The eyes will remain on the ECB Financial Stability Review, and President Lagarde Speaks on the news front. The ECB Financial Stability report is an assessment of conditions in the financial system and potential risks to financial stability – the evidence on strains and imbalances can provide insight into monetary policy’s future. Therefore, traders keep a closer eye on reports to predict policy decisions to cope with Covid19 driven economic slowdown.

Economic Events to Watch Today

EUR/USD – Daily Analysis

The EUR/USD currency pair managed to extend its previous 2-day gaining streak and remained bullish around near above mid-1.1800 level, mainly due to the broad-based U.S. dollar selling bias, triggered by the risk-on market sentiment, which keeps the currency pair higher. Hence the market trading sentiment was being supported by the coronavirus vaccine-led enthusiasm.

On the contrary, the buying interest around the currency pair was capped by the intensifying virus fugues in Europe, which raised doubts over the Eurozone economic recovery and became the key factor that has been capped further upside in the currency pair. At the moment, the EUR/USD currency pair is currently trading at 1.1849 and consolidating in the range between the 1.1834 – 1.1854.

Despite the doubts over the global economic recovery from intensifying coronavirus (COVID-19) woes in the U.S. and Europe, the market trading sentiment flashing green at the start of the week’s trading and remained supportive by the optimism over a potential vaccine for the highly infectious coronavirus disease. After cheering the U.S. pharma giant Pfizer’s recent declaration of its coronavirus vaccine’s positive results, the market traders expect the biotechnology company Moderna to follow suit this week. This, in turn, the futures tied to the S&P 500, Wall Street’s benchmark index, is currently trading 0.8% higher on the day and the major Asian indices are up at approximately 1% each.

At the USD front, the broad-based U.S. dollar failed to gain any positive traction on the day as doubts persist over the global economic recovery from COVID-19. Besides this, the risk-on market sentiment, backed by the optimism over a potential vaccine for the highly contagious coronavirus disease, also played its major role in weakening the safe-haven U.S. dollar. However, the U.S. dollar losses became the key factor that kept the currency pair’s higher. Meantime, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped by 0.14% to 92.588 by 10:05 PM ET (2:05 AM GMT).

On the contrary, the bullish bias around the EUR/USD currency pair was capped by the on-going doubts over the Eurozone economic recovery amid intensifying coronavirus (COVID-19) worries in the U.S. and Europe. The rising coronavirus (COVID-19) worries urged some European countries, such as the U.K. and France, to imposing restrictive measures such as lockdowns and curfews. As in result, the vehicle traffic in both Europe and the U.S. slowing sharply. As per the latest report, there were over 54 million cases across the globe and over 1.3 million deaths as of November 16.

Looking ahead, the market traders will keep their eyes on updates surrounding the U.S. stimulus package. In the meantime, the risk catalyst like geopolitics and the virus woes, not to forget the Brexit, could not lose their importance. Apart from this, the RBA Gov Lowe Speaks and Monetary Policy Meeting Minutes will also be key to watch.

Daily Technical Levels

Support Resistance

1.1738 1.1827

1.1697 1.1875

1.1648 1.1917

Pivot point: 1.1786

EUR/USD– Trading Tip

The EUR/USD traded bullish at 1.1850 level, but recently it has formed a Doji pattern followed by bullish candles, suggesting that the buyers are exhausted, and sellers may enter the market soon. Therefore, we can expect the EUR/USD price to trade bearish until the 1.1838 level, the support level extended by an upward trendline on the hourly timeframe. Bullish crossover of 1.1856 level can also trigger buying until 1.1880.

GBP/USD – Daily Analysis

The GBP/USD currency pair managed to extend its overnight winning streak and refreshed 4-day high around above 1.3200 level as the currency pair buyers get a warm welcome after returning from the weekend. However, the bullish tone around the currency pair could be attributed to the broad-based U.S. dollar weakness. The U.S. dollar was being pressured by the market risk-on sentiment, undermining the safe-haven U.S. dollar and contributing to the currency pair gains.

Whereby, the market trading sentiment has remained supportive by the renewed optimism over a possible vaccine for the highly infectious coronavirus disease, which lends some support to the higher-yielding Pound and contributes to the currency pair gains. On the contrary, the Brexit woes and the virus concerns could stop the currency pair’s on-going recovery moves. At this particular time, the GBP/USD currency pair is currently trading at 1.3234 and consolidating in the range between 1.3174 – 1.3235.

Despite the lingering doubts about global economic recovery and the intensifying tension between the world’s two biggest economies, the market players continue to cheering the optimism over a possible vaccine for the highly infectious coronavirus disease. In the meantime, the release of an above-forecast China factory data, which raised hopes of China’s economic growth, has also played its major role in underpinning the market trading sentiment. However, the risk-on mood slightly overshadowed the concerns over virus cases and restrictions in the U.S.

On the data front, the Industrial production in China’s economy surged 6.9% year-on-year for the 2nd-straight month in October, surpassing the expected gain of 6.5%. Moreover, the Fixed Asset Investment grew 1.8% year-on-year in October against 1.6% expected and 0.8% previous.

As a result, the higher-yielding British Pound took support from the risk-rally by ignoring the Brexit issue’s latest negative developments. As per the latest report, the discussions over a possible trade deal between the U.K. and E.U. are expected to extend beyond this week.

At the USD front, the broad-based U.S. dollar failed to stop its previous losses and remain depressed on the day, mainly due to the risk-on market sentiment. Moreover, the losses in the U.S. dollar could also be attributed to the on-going doubts over the global economic recovery in the wake of intensifying coronavirus (COVID-19) worries in the U.S., which tend to undermine the American currency. However, the losses in the U.S. dollar kept the currency pair higher. Meantime, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies dropped by 0.14% to 92.588 by 10:05 PM ET (2:05 AM GMT).

On the negative side, the latest negative developments surrounding the Brexit issue and the rising number of coronavirus in the U.K. could be considered the leading factor that kept the lid on a y additional gains in the currency pair. As per the latest report, Irish Foreign Minister Simon Coveney clearly warned that we would not get a deal if the U.K. imposes Internal Market Bill. In the meantime, the U.K. Environment Secretary George Eustice stated that both sides’ agreement remains intact, keeping the hopes alive as differences continue to persist over fisheries and state aid.

Looking ahead, the market traders will keep their eyes on updates surrounding the U.S. stimulus package. In the meantime, the risk catalyst like geopolitics and the virus woes, not to forget the Brexit, could not lose their importance. Apart from this, the RBA Gov Lowe Speaks and Monetary Policy Meeting Minutes will also be key to watch.

Daily Technical Levels

Support Resistance

1.3170 1.3291

1.3119 1.3361

1.3050 1.3412

Pivot point; 1.3240

GBP/USD– Trading Tip

The GBP/USD pair is trading at 1.3208 level, holding over 1.3189 level, which is extended by an upward trendline on a 2-hour timeframe. The Cable has recently crossed over the resistance level of the 1.3185 resistance level as the candle’s closing above this level may drive further upward movement in the market. The MACD and RSI support buying trend, and considering the trendline support and oversold indicators, it is worth giving a buy shot to GBP/USD pair. Let’s consider buying over 1.3160 level today.

USD/JPY – Daily Analysis

The USD/JPY pair was closed at 105.121 after placing a high of 105.476 and a low of 105.068. The pair USD/JPY reversed its direction and started falling on Thursday amid the broad-based U.S. dollar weakness. The decreased risk sentiment due to the escalated second wave of the coronavirus in the United States weighed on the USD/JPY pair on Thursday. The investors started to fear that governments might respond by imposing the lockdown restrictions that will slow down the economic recovery.

The United States reported about 140,453 cases on a single day on Wednesday, and it was the ninth straight day of above 100,000 cases. According to Johns Hopkins University, about 10.4 million Americans have been infected by the coronavirus so far, and nearly 242,000 have died from it. These concerns raised the safe-haven appeal and supported the Japanese Yen that ultimately weighed on the USD/JPY.

On the data front, at 04:50 GMT, the Core Machinery Orders from Japan for September came in as -4.4% against the expected -1.1% and weighed on the Japanese Yen. The Purchasing Price Index (PPI) from Japan remained flat with the expectations of -2.1% for the year. At 09:30 GMT, the Tertiary Industry Activity for September raised to 1.8% against the anticipated 1.3% and supported the Japanese Yen and weighed on the USD/JPY pair.

The Federal Reserve Chairman Jerome Powell cautioned that the U.S. economy would further need support from Congress and the central bank even if a coronavirus vaccine becomes available by the end of the year. He said that despite the vaccine’s availability, there still will be millions of people left who have lost their job to the pandemic, and they will still struggle to find work as the economy will attempt to recover from the economic downturn.

He added that in the Federal Reserve’s eyes, the terrible rise in COVID-19 cases across the country was the “main risk” for the U.S. economy. He added that the coronavirus’s third wave had forced several states to re-impose lockdown restrictions and caused people to lose confidence. He stressed that the economy would not fully recover until people are confident that it was safe to resume activities involving the crowd. These comments from Powell also weighed on the U.S. dollar and added in the losses of the USD/JPY pair on Thursday.

Daily Technical Levels

Support Resistance

103.82 106.29

102.27 107.21

101.35 108.75

Pivot point: 104.74

USD/JPY – Trading Tips

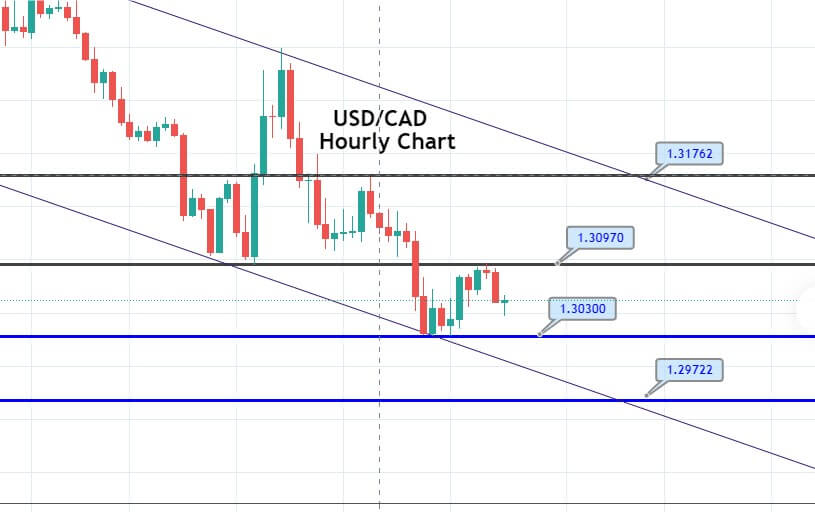

The USD/JPY is with a bearish bias at the 104.400 level, falling from the 104.850 support area. On the lower side, the USD/JPY pair is likely to find support at the 104.141 level, and violation of this level can also extend further selling boas until 103.500. On the higher side, the USD/JPY safe-haven pair may find resistance at 104.845 and may help us capture a selling trades below this level as the MACD and RSI are supporting the selling trend today. Good luck!