AUD/USD Exogenous Analysis

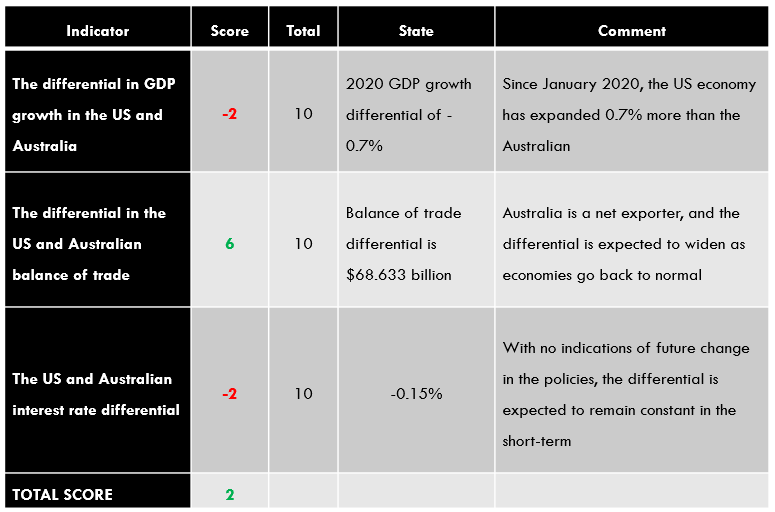

In the exogenous analysis, we will compare the differentials in the US and the Australian economies at an international level. We will use:

- The differential in GDP growth in the US and Australia

- The US and Australian interest rate differential

- The differential in the US and Australian balance of trade

The differential in GDP growth in the US and Australia

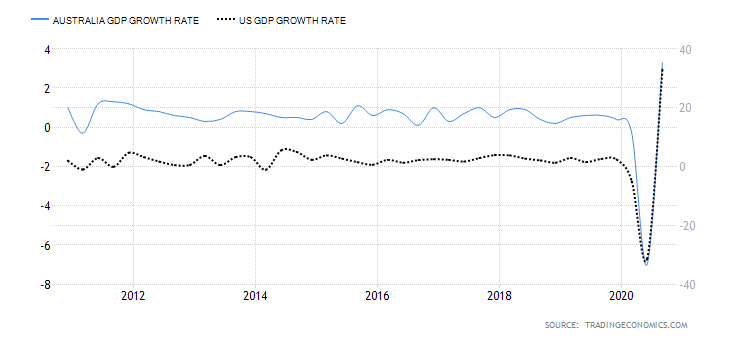

Domestically, the value of USD and AUD are pushed by the changes in the macroeconomic factors that drive GDP growth. The dynamic of the AUD/USD exchange rate is affected by the difference in the GDP growth rate. The country with a faster GDP growth will see its currency appreciate more than the one with slower growth.

In Q3 of 2020, the Australian GDP increased by 3.3% compared to the 7% drop in Q2. The US economy expanded by 33.1% in Q3 2020 compared to a 31.4% drop in Q2. In the first three quarters, the US economy has contracted by 3.3% while the Australian economy has contracted by 4%. Therefore, the GDP growth differential between Australia and the US is -0.7%. Based on the correlation analysis with the AUD/USD pair, we assign a score of -2.

The US and Australian interest rate differential

This measures the difference between the interest rate set by the Reserve Bank of Australia (RBA) and the US Federal Reserve. In the forex market, carry traders tend to be bullish when a currency pair has a positive interest rate differential and bearish when it is negative. That is because more investor funds flow towards the country with a higher interest rate.

At the onset of the COVID-19 pandemic, the RBA cut interest rates from 0.75% to 0.1%, while the Federal Reserve cut interest rates from 1.75% to 0.25%. That makes the interest rate differential for the AUD/USD pair -0.15%. Based on correlation analysis with the exchange rate for the AUD/USD pair, we assign a score of -2.

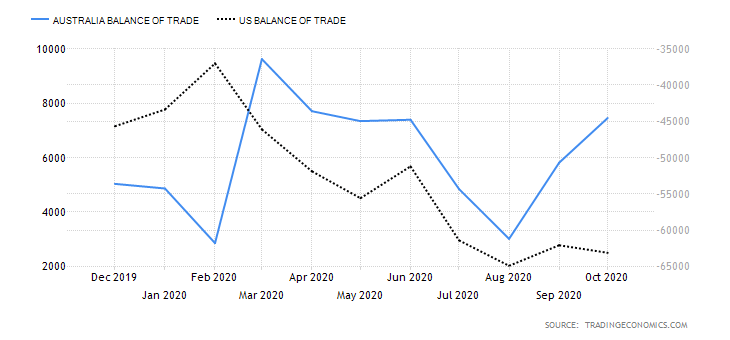

The differential in the US and Australian balance of trade

The difference between the balance of trade for Australia and the US will help determine which currency is in higher demand in international trade. Note that increased demand in the forex market also increases the value of that currency.

In October 2020, Australia’s trade surplus increased to AUD 7.46 billion compared to 5.82 billion in September. However, it is still lower than the highest recorded AUD 9.62 billion surpluses in March. The US had a trade deficit of $63.1 billion in October, which has been expanding since January. The balance of trade differential is $68.633 billion between Australia and the US. Based on the correlation with the AUD/USD exchange rate, we assign a score of 6.

Conclusion

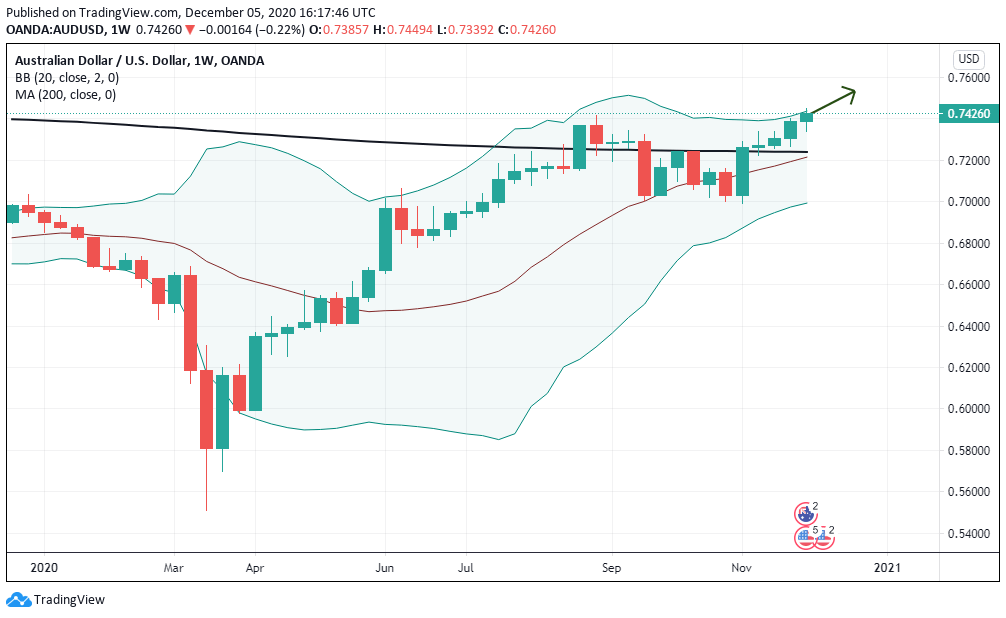

The exogenous score for the AUD/USD pair is 2. It means that we can expect that the pair will be on a bullish trend in the short-term.

In technical analysis, the short-term bullish trend is supported by the fact that the pair is trading above the 200-period MA and breaching the upper Bollinger Band. Cheers!

One reply on “AUD/USD Global Macro Analysis – Part 3”

Reddy I’m impressed by this and surprised because you seem to be an engineer !