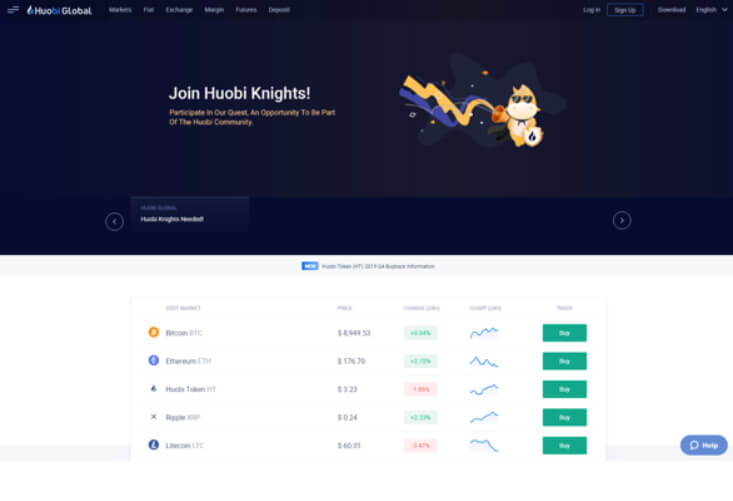

Is Huobi the right exchange for you? In-depth exchange review part 1/2

Huobi is a cryptocurrency exchange that started operating in 2013. It currently has over a million users as well as over $1 billion in assets under its custody. Though headquartered in Singapore, Huobi has an international presence. It has subsidiaries located in China, South Korea as well as the United States, where it is registered with the FinCen under HBUS Inc. As of March 2018, Huobi is active in 52 US states, operating as a Money Service Business (MSB).

Huobi offers support to nearly 280 crypto assets, including 88 Ethereum-priced pairs, 105 Bitcoin-priced pairs, 37 pairs priced in USDT, as well as over 50 pairs on its HADAX platform.

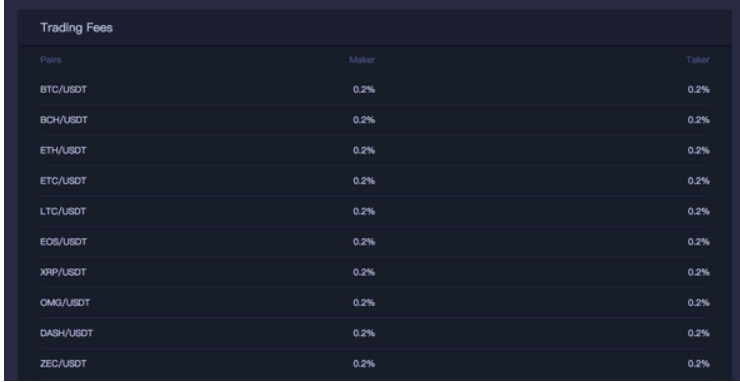

Huobi Commissions & Fees

Huobi tries to offer competitive trading fees to its users. It charges a 0.2% fee on major crypto pairs. Being a market maker or taker does not matter on Huobi.

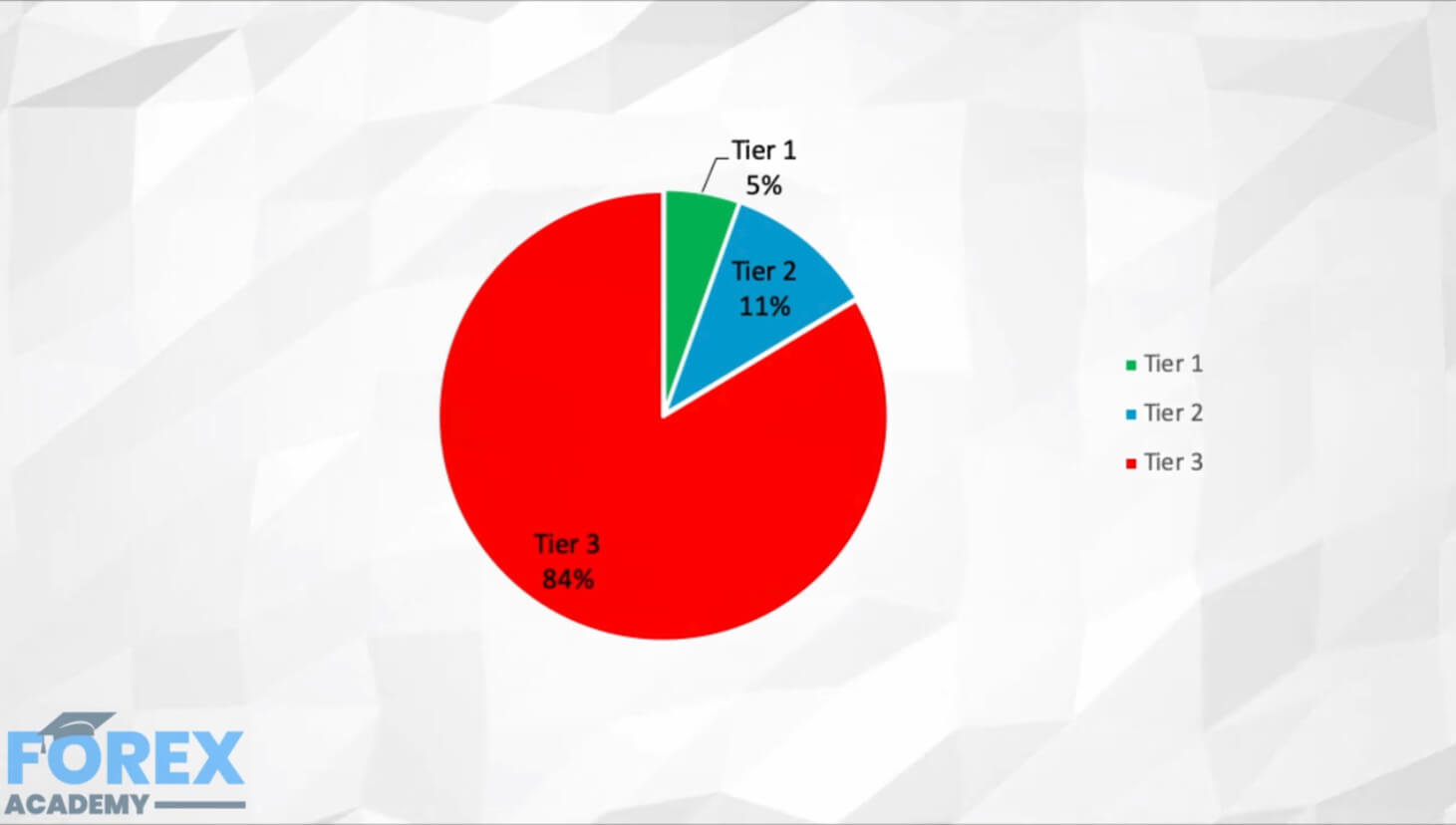

Huobi offers a VIP trading commission schedule to its active traders. The VIP trading commission is tier-based. The higher the VIP membership tier, the greater the commission discount is. In order to obtain a VIP trading discount, Houbi users must pre-purchase the VIP tier they think is the most cost-effective for them. This purchase can only be made with the Huobi Token that is issued by Huobi.

The Huobi Token simply acts as a discount token for the Houbi VIP users. The number of tokens directly determines the level of VIP access. The VIP level can range from level 1, which requires 120 tokens per month all the way up to level 5, which requires 12,000 tokens per month.

Determining the most cost-effective deal is detrimental. A user looking for a 10% discount on their trading fees would need to pay 120 HT, which, with Huobi Token costing $3.23 per unit, would cost $387.6. Therefore, buying this discount level would only be worth it if the trader is willing to spend more than $3,876 in trading commissions. This would, at a 0.2% commission rate, require spending of $1,938,000. However, as the company gave away around three million Huobi Tokens for free in early 2018, the exchange’s earliest users can have access to the greatest discounts if they use these tokens to purchase their VIP memberships.

While Houbi’s VIP profitability “threshold” is high, its base fees seem competitive enough for regular traders.

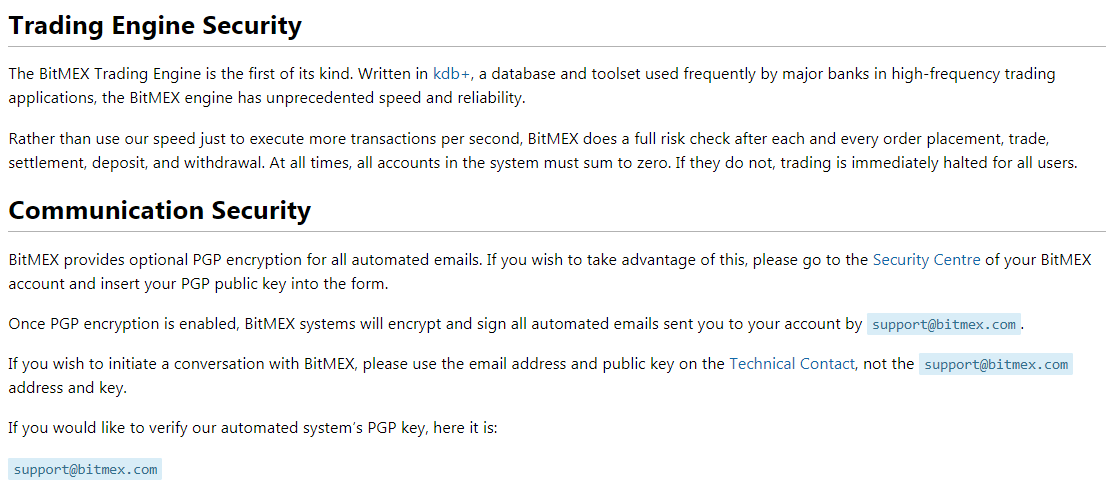

Security

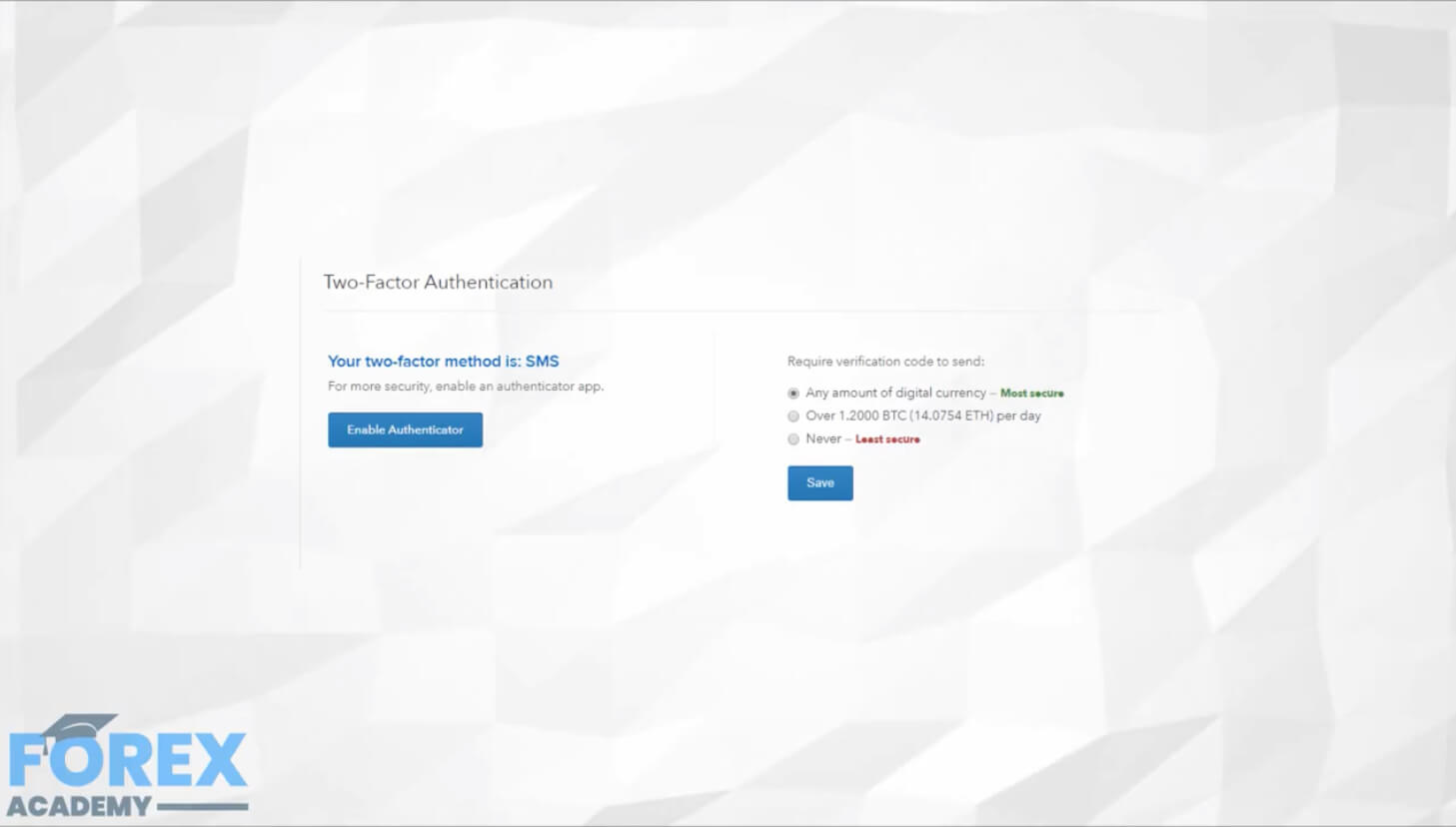

Huobi offers its users a hosted wallet solution, where users can enable Two-Factor Authentication (2FA). However, this security layer has become an industry standard and, therefore, cannot be considered a feature. Users are notified via SMS upon each successful login.

When talking about storage security, Huobi users should not be worried about security breaches as much as other exchange users. This is because Huobi keeps 98% of its assets in cold storage. The access to cold storage is only granted to internal staff. It is also protected by multi-sig technology.

Huobi has built an anti-DDOS attack system to keep its infrastructure as sturdy as possible.

Account security is also something Huobi is proud of, as fund withdrawals have a couple of interesting caveats. If users change their security settings and immediately attempt to withdraw their funds, Huobi will manually review the withdrawal. On top of that, they may email or call the user to obtain a withdrawal confirmation. Otherwise, withdrawals require three separate codes:

One sent via SMS to the user!

One sent via email!

One 2FA code generated on the user’s device.

In addition to these security features, Huobi created an Investor Protection Fund in January 2018. This fund is used for compensating investors in extraordinary circumstances.

Check out our part 2 of Huobi in-depth review for more on how the platform works.

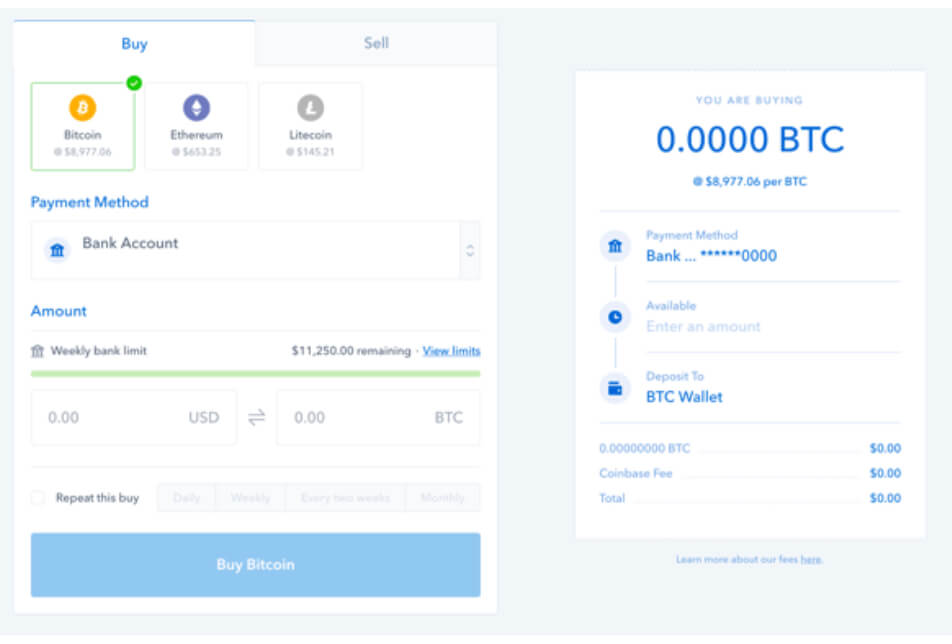

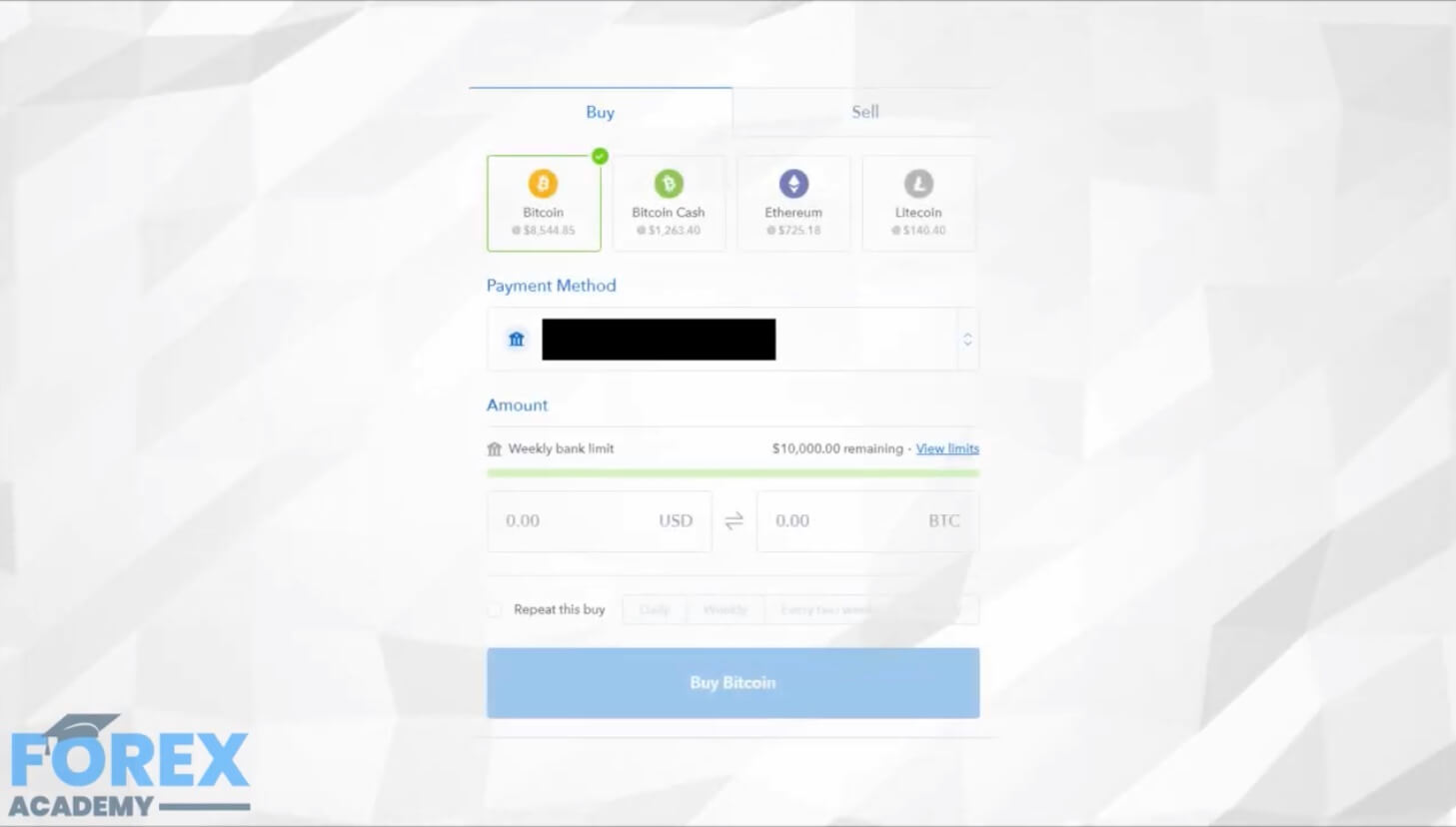

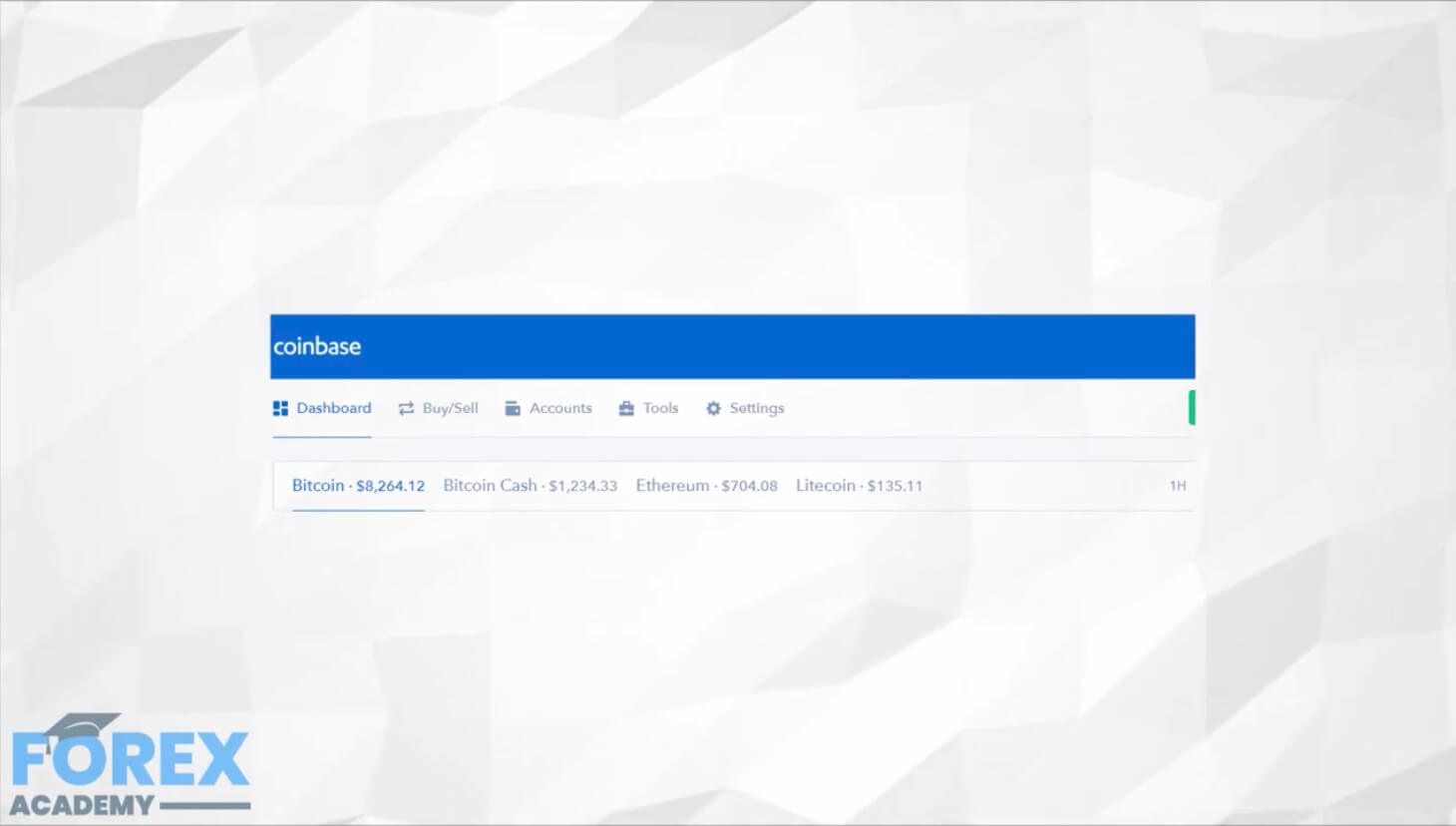

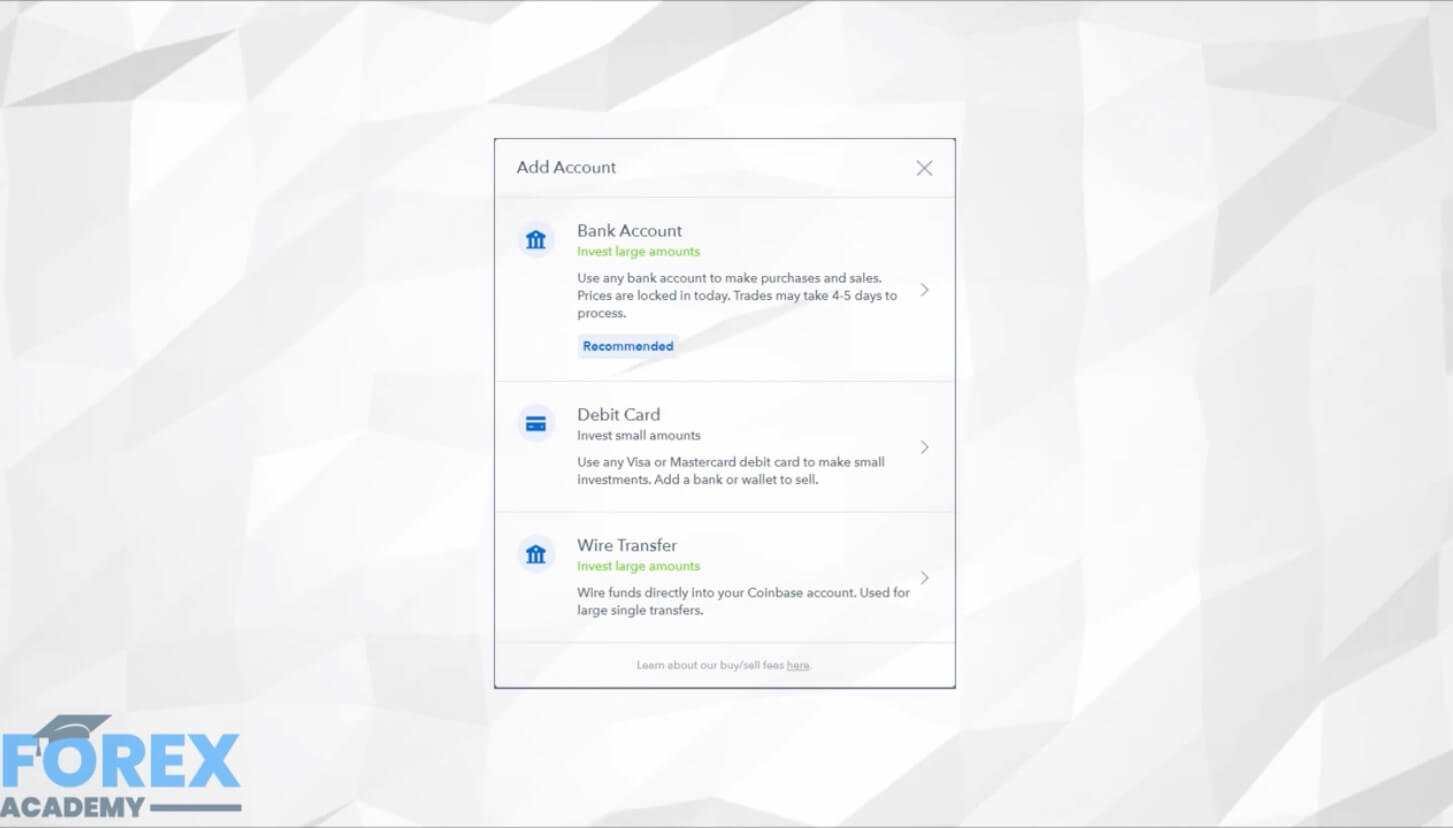

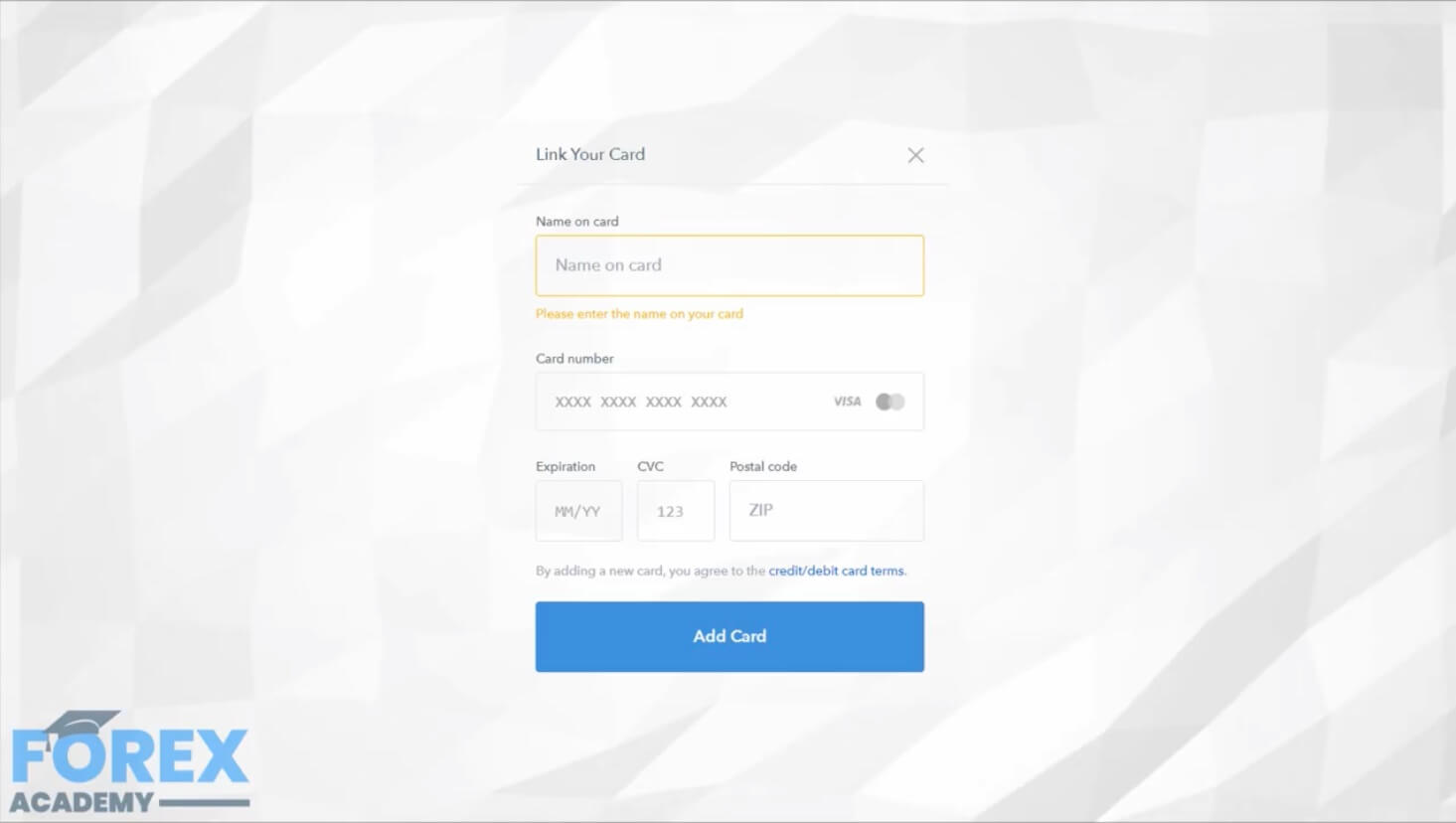

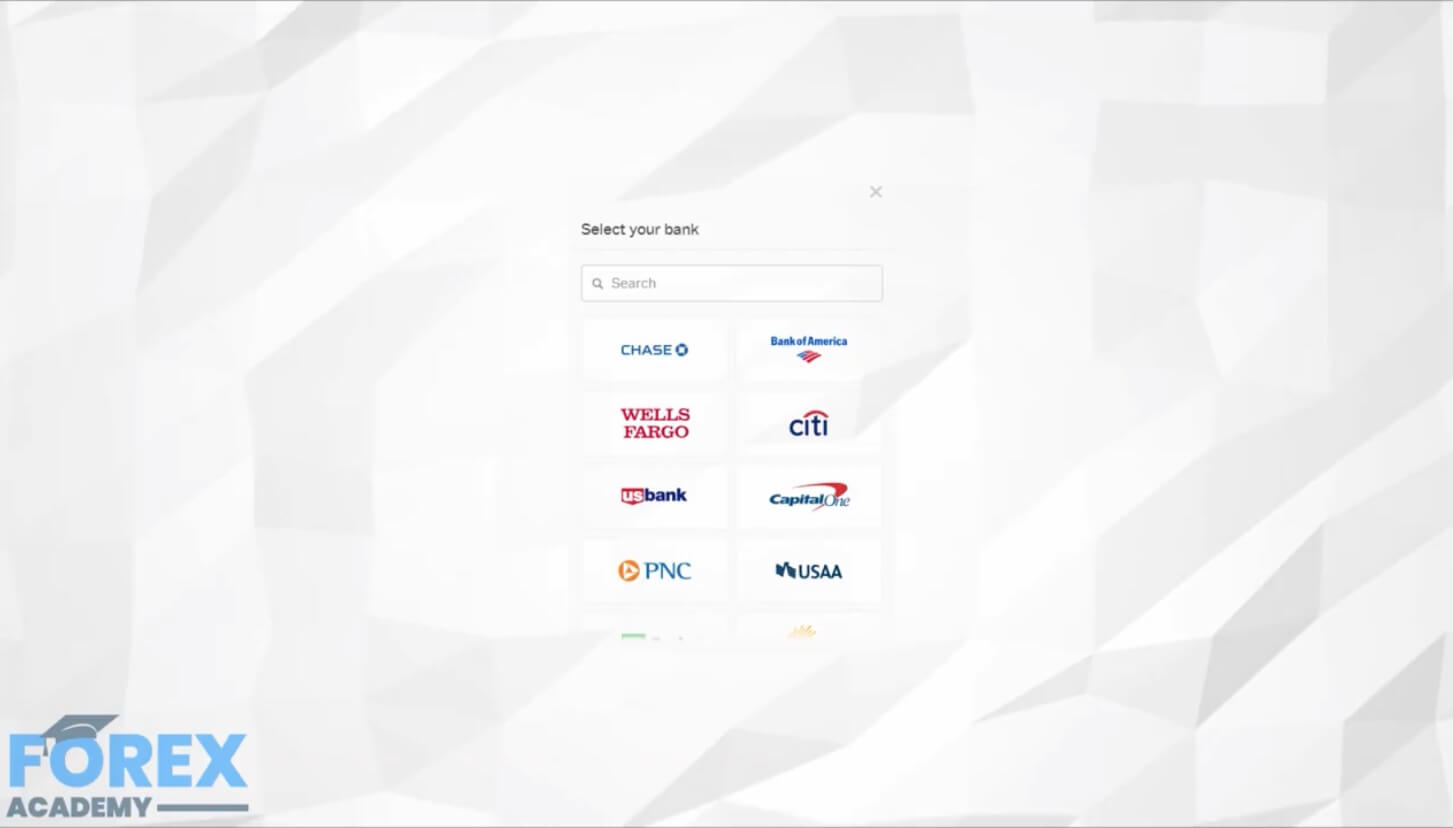

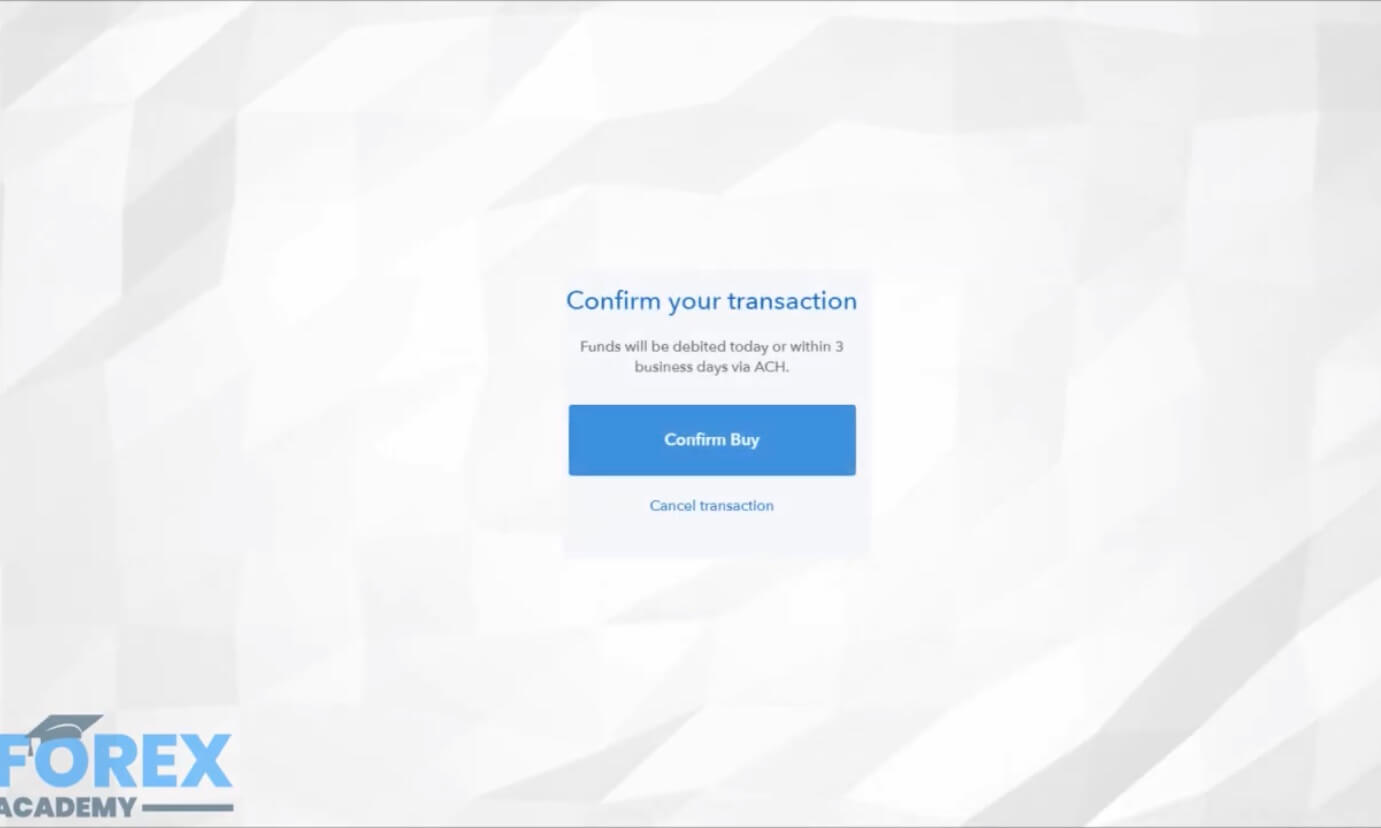

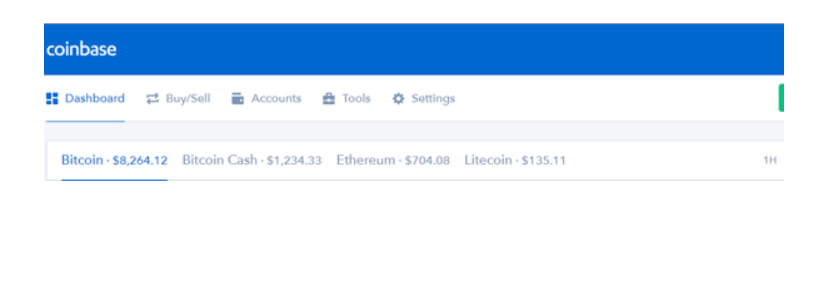

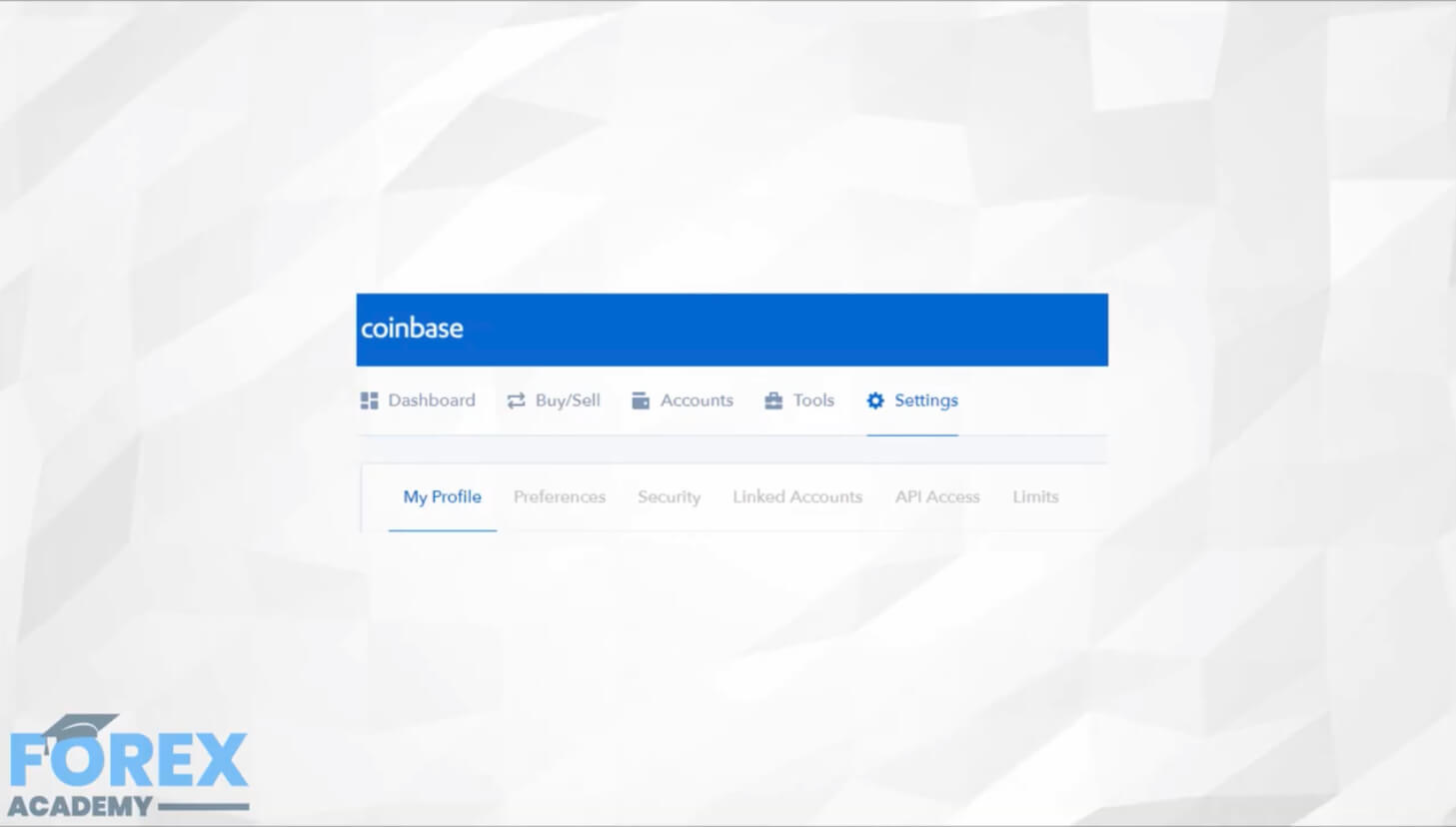

Coinbase users are offered the option to only “buy” or “sell.”

Coinbase users are offered the option to only “buy” or “sell.”

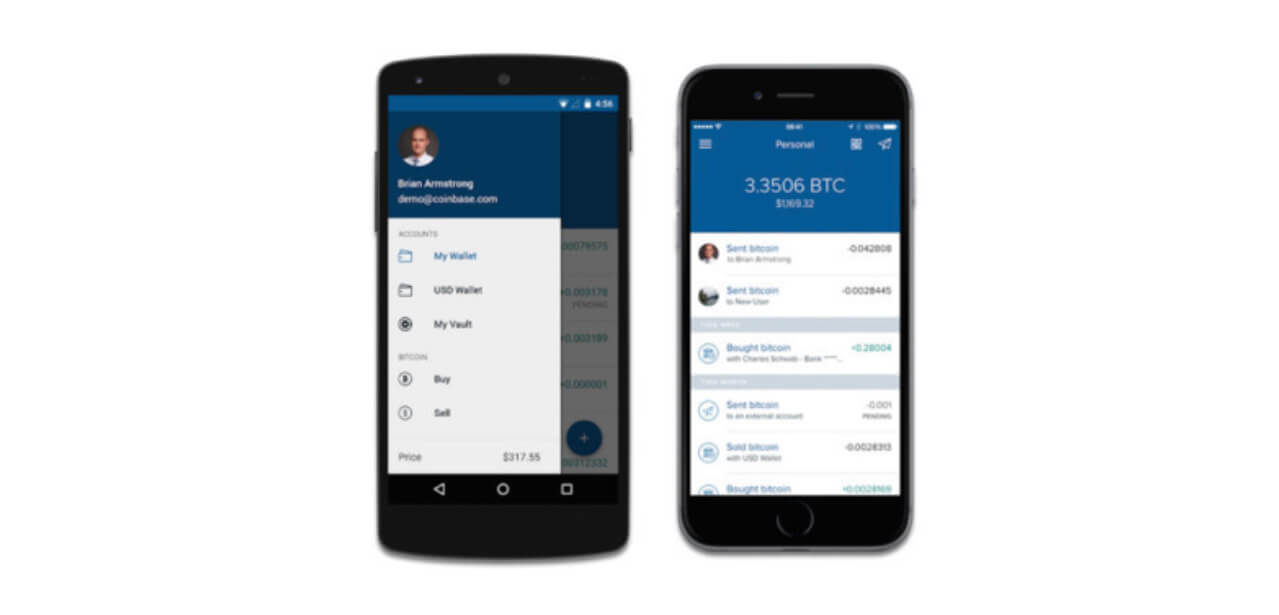

Coinbase can be used on mobile devices as well. It has mobile apps for Android and iOS devices.

Coinbase can be used on mobile devices as well. It has mobile apps for Android and iOS devices.

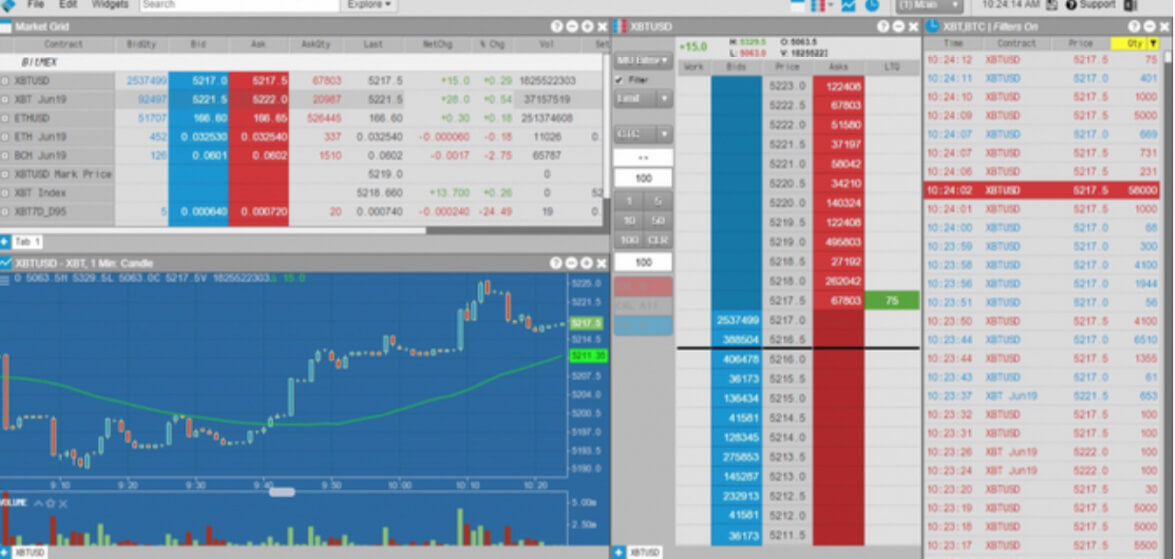

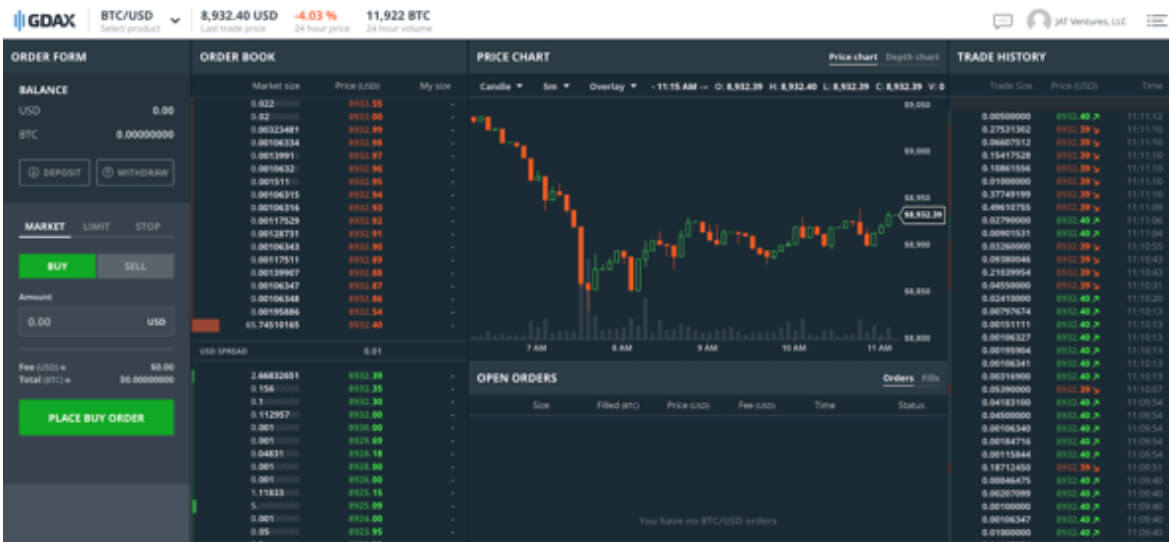

The Left-hand side middle part of the UI is reserved for the trading history panel. This part of the UI shows users all trades that occurred on the selected trading pair and in a certain period.

The Left-hand side middle part of the UI is reserved for the trading history panel. This part of the UI shows users all trades that occurred on the selected trading pair and in a certain period.

Mining pools

Mining pools