The title of this article is not some forex movie spinoff, although there is one “bad” currency in this article. Not all things work in forex trading. You will have tools and indicators that are just bad, and unfortunately, they are abundant. Additionally, some currency pairs are not good for your strategy. If you do not know by now, the trend following strategies are the most successful according to many research studies and confirmed by experience. A group of experienced prop traders has more success in certain currency pairs than with others. The most common ones are the EUR/GBP and the GBP/CHF, out of the major 8 currencies. We will discuss these three currencies, and why they are good for trend following trading. Also, some warning signs about trading that could even ruin the best trades out of thee pairs.

Note that all this material is just an opinion by a forex prop trade who is relying on a technical analysis most of the time. Therefore, trend trading like thins involves a lot of systematic, mathematical decision making using indicators in specialized roles. Following the trend and avoiding events that could disrupt it is also one of the elements. This implies the USD is not a really good choice for this trading type. Not that it is impossible to trade, just unlikely as good as involving the EUR, GBP, and CHF. Traders that have been doing this for 10 years say the USD is full of surprises that could ruin what looked like a very consistent trend. There are several reasons for this. The first one is that the USD is heavily manipulated by the big institutions.

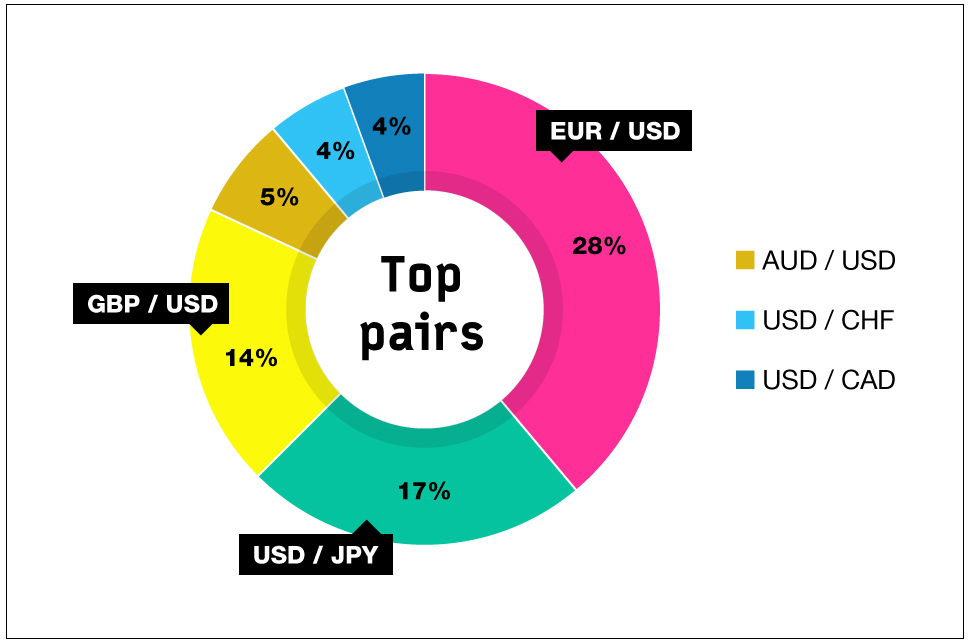

One proof of this is the sentiment, every time traders go long, big players go short and move the price and vice versa. The USD pairs are also most traded, or most popular. This is the place where it is easy to counter the majority of traders’ positions. The big banks and institutions will go where the traders’ money is, hence why the USD pairs are also very hard to master, especially for amateur traders who use the same tools as everybody else. News events are also more frequent with the USD pairs, the price will move illogically to the report or doing extreme shakeouts before the move happens. Anytime you see the major events like the non-farm payrolls or interest rates, the market will go crazy, disrupting your strategy and planed trades.

The Power of Tweets

Interestingly, the USD is affected by one more phenomenon – Trump tweets. Whenever the president of the US has some comment, regardless if it is related to the US economy, the media start to make stories and predictions to which forex market reacts. Now, we have one more event to pay attention to, making the USD unforgiving, choppy currency. If you like trading the news, this is not something you could use to your advantage, these events are unpredictable, unlike the reports. There is no “logical” move behind them.

Luckily for every forex trader, there are cross pairs. Cross pairs can be defined as the ones that do not have the USD, among other definitions. Again, most of the traders do not come to these markets for several reasons. Of course, it is ok to specialize on one or a few currency pairs, but we all know the basic rule of the Risk Management, diversification is good for your loss protection, never put all of your eggs in one basket. There will be times your favorite pairs will act differently, your system will have a hard time giving you any gains. If you have a specialized system, it means you will not be able to trade once markets change their face, there will be no market you can migrate your system to.

Options for Trend Followers

Back to the currencies that we think are the good ones for trend followers. The advantages of the EUR come from the currency segregation. The Euro is segregated, it is a currency of many EU countries, and it has low relation to the US economy. The EUR/USD is of course affected by the news events from the US but if we look at the EUR alone, it does not care what the USD is doing. The news that the EUR has are scattered, you will see interest rates of Germany, France, and other strong countries, but the impact they will have on the EU and the EUR is not as strong. The EUR is unlike the CAD, for example, where every bad or good event affects the price of CAD drastically. Also, the EUR news schedule is not as tight as with the USD, they are easy to follow and the ones that are not tied to a specific EU country are those that matter. You can easily plan accordingly when you know the ECB is releasing the decision on the interest rates, for example. You do not have to worry about the tweets or hysterical media that make markets go wild.

Moving on to the GBP, this currency is an oldtimer on forex. It has its own “personality” and is not correlated to anything. Depending on how much you are familiar with the market, you may notice that the EUR and the CHF are somewhat correlated. The USD and the JPY are also similarly correlated, they are both regarded as the safe-haven currencies. The USD and the CAD are correlated because they are both North American currencies. Unlike these, the GBP is not correlated to anything. Because of this, the GBP pairs are on the constant move, the constant move means strong quality trends. More trends mean more gains for trend followers. Sideways movement is bad for trend traders and GBP does this rarely. Just pay attention, when the GBP moves sideways, these ranges are whipsawing faster and higher than with other currencies.

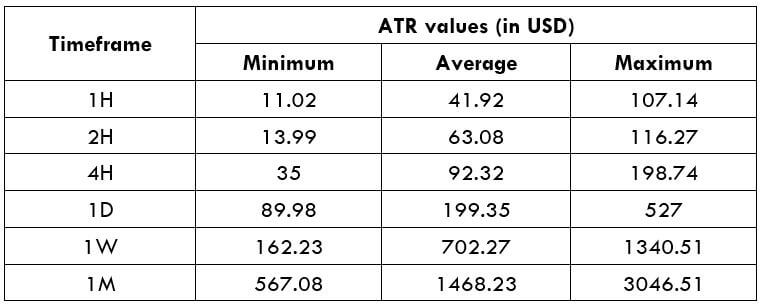

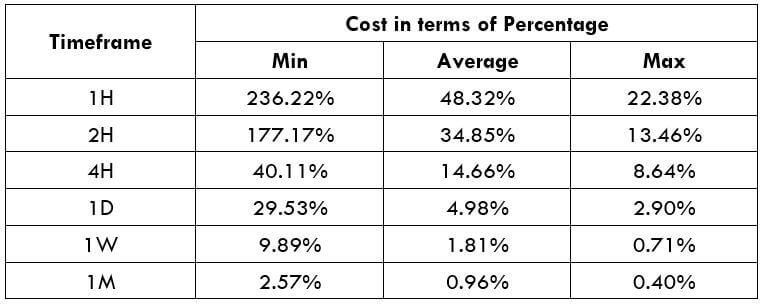

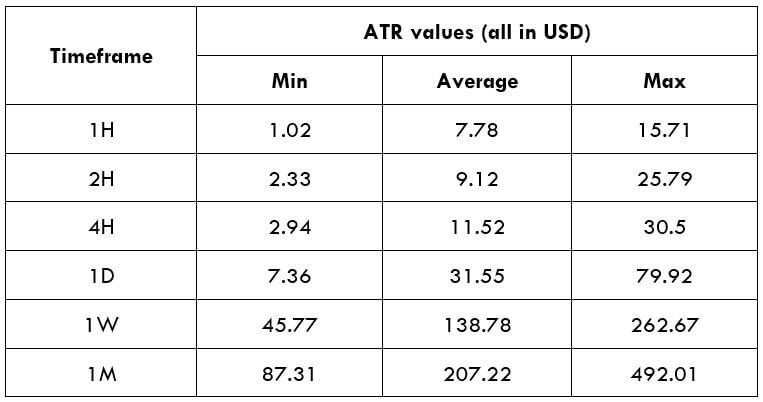

Another specialty about the Pound is that the moves are more extreme, this is easily spotted if we compare the ATR (Average True Range) of GBP pairs and other non-exotics. Similarly to the EUR, GBP news events are also easy to follow. It is common to see the same type of news affect the GBP, fewer surprises – fewer losses. What news events affect major 8 currencies the most would require another article, but it Is important to know the outlines about the GBP, EUR, and CHF.

Coping with Neutrality

The Swissy is very neutral, just as the country politics itself. Very few news events affect the CHF, the only one you need to pay attention to is the Swiss National Bank. Whatsmore, the SNB does not have a lot to say. This means you can leave your trades running, the news will not affect trends as much. Another similar currency to the Swissy regarding this is the JPY. Swissy is also regarded as a safe haven currency, it is common to see it negatively correlated with the equities market but also positively correlated with the EUR. This is not always the case of course although when the Swissy correlates with the EUR the movements are not to the same extent. This trait of the Swissy can be used for so-called Pairs Trading method. Whatsmore, this gives you the ability to “switch” the trend if you have a position with the EUR, move it to the CHF where the news event will not affect it much.

There are moments in the forex market where a certain currency will behave like a major news event was ongoing even though you will not see anything that could cause such a drastic move. AUD might be one of these currencies, but not the CHF, at least not always (remember the CFH flash crash off the peg?). So Swissy is also the currency with few “weird” moves that do not have any arguments. It is usually the big banks play when you see something like this. So predictability is great, always take inherent risk into account with a certain currency. You mat even eyeball some chart and see if it is too choppy for your system, do you see some spikes and are those spikes affected by news which you can predict or not.

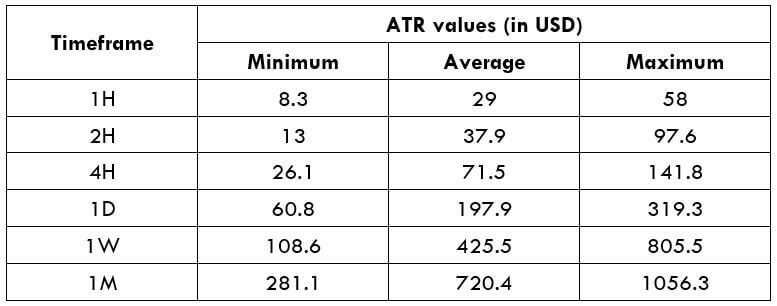

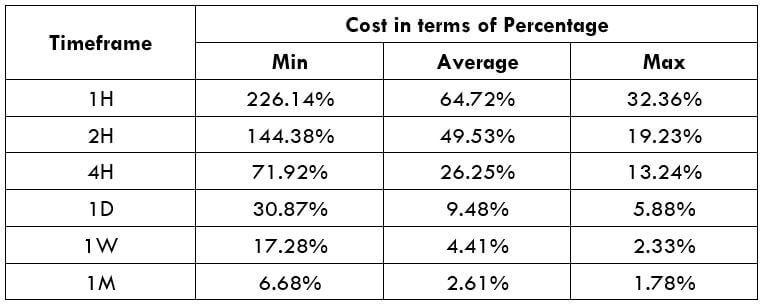

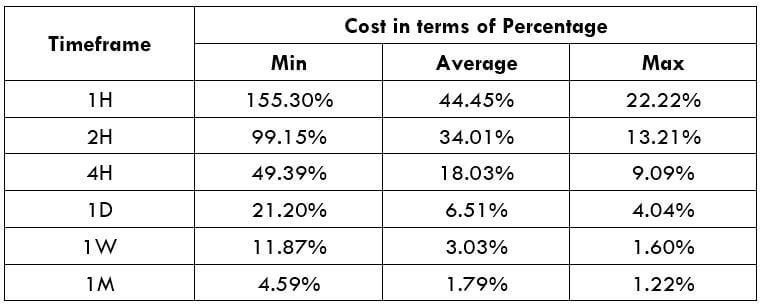

This trio can make a lot of gains when paired together. Starting with the EUR/GBP, what is so special about it?. It is the slowest out of the major 8 pairs. According to the ATR, this is what is usually seen and measured on the charts historically. Slow movement can be a good thing when you want more control. The pair is also USD news proof. The relation to the USD news is minor at best so you can focus only on GBP and the EU news, which are easy to follow. The movements on the EUR/GBP are rarely in balance, more often than not there are some trends in this pair. So when you combine something that has slow predictable movements, without much news disruptions and having trends…this is the golden choice for trend traders.

Still, this pair is not on the top of the most traded pairs list, not even close. The analogy of this might be like when most people want to have a trendy iPhone smartphone instead of a Samsung, even though it may not be a good fit for their needs or financial capabilities. According to the reports of professional prop traders, this pair has a great winning percentage. If they have a signal to buy on the GBP, they would rather trade the EUR/GBP than the GBP/USD. They are not even splitting the risk profile on two, just go full on the EUR/GBP. The probabilities they have gathered say it is just better to allocate positions on this pair, even if it means more risk by not diversifying.

Other Pairs to Consider

Moving on to the GBP/CHF, the ATR of this currency pair is higher than the EUR/GBP. The Swissy is a single national currency, unlike the EUR and is sensitive to the GBP movement, boosting the momentum. So if the EUR/GBP is too slow to trigger your trade entry or exit, check this pair as there are similar qualities. To some extent, this causes the pair to be even more trendy than the EUR/GBP. Having better “spool” and consistent trends. Stagnation is not common, at least not for the forex majors pairs standards. As with the rest of the pairs, the news events are not frequent, do not cut the trends, and are predictive. The USD events’ effects are not noticeable. GBP/CHF pair is very very unpopular. As such do not expect those weird price action movements without any news to back it up, nor sudden whipsaws.

The EUR/CHF, well, this is the one to avoid. Consider how much the Swissy is correlated to the Euro. Are the baskets similar? Compare the sideways or consolidation ranges to the GBP. You will understand this is a place where trenders either do not trade a lot or just lose. The stagnation or positive correlation to the EUR can change, at this moment this pair is moving nicely like the CHF is now more expressive in less certain times. Trading the EUR/AUD would be the same as trading the EUR/CHF a while ago before 2018, but now it is a bit different. The correlation will probably start again when the markets get out of the (if) COVID-19 crisis. For now, there is not enough historical evidence to say this pair is not correlated anymore. If you are trading this one, try it with less risk.

These observations can be seen on the charts. When we open the mentioned currency pairs charts in the MT4 or any other trading platform, you will notice the sideways movements on the daily timeframe that could last for a month or two. These are areas you should avoid. Some traders can spot these periods by the naked eye, others rely on indicators. These types of indicators are not common, but this is another subject. Take all of this as advice, especially if you have a trend following system.

A few more warnings or tips for you. When you see the GBP/CHF and the EUR/CHF charts and you have a signal on one but the other is very close to giving one, do not wait for it, go with the first pair with a signal. This hesitation could lead you to miss great trades. Professional prop traders are often calm when they lose a trade, although when they miss significant trends because they are late to the party, they are very self-critical. The second tip or a warning is not to trade GBP/CHF and the EUR/GBP at the same time. Your exposure on the GBP will be doubled, so trade one or split the risk if you have two signals.

To conclude, be aware of the USD, if you trade USD related pairs, go with reduced risk or smaller positions. Find more opportunities with cross pairs, they tend to have better trends, especially the ones mentioned. Finally, the elementary part of your Risk Management setup should be not to overexpose on one currency, remember the eggs and the basket.

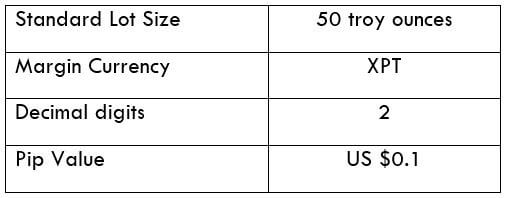

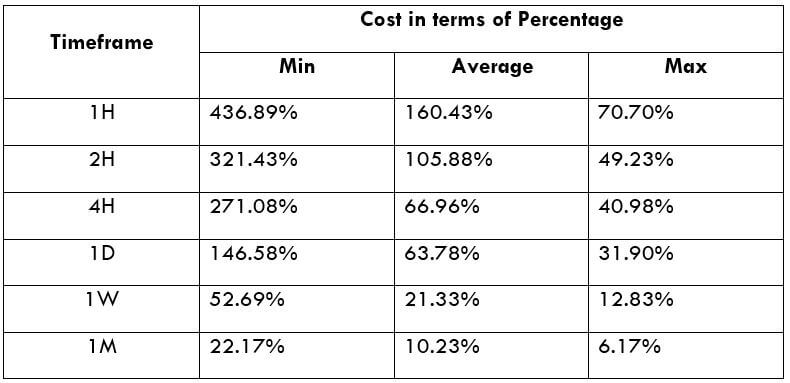

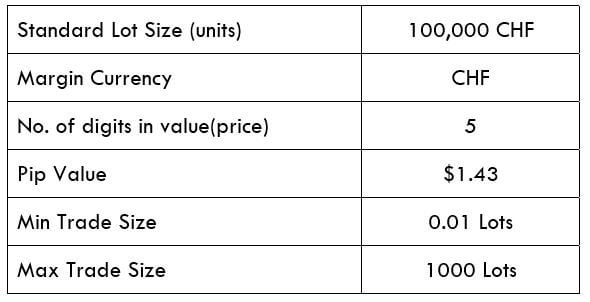

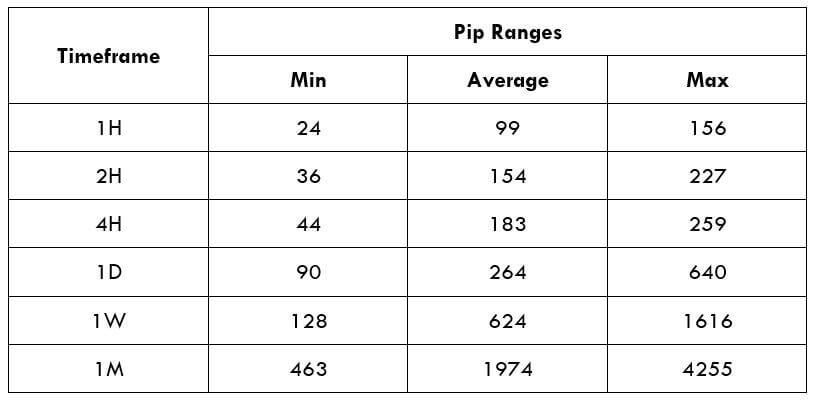

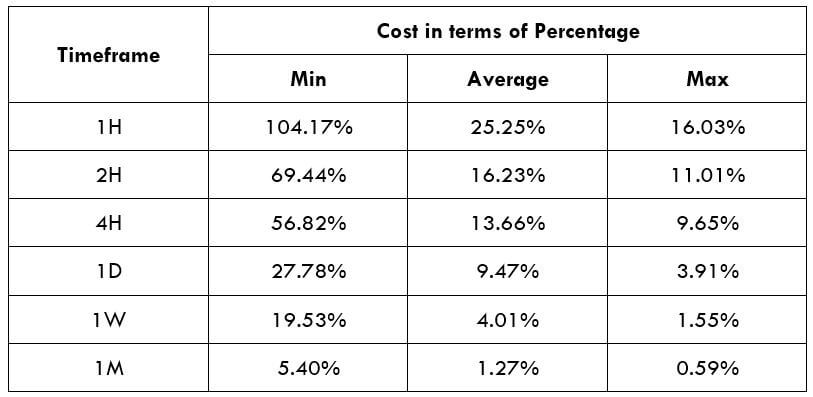

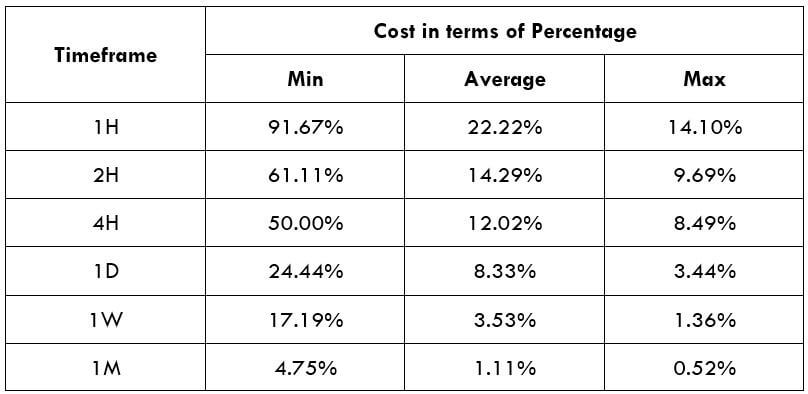

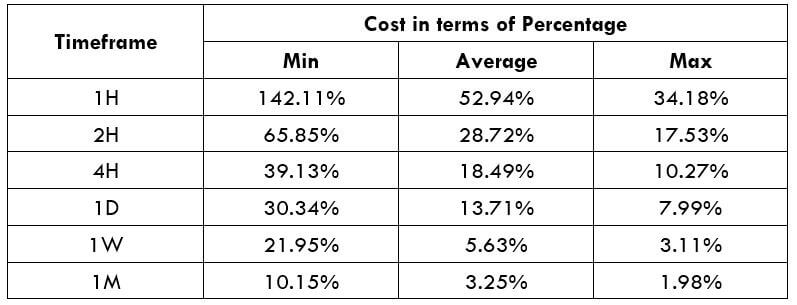

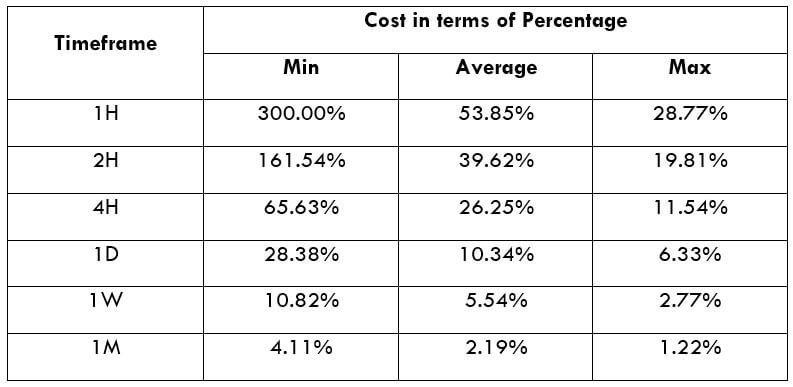

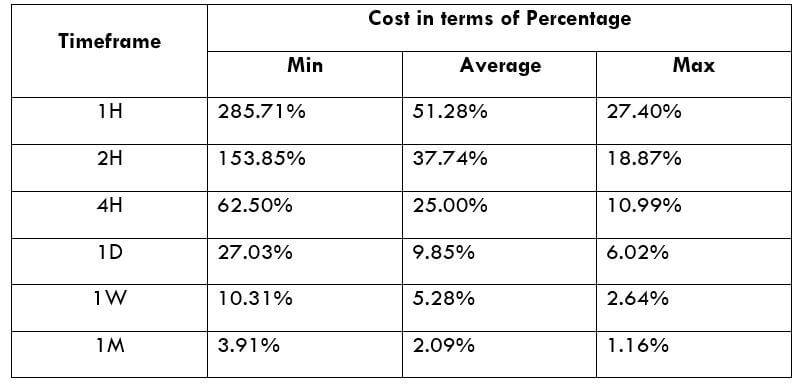

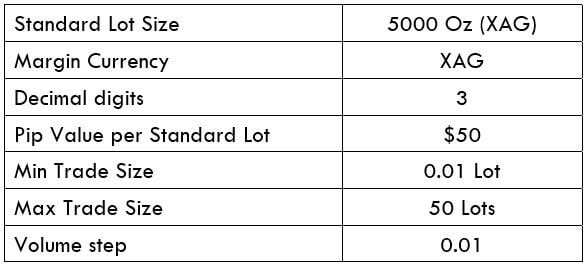

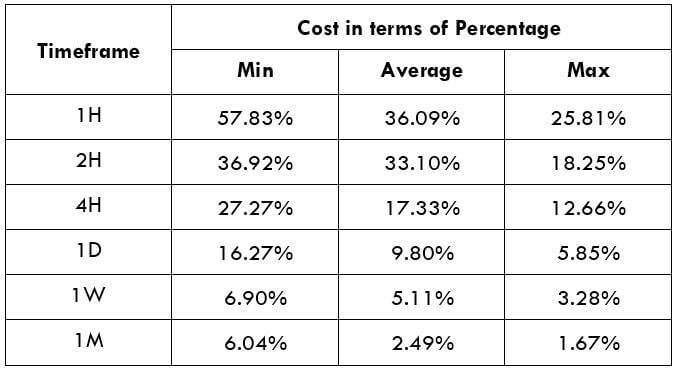

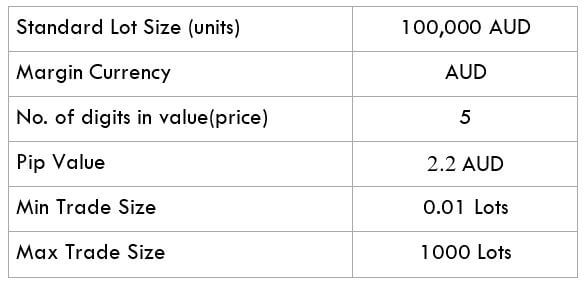

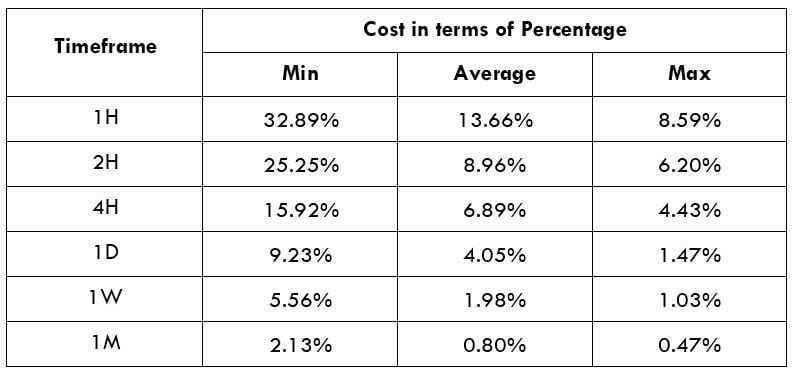

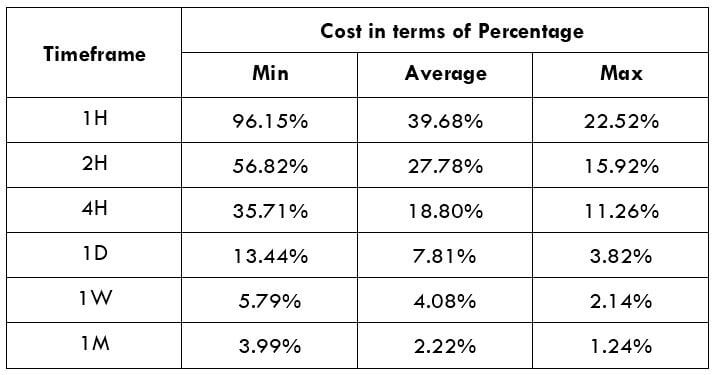

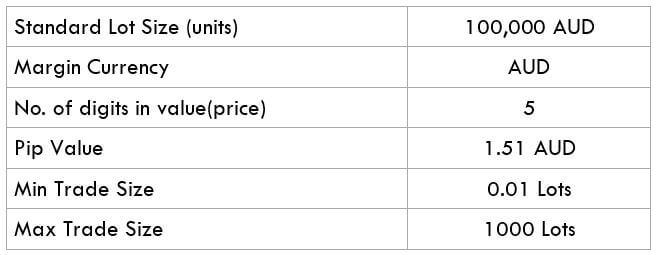

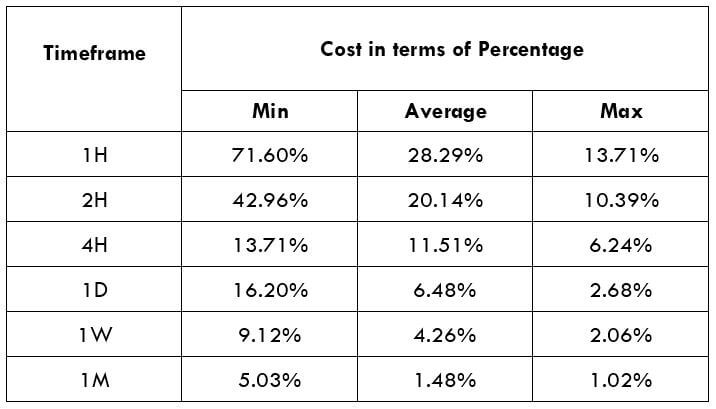

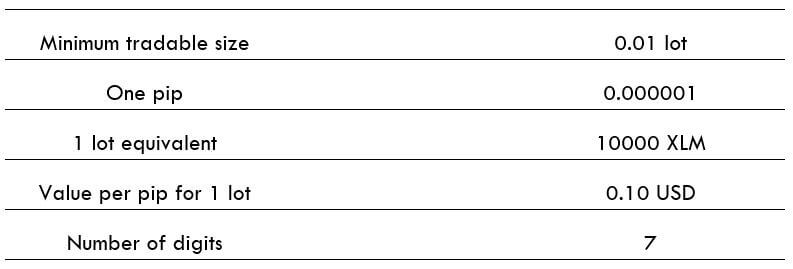

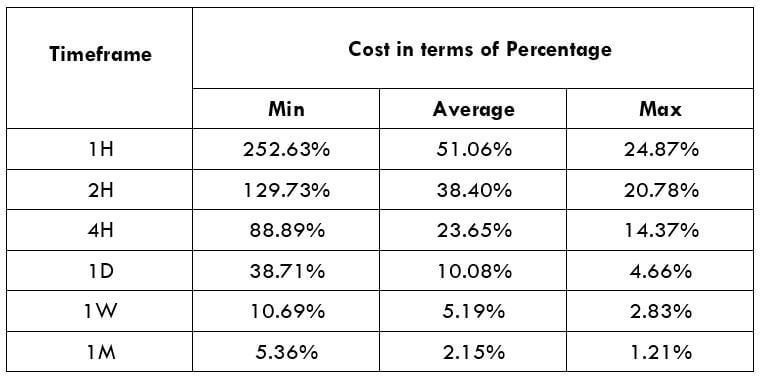

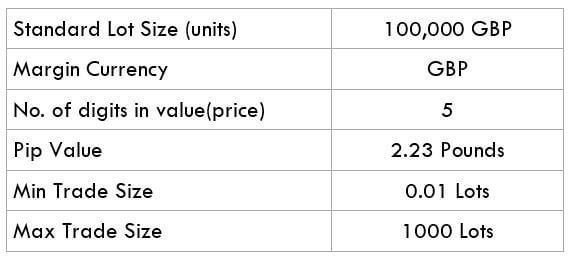

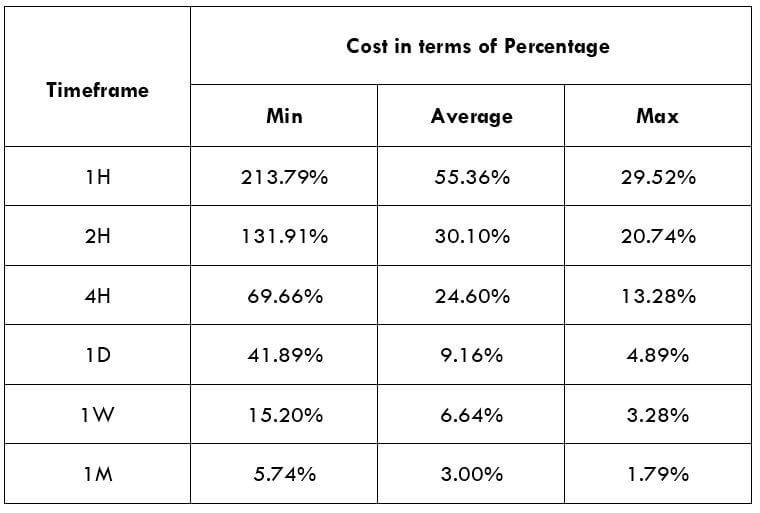

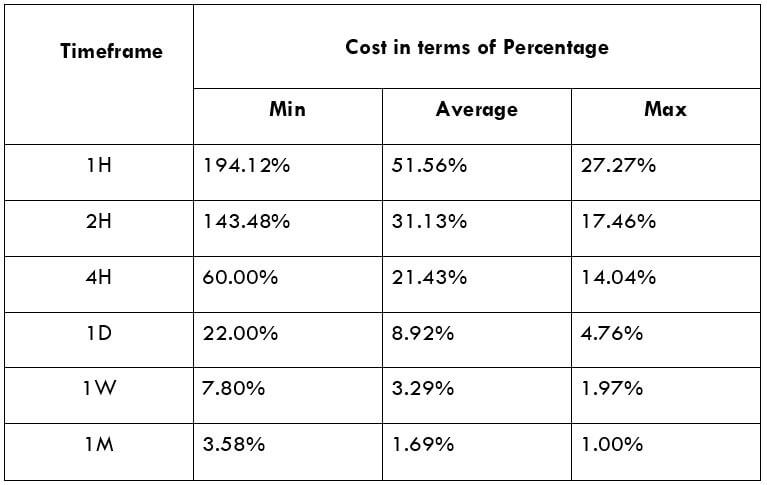

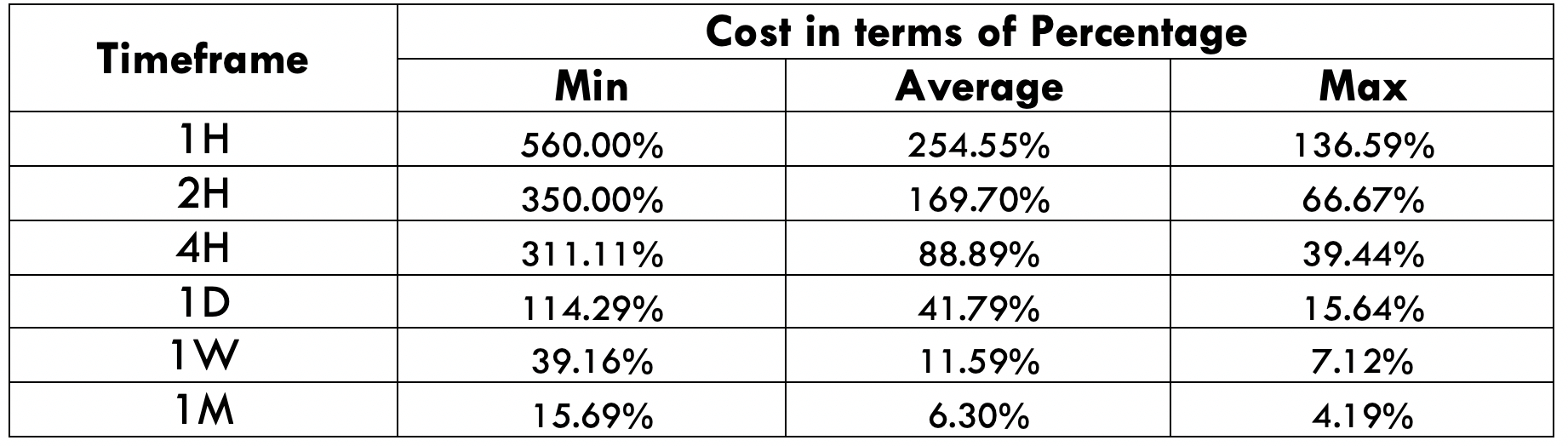

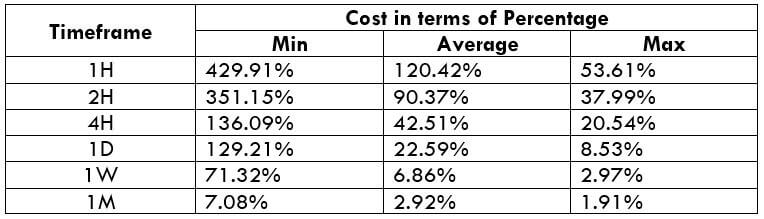

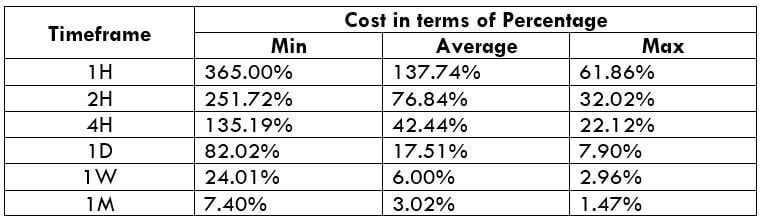

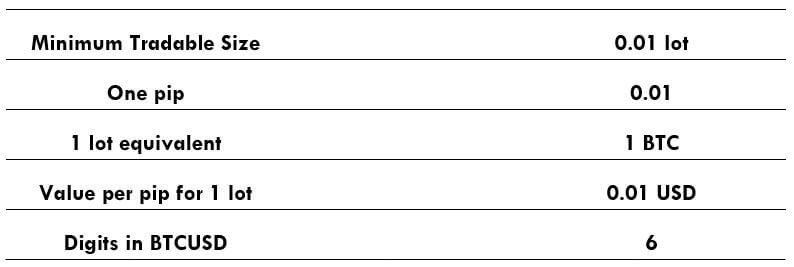

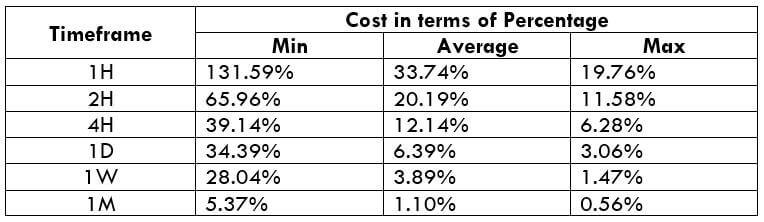

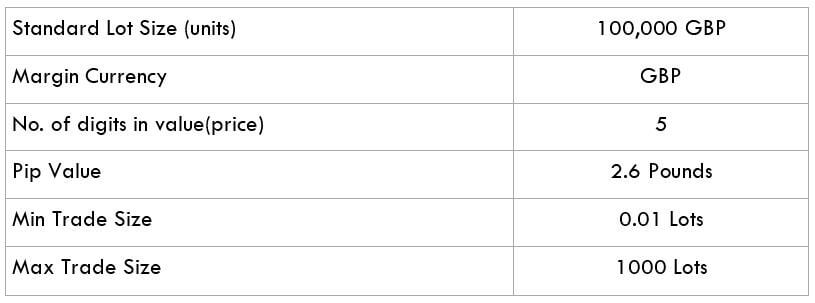

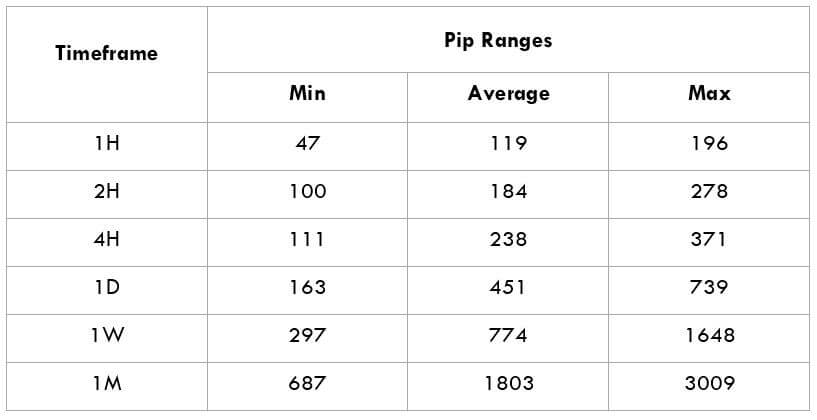

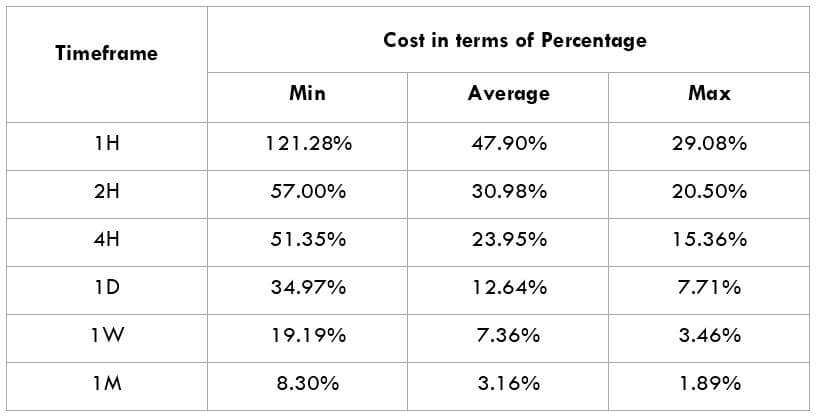

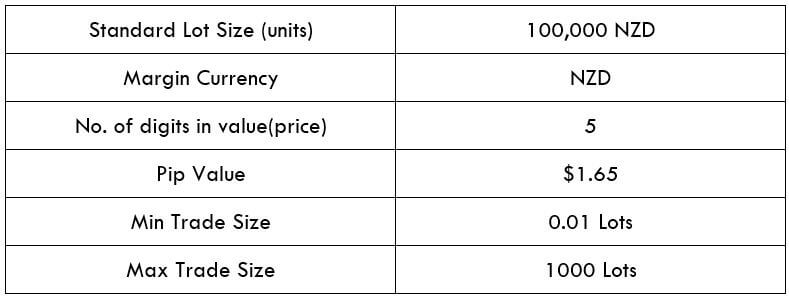

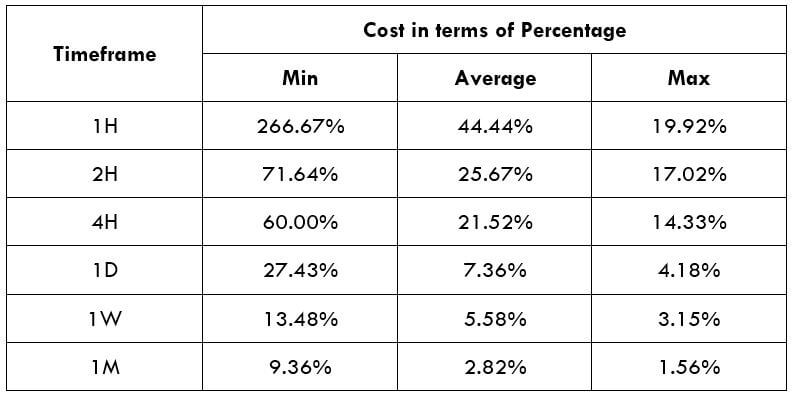

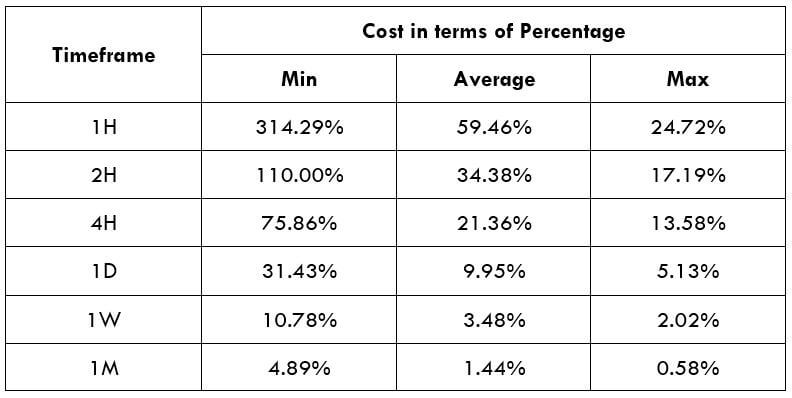

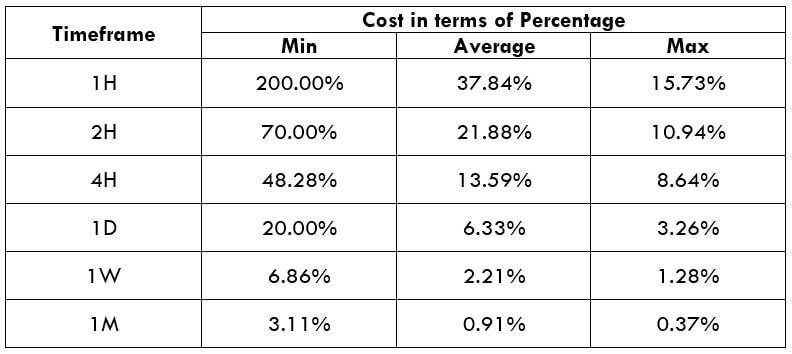

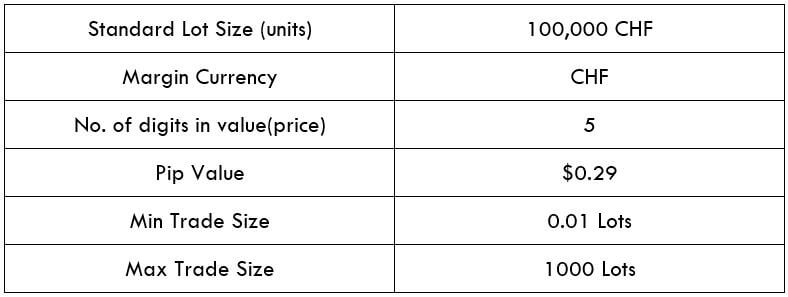

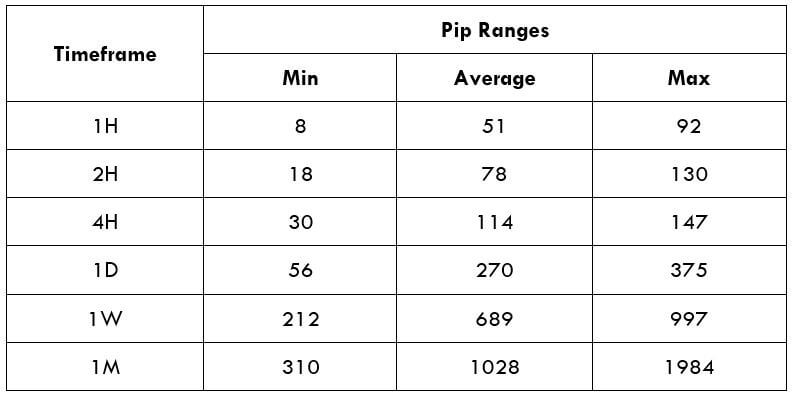

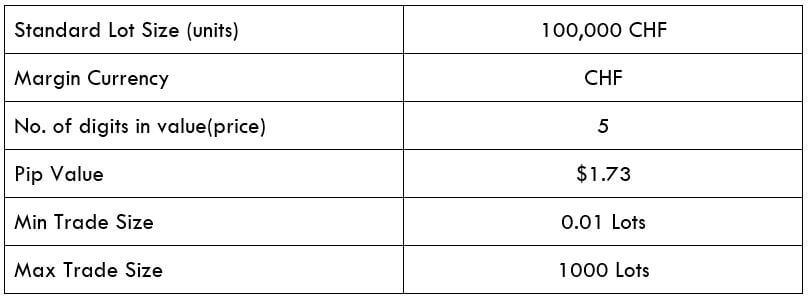

Spread

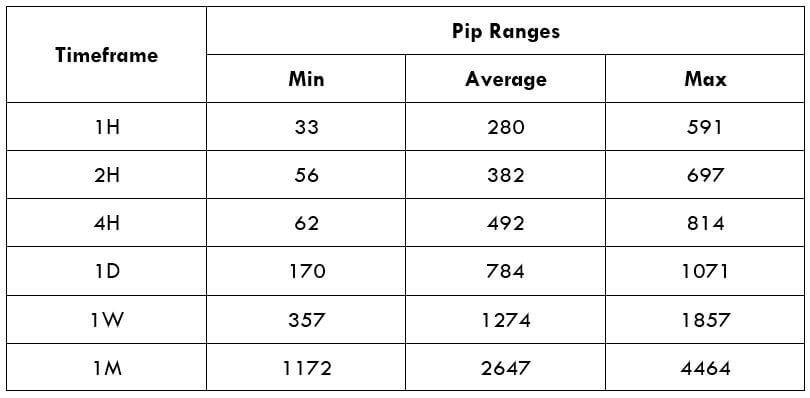

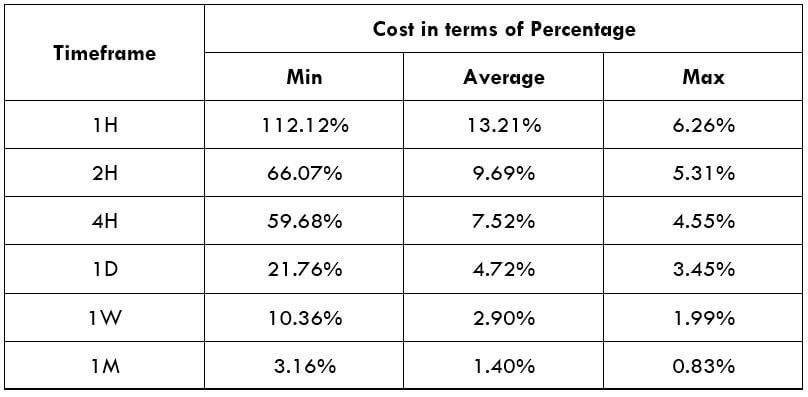

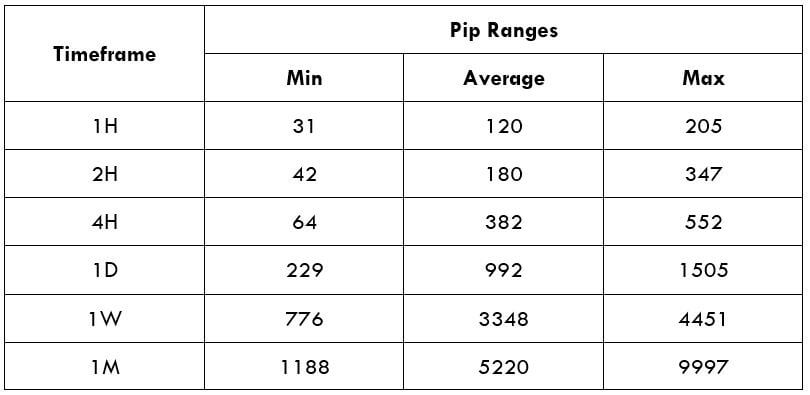

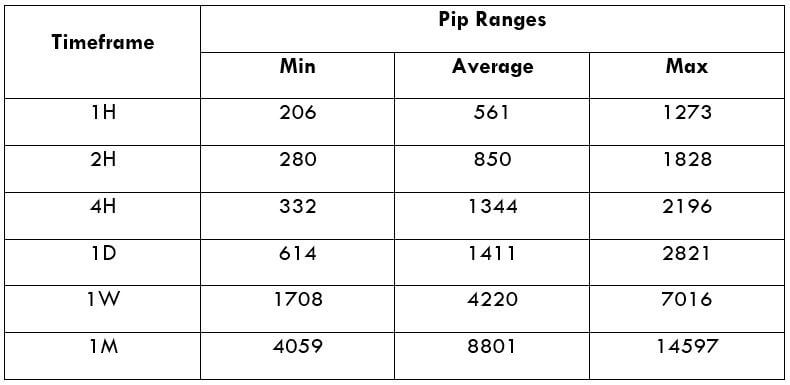

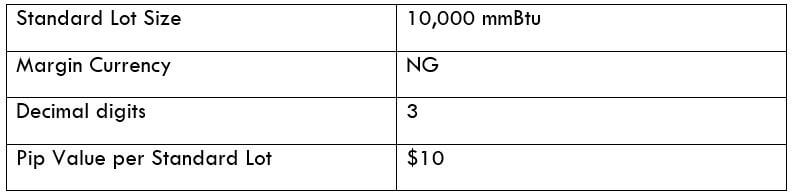

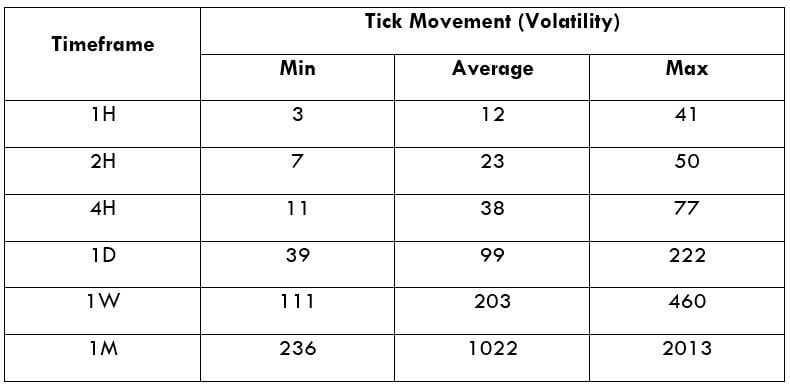

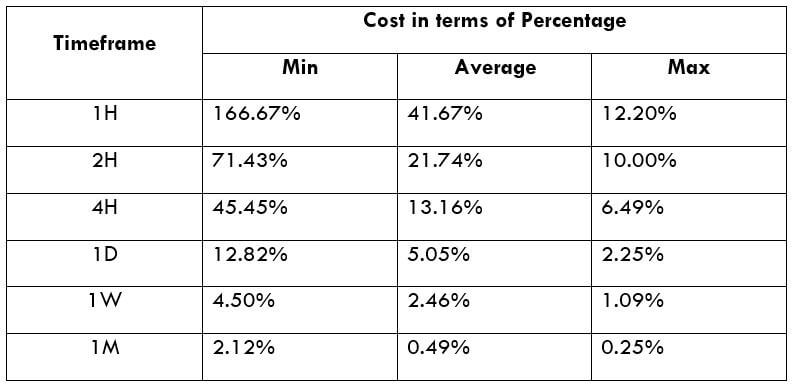

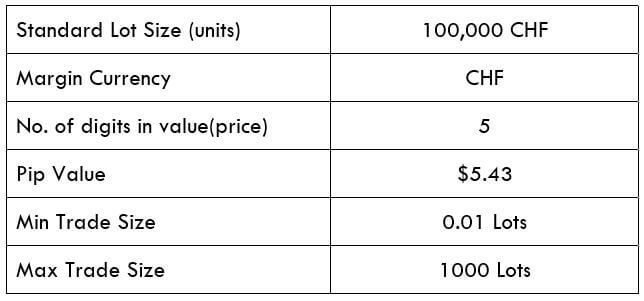

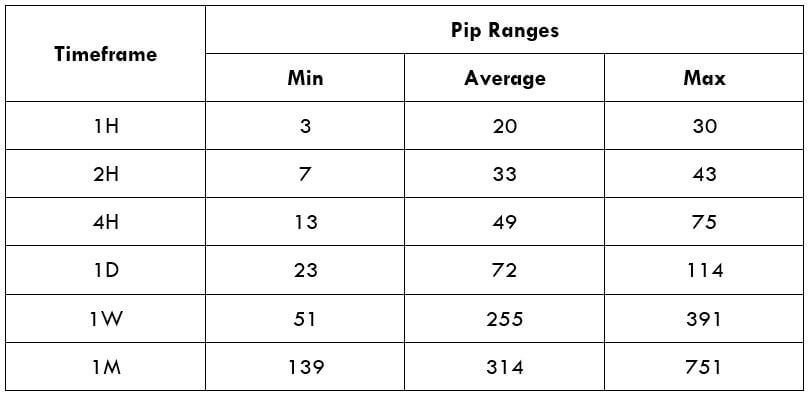

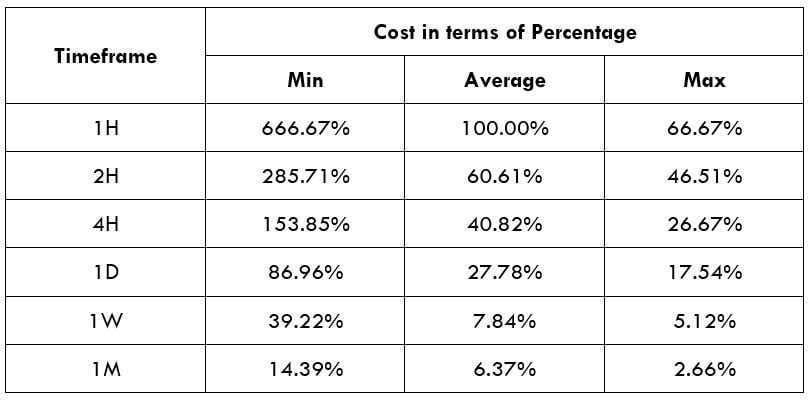

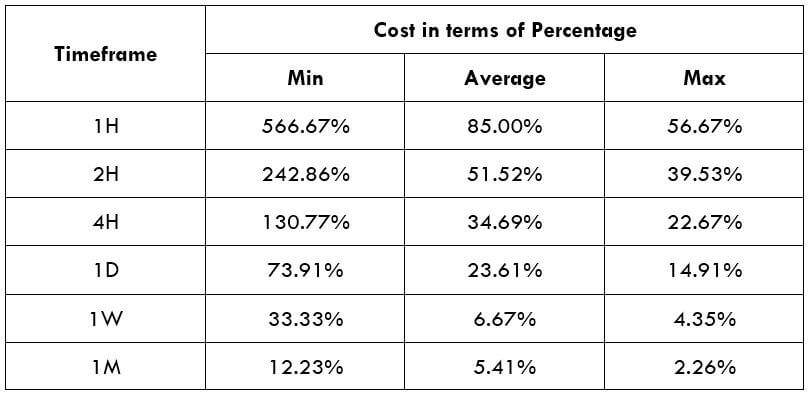

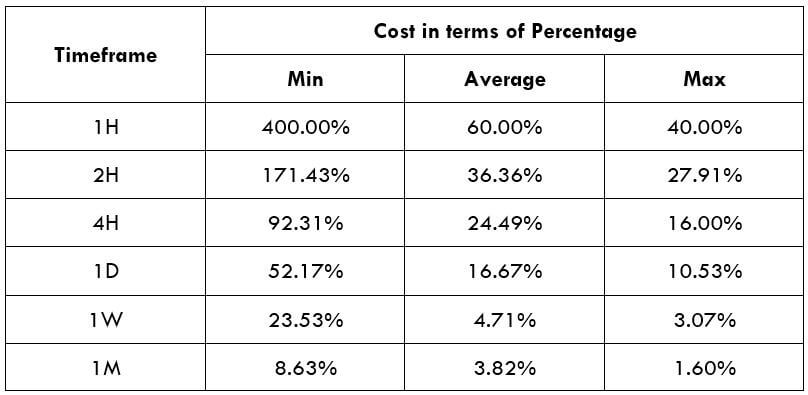

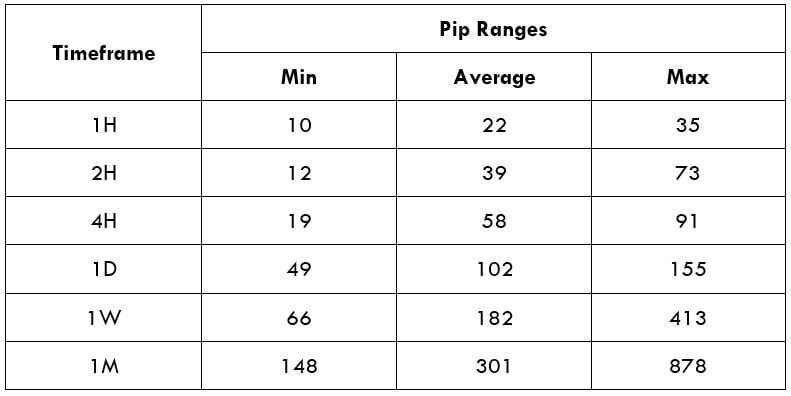

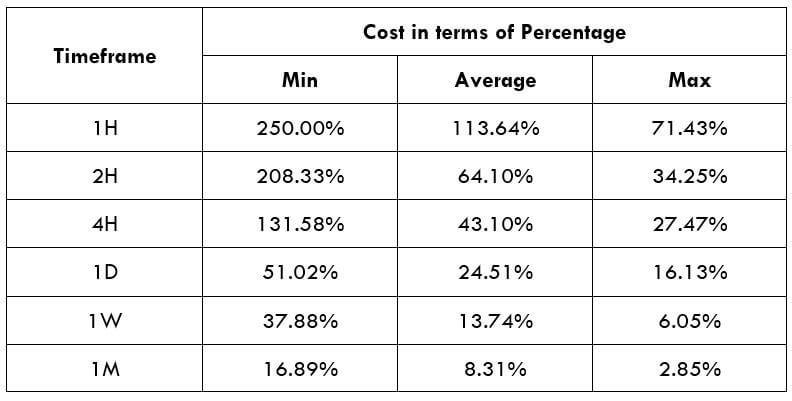

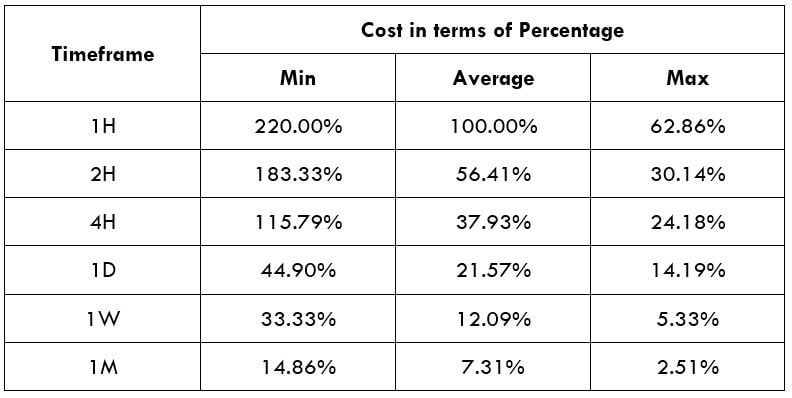

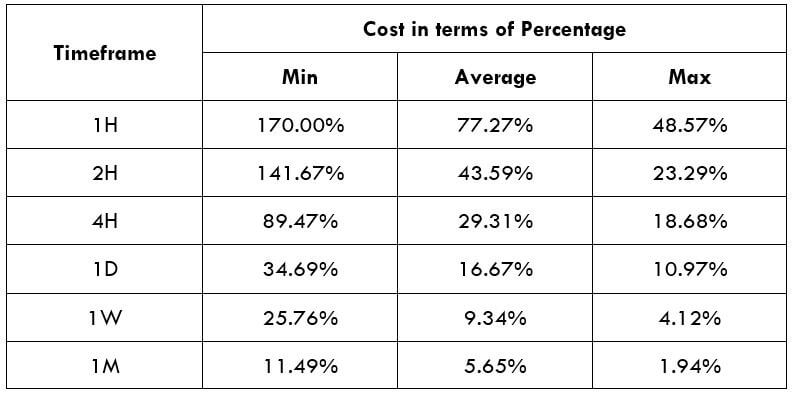

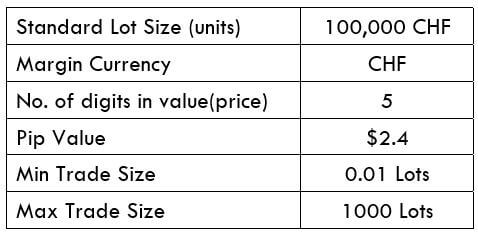

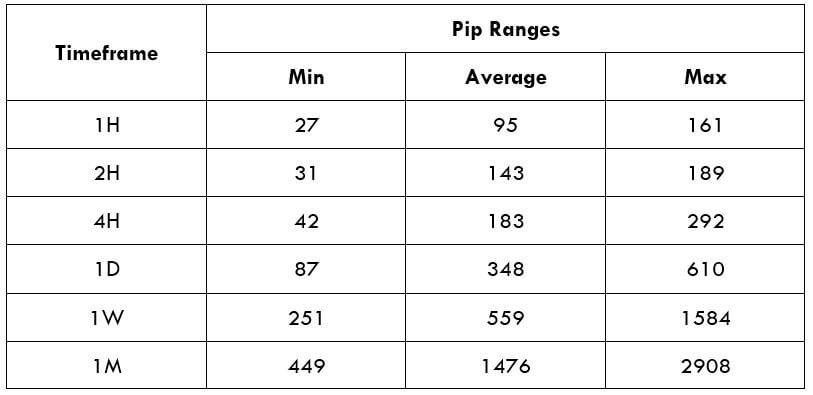

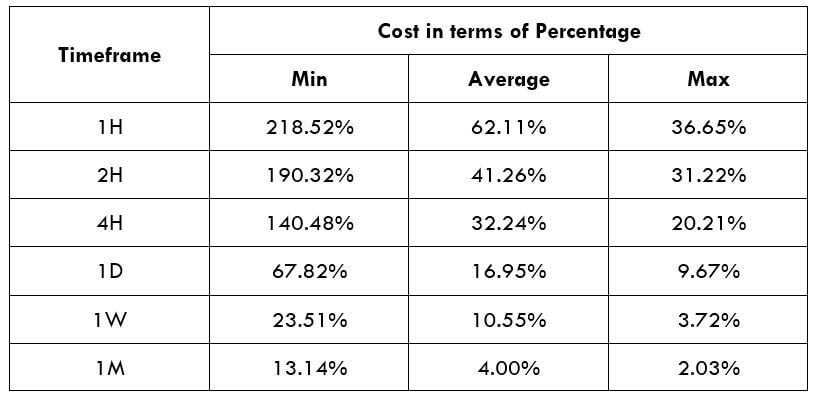

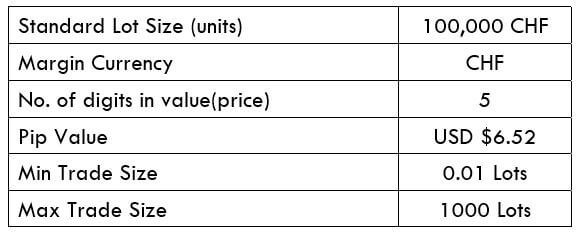

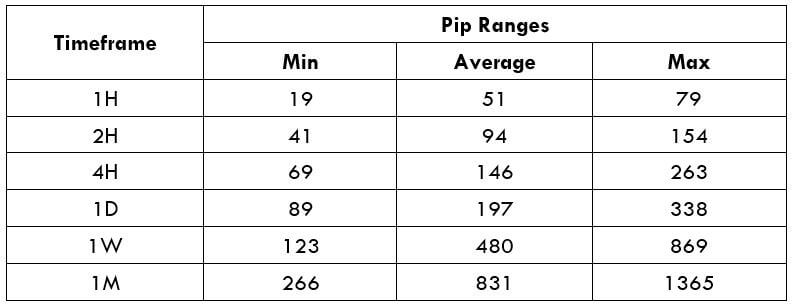

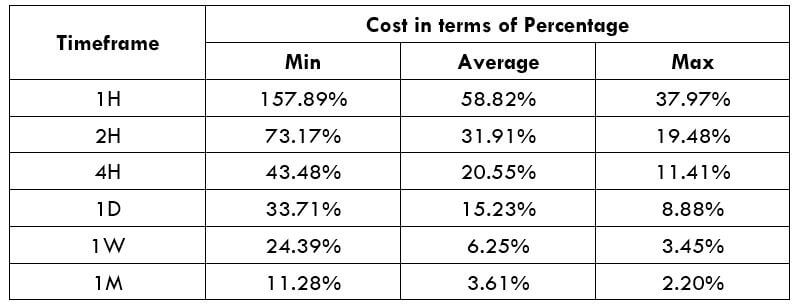

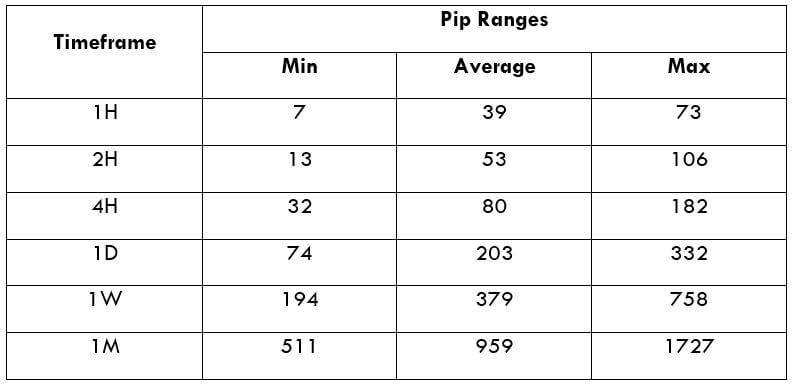

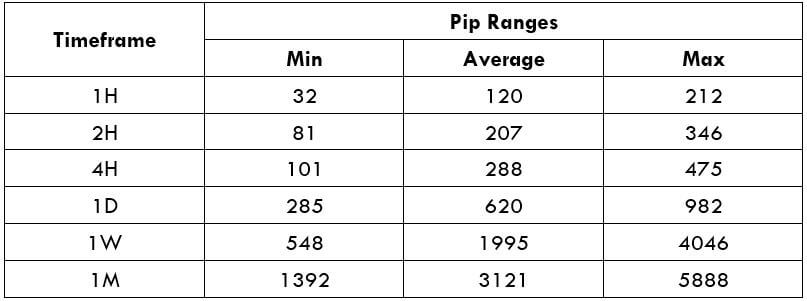

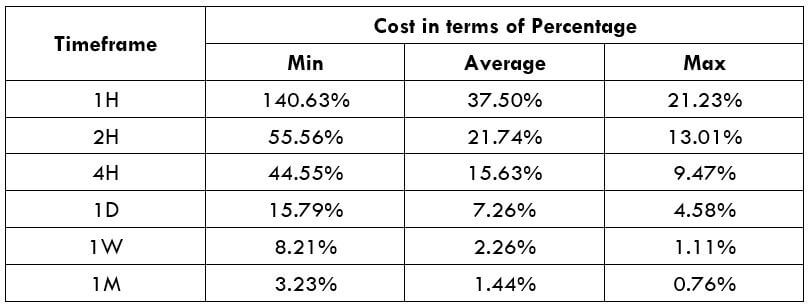

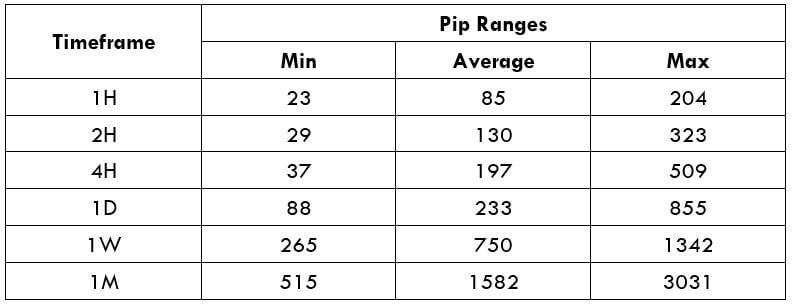

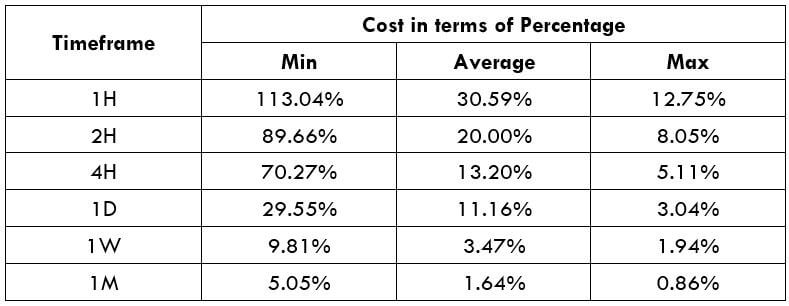

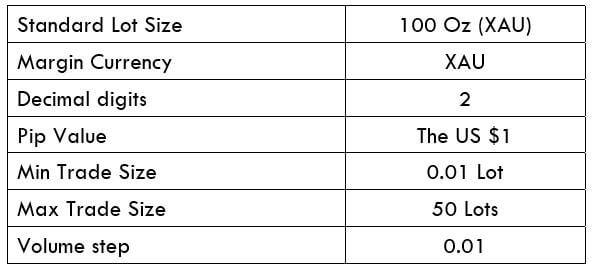

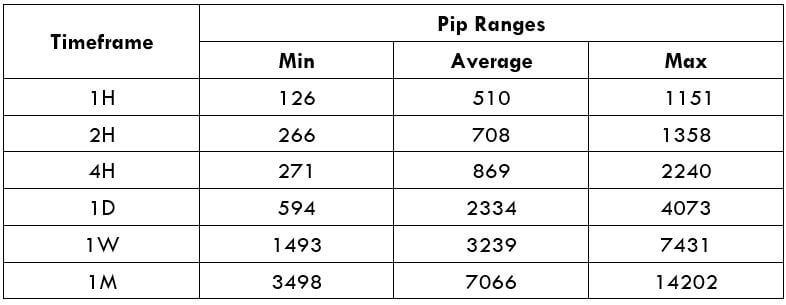

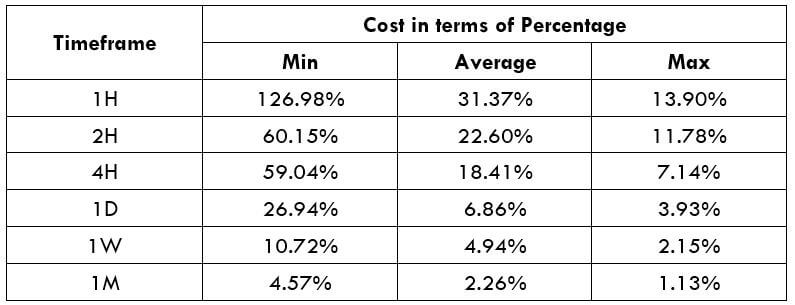

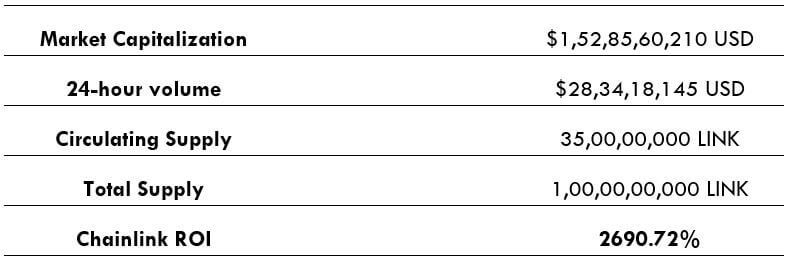

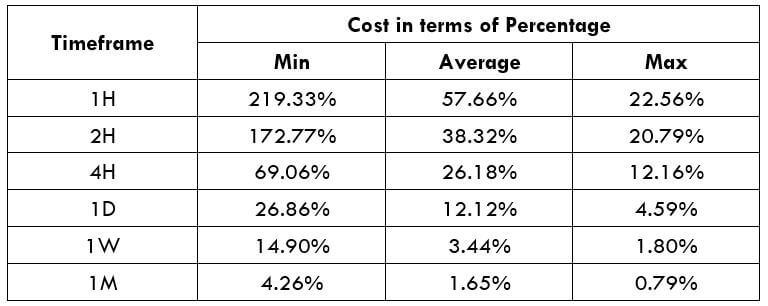

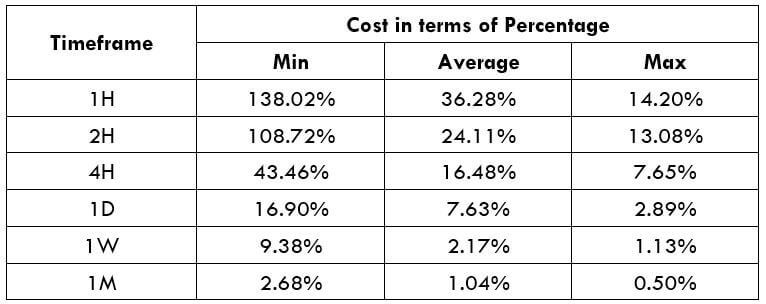

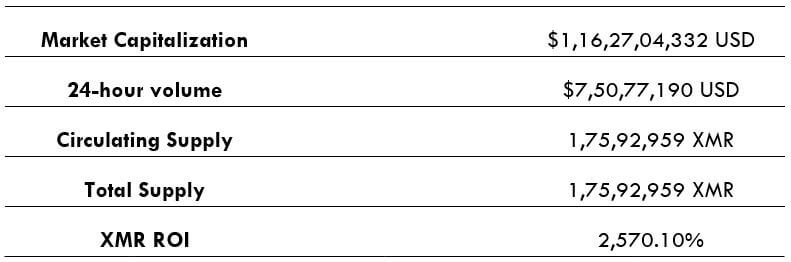

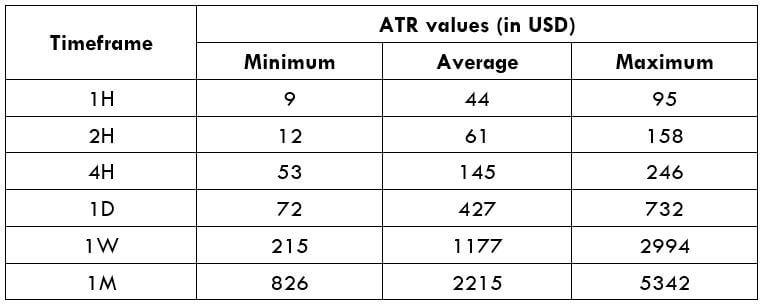

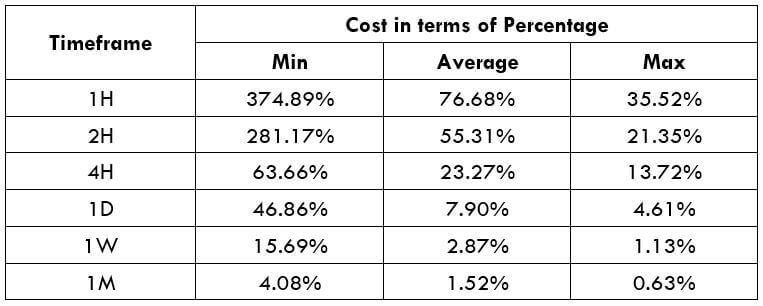

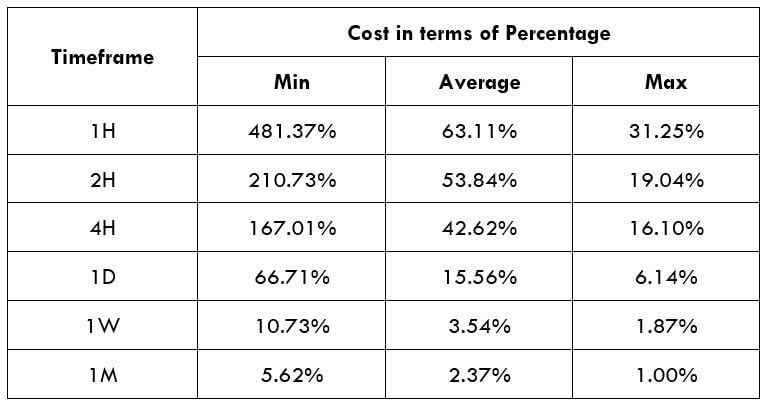

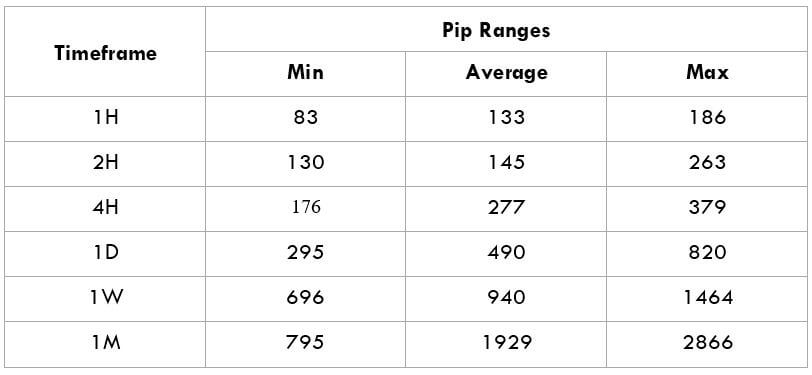

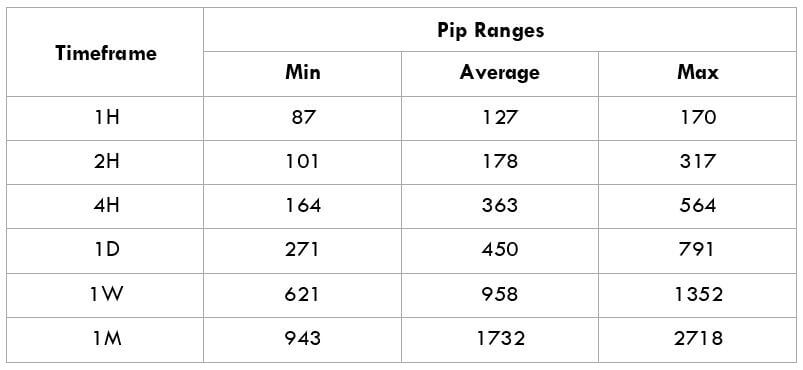

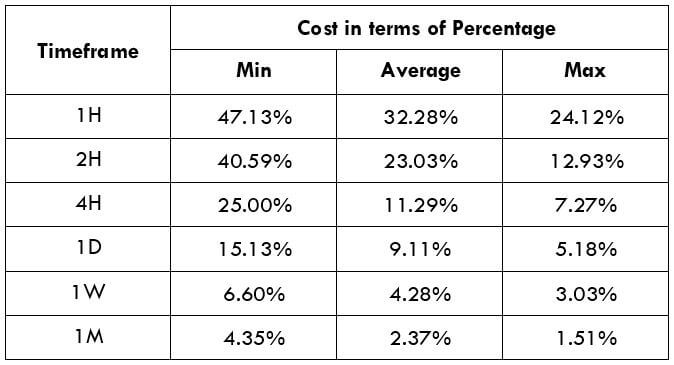

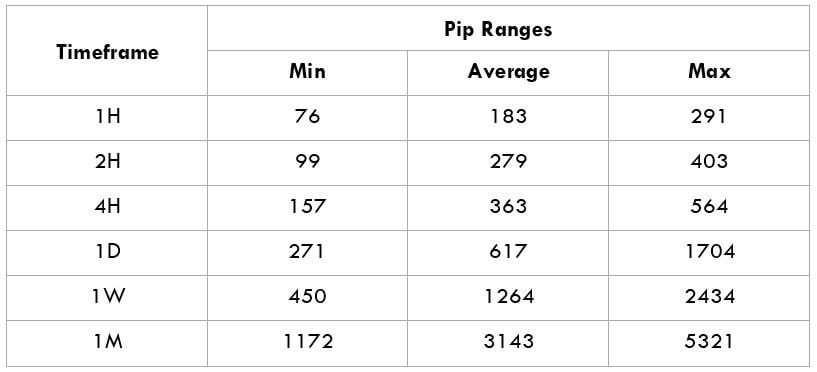

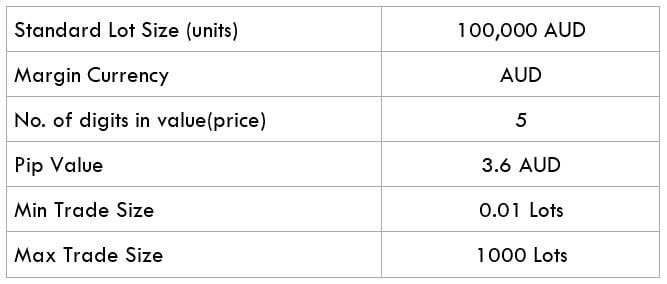

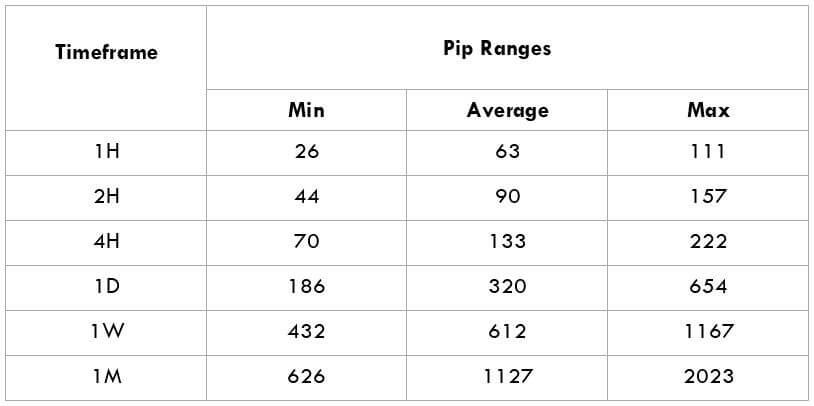

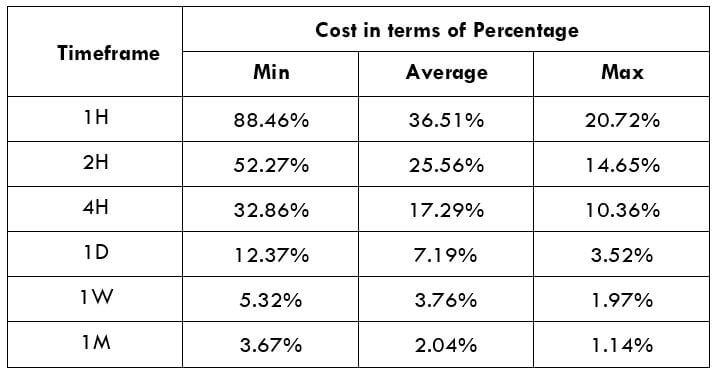

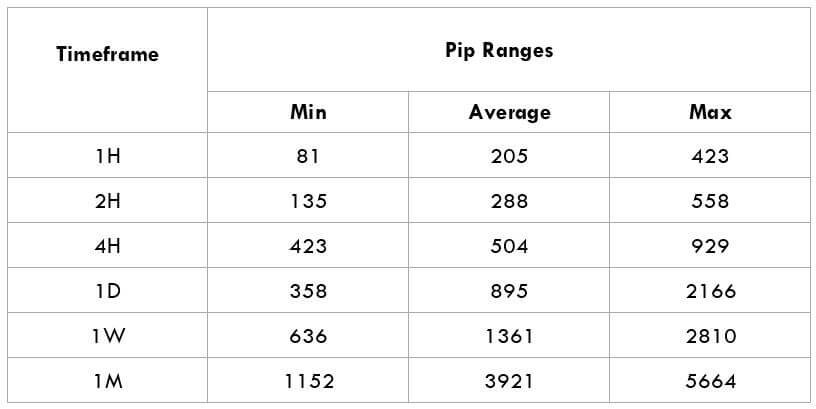

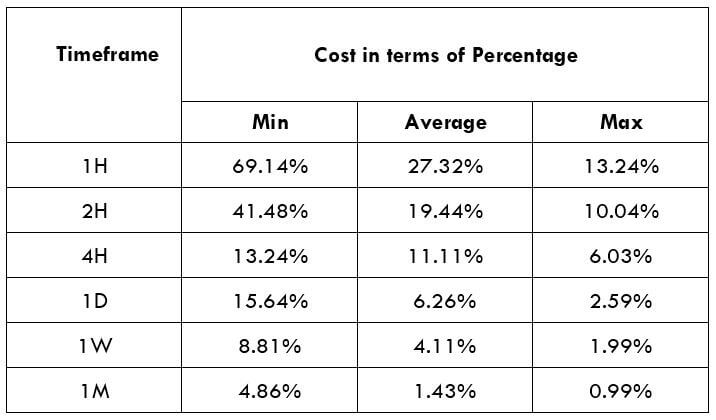

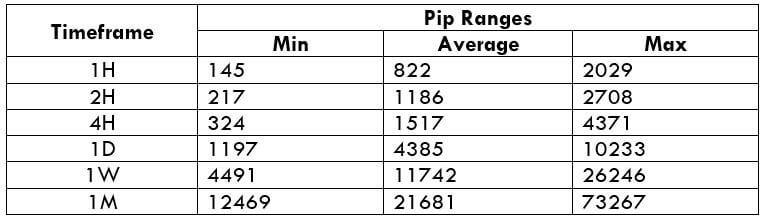

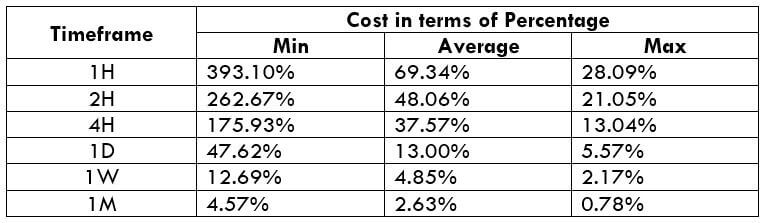

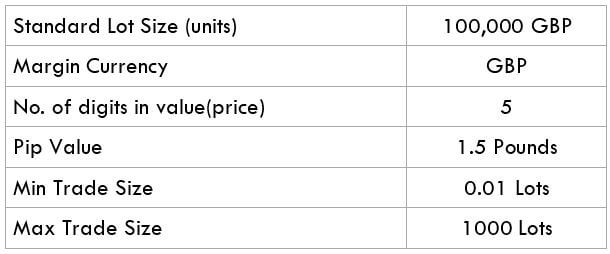

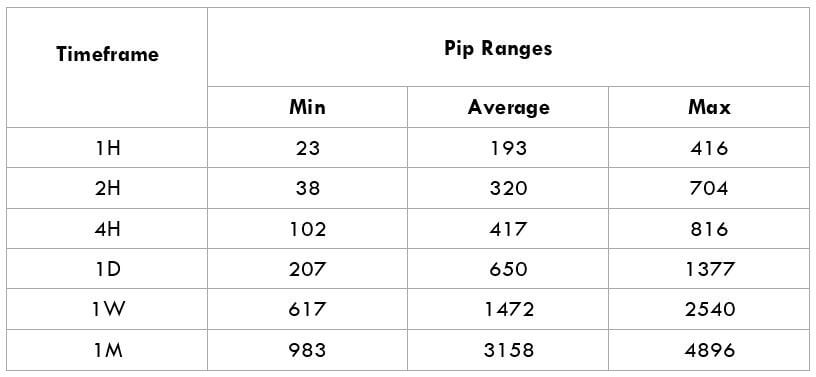

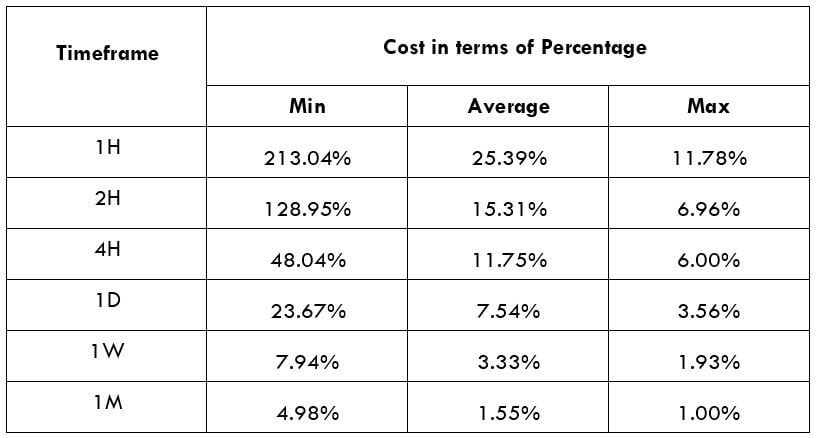

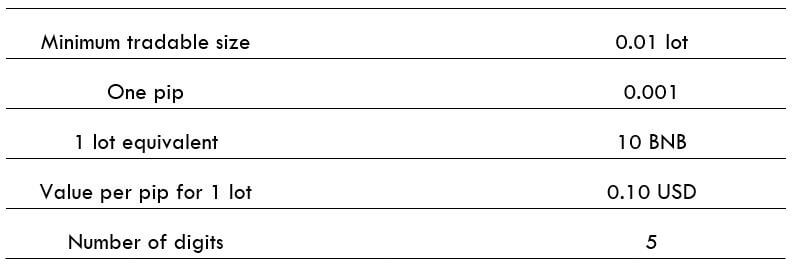

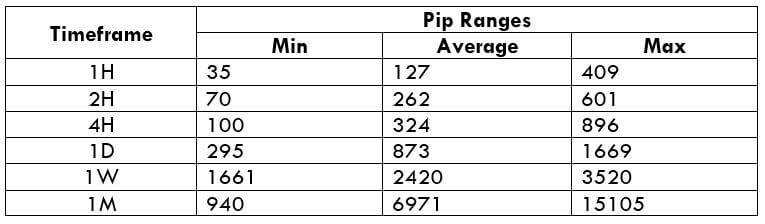

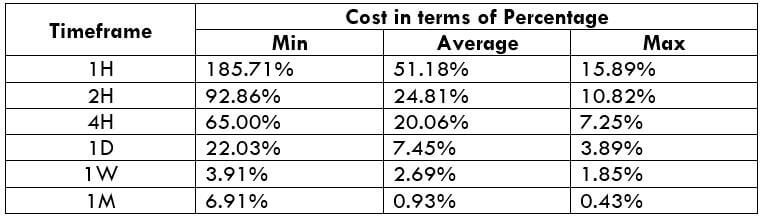

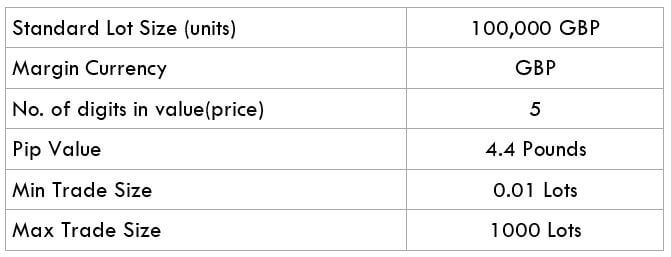

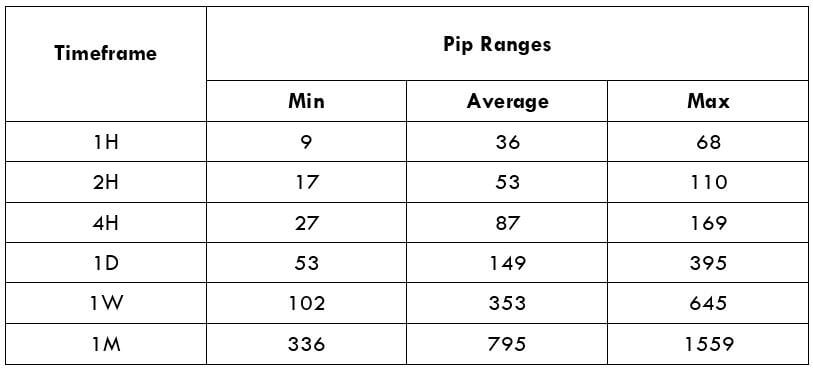

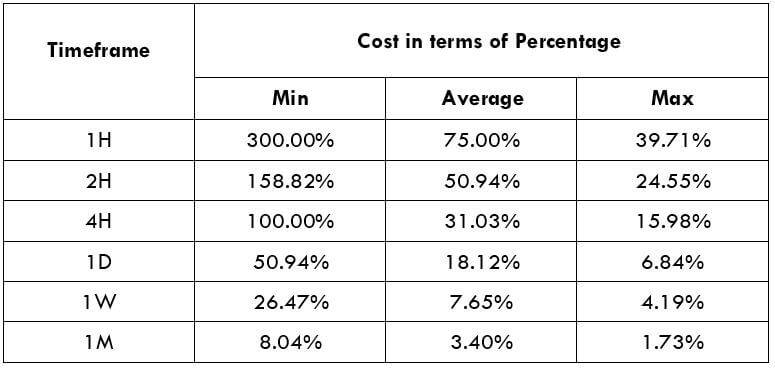

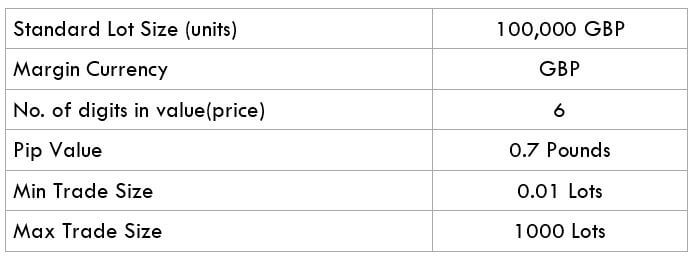

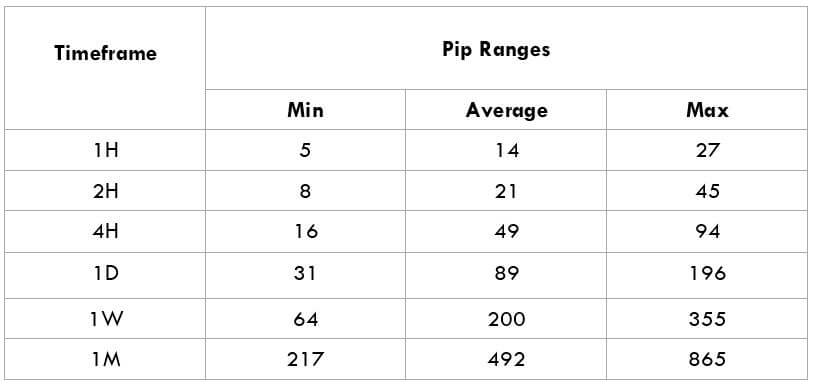

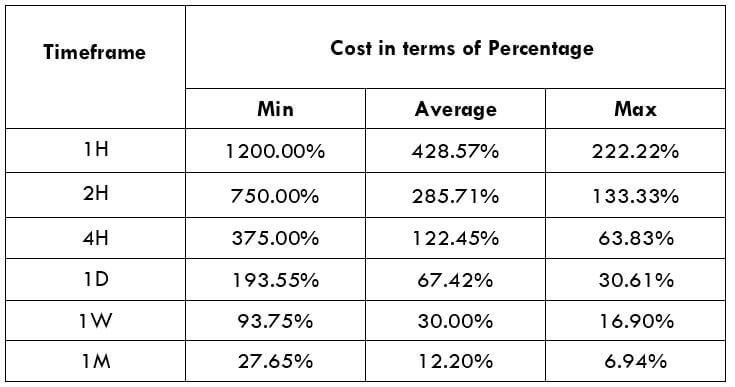

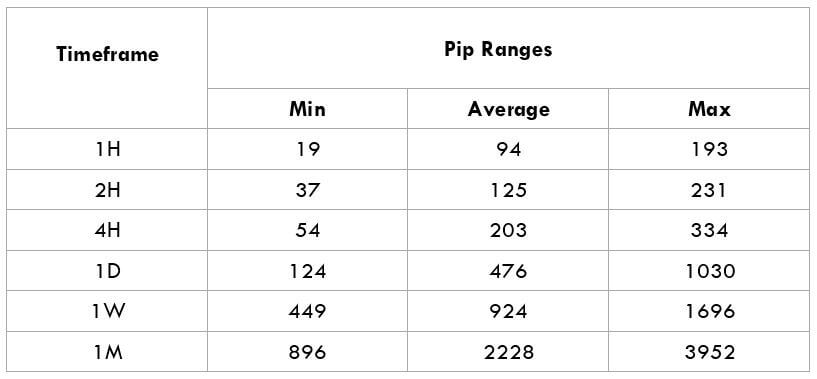

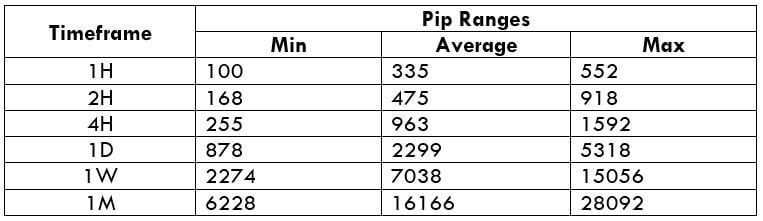

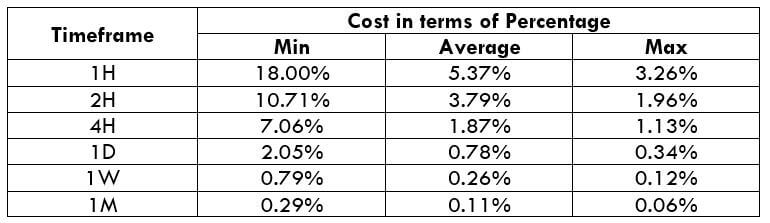

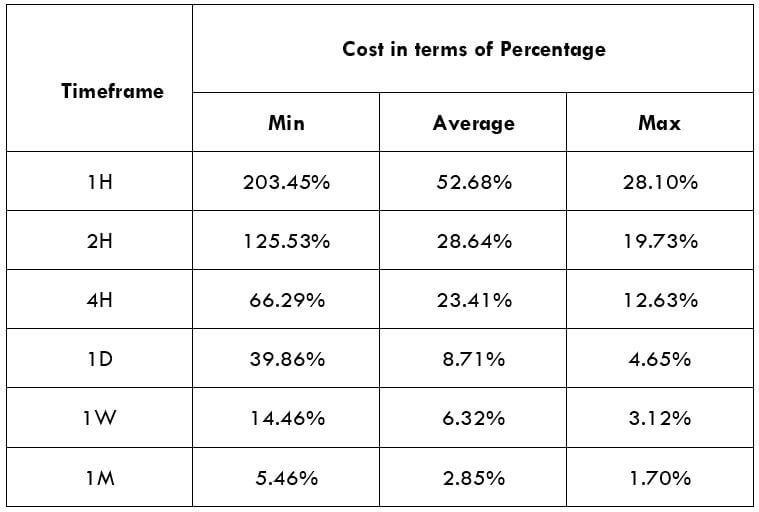

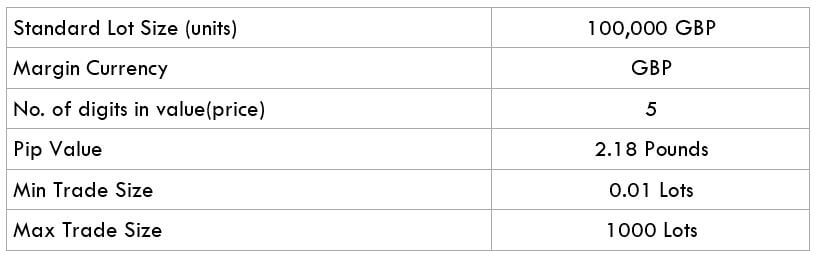

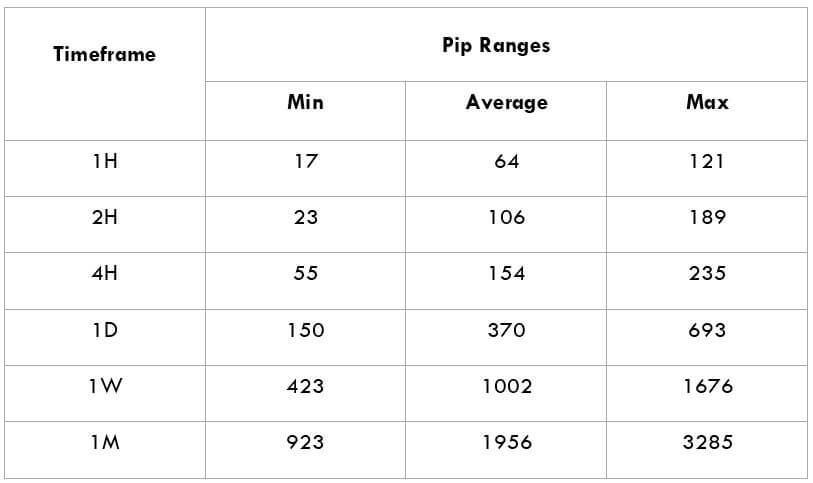

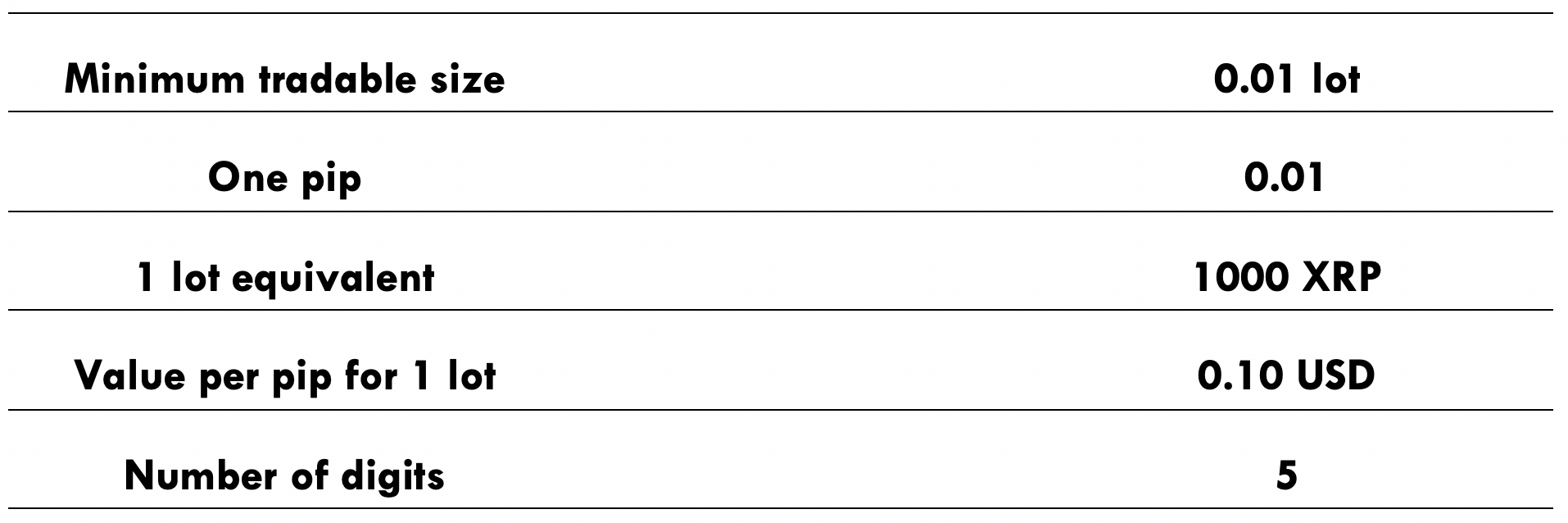

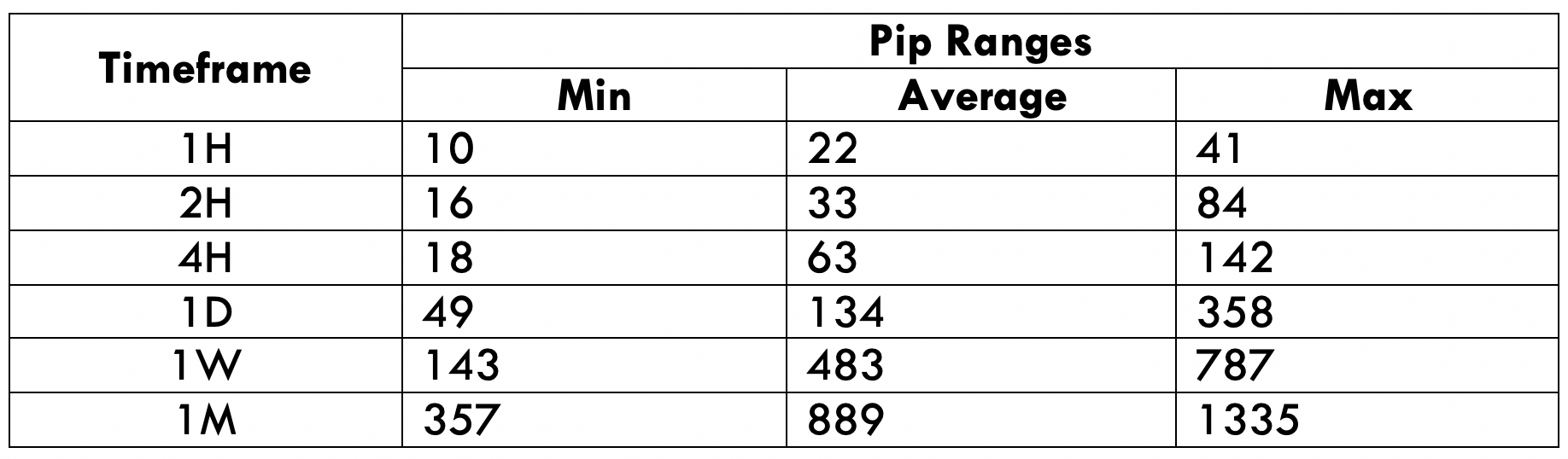

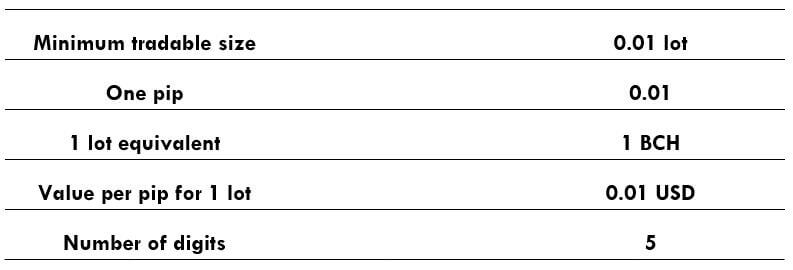

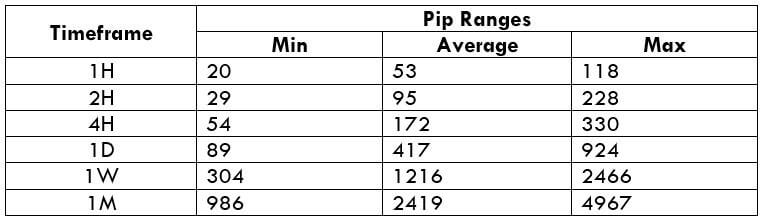

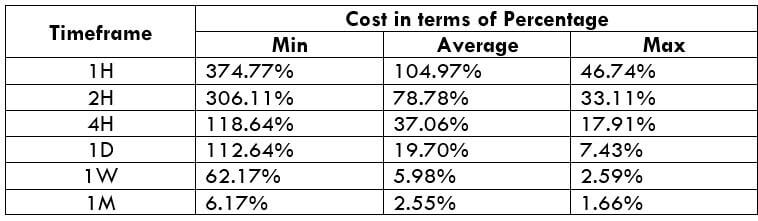

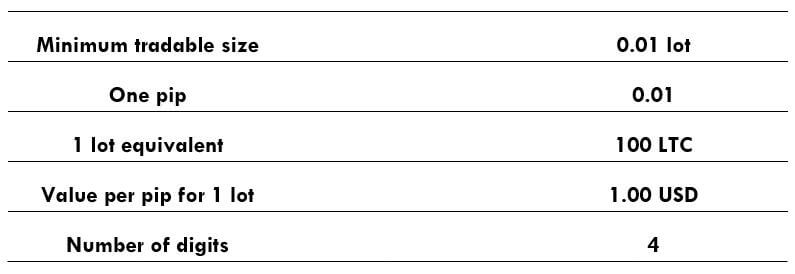

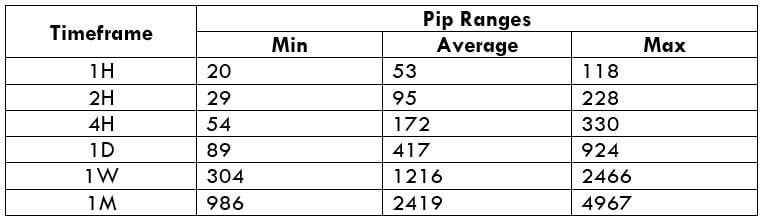

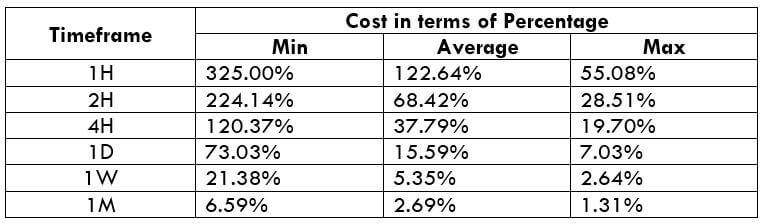

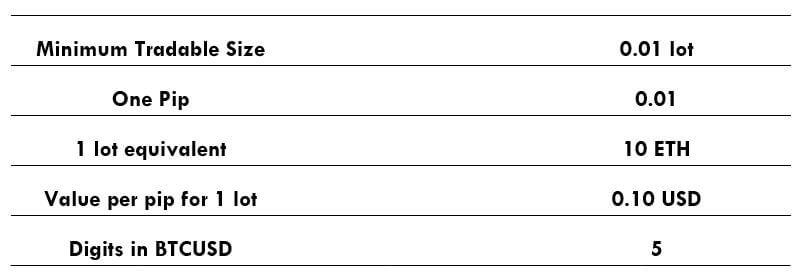

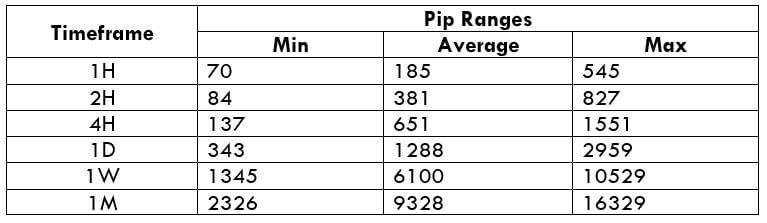

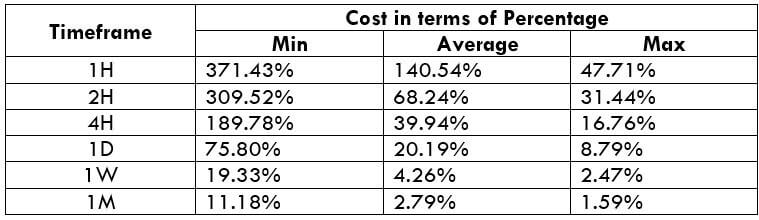

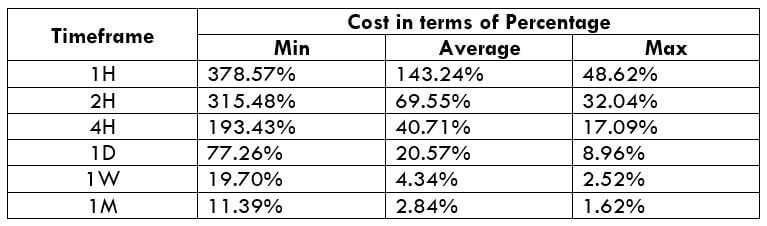

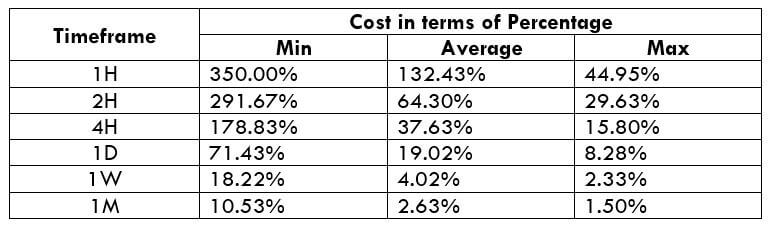

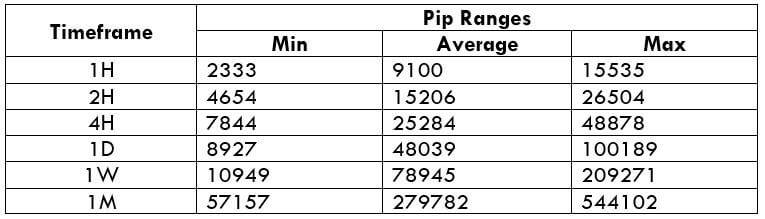

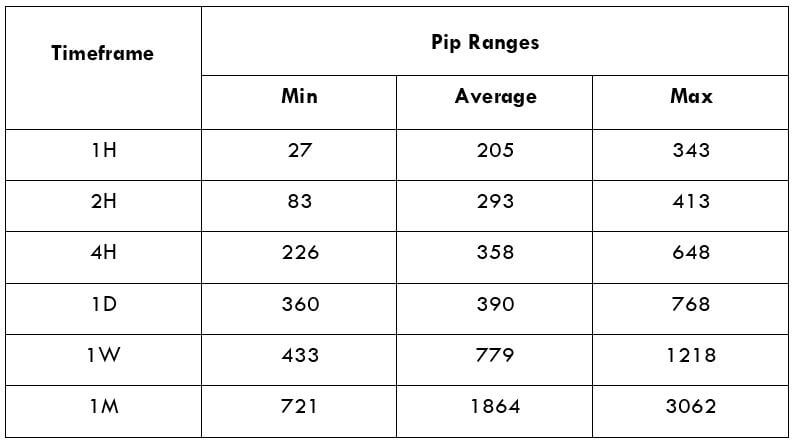

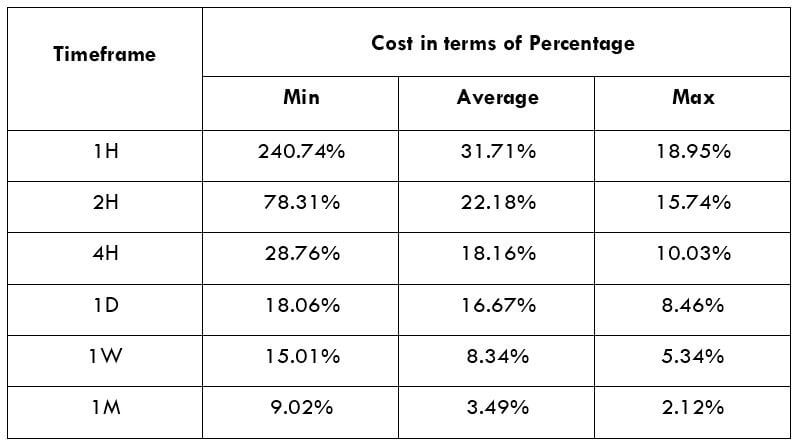

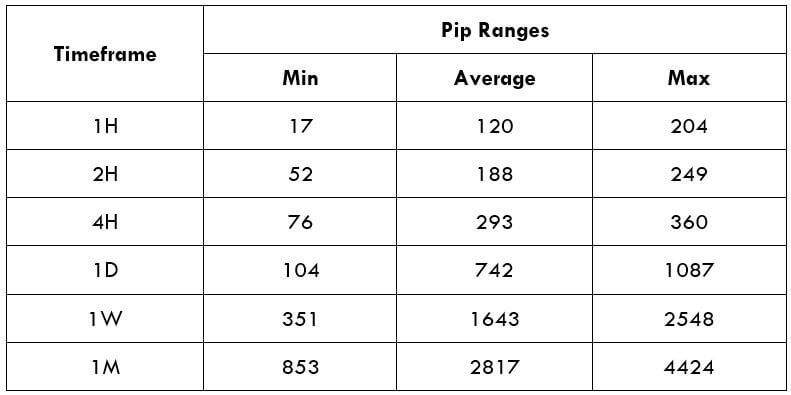

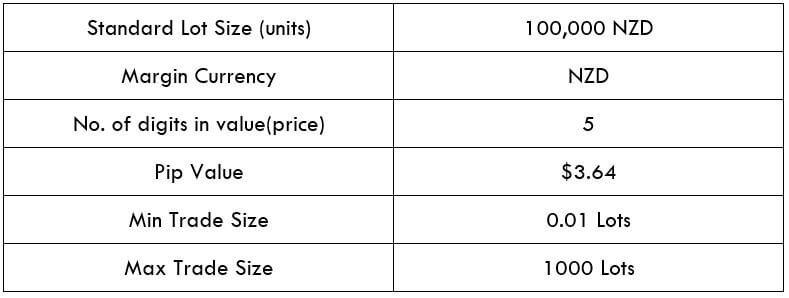

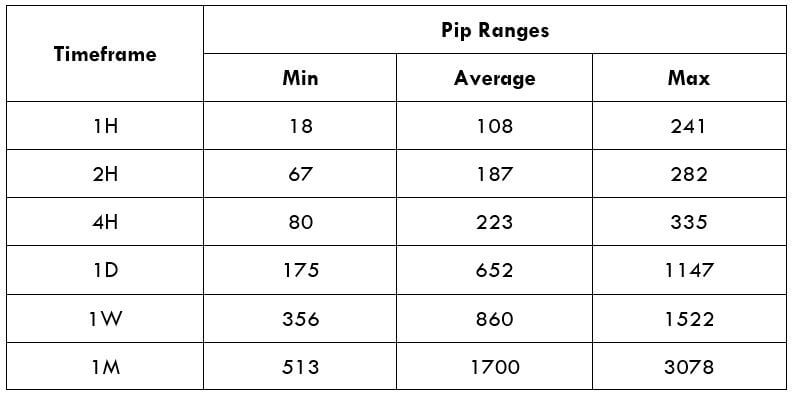

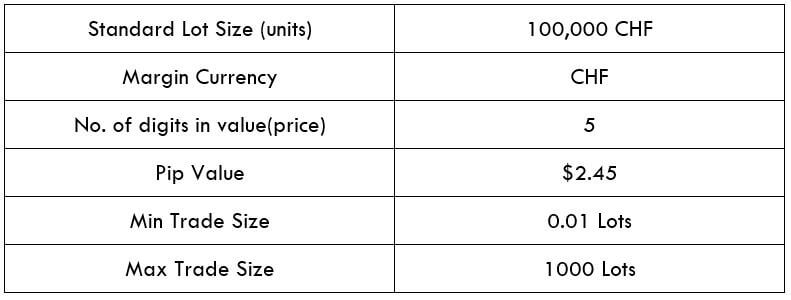

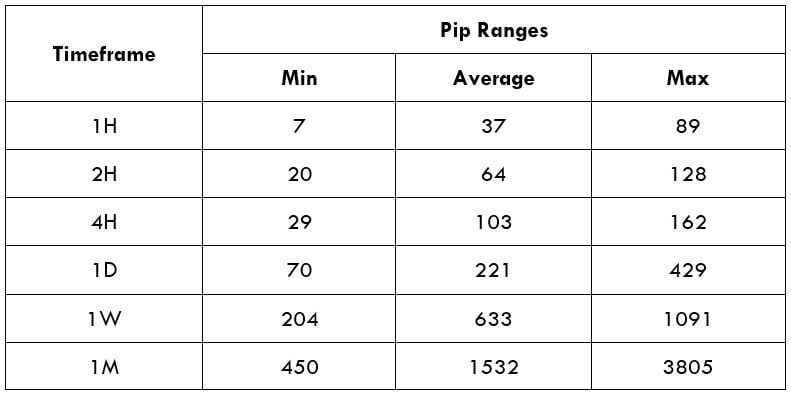

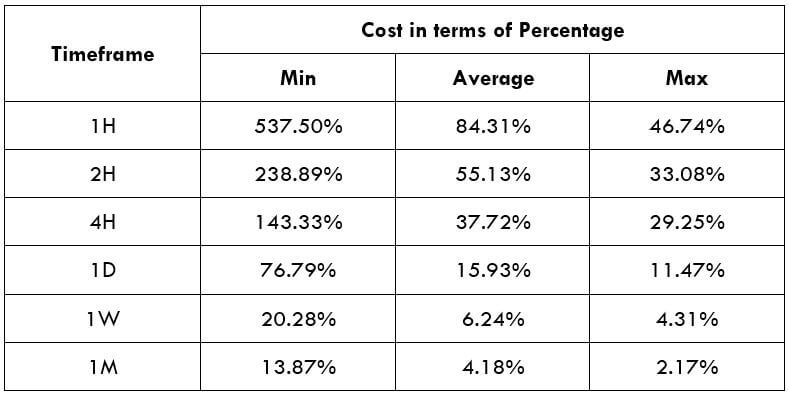

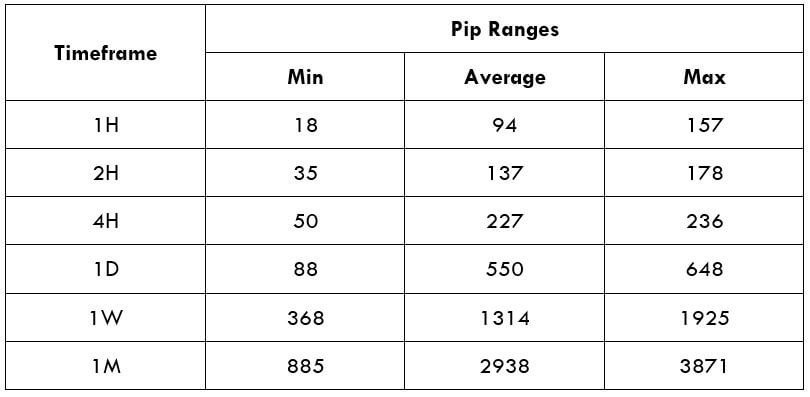

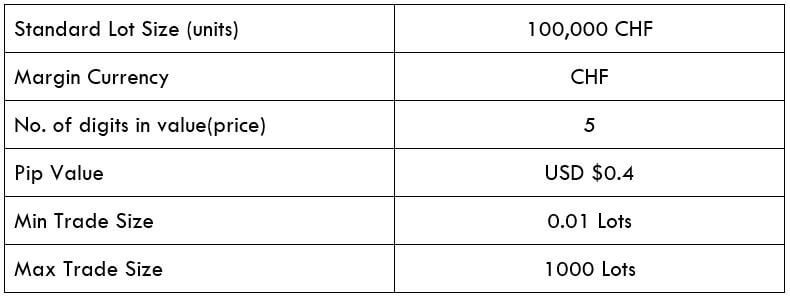

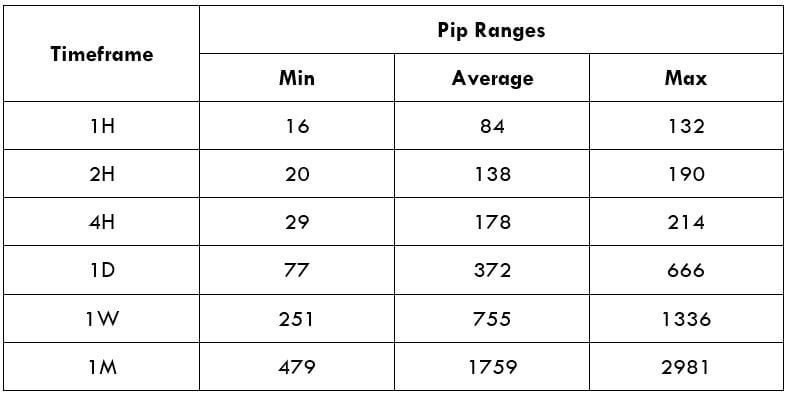

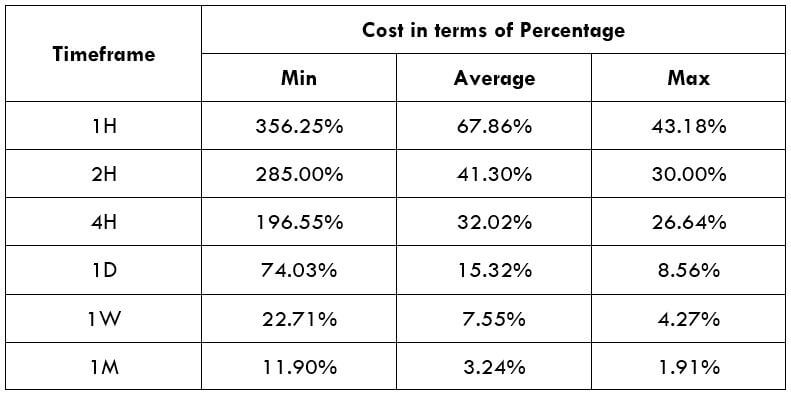

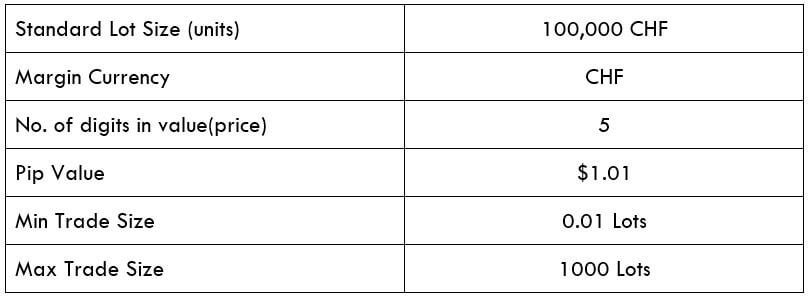

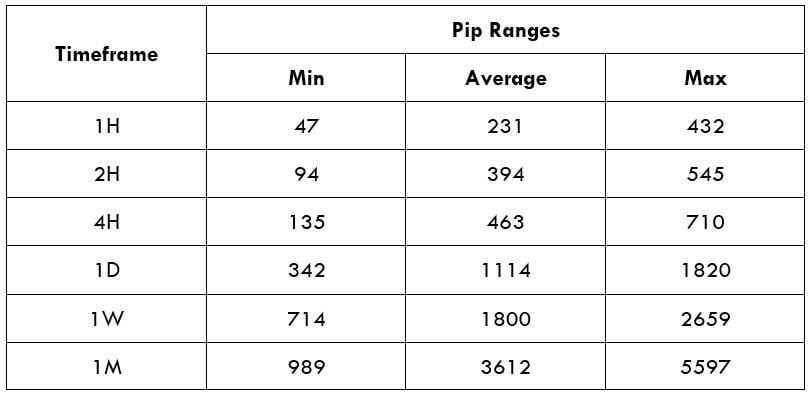

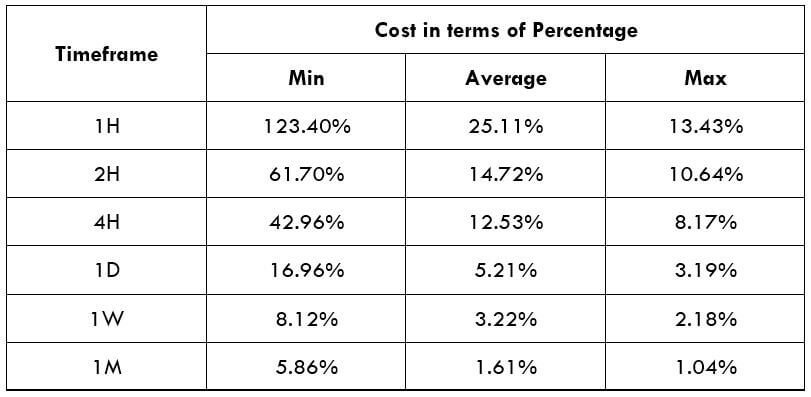

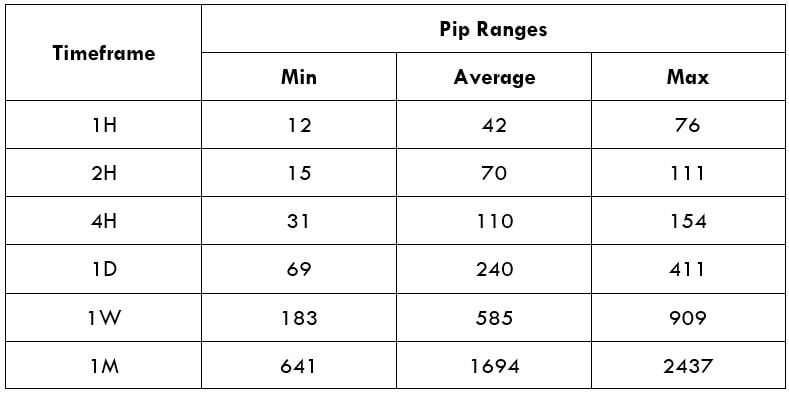

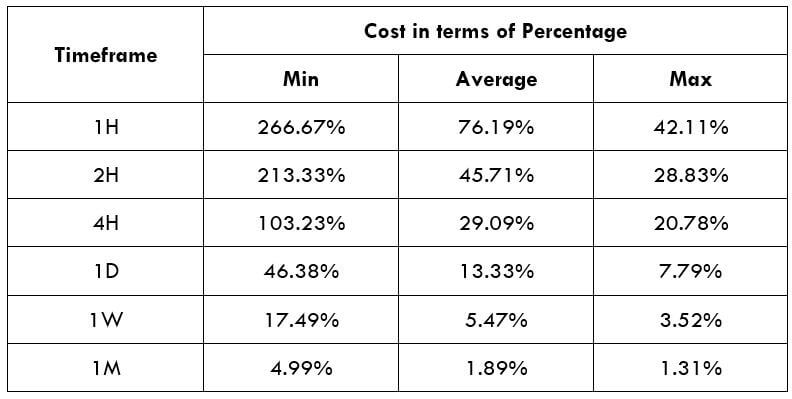

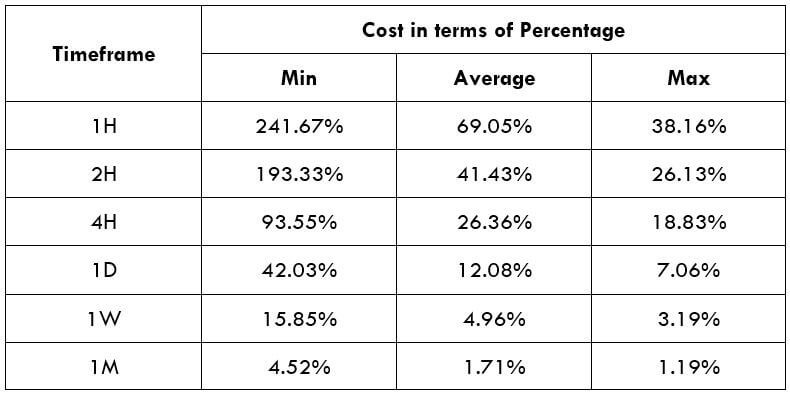

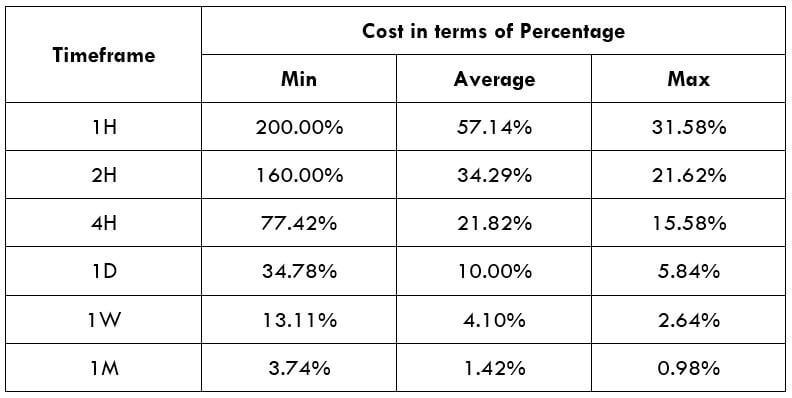

Spread Procedure to assess Pip Ranges

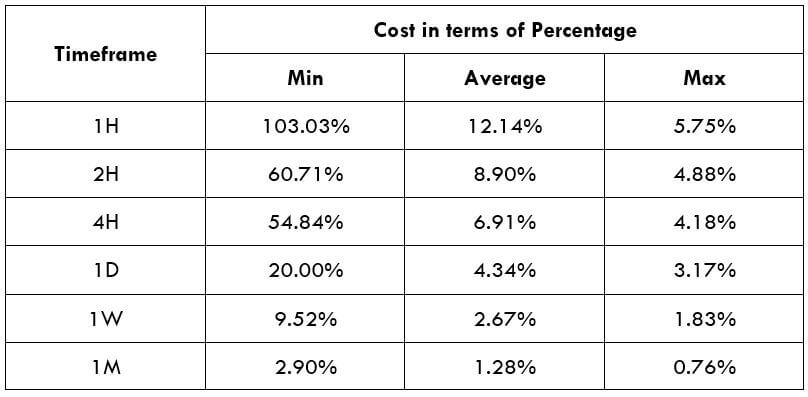

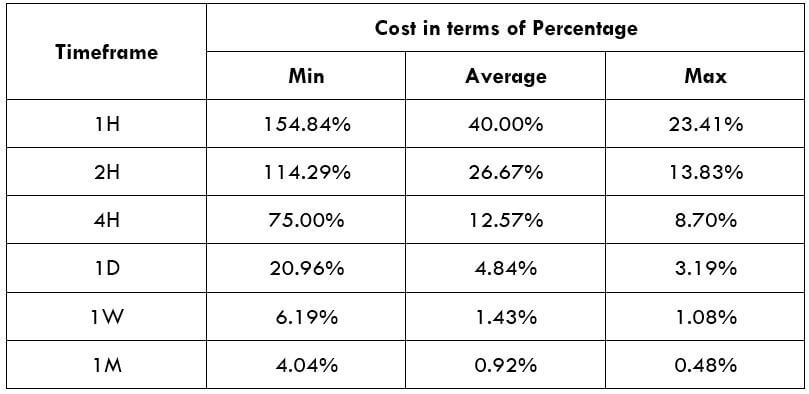

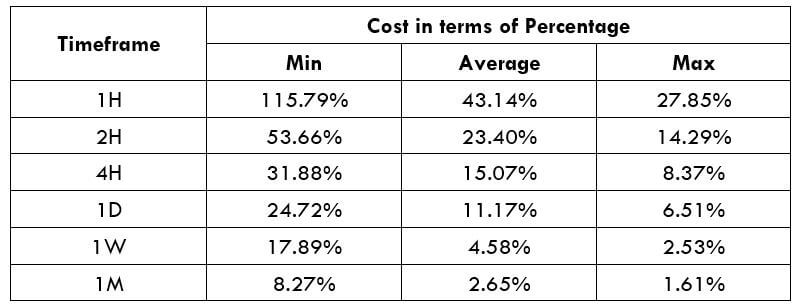

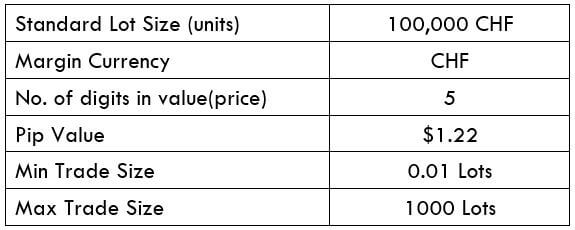

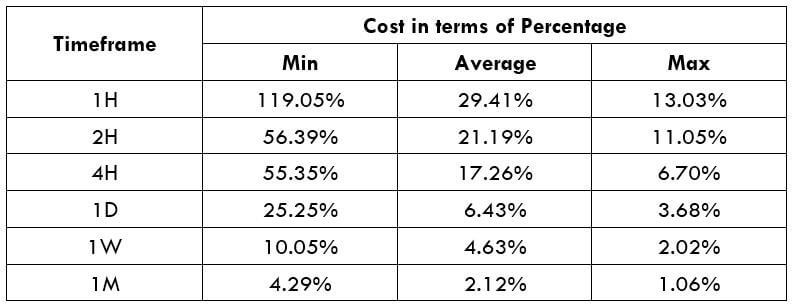

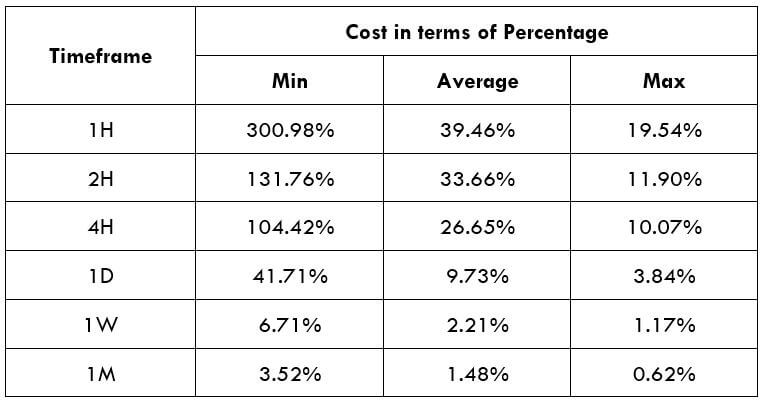

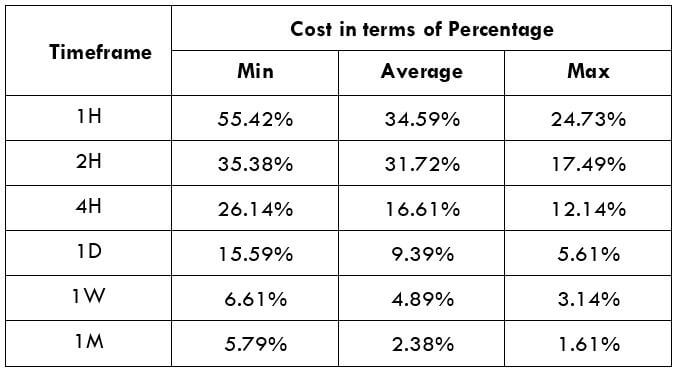

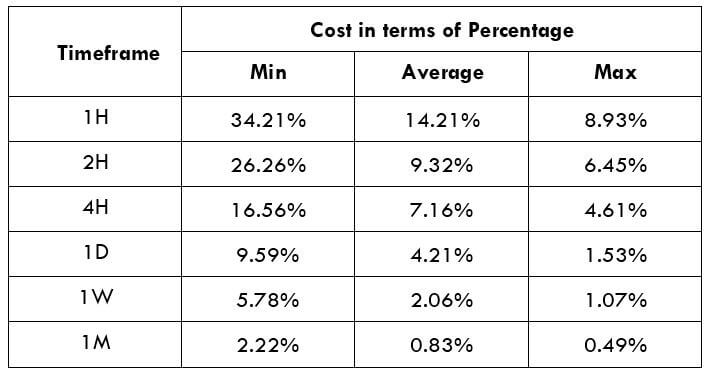

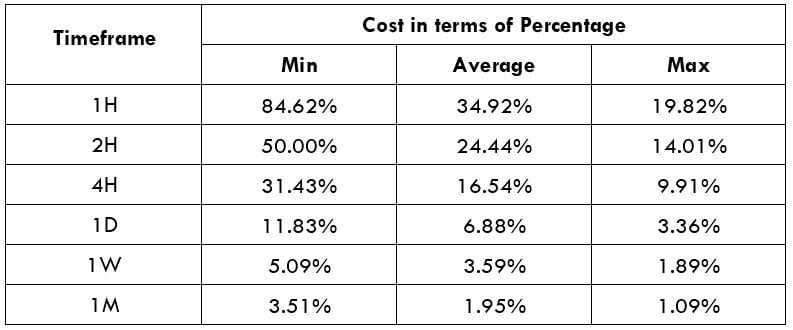

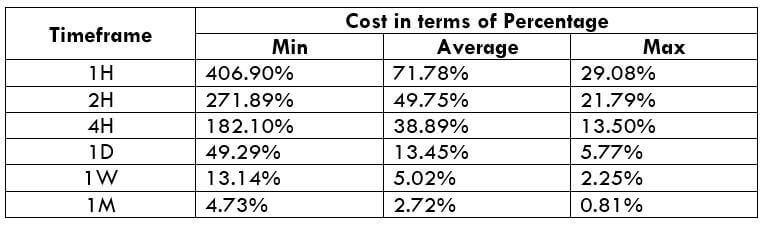

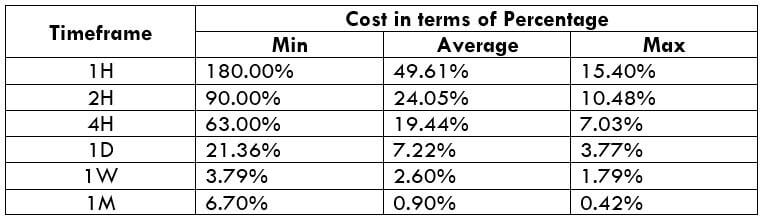

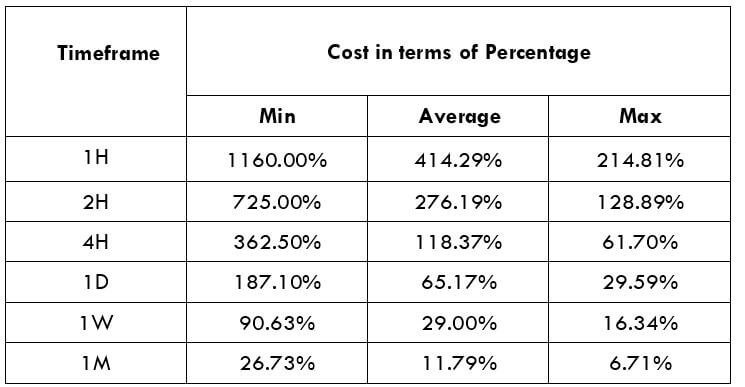

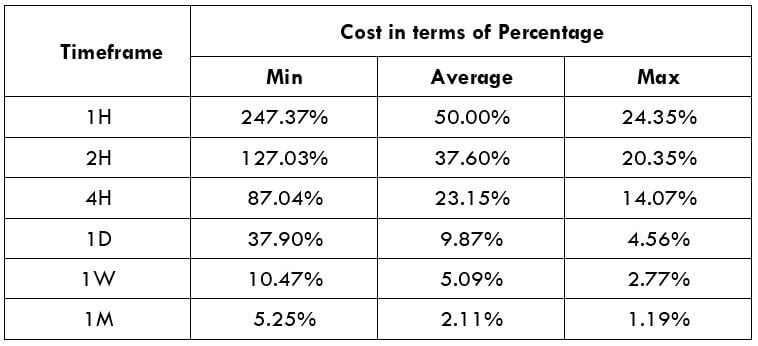

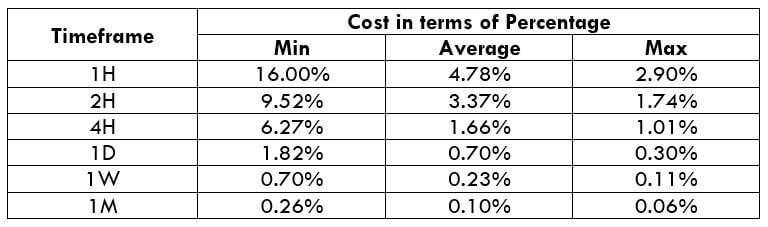

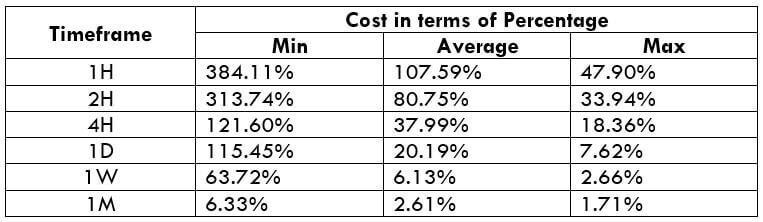

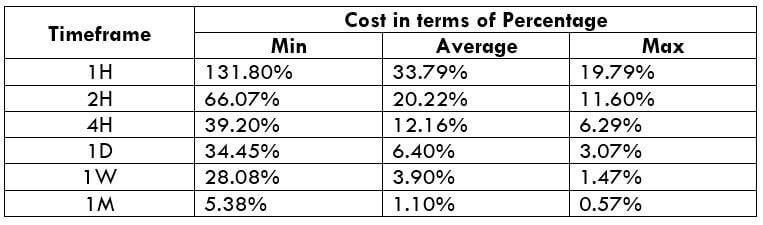

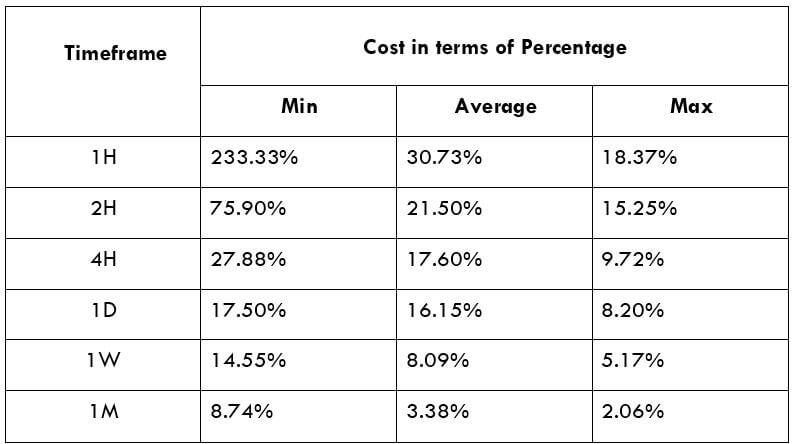

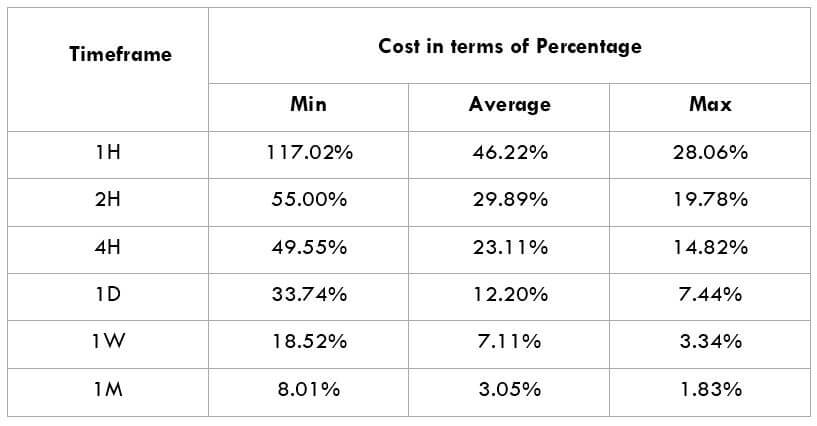

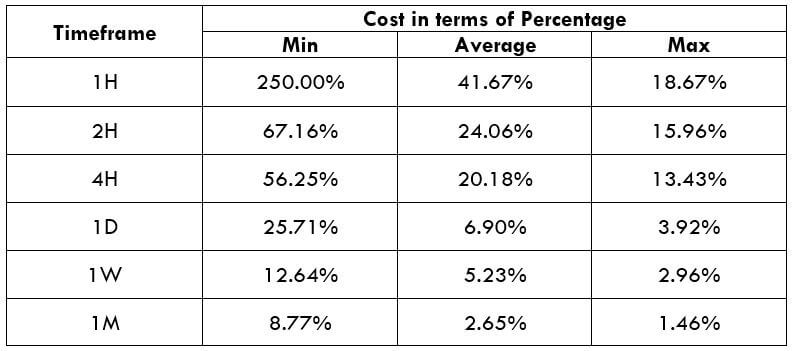

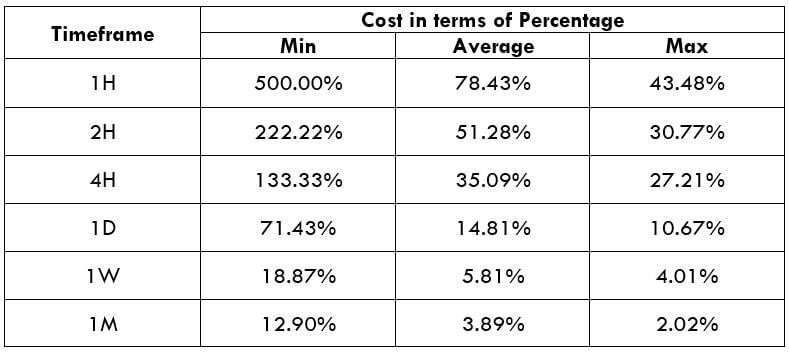

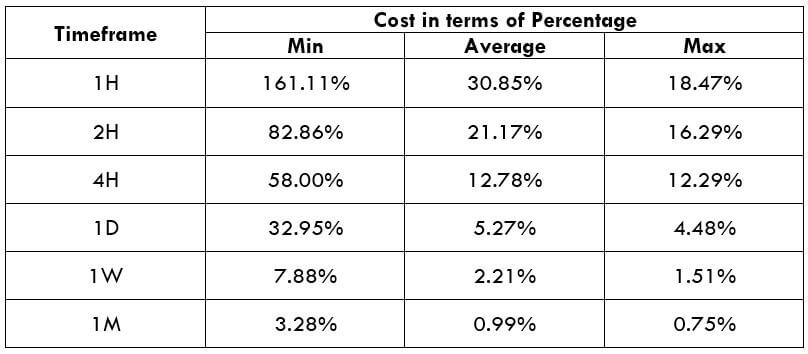

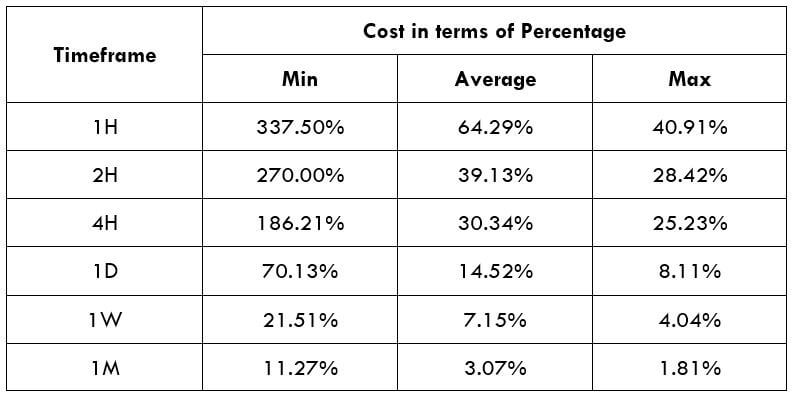

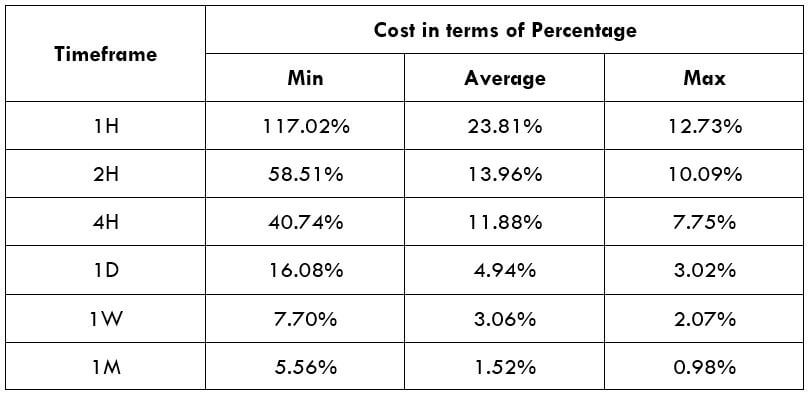

Procedure to assess Pip Ranges STP Model Account

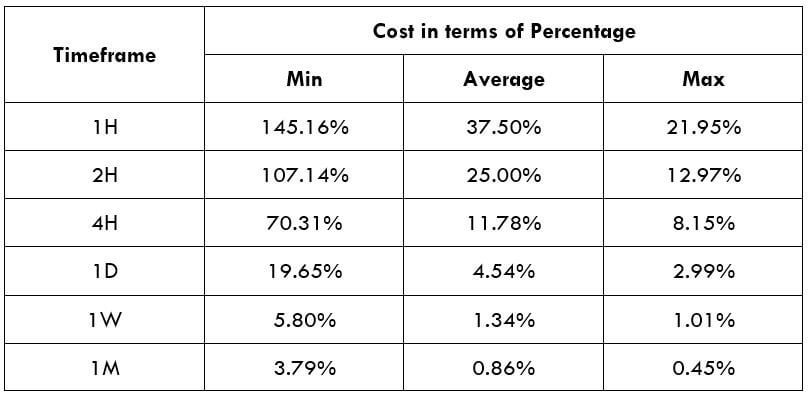

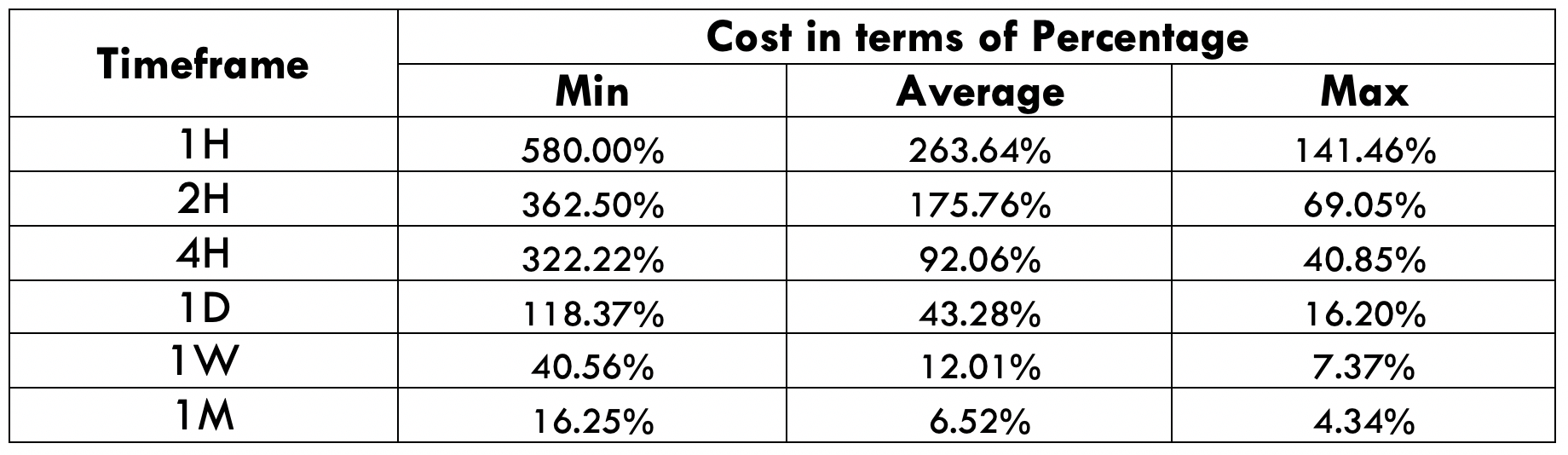

STP Model Account

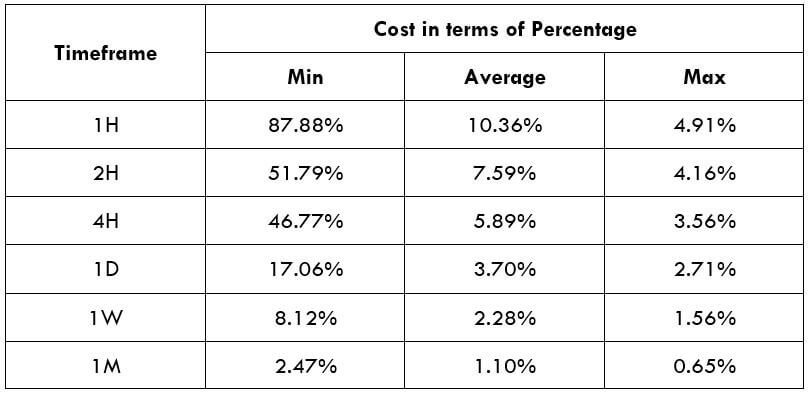

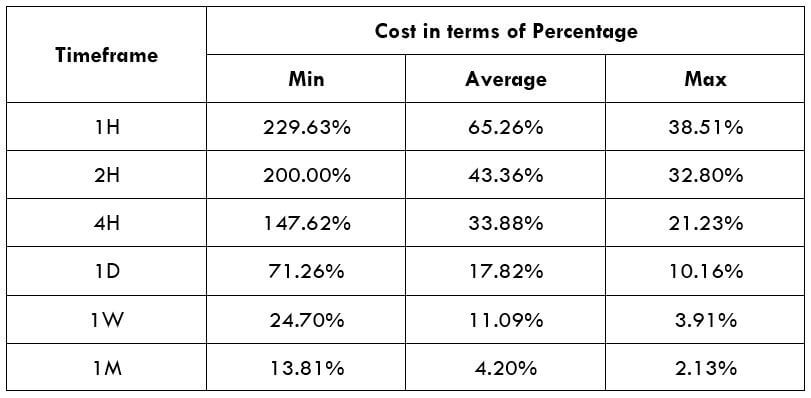

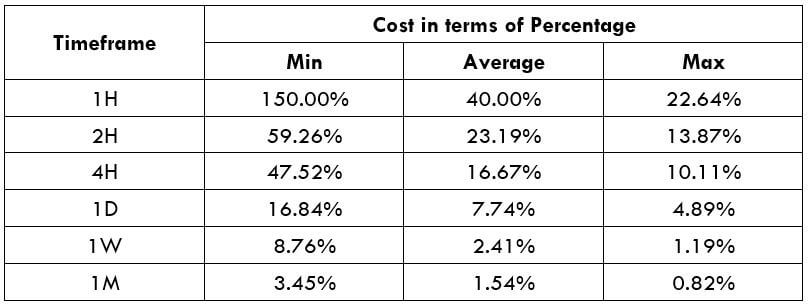

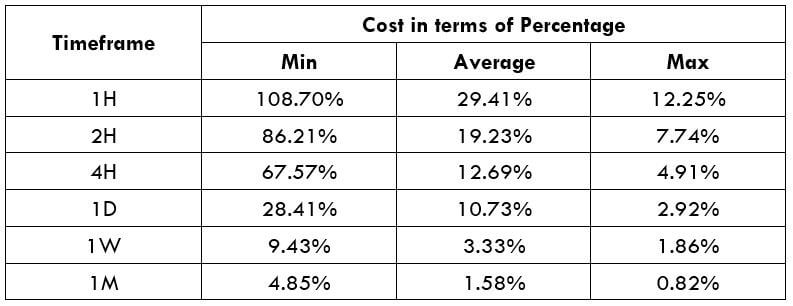

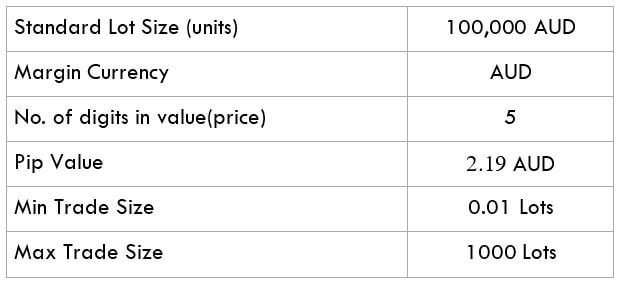

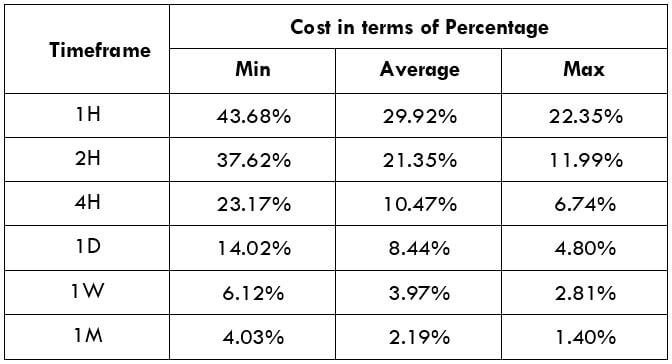

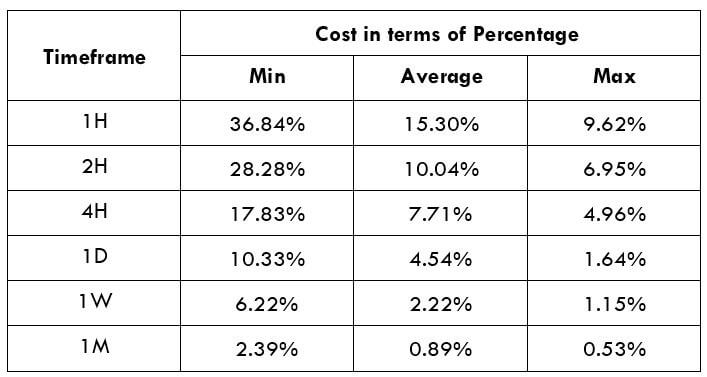

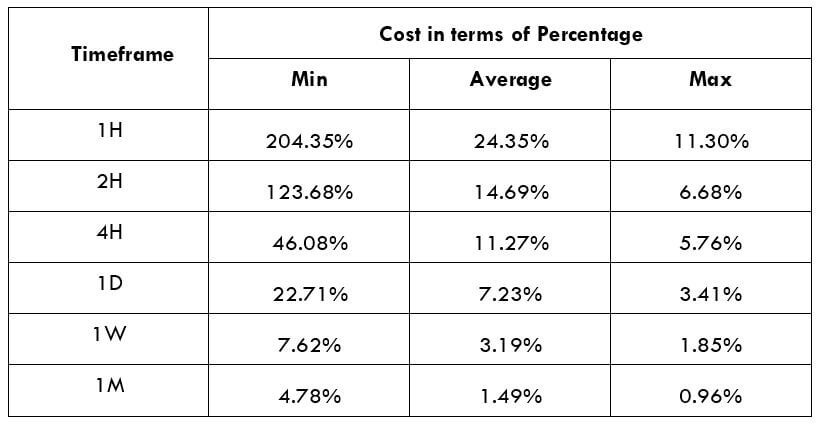

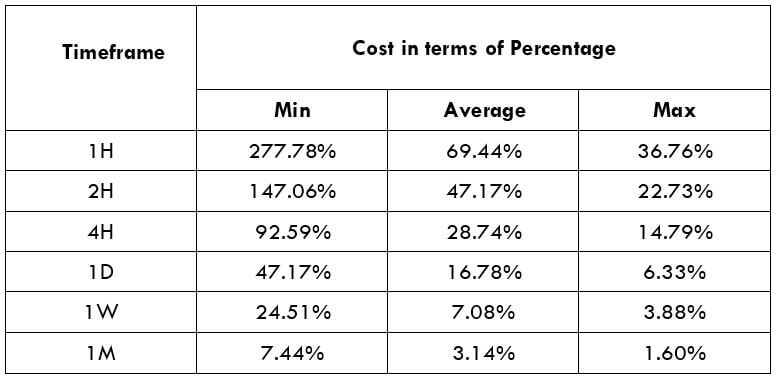

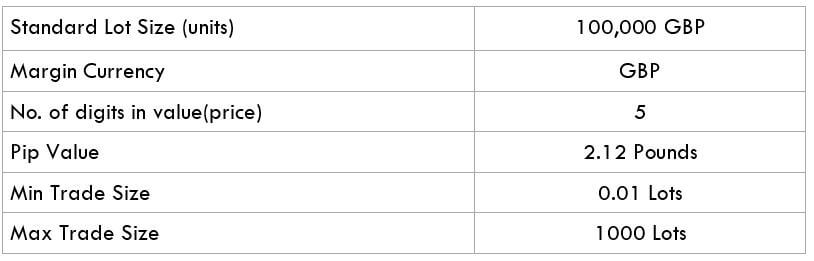

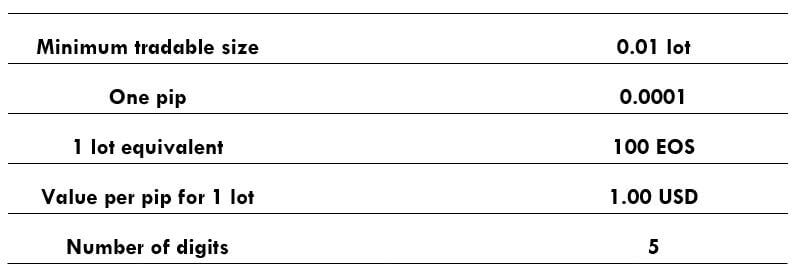

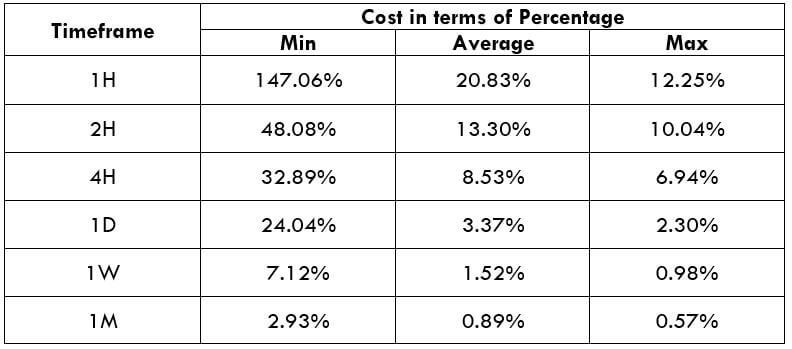

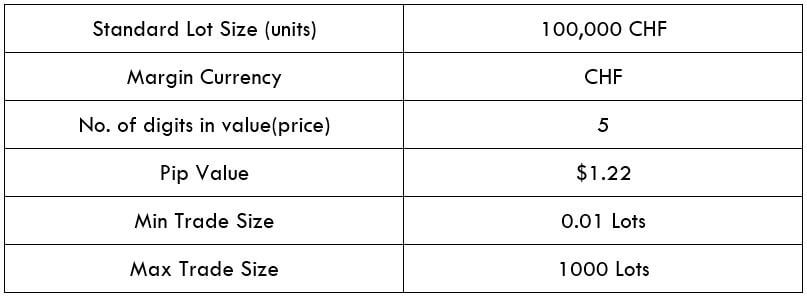

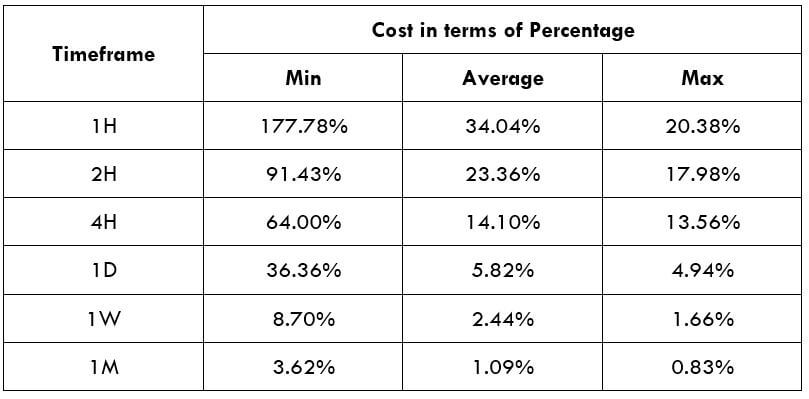

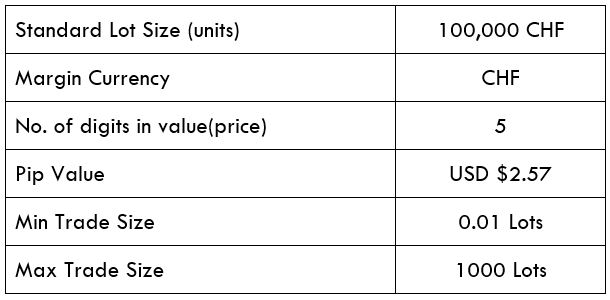

Spread

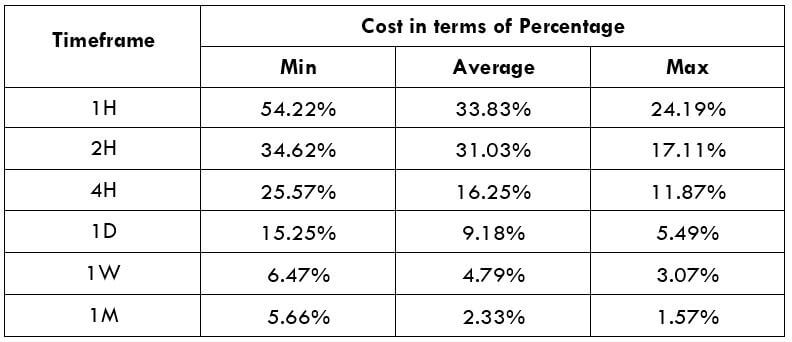

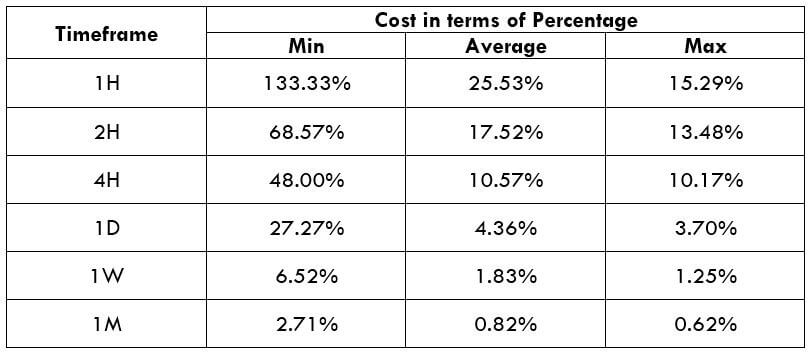

Spread