Introduction

The forex market is traded all across the world. In fact, it is open 24 hours. And these markets are traded in countries when their national markets are open. There are about four major countries where vast lumps of cash flow in and out of the forex market and thereby keeping it very liquid and volatile. To trade professionally, having an idea of the different markets open and close is vital. Hence, in this lesson, we shall be going over the various sessions in the forex market.

Forex market trading sessions

Though all countries trade in the forex market, there are a few countries where the massive volume of trading takes place. The 24 hours trading in the forex market is divided into four sessions. These four sessions are given as follows:

• The Sydney Session

• The Tokyo Session

• The London Session

• The New York Session

Moreover, the open and close of these sessions vary based on the season as well. One session falls between March/April to October/November, and the other starts from October/November and goes up to March/April. The former is the spring/summer session, and the latter is the Fall/Winter session.

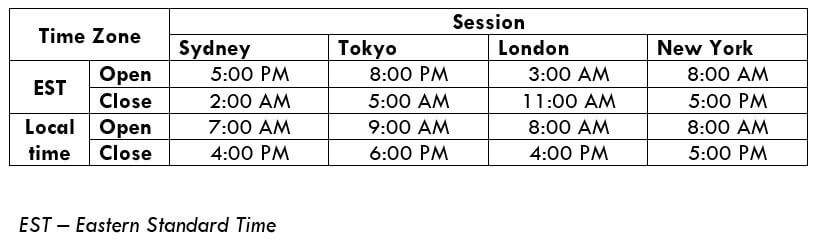

Trade timings during Spring/Summer (in the US)

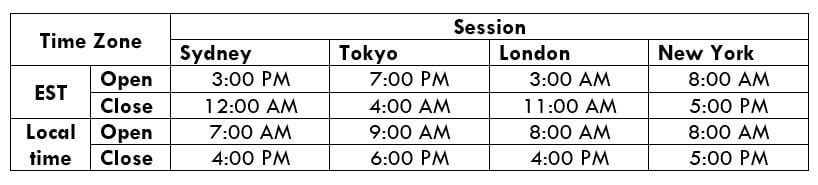

Trade timings during the Fall/Winter (in the US)

Note that the time represented is the local time (US) and the EST, and is different from every country’s standard time. However, the standard market timings for most countries lie within 7:00 AM and 6:00 PM.

Furthermore, there is an overlap between sessions. That is, during the overlap, the Forex market is traded by two regions simultaneously. For example,

The New York and the London session has an overlap between 8:00 AM – 12:00 PM EST

The Sydney and the Tokyo session overlaps between 7:00 AM and 2:00 AM

And the London and the Tokyo session overlaps between 3:00 AM to 4:00 AM.

These overlapping sessions are essential for traders because at that time is when more liquidity and volatility are created in currency pairs. This is so because traders from two markets operate simultaneously.

Hence, this completes the lesson on the different sessions in the forex market. And in further lessons, we shall discuss each one of the sessions in detail. For now, test your learning of this lesson by taking up the quiz below. [wp_quiz id=”46553″]