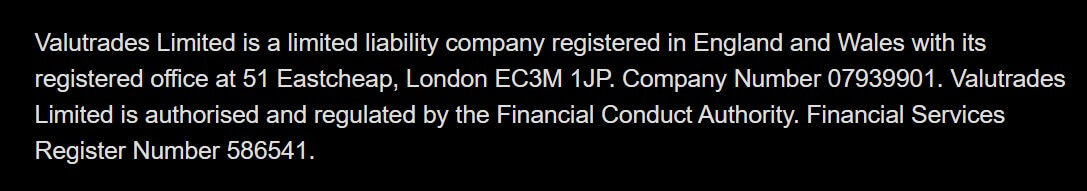

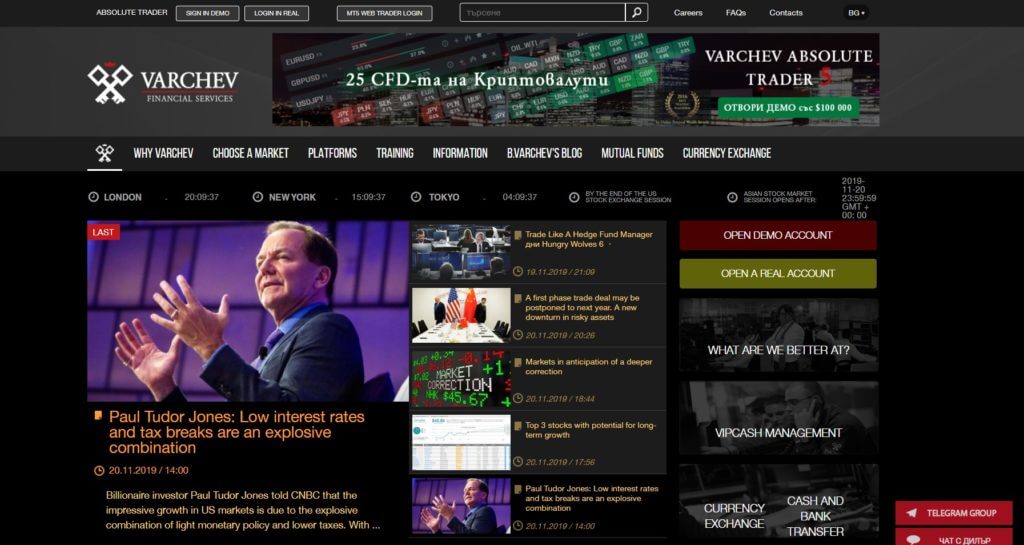

At first look at the Varchev website, visitors will think it is Bloomberg with a dark theme. News around the world will dominate the page without the classic template we see with many brokers. Varchev presents itself as a professional information station that is supremely packed with knowledge on many markets and finance subjects. Varchev is multidisciplinary and provides more services than an average broker. It is regulated in the UK by the FCA although Varchev is based in Bulgaria and obeys the MiFID directive of the EU and Bulgaria’s Financial Supervision Commission. Transparency is great, a lot of useful information can be found on the website without redundancy, leaving a serious, formal business approach to customers.

To understand what makes Varchev a different choice, a simple page is created with all the key points about his broker, like its business model, No Dealing Desk Direct Market Access, great trading instruments range, exact figures of spreads, bonuses, 3 different platforms and many more. This may be overwhelming for first-time traders, for anyone having at least basic knowledge will stay and explore what this broker has to offer. This review will summarize the most interesting aspects.

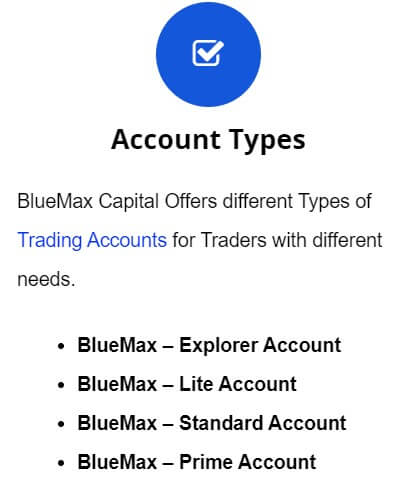

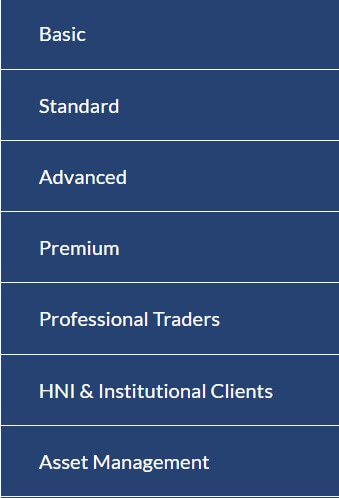

Account Types

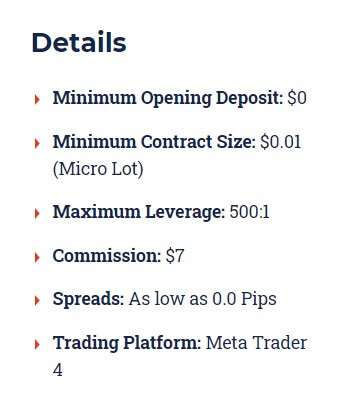

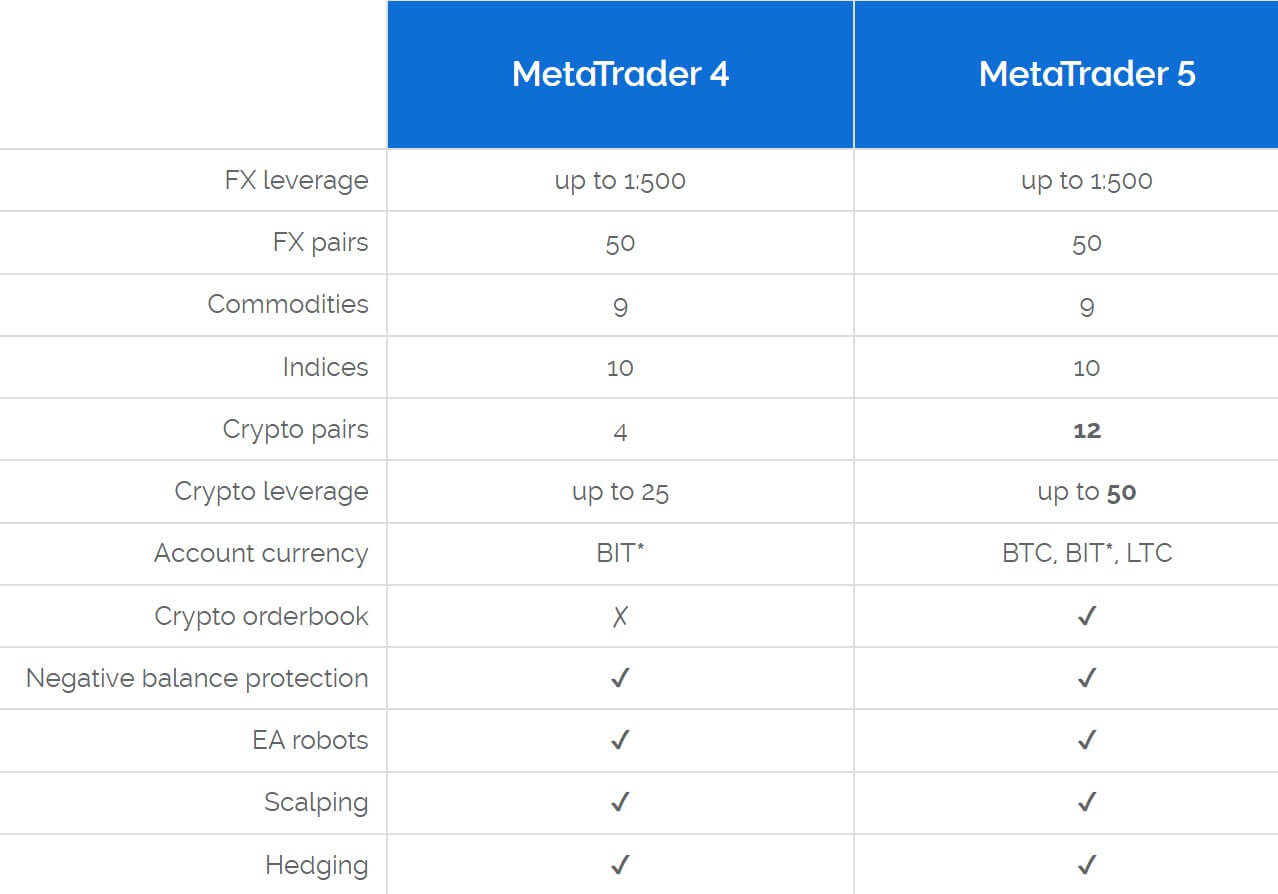

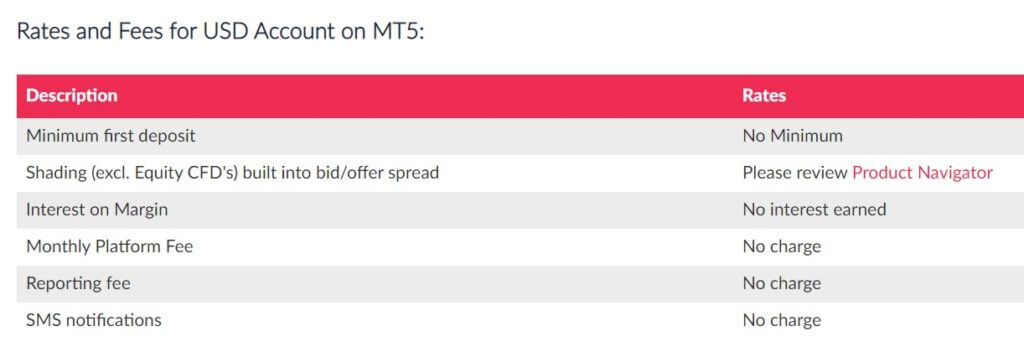

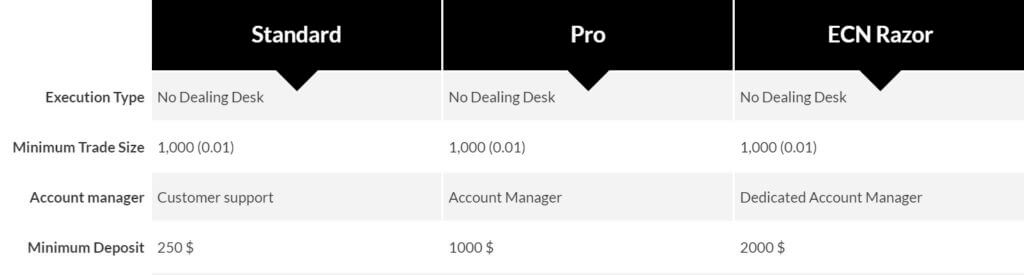

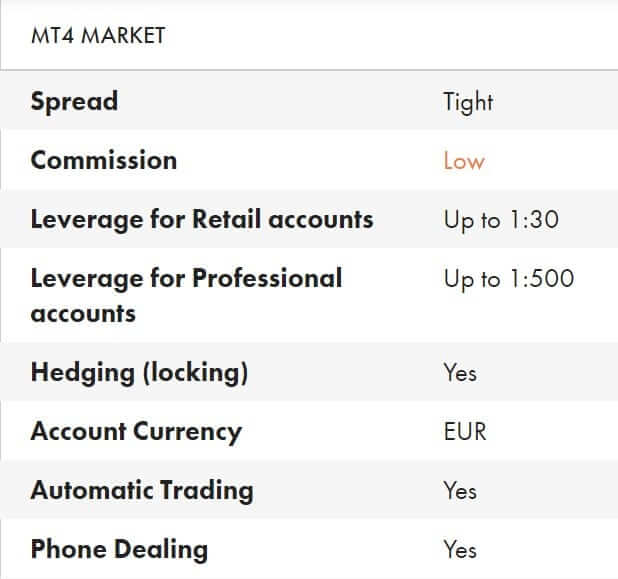

Varchev does not feature different account packages. Once applying for trading, you will be given 3 platform options, each has its trading conditions that do not differ much. We have noticed some inconsistencies about the minimum deposit amount on the website and the Trading Conditions document. The documents for all platforms state no minimum is required although the website mentions $200 or another currency equivalent. Trading terms are very detailed, transparent and plentiful, both online and on paper. Terms are also separated across trading instrument categories like Gold Trading Terms, Cryptocurrencies Trading Terms, and so on.

Varchev will present the Demo account many times on their website to see all the trading figures applicable to the real account. The VIP Account is mentioned although not as clearly, for clients that deposit $50.000 will have the option to negotiate some trading conditions such as the leverage level.

MT4 platform account features benefits like Video lessons, although we are sure the MT4 platform does not have videos. Also, traders will enjoy negative balance protection, narrow spreads, EA allowance and all types of strategies, winning trading tips, etc.

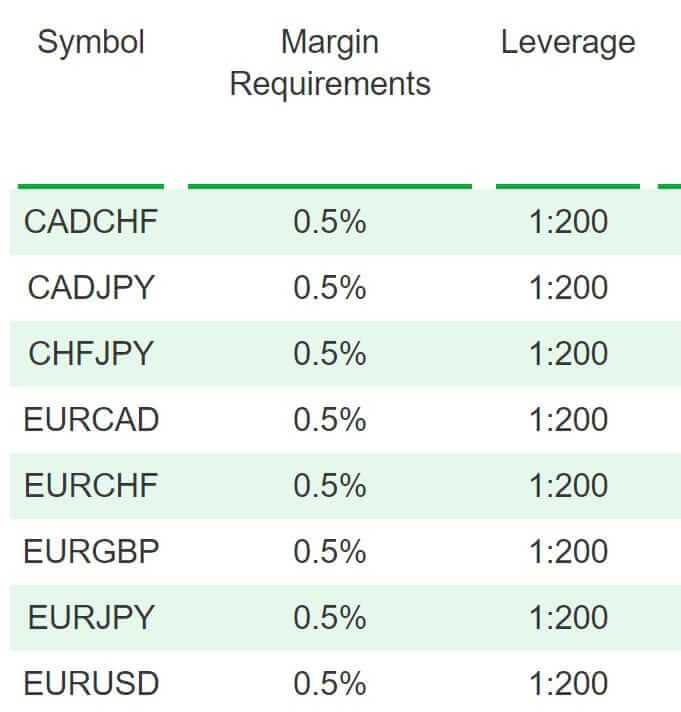

MT5 has the same offers while the Varchev Absolute Trader platform has slightly different margin requirements. The margin requirements list is extensive and split into 9 tiers, ranging from 1% requirement to 100%.

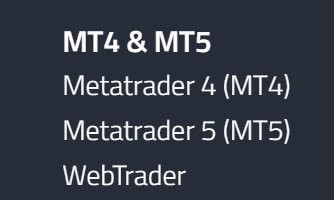

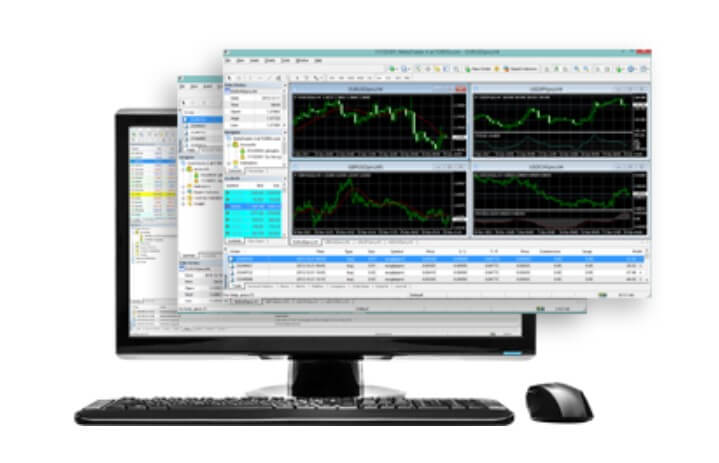

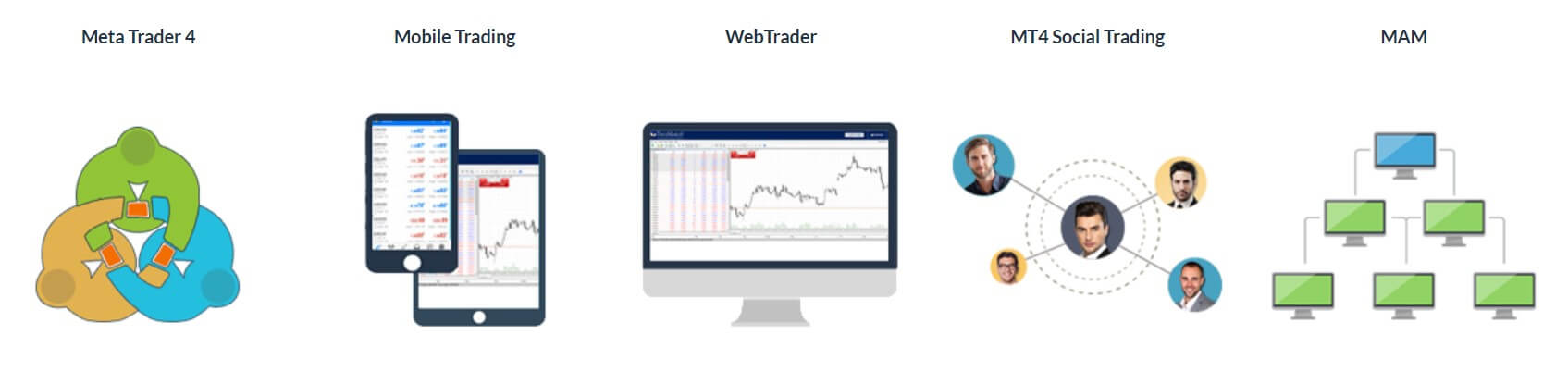

Platforms

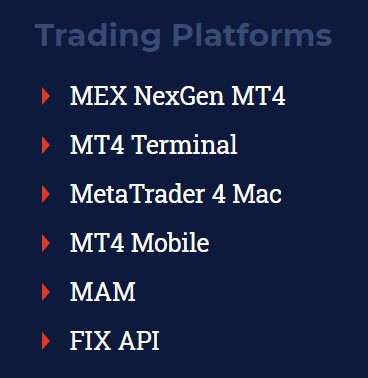

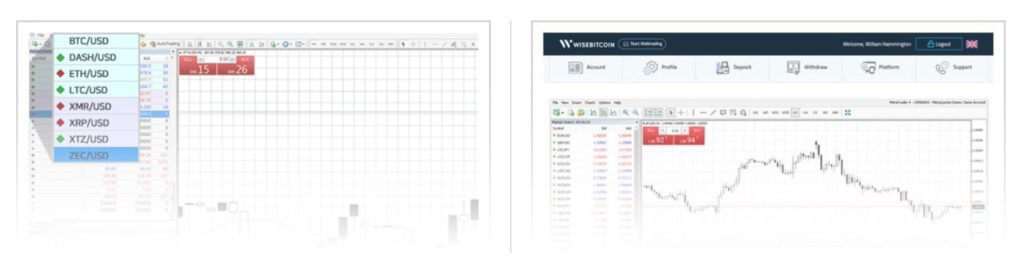

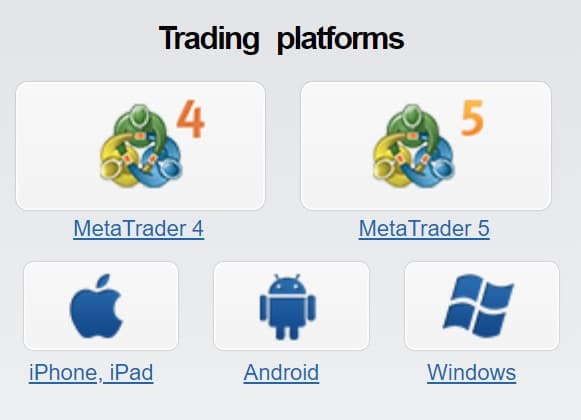

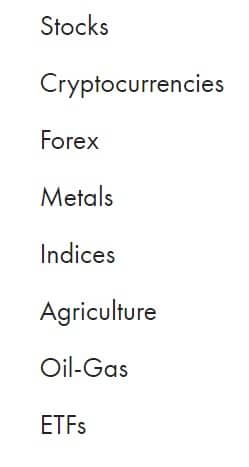

Varchev goes a step further than other brokers offering 3 platforms for different devices and computers. Both MetaTrader 4 and 5 platforms are offered with the addition of Varchev’s branded xStation platform called Varchev Absolute Trader (VAT), platform originally developed by XTB broker.

The VAT is a web-accessible platform that is well developed with user experience in mind. The VAT has a dark theme by default and looks more pleasant than both MetaTrader platforms. The market watch has a built-in sorting, asset categorization with additional context buttons, search box, and asset basket creation, thus making it much more useful than MT4 / 5 counterpart. One-click trading is available immediately without any confirmation. VAT charts have a great overview by giving the trader all the major information ready to consume around the chart. Such as period countdown, handy toolbars for drawing, text, chart comparisons in the same window, customizable visible layers or toolbars, better crosshair information, and indicators insertion.

A major drawback is immediately clear once you scroll for the available list of indicators, only a handful are listed. This also means no automated trading is possible. The same chart can be detached as a separate browser window but also arranged into a grid, vertical, horizontal or full screen. Aside from charts, other tabs can be selected so traders can see the News, Calendar, Market Analysis, and trading history. The news feed comes from the xStation sources with good quality and quantity relevant to different asset categories that can be filtered to the trader’s interest. All content has charts and related arguments that go well with the analysis, clearly professionally made.

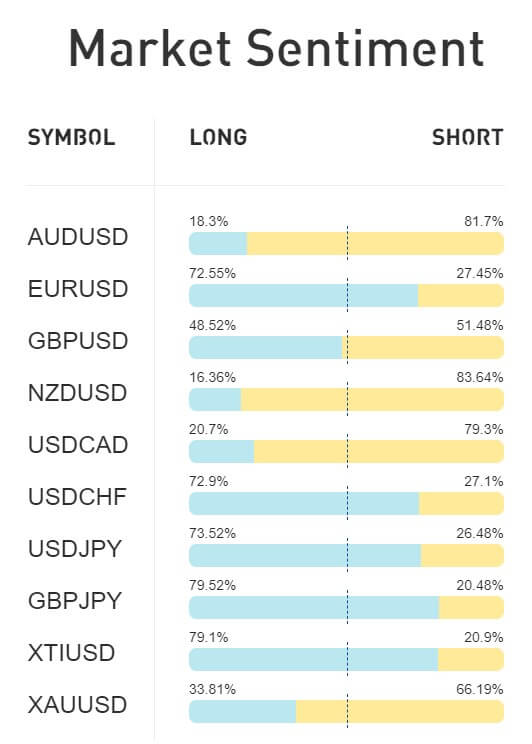

Next is the Economic Calendar that is well designed, although we found that the filtering is available but not working. Sorting by Impact or Currency is possible, yet some currencies are not typed in. Market Analysis gadget has 4 sections: Market Sentiment, Top Mover, Heatmap, and Stocks Scanner. All of these are very useful and interesting, especially the Stocks Scanner that has an impressive range of Ratio Analysis applicable to all stocks tradeable. Trade Ordering has advanced Stop Loss and Take Profit, as well as other pending orders with the addition to set price levels according to pips, price or percentage.

Execution times are very fast, we have not encountered anything slower than 100ms. This platform is very useful as a demo or to execute signals out of MT4 or other platforms that support more technical indicators. Whatsmore, this platform analysis, and news feature provide great value to traders. Some of these could be added to MT4/5 in the form of various plugins or indicators although a ready-made quality solution like VAT platform has its advantages. VAT platform is also available for mobile devices, both Android and iPhone.

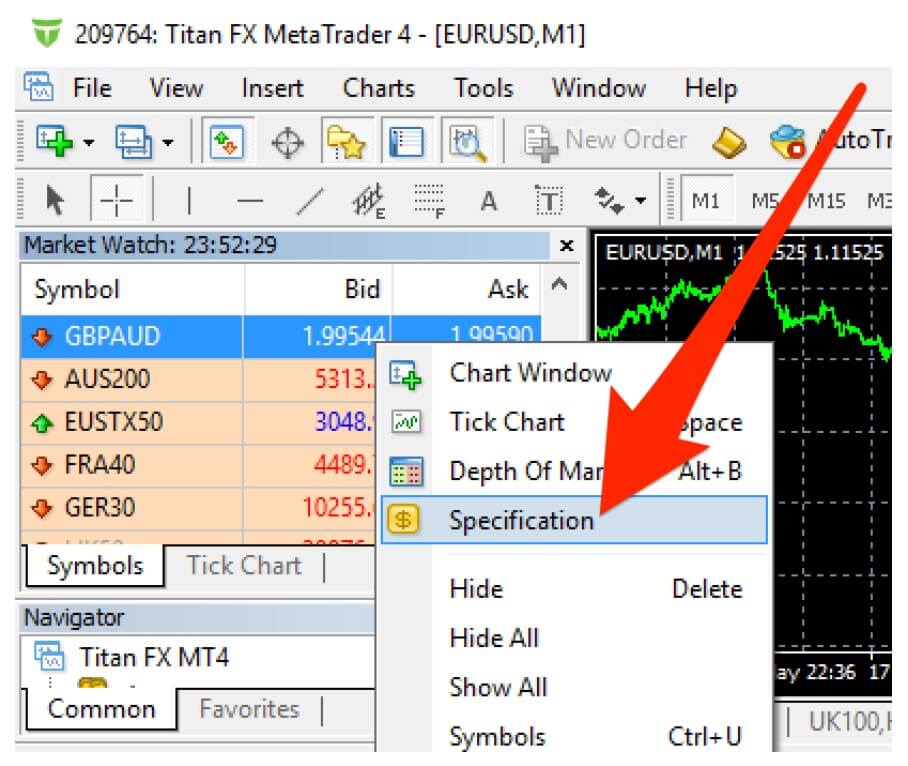

MetaTrader 5 platform found Varchev’s servers in a blink and relays the signal in 35ms. Everything is at default settings, the client updated to the latest version with one-click buttons visible. We have moved on to see if the execution times are as great as with the VAT platform and they were around 140ms, slightly slower than with the VAT. The asset specification window is fully loaded with information on all key points. We have noticed that some assets are disabled for trading even though they have active trading sessions and no risky market events. The same assets were enabled on the VAT platform. Assets range is neatly categorized in groups and subgroups.

Unlike the MT5, the MT4 platform is not by default settings. Varchev customized the platform with its in-house indicators, chart layout, and templates. We have explored what custom indicators are offered by Varchev and found a total of 15 Varchev Indicators. Some of them are and extended versions of popular indicators like the Keltner Channel with additional settings options. Indicators extend the MT4 in numerous ways, the Overlay indicator adds the ability to plot another instrument chart over the other. Trend Filter shows multiple signals from poplar indicators under the bottom corner of the chart, giving an easy big picture glance of the market.

Varchev did a great job providing these indicators that greatly contribute to the trading environment and presenting them in full glory with a non-default layout. MT5 does not have these probably because they are not ported to the MQ5 language yet, a common drawback for MT5 that is still missing the support MT4 has. The execution times are around 350ms which is a bit slower than with the MT5 and the VAT platform. What amazed us is that MT4 has some assets that are not found either on the MT4 or VAT. More info on this in the Assets section.

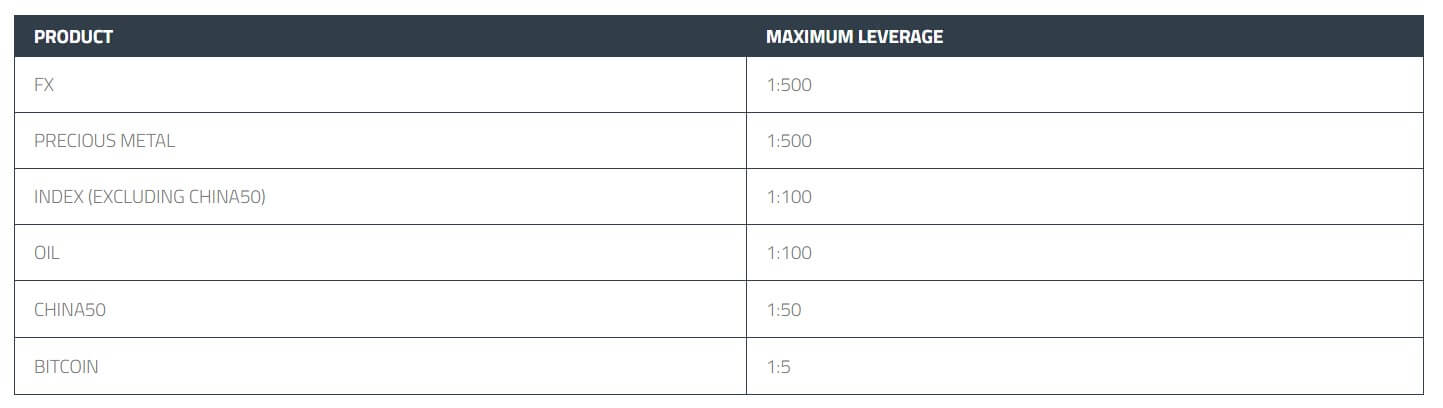

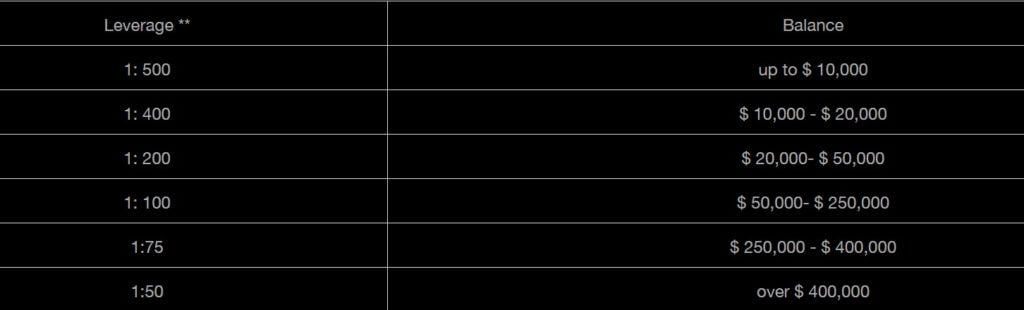

Leverage

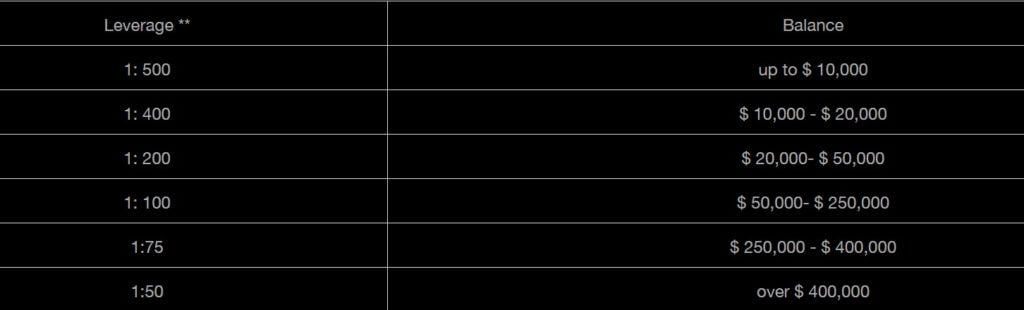

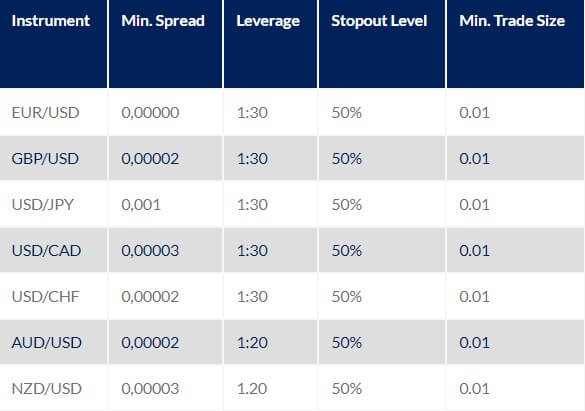

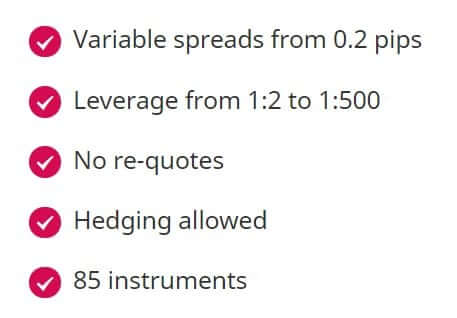

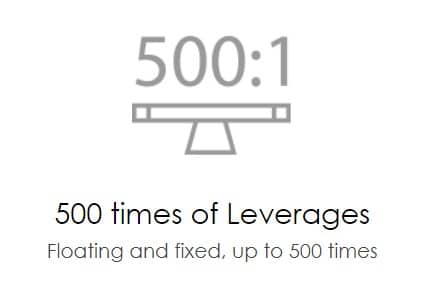

The leverage is presented at the 1:500 level and traders should know this is for professional traders. Since the ESMA policies went into effect in 29.07.2018, to have higher leverage than 1:30, traders will need to meet two of three criteria. These are transaction size requirements, in significant size, on the relevant market and frequency; The size of your financial instrument portfolio exceeds EUR 500,000; You work or have worked in the financial sector for at least one year in a professional position. We will display leverages for non-professional traders as these are the majority.

For VAT and other platforms accounts, except the VIP clients, the leverage is 1:30 for Forex majors, 1:20 for non-majors like EUR/AUD or USD/TRY, 1:20 for Gold and major Indices, 1:10 for the rest of the metals and commodities, and 1:5 for the remaining of available CFDs. Cryptocurrencies have 1:2 leverage.

Trade Sizes

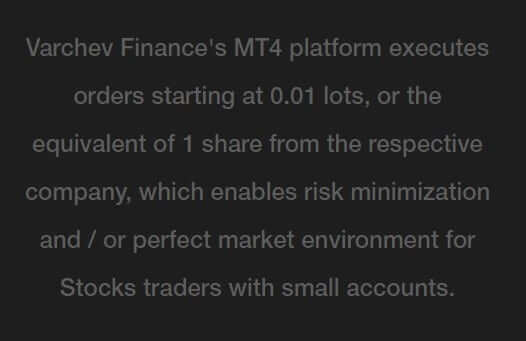

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is 100 lots. This trade size setup is consistent across the Forex range. For Oil, only the maximum is set to 10 lots, and for Gold and other precious metals at 50. Indices have the minimum set at 0.1. Bitcoin and other cryptos are set to the maximum trade size of 5 lots and a minimum of 0.01. VAT platform had a minimum trade size of 0.1 lots for crypto. Note that the VAT platform has more assets to trade as well as some minor differences in the trading conditions. Margin Stop Out is at 30% and Margin Call at 50%.

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is 100 lots. This trade size setup is consistent across the Forex range. For Oil, only the maximum is set to 10 lots, and for Gold and other precious metals at 50. Indices have the minimum set at 0.1. Bitcoin and other cryptos are set to the maximum trade size of 5 lots and a minimum of 0.01. VAT platform had a minimum trade size of 0.1 lots for crypto. Note that the VAT platform has more assets to trade as well as some minor differences in the trading conditions. Margin Stop Out is at 30% and Margin Call at 50%.

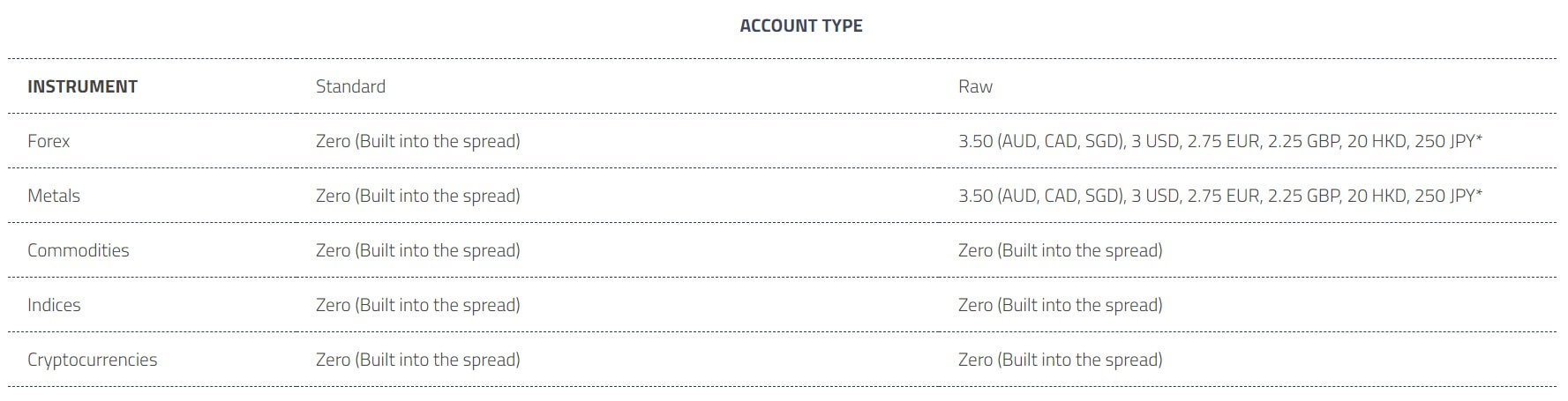

Trading Costs

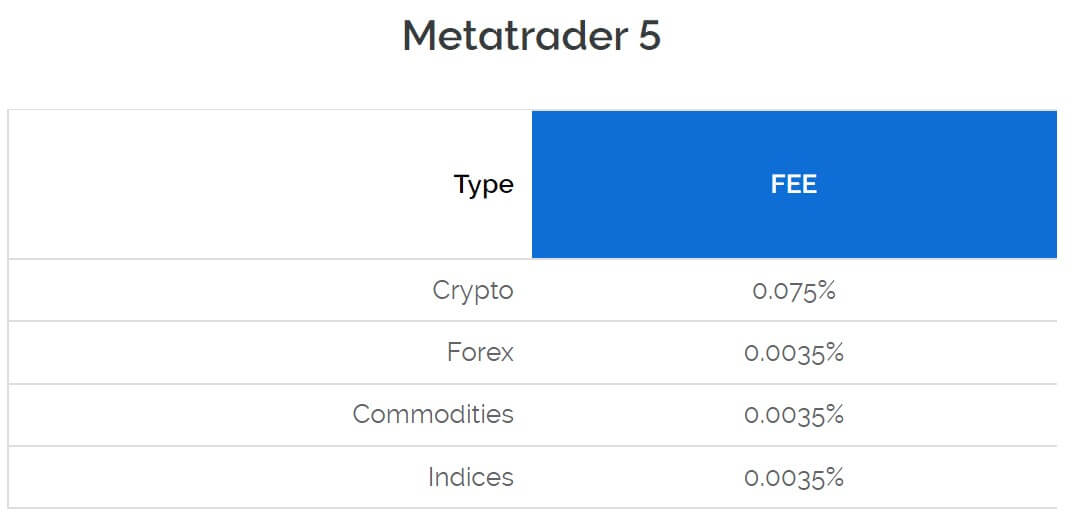

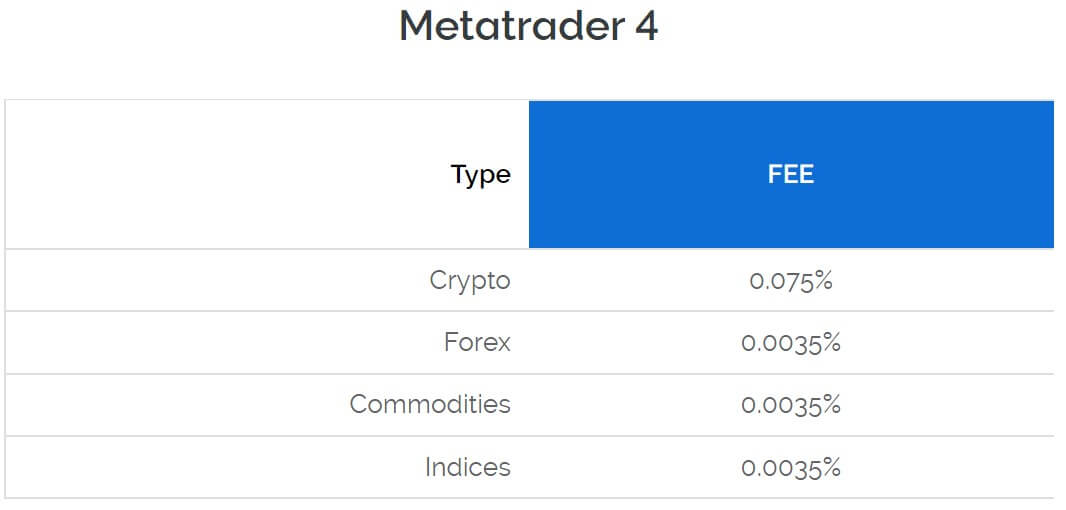

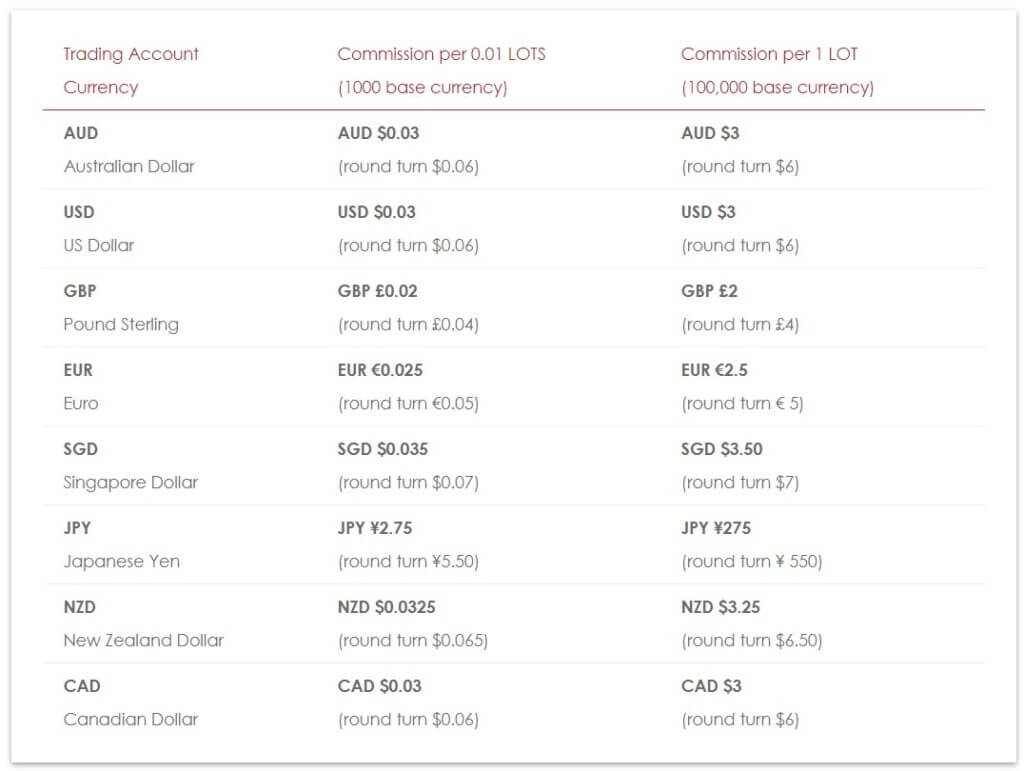

Varchev does not charge commissions except for CFDs on shares, Oil, and ETFs. For the MT5 platform, the commission for US shares is $0.05 per stock, min $5 and EU 0.10%, min 5 EUR. As stated for the MT4 platform, only $0.05 per any stock is charged. For traders utilizing the VAT platform, the commission for shares is specific to countries. For Czech companies, the commission is 0.25% (min 300 CZK), 0.08% (min 8 EUR/USD)for the EU, United Kingdom, Swiss, and US companies. Poland is an exception like Czech Republik and has 0.25% (min 25 PLN) commission charged. For the EU ETFs, the commission is 0.1%. (min 8 EUR) and for the US ETFs, 0.08% (min 8 USD).

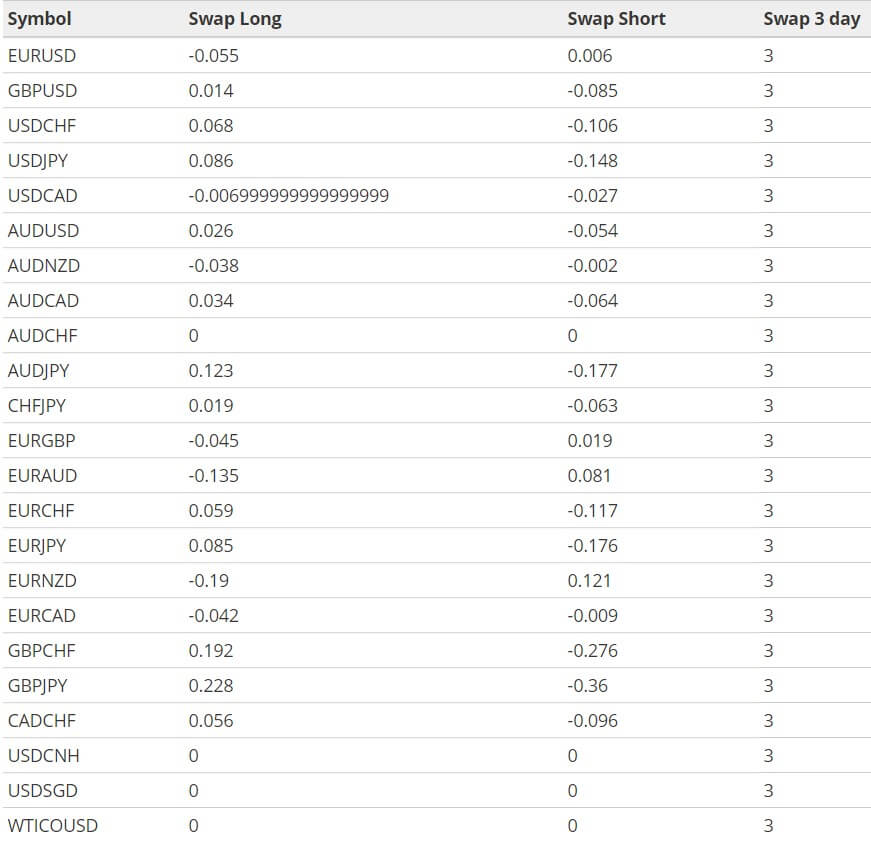

The Swaps are under normal industry levels and with frequent positive values. They are calculated in points for forex. EUR/USD swap has a positive figure on short position 6.245 and -9.981 for long, the US dollar has a positive on USD/JPY and –8.627 on the short position. EUR/GBP also has a positive swap on the GBP side 1.395. From what we have seen in the MT5 platform, many pairs have a positive swap, tripled on Wednesdays. Spot Gold swap is also calculated in points with -10.24 for long and 7.733 for short positions. Palladium has somewhat higher levels, -14 for long and -35 for short. For stocks, the swap is calculated in percentage terms per annum and Cryptocurrencies -30% per annum on both positions, tripled on Fridays. VAT platform has different swaps, so for example, Bitcoin had -30% for long and -10% for short positions. Varchev also has a Rollover Table for Indices and Commodities published under Trading Conditions.

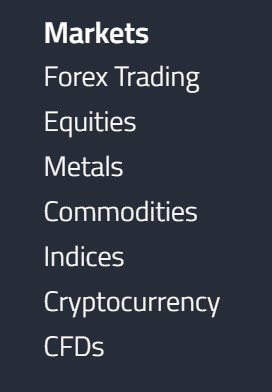

Assets

Varchev took great efforts to bring numerous instruments to traders. Is it promoted that over 3000 assets can be found. We have confirmed that this true although traders should know that not all are open for trading and that some have limited trading sessions.

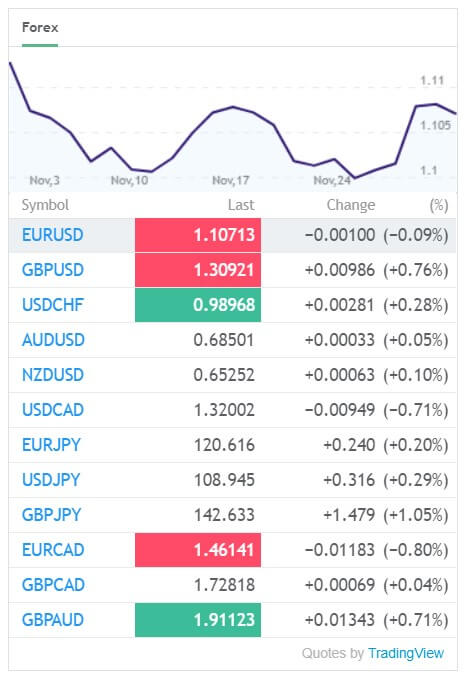

The Forex category is separated into Majors, Minors and Exotic groupings. All of the majors are present and interestingly currency pairs like USD/TRY and USD/BGN are under the Minors group. The Bulgarian Lev is certainly an exotic, very rare to see even with Forex focused brokers. Under Exotics, we found USD/MXN, USD/HKD, EUR/NOK, USD/RUB, and Scandinavian currencies.

VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The MT4 Forex range stepped to another level. In addition to the major pairs all brokers have, the exotics are unique and only a handful of brokers can offer Serbian Dinar, Croatian Kuna, Macedonian Denar, Ukrainian Hryvna, and Israeli Shekel. What we have disliked is that all of these were disabled for trading at the moment of our review.

VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The MT4 Forex range stepped to another level. In addition to the major pairs all brokers have, the exotics are unique and only a handful of brokers can offer Serbian Dinar, Croatian Kuna, Macedonian Denar, Ukrainian Hryvna, and Israeli Shekel. What we have disliked is that all of these were disabled for trading at the moment of our review.

Commodities are separated into Oil types, natural Gas and Metals. Crude, WTI, and Natural Gas are listed as several futures too. From Metals Gold, Platinum, Palladium, and Silver are present, completing the list for any metal-oriented trader. MetaTrader 4/5 does not have all the Commodities VAT platform has. In the VAT, traders can find Cocoa, Coffee, Cotton, Sugar, Wheat, Corn, Soybean, Zinc, Aluminium, Copper, and Nickel. The MT4 has Pork Bellies not found in MT5 or VAT. Also, Palladium is not listed in VAT, only MT4/5 has it.

Bonds are not officially listed as a category but they are present under the Commodities group in VAT for unknown reasons. There are 4 of them under BUND10Y for German 10 year Bonds, SCHATZ 2 Year German Bonds, TNOTE for the US 10 year Treasury Note, and an interesting EMISS for CO2 Emissions Contract. These Bonds are not found in MT4/5.

In the MT5 platform, we found a total of 15 Indices, some disabled for trading like the Volatility Index, VIX and the Dollar Index. All of the majors are present with a few specialties like the Swiss SMI, CAC 40 and UK 100 besides FTSE. The VAT platform, again, offers much more. Indices are split into Asia-Pacific, Americas and Europe groups.

A total of an amazing 24 indices are listed with a lot of interesting, uncommon like the Largest Polish companies Index, W20, HUNComp, Netherlands NED25, CZKCASH, RUS50, INDIA 50, CHNComp, HKComp, South Korean KOSP200, MEXComp, and more. A great range that offers more diversification in the indices category, experienced traders know many indices are heavily correlated. Under the “New” group, the MT4 has a few of Indices and stocks that are introduced recently, further expanding the range.

ETF range in the VAT is again much better than what is commonly seen in the industry. We have counted more than 100 ETF in the VAT and most are from the US. These are not available in the MT4 or 5.

Varchev stocks range follows similar depth as with other categories. Impressive companies range is from the US, UK and the rest of Europe. We found some differences from the MT4 / 5 and the VAT platform although they are hard to find. For example, Holland companies are not found in VAT but are listed within the MT5 and 4. Stocks traders should find even the rarest of companies within the Varchev offer.

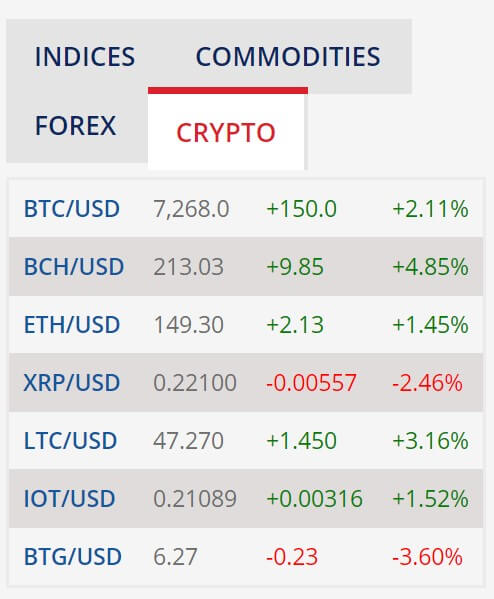

Cryptocurrencies are most dominant with the VAT platform. The only drawback is the minimum trade size volume is 0.1 lots. A total of 29 crypto pairs are found and all are available for trading. Apart from the majors like Bitcoin or Ripple, traders will see EOS against the USD and Ethereum, Dash vs BTC, TRON, Monero, IOTA, Zcash, Stellar, NEO, Cardano, NEM and many crosses with another major crypto. MT4 and 5 do not have such an extensive range or are disabled for trading.

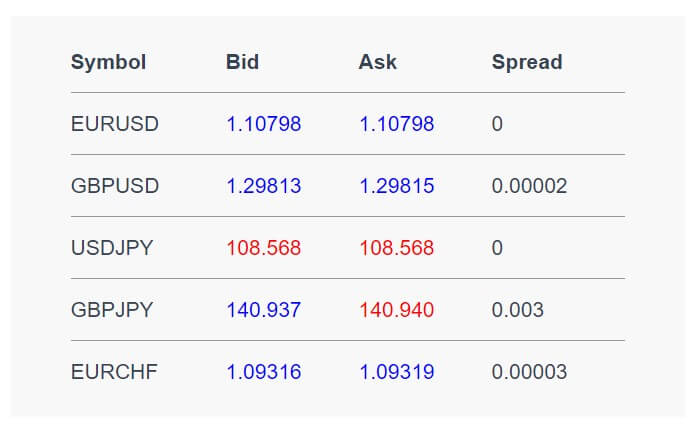

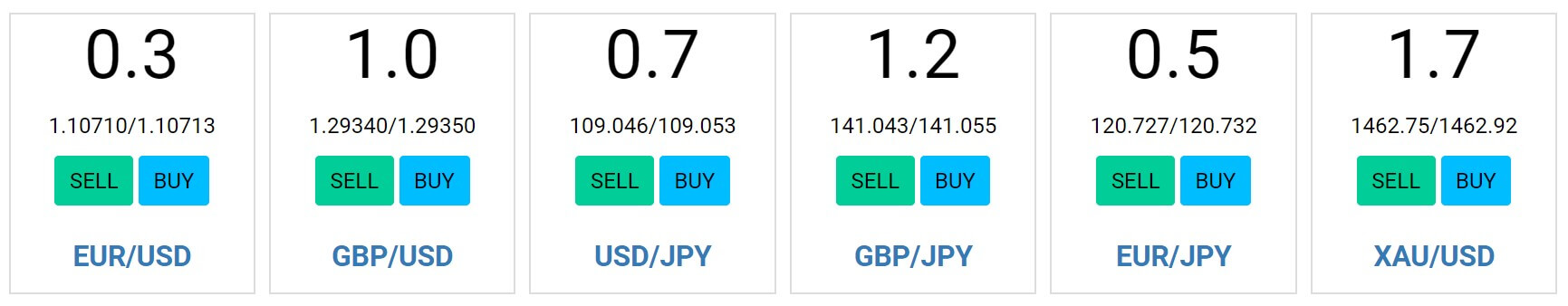

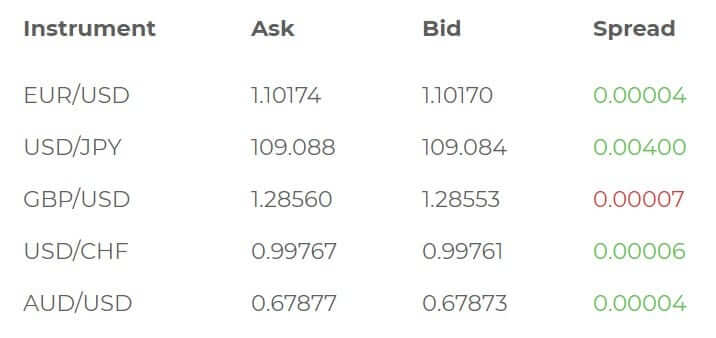

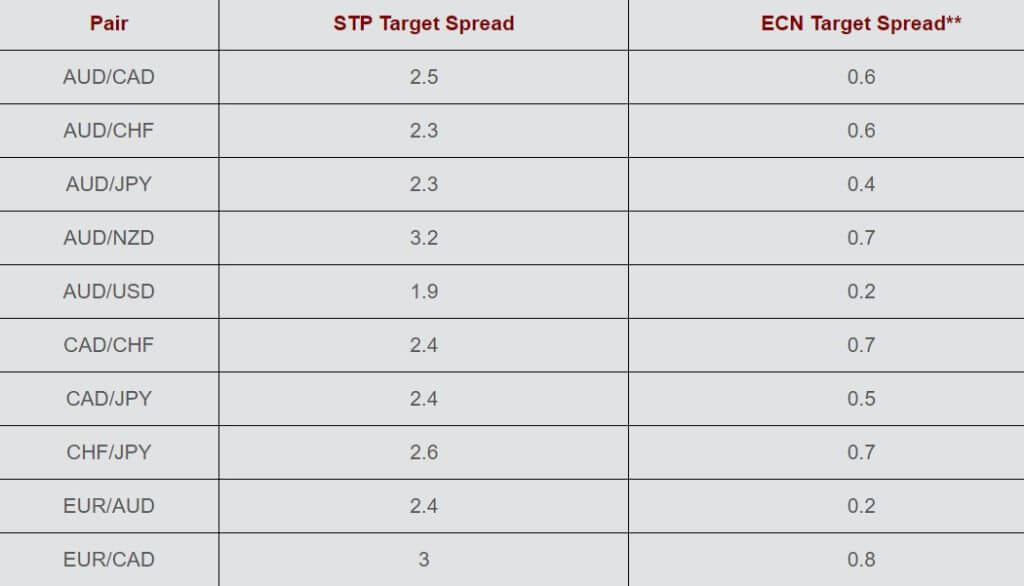

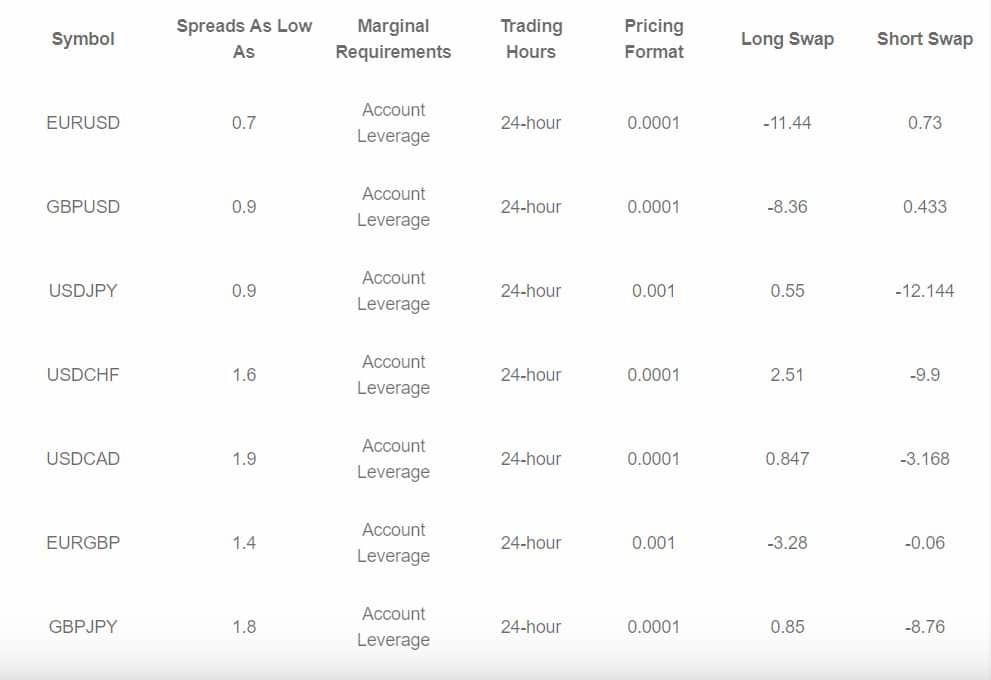

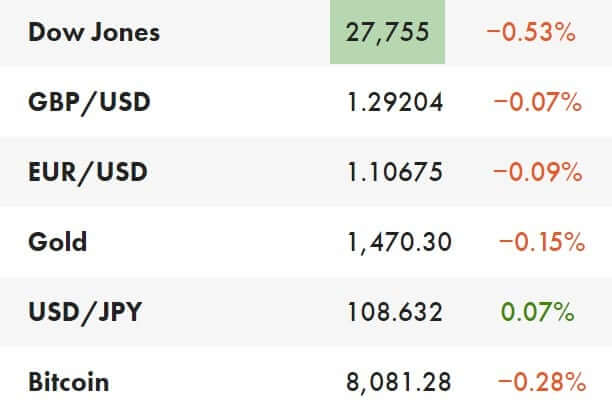

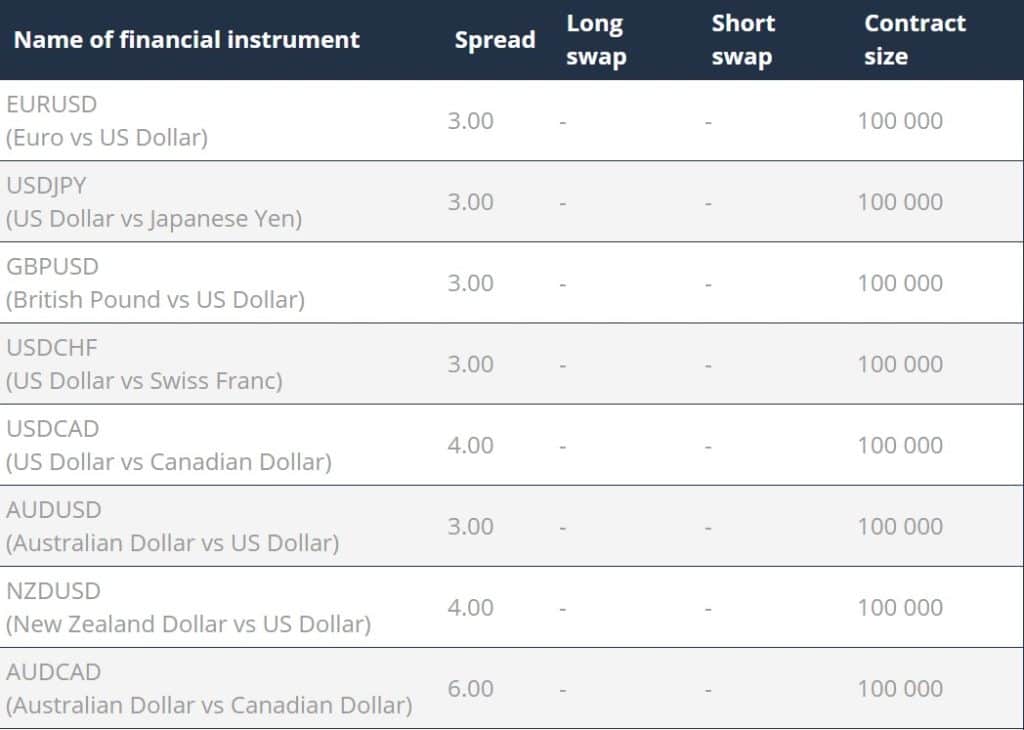

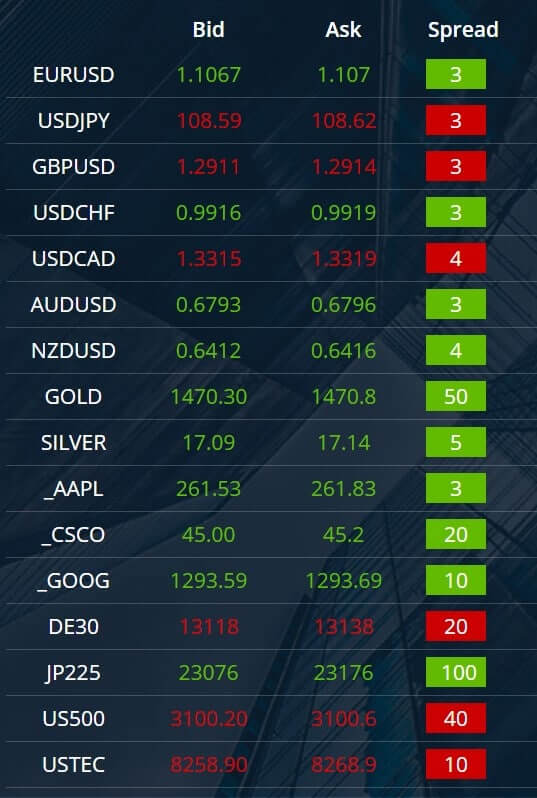

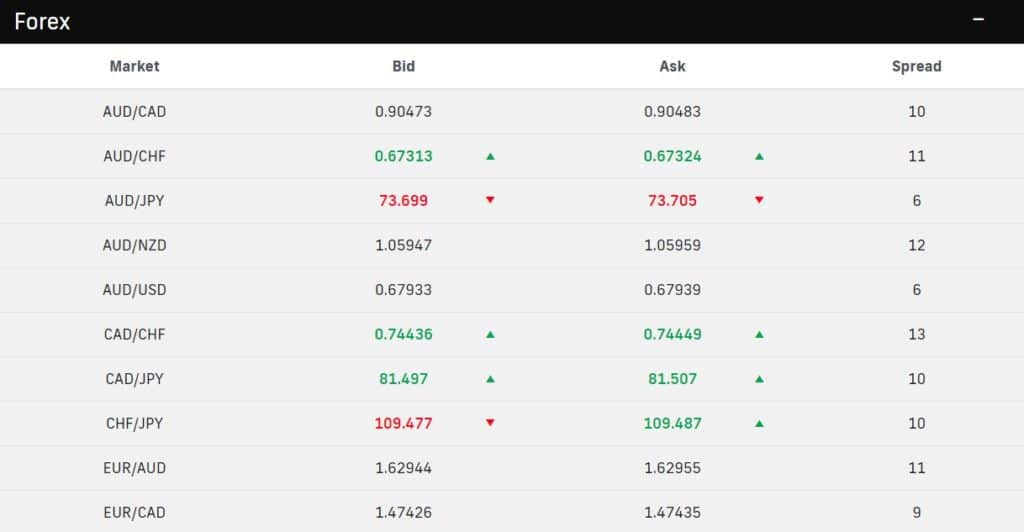

Spreads

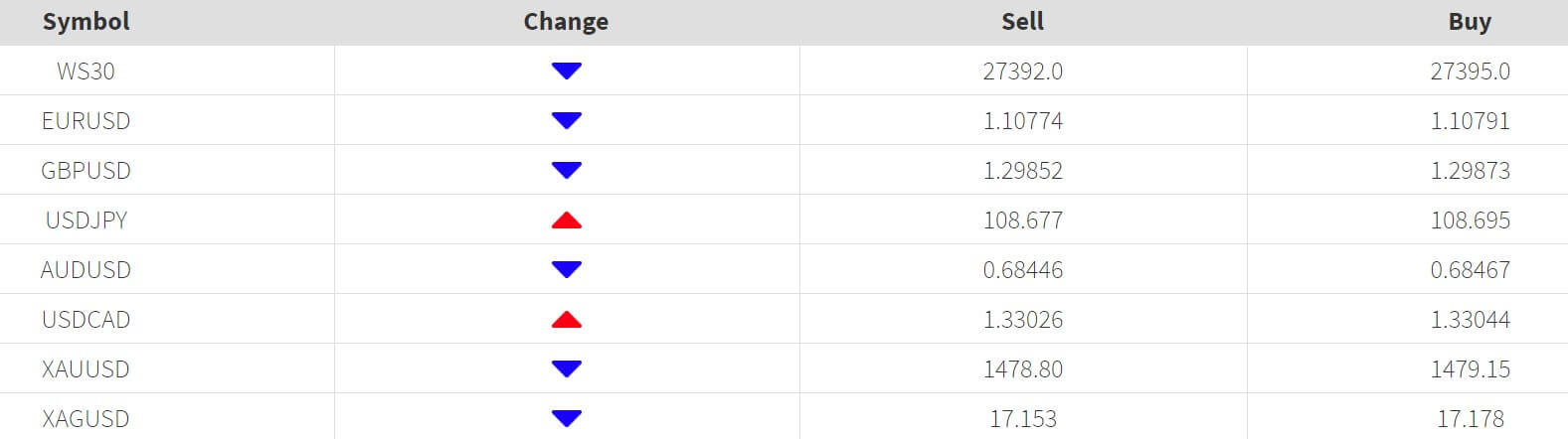

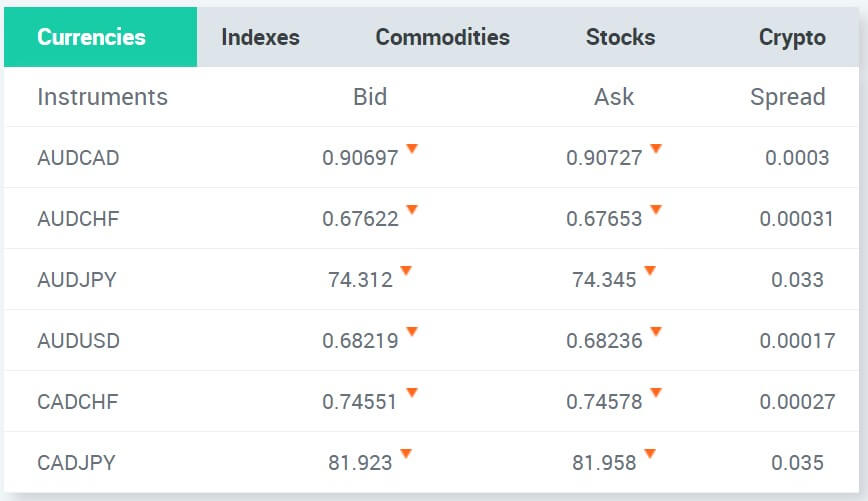

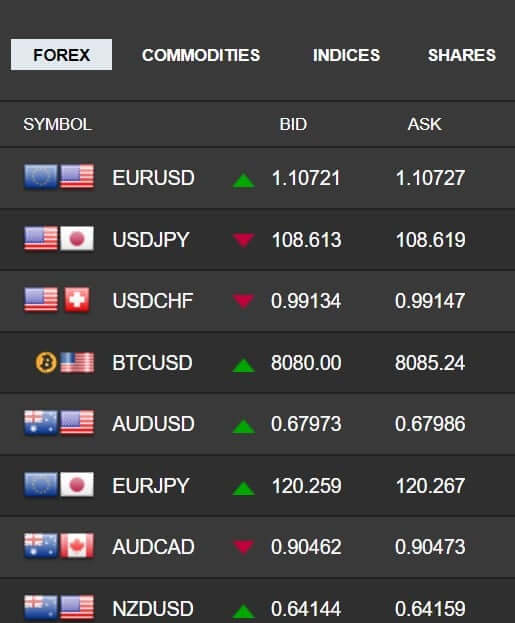

Varchev has floating spreads that are competitive. The tightest spread comes from the EUR/USD and USD/JPY at 8 points and there is a very small spread difference in the comparison of VAT and the MT5/4 platforms. The widest spread among the major forex group was with the GBP/CHF at 2.7 pips and GBP/NZD at 4 pips. The spread does not have high deviation so the spreads are competitive across all currency pairs. Exotics also had very competitive spreads, for example, EUR/CZK had 2.8 pips, USD/PLD 11.5 pips, and GBP/PLN 29.5 pips.

Spot Gold spread had a slight difference, VAT platform showed about 38 pips while MT4 was like fixed on 40 pips. Bitcoin/USD spread was around 34 pips in MT4/5 and almost double, 60 pips in the VAT. On the other hand, Etereum/USD has 40 pips spread in MT4/5 and 37 pips in VAT. For some coins the spread difference is more noticeable like for LTC/USD – 102 pips in VAT and 145 in MT4/5. When having this mixed trading environment, it is best to see what are the most traded assets and compare those among the platforms. Traders can also use both of them and select what is best of each although this will make management more complex.

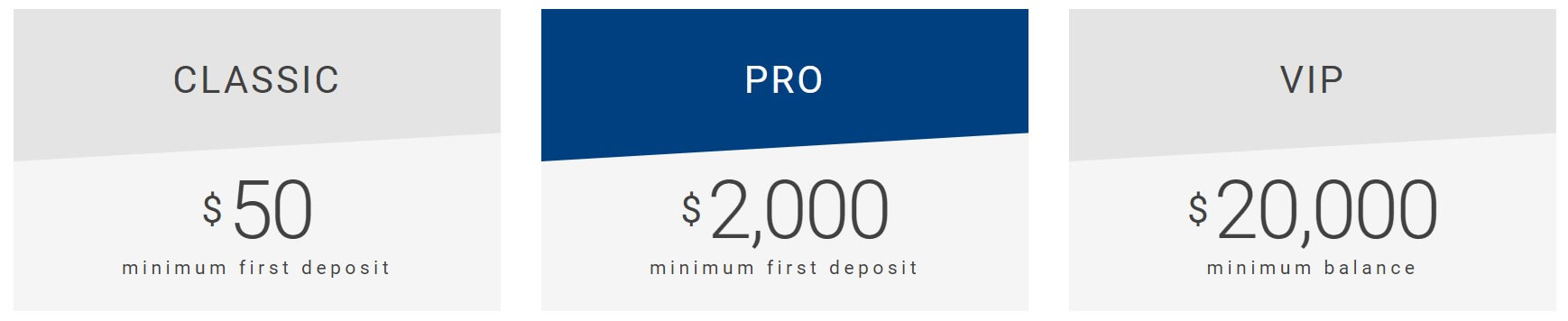

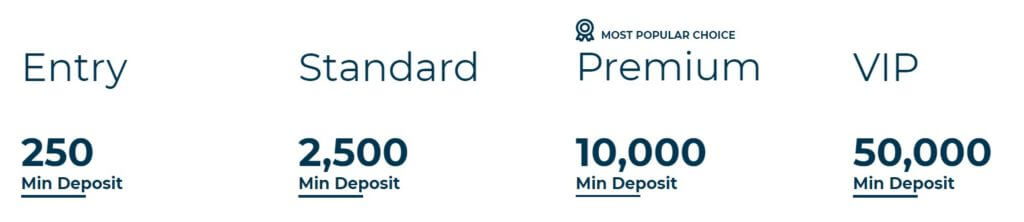

Minimum Deposit

Varchev website and the trading documents show different statements about the minimum deposit. On the website, the minimum is 200 USD/EUR/GBP or 400 BGN for all 3 Account types or platforms. Trading Conditions state no minimum is required. To make sure, we have confirmed with Varchev support that the true information is stated on the Trading Conditions website page. The VIP account requires a $50.000 minimum deposit which will allow negotiable trading conditions.

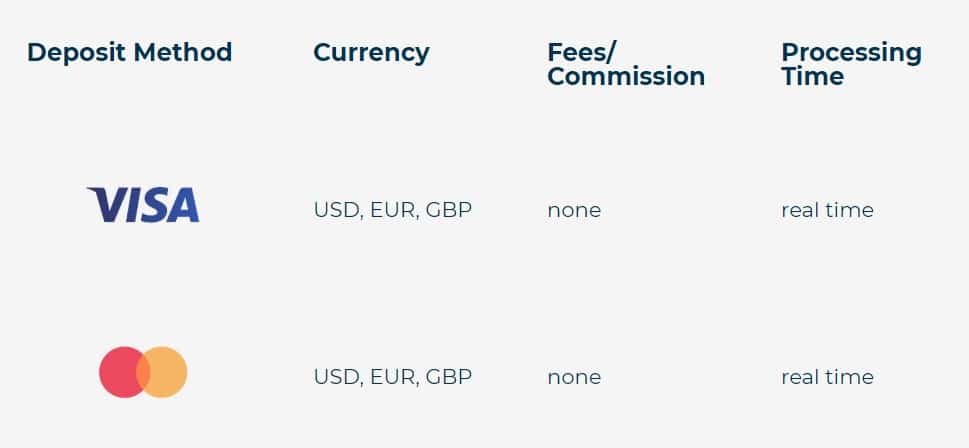

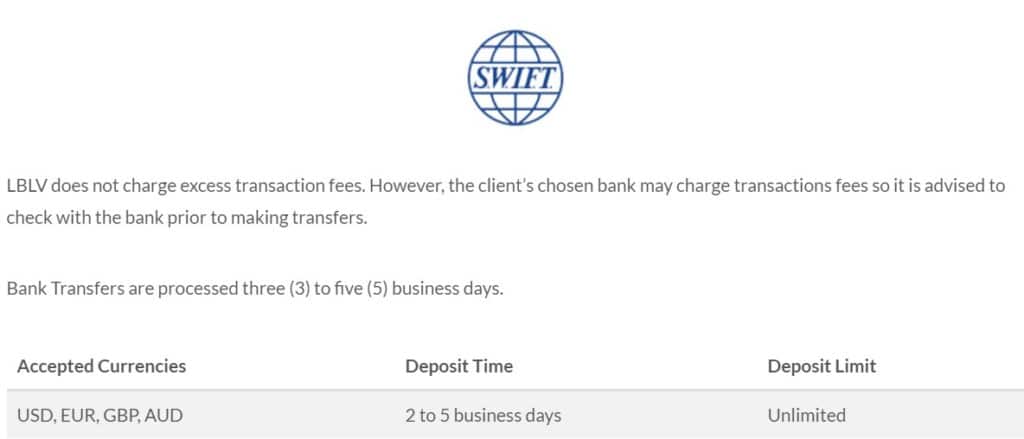

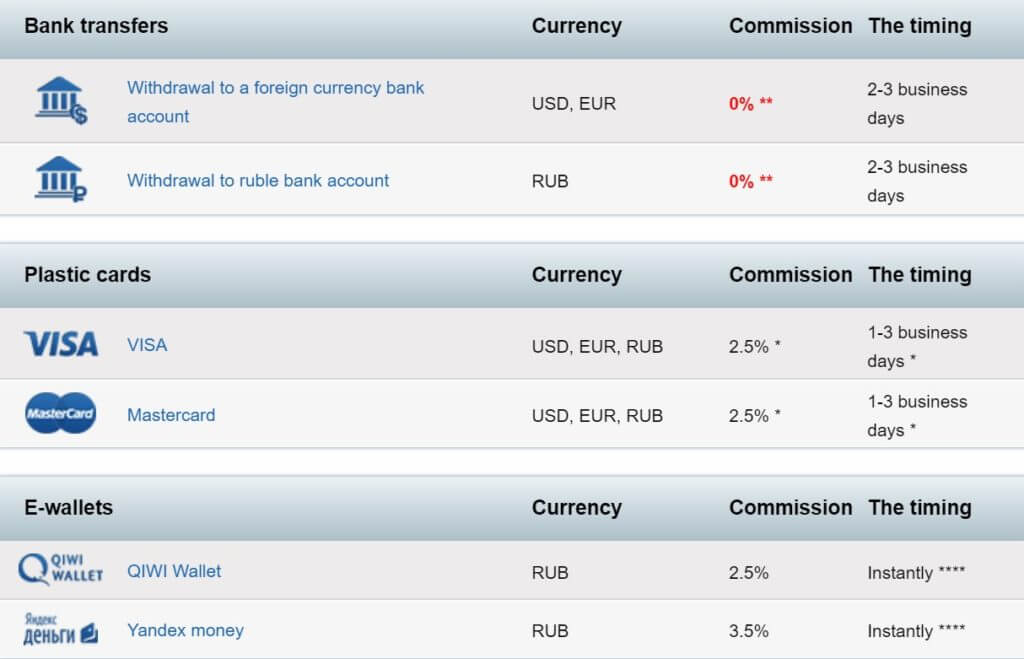

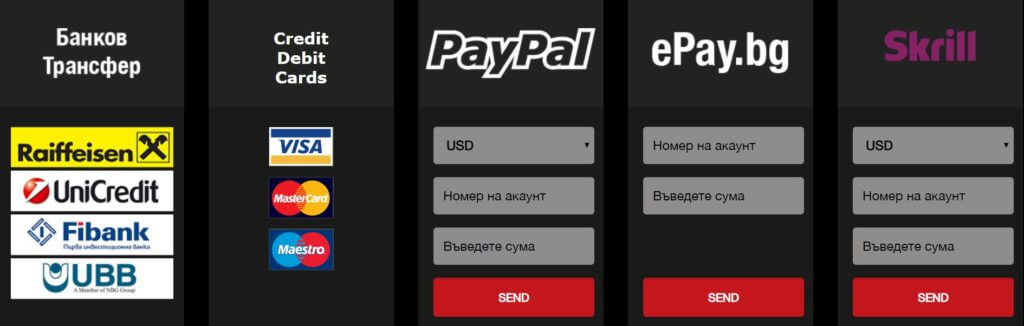

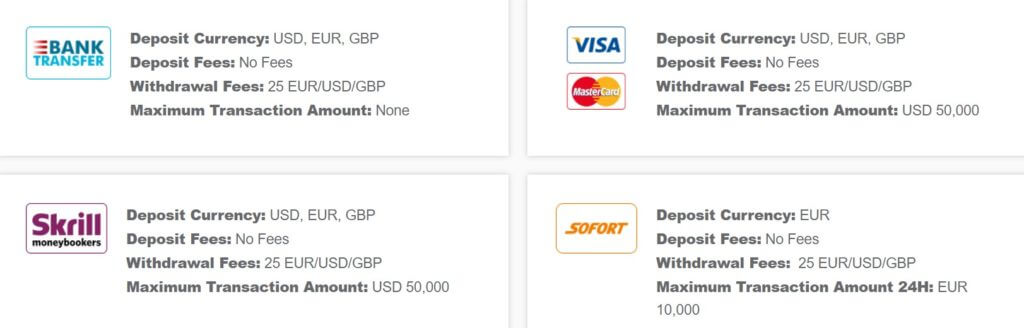

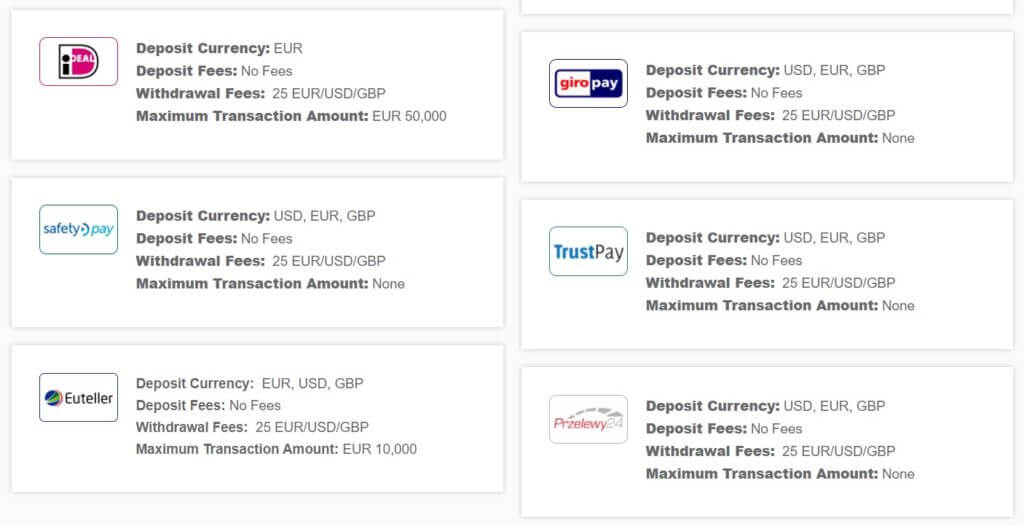

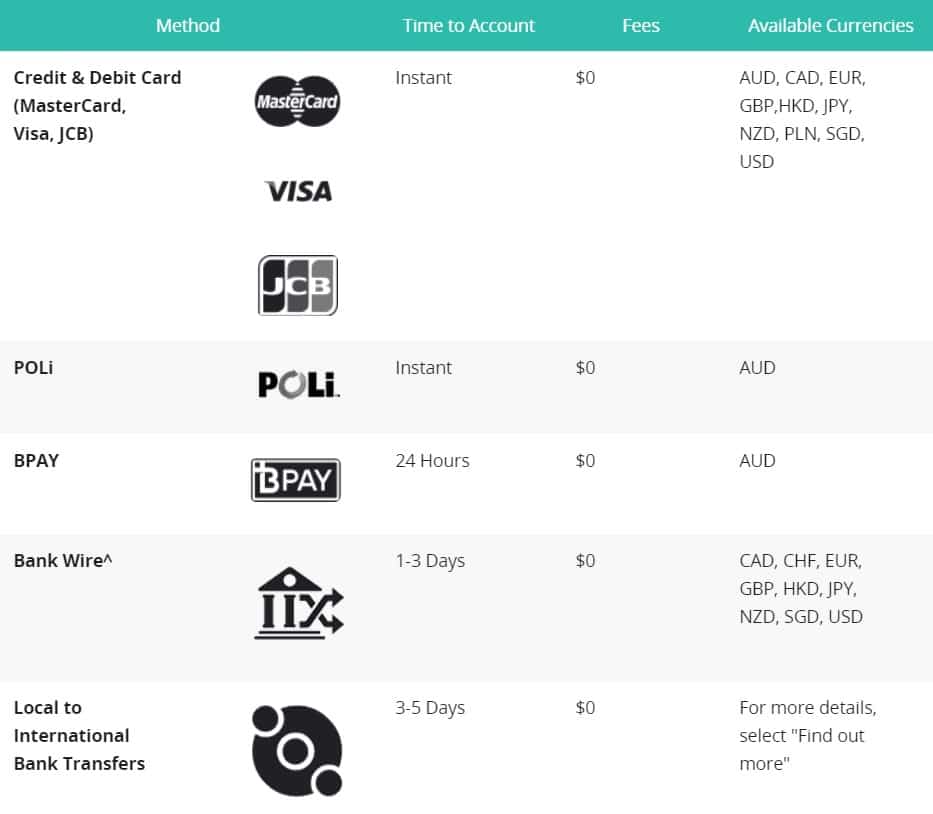

Deposit Methods & Costs

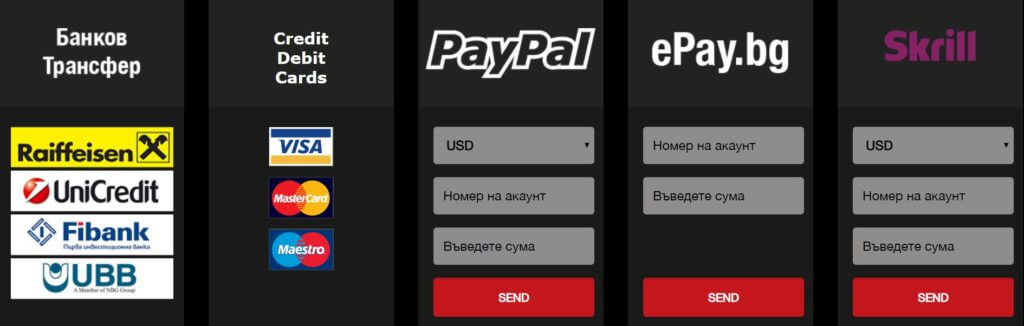

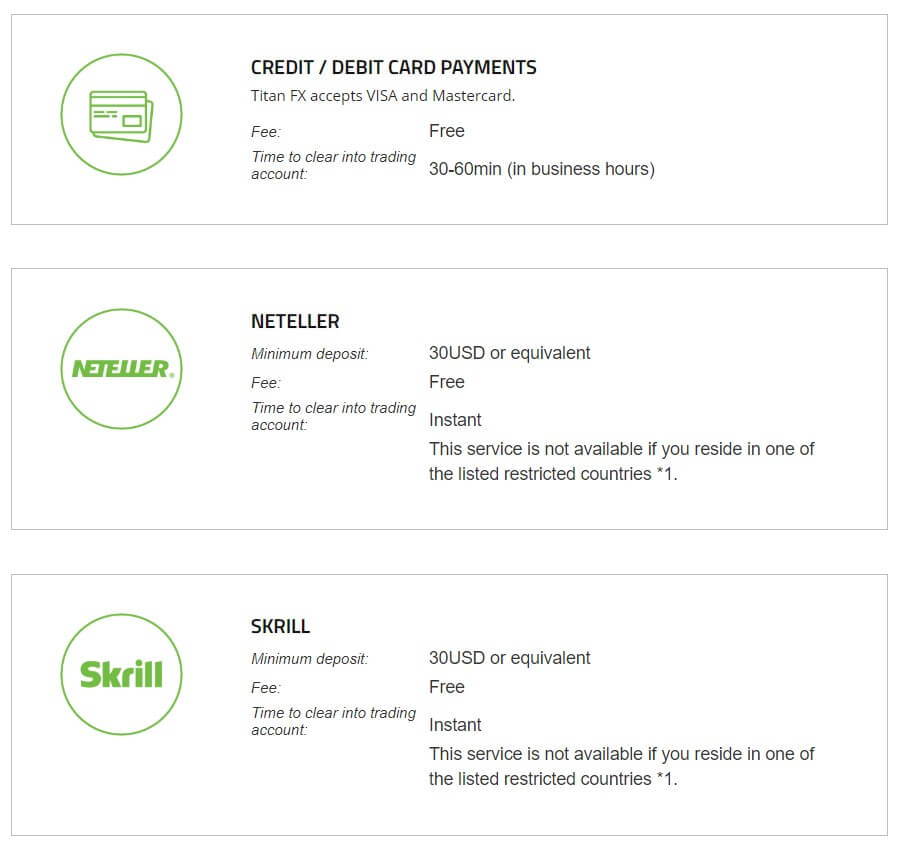

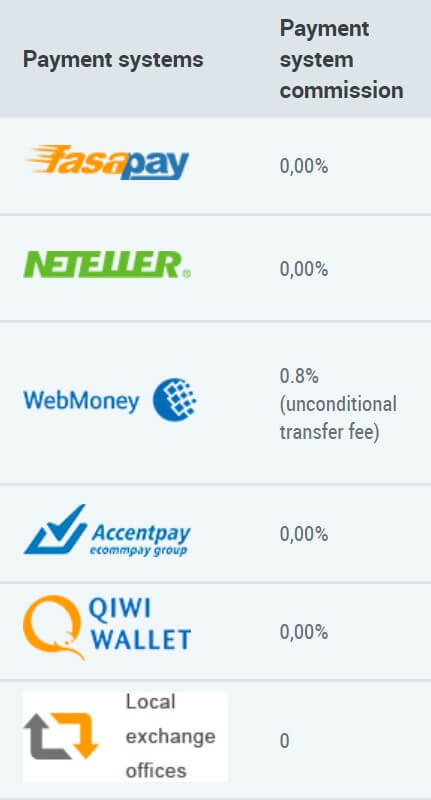

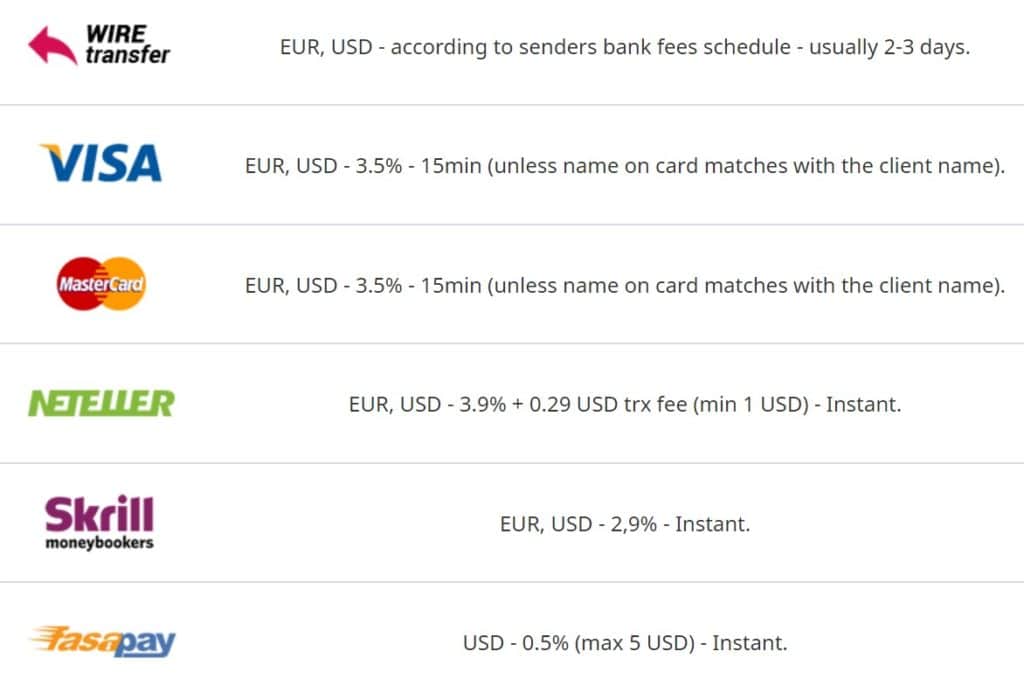

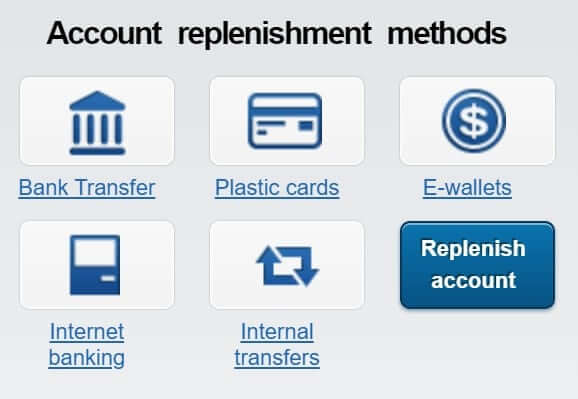

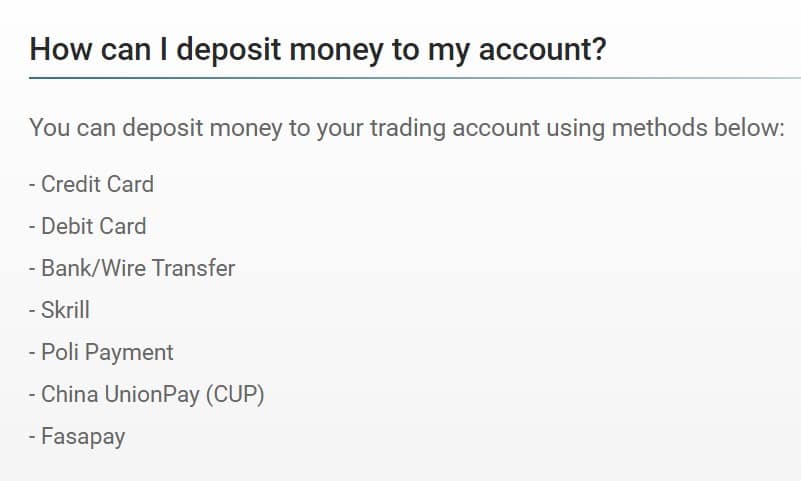

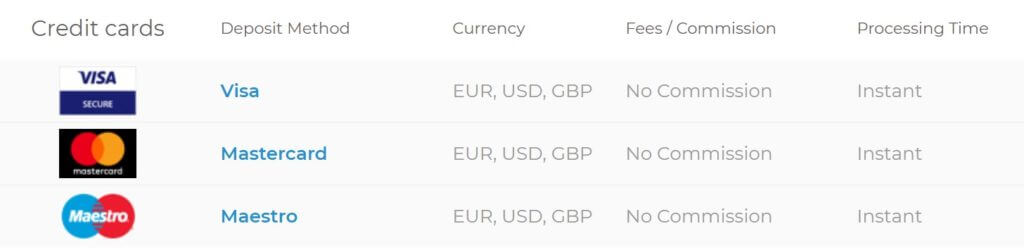

Varchev has a good range of methods of deposit. E-wallets supported are Skrill, Paypal, ePay.bg, Netteler, Giro pay, Itau, Ukash, and even Bitcoin. Whatsmore, traders can even deposit in cash within Varchev’s offices in Sofia and Varna. Aside from these, the usual deposit methods via Credit/Debit card and Bank Transfer exist. The costs will depend on the method used, Varchev will not charge any additional costs. As per the latest info from the Varchev support, Bitcoin deposits are not possible at the moment because of Netteler.

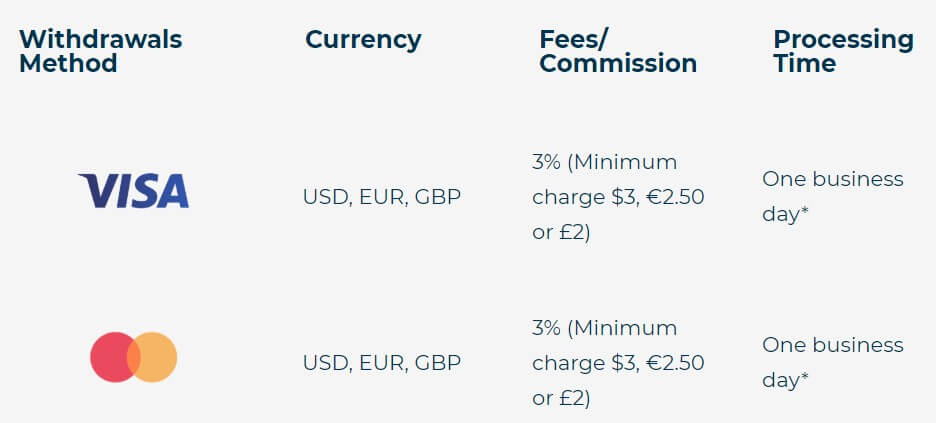

Withdrawal Methods & Costs

Varchev will use the same method as with the original deposit for withdrawals. For a bank transfer, it is required to download and print the withdrawal request form, sign it and send it to Varchev. Varchev does not charge any fees for withdrawals, all the cost associated with the withdrawal from third parties are carried over to the client. Not all withdrawal options will be available for every country the client comes from. In-hand cash withdrawal is possible with the commission of 0.5%.

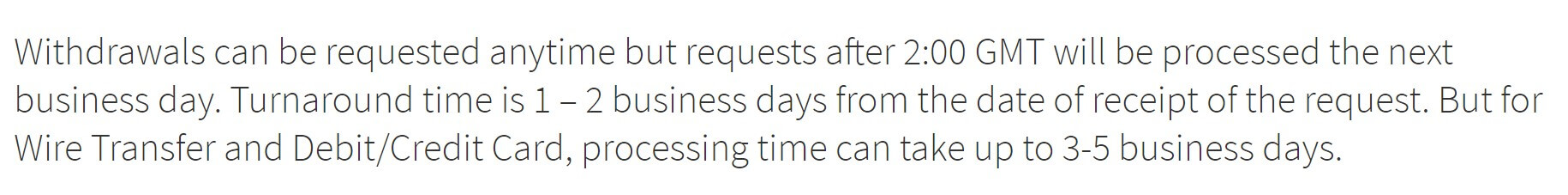

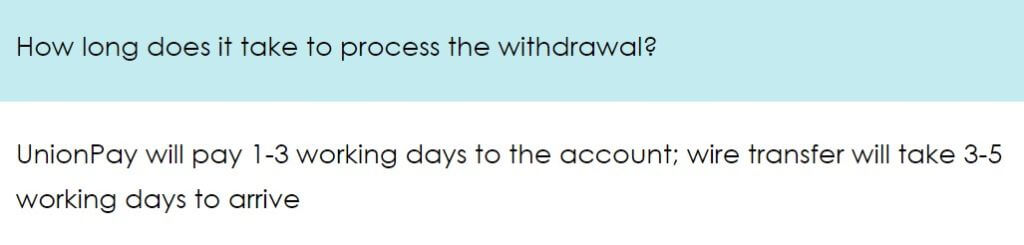

Withdrawal Processing & Wait Time

Varchev will process the withdrawal request in 24 hours. At the moment Varchev receives your withdrawal request, the broker will issue a wire transfer through a Bulgarian bank – within the day. If it is towards a foreign bank – 3 to 5 working days will be required. For e-wallets, this time is reduced and is usually within the same day of the withdrawal request.

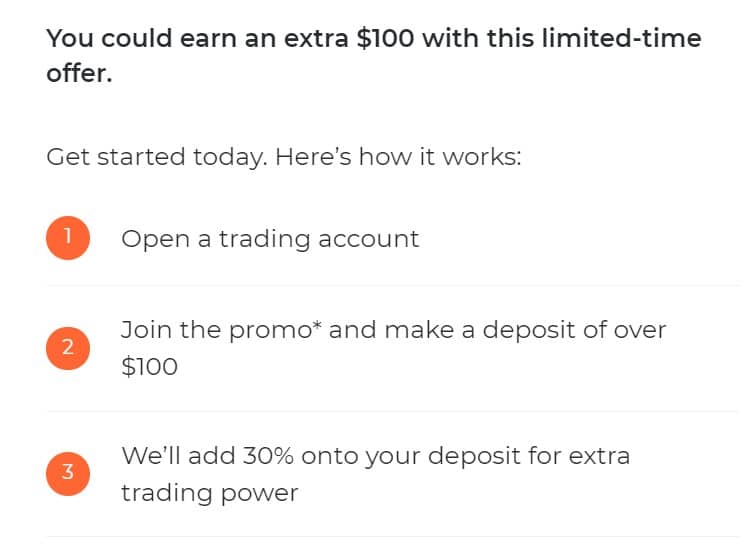

Bonuses & Promotions

ESMA restricts bonuses, as can been noticed with Varchev that offers bonuses only to professional traders classification. If a trader is accepted as a professional client, there are 3 kinds of bonuses Varchev offers.

Client Bonus is a classic addition of company funds to new real accounts. The structure is scaled to the initial deposit amount. Over $3000 – $250 bonus is applied, Over $10 000 – $1000 and over $50.000 the bonus can be negotiated as well as other trading conditions. The bonus follows the usual trading volume clause to become withdrawable. A client has to trade 10 lots for every $1 bonus, which is very high although there is no timeframe this has to be achieved. Withdrawals will reduce the bonus proportionally to the amount taken.

Cashback Bonus is not a rebate benefit but a reimbursement in case clients go into negative on the first trading day. $500 will be compensated or if the trader has a loss below $500, his account will be restored to the original amount.

Friend Bonus is a classic referral bonus of $100 that is awarded to both parties. The conditions are the minimum deposit of at least $1000, introduced trader has to trade at least 10 lots for you to receive $100, and the other $100 will be funded to the introduced trader after he trades another 10 lots. Introducing more than 10 clients in 6 months gives the ability to apply for Introducing Broker program.

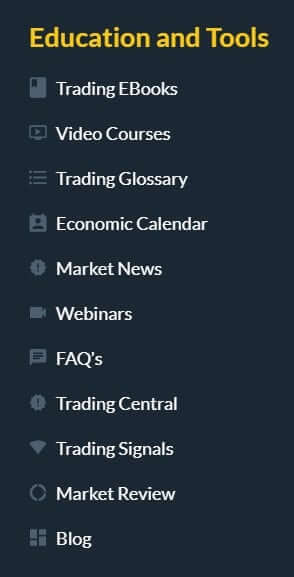

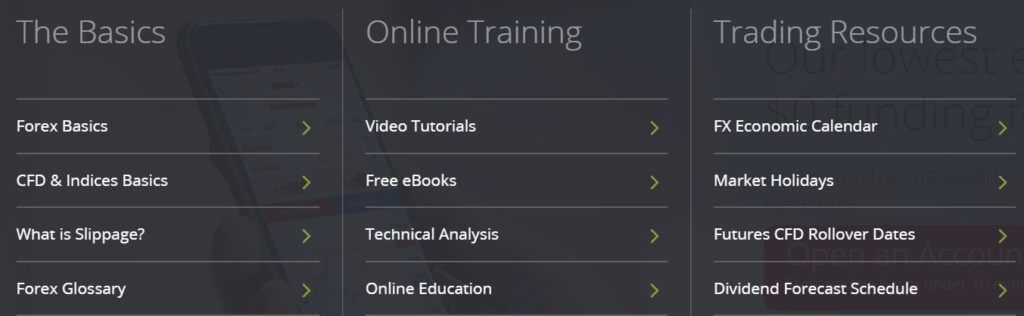

Educational & Trading Tools

Varchev features a special section for training. It consists of various categories of material, ranging from videos, ebooks and just fresh economic events. It is not well organized although the content is of good quality. Interesting is the “60 seconds with Biser Varchev” videos that explain interesting trading topics but it is not in English, YouTube has captions in English available though. Technical analysis features explanations on some advanced topics that are narrow in scope, like “Falling Knives” FX Strategy and how to use Varchev’s mentioned indicators already inserted in the MT4 platform. There is a lot of material to consume but finding what you need might be tedious.

The second section that could be regarded as an additional information tool is the Varchev Blog. This is a combo of tweets from the founder Biser Varchev and other social media content. Here you can see how Varchev is trading, his positions, and opinions, something other brokers do not do. This section is not frequently updated and 2 months gaps are not uncommon. On the same page, there is a contact form for directly asking questions to Varchev. FAQ section is not comprehensive enough and is separated dor different sections of the website.

Economic Calendar is not present although the VAT platform has it integrated.

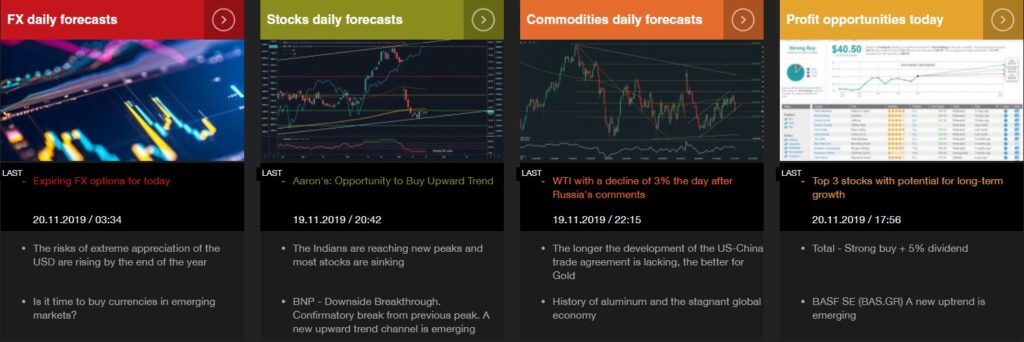

A lot of additional content is presented on the website homepage. This is a mix of in-house analysis, news, and tutorials. News windows are categorized by asset classes, so you can find Commodities news, Stocks Daily Forecasts, Market Rumors, Great Traders, Interest Rates, Trading Univesity and much more. This page is also one of the Varchevs selling points.

Varchev website also features a Currencies Exchange calculator. This calculator is specific because it lists offices in different parts of Bulgaria, adhering to different BLG exchange rates. There is also a crypto exchange office rates located in Bulgaria. Therefore, Varchev is also offering exchange services.

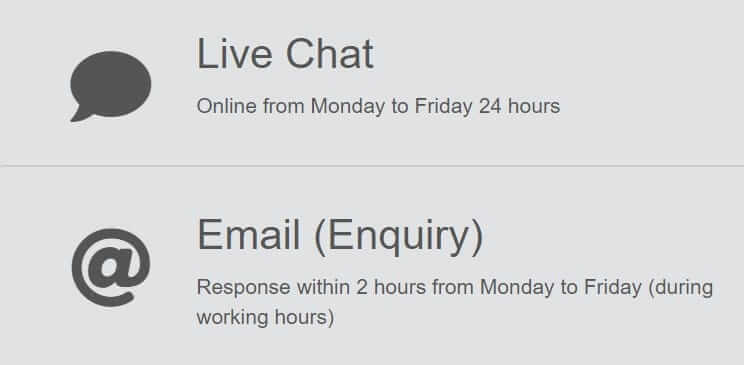

Customer Service

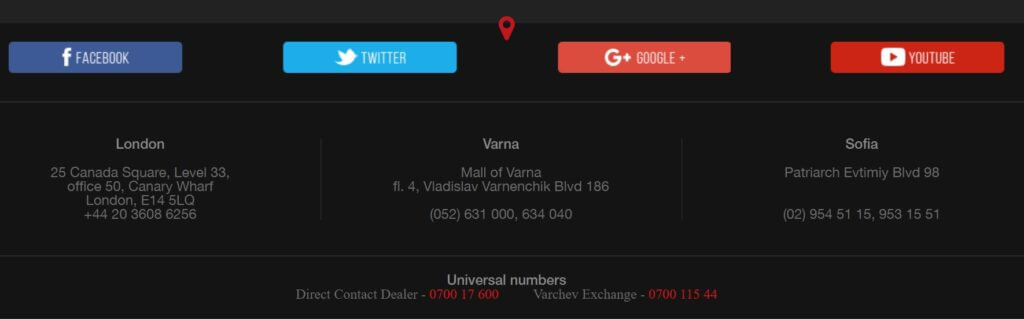

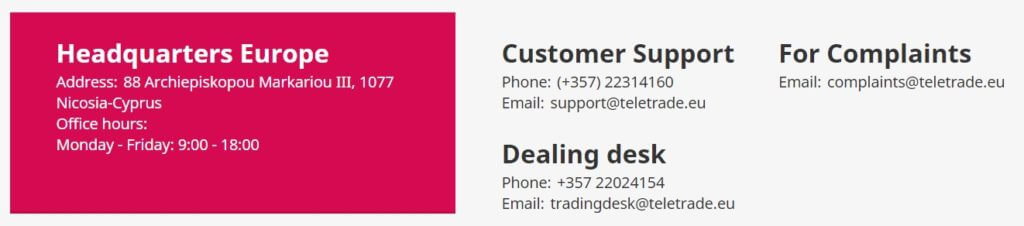

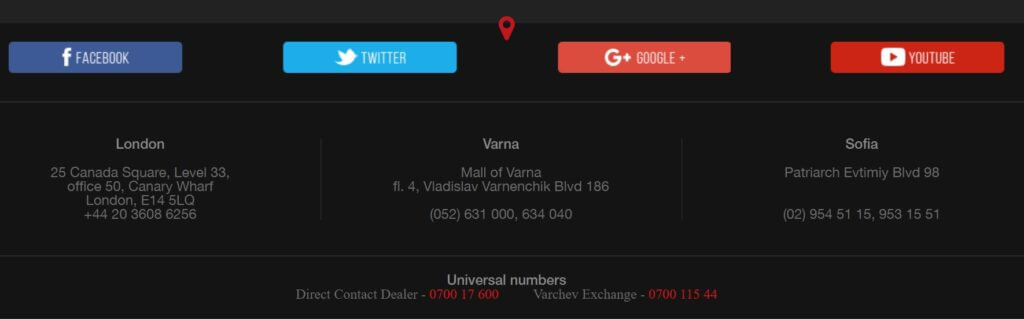

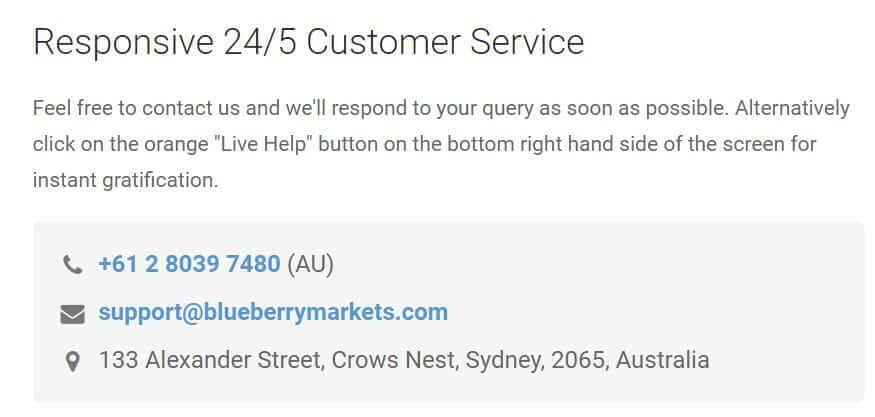

Varchev Customer service is 24/5 available through e-mail, contact form, chat, and Telegram group. The broker is also very active on social media. Chat service uses a unique client that features a chatting room where all Varchev treaders and staff can see and answer you. You will also see questions from other clients. Talking is possible as well as uploading a file. The staff is knowledgable and responsive within minutes, so you will not feel someone is giving full attention only to you.

Demo Account

The Demo account is encouraged all over the Varchev website. The demo does not have a time limit and is customizable in terms of leverage, currency, amount, and all the platform types. The Demo will correctly reflect real trading conditions in all platforms offered. The opening process is simplified and can be done through the MT4/5 terminal or by the standard e-mail credential procedure for the VAT platform.

Countries Accepted

Varchev does not show this information as all countries are accepted. Of course, this cannot be true since they are regulated. We are informed by the Varchev staff that the USA and Belgium are the currently prohibited countries.

Conclusion

Varchev ahs established good connections in London and with the XTB brokerage house especially. The VAT is based on XTB’s xStation platform that received a lot of rewards. The asset range is strangely similar to the XTB as this broker is just a proxy with a markup. Still, Varchev offers a lot of additional services like Investment Consulting, business plans, marketing analysis, enterprise processes optimization, opportunities for attracting equity, crisis management planning, tender preparation and more. Varchev also features Portfolio management for VIP clients and manages their Fund called High-Yield Fund. The Fund price chart is not that promising as it shows a negative number in the past two years. Whatsmore, the Fund assets diversification is heavily biased towards the Bulgarian market.

Varchev security rating is good enough as it is regulated in different jurisdictions by reputable FCA and less important FSA of Bulgaria. The broker adheres to MiFID directives, has segregated funds within multiple banks and features Investor Compensation Fund that protects clients funds with 20.000 EUR pool. Most experts think this pool is far from enough to cover everyone’s losses in case of broker default.

Varchev does not have any rating on benchmarking sites, as completely unpopular worldwide despite the well-developed structure. The rating on other social media has less weight although is mostly positive and from Bulgarian clients.

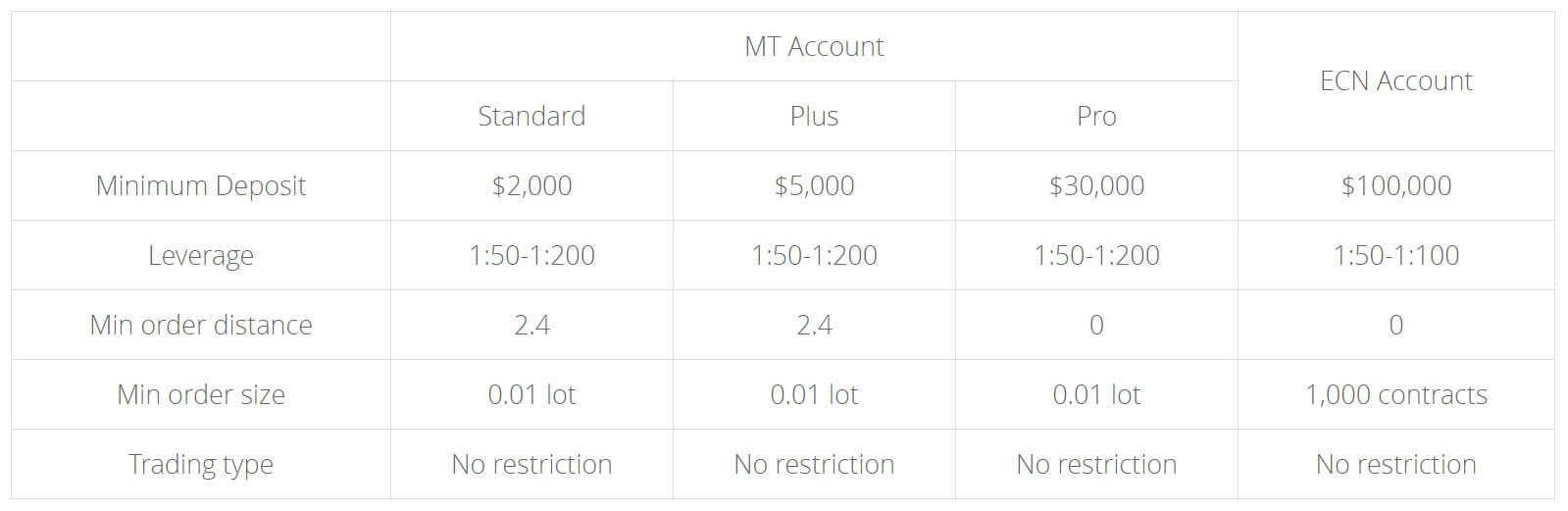

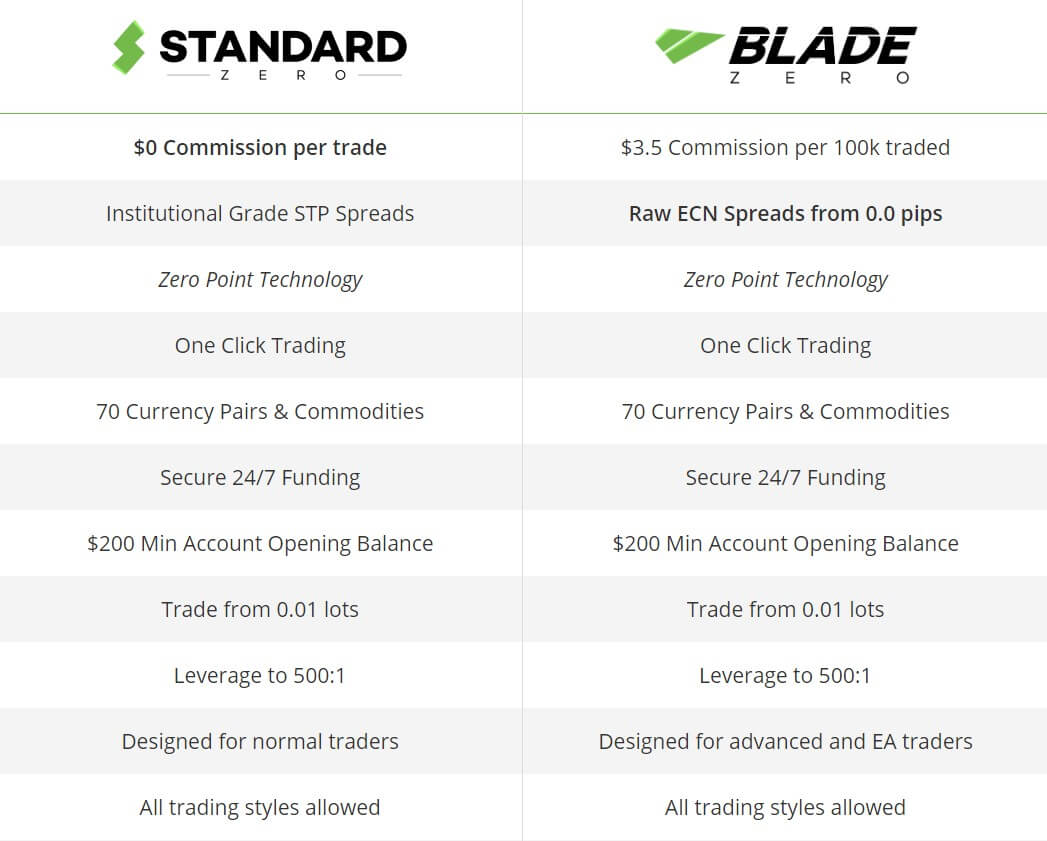

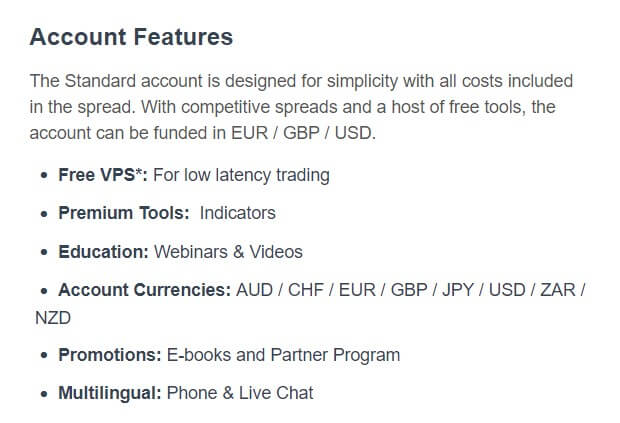

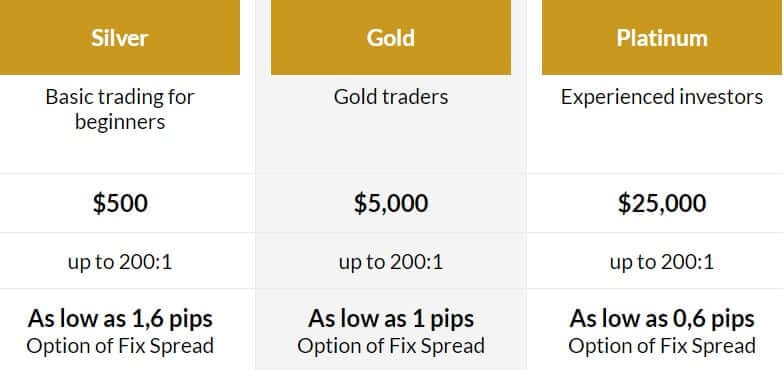

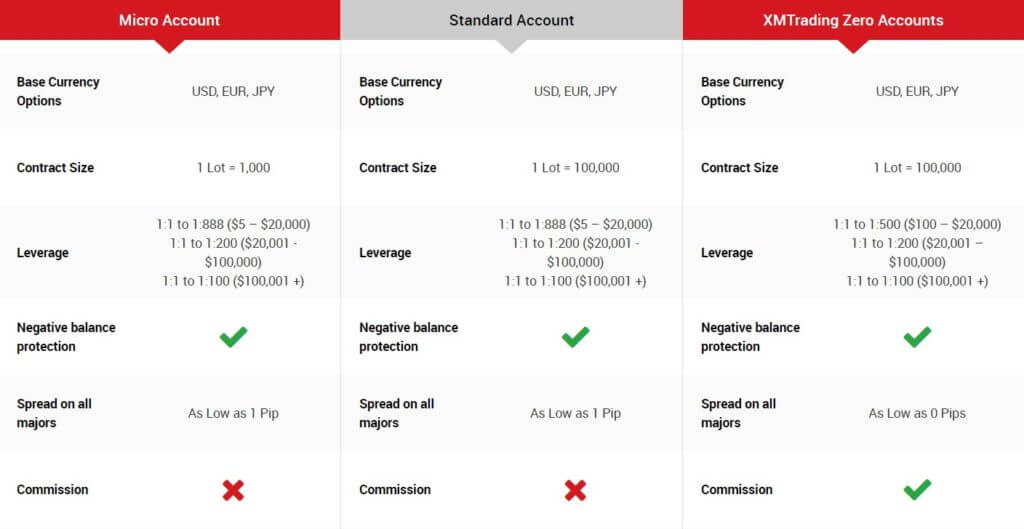

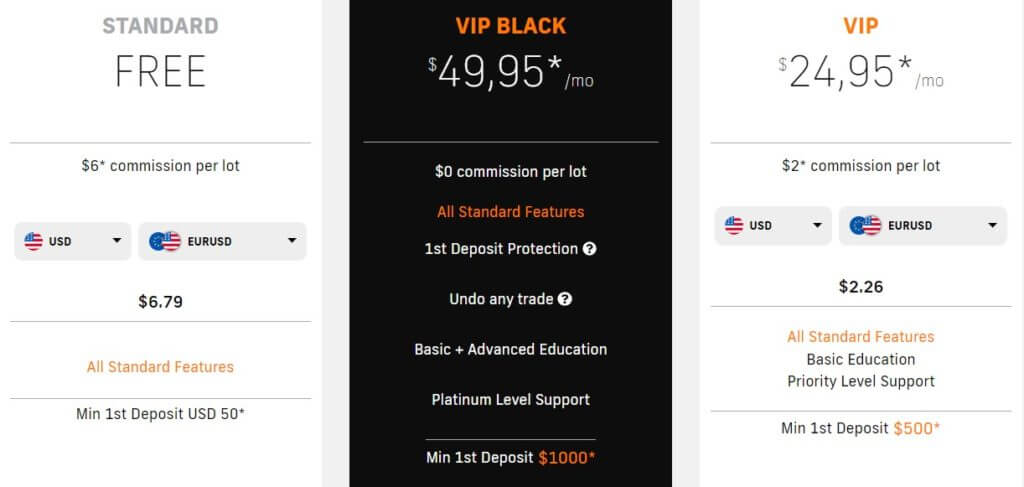

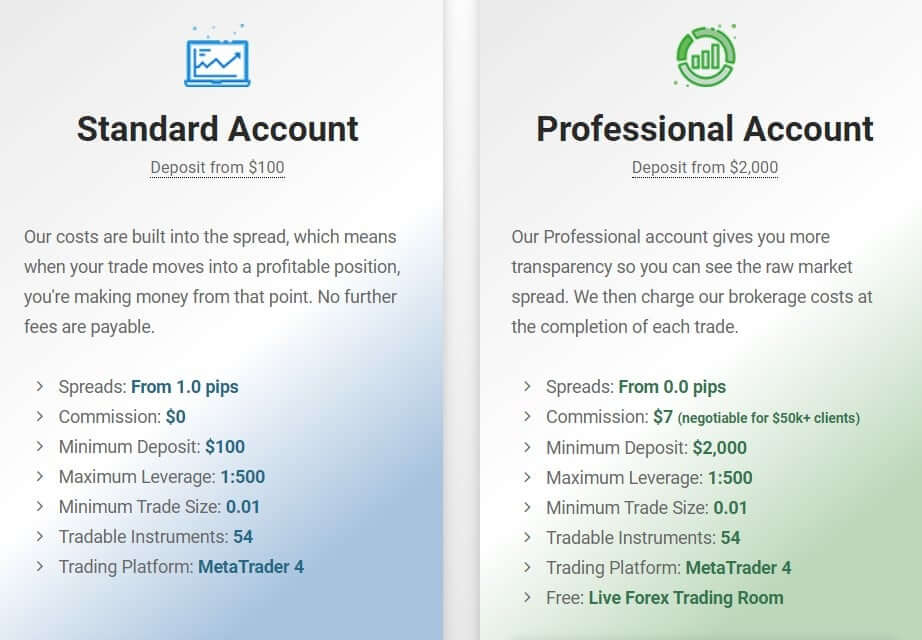

Standard Account: The standard account is the entry-level account from Global Market Index, it has a minimum deposit amount of $2,000 which is quite high for an entry-level account. It has a leverage of between 1:50 and 1:200 and its minimum order size is 0.01 lots. Any orders either buy or sell must be made at least 2.4 pips away from the current market position and there are no restrictions when it comes to trading styles.

Standard Account: The standard account is the entry-level account from Global Market Index, it has a minimum deposit amount of $2,000 which is quite high for an entry-level account. It has a leverage of between 1:50 and 1:200 and its minimum order size is 0.01 lots. Any orders either buy or sell must be made at least 2.4 pips away from the current market position and there are no restrictions when it comes to trading styles.

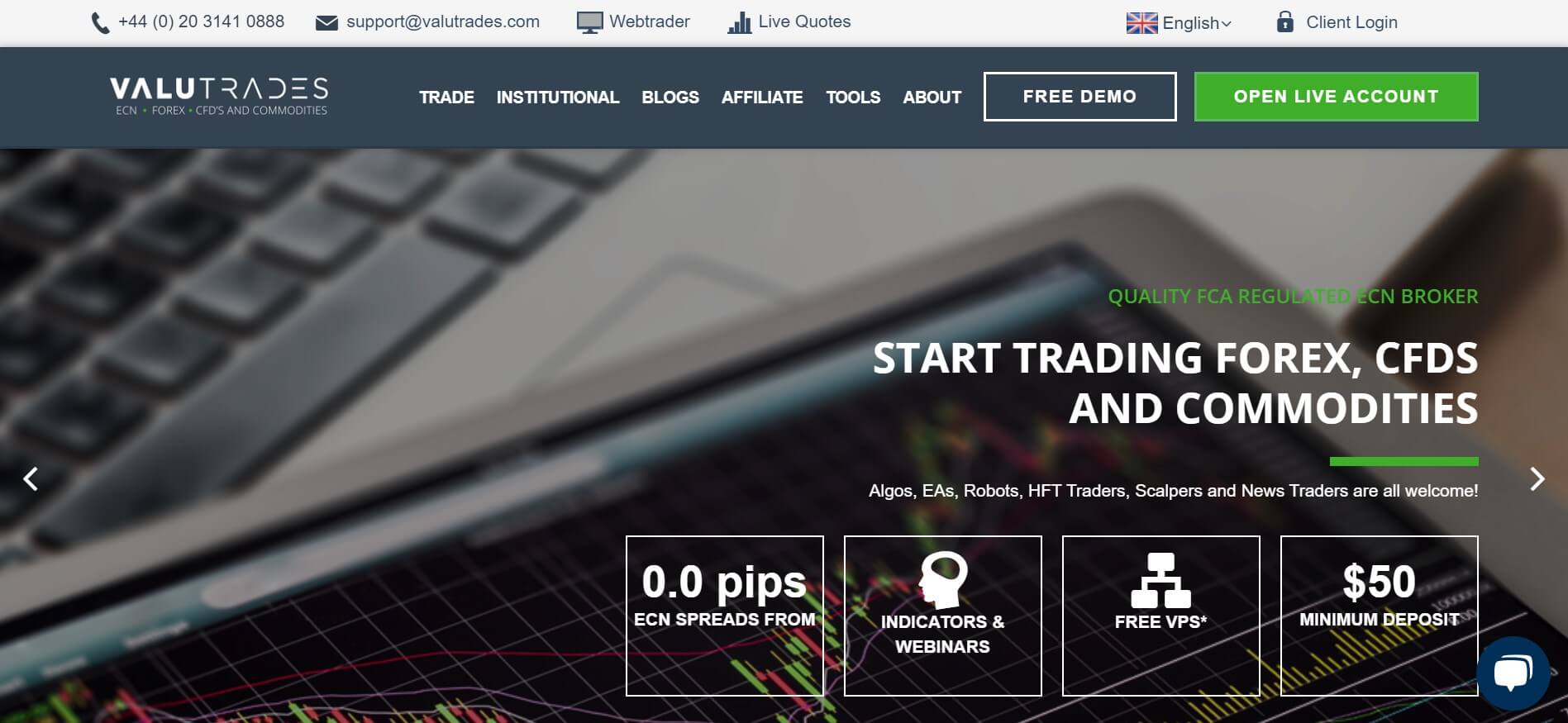

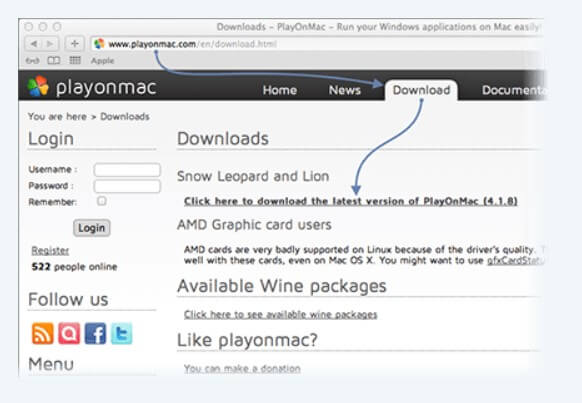

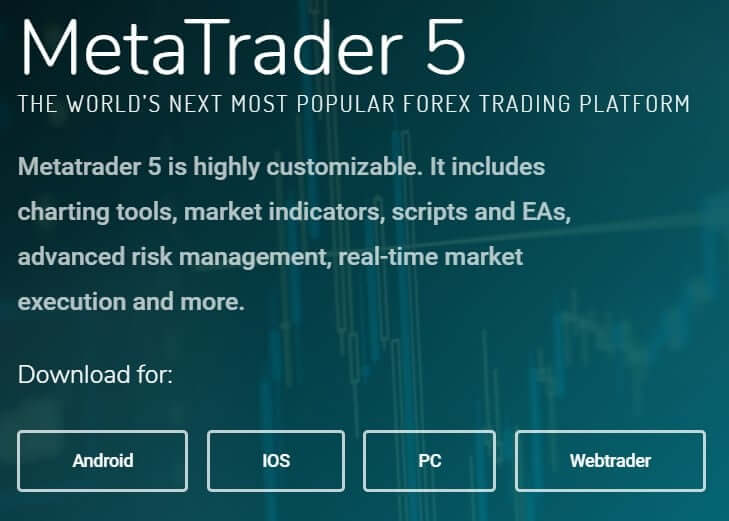

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more.

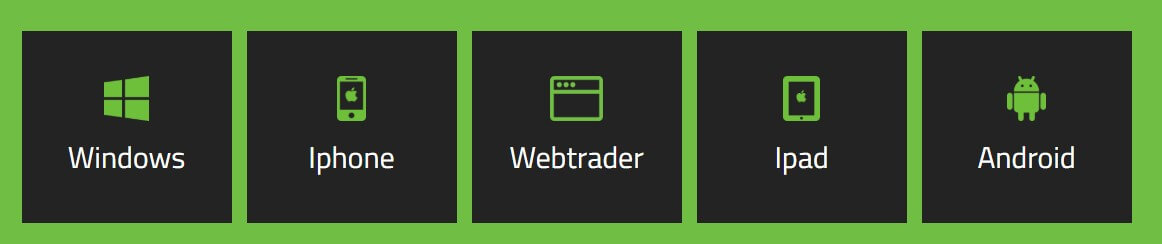

MT5 builds on its predecessor’s features and adds more pending order types, an improved strategy tester for EAs, a built-in economic calendar, and greater flexibility for different trading styles. Both MT4 and MT5 are highly accessible, available through download on PC, Mac, Android, or through Google Play for iPhone/iPad. These platforms can also be accessed through the browser-based WebTrader. Moving on, we were interested to get more of an in-depth look at the Iress platform, since this broker markets three account types around this trading platform.

MT5 builds on its predecessor’s features and adds more pending order types, an improved strategy tester for EAs, a built-in economic calendar, and greater flexibility for different trading styles. Both MT4 and MT5 are highly accessible, available through download on PC, Mac, Android, or through Google Play for iPhone/iPad. These platforms can also be accessed through the browser-based WebTrader. Moving on, we were interested to get more of an in-depth look at the Iress platform, since this broker markets three account types around this trading platform.

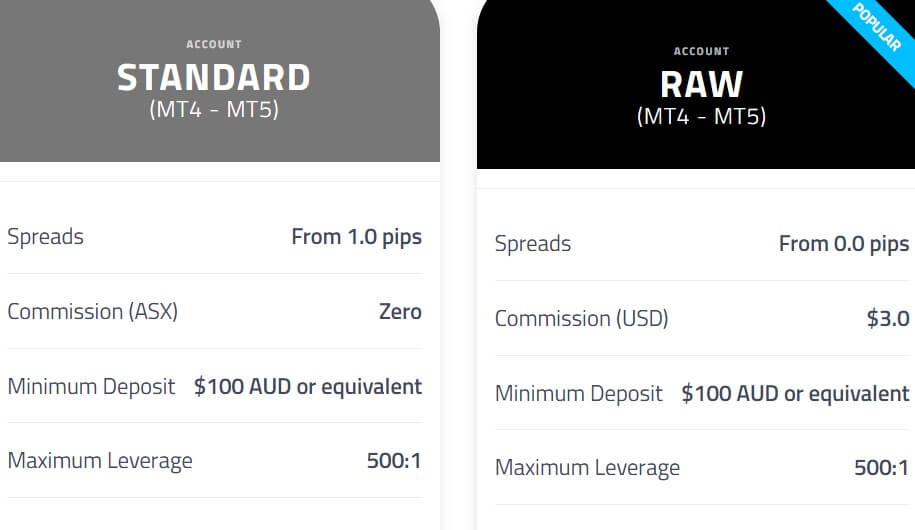

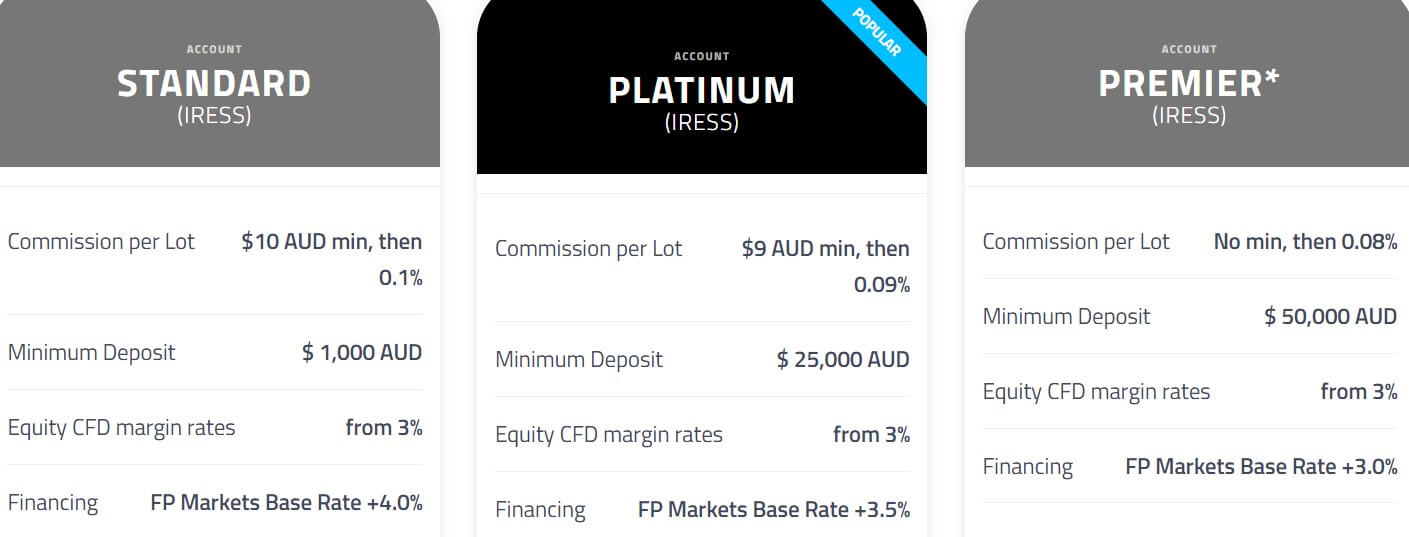

Available markets include Forex, Equities, Metals, Commodities, Indices, and Cryptocurrency CFDs. All options are available on Iress accounts, while both MT4/MT5 centered accounts limit the options to FX pairs, Metals, Indices, and Commodities. The broker advertises 70 currency pairs as being available; however, we only counted 52 available instruments ourselves, all of which were made up of majors, minors, and exotics. Trading Metals is available with leverage of up to 500:1 on

Available markets include Forex, Equities, Metals, Commodities, Indices, and Cryptocurrency CFDs. All options are available on Iress accounts, while both MT4/MT5 centered accounts limit the options to FX pairs, Metals, Indices, and Commodities. The broker advertises 70 currency pairs as being available; however, we only counted 52 available instruments ourselves, all of which were made up of majors, minors, and exotics. Trading Metals is available with leverage of up to 500:1 on

Royal Financial Trading offers both the well known and trusted MetaTrader 4 as well as ZuluTrade PLatform which gives clients access to smaller spreads. Both platforms are amicable but bear in mind that the Classic account is limited to the use of MT4 and web trader only.

Royal Financial Trading offers both the well known and trusted MetaTrader 4 as well as ZuluTrade PLatform which gives clients access to smaller spreads. Both platforms are amicable but bear in mind that the Classic account is limited to the use of MT4 and web trader only.

Royal Financial Trading offers the following methods to their clients for withdrawals: Bank Card, Bank Wire, Skrill or Neteller. Royal Financial Trading covers the fee for the client if the withdrawal is less than $50. Above that, you could be subject to a 2.5% conversion fee in addition to any transaction fee while Neteller and Skrill charge 2% to return funds to your Skrill/Neteller account. Lastly, Bank Card/ Wire (Domestic AUD transfers) do not incur any fees. All other international transfers and currencies will attract fees that are charged by the bank, so ensure you speak with your bank first to understand what you may be charged.

Royal Financial Trading offers the following methods to their clients for withdrawals: Bank Card, Bank Wire, Skrill or Neteller. Royal Financial Trading covers the fee for the client if the withdrawal is less than $50. Above that, you could be subject to a 2.5% conversion fee in addition to any transaction fee while Neteller and Skrill charge 2% to return funds to your Skrill/Neteller account. Lastly, Bank Card/ Wire (Domestic AUD transfers) do not incur any fees. All other international transfers and currencies will attract fees that are charged by the bank, so ensure you speak with your bank first to understand what you may be charged.

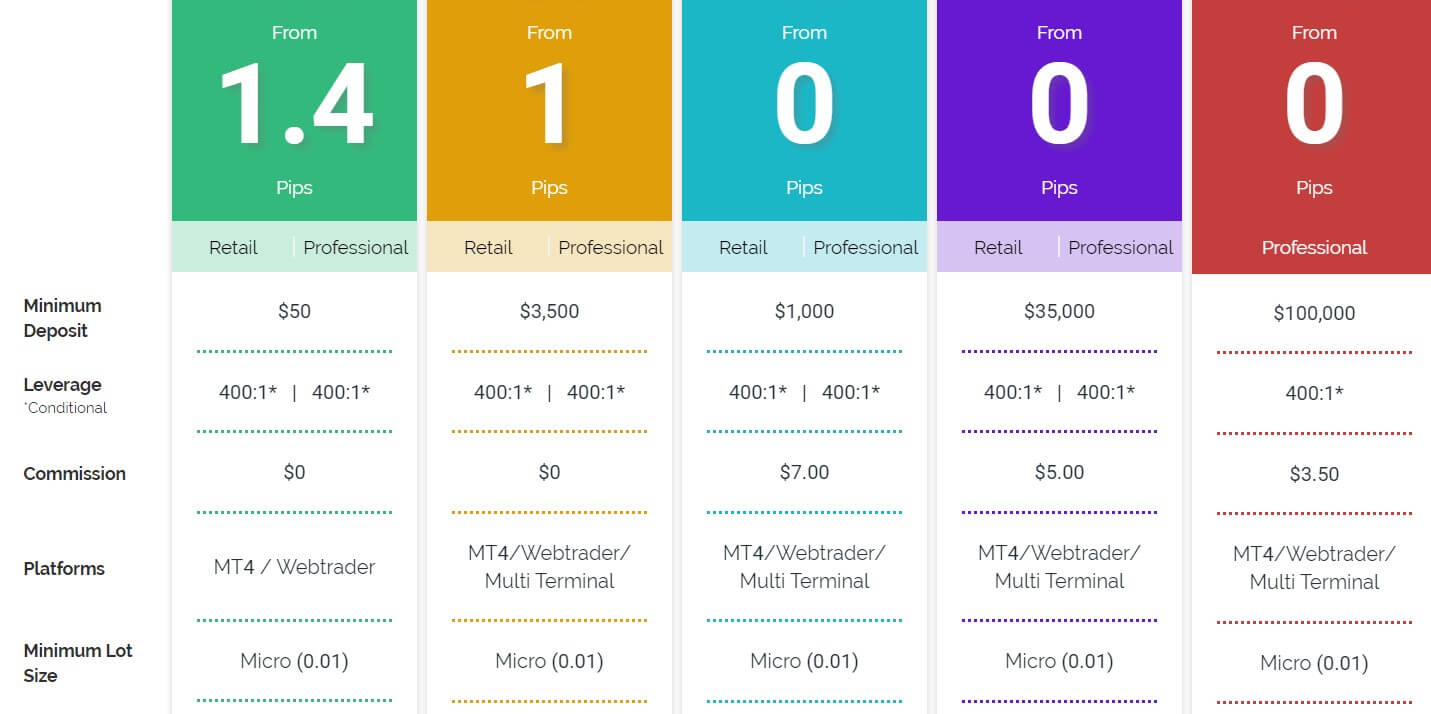

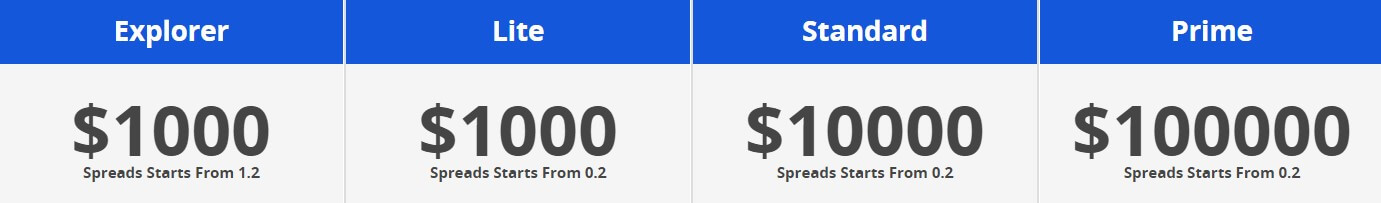

Lite Account has increased deposit requirement and it is different from the Explorer Account by tighter spreads and the included commission. As we go to the next tier, Standard Account has further increased deposit requirement, lower commission but the spread is the same. The leverage is reduced and also the trading sizes are bigger. The final, Prime Account has a very big deposit requirement and the smallest commission of them all. Trade sizes are increased and the leverage is further reduced.

Lite Account has increased deposit requirement and it is different from the Explorer Account by tighter spreads and the included commission. As we go to the next tier, Standard Account has further increased deposit requirement, lower commission but the spread is the same. The leverage is reduced and also the trading sizes are bigger. The final, Prime Account has a very big deposit requirement and the smallest commission of them all. Trade sizes are increased and the leverage is further reduced.

BlueMax has a few deposit methods, one of which is via Bitcoin and Ethereum. Bank Transfer fees depend on the depositor’s bank, the deposit process will take 3 to 5 days. Card deposits will induce a 3% transaction fee and will take 1 to 2 days to be completed. Netteler deposits should be faster but the broker will need 1 day to process the funds. A fee of 2.5% will apply. Skrill is similar to Netteler but with an increased fee to 2.8%.

BlueMax has a few deposit methods, one of which is via Bitcoin and Ethereum. Bank Transfer fees depend on the depositor’s bank, the deposit process will take 3 to 5 days. Card deposits will induce a 3% transaction fee and will take 1 to 2 days to be completed. Netteler deposits should be faster but the broker will need 1 day to process the funds. A fee of 2.5% will apply. Skrill is similar to Netteler but with an increased fee to 2.8%.

The User Guide is an addition on how to use the MT4 platform, PAMM features and guides, IB program introduction, how to deposit and withdraw and some other articles that are mostly marketing content.

The User Guide is an addition on how to use the MT4 platform, PAMM features and guides, IB program introduction, how to deposit and withdraw and some other articles that are mostly marketing content.

Conclusion

Conclusion

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors,

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors,

Credit / Debit Card (Visa and MasterCard): Deposits over $100 there will be a fee of 2% + EUR 0.24 (or equivalent) and for international cards there will be a fee of 2.5% + EUR 0.24 (or equivalent). For deposits under $100, there will be an additional service charge of $10 (or equivalent). The maximum daily deposit limit is $15,000 (or equivalent).

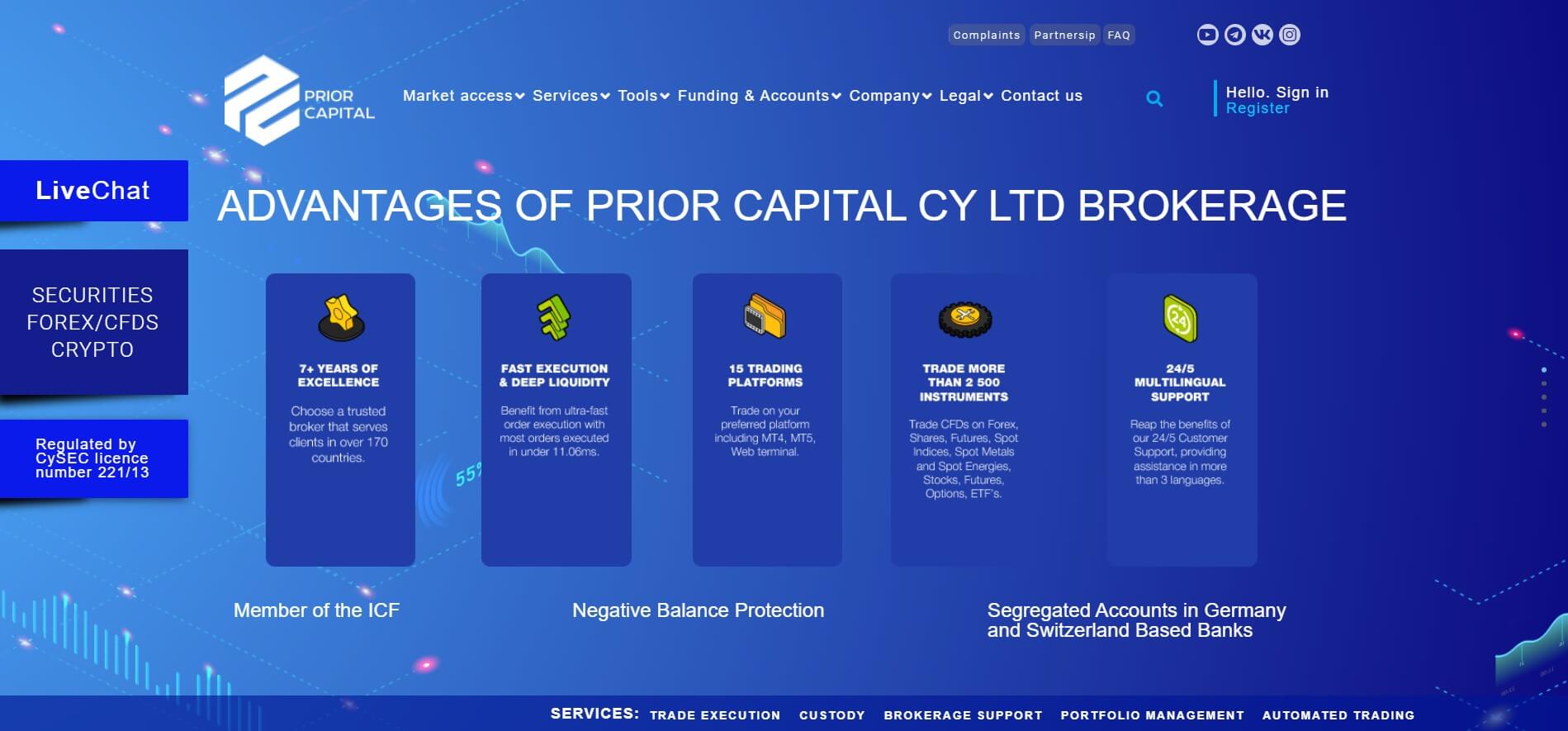

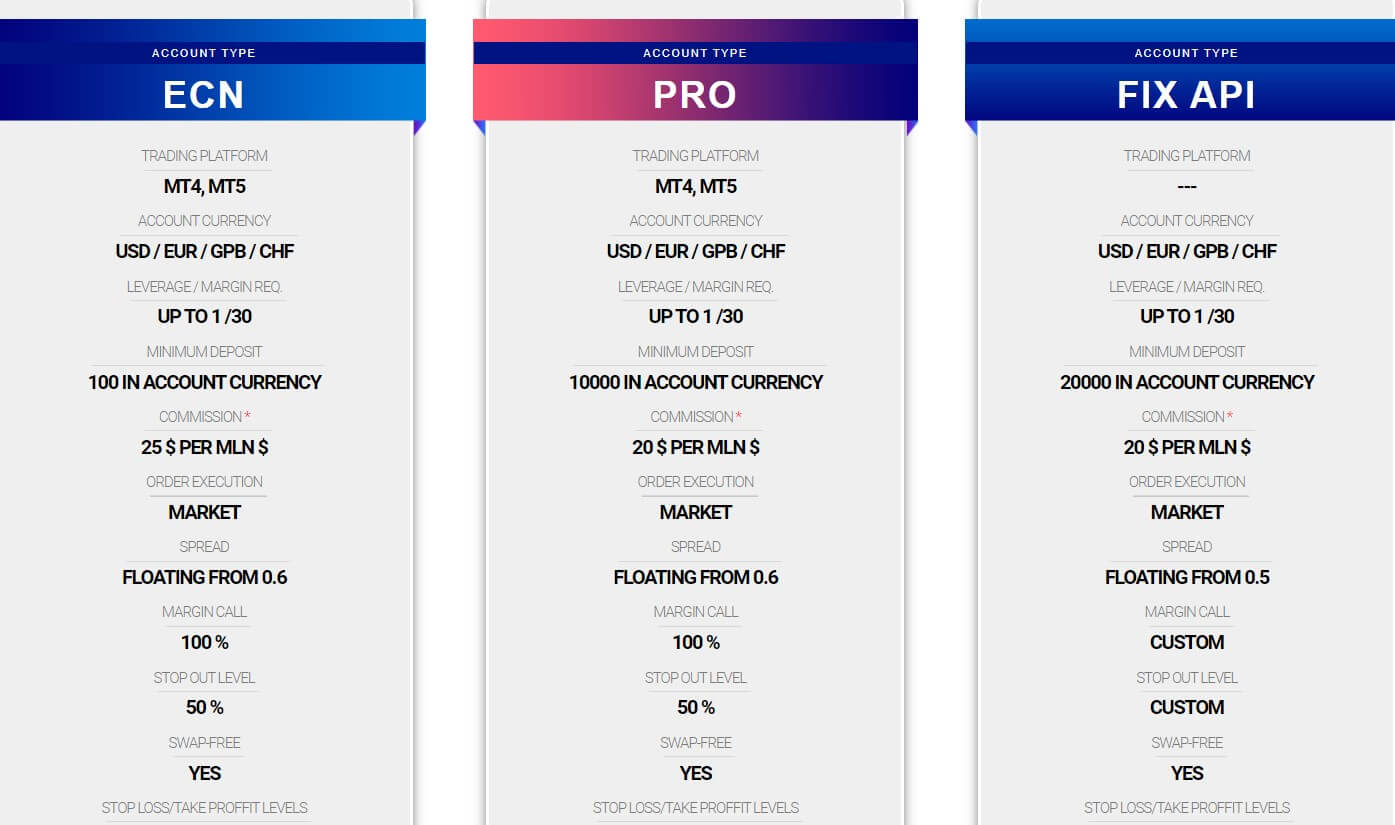

Credit / Debit Card (Visa and MasterCard): Deposits over $100 there will be a fee of 2% + EUR 0.24 (or equivalent) and for international cards there will be a fee of 2.5% + EUR 0.24 (or equivalent). For deposits under $100, there will be an additional service charge of $10 (or equivalent). The maximum daily deposit limit is $15,000 (or equivalent). There are a few basic tools on offer to help with your trading, there is some market analysis that is very basic showing a chart of various currencies but not much more information than that. You can contact Prior Capital though to help create a personalized report. Market data is also available but this much the same thing as the market analysis. The economic calendar on offer gives you information about any upcoming news events that may affect the pairs you are trading ut there are more detailed ones available for free on the internet. Finally, there is a

There are a few basic tools on offer to help with your trading, there is some market analysis that is very basic showing a chart of various currencies but not much more information than that. You can contact Prior Capital though to help create a personalized report. Market data is also available but this much the same thing as the market analysis. The economic calendar on offer gives you information about any upcoming news events that may affect the pairs you are trading ut there are more detailed ones available for free on the internet. Finally, there is a

The available leverage caps for your account can vary depending on the price volatility of the underlying instrument. The leverage cap is set at 30:1 on major Indices, 10:1 on Commodities other than Gold and non-major Equity Indices, and 5:1 on individual Equities and other reference values. On another note, the broker offers a slight advantage in this category for Pro account holders by setting the

The available leverage caps for your account can vary depending on the price volatility of the underlying instrument. The leverage cap is set at 30:1 on major Indices, 10:1 on Commodities other than Gold and non-major Equity Indices, and 5:1 on individual Equities and other reference values. On another note, the broker offers a slight advantage in this category for Pro account holders by setting the  The Direct account offers access to Forex, Metals, Futures, Shares, and Cash CFDs and would be the best choice if you’re looking for more variety. The Zero account limits tradable instruments to Forex, Energies, and Metals. FX options are made up of majors and minors and include 34 options. Precious Metals include Gold and Silver. Energies include Light Sweet Crude Oil, Brent Crude Oil, and Natural Gas. Note that this would be the extent of what is offered on the Zero account type. There are 45 total options available under US stocks and major brands like Apple, Citigroup Inc., Google, Microsoft, Disney, and more are available. The broker also lists 6 Index Futures and 11 Cash CFDs.

The Direct account offers access to Forex, Metals, Futures, Shares, and Cash CFDs and would be the best choice if you’re looking for more variety. The Zero account limits tradable instruments to Forex, Energies, and Metals. FX options are made up of majors and minors and include 34 options. Precious Metals include Gold and Silver. Energies include Light Sweet Crude Oil, Brent Crude Oil, and Natural Gas. Note that this would be the extent of what is offered on the Zero account type. There are 45 total options available under US stocks and major brands like Apple, Citigroup Inc., Google, Microsoft, Disney, and more are available. The broker also lists 6 Index Futures and 11 Cash CFDs. On the Account Type Table, we see spreads on the Zero account listed as starting from 0 pips. However, reading the fine print reveals that this is only on the EUR/USD pair. The broker is vague when it comes to describing the spreads on the Direct account type and suggests potential clients check out the Contract Specifications for themselves in order to view them. Upon checking the spreads for ourselves, we weren’t exactly surprised that the broker wasn’t boasting about their offers.

On the Account Type Table, we see spreads on the Zero account listed as starting from 0 pips. However, reading the fine print reveals that this is only on the EUR/USD pair. The broker is vague when it comes to describing the spreads on the Direct account type and suggests potential clients check out the Contract Specifications for themselves in order to view them. Upon checking the spreads for ourselves, we weren’t exactly surprised that the broker wasn’t boasting about their offers.

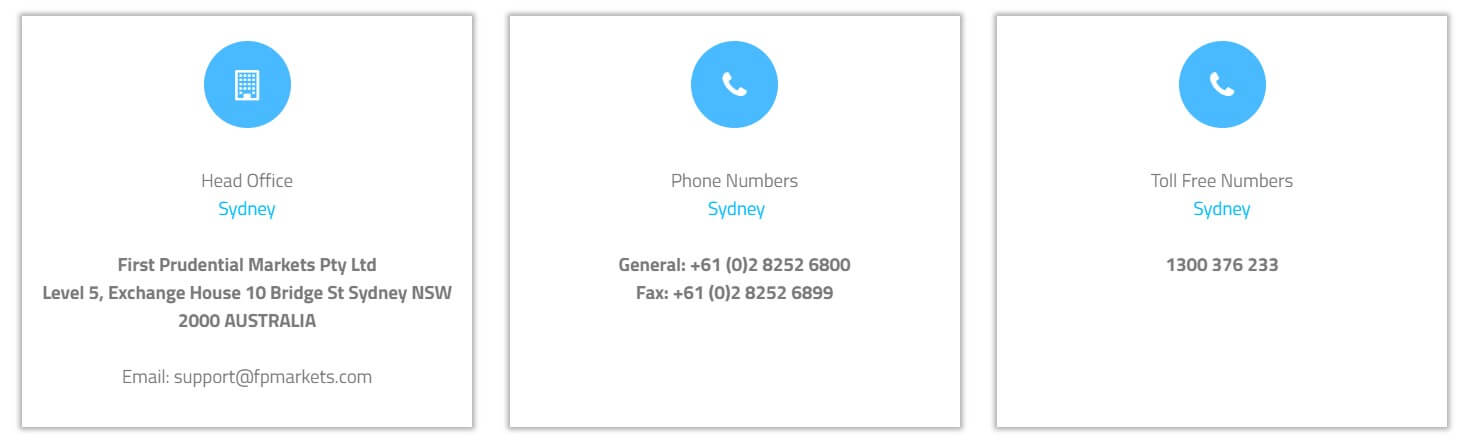

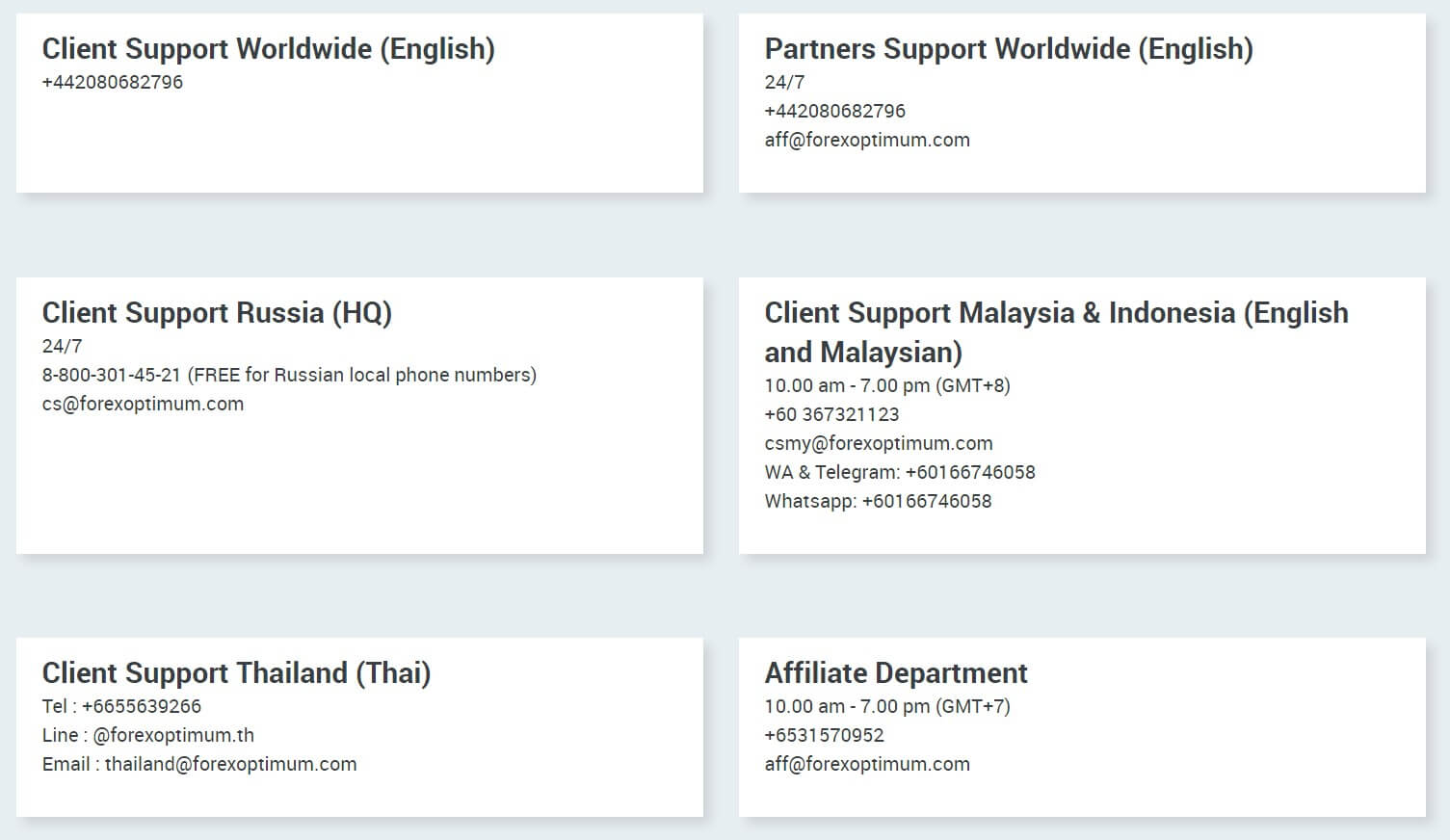

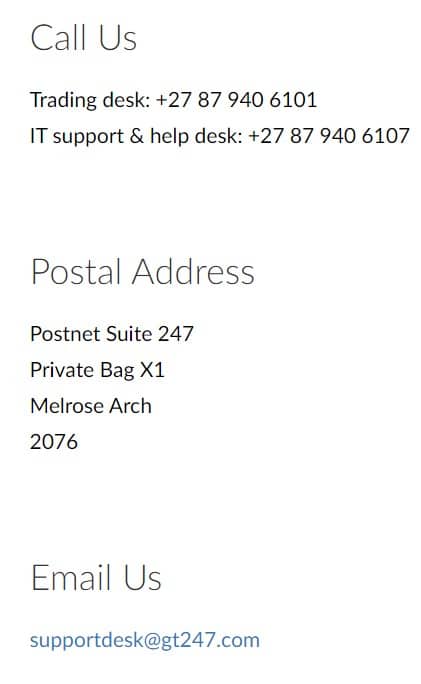

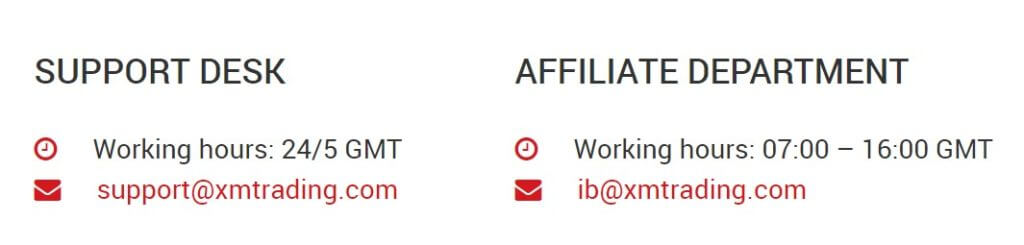

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

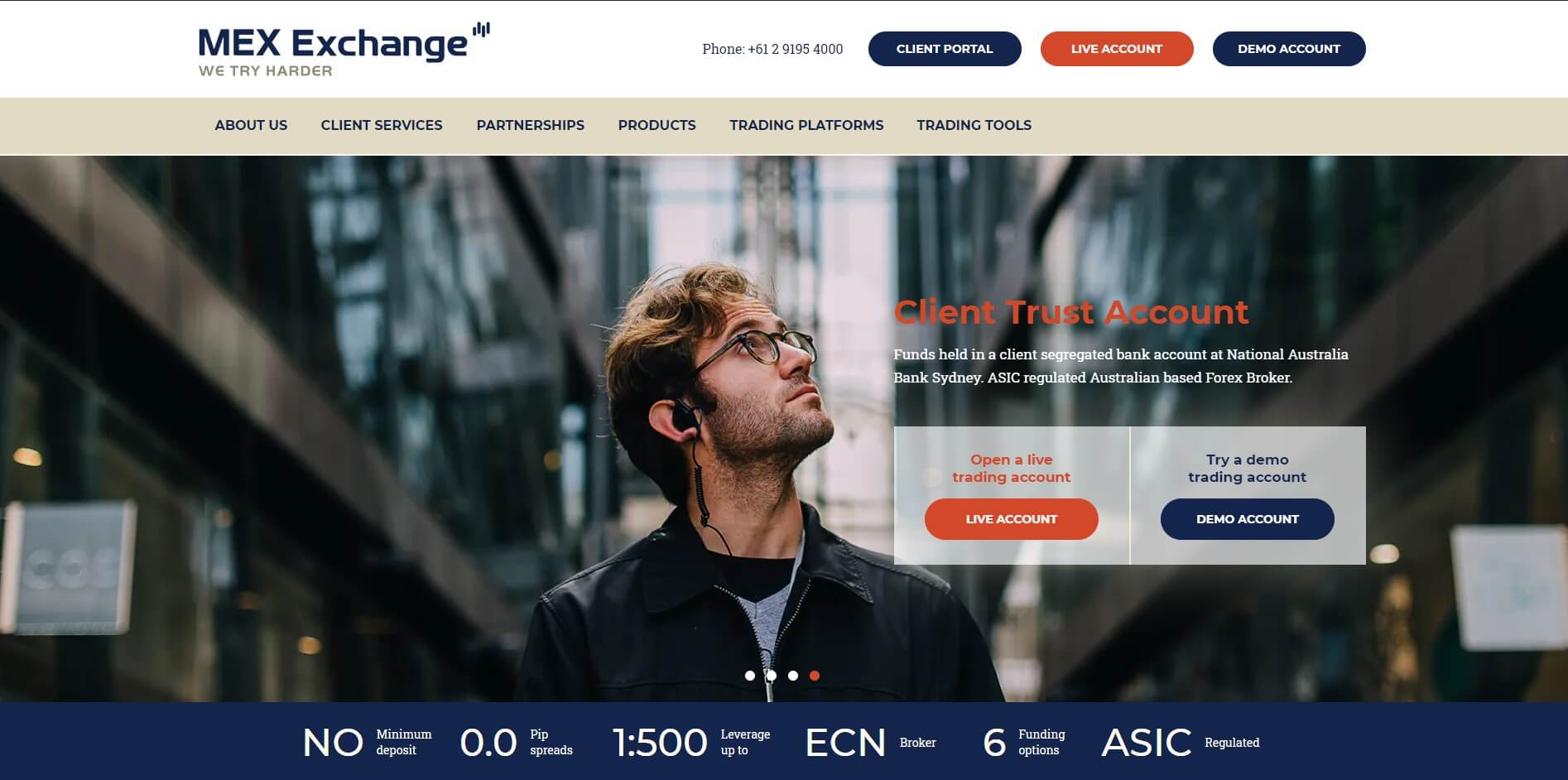

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

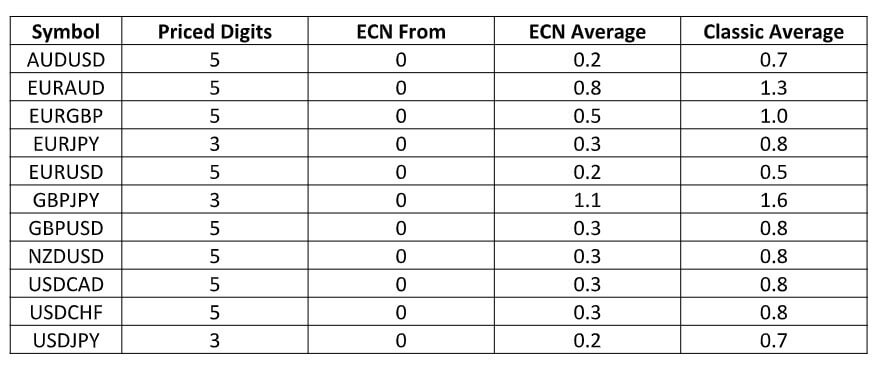

Emporio servers have an impressive 50ms average execution time like the server does not have any utilization. The same server is for Demo and Live accounts. Assets listing was very long and they are neatly categorized, for example, Forex pairs are grouped into 6 liquidity levels, where the most

Emporio servers have an impressive 50ms average execution time like the server does not have any utilization. The same server is for Demo and Live accounts. Assets listing was very long and they are neatly categorized, for example, Forex pairs are grouped into 6 liquidity levels, where the most

Emporio has a really impressive range of assets. Traders will enjoy great Forex offer, Metals, Stocks, Indices, Oil, and Cryptocurrencies. Starting with Forex, a plethora of exotics marks the broker. We counted a total of 56 currency pairs listed in the MT5. Apart from majors and major crosses, traders can find all of the Scandinavian currencies crossed with USD and EUR, Turkish Lira quoted with EUR, USD, and CHF. MXN, CHN, SGD, HUF also crossed with USD and EUR. The most

Emporio has a really impressive range of assets. Traders will enjoy great Forex offer, Metals, Stocks, Indices, Oil, and Cryptocurrencies. Starting with Forex, a plethora of exotics marks the broker. We counted a total of 56 currency pairs listed in the MT5. Apart from majors and major crosses, traders can find all of the Scandinavian currencies crossed with USD and EUR, Turkish Lira quoted with EUR, USD, and CHF. MXN, CHN, SGD, HUF also crossed with USD and EUR. The most

The broker states that maximum leverage is 1:500 for Forex and 1:50 for Cryptocurrencies. These levels were exactly what we found in both platforms. The only exception was the Tezos with the leverage of 1:2. Evolve Markets has a great overview of trading instruments online, with a filter that you can use if you seek a particular asset. The leverage of 1:500 on precious metals like Gold or Palladium is uncommon, but this broker can offer it as there are no restrictions by regulations. Also, this can be useful for low-risk Money Management to reduce the

The broker states that maximum leverage is 1:500 for Forex and 1:50 for Cryptocurrencies. These levels were exactly what we found in both platforms. The only exception was the Tezos with the leverage of 1:2. Evolve Markets has a great overview of trading instruments online, with a filter that you can use if you seek a particular asset. The leverage of 1:500 on precious metals like Gold or Palladium is uncommon, but this broker can offer it as there are no restrictions by regulations. Also, this can be useful for low-risk Money Management to reduce the

Evolve Markets has 5 categories, with each being deep enough to satisfy most traders. Starting with Forex, there are 50 total currency pairs. All majors are listed as well as the minors. To appeal to more demanding traders the list is expanded with exotics like the Scandinavian currencies with the EUR and USD and also NOK/SEK cross, USD/THB, TRY, SGD, RUB, PLN, MXN, HUF, HKD, and CNH, some of which have the EUR as the base.

Evolve Markets has 5 categories, with each being deep enough to satisfy most traders. Starting with Forex, there are 50 total currency pairs. All majors are listed as well as the minors. To appeal to more demanding traders the list is expanded with exotics like the Scandinavian currencies with the EUR and USD and also NOK/SEK cross, USD/THB, TRY, SGD, RUB, PLN, MXN, HUF, HKD, and CNH, some of which have the EUR as the base. Commodities range is minimal and only energies. Both Oil types, WTI and Brent are listed with the addition of Natural Gas. Other commodity assets are not very popular with the new age, younger traders, hence they are not listed.

Commodities range is minimal and only energies. Both Oil types, WTI and Brent are listed with the addition of Natural Gas. Other commodity assets are not very popular with the new age, younger traders, hence they are not listed.

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

Precious metals are limited to Spot Silver and Gold. Forex Optimum offers different currency quotes for these thus making a better selection even though the charts look very similar. A trader can find Spot Gold crossed with USD, GBP, CHF, EUR, and AUD. The same is with Silver making a total of 10 CFD on Metals.

Precious metals are limited to Spot Silver and Gold. Forex Optimum offers different currency quotes for these thus making a better selection even though the charts look very similar. A trader can find Spot Gold crossed with USD, GBP, CHF, EUR, and AUD. The same is with Silver making a total of 10 CFD on Metals.

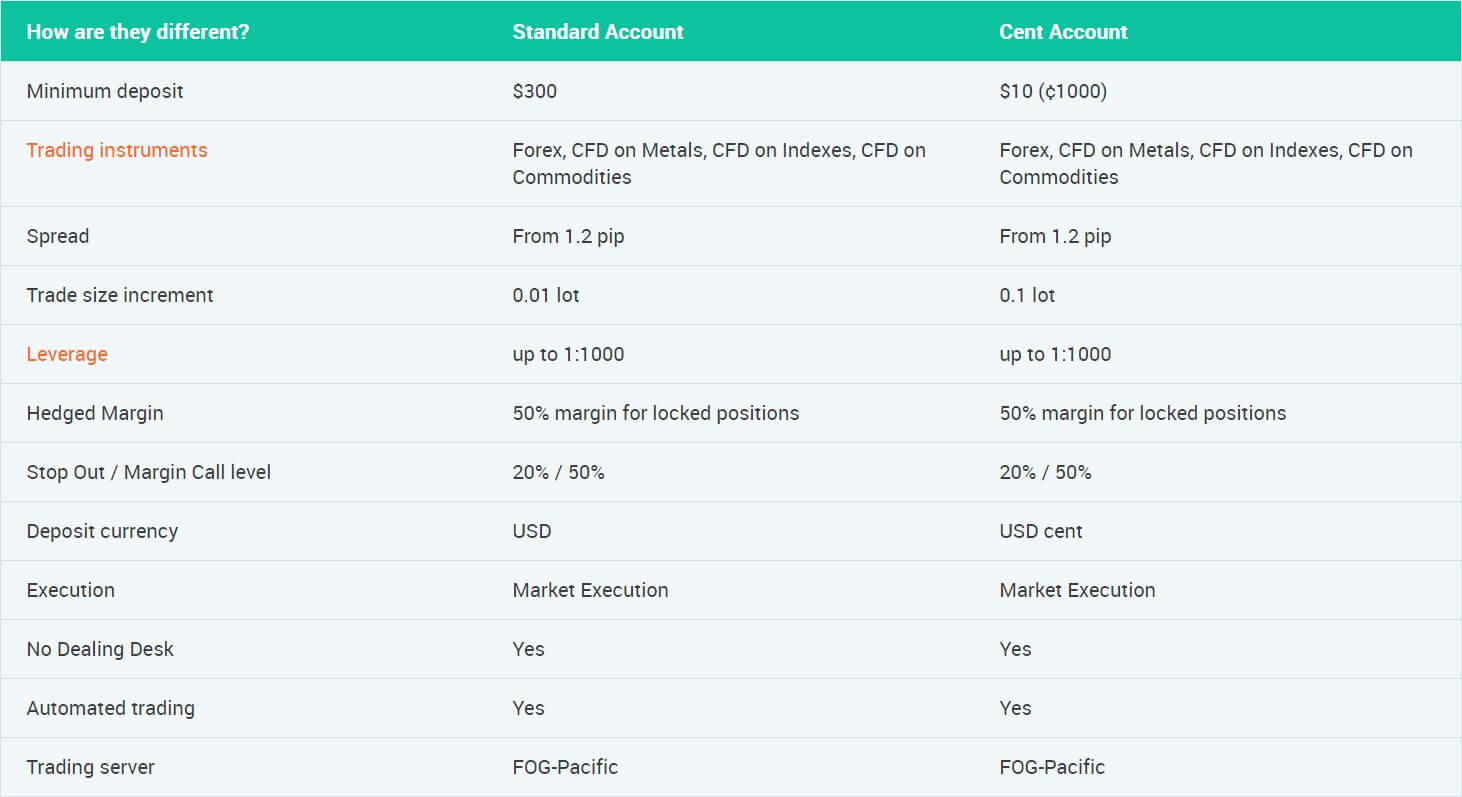

For the Cent Account, the minimum deposit is only $10. Traders that want to invest with Forex optimum can try their services, including the withdrawals and Signals with little risk. Scam brokers rarely have low-value deposit minimums. Standard Account requires a $300 deposit to be opened as well as the BTC (micro BTC) nominated. Mentioned

For the Cent Account, the minimum deposit is only $10. Traders that want to invest with Forex optimum can try their services, including the withdrawals and Signals with little risk. Scam brokers rarely have low-value deposit minimums. Standard Account requires a $300 deposit to be opened as well as the BTC (micro BTC) nominated. Mentioned

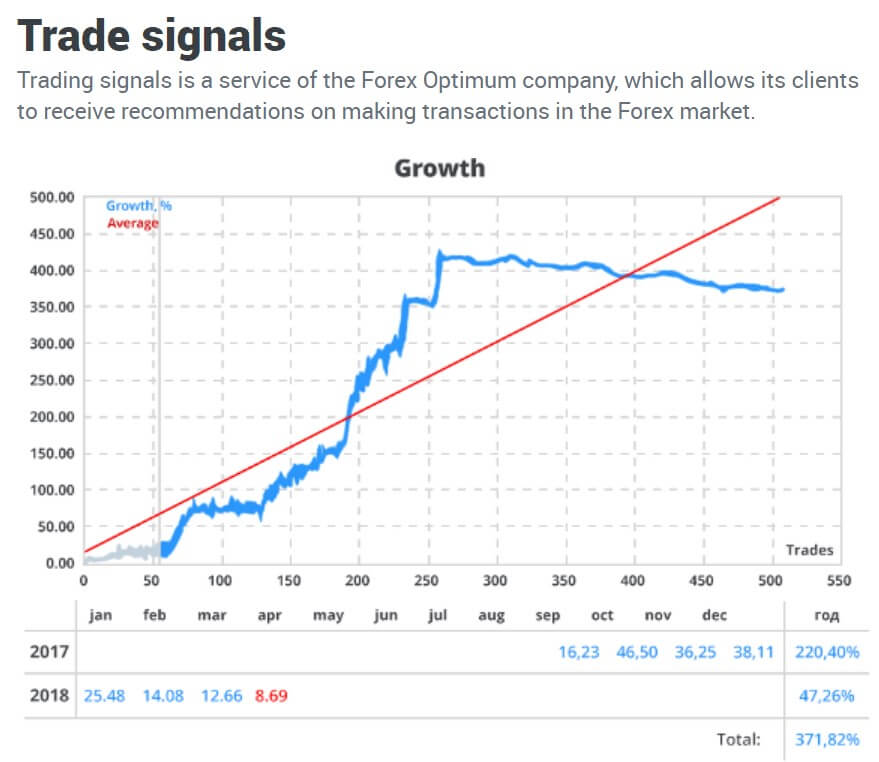

Trading Signal service is provided for registered accounts and has to be requested within the Client’s Portal. At first glance, the signals provided by the broker do not have a great depth and are based on Support/Resistance levels, basic trend indicators, channels, and

Trading Signal service is provided for registered accounts and has to be requested within the Client’s Portal. At first glance, the signals provided by the broker do not have a great depth and are based on Support/Resistance levels, basic trend indicators, channels, and

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free.

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free. Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

Educational & Trading Tools

Educational & Trading Tools

Trading Costs

Trading Costs

Educational & Trading Tools

Educational & Trading Tools LegacyFX provides a very satisfied customer support service via Telephone, Email and Live Chat. If you need to reach out to LegacyFX with any issues or queries, you may send your messages in between the hours of 8 AM-10 PM (UK time) Monday – Friday. Overall it should be noted that the quality of customer service is more than adequate, and responses are delivered efficiently. All answers received were comprehensive, polite and friendly, and live chat responds very promptly (a couple of minutes).

LegacyFX provides a very satisfied customer support service via Telephone, Email and Live Chat. If you need to reach out to LegacyFX with any issues or queries, you may send your messages in between the hours of 8 AM-10 PM (UK time) Monday – Friday. Overall it should be noted that the quality of customer service is more than adequate, and responses are delivered efficiently. All answers received were comprehensive, polite and friendly, and live chat responds very promptly (a couple of minutes).

The e-book has high quality and solid structure, it describes the basics very well and has some interesting unique content, with some company marketing mixed in. ACY e-book is genuine and good for any beginner, just do not expect to learn something if you know how to trade even the basic setups.

The e-book has high quality and solid structure, it describes the basics very well and has some interesting unique content, with some company marketing mixed in. ACY e-book is genuine and good for any beginner, just do not expect to learn something if you know how to trade even the basic setups.

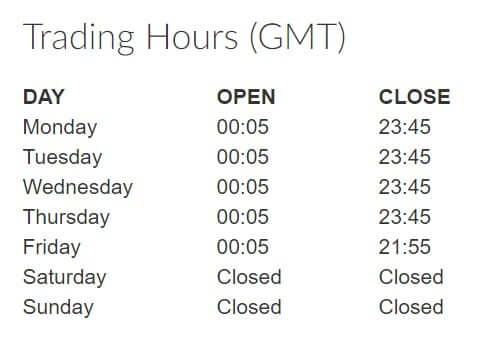

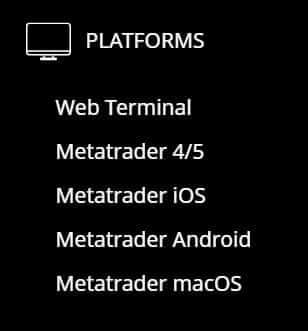

GT247 states that they offer 6 different platforms when in reality they offer a single platform (MetaTrader 5) which has multiple versions for different platforms such as desktop or iOS devices.

GT247 states that they offer 6 different platforms when in reality they offer a single platform (MetaTrader 5) which has multiple versions for different platforms such as desktop or iOS devices. Leverage can be selected up to 1:80 as a maximum, it can range from between 1:1 as a low up to 1:80. This can be selected when opening a new account.

Leverage can be selected up to 1:80 as a maximum, it can range from between 1:1 as a low up to 1:80. This can be selected when opening a new account.

The full extent of assets and instruments available on GT247 is not apparent to us. There is mention of there being over 65 fx pairs, indices, commodities, and crypto to trade, however, there is not a breakdown of what they are.

The full extent of assets and instruments available on GT247 is not apparent to us. There is mention of there being over 65 fx pairs, indices, commodities, and crypto to trade, however, there is not a breakdown of what they are.

Customer Service

Customer Service

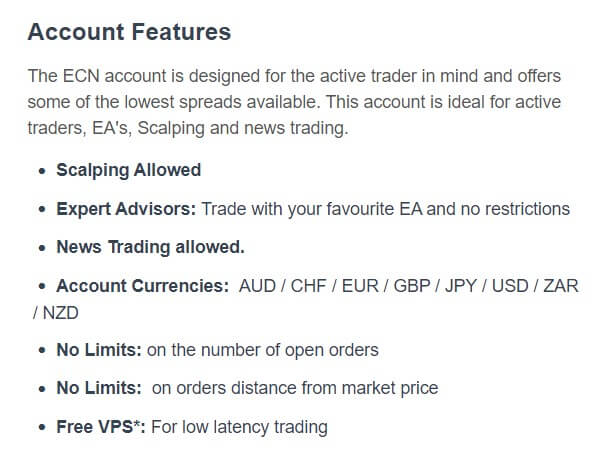

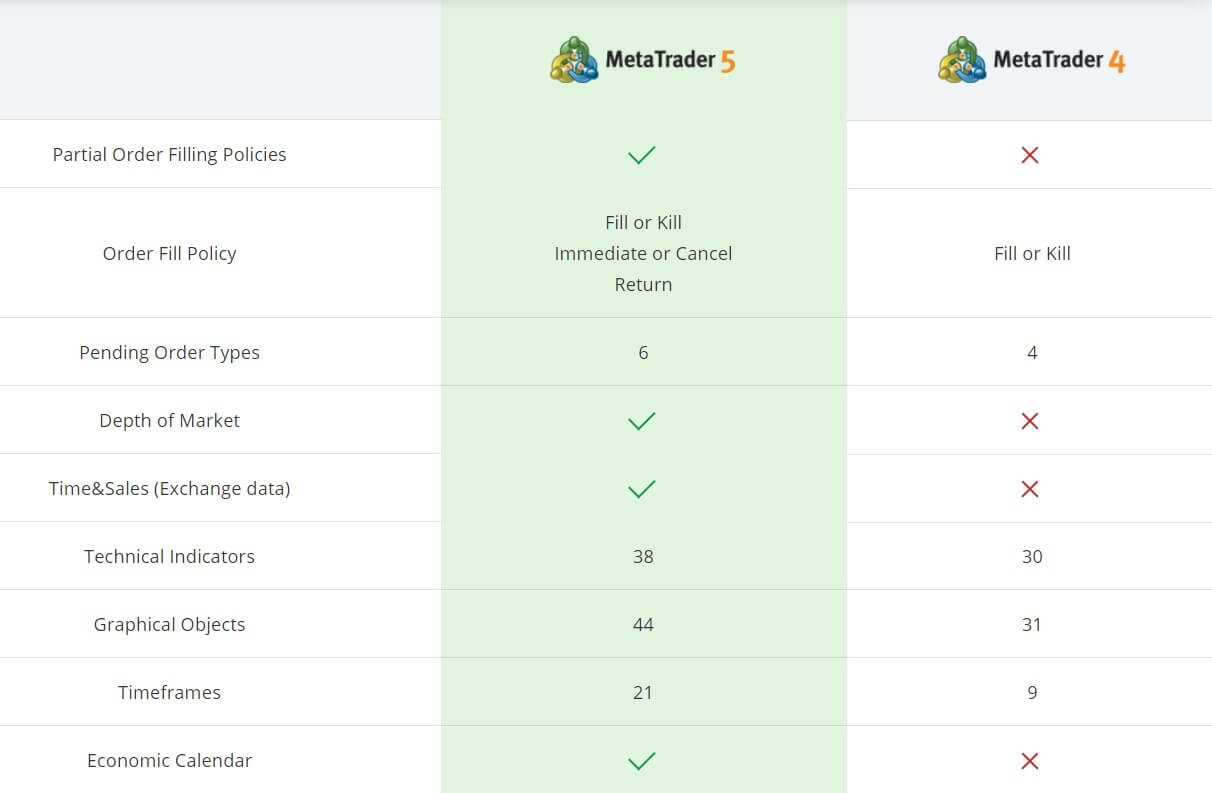

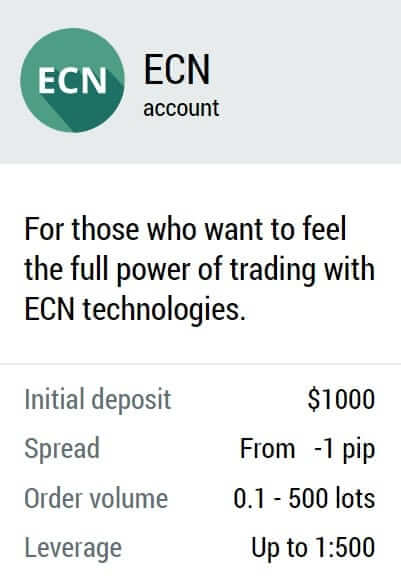

The Standard and NDD account types both support MetaTrader 4, while the ECN account supports MetaTrader 5. If you’ve used either platform before, you’ll already know just how powerful MT4/MT5 can be. Both offer advanced tools, although MT5 includes 2 more pending order types, more technical indicators, graphical objects, and timeframes than its predecessor.

The Standard and NDD account types both support MetaTrader 4, while the ECN account supports MetaTrader 5. If you’ve used either platform before, you’ll already know just how powerful MT4/MT5 can be. Both offer advanced tools, although MT5 includes 2 more pending order types, more technical indicators, graphical objects, and timeframes than its predecessor.

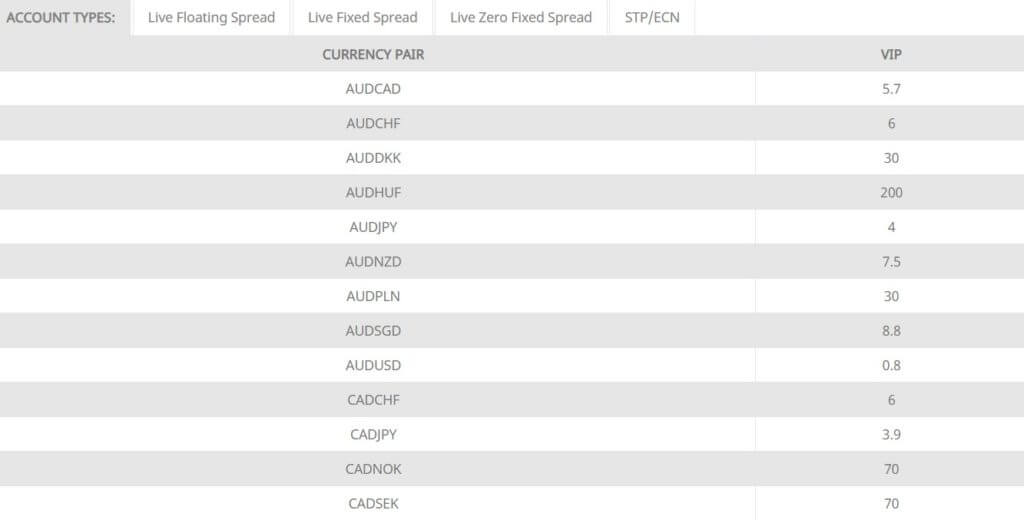

All accounts offer FX and CFD instruments; however, the Standard and NDD accounts offer more than 200 instruments, while the ECN account limits the number of available instruments to 100. CFDS are made up of Metals, Indices, Energies, Stocks, ETFs, and Cryptocurrencies. Beginning with FX options, we counted 66 available currency pairs on the Standard account, 60 options on the NDD account, and 57 options on the ECN account. This isn’t much of a difference, although some traders will find these numbers important.

All accounts offer FX and CFD instruments; however, the Standard and NDD accounts offer more than 200 instruments, while the ECN account limits the number of available instruments to 100. CFDS are made up of Metals, Indices, Energies, Stocks, ETFs, and Cryptocurrencies. Beginning with FX options, we counted 66 available currency pairs on the Standard account, 60 options on the NDD account, and 57 options on the ECN account. This isn’t much of a difference, although some traders will find these numbers important.

Accounts can be funded by Wire Transfer, cards, or through a few electronic payment methods. One of this broker’s disadvantages would be fees charged on deposits and withdrawals, which can really add up, especially for those making large deposits, or withdrawing through international Bank Wire. The only way to avoid these fees would be to hold an account of Gold or Platinum status.

Accounts can be funded by Wire Transfer, cards, or through a few electronic payment methods. One of this broker’s disadvantages would be fees charged on deposits and withdrawals, which can really add up, especially for those making large deposits, or withdrawing through international Bank Wire. The only way to avoid these fees would be to hold an account of Gold or Platinum status.

Assets

Assets

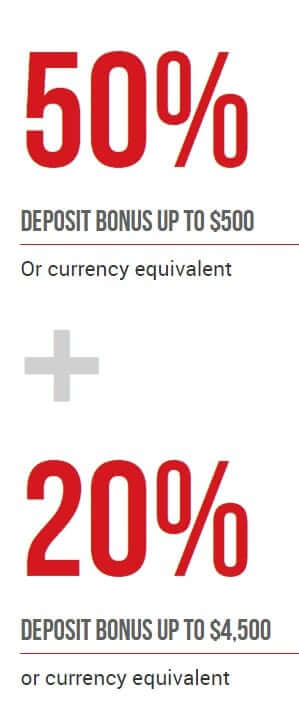

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

For Pro account holders, the smallest leverage option is 1:1. On Crypto accounts, clients can start with leverage of 1:3. Note that choosing leverage of 1:1 would simply mean that one is trading with the exact amount of funds that are available in their account. The Crypto account type allows for

For Pro account holders, the smallest leverage option is 1:1. On Crypto accounts, clients can start with leverage of 1:3. Note that choosing leverage of 1:1 would simply mean that one is trading with the exact amount of funds that are available in their account. The Crypto account type allows for  All three of the remaining account types offer the largest variety, with Forex, Metals, and Commodities being available. Now, we will look into the tradable instruments in more detail. Starting with

All three of the remaining account types offer the largest variety, with Forex, Metals, and Commodities being available. Now, we will look into the tradable instruments in more detail. Starting with

Support can be contacted through LiveChat, email, by phone, or by filling out a callback request. The company doesn’t advertise their hours on the website, so we used the opportunity to test out the website’s LiveChat feature. Sadly, support did not get back to us as quickly as we had hoped. After seven minutes with no initial response, we messaged our support agent a second time. Eventually, we gave up on the chat. This could be blamed on it being a late hour when we tested, although our support agent was active and online.

Support can be contacted through LiveChat, email, by phone, or by filling out a callback request. The company doesn’t advertise their hours on the website, so we used the opportunity to test out the website’s LiveChat feature. Sadly, support did not get back to us as quickly as we had hoped. After seven minutes with no initial response, we messaged our support agent a second time. Eventually, we gave up on the chat. This could be blamed on it being a late hour when we tested, although our support agent was active and online.

Both the MetaTrader 4 and 5 platforms are available for clients to choose from. Many brokers make the selection for their clients, so it’s nice to see options here, especially since these are the most popular trading platforms in the world today. Both offer many similarities, although MT5 offers a few additional features. The company provides the same specifications, including tradable assets, on both platforms, so the decision would really only need to be based on the platform alone. Demo accounts are available on both platforms, so consider testing out one version or the other on a demo account if you’re not sure which to choose. Both platforms can be downloaded on PC and MAC, through mobile apps, or via the WebTrader.

Both the MetaTrader 4 and 5 platforms are available for clients to choose from. Many brokers make the selection for their clients, so it’s nice to see options here, especially since these are the most popular trading platforms in the world today. Both offer many similarities, although MT5 offers a few additional features. The company provides the same specifications, including tradable assets, on both platforms, so the decision would really only need to be based on the platform alone. Demo accounts are available on both platforms, so consider testing out one version or the other on a demo account if you’re not sure which to choose. Both platforms can be downloaded on PC and MAC, through mobile apps, or via the WebTrader.

We mentioned the spreads for each account type earlier, but we will go into further detail now. Just to recap, the

We mentioned the spreads for each account type earlier, but we will go into further detail now. Just to recap, the

50% Welcome Bonus: Currently, clients can earn a 50% bonus, based on their initial deposit on MT4 Standard STP accounts. The smallest bonus is applied on deposits of at least $300, while the largest bonus tops out at $250 on deposits of $500 or more. Note that you’ll need to make a deposit that is $100 higher than the minimum requirement on this account type in order to qualify for this bonus. There are a lot of conditions for this bonus, so we will list the most important terms here and recommend that anyone interested in this bonus should take a look at the full list of terms & conditions.

50% Welcome Bonus: Currently, clients can earn a 50% bonus, based on their initial deposit on MT4 Standard STP accounts. The smallest bonus is applied on deposits of at least $300, while the largest bonus tops out at $250 on deposits of $500 or more. Note that you’ll need to make a deposit that is $100 higher than the minimum requirement on this account type in order to qualify for this bonus. There are a lot of conditions for this bonus, so we will list the most important terms here and recommend that anyone interested in this bonus should take a look at the full list of terms & conditions. Vantage FX Rebate: When you join the Vantage FX Rebate program, you can receive $2 AUD per standard FX back to your MT4 trading account in cash rebates. Rebates are calculated and added to account balances daily and can be withdrawn at any time. There are no time limits and no restrictions on trade sizes, which maximizes the potential to earn. Sadly, rebates are only available on the Standard STP account type. Also, traders must deposit at least $1,000 to participate. Note that this account has a minimum of only $200.

Vantage FX Rebate: When you join the Vantage FX Rebate program, you can receive $2 AUD per standard FX back to your MT4 trading account in cash rebates. Rebates are calculated and added to account balances daily and can be withdrawn at any time. There are no time limits and no restrictions on trade sizes, which maximizes the potential to earn. Sadly, rebates are only available on the Standard STP account type. Also, traders must deposit at least $1,000 to participate. Note that this account has a minimum of only $200. Educational resources are mostly made up of manuals and learning videos. The company has provided a breakdown of the Market Overview, Markey Analysis, and Trading Psychology under ‘Education’ > ‘Learn Forex’. Manuals are also provided that explain everything relevant to installing and

Educational resources are mostly made up of manuals and learning videos. The company has provided a breakdown of the Market Overview, Markey Analysis, and Trading Psychology under ‘Education’ > ‘Learn Forex’. Manuals are also provided that explain everything relevant to installing and

Vantage FX is a multiple award-winning, regulated Forex and CFD broker that offers three different account types with varying deposit requirements that start from $200. Trading costs can be advantageous but differ based on which account type has been chosen, with better spreads offered on the more expensive account types. Leverage options can go as high as 500:1 but those options are only available upon approval.

Vantage FX is a multiple award-winning, regulated Forex and CFD broker that offers three different account types with varying deposit requirements that start from $200. Trading costs can be advantageous but differ based on which account type has been chosen, with better spreads offered on the more expensive account types. Leverage options can go as high as 500:1 but those options are only available upon approval.

Platforms

Platforms Trade Sizes

Trade Sizes

Demo Account

Demo Account

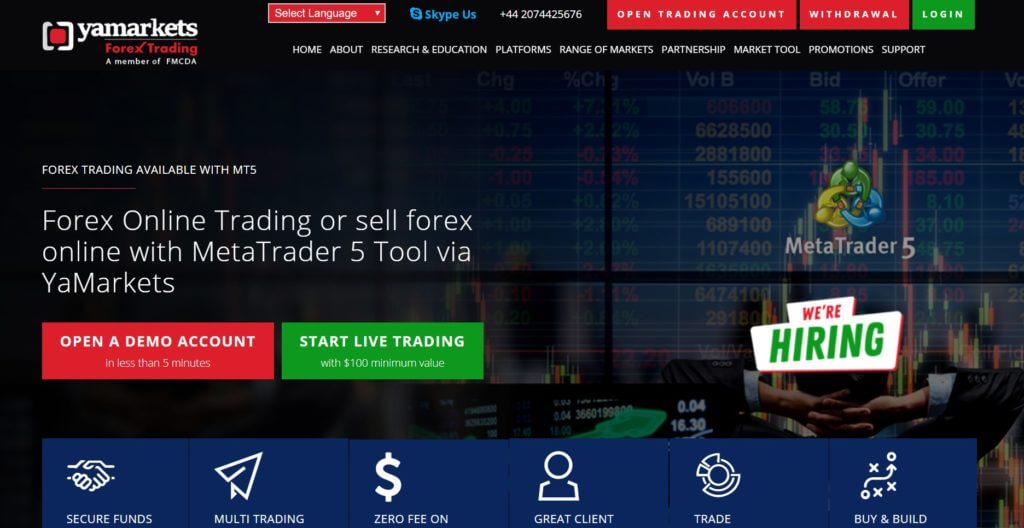

It took a while to find, but there are a few different deposit methods available from YaMarkets, these are credit/debit cards, bank wire transfers, Neteller and Moneybookers. There are be others available but we could not locate much information about them. There is also no indication of any fees, although the promotion regarding free transfer fees states that deposits over $200 have no fees, so we can assume that there are if you are depositing a smaller amount.

It took a while to find, but there are a few different deposit methods available from YaMarkets, these are credit/debit cards, bank wire transfers, Neteller and Moneybookers. There are be others available but we could not locate much information about them. There is also no indication of any fees, although the promotion regarding free transfer fees states that deposits over $200 have no fees, so we can assume that there are if you are depositing a smaller amount.

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

a. Complete at least 5

a. Complete at least 5  There are a number of different educational and trading tools available as well as some other basics to help with analysis.

There are a number of different educational and trading tools available as well as some other basics to help with analysis.

Leverage

Leverage

The FXGlobe academy is there to help you learn and earn. There are a number of different courses available which will teach you a lot of the basics when it comes to trading and how to use different software such as MetaTrader 4.

The FXGlobe academy is there to help you learn and earn. There are a number of different courses available which will teach you a lot of the basics when it comes to trading and how to use different software such as MetaTrader 4.

LBLV are offering a single trading platform, the good news is that it is MetaTrader 5 (MT5).

LBLV are offering a single trading platform, the good news is that it is MetaTrader 5 (MT5). Assets

Assets

Rebates: Ther is also a simpler rebate program where you can receive $2 per lot on a Standard STP account which technically is just lowering the overall trading cost.

Rebates: Ther is also a simpler rebate program where you can receive $2 per lot on a Standard STP account which technically is just lowering the overall trading cost.

Direct: The direct account keeps the $1 minimum deposit as well as the same leverage levels and trade sizes. It has a spread from 0.7 pips and has 117 tradable instruments including forex, crypto, and CFDs. Margin call level remains at 100% and the stop out level is at 20%. This account can use MetaTrader 5 only as its trading platform. This account also uses instant execution to make the trades.

Direct: The direct account keeps the $1 minimum deposit as well as the same leverage levels and trade sizes. It has a spread from 0.7 pips and has 117 tradable instruments including forex, crypto, and CFDs. Margin call level remains at 100% and the stop out level is at 20%. This account can use MetaTrader 5 only as its trading platform. This account also uses instant execution to make the trades.

Customer support is open from 9:00 to 21:00 Monday to Friday Moscow time rather than the usual 24 hours. You can use the online web form to send your query and receive a message back via email, or you can use the email address provided directly. There is also a phone number provided should you wish to talk with someone directly. We sent a message using the webform, it has currently been 48 hours and we are yet to receive a reply which does not fill us with confidence.

Customer support is open from 9:00 to 21:00 Monday to Friday Moscow time rather than the usual 24 hours. You can use the online web form to send your query and receive a message back via email, or you can use the email address provided directly. There is also a phone number provided should you wish to talk with someone directly. We sent a message using the webform, it has currently been 48 hours and we are yet to receive a reply which does not fill us with confidence.

Leverage

Leverage Assets

Assets

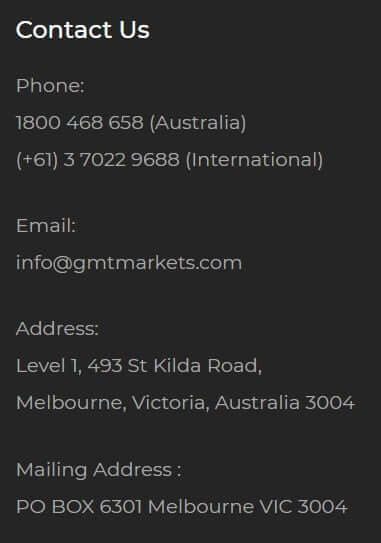

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

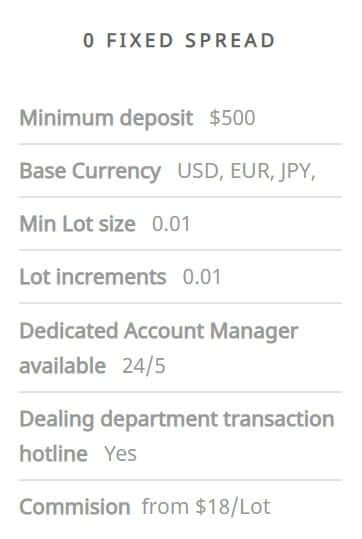

0 Fixed Spread: This account takes a slightly different approach, it has a minimum deposit of $500 but in terms of base currencies, you can only use USD, EUR or JPY. The minimum trade size remains at 0.01 (micro lot) but this time there is a commission charged for each trade, this is set at $18 per lot traded, which is extremely high. As the name suggests, spreads are set at 0 pips.

0 Fixed Spread: This account takes a slightly different approach, it has a minimum deposit of $500 but in terms of base currencies, you can only use USD, EUR or JPY. The minimum trade size remains at 0.01 (micro lot) but this time there is a commission charged for each trade, this is set at $18 per lot traded, which is extremely high. As the name suggests, spreads are set at 0 pips. Absolute Zero STP/ECN: This account requires you to contact an account manager to get set up, it has a leverage of 1:30, can be used with USD or EUR as the base currency and has no commissions, while the spreads can also be as low as 0 for pairs such as EUR/USD.

Absolute Zero STP/ECN: This account requires you to contact an account manager to get set up, it has a leverage of 1:30, can be used with USD or EUR as the base currency and has no commissions, while the spreads can also be as low as 0 for pairs such as EUR/USD.

When it comes to choosing what to trade, there is plenty on offer from FXGiants, they currently have the following instruments to trade: Shares, Forex, Metals, Indices, Commodities, Futures, and Cryptocurrencies. There is a full breakdown of

When it comes to choosing what to trade, there is plenty on offer from FXGiants, they currently have the following instruments to trade: Shares, Forex, Metals, Indices, Commodities, Futures, and Cryptocurrencies. There is a full breakdown of

Demo accounts are available, you can simply sign up and start using one, they work indefinitely as long as they are being used, if left dormant for too long they will be deleted to free up server space, however, a new one can be opened. Trading conditions are set to mimic the real markets.

Demo accounts are available, you can simply sign up and start using one, they work indefinitely as long as they are being used, if left dormant for too long they will be deleted to free up server space, however, a new one can be opened. Trading conditions are set to mimic the real markets.

Assets

Assets

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is  VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The

VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The

Spreads

Spreads

MetaTrader 4 (MT4):

MetaTrader 4 (MT4):

Assets

Assets

Education: There are trading Ebooks available to read online which go over different aspects of how to successfully trade with forex, CFDs, and stocks. There are also plenty of videos available that go over all aspects of trading, including the use of the trading platforms to how to analyze the market effectively. There is also a glossary available to help you understand any terms that you may not have heard before.

Education: There are trading Ebooks available to read online which go over different aspects of how to successfully trade with forex, CFDs, and stocks. There are also plenty of videos available that go over all aspects of trading, including the use of the trading platforms to how to analyze the market effectively. There is also a glossary available to help you understand any terms that you may not have heard before. Customer Service

Customer Service

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by  Leverage

Leverage Spreads

Spreads Minimum Deposit

Minimum Deposit

Spreads

Spreads Deposit Methods & Costs

Deposit Methods & Costs

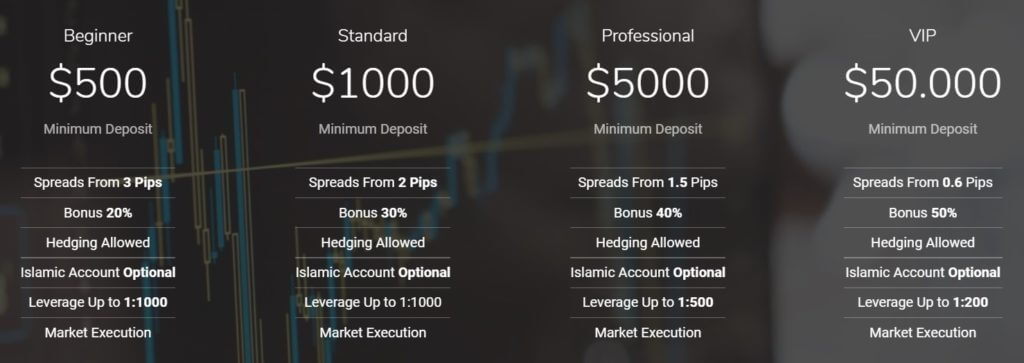

50% Tradable Bonus: Every deposit that you make can receive a tradable bonus, the amount that you receive depends on the amount that you deposit, the bonuses start from 20% for a deposit of $500 – $999 and go up to 50% for deposits over $50,000. The funds are fully tradable but can not be withdrawn until they are converted into real funds, in order to convert them to real funds the following volume of trading must be done: < Number of Lots > = < Bonus amount > / 3.

50% Tradable Bonus: Every deposit that you make can receive a tradable bonus, the amount that you receive depends on the amount that you deposit, the bonuses start from 20% for a deposit of $500 – $999 and go up to 50% for deposits over $50,000. The funds are fully tradable but can not be withdrawn until they are converted into real funds, in order to convert them to real funds the following volume of trading must be done: < Number of Lots > = < Bonus amount > / 3. Rebates: Depending on the amount that you trade, you are able to receive a certain amount of your spreads back as a rebate, starting at $1 for trading between 1 and 9 lots, up to $5 for trading 1000+ lots. Rebates are fully withdrawable funds.

Rebates: Depending on the amount that you trade, you are able to receive a certain amount of your spreads back as a rebate, starting at $1 for trading between 1 and 9 lots, up to $5 for trading 1000+ lots. Rebates are fully withdrawable funds.

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

Spreads

Spreads

ECN Account

ECN Account

The account with the lowest leverage cap would be the ECN account, which allows for a leverage of up to 1:500. This is still a noteworthy option, and the choices only go up from there. On the Cent account, we see a leverage cap of 1:1000, while all of the remaining accounts (Micro, Standard, and Zero Spread) allow for outstanding

The account with the lowest leverage cap would be the ECN account, which allows for a leverage of up to 1:500. This is still a noteworthy option, and the choices only go up from there. On the Cent account, we see a leverage cap of 1:1000, while all of the remaining accounts (Micro, Standard, and Zero Spread) allow for outstanding  Spreads

Spreads Minimum Deposit

Minimum Deposit This broker is currently offering a 100% deposit bonus and a Trade 100 Bonus. We also found a promotion to win a car that is not currently running, although it seems to be offered from time to time. Typically, we try to include some of the most important terms and conditions for any offers in this category, but we couldn’t access the terms and conditions for at least one of these bonuses without registering an account, which is impossible to do from our US-based offices. If you’re going to try to earn any of these rewards, we highly recommend taking a look at that section to be sure that you’re meeting all the criteria.

This broker is currently offering a 100% deposit bonus and a Trade 100 Bonus. We also found a promotion to win a car that is not currently running, although it seems to be offered from time to time. Typically, we try to include some of the most important terms and conditions for any offers in this category, but we couldn’t access the terms and conditions for at least one of these bonuses without registering an account, which is impossible to do from our US-based offices. If you’re going to try to earn any of these rewards, we highly recommend taking a look at that section to be sure that you’re meeting all the criteria.