Spoiler for newcomers to the world of investment: In the long term, between 90% and 95% of funds fail to beat the benchmark they intend to surpass. This means that the active management fund (with that “star manager” so famous) they offer you in their bank branch (or in the luxurious private banking office, as if it were something very special and exclusive “only for a few”), has only a ten-to-ten chance of surpassing the index. An index in which you could invest much cheaper (up to 70 times cheaper) and profitable.

After the initial shock-if you were unaware of this reality, take the time to think about what your savings have been putting you through all these years-some questions arise: What lies behind this superiority of indices over active fund management? Is this a generalized clumsiness on the part of managers, or is it a consequence of the idiosyncrasy of an industry with perverse incentives?

What if the success of the indices is telling us something much more important and profound about the nature of the markets, and therefore they are a clue as to how we should or should not face investment? Although the most common question is the one that the media themselves induce us to pose uselessly:

What funds will beat the index?

This question is formulated with very bad intentions because it induces us to try to “guess” that fund every 10 that in the future will do better than the remaining 9. Are you familiar with the typical headlines in the press: “The funds that rent the most this year”? Obviously, the industry is interested in adopting this perspective because then we will always be subscribing to the fund that we believe will surpass the rest, thus changing the background as who changes shirts, instead of “standing still” indexing us.

The question does not make sense for two reasons:

Firstly, it is not possible to predict today what specific funds will beat the indices over the next few years. The fact that a fund has done so in recent years is not a sufficient reason for it to continue to do so. In fact, it is usually indicative of just the opposite. An example: Only 5% of US first quartile stock market funds in 2013 repeated quartile in 2014. And five years later, none of the funds that invest in large or medium-capitalization equities manages to stay within 25% of the best funds. Although the press and specialized media devote all their attention and praise to the funds that broke their index last year, investing “in pursuit of the best funds” is the worst way to choose an investment fund (and yet it remains the determining factor with which most investors make their investment decisions).

The second reason why there is no point in asking who will beat the index is practical: we do not need to know which funds will beat the index to achieve reasonable returns, with very low long-term risk. To illustrate this, imagine investing being like betting on a 20-team football league that will last 20 years. We can’t know who will end up being number 1, but we do know who will always be second to the rest of 18 teams: the index that everyone is trying to overcome. That is to say, obsessing about getting the first one right, when in the long run we have easy access to the runner-up -above the other 18 options available-, is at best frustrating and at worst very dangerous for our long-term heritage.

Why is this happening?

But let’s go back to the main question and stop being distracted by interesting distractions: What are the reasons for the success of indexation compared to other active investment strategies?

Although there are many reasons why managers have so many problems to overcome the index, we will summarize below the two most common: the costs and the idiosyncrasy of the management profession.

What I would like most in this article is to propose a third, much deeper and more fundamental cause, we could almost say philosophical, that justifies as much or more than those usually attributed to the success of indices as an investment strategy.

Is there passive management?

Before continuing, a necessary clarification: “passive” management does not exist. Someone, if not us, ultimately makes the decisions-systematically or discretionally-on what, how much, and when to invest. As we shall see, the dynamics of indices do not escape this unavoidable condition. By investing in indices we are investing according to its construction strategy-which by definition is active-, not immobilizing the money in a chest at the bottom of the sea. The appellation of “passive management” used by the industry is therefore unfortunate and leads to misunderstanding. The most appropriate “indexed management” or indexing should be generalized. But then,

What is an Index?

Apart from its orthodox definition, an index is nothing more than an attempt at simplified representation-and like any representation of reality, it is biased-of the market. We must not forget that its great success as a form of investment was neither premeditated nor intentional in its origins; it was simply an attempt to take a “picture” of the markets.

Very briefly, it consists of deciding on an amount of N shares to be included in a portfolio together with a selection and weighting criterion, which will result in a number (the “level” of the index at each point in time according to the quotation of its underlying components). For example, N=35 in our Spanish IBEX, N=500 for the S&P of large capitalization shares in the United States, etc. The most common criterion is that, in order to be representative of a market, they have to be the most “large”, as defined by those with greater liquidity and turnover. A committee of experts will meet regularly to assess whether existing actions meet the criteria and represent the market, or whether changes need to be made. That is, actively take and put actions to continue fulfilling the original criteria.

How does an Index work?

The indices are, in essence, baskets of dynamic actions in which their components are “recycled” as time passes, expelling the companies in decline and entering the ones that are capitalizing (for whatever reason or reasons) current dynamics of the current business cycle. The indices are therefore much more than “a picture of the market”, they are the tip of the iceberg -what you see- of a long previous process.

This process of “recycling” resembles the creative destruction that occurs in the real economy throughout economic cycles and that was described by Joseph Schumpeter in 1942. In free-market economies and throughout the inevitable economic cycles, the process of innovation involves the destruction of old companies and their business models (the winners in previous business cycles) by new products and emerging business models.

For Schumpeter, entrepreneurial innovation is the driving force behind long-term net economic growth, despite destroying companies from previous cycles along the way. Indeed, nothing is forever. Neither IBM was going to be eternal in the ’70s, nor today’s FAANG are going to dominate forever, no matter how much the myopia of the present makes us believe otherwise. Schumpeter called this recursive and inescapable process “creative destruction”.

If you look, the indices execute the same process of creative destruction as the economy but applied to the selection of their portfolio constituents. In fact, the indices are the last step in a company selection strategy that began decades ago with thousands of previous start-ups (most of which failed). Indeed, of all the start-ups, only a small group survives, and even less are profitable. Of that small, profitable group, only a small percentage eventually goes on the stock market. On the way are those companies unable to scale their business model or simply survive. And of that minuscule group of companies listed on the stock exchange, only the most successful companies become part of the stock index that represents that market and, by extension, the best of the economy of the sector, country, or region that the index tries to represent.

Usually, once inside the index, those companies with greater capitalization will have a greater weight in the index. Thus, the more successful a company is for investors, or so it is perceived, the more it will rise in price and its weight in the index will be higher. The effect of this process is that, in each new business cycle, those companies that better capitalize on the new business models of the current economy are the ones that weigh the most, so the indices end up capturing -automatically and inevitably- the most successful companies in each cycle.

The S&P-500 index first included 500 companies in 1957. Today only 86 of the original companies remain in the index. Since then, the remaining 414 original companies have been replaced by new ones.

It is this sense, and unlike investment in isolated companies, indices imply a low risk for the long-term investor because by definition they cannot fail. Although recessive periods are unavoidable (we must always bear in mind that stock market indices can drop temporarily around -50% or more at the worst times, which is not usually obvious to most investors) throughout business cycles, investing in indices globally ensures we capitalize on every new wave of growth. So, if we understand volatility as a mathematical description of how much an asset moves over time, and not as risk, then we can recognize that indexed investment, despite its high volatility, involves a lower real risk to the long-term investor than other investment alternatives.

Indexation thus allows us to participate in the process of natural creative destruction of the economy and its economic cycles, in a sufficiently efficient way -in fact, more efficient than 90% of all funds- automatically (the investor does not have to do anything) and much cheaper than through active management.

The next question is, being these investment rules that implement indices so simple…

Why don’t most managers surpass the Index?

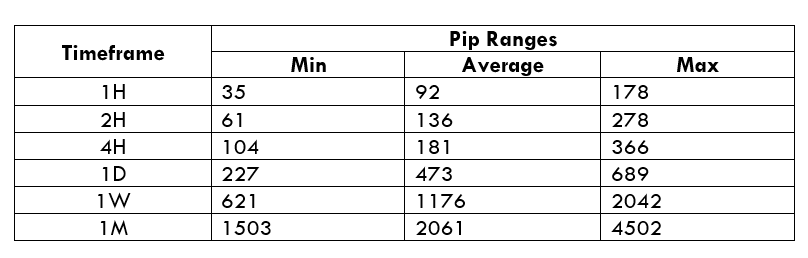

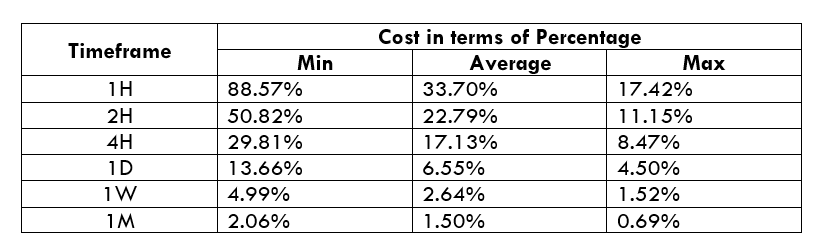

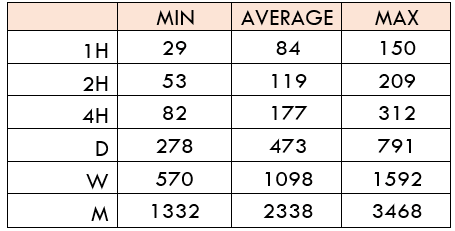

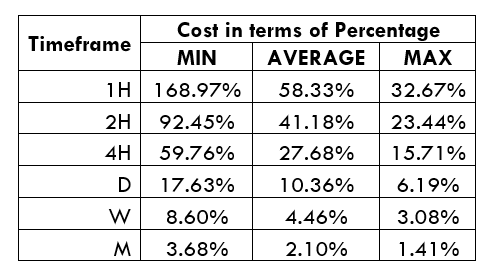

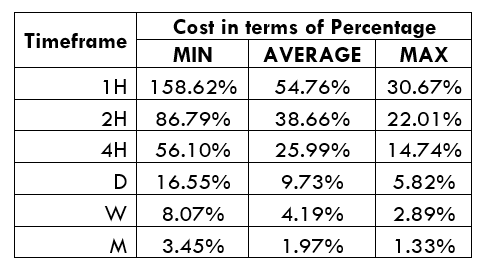

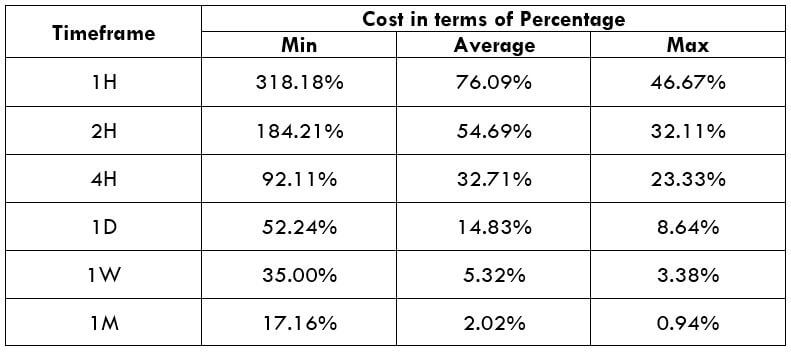

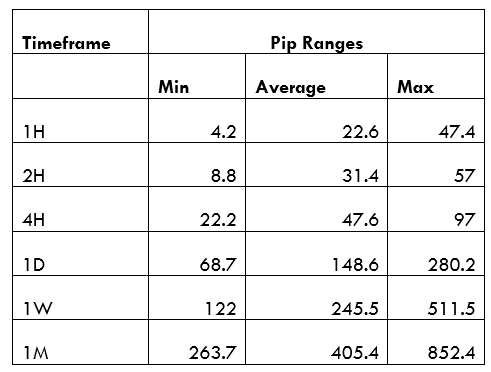

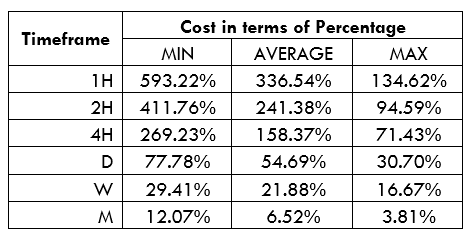

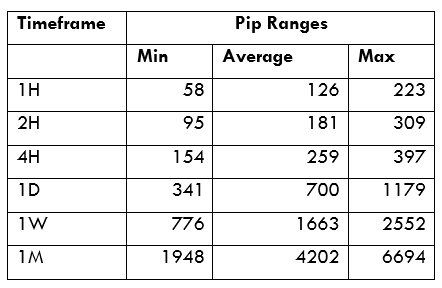

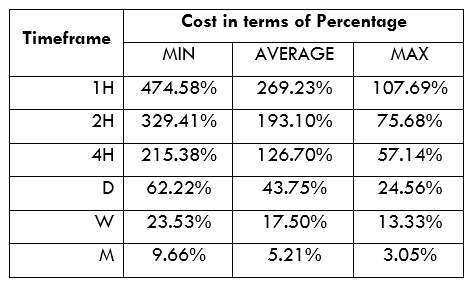

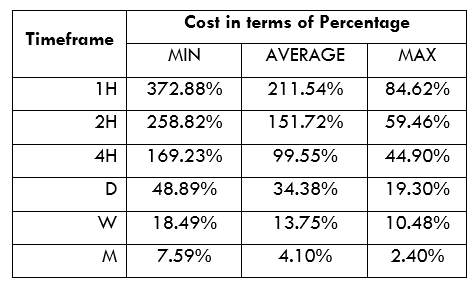

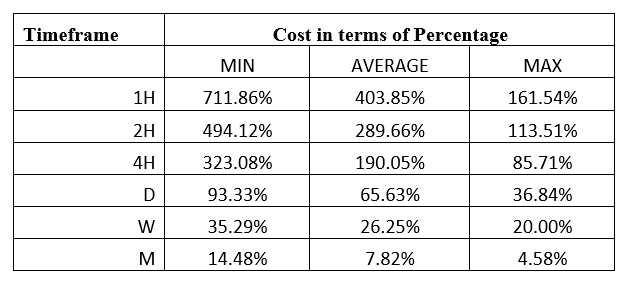

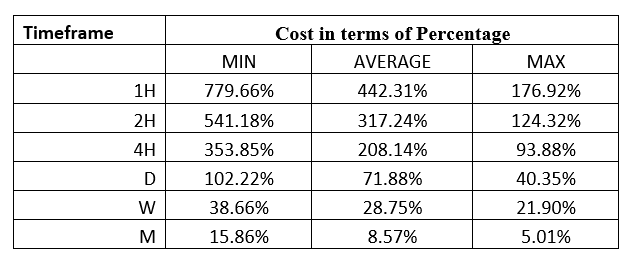

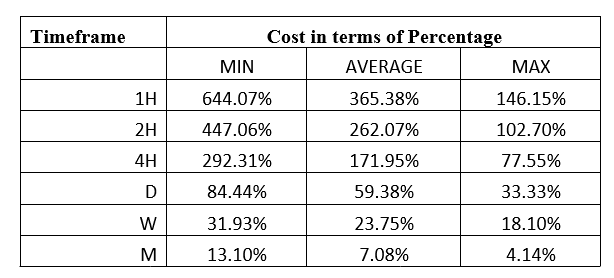

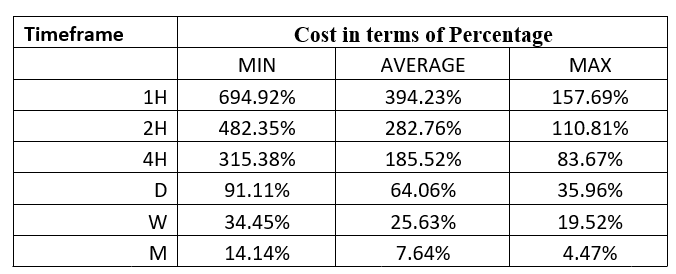

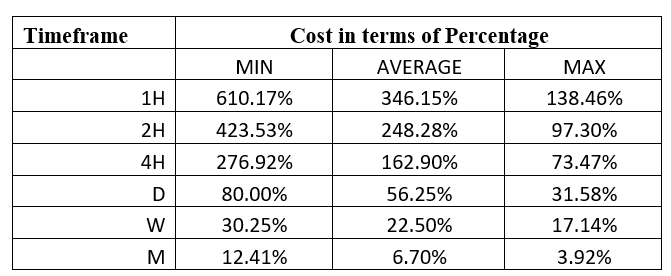

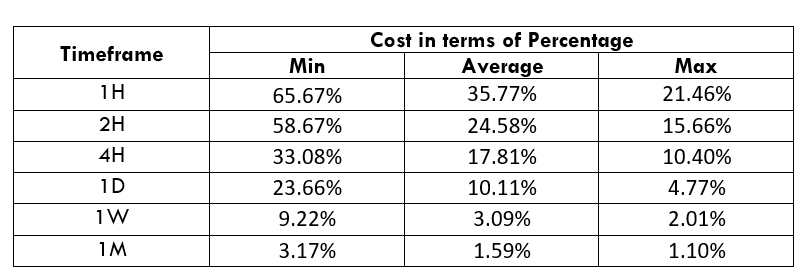

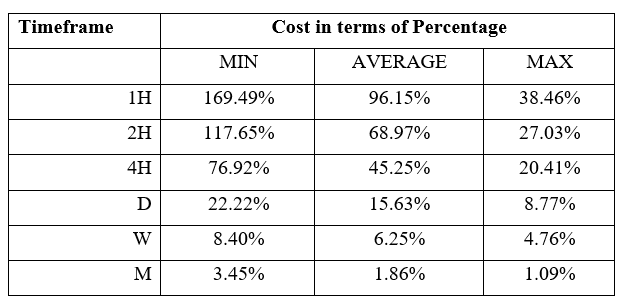

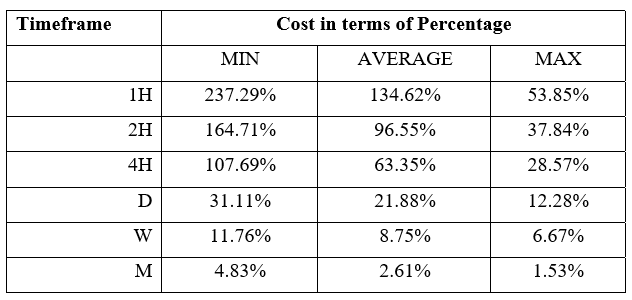

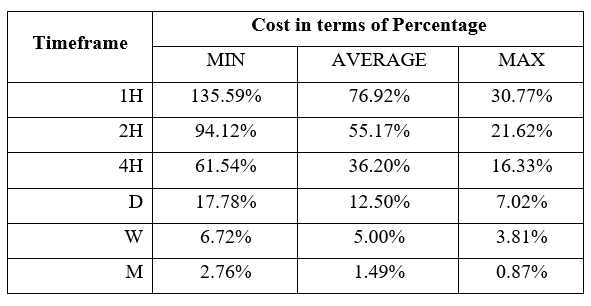

We discussed this in-depth here. In short, the first reason is cost: Investment funds bear cumulative costs and fees which, in total, average between 2%-3% per year. This may seem little, but it would be the equivalent of participating in a marathon in which active managers are added between 20 and 30 meters more to run per kilometer. At first, it doesn’t seem like much, but in the long run of an “investment marathon,” leaving a 3% annual return on commissions means reaching only half of the accumulated return that we could achieve without that ballast. Ballast that indices lack, being simply an abstract numerical result.

The second reason is the idiosyncrasy of the industry, which generates perverse incentives in managers. On a personal level (yes, managers are also normal people), a fund manager within a large fund manager -usually within a large bank with a large product distribution chain- is not compensated for the risk of making investment decisions that are too different from those of his colleagues and therefore from those of the index construction. The manager has an unknown chance of getting it right. But if it goes wrong, he risks losing his job. This asymmetric incentive and the tyranny of being judged short-term work (if we deviate from the index, it is impossible to overcome it always and during all periods), cause mimetic behaviors that explain part of the little dispersion of results between managers with the same benchmark. These incentives cause managers to devote themselves to managing the best that their careers can, not the money of their clients. Usually, who pays for this perverse incentive dynamic is the final investor, who sees his active management funds moving further and further away from the total return on the index.

But as I outlined at the beginning, the costs and perverse incentives of the industry are not sufficient reasons to explain the overwhelming success of indexation versus active management. There is a deeper and more impactful reason, which however usually goes unnoticed or is not given the importance it deserves.

This reason has a lot to do with the worldview we have of the world, of what the world really is, and the path we take in the face of the inescapable dilemma of all investment.

The Dilemma of Investment

Investing means facing, whether we are aware of it or not, a dilemma from which we cannot escape. Regardless of the narratives, styles, or instruments used, and profitable investment strategy-that is, with positive mathematical hope in the long run-ultimately has to choose between two mutually exclusive ways of investing: Look for a high profit/loss ratio at the cost of sacrificing the percentage of hits. Or, pursue a high success rate at the cost of a low profit/loss ratio.

Unfortunately, in the real world, there are no consistent strategies that combine both a high degree of accuracy and a high profit/loss ratio. Attempts to pursue these “unicorns” are not sustainable and have always ended catastrophically (for the investor).

Thus, for deterministic environments, it is very efficient to assign media and talented people (and “hedgehog mentality”) to solve the problem via concave strategies. Very intelligent people are often attracted to these kinds of strategies, of increasing complexity and sophistication, with which they feel that they are controlling what is happening and can bring even more value the more they try. One example could be the engineering associated with the thermodynamics of gases and their mechanical conversion into transport vehicles. A car today has a sophisticated engine and systems that are far more efficient than any car half a century ago.

Decreasing marginal return on complexity when investing.

However, as Jack Bogle has commented on numerous occasions, today’s average manager, regardless of his intelligence, does not manage better than the typical manager of half a century ago. For many great hedgehogs (including Nobel Prize winners) and dedicated media (including the now fashionable Artificial Intelligence and Machine Learning techniques), the marginal benefit of increasing complexity decreases very quickly from an optimal point (# a’ in the following diagram). Indeed, despite the “sophistication inflation” that the industry has suffered in terms of mathematical models and products in recent decades, there has been hardly any material advance for the investor in the quality of active management. The reason is that the system on which the manager works-the financial markets-, regardless of their talent and available means, is fundamentally non-deterministic.

Indeed, since markets are an emerging phenomenon as a result of human action, even if the mathematical models that describe the markets were definitely correct-something impossible in Popper’s scientific sense-and/or complete in his description of social reality-something impossible in Hayek’s sense-; the evolution of the markets in the short and medium-term will always and necessarily be unpredictable.

Warren Buffett reminds us of them in his own words on the next date. You don’t just need a great expert to obtain good investment results, but it is likely that, if we are very smart, we will be an obstacle to achieve our objectives because we will tend towards attitudes and worldviews of the hedgehog:

“If you have an IQ of 160, sell 40 points to another. You need to be smart but not a genius: Investing is not a game where the player with an IQ of 160 beats the one with 130. The rationality of what you’re doing is essential.” -Warren Buffett

Indeed, the industry is reluctant to accept that, in financial markets, as a paradigm of an environment dominated by uncertainty, less is more. In other words, maximum efficiency when investing is not achieved by indefinitely increasing the complexity of the models (point ìc’ in the upper scheme), but by keeping it at an optimal and reasonable level of complexity (point ìa’), adequate and consistent with its unpredictable nature. Once an optimal threshold of complexity has been passed to the environment, it is useless to continue allocating more resources or to increase the complexity of the solutions. It seems that the industry is endeavoring to increase the complexity of its services and products not to increase the value brought to the customer, but simply to use this striking sophistication as an advertising tool.

Indices resist where humans fail.

Most of the success in investing is in not letting us become our worst enemy (what I call investment iatrogenia). If markets and investments are by themselves a difficult art to learn, adding ourselves as a traitor to our goals sometimes gives it an insurmountable difficulty. We come into the world laden with psychological biases and are easy prey to fallacies. Becoming our worst enemy by investing is the easiest and fastest thing that can happen to us. And it is not a question of being more or less intelligent, but of knowing and being able to manage our emotions during the long journey. However, the indices, like any systematic strategy, lack the possibility of falling into some fallacy or psychological bias. Indeed, like any cost-effective systematic and convex strategy:

The index keeps winning shares as long as they meet the conditions to stay in the index. Be it for 1 year or be 100 years. This may seem obvious, but not at all during the time that we are invested, as human beings are very sensitive to the path traveled (“path-dependent”, which an old quant would say). If we invest in a company that after a few years suffers a fall of -70% or -90%, it is most likely that the “pain” for said loss leads us to abandon it and sell. . Philip Morris

The index eliminates the losers, even if we are “in love” with them. Once we have bought an action, we tend to reinforce the reasons for that decision, to “like” it beyond the pure strategic investment decision. When it falls below our purchase price, we tend to justify and believe that it is the market that is making a mistake. This results in many investors accumulating a large stock market that, if they had followed the criteria of the index, would have been sold long ago to make room for other stocks. In other words, indices don’t fall in love with any action. If it does not meet the conditions to stay in the index, then it is removed without hesitation twice.

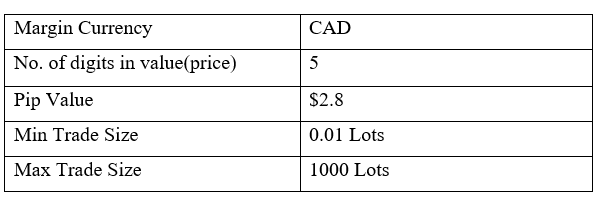

In other words, by definition and when implementing a profitable convex strategy, an index cannot fail (the shares can). It is neutral with regard to sectors and investment factors (some sectors and investment factors do better or worse than others over time, but we do not know which and when). It is neutral regarding the risk of the manager as an incentive worker to keep their job; that may be implementing strategies that end up being, in the most benign cases, followers of the index (the problem of close trackers), and in the worst incoherent with the nature of the market (and make it much worse than the index). And above all, it is practically neutral with respect to the erosion of commissions, which in active management are usually around 2%, while funds and indexed ETFs are already reaching the 0.05% annual (up to 40 times cheaper) environment.

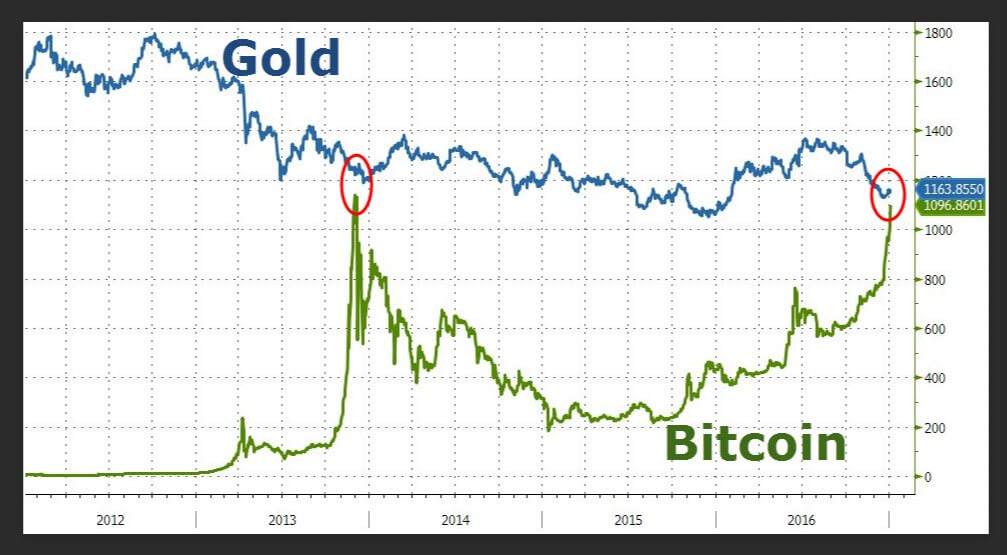

In the 2008-2009 crisis period, gold was also falling in value. And even with its peak growth in 2012, long-term investments were not the most profitable. As international stock markets recovered to pre-crisis levels, gold quickly devalued. It was at the end of 2018 that the stock markets collapsed. Even if we consider this situation as an example when gold was a safe asset, it is not convincing compared to the overall trend.

In the 2008-2009 crisis period, gold was also falling in value. And even with its peak growth in 2012, long-term investments were not the most profitable. As international stock markets recovered to pre-crisis levels, gold quickly devalued. It was at the end of 2018 that the stock markets collapsed. Even if we consider this situation as an example when gold was a safe asset, it is not convincing compared to the overall trend.