government experiencing numerous ups and downs. If a country keeps all the wealth in their own currency, they risk endangering their financial stability in times of instability or crises, which is why other countries’ safe currencies are employed.

History keeps records of such cases where a country put practically all their eggs into one basket, in a manner of speaking, leaving the country in utter chaos. The notorious example of Zimbabwe, which kept printing more money to the point where it became entirely worthless, should serve as a 30-year-old example of why countries prefer to keep their reserves in more stable currencies such as the USD. The United States’ currency is the standard nowadays which is why many countries across the globe prefer this currency over the others.

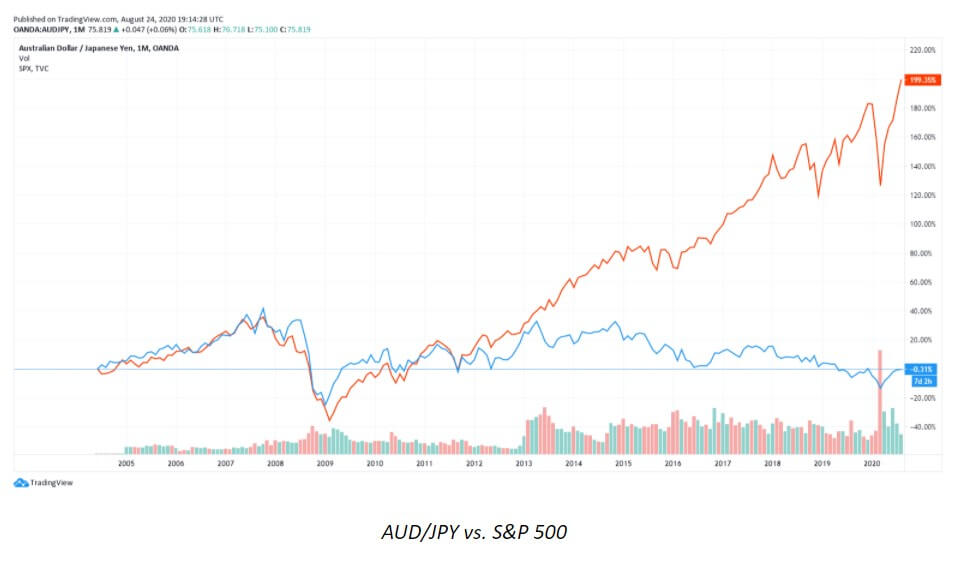

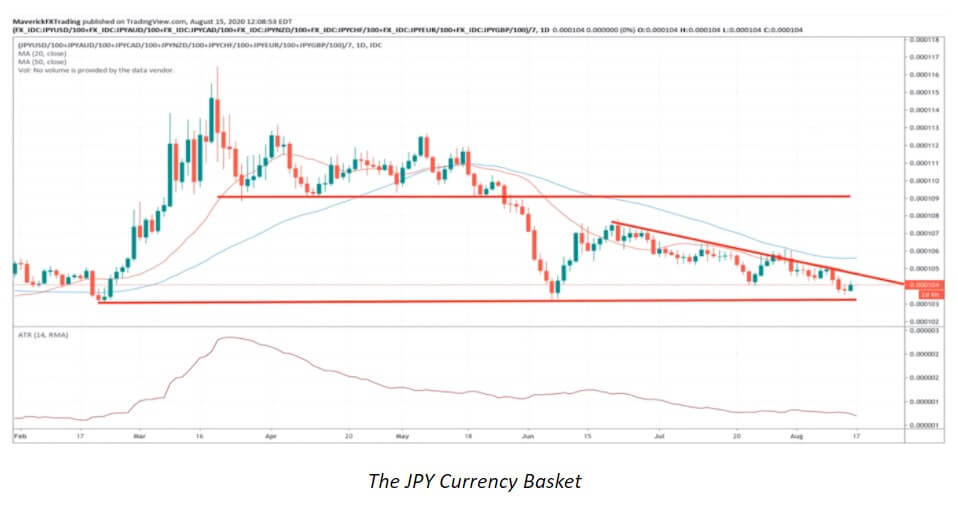

The many stories discussing, for example, China buying the US government’s debt are actually the stories of how foreign money is invested in the USD. Even the currency’s value decline due to China’s massive spending involving hundreds of billions of dollars upon their preparations for the Olympics could not shake the USD’s long-term stability. Amid the booming of the world economy, feeling afraid of how this prolonged decline of the USD could impact their reserves, other countries finally decided against keeping their wealth in this currency. The news started to circulate, the tension just kept building up, and the financial collapse hit in the middle of these speculations. Nonetheless, all other currencies except for the USD and JPY fell in value. The event proves the point that the USD is an exceptional currency with the best track record and a strong economy to back it up.

Each time other countries, aside from the United States, have some additional reserves, they often choose to buy the USD, which is generally bullish for this currency. However, whenever countries undergo challenging periods, they may typically decide to sell a portion of their USD holdings which has a negative impact on the currency. Generally looking at the connection between the USD and other currencies, most currencies have historically been pegged to the dollar at some point, especially around WWII and after.

Another important fact concerning the USD is that almost all commodities are generally traded in this currency. Should you, therefore, wish to purchase oil, you would have to do it in the USD. In case you have some other currency at your disposal, such as the EUR, you would then exchange it into the USD to proceed with the purchase. This connection is really significant which is why this topic will be thoroughly discussed later in the text.

With regard to US institutions governing the matters vis-à-vis the USD, the US Treasury Department, which is part of the US government, bears the responsibility for the supply of the money, while the Federal Open Market Committee (FOMC), a partly government agency, handles the related policies. These are two main bodies that control the money in the United States and whose responsibilities will be further discussed in another section below.

The Gold Standard

The US government was the first one to leave the gold standard back in the 1930s, which basically refers to the idea that a country had to have a hard asset to back up the money it wanted to print. Prior to the onset of the new dollar era, the United States would print the gold, silver, and bronze dollars. Back in the days where this monetary system was followed, the value of the dollar derived from the commodity, not the government. This further means that the same quantity of gold had an equal price across different countries, so the money had equal value worldwide regardless of the printing design.

With the shift toward the use of paper money in the late 1600s, the US government still followed the same principle of hard assets providing the money’s value, which gave birth to the above-mentioned gold and silver notes. While these old notes are still available for online purchase nowadays, we cannot now go into any bank and exchange such a gold note of 100 dollars for the equal worth of gold as was possible before. The price of the USD was, hence, entirely attached to the price of the hard assets, and this is how worthless paper actually acquired the value of real gold and silver.

The previously mentioned FOMC was formed in 1933 when some of the United States’ best bankers gathered in private at which point the country decided upon letting go of the rule that prohibited countries from printing as much money as they wanted. Although this country was the first to move towards another monetary policy, which caused great turmoil around the world, all other countries moved along with applying the same changes. By the late 60s, the entire world had already adopted the same strategy.

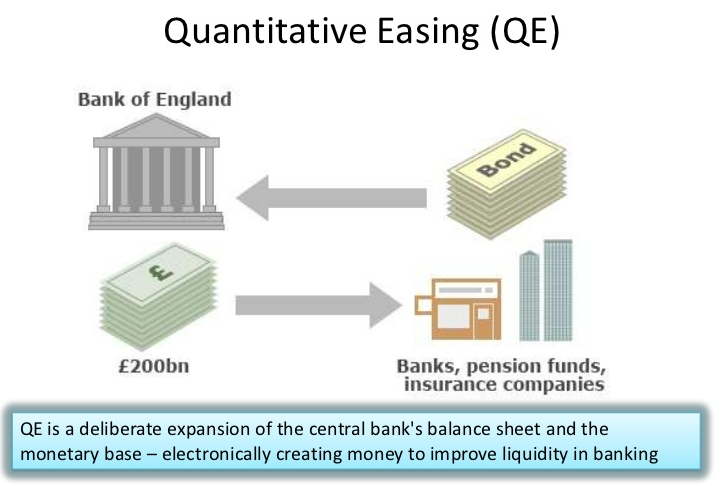

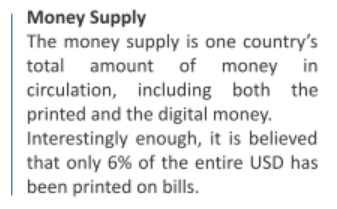

The new system implied that countries no longer had to store all the gold and the silver, i.e. the hard assets, in order for them to be able to print money, called the money supply. The money supply is basically the total amount of one country’s money in circulation. This however does not only refer to the printed money as only 6% of the entire USD has been printed on bills. The remainder actually pertains to digital numbers, such as the money in an individual’s bank account. The phenomenon is similar to that of cryptocurrencies, and some companies may even allow you to exchange these numbers in a ledger for the USD. As money is generally digital, if the bank does have enough money at the time of the desired withdrawal, you will not be able to take out the money, or the bills, that you requested.

The US Agencies

As discussed before, the US Treasury is tasked with deciding on how much money is going to be printed, controlling the money supply. The FOMC, on the other hand, is responsible for monetary policy, which further implies that they control interest rates, bailouts, and other important segments related to the country’s finances.

The United States comprises 12 sections governed by 12 different bank presidents charged with submitting individual reports concerning their districts. The reports are shared and discussed upon meeting with other committee members going through the information prior to making a vote. The voting is conducted so that it allows only five regional bank presidents to get a vote, rotating the votes in a manner that prevents the past year’s vote from coming up again. Out of the 12 members, the 7 remaining ones actually come from the FOMC. They alternate meetings between six and eight weeks apart, and the head of the committee that is the Chair of the Federal Reserve (the Fed) has the tie-breaking vote.

FOMC Procedures

The current Chair of the Federal Reserve of the United States is Jerome Powell, who spent most of his time in the Banking Industry. Due to his banking background, he differs from the previous scholars and economists who used to perform this function in the past. The current Chair’s aforementioned experiences make him appear to truly understand more about banks than the previously chosen individuals, who are appointed every four-six years.

Every other meeting involves the Chair holding a press conference, where he reads a prepared statement and conducts the Q&A session. In these meetings, the Chairs would typically share a lot of important information, which has historically been likely to usurp the market’s stability. The market would suddenly become quite volatile and traders would react to these events. The former Chair of the Federal Reserve of the United States, Alan Greenspan, was famous for the statement about the market he gave in the 90s that resulted in quite a turmoil. The market went down by 10% the same day only to go up and double after that, making the market even more unstable. These figures appear to exercise more control in their public statements nowadays, although these events have been said to still have an effect on traders and the market.

Key US Reports

The key documents providing the greatest insight into the state of the USD and related matters include the following five reports: GDP, employment, producer and consumer price index, retail sales, and trade deficit reports.

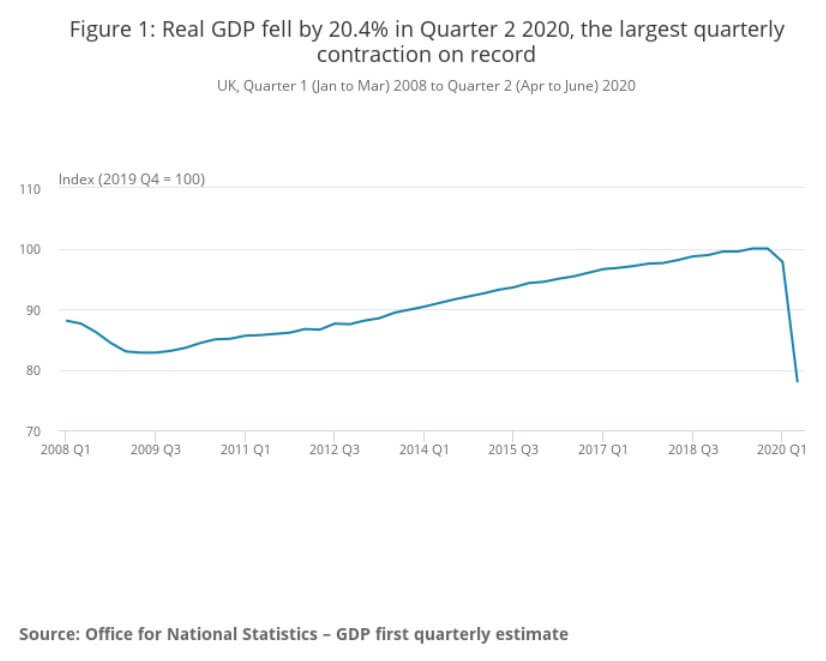

The GDP or the Gross Domestic Product report provides information on this important economic indicator that signals the condition of the overall economy of the United States. Providing insight into the country’s productivity, the quarterly report is said to have a particular impact on traders and their decision-making. The United States, in fact, issues three such GDP reports: the initial report that comes out approximately three weeks upon the end of the quarter (e.g. if the quarter ends toward the second part of the month, the initial report will probably come out around the 20th of the following month); the second report issued a month later that will contain some actual numbers based on the revision of the previous data; and, the final number that comes out three months upon the quarter ending. Among the three, the least attention will be directed towards the final reports, which appear to only hold relevance for the record books, whereas the first one will generate the most interest. As the initial report of the quarter, it gives important clues to traders, which is why, for example, every January 20, April 20, July 20, etc. will be important dates that should be part of the traders’ calendars.

Non-farm Payroll measures employment or the number of people employed in the previous month and many traders rely on this information due to its relevance. The report typically comes out the first Friday each month and entails an extremely important indicator of consumer spending. Should the Friday fall on the first of the month, the issuance will be postponed to the following Friday of the month. When the results exceed expectations or predictions, they are considered to be positive (bullish) for the USD, while the opposite scenario is considered as negative (bearish) for the currency in question. Some currency traders claim that the Non-farm Payroll report is one of the best reports to trade.

The monthly producer and consumer price index (PPI and CPI) are important indicators measuring the economy’s performance. PPI is an important piece of data that signals future expected inflation, any positive change in this index entails the rise of prices as well as the possibility to save money and earn interest. The PPI is said to have little effect on the USD per se, but its correlation with the CPI is found to be extremely important by some astute forex traders. The CPI, unlike the PPI, provides insight into current growth and inflation levels. What traders can generate from this information is an understanding of the impact of inflation on the USD. For example, the first half of 2018 recorded a rise in inflation which correlated with the increase in the US Dollar Index (DXY).

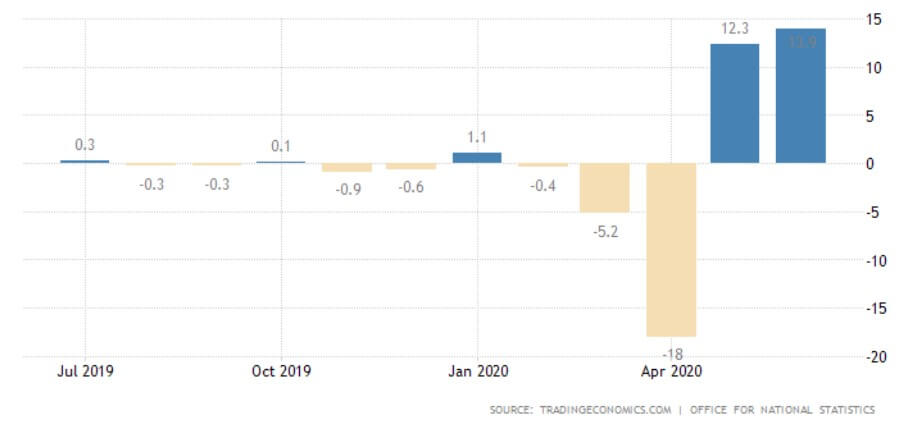

The retail sales report notes the changes in sales as an important indicator of consumer spending, which is said to account for approximately 70% of economic growth in general. Traders keen on trading the news find this information important, especially in the light of the recent pandemic. Similar to the Non-farm Payroll report, a positive retail sales reading generally proves to be bullish for the USD, whereas a low reading is seen as bearish.

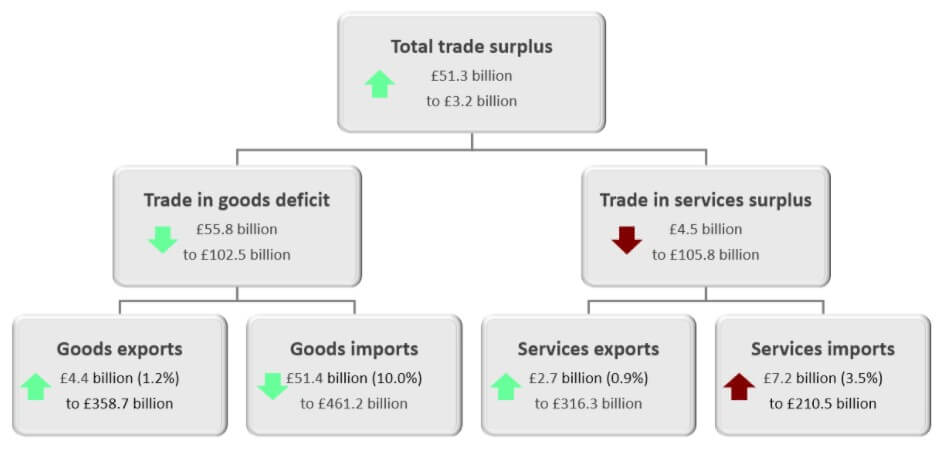

The trade deficit, the last report, is considered important due to the fact that during such deficits, the USD is generally noted to weaken. As currencies are susceptible to change because of a number of factors (e.g. economic growth, interest rates, inflation, and government policies), trade deficit should be perceived as one of the determinants. Generally, the trade deficit is considered to have a negative impact on the USD although the currency’s appreciation could stem from other reasons.

Major Currency Pairs

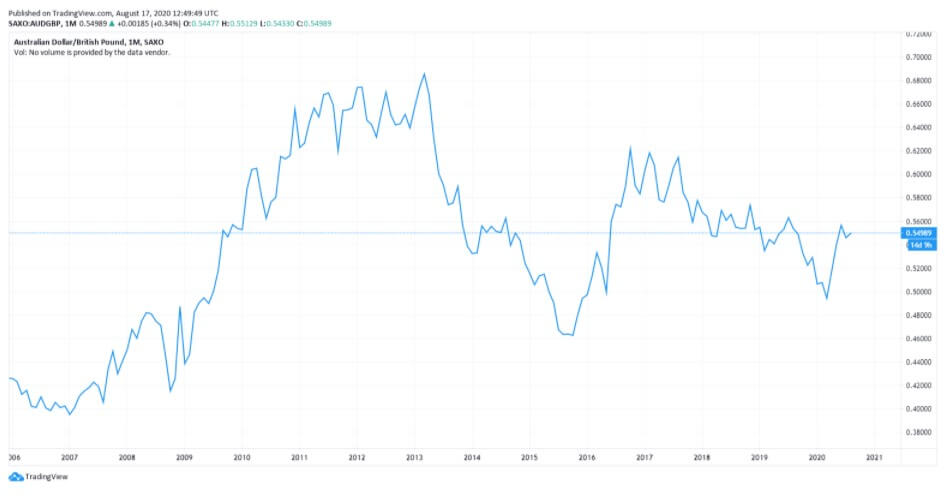

The following seven currency pairs are said to have the greatest volume: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. The EUR/USD pair is said to hold 37% of all trading volume in the world. While this number can oscillate up and down, this currency pair is in fact the most liquid pair among the seven major ones and is generally considered one of the safer pairs to trade. Traders who are invested in trading big news events are the ones that should be particularly drawn towards the most liquid currency pairs since these entail tighter spreads and less slippage. What is more, traders interested in trading the Non-farm Payrolls report are advised to give this currency pair a try because, while it cannot grant 100% success, it does alleviate some of the challenges concerning trading currencies.

With a total of 10% of the entire trading volume, USD/JPY accompanies the previously discussed currency pair to hold almost half of the world’s trading, making these two a focus of many traders’ attention. As the USD is the most popular currency in the world, every trade involving this currency should entail great trading volume even with pairs such as NZD/USD.

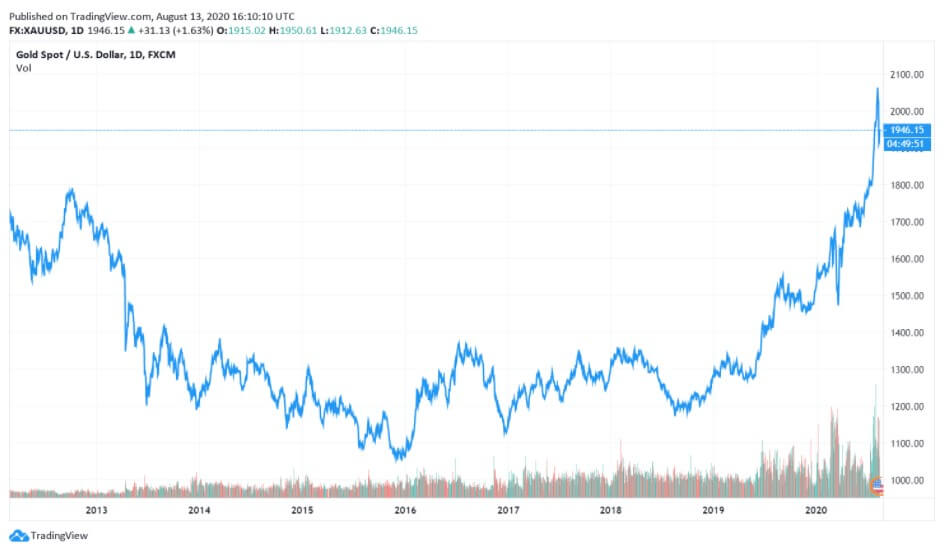

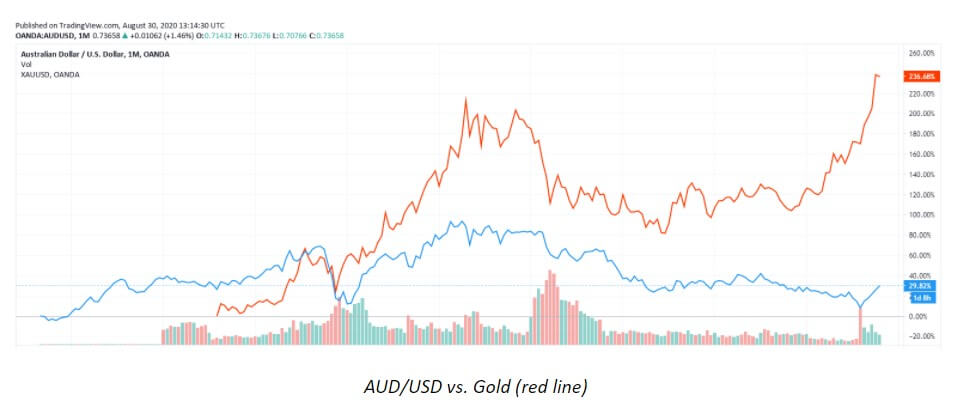

USD/Gold Correlation

The negative correlation between the USD and gold is considered as one of the most important topics regarding this currency. These correlations can at times increase or decrease in strength, but from the perspective of history, the USD has an 80% negative correlation with the price of gold. This further implies that once the price of the USD appreciates, the gold’s price should plummet, and vice versa, which can be seen from the chart below (spot gold is red while DXY is blue). Although at one point both prices started moving in the same direction, these occurrences are very short-lived because the standard negative USD-gold correlation is of a long-term nature and eventually everything goes back to its place. The strongest correlation, and the most prominent one, is the one that the USD has with the price of gold. It is an indicator that as soon as the price of one goes up, the price of the other will start moving in the opposite direction. Naturally, traders can find exceptions and this cannot be perceived as a guarantee, but this correlation has been present for many years.

Trading USD

As one of the most liquid currencies worldwide, the USD allows for traders peace of mind when trading the related currency pairs. The only exception to this rule is when trading big news events or if traders are expecting some important move in the market. The USD is generally perceived as the safest currency to trend with the tightest spreads and the least amount of slippage, although some traders avoid it due to the big banks’ attention, involvement, and impact on this currency and, hence, traders.

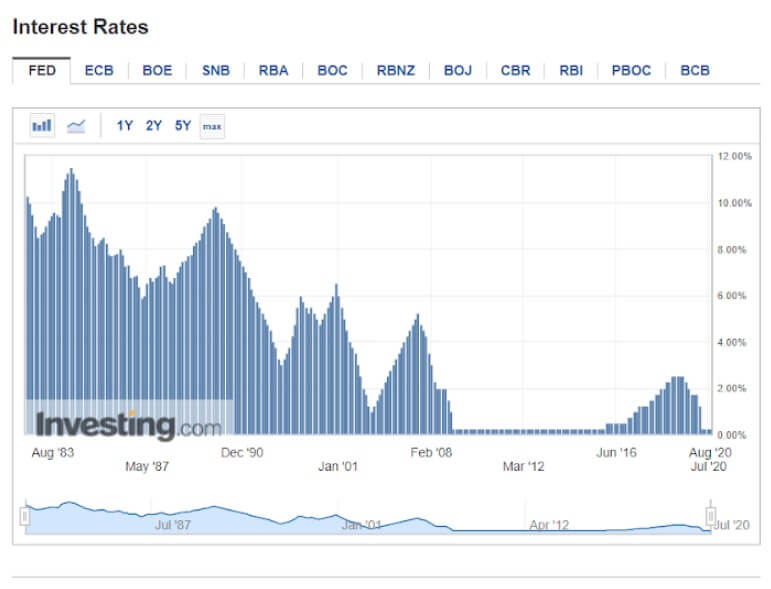

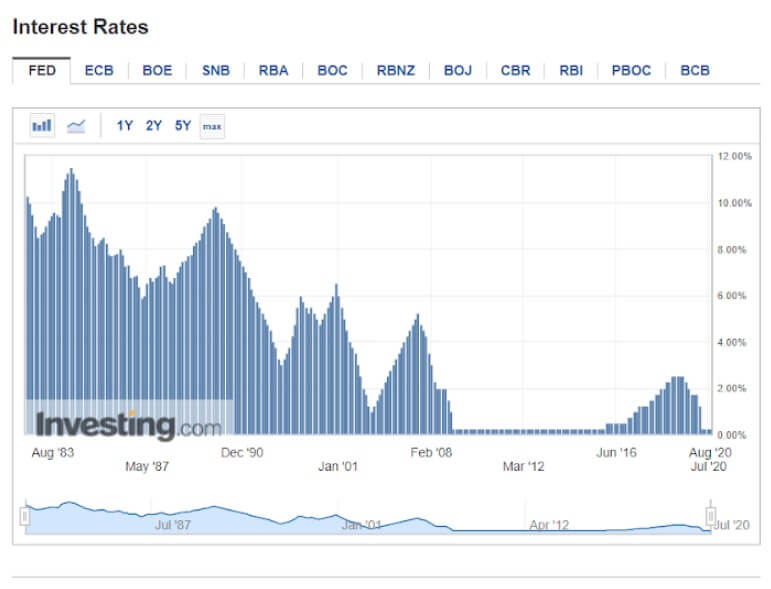

Upon the economic crisis of 2008, the FOMC was the first central bank to raise interest rates, and years passed until others started to do the same. The USD is certainly not the currency with the highest interest rates in the world at the moment, but we have witnessed how they kept soaring at a dramatic pace at a few points in the past. The reason why this happens lies in the central bankers’ desire to keep inflation under control. Therefore, whenever the economy is improving, the interest rates are increasing.

The currency market implies the flight to safety on one hand and the flight to risk on the other, which is why we have money flowing either in or out of the country. Therefore we can conclude that the reason behind the FOMC’s aggressive rise in interest rates is the strength of the US economy. As it is the largest economy in the world, it does impact the rest of the world. Hence, when the US economy is doing well, so are the other countries.

Whenever money is on the lookout for investment, it will direct itself towards risk, which entails locations such as China, Vietnam, and South America, heading towards the places where the greatest return on money can be found. The FOMC kept increasing the interest rates, but this did not always entail a strong US dollar since the rest of the world was in fact doing better at the time. Inflation was kept under control since 2008 and the world seemed stable until the onset of the COVID-19 pandemic.

An important fact regarding the USD concerns trade deficits owing to the fact that the United States imports increasingly more than it exports, in particular with countries such as China and Japan. These trade deficits are a long-term negative for the currency because the individuals living in the United States and buying foreign goods keep seeding the money out of the country, and it is these other countries where this money is reinvested. The opposite scenario, where the United States could do more exports and the money would come into the country, as a result, would create a trade surplus. The country’s age-old tendency has been one of the popular topics highlighted by US politicians as a long-term negative on the currency.

Economic activities always affect the USD price, so if the United States is undergoing a challenging period unlike other countries, the US economy can be expected to keep struggling. On the contrary, should the rest of the world be experiencing economic struggles, the US economy would probably be doing well. Nevertheless, in order to trade the USD successfully, traders are always advised to do extensive research and monitor the external factors surrounding the currency market.

Impact of COVID-19

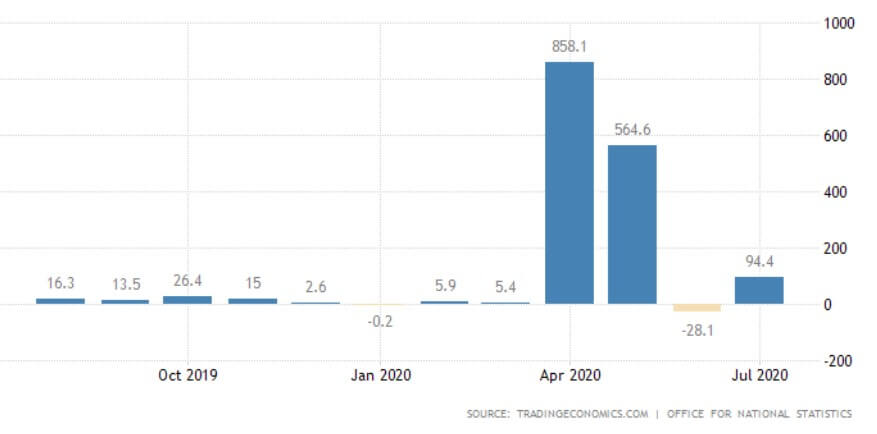

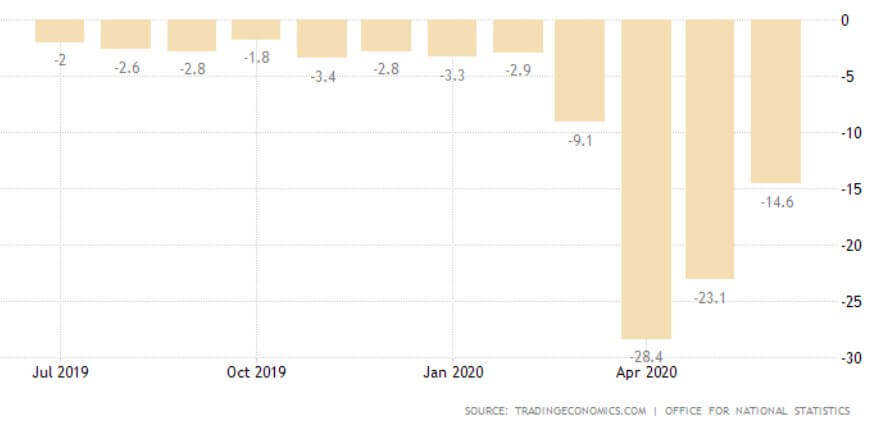

The pandemic has taken the entire world by surprise, also shaking the United States economy, leaving 22 million Americans unemployed. The worldwide economic shock has revealed a silver lining for the USD as it has led to a number of investors selling riskier assets (e.g. stocks and bonds) and taking cash as a form of safety. The currencies which were highly exposed to global trade suffered depreciation as they typically sell-off in the face of economic deterioration, but the US dollar again emerged as the currency of choice in times of crisis. As investors always flee to safe-haven currencies in such unpredictable times and as the COVID-19 pandemic is driving the global economy into recession, the demand for the USD rose to the extent that the US Federal Reserve has to set up new swap lines in order to be able to lend money to the central banks of other currencies. The USD is currently seen as the strongest currency probably due to the country’s stable and safe economy. However, such strong demand can even exacerbate the current situation which pushed the Federal Reserve to protect the currency from shortages.

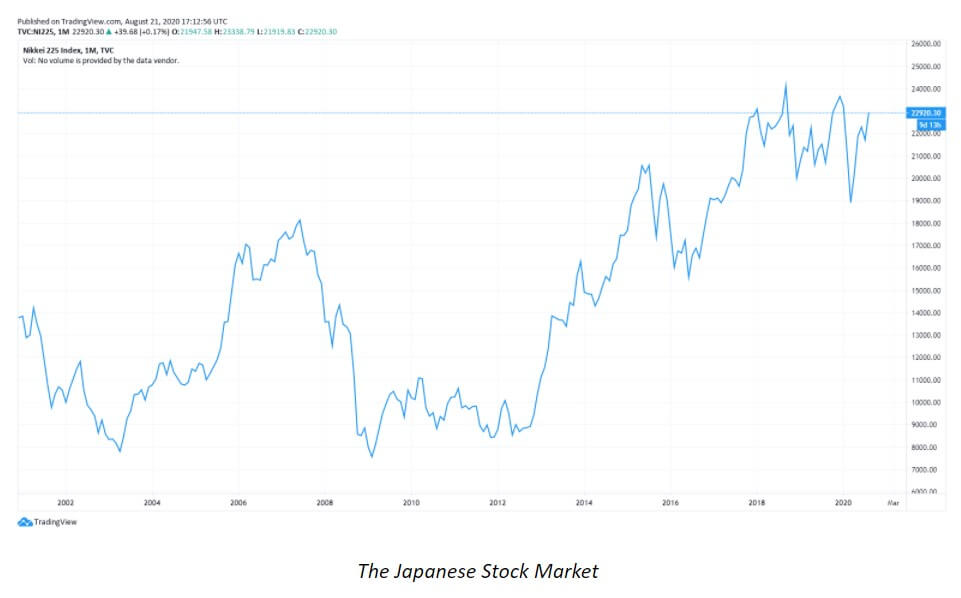

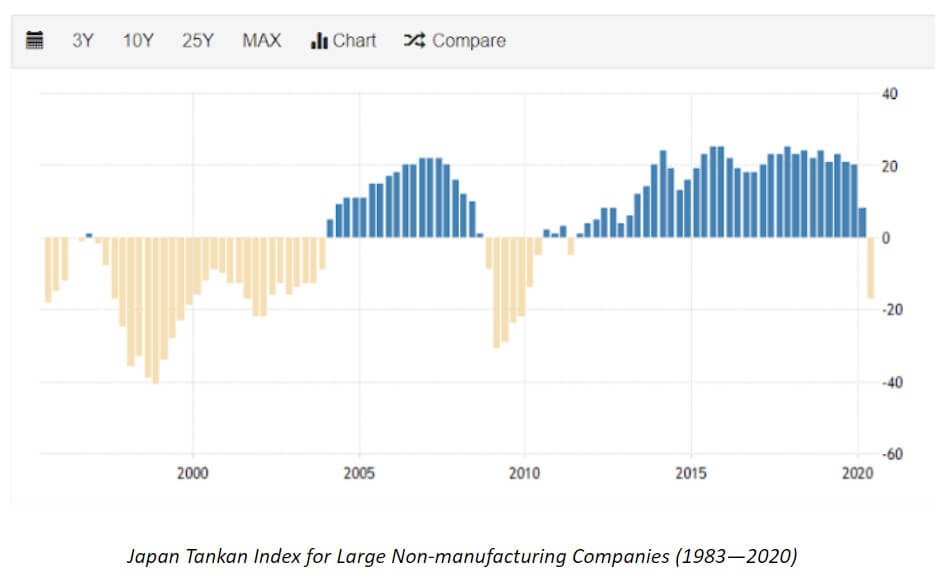

Although the USD did not appreciate more than in 2007, the currency’s index value did approach near record highs. So far, the USD has slightly leveled, still maintaining an edge similar to many major currencies (e.g. EUR or JPY). Nonetheless, the current preference of the USD and its strength seem to be calling for an increase in international collaboration. Now, as the Federal Reserve is yet again pumping the currency into the world market, the trend may have serious implications for other economies. For example, after the 2008 crisis, the cost of export created by a soaring JPY left Japan worse off than some countries directly affected by the financial tumult, starting with the United States itself.

Business owners across the world understand that should the pandemic continue, they will require significant capital reserves to withstand the blows of the economic contraction. The spread of the virus certainly motivated some large currency moves as well and, although similar tendencies have been recorded in the past, the pandemic does make this situation one of a kind. The quick-paced forex dynamics and capital outflows from emerging markets appear to be much more prominent.

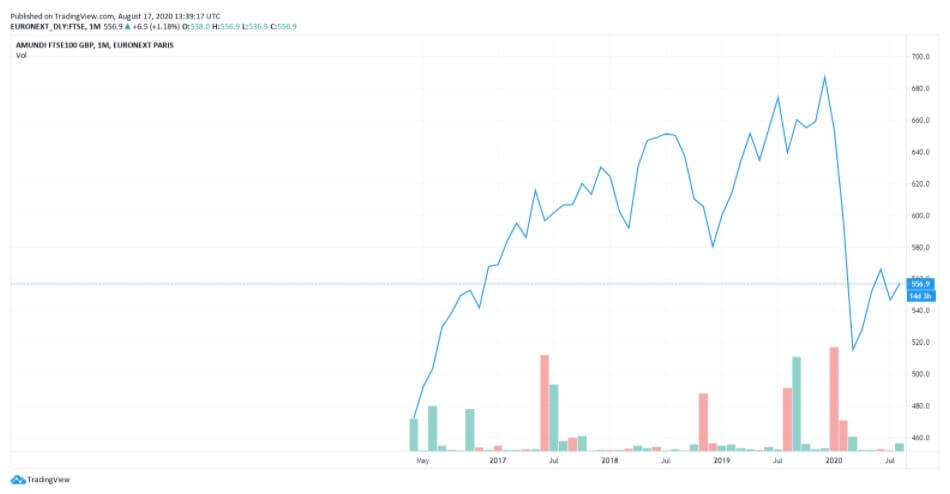

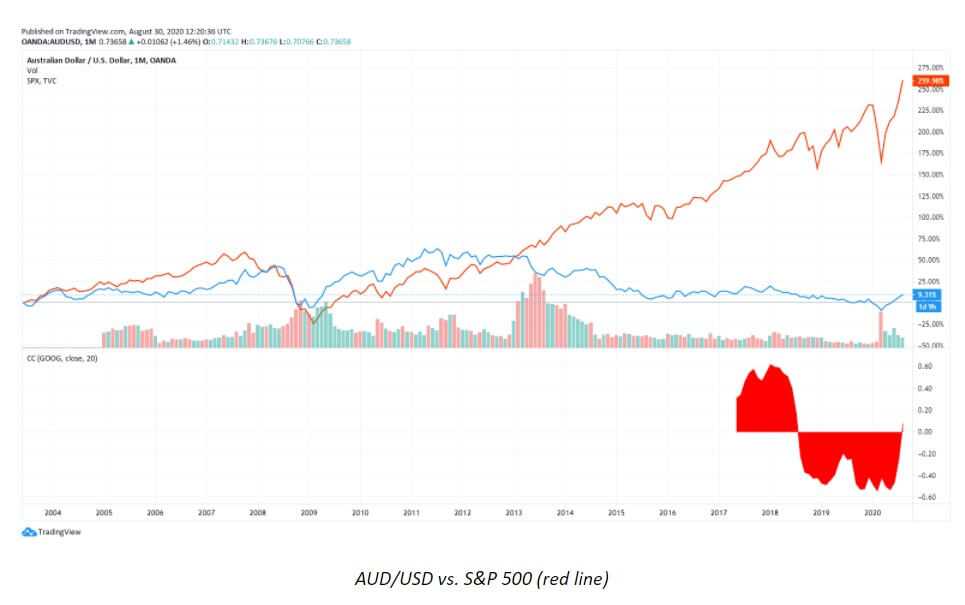

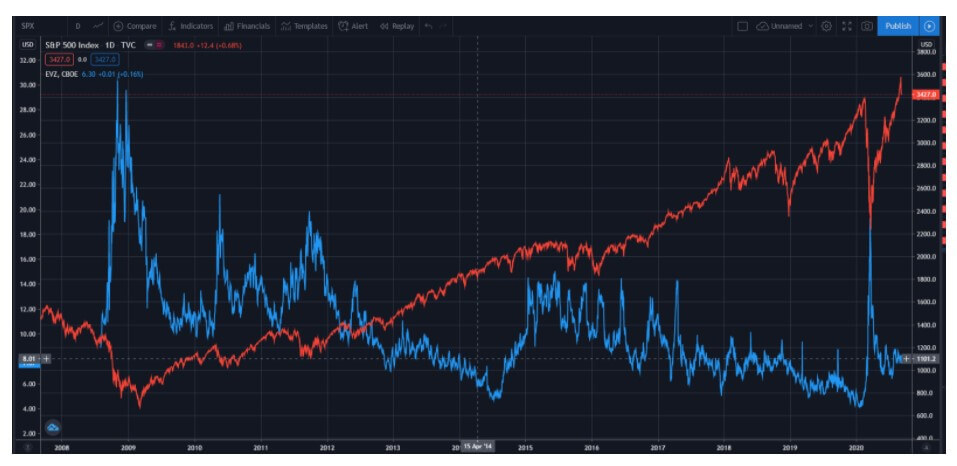

The state of equities at the moment is certainly interesting as we can see from the chart below. The same contrasting behavior between DXY and SPX500 was noticeable before as well as during the financial crash of 2007. March was another time in history when a significant drop in equities was quite prominent only to go up recently.

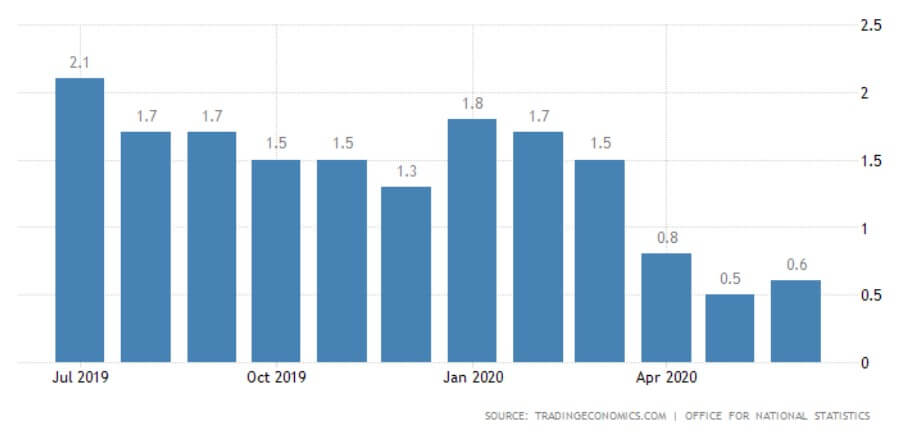

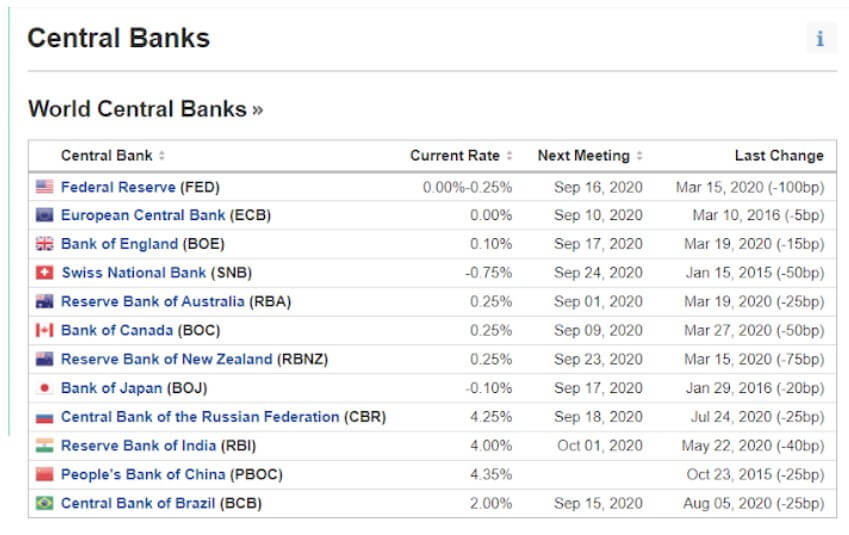

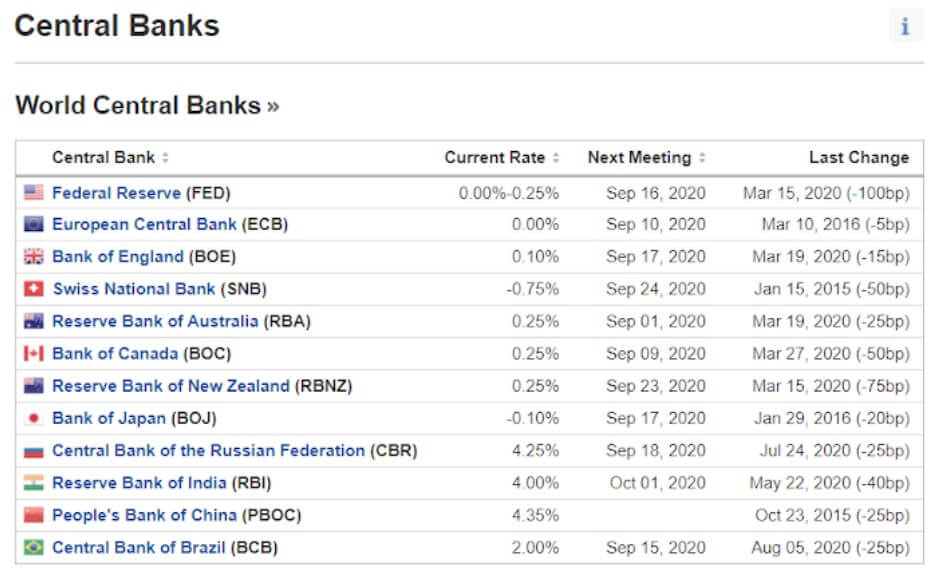

Interest rates in the United States of America have leveled after the brief increase in the past year and as of March equal 0.25%, unlike the values proposed by some other central banks of the world. The current interest rate is practically the same as it was in the post-crisis period of 2008, where it maintained the same 0.25% until the beginning of 2015. Interest rates across the world mimic the same decline as that of the FOMC. However, some other central banks, e.g. the Central Bank of the Russian Federation (CBR) and People’s Bank of China (PBOC) keep their interest rates above 4%.

China’s and Russia’s attitude towards the USD has kept economy-related media and various markets’ participants quite entertained in the past few years, especially in relation to gold and surrounding events. The so-called de-dollarization appears to be backed up by previous political altercations between China and Russia on one hand and the United States on the other. These long-term geopolitical rivals were found in the middle of a currency war where the two countries appear to be fighting against the global hegemony of the USD.

Despite countries leaving the gold rule, this pre-pandemic gold spree appeared strange in this digital era. However, the central bank of Russia suspended buying of gold on the domestic market which has been explained by the attempt to strengthen the local currency aligning with lower oil prices and the spread of COVID-19. Quite interestingly, Russia is claimed to have exported more gold than gas in the second quarter of the current year for the first time in approximately the past 30 years. Analysts explain the entire situation as a mechanism that stops Russia’s purchases of foreign currency and gold when the prices of oil fall below $42 a barrel. With gold prices reaching all-time highs beginning of August 2020, many major Chinese banks have already taken measures to stop customers from purchasing gold and other precious metal-related products through them.

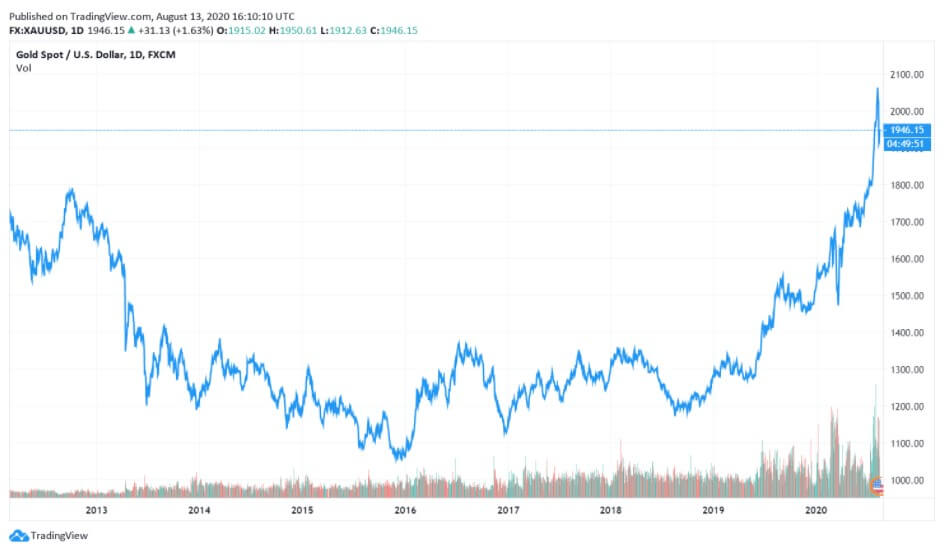

Gold prices have gone up and down in the past, so the increase from the beginning of 2020 can be attributed to the onset of the COVID-19 pandemic as well as part of its natural longer upward trend. The current price exceeds that of the financial crisis of 2007 by far and the precious metals appear to be moving even higher, supporting the expectations of the US inflation increase.

The FOMC maintains a positive outlook on the future, assessing the May employment rise in a number of sectors, employees’ return to work, and the reopening of many businesses. Some analysts even look back at the times of the previous financial crisis where many feared inflation, highlighting the importance of preserving a more enthusiastic perspective of the future of the USD and the US market.

The USD has once again been proved to be the reserve currency of most countries across the world with more than $1.8 trillion of Federal Reserve notes in circulation. This de facto global currency appears to be positioned well for future trades despite the severity of the global viral threat. The United States’ official currency is currently largely outside the country’s borders, yet it may be difficult to foresee any other currency taking over the USD prominence in the near future.

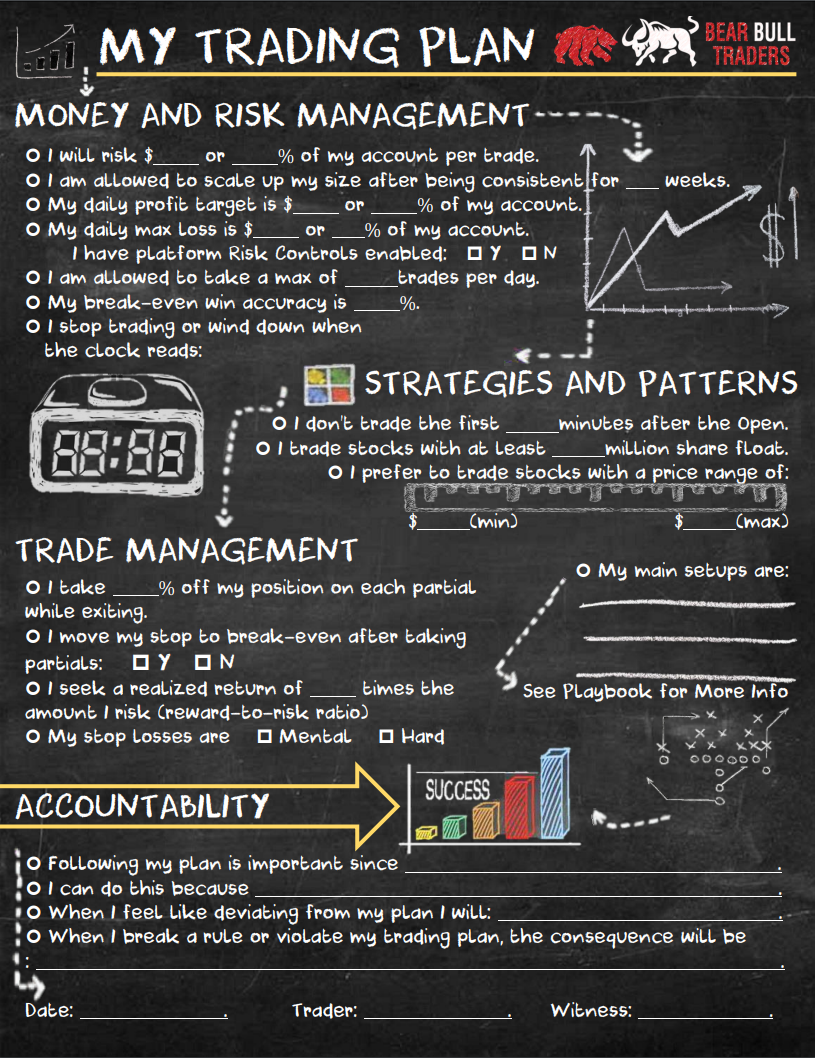

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes.

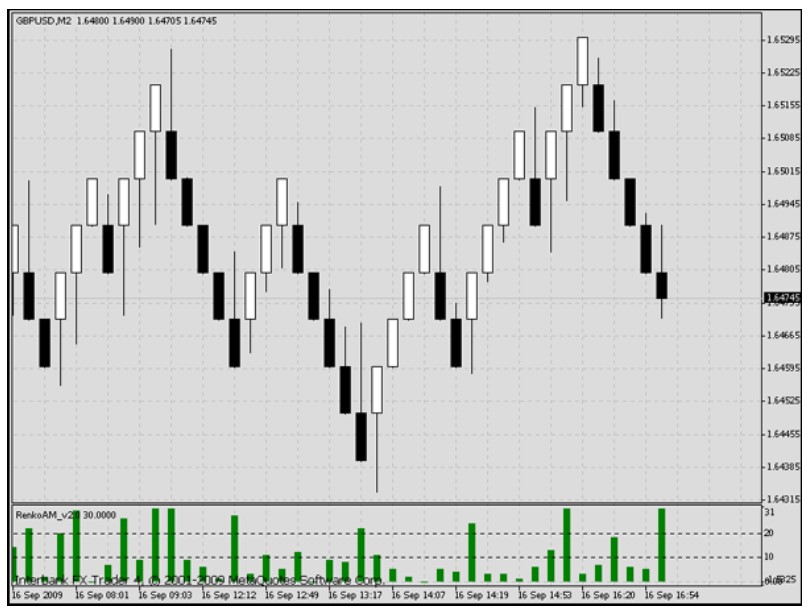

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes.![]() You can do this regardless of whether you did our previous point of writing things down, however, it is far easier to do if you have all the relevant information written in front of you. We now need to analyse the trade that we made in order to work out whether it would be classed as a good trade or a bad trade. A good trade is one that followed all of our trading plans and rules, you can then probably guess that a bad trade is simply a trade that did not follow all of our rules, a trade placed outside of our strategy, regardless of the outcome. If we placed a bad trade we need to work out why, what part of the trade went against our pre-planned strategy? Work that out and you will find it far easier to avoid making the same sort of bad trades in the future. The result of the trade in regards to profit or loss is not important at this stage, what is important is that you get used to trading in line with your strategy and that you gain experience with placing trades with your platform and broker.

You can do this regardless of whether you did our previous point of writing things down, however, it is far easier to do if you have all the relevant information written in front of you. We now need to analyse the trade that we made in order to work out whether it would be classed as a good trade or a bad trade. A good trade is one that followed all of our trading plans and rules, you can then probably guess that a bad trade is simply a trade that did not follow all of our rules, a trade placed outside of our strategy, regardless of the outcome. If we placed a bad trade we need to work out why, what part of the trade went against our pre-planned strategy? Work that out and you will find it far easier to avoid making the same sort of bad trades in the future. The result of the trade in regards to profit or loss is not important at this stage, what is important is that you get used to trading in line with your strategy and that you gain experience with placing trades with your platform and broker. When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind.

When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind. If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are.

If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are. So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

Brokers are always very interested in being able to develop their business more and thus be able to attract new customers. They make profits by receiving commissions for the transactions made by their clients. They themselves do not always manage to attract a sufficient number of new customers. That’s why

Brokers are always very interested in being able to develop their business more and thus be able to attract new customers. They make profits by receiving commissions for the transactions made by their clients. They themselves do not always manage to attract a sufficient number of new customers. That’s why

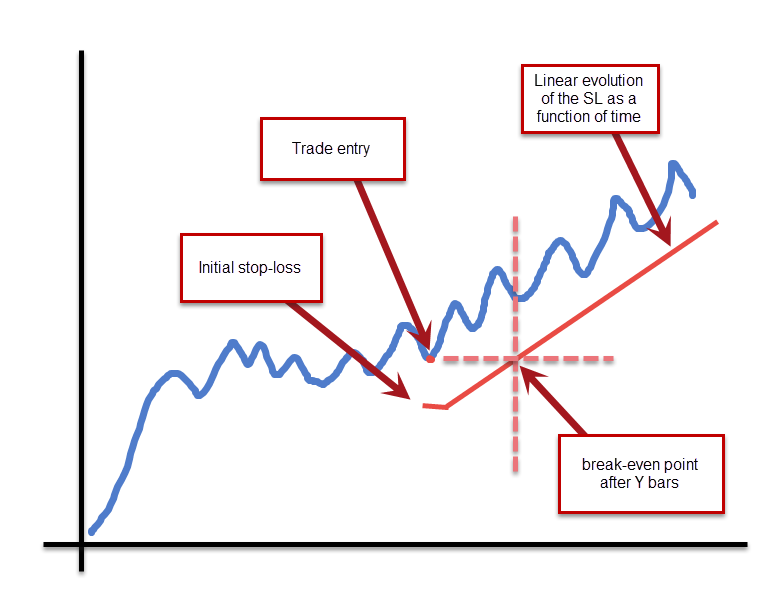

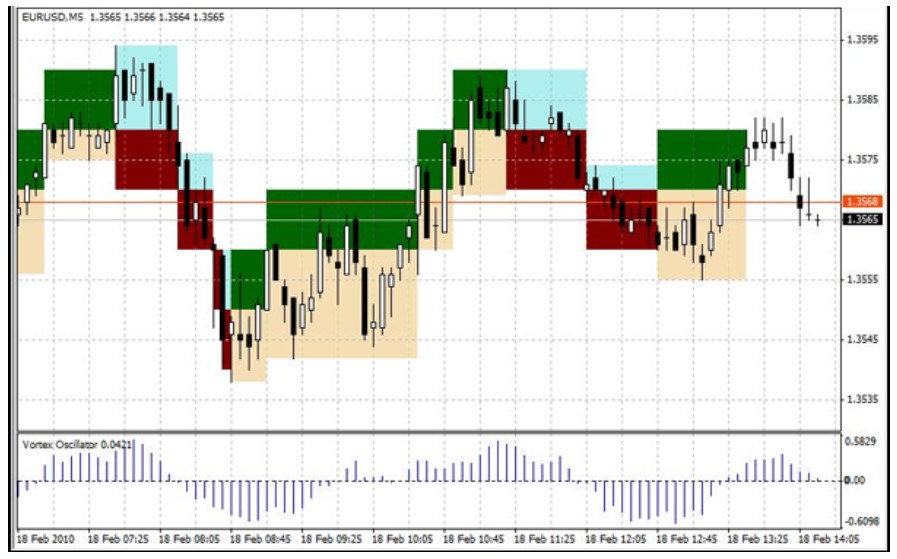

The Stop Loss can be dynamic, as a way to ensure profits in a transaction that progresses in a profitable way. However, the Stop Loss should be moved only in the direction of reducing losses or blocking profits. This way, a trade with good performance will end up giving benefits. This is of course an excellent way to leave an operation ends with a “natural death,” rather than aiming for profit goals that can be very difficult to predict.

The Stop Loss can be dynamic, as a way to ensure profits in a transaction that progresses in a profitable way. However, the Stop Loss should be moved only in the direction of reducing losses or blocking profits. This way, a trade with good performance will end up giving benefits. This is of course an excellent way to leave an operation ends with a “natural death,” rather than aiming for profit goals that can be very difficult to predict. There is a possible compromise. You may want to use dynamic pickups set in locations relatively far from the current price, which could be reached by, for example, a sudden news spike. This could get you some nice benefit at the peak, and allow you to re-enter at a better price when the turbulence passes. This is the most suitable use of Hard Take Profit commands within “non-scalping” negotiating styles.

There is a possible compromise. You may want to use dynamic pickups set in locations relatively far from the current price, which could be reached by, for example, a sudden news spike. This could get you some nice benefit at the peak, and allow you to re-enter at a better price when the turbulence passes. This is the most suitable use of Hard Take Profit commands within “non-scalping” negotiating styles.

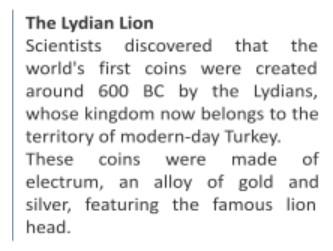

The story of trade started many years before we even had the currencies of today. People would exchange goods for other things they needed. So, they would weigh whether the value of their eggs and flour would equal the materials they needed to sew their clothes for example. The currency of the time was anything people made or obtained from nature.

The story of trade started many years before we even had the currencies of today. People would exchange goods for other things they needed. So, they would weigh whether the value of their eggs and flour would equal the materials they needed to sew their clothes for example. The currency of the time was anything people made or obtained from nature. Nowadays, there is much room for governments and banks to manipulate the circulation of currencies, increasing the overall money supply. Therefore, to trade in this market and have any hope of being successful, we need to invest in financial literacy. As forex traders, we need to know what we are dealing with.

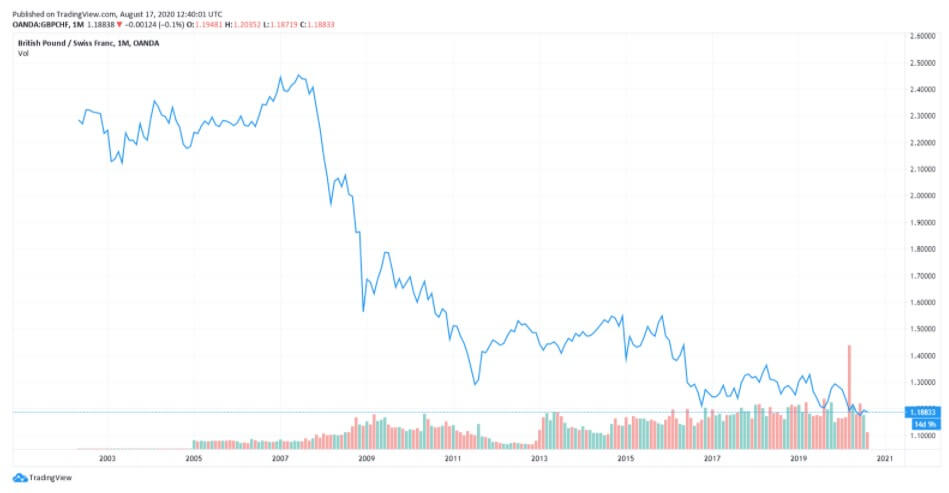

Nowadays, there is much room for governments and banks to manipulate the circulation of currencies, increasing the overall money supply. Therefore, to trade in this market and have any hope of being successful, we need to invest in financial literacy. As forex traders, we need to know what we are dealing with. Historically, there have been a few currencies that are considered to be a safe haven. In periods of crisis, governments consider currencies such as the CHF to be the safest options to hold due to the stability of their countries’ central banks and governments.

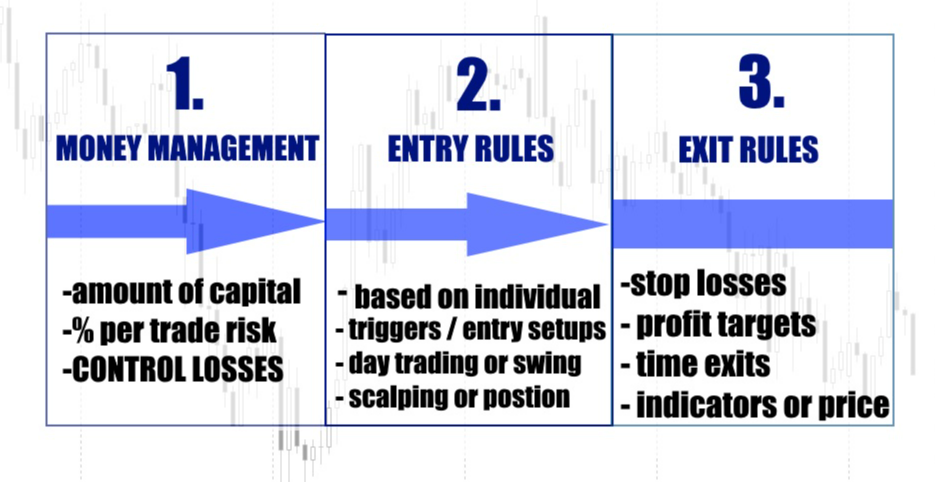

Historically, there have been a few currencies that are considered to be a safe haven. In periods of crisis, governments consider currencies such as the CHF to be the safest options to hold due to the stability of their countries’ central banks and governments.  As currency traders, we all need to develop systems that allow trading to function regardless of what is happening in the world or the market. Forex is recession-proof, which means that your trading strategies and algorithms extract profits from both, bull and bear markets.

As currency traders, we all need to develop systems that allow trading to function regardless of what is happening in the world or the market. Forex is recession-proof, which means that your trading strategies and algorithms extract profits from both, bull and bear markets.

It’s true that some forex traders sit in front of their computer screen multiple hours each day, but many others only trade part-time or devote a very small amount of time each week to trading. It’s very easy to find a profitable strategy like swing trading that doesn’t ask you to constantly monitor the market. Also, with all of the convenience offered by the modern world, traders can use

It’s true that some forex traders sit in front of their computer screen multiple hours each day, but many others only trade part-time or devote a very small amount of time each week to trading. It’s very easy to find a profitable strategy like swing trading that doesn’t ask you to constantly monitor the market. Also, with all of the convenience offered by the modern world, traders can use

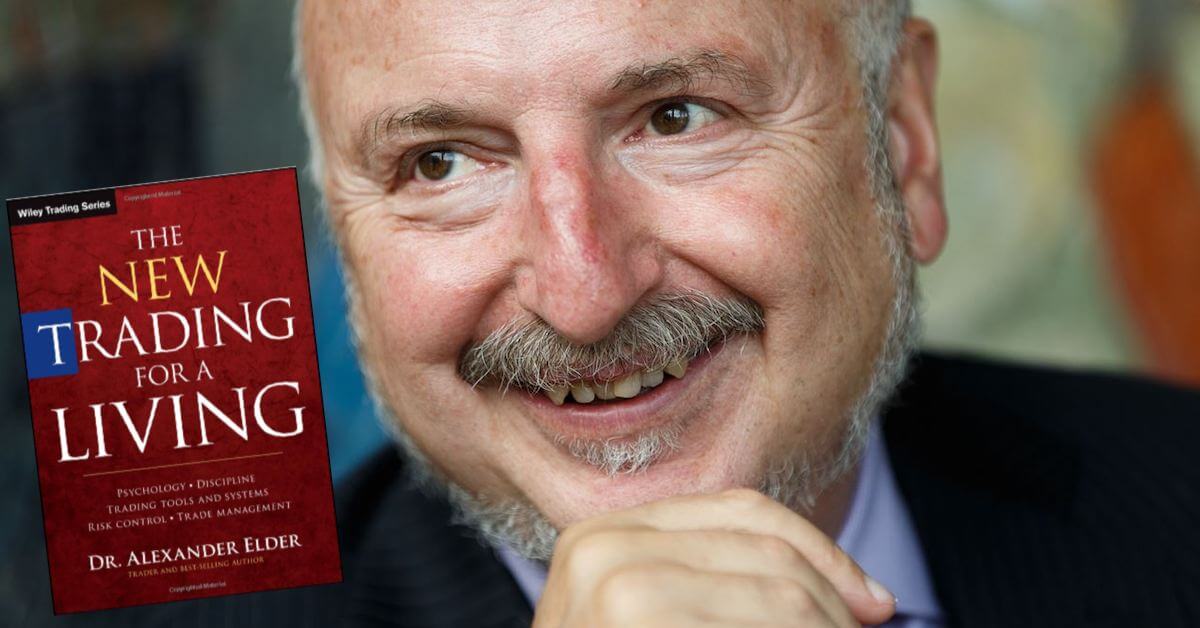

One of the first factors we need to include in the book selection process is the existence of a wide variety of trading styles. Some may be more popular, whereas some others might not be as widely advertised thus creating a minority in the forex market. If you happen to feel passionate about support and resistance lines,

One of the first factors we need to include in the book selection process is the existence of a wide variety of trading styles. Some may be more popular, whereas some others might not be as widely advertised thus creating a minority in the forex market. If you happen to feel passionate about support and resistance lines,  Dubbed the predecessor of all motivational books, this 1937 masterpiece is the place to start growing your mindset. Naturally, all forex traders dream of becoming wealthy, affluent individuals, who wish to stop spending long hours working behind the desk. Luckily, the book is focusing on an extensive study of people who have accumulated a lot of wealth, based on which it provides a list of key principles to live by. If you are a career-driven professional and you feel passionate about expanding your opportunities, Think and Grow rich may just open a new window in your mind. Media all around the world praises the book to the extent that it even provided scientific evidence of how some of the suggestions from the book can truly and tangibly alter your everyday life.

Dubbed the predecessor of all motivational books, this 1937 masterpiece is the place to start growing your mindset. Naturally, all forex traders dream of becoming wealthy, affluent individuals, who wish to stop spending long hours working behind the desk. Luckily, the book is focusing on an extensive study of people who have accumulated a lot of wealth, based on which it provides a list of key principles to live by. If you are a career-driven professional and you feel passionate about expanding your opportunities, Think and Grow rich may just open a new window in your mind. Media all around the world praises the book to the extent that it even provided scientific evidence of how some of the suggestions from the book can truly and tangibly alter your everyday life.  A natural successor of Rich Dad, Poor Dad, this book is a logical continuation for anyone who has given work hours and schedules a thought. If you are keen on changing your daily routine and ready to take on new challenges, be prepared to be astounded by some amazing facts. While the title of this piece may invoke feelings of disbelief or doubt, it does not fall short of its name. You can learn from the author’s personal experience of growing his finances from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week. This approach is particularly important for forex traders since we, as people, tend to try to copy the same type of mindset (e.g., belief that you need to work hard to earn more money) onto trading currencies, which need not be the case.

A natural successor of Rich Dad, Poor Dad, this book is a logical continuation for anyone who has given work hours and schedules a thought. If you are keen on changing your daily routine and ready to take on new challenges, be prepared to be astounded by some amazing facts. While the title of this piece may invoke feelings of disbelief or doubt, it does not fall short of its name. You can learn from the author’s personal experience of growing his finances from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week. This approach is particularly important for forex traders since we, as people, tend to try to copy the same type of mindset (e.g., belief that you need to work hard to earn more money) onto trading currencies, which need not be the case.  Another more recent mindset masterpiece, Choose Yourself, combines the lessons you could learn from the previous two books we mentioned above. The book is often described as a source of refreshment and motivation, which everyone in this market needs – be it at the beginning of a

Another more recent mindset masterpiece, Choose Yourself, combines the lessons you could learn from the previous two books we mentioned above. The book is often described as a source of refreshment and motivation, which everyone in this market needs – be it at the beginning of a  As the name suggests, Jocko Willink’s book discusses the topics of discipline and preparedness to be patient. The author’s immeasurable quality and variety of experience have been cleverly focused in such a way that you will never feel like you are reading a mindset book alone. If you are the type of person who is not a big fan of so-called self-help books, this one will teach you something you may not learn anywhere else. We can at last read about how a well-organized and orderly style of living can bring about the positive changes we aspire to see. No longer are people told to only visualize positive outcomes or a windfall of money because now we have a clear and straightforward instruction based on what constitutes a successful person. Human beings are heavily prone to procrastination, fear, and weakness regardless of their chosen profession.

As the name suggests, Jocko Willink’s book discusses the topics of discipline and preparedness to be patient. The author’s immeasurable quality and variety of experience have been cleverly focused in such a way that you will never feel like you are reading a mindset book alone. If you are the type of person who is not a big fan of so-called self-help books, this one will teach you something you may not learn anywhere else. We can at last read about how a well-organized and orderly style of living can bring about the positive changes we aspire to see. No longer are people told to only visualize positive outcomes or a windfall of money because now we have a clear and straightforward instruction based on what constitutes a successful person. Human beings are heavily prone to procrastination, fear, and weakness regardless of their chosen profession.  The concept of stoicism implies the endurance of any hardship and acceptance that both good and bad with all the in-between shades that exist in this world. This Greek school of thought originates from the third century BC and the book cleverly and practically covers the thought patterns that many great minds have incorporated in their daily lives to this day. Traders are often compelled to do exactly what the majority does, without feeling the right to make any changes due to the fear of being different and experiencing losses as a consequence. This book, however, will show you how it is not what is happening on the outside that you should be worried about, but your own reflection of it. This crucial idea is key for surviving and being on top of situations, such as negative news or other external events that traders inevitably face quite a few times in their careers.

The concept of stoicism implies the endurance of any hardship and acceptance that both good and bad with all the in-between shades that exist in this world. This Greek school of thought originates from the third century BC and the book cleverly and practically covers the thought patterns that many great minds have incorporated in their daily lives to this day. Traders are often compelled to do exactly what the majority does, without feeling the right to make any changes due to the fear of being different and experiencing losses as a consequence. This book, however, will show you how it is not what is happening on the outside that you should be worried about, but your own reflection of it. This crucial idea is key for surviving and being on top of situations, such as negative news or other external events that traders inevitably face quite a few times in their careers.  One of the richest men on this planet wrote a book about the importance of understanding the relationship between cause and effect in analyzing some existing patterns in life. The book so skillfully elaborates on the topic of life principles, covering many different points that traders may at times disregard as irrelevant. Concepts such as humility and open-mindedness are dexterously combined with practical tips on how to reach the level of success you desire. Traders who mostly sit at their computers may find some ingenious lessons on people in this book as it points to the belief that all industries inevitably fall on individuals. Although the forex market appears to be made of people making individual decisions, the chart often shows how the majority acts in the same way with everyone losing their money at the same time.

One of the richest men on this planet wrote a book about the importance of understanding the relationship between cause and effect in analyzing some existing patterns in life. The book so skillfully elaborates on the topic of life principles, covering many different points that traders may at times disregard as irrelevant. Concepts such as humility and open-mindedness are dexterously combined with practical tips on how to reach the level of success you desire. Traders who mostly sit at their computers may find some ingenious lessons on people in this book as it points to the belief that all industries inevitably fall on individuals. Although the forex market appears to be made of people making individual decisions, the chart often shows how the majority acts in the same way with everyone losing their money at the same time.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

Having a central currency helped the member states overcome and bypass many of the barriers that had previously existed. The EUR unites 19 of the 27 European Union member states in a monetary union called the

Having a central currency helped the member states overcome and bypass many of the barriers that had previously existed. The EUR unites 19 of the 27 European Union member states in a monetary union called the  The ECB is a single-mandate institution tasked with setting the interest rates for the eurozone, managing the eurozone’s foreign currency reserves, ensuring the supervision of financial markets and institutions and the functioning of the payment system, authorizing eurozone countries’ production of the EUR banknotes, monitoring price trends, and most importantly assessing price stability (inflation). Unlike other central banks, the ECB is not responsible for promoting employment or growth; however, this approach appears to be slowly changing, realizing the need to foster economic development. With regards to decision-making, the main body within the ECB responsible for this task is the Governing Council and all decisions are based on the majority of the votes of the body’s members. It consists of the six members of the Executive Board, accompanied by the governors of the national central banks of the 19 eurozone countries.

The ECB is a single-mandate institution tasked with setting the interest rates for the eurozone, managing the eurozone’s foreign currency reserves, ensuring the supervision of financial markets and institutions and the functioning of the payment system, authorizing eurozone countries’ production of the EUR banknotes, monitoring price trends, and most importantly assessing price stability (inflation). Unlike other central banks, the ECB is not responsible for promoting employment or growth; however, this approach appears to be slowly changing, realizing the need to foster economic development. With regards to decision-making, the main body within the ECB responsible for this task is the Governing Council and all decisions are based on the majority of the votes of the body’s members. It consists of the six members of the Executive Board, accompanied by the governors of the national central banks of the 19 eurozone countries.

The first steps are not easy to find among all the material without substance. Whatsmore, the material you find will likely point to a direction where 90% of traders end – giving up on trading after a very fast account busting. Even though forex trading is hard to master on a psychological and technical level, once mastered it offers a very attractive lifestyle most would put into the ideal category. Getting there is the hardest part, but it does not take long, especially if you have great educational and

The first steps are not easy to find among all the material without substance. Whatsmore, the material you find will likely point to a direction where 90% of traders end – giving up on trading after a very fast account busting. Even though forex trading is hard to master on a psychological and technical level, once mastered it offers a very attractive lifestyle most would put into the ideal category. Getting there is the hardest part, but it does not take long, especially if you have great educational and

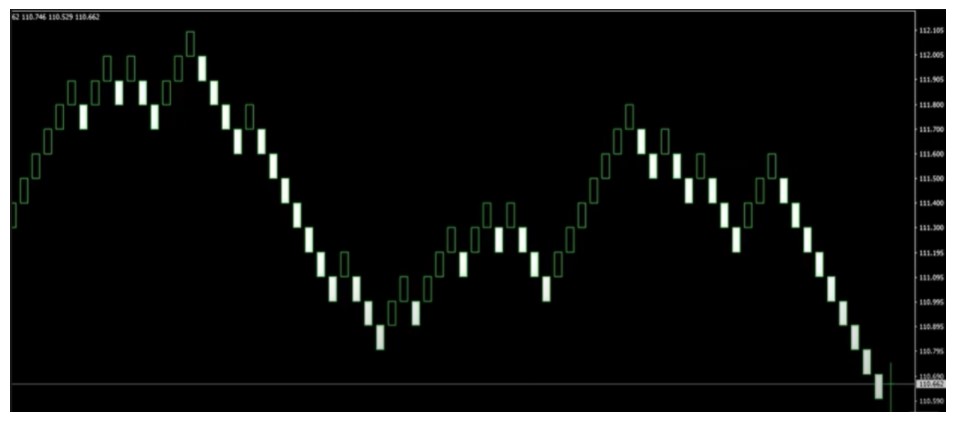

The first thing to check is the $EVZ, VIX Index, or other global forex volatility benchmark. It is our first information about the market conditions that affect our money management mode. Markets move in cycles, from chaotic to calm.

The first thing to check is the $EVZ, VIX Index, or other global forex volatility benchmark. It is our first information about the market conditions that affect our money management mode. Markets move in cycles, from chaotic to calm.

There are no shortcuts to becoming a trader, there is no substitute for experience so if you are looking for a guide to set you up and ready to go you may be disappointed. If you are looking for guidance on your determined long way of becoming a trader, get ready for putting the work before you even take a step into forex. Every percentage on your side has to be earned with careful analysis, discipline, and lots of ideas testing. Trading is fun and exciting, the part before that winning percentage above 50% is hard work, which is essentially the biggest part of professional traders’ activity. The difference between 50% sports better and 51% is extreme. If you are playing poker that 1% is also decisive in the long run.

There are no shortcuts to becoming a trader, there is no substitute for experience so if you are looking for a guide to set you up and ready to go you may be disappointed. If you are looking for guidance on your determined long way of becoming a trader, get ready for putting the work before you even take a step into forex. Every percentage on your side has to be earned with careful analysis, discipline, and lots of ideas testing. Trading is fun and exciting, the part before that winning percentage above 50% is hard work, which is essentially the biggest part of professional traders’ activity. The difference between 50% sports better and 51% is extreme. If you are playing poker that 1% is also decisive in the long run.  The emotional control level is easy to spot. People who complain, rant, conflict, are the loudest and probably most present on social media. It is easy to understand their emotional control is nonexistent, and are consequently unsuccessful traders. It is logical to conclude their comments or advice are not worth taking.

The emotional control level is easy to spot. People who complain, rant, conflict, are the loudest and probably most present on social media. It is easy to understand their emotional control is nonexistent, and are consequently unsuccessful traders. It is logical to conclude their comments or advice are not worth taking. Avoid or accept what you cannot control on the market

Avoid or accept what you cannot control on the market

The only way for any trader to truly feel in control of trading in this market is to make a clear distinction between their emotions and logical thinking. If we allow ourselves to enter and exit trades solely based on how we feel, we are then making vital money-related decisions grounded in our subjective idea of where the market is going to move. This sentiment-governed action is not based on any actual plan or structure, which is why a system is very much needed to bypass the dangers of our human nature. If you have developed and tested one, you have a tool that can certainly work and get you to where you wish to go, unlike this emotion-driven, reckless approach that will undeniably make all your fears come alive sooner or later.

The only way for any trader to truly feel in control of trading in this market is to make a clear distinction between their emotions and logical thinking. If we allow ourselves to enter and exit trades solely based on how we feel, we are then making vital money-related decisions grounded in our subjective idea of where the market is going to move. This sentiment-governed action is not based on any actual plan or structure, which is why a system is very much needed to bypass the dangers of our human nature. If you have developed and tested one, you have a tool that can certainly work and get you to where you wish to go, unlike this emotion-driven, reckless approach that will undeniably make all your fears come alive sooner or later.

Many traders are passionate about beating the competition when, in fact, their greatest opponent is their own lack of knowledge or understanding. In the forex market, we can say that everyone is fighting their own battle, so we cannot really discuss competition as we can do in the world of sports. Fighting against the big banks in the literal sense has been proven to be in vain, but understanding how to rise above their radar and focus of attention is most likely to bring you to where you want to go.

Many traders are passionate about beating the competition when, in fact, their greatest opponent is their own lack of knowledge or understanding. In the forex market, we can say that everyone is fighting their own battle, so we cannot really discuss competition as we can do in the world of sports. Fighting against the big banks in the literal sense has been proven to be in vain, but understanding how to rise above their radar and focus of attention is most likely to bring you to where you want to go.

Q3: How much money can you make as a forex trader?

Q3: How much money can you make as a forex trader?

Q12: How much money does it cost to learn to trade?

Q12: How much money does it cost to learn to trade? Q16: Can forex robots make me rich?

Q16: Can forex robots make me rich?

If you’re already tense when you first log into your trading account for the day, the anxiety of trading will likely add to your tension, even if you’re making money. The best thing you can do is to start fresh each day in a great mood, so we suggest finding something that helps you relax beforehand. This could be as simple as drinking a morning cup of coffee or listening to your favorite song. Exercise is another popular option that makes people feel good, so consider yoga, meditation, going for a jog, or some other form of exercise to get those endorphins flowing.

If you’re already tense when you first log into your trading account for the day, the anxiety of trading will likely add to your tension, even if you’re making money. The best thing you can do is to start fresh each day in a great mood, so we suggest finding something that helps you relax beforehand. This could be as simple as drinking a morning cup of coffee or listening to your favorite song. Exercise is another popular option that makes people feel good, so consider yoga, meditation, going for a jog, or some other form of exercise to get those endorphins flowing.